false

0000714395

0000714395

2024-07-29

2024-07-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 29, 2024

GERMAN AMERICAN BANCORP, INC.

(Exact name of registrant as specified in its charter)

Indiana

(State or other jurisdiction of incorporation)

| 001-15877 |

|

35-1547518 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| 711 Main Street |

|

|

| Jasper, Indiana |

|

47546 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (812) 482-1314

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

x Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange

Act (17 CFR 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, no par value |

|

GABC |

|

Nasdaq Global Select Market |

Item 2.02. Results of Operations and Financial

Condition.

On July 29, 2024, German American Bancorp, Inc.

(the “Company”) issued a press release announcing its results for the quarter ended June 30, 2024, and making other disclosures.

The press release (including the accompanying unaudited consolidated financial statements as of and for the quarter ended June 30,

2024, and other financial data) is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02, including the

information incorporated herein from Exhibit 99.1, is furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by

reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific

reference in such a filing.

Item 8.01. Other Events.

Cash

Dividend. As announced in the press release furnished as Exhibit 99.1 to this report, the Company’s Board of Directors

has declared a cash dividend of $0.27 per share which will be payable on August 20, 2024 to shareholders of record as of August 10,

2024.

Item

9.01. Financial Statements and Exhibits.

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* * * * * *

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

GERMAN AMERICAN BANCORP, INC. |

| |

|

|

| Date: July 29, 2024 |

By: |

/s/ D. Neil Dauby |

| |

|

D. Neil Dauby, Chairman and Chief Executive Officer |

Exhibit 99.1

NEWS RELEASE

For additional information, contact:

D.

Neil Dauby, Chairman and Chief Executive Officer

Bradley

M Rust, President and Chief Financial Officer

(812) 482-1314

1 of 16

| July 29, 2024 | GERMAN AMERICAN BANCORP, INC.

(GABC)

REPORTS STRONG SECOND QUARTER 2024 EARNINGS |

Jasper, Indiana, July 29, 2024 –

German American Bancorp, Inc. (Nasdaq: GABC) reported strong second quarter earnings of $20.5 million, or $0.69 per share. This

level of quarterly earnings reflected a linked quarter increase of $1.5 million, or approximately 8% on a per share basis, from 2024

first quarter earnings of $19 million or $0.64 per share.

Second quarter 2024 operating performance was

highlighted by a stabilized net interest margin, solid loan and deposit growth, continued strong credit metrics, growth in most non-interest

income categories and controlled non-interest expense. As previously reported, the Company also sold the assets of its wholly-owned subsidiary,

German American Insurance, Inc., during the second quarter, for $40.0 million (or approximately 4x the subsidiary’s 2023 revenue)

in an all-cash transaction, resulting in a $27.5 million after-tax gain. In addition, the Company subsequently commenced a restructuring

of its securities portfolio by selling securities, representing approximately $375 million in book value, at an after-tax loss of $27.2

million. With its strong second quarter 2024 operating performance, the Company remained well-positioned at the end of second quarter

2024 with continued solid liquidity and strong capital ratios.

The Company views certain non-operating items,

like the German American Insurance sale and the restructuring of the securities portfolio, as being unrepresentative of the Company’s

core operating performance. As such, the Company generally considers those items as adjustments to net income reported under U.S. generally

accepted accounting principles. Nonetheless, as a result of these two transactions, second quarter 2024 net income, on a combined basis,

was positively impacted by only $0.3 million.

Net interest margin for the second quarter of

2024 was relatively stable at 3.34%, compared to linked first quarter 2024 net interest margin of 3.35%, as the earning asset yield increase

of 12 basis points mostly kept pace with the funding cost increase of 13 basis points. The cost of funds in the second quarter of 2024

continued to increase at a pace similar to that of first quarter 2024, driven by continued competitive deposit pricing in the marketplace

and ongoing re-mixing of the Company’s deposit composition as customers continued to move into time and money market accounts seeking

higher yields.

Second quarter 2024 deposits increased approximately

$94 million, or approximately 7% on an annualized basis, compared to first quarter 2024. Non-interest-bearing accounts remained at a

healthy 27% of total deposits.

During the second quarter of 2024, total loans

increased $65 million, or approximately 7% on an annualized basis, with virtually all categories of loans showing growth. The Company’s

loan portfolio composition remained diverse with little commercial real estate office concentration. Credit metrics remained strong as

non-performing assets were 0.12% of period end assets and non-performing loans totaled 0.18% of period end loans.

| NEWS RELEASE For additional information, contact: D. Neil Dauby, Chairman and Chief Executive Officer Bradley M Rust, President and Chief Financial Officer (812) 482-1314 2 of 16 |

Non-interest income for the second quarter of

2024, compared with the first quarter of 2024, excluding any impact related to the insurance sale and the securities portfolio restructuring,

reflected solid growth in most categories, highlighted by an increase in wealth management fees of approximately 12% attributable to

increased assets under management and improving capital markets; increased interchange fee income of approximately 8% driven by increased

customer card utilization; and increased net gain on sale of loans of approximately 29% driven by higher mortgage sales volume.

Excluding professional fees associated with both

the sale of the insurance subsidiary and the recently announced pending merger transaction with Heartland BancCorp, the Company’s

operating expenses for the second quarter of 2024 remained well-controlled.

The Company also announced that its Board of

Directors declared a regular quarterly cash dividend of $0.27 per share, which will be payable on August 20, 2024, to shareholders

of record as of August 10, 2024.

D. Neil Dauby, German American’s Chairman &

CEO stated, “We are extremely pleased to deliver a strong second quarter operating performance. In addition, the Company executed

on several key strategic initiatives with the sale of its insurance subsidiary and the partial restructuring of our securities portfolio.”

In a separate news release, German American also announced today its proposed merger with Heartland BancCorp. Heartland Bank is a premier

community bank operating within the high growth markets of Columbus and Cincinnati, Ohio. Dauby added, “This strategic partnership

coupled with our balance sheet repositioning will build on our strong quarterly operating performance and position our Company for improved

profitability and future success.”

Balance Sheet Highlights

Total assets for the Company totaled $6.217

billion at June 30, 2024, representing an increase of $105.0 million compared with March 31, 2024 and an increase of

$163.7 million compared with June 30, 2023. The increase in total assets at June 30, 2024 compared with both

March 31, 2024 and June 30, 2023 was largely related to an increase in total loans and fed funds sold and other short-term

investments, partially offset by a decline in the securities portfolio.

Securities available-for-sale declined

$165.5 million as of June 30, 2024 compared with March 31, 2024 and declined $226.9 million compared with June 30,

2023. The decline at June 30, 2024 in the available-for-sale securities portfolio compared with the end of the first quarter of

2024 and the end of the second quarter of 2023 was largely the result of the Company’s utilization of cash flows from the

securities portfolio to fund loan growth in addition to the timing of the sale and reinvestment of proceeds related to the

restructuring transaction.

During June 2024, the Company commenced

a securities portfolio restructuring transaction whereby available-for-sale securities totaling approximately $375 million in book value

were identified to be sold. As of June 30, 2024, $175 million of securities had been sold with the remaining $200 million sold during

early July 2024. The tax-equivalent yield on the bonds sold was approximately 3.12% with a duration of approximately 7 years. Approximately

$80 million of the proceeds of the securities sold were reinvested as of June 30, 2024. It is anticipated the remainder of the proceeds

from the sale will be reinvested back into the securities portfolio.

| NEWS RELEASE For additional information, contact: D. Neil Dauby, Chairman and Chief Executive Officer Bradley M Rust, President and Chief Financial Officer (812) 482-1314 3 of 16 |

June 30, 2024 total loans increased $65.3

million, or 7% on an annualized basis, compared with March 31, 2024 and increased $213.8 million, or 6%, compared with June 30,

2023. The increase during the second quarter of 2024 compared with March 31, 2024 was broad-based across most segments of the portfolio.

Commercial and industrial loans increased $18.3 million, or 11% on an annualized basis, commercial real estate loans increased $23.6

million, or 4% on an annualized basis, while agricultural loans grew $13.0 million, or 13% on an annualized basis, and retail loans grew

by $10.4 million, or 5% on an annualized basis.

The composition of the loan portfolio has remained

relatively stable and diversified over the past several years, including 2024. The portfolio is most heavily concentrated in commercial

real estate loans at 54% of the portfolio, followed by commercial and industrial loans at 16% of the portfolio, and agricultural loans

at 10% of the portfolio. The Company’s commercial lending is extended to various industries, including multi-family housing and

lodging, agribusiness and manufacturing, as well as health care, wholesale, and retail services. The Company’s commercial real

estate portfolio has limited exposure to office real estate, with office exposure totaling approximately 4% of the total loan portfolio.

End of Period Loan Balances

(dollars in thousands) | |

6/30/2024 | | |

3/31/2024 | | |

6/30/2023 | |

| Commercial & Industrial Loans | |

$ | 664,435 | | |

$ | 646,162 | | |

$ | 669,137 | |

| Commercial Real Estate Loans | |

| 2,172,447 | | |

| 2,148,808 | | |

| 2,021,109 | |

| Agricultural Loans | |

| 413,742 | | |

| 400,733 | | |

| 395,466 | |

| Consumer Loans | |

| 424,647 | | |

| 421,980 | | |

| 389,440 | |

| Residential Mortgage Loans | |

| 368,997 | | |

| 361,236 | | |

| 355,329 | |

| | |

$ | 4,044,268 | | |

$ | 3,978,919 | | |

$ | 3,830,481 | |

The Company’s allowance for credit losses

totaled $43.9 million at June 30, 2024, $43.8 million at March 31, 2024 and $44.3 million at June 30, 2023. The allowance

for credit losses represented 1.09% of period-end loans at June 30, 2024, 1.10% of period-end loans at March 31, 2024 and 1.16%

of period-end loans at June 30, 2023.

Non-performing assets totaled $7.3 million at

June 30, 2024, $10.0 million at March 31, 2024 and $12.4 million at June 30, 2023. Non-performing assets represented 0.12%

of total assets at June 30, 2024, 0.16% at March 31, 2024 and 0.21% at June 30, 2023. Non-performing loans represented

0.18% of total loans at June 30, 2024, 0.25% at March 31, 2024 and 0.32% at June 30, 2023.

| NEWS RELEASE For additional information, contact: D. Neil Dauby, Chairman and Chief Executive Officer Bradley M Rust, President and Chief Financial Officer (812) 482-1314 4 of 16 |

Non-performing Assets

(dollars in thousands) | |

6/30/2024 | | |

3/31/2024 | | |

6/30/2023 | |

| Non-Accrual Loans | |

$ | 6,583 | | |

$ | 9,898 | | |

$ | 11,423 | |

| Past Due Loans (90 days or more) | |

| 706 | | |

| 85 | | |

| 1,000 | |

| Total Non-Performing Loans | |

| 7,289 | | |

| 9,983 | | |

| 12,423 | |

| Other Real Estate | |

| 33 | | |

| — | | |

| — | |

| Total Non-Performing

Assets | |

$ | 7,322 | | |

$ | 9,983 | | |

$ | 12,423 | |

June 30, 2024 total deposits increased $94.2

million, or 7% on an annualized basis, compared to March 31, 2024 and increased $133.9 million, or 3%, compared with June 30,

2023. The increase at June 30, 2024 compared to March 31, 2024 was largely attributable to seasonal inflows of public entity

funds. The Company has continued to see customer movement from both interest bearing and non-interest bearing transactional accounts

to time deposits due primarily to a higher interest rate environment. Non-interest bearing deposits have remained relatively stable as

a percent of total deposits with June 30, 2024 non-interest deposits totaling 27% of total deposits while non-interest deposits

totaled 28% of total deposits at March 31, 2024 and 30% at June 30, 2023.

End of Period Deposit Balances

(dollars in thousands) | |

6/30/2024 | | |

3/31/2024 | | |

6/30/2023 | |

| Non-interest-bearing Demand

Deposits | |

$ | 1,448,467 | | |

$ | 1,463,933 | | |

$ | 1,540,564 | |

| IB Demand, Savings, and MMDA Accounts | |

| 2,984,571 | | |

| 2,918,459 | | |

| 3,056,396 | |

| Time Deposits < $100,000 | |

| 348,025 | | |

| 328,804 | | |

| 256,504 | |

| Time Deposits >

$100,000 | |

| 532,494 | | |

| 508,151 | | |

| 326,241 | |

| | |

$ | 5,313,557 | | |

$ | 5,219,347 | | |

$ | 5,179,705 | |

At June 30, 2024, the capital levels for

the Company and its subsidiary bank, German American Bank (the “Bank”), remained well in excess of the minimum amounts needed

for capital adequacy purposes and the Bank’s capital levels met the necessary requirements to be considered well-capitalized.

| NEWS RELEASE For additional information, contact: D. Neil Dauby, Chairman and Chief Executive Officer Bradley M Rust, President and Chief Financial Officer (812) 482-1314 5 of 16 |

| |

|

6/30/2024

Ratio |

|

|

3/31/2024

Ratio |

|

|

6/30/2023

Ratio |

|

| Total Capital (to Risk Weighted Assets) |

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated |

|

|

16.78 |

% |

|

|

16.57 |

% |

|

|

16.06 |

% |

| Bank |

|

|

14.52 |

% |

|

|

14.53 |

% |

|

|

14.50 |

% |

| Tier 1 (Core) Capital (to Risk Weighted

Assets) |

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated |

|

|

15.19 |

% |

|

|

14.97 |

% |

|

|

14.50 |

% |

| Bank |

|

|

13.72 |

% |

|

|

13.73 |

% |

|

|

13.76 |

% |

| Common Tier 1 (CET 1) Capital Ratio

(to Risk Weighted Assets) |

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated |

|

|

14.49 |

% |

|

|

14.27 |

% |

|

|

13.78 |

% |

| Bank |

|

|

13.72 |

% |

|

|

13.73 |

% |

|

|

13.76 |

% |

| Tier 1 Capital (to Average Assets) |

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated |

|

|

11.92 |

% |

|

|

12.01 |

% |

|

|

11.44 |

% |

| Bank |

|

|

10.78 |

% |

|

|

11.02 |

% |

|

|

10.87 |

% |

Results of Operations Highlights –

Quarter ended June 30, 2024

Net income for the second quarter of 2024 totaled

$20,530,000, or $0.69 per share, an increase of 8% on a per share basis, compared with the first quarter of 2024 net income of $19,022,000,

or $0.64 per share, and a decline of 8% on a per share basis compared with the second quarter 2023 net income of $22,123,000, or $0.75

per share.

Net income for the second quarter of 2024 was

impacted by the previously announced completion of the sale of the assets of its wholly-owned subsidiary German American Insurance, Inc.

(“GAI”) to Hilb Group, an industry-leading insurance broker. The all-cash transaction sale price totaled $40 million, and

resulted in an after-tax gain, net of transaction costs, of approximately $27,476,000, or $0.93 per share.

Net income for the second quarter of 2024 was

also impacted by the aforementioned securities portfolio restructuring transaction whereby available securities totaling approximately

$375 million in book value were identified to be sold. The approximate loss on these securities totaled $34,893,000, $27,189,000 after

tax, or $0.92 per share, and was included in earnings for the second quarter of 2024.

| NEWS RELEASE For additional information, contact: D. Neil Dauby, Chairman and Chief Executive Officer Bradley M Rust, President and Chief Financial Officer (812) 482-1314 6 of 16 |

Summary

Average Balance Sheet

(Tax-equivalent

basis / dollars in thousands)

| | |

Quarter Ended | | |

Quarter Ended | | |

Quarter Ended | |

| | |

June 30,

2024 | | |

March 31,

2024 | | |

June 30,

2023 | |

| | |

Principal

Balance | | |

Income/

Expense | | |

Yield/

Rate | | |

Principal

Balance | | |

Income/

Expense | | |

Yield/

Rate | | |

Principal

Balance | | |

Income/

Expense | | |

Yield/

Rate | |

| Assets | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Federal Funds Sold and

Other Short-term Investments | |

$ | 180,595 | | |

$ | 2,383 | | |

| 5.31 | % | |

$ | 22,903 | | |

$ | 299 | | |

| 5.25 | % | |

$ | 54,228 | | |

$ | 660 | | |

| 4.88 | % |

| Securities | |

| 1,505,807 | | |

| 11,224 | | |

| 2.98 | % | |

| 1,595,700 | | |

| 11,537 | | |

| 2.89 | % | |

| 1,667,871 | | |

| 12,094 | | |

| 2.90 | % |

| Loans and Leases | |

| 4,022,612 | | |

| 59,496 | | |

| 5.95 | % | |

| 3,972,232 | | |

| 58,067 | | |

| 5.88 | % | |

| 3,787,436 | | |

| 52,350 | | |

| 5.54 | % |

| Total Interest Earning Assets | |

$ | 5,709,014 | | |

$ | 73,103 | | |

| 5.14 | % | |

$ | 5,590,835 | | |

$ | 69,903 | | |

| 5.02 | % | |

$ | 5,509,535 | | |

$ | 65,104 | | |

| 4.74 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Demand Deposit Accounts | |

$ | 1,421,710 | | |

| | | |

| | | |

$ | 1,426,239 | | |

| | | |

| | | |

$ | 1,545,455 | | |

| | | |

| | |

| IB Demand, Savings, and MMDA

Accounts | |

$ | 3,049,511 | | |

$ | 14,006 | | |

| 1.85 | % | |

$ | 2,969,755 | | |

$ | 12,823 | | |

| 1.74 | % | |

$ | 3,118,225 | | |

$ | 10,035 | | |

| 1.29 | % |

| Time Deposits | |

| 881,880 | | |

| 9,379 | | |

| 4.28 | % | |

| 806,976 | | |

| 8,166 | | |

| 4.07 | % | |

| 546,982 | | |

| 3,322 | | |

| 2.44 | % |

| FHLB Advances and Other Borrowings | |

| 182,960 | | |

| 2,221 | | |

| 4.88 | % | |

| 196,348 | | |

| 2,275 | | |

| 4.66 | % | |

| 177,146 | | |

| 1,899 | | |

| 4.30 | % |

| Total Interest-Bearing Liabilities | |

$ | 4,114,351 | | |

$ | 25,606 | | |

| 2.50 | % | |

$ | 3,973,079 | | |

$ | 23,264 | | |

| 2.36 | % | |

$ | 3,842,353 | | |

$ | 15,256 | | |

| 1.59 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of Funds | |

| | | |

| | | |

| 1.80 | % | |

| | | |

| | | |

| 1.67 | % | |

| | | |

| | | |

| 1.11 | % |

| Net Interest Income | |

| | | |

$ | 47,497 | | |

| | | |

| | | |

$ | 46,639 | | |

| | | |

| | | |

$ | 49,848 | | |

| | |

| Net Interest Margin | |

| | | |

| | | |

| 3.34 | % | |

| | | |

| | | |

| 3.35 | % | |

| | | |

| | | |

| 3.63 | % |

During the second quarter of 2024, net interest

income, on a non tax-equivalent basis, totaled $45,971,000, an increase of $977,000, or 2%, compared to the first quarter of 2024 net

interest income of $44,994,000 and a decline of $2,287,000, or 5%, compared to the second quarter of 2023 net interest income of $48,258,000.

The increase in net interest income during the

second quarter of 2024 compared with the first quarter of 2024 was primarily driven by a higher level of average earning assets and a

relatively stable net interest margin. The higher level of earning assets during the second quarter of 2024 was driven by both loan growth

and a higher level of other short-term investments driven by a seasonal increase in deposits. The decline in net interest income during

the second quarter of 2024 compared with the second quarter of 2023 was primarily attributable to a decline in the Company’s net

interest margin.

The tax-equivalent net interest margin for the

quarter ended June 30, 2024 was 3.34% compared with 3.35% in the first quarter of 2024 and 3.63% in the second quarter of 2023.

The decline in the net interest margin during the second quarter of 2024 compared with the second quarter of 2023 was largely driven

by an increase in the cost of funds. The cost of funds has continued to move higher over the past year, including the second quarter

of 2024, due to competitive deposit pricing in the marketplace, customers actively looking for yield opportunities within and outside

the banking industry, and a continued shift in the Company’s deposit composition to a higher level of time deposits.

| NEWS RELEASE For additional information, contact: D. Neil Dauby, Chairman and Chief Executive Officer Bradley M Rust, President and Chief Financial Officer (812) 482-1314 7 of 16 |

The previously described securities portfolio

restructuring transaction did not have a meaningful impact on the second quarter of 2024 net interest income or net interest margin as

the transaction commenced in the latter part of June 2024. The Company expects the securities restructuring to result in an improved

yield of approximately 2%, on a tax-equivalent basis, on the securities sold compared with the reinvestment of the proceeds into the

securities portfolio.

The Company’s net interest margin and net

interest income have been impacted by accretion of loan discounts on acquired loans. Accretion of discounts on acquired loans totaled

$275,000 during the second quarter of 2024, $360,000 during the first quarter of 2024 and $716,000 during the second quarter of 2023.

Accretion of loan discounts on acquired loans contributed approximately 2 basis points to the net interest margin in the second quarter

of 2024, 3 basis points in the first quarter of 2024 and 5 basis points in the second quarter of 2023.

During the quarter ended June 30, 2024,

the Company recorded a provision for credit losses of $625,000 compared with a provision of $900,000 in the first quarter of 2024 and

a provision for credit losses of $550,000 during the second quarter of 2023. Net charge-offs totaled $433,000, or 4 basis points on an

annualized basis, of average loans outstanding during the second quarter of 2024 compared with $911,000, or 9 basis points on an annualized

basis, of average loans during the first quarter of 2024 and compared with $599,000, or 6 basis points, of average loans during the second

quarter of 2023.

During the quarter ended June 30, 2024,

non-interest income totaled $18,923,000, an increase of $3,101,000 or 20%, compared with the first quarter of 2024 and an increase of

$4,027,000, or 27%, compared with the second quarter of 2023. The second quarter of 2024 non-interest income was positively impacted

by approximately $38,323,000 related to the net proceeds of the sale of the GAI assets and negatively impacted by $34,893,000 related

to the net loss recognized on the securities restructuring transaction.

| NEWS RELEASE For additional information, contact: D. Neil Dauby, Chairman and Chief Executive Officer Bradley M Rust, President and Chief Financial Officer (812) 482-1314 8 of 16 |

| Non-interest Income | |

Quarter

Ended | | |

Quarter

Ended | | |

Quarter

Ended | |

| (dollars in thousands) | |

6/30/2024 | | |

3/31/2024 | | |

6/30/2023 | |

| Wealth Management Fees | |

$ | 3,783 | | |

$ | 3,366 | | |

$ | 2,912 | |

| Service Charges on Deposit Accounts | |

| 3,093 | | |

| 2,902 | | |

| 2,883 | |

| Insurance Revenues | |

| 1,506 | | |

| 2,878 | | |

| 2,130 | |

| Company Owned Life Insurance | |

| 525 | | |

| 441 | | |

| 429 | |

| Interchange Fee Income | |

| 4,404 | | |

| 4,087 | | |

| 4,412 | |

| Other Operating Income | |

| 39,536 | | |

| 1,362 | | |

| 1,462 | |

| Subtotal | |

| 52,847 | | |

| 15,036 | | |

| 14,228 | |

| Net Gains on Sales of Loans | |

| 969 | | |

| 751 | | |

| 630 | |

| Net Gains (Losses) on Securities | |

| (34,893 | ) | |

| 35 | | |

| 38 | |

| Total Non-interest Income | |

$ | 18,923 | | |

$ | 15,822 | | |

$ | 14,896 | |

Wealth management fees increased $417,000, or

12%, during the second quarter of 2024 compared with the first quarter of 2024 and increased $871,000, or 30%, compared with the second

quarter of 2023. The increase during the second quarter of 2024 was largely attributable to increased assets under management due to

healthy capital markets and strong new business results compared with both the first quarter of 2024 and second quarter of 2023.

Insurance revenues declined $1,372,000, or 48%,

during the quarter ended June 30, 2024, compared with the first quarter of 2024 and declined $624,000, or 29%, compared with the

second quarter of 2023. The decline during the second quarter of 2024 compared with both the first quarter of 2024 and the second quarter

of 2023 was the result of the sale of the assets of GAI effective June 1, 2024, with only two months of revenue being recognized

by the Company during the second quarter of 2024. In addition, the second quarter of 2024 was lower than the first quarter of 2024 due

to contingency revenue of $4,000 during the second quarter of 2024 compared with $391,000 during the first quarter of 2024. Typically,

the majority of contingency revenue is recognized during the first quarter of the year.

Interchange fee income increased $317,000, or

8%, during the quarter ended June 30, 2024 compared with the first quarter of 2024 and remained relatively flat declining $8,000,

or less than 1%, compared with the second quarter of 2023. The increase during the second quarter of 2024 compared with the first quarter

of 2024 was largely related to a seasonally higher level of customer transaction volume.

Other operating income increased $38,174,000

during the second quarter of 2024 compared with the first quarter of 2024 and increased $38,074,000 compared with the second quarter

of 2023. The increase during the second quarter of 2024 non-interest income compared to both periods was the result of the approximately

$38,323,000 in net proceeds of the sale of the GAI assets during the second quarter of 2024.

| NEWS RELEASE For additional information, contact: D. Neil Dauby, Chairman and Chief Executive Officer Bradley M Rust, President and Chief Financial Officer (812) 482-1314 9 of 16 |

Net gains on sales of loans increased $218,000,

or 29%, during the second quarter of 2024 compared with the first quarter of 2024 and increased $339,000, or 54%, compared with the second

quarter of 2023. The increase during the second quarter of 2024 compared with both the first quarter of 2024 and the second quarter of

2023 was largely related to a higher volume of sales. Loan sales totaled $33.0 million during the second quarter of 2024 compared with

$24.0 million during the first quarter of 2024 and $24.8 million during the second quarter of 2023.

The net loss on securities during the second

quarter of 2024 totaled $34,893,000 related to the net loss recognized on the securities restructuring transaction previously discussed.

During the quarter ended June 30, 2024,

non-interest expense totaled $37,674,000, an increase of $936,000, or 3%, compared with the first quarter of 2024, and an increase of

$1,948,000, or 5%, compared with the second quarter of 2023. The increase in non-interest expenses during the second quarter of 2024

was primarily the result of professional fees related to the GAI asset sale and the recently announced pending merger transaction with

Heartland BancCorp (“Heartland”), which totaled approximately $1,904,000.

| Non-interest Expense | |

Quarter

Ended | | |

Quarter

Ended | | |

Quarter

Ended | |

| (dollars in thousands) | |

6/30/2024 | | |

3/31/2024 | | |

6/30/2023 | |

| Salaries and Employee Benefits | |

$ | 20,957 | | |

$ | 21,178 | | |

$ | 20,103 | |

| Occupancy, Furniture and Equipment Expense | |

| 3,487 | | |

| 3,804 | | |

| 3,443 | |

| FDIC Premiums | |

| 710 | | |

| 729 | | |

| 687 | |

| Data Processing Fees | |

| 3,019 | | |

| 2,811 | | |

| 2,803 | |

| Professional Fees | |

| 3,462 | | |

| 1,595 | | |

| 1,614 | |

| Advertising and Promotion | |

| 909 | | |

| 1,138 | | |

| 1,261 | |

| Intangible Amortization | |

| 532 | | |

| 578 | | |

| 734 | |

| Other Operating Expenses | |

| 4,598 | | |

| 4,905 | | |

| 5,081 | |

| Total Non-interest Expense | |

$ | 37,674 | | |

$ | 36,738 | | |

$ | 35,726 | |

Salaries and benefits declined $221,000, or

1%, during the quarter ended June 30, 2024 compared with the first quarter of 2024 and increased $854,000, or 4%, compared with

the second quarter of 2023. The decline in salaries and benefits during the second quarter of 2024 compared with the first quarter

of 2024 was primarily due to a lower level of full-time equivalent employees resulting from the sale of the assets of GAI during the

second quarter of 2024. The increase in salaries and benefits for the second quarter of 2024 compared with the same period of 2023

was primarily related to an increase in costs of incentive compensation plans.

Occupancy, furniture and equipment expense declined

$317,000, or 8%, during the second quarter of 2024 compared with the first quarter of 2024 and increased $44,000, or 1%, compared to

the second quarter of 2023. The decline during the second quarter of 2024 compared with the first quarter of 2024 was largely due to

lower property tax assessments and lower seasonal utilities costs.

| NEWS RELEASE For additional information, contact: D. Neil Dauby, Chairman and Chief Executive Officer Bradley M Rust, President and Chief Financial Officer (812) 482-1314 10 of 16 |

Data processing fees increased $208,000, or

7%, during the second quarter of 2024 compared with the first quarter of 2024 and increased $216,000, or 8%, compared with the

second quarter of 2023. The increase during the second quarter of 2024 compared with both the first quarter of 2024 and second

quarter of 2023 was largely driven by costs associated with enhancements to the Company’s digital banking systems.

Professional fees increased $1,867,000, or 117%,

in the second quarter of 2024 compared with the first quarter of 2024 and increased $1,848,000, or 115%, compared with the second quarter

of 2023. The increase during the second quarter of 2024 compared with both the first quarter of 2024 and second quarter of 2023 was largely

attributable to the professional fees associated with the sale of assets of GAI and the recently announced pending merger transaction

with Heartland totaling $1,904,000.

Advertising and promotion expense declined $229,000,

or 20%, in the second quarter of 2024 compared with the first quarter of 2023 and declined $352,000, or 28%, compared with the second

quarter of 2023. The decline during the second quarter of 2024 compared with both the first quarter of 2024 and the second quarter of

2023 was largely attributable to the timing of sponsorships and contributions to organizations within the Company’s markets.

About German American

German American Bancorp, Inc. is a Nasdaq-listed

(symbol: GABC) financial holding company based in Jasper, Indiana. German American, through its banking subsidiary German American

Bank, operates 74 banking offices in 20 contiguous southern Indiana counties and 14 counties in Kentucky.

Additional

Information About the Merger and Where to Find It

The proposed merger of Heartland BancCorp (“Heartland”)

with and into German American Bancorp, Inc. (“German American”) will be submitted to both the German American and Heartland

shareholders for their consideration. In connection with the proposed merger, German American will file a Registration Statement on Form S-4

with the U.S. Securities and Exchange Commission (“SEC”) that will include a joint proxy statement for German American and

Heartland and a prospectus for German American and other relevant documents concerning the proposed merger. INVESTORS ARE URGED TO READ

THE REGISTRATION STATEMENT AND THE CORRESPONDING JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN IT BECOMES AVAILABLE,

AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, TOGETHER WITH ALL AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS, AS THEY

WILL CONTAIN IMPORTANT INFORMATION. You will be able to obtain a copy of the joint proxy statement/prospectus once filed, as well as

other filings containing information about German American, without charge, at the SEC’s website (http://www.sec.gov) or by accessing

German American’s website (http://www.germanamerican.com) under the tab “Investor Relations” and then under the heading

“Financial Information”. Copies of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated

by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a request to Bradley C. Arnett, Investor

Relations, German American Bancorp, Inc., 711 Main Street, Box 810, Jasper, Indiana 47546, telephone 812-482-1314 or to Jennifer

Eckert, Investor Relations, Heartland BancCorp, 430 North Hamilton Road, Whitehall, Ohio 43213, telephone 614-337-4600.

| NEWS RELEASE For additional information, contact: D. Neil Dauby, Chairman and Chief Executive Officer Bradley M Rust, President and Chief Financial Officer (812) 482-1314 11 of 16 |

German American and Heartland and certain of

their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of German

American and Heartland in connection with the proposed merger. Information about the directors and executive officers of German American

is set forth in the proxy statement for German American’s 2024 annual meeting of shareholders, as filed with the SEC on Schedule

14A on March 21, 2024, which information has been updated by German American from time to time in subsequent filings with the SEC.

Information about the directors and executive officers of Heartland will be set forth in the joint proxy statement/prospectus relating

to the proposed merger. Additional information about the interests of those participants and other persons who may be deemed participants

in the transaction may also be obtained by reading the joint proxy statement/prospectus relating to the proposed merger when it becomes

available. Free copies of this document may be obtained as described above.

Cautionary Note Regarding Forward-Looking

Statements

Certain statements in this press release may

be deemed “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Readers are cautioned

that, by their nature, forward-looking statements are based on assumptions and are subject to risks, uncertainties, and other factors.

Forward-looking statements can often, but not always, be identified by the use of words like “believe”, “continue”,

“pattern”, “estimate”, “project”, “intend”, “anticipate”, “expect”

and similar expressions or future or conditional verbs such as “will”, “would”, “should”, “could”,

“might”, “can”, “may”, or similar expressions.

These forward-looking statements include, but

are not limited to, statements relating to German American’s goals, intentions and expectations; statements regarding German American’s

business plan and growth strategies; statements regarding the asset quality of German American’s loan and investment portfolios;

and the expected timing and benefits of the Merger, including future financial and operating results, cost savings, enhanced revenues,

and accretion/dilution to reported earnings that may be realized from the Merger; and estimates of German American’s risks and

future costs and benefits, whether with respect to the Merger or otherwise.

Actual results and experience could differ materially

from the anticipated results or other expectations expressed or implied by these forward-looking statements as a result of a number of

factors, including but not limited to, those discussed in this press release. Factors that could cause actual experience to differ from

the expectations expressed or implied in this press release include:

| a. | changes in interest rates and the timing

and magnitude of any such changes; |

| NEWS RELEASE For additional information, contact: D. Neil Dauby, Chairman and Chief Executive Officer Bradley M Rust, President and Chief Financial Officer (812) 482-1314 12 of 16 |

| b. | unfavorable economic conditions, including

a prolonged period of inflation, and the resulting adverse impact on, among other things,

credit quality; |

| c. | the soundness of other

financial institutions and general investor sentiment regarding the stability of financial

institutions; |

| d. | changes in our liquidity

position; |

| e. | the impacts of epidemics,

pandemics or other infectious disease outbreaks; |

| f. | changes in competitive conditions; |

| g. | the introduction, withdrawal, success

and timing of asset/liability management strategies or of mergers and acquisitions and other

business initiatives and strategies; |

| h. | changes in customer borrowing, repayment,

investment and deposit practices; |

| i. | changes in fiscal,

monetary and tax policies; |

| j. | changes in financial

and capital markets; |

| k. | capital management activities, including

possible future sales of new securities, or possible repurchases or redemptions by German

American of outstanding debt or equity securities; |

| l. | risks of expansion through acquisitions and mergers, such as unexpected

credit quality problems of the acquired loans or other assets, unexpected attrition of the

customer base or employee base of the acquired institution or branches, and difficulties

in integration of the acquired operations; |

| m. | factors driving credit losses on investments; |

| n. | the impact, extent

and timing of technological changes; |

| o. | potential cyber-attacks,

information security breaches and other criminal activities; |

| p. | litigation liabilities, including related

costs, expenses, settlements and judgments, or the outcome of matters before regulatory agencies,

whether pending or commencing in the future; |

| q. | actions of the Federal Reserve Board; |

| r. | changes in accounting principles and

interpretations; |

| s. | potential increases of federal deposit

insurance premium expense, and possible future special assessments of FDIC premiums, either

industry wide or specific to German American’s banking subsidiary; |

| t. | actions of the regulatory authorities

under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank

Act”) and the Federal Deposit Insurance Act and other possible legislative and regulatory

actions and reforms; |

| u. | impacts resulting from possible amendments

or revisions to the Dodd-Frank Act and the regulations promulgated thereunder, or to Consumer

Financial Protection Bureau rules and regulations; |

| v. | the continued availability of earnings

and excess capital sufficient for the lawful and prudent declaration and payment of cash

dividends; |

| NEWS RELEASE For additional information, contact: D. Neil Dauby, Chairman and Chief Executive Officer Bradley M Rust, President and Chief Financial Officer (812) 482-1314 13 of 16 |

| | w. | with respect to the

Merger: (i) failure to obtain necessary regulatory approvals when expected or at all

(and the risk that such approvals may result in the imposition of conditions that could adversely

affect the combined company or the expected benefits of the transaction), or the failure

of either company to satisfy any of the other closing conditions to the transaction on a

timely basis or at all; (ii) the occurrence of any event, change or other circumstances

that could give rise to the right of one or both of the parties to terminate the merger agreement;

and (iii) the possibility that the anticipated benefits of the transaction, including

anticipated cost savings and strategic gains, are not realized when expected or at all, including

as a result of the impact of, or problems arising from, the integration of the two companies,

unexpected credit quality problems of the acquired loans or other assets, or unexpected attrition

of the customer base of the acquired institution or branches, or as a result of the strength

of the economy, competitive factors in the areas where German American and Heartland do business,

or as a result of other unexpected factors or events; and |

| | | |

| x. | other

risk factors expressly identified in German American’s cautionary

language included under the headings “Forward-Looking Statements and Associated Risk”

and “Risk Factors” in German American’s Annual Report on Form 10-K

for the year ended December 31, 2023, and other documents subsequently filed by German

American with the SEC. |

Such statements reflect our views with respect

to future events and are subject to these and other risks, uncertainties and assumptions relating to the operations, results of operations,

growth strategy and liquidity of German American. Readers are cautioned not to place undue reliance on these forward-looking statements.

It is intended that these forward-looking statements speak only as of the date they are made. We do not undertake any obligation to release

publicly any revisions to these forward-looking statements to reflect future events or circumstances or to reflect the occurrence of

unanticipated events.

| GERMAN

AMERICAN BANCORP, INC. |

| (unaudited,

dollars in thousands except per share data) |

| |

|

|

|

|

|

| Consolidated

Balance Sheets |

| | |

June 30,

2024 | | |

March 31,

2024 | | |

June 30,

2023 | |

| ASSETS | |

| | | |

| | | |

| | |

| Cash and Due from Banks | |

$ | 70,418 | | |

$ | 52,839 | | |

$ | 78,223 | |

| Short-term Investments | |

| 259,401 | | |

| 71,131 | | |

| 62,948 | |

| Investment Securities | |

| 1,374,165 | | |

| 1,539,623 | | |

| 1,601,062 | |

| | |

| | | |

| | | |

| | |

| Loans Held-for-Sale | |

| 15,419 | | |

| 10,325 | | |

| 8,239 | |

| | |

| | | |

| | | |

| | |

| Loans, Net of Unearned Income | |

| 4,037,127 | | |

| 3,971,910 | | |

| 3,826,009 | |

| Allowance for Credit

Losses | |

| (43,946 | ) | |

| (43,754 | ) | |

| (44,266 | ) |

| Net Loans | |

| 3,993,181 | | |

| 3,928,156 | | |

| 3,781,743 | |

| | |

| | | |

| | | |

| | |

| Stock in FHLB and Other Restricted Stock | |

| 14,530 | | |

| 14,630 | | |

| 14,856 | |

| Premises and Equipment | |

| 105,651 | | |

| 106,030 | | |

| 112,629 | |

| Goodwill and Other Intangible Assets | |

| 184,095 | | |

| 186,022 | | |

| 188,130 | |

| Other Assets | |

| 200,063 | | |

| 203,173 | | |

| 205,439 | |

| TOTAL ASSETS | |

$ | 6,216,923 | | |

$ | 6,111,929 | | |

$ | 6,053,269 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | | |

| | |

| Non-interest-bearing Demand Deposits | |

$ | 1,448,467 | | |

$ | 1,463,933 | | |

$ | 1,540,564 | |

| Interest-bearing Demand, Savings, and

Money Market Accounts | |

| 2,984,571 | | |

| 2,918,459 | | |

| 3,056,396 | |

| Time Deposits | |

| 880,519 | | |

| 836,955 | | |

| 582,745 | |

| Total Deposits | |

| 5,313,557 | | |

| 5,219,347 | | |

| 5,179,705 | |

| | |

| | | |

| | | |

| | |

| Borrowings | |

| 166,644 | | |

| 191,810 | | |

| 227,484 | |

| Other Liabilities | |

| 48,901 | | |

| 45,518 | | |

| 43,515 | |

| TOTAL LIABILITIES | |

| 5,529,102 | | |

| 5,456,675 | | |

| 5,450,704 | |

| | |

| | | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Common Stock and Surplus | |

| 420,434 | | |

| 419,520 | | |

| 418,033 | |

| Retained Earnings | |

| 485,256 | | |

| 472,689 | | |

| 433,384 | |

| Accumulated Other

Comprehensive Income (Loss) | |

| (217,869 | ) | |

| (236,955 | ) | |

| (248,852 | ) |

| SHAREHOLDERS’ EQUITY | |

| 687,821 | | |

| 655,254 | | |

| 602,565 | |

| | |

| | | |

| | | |

| | |

| TOTAL LIABILITIES

AND SHAREHOLDERS’ EQUITY | |

$ | 6,216,923 | | |

$ | 6,111,929 | | |

$ | 6,053,269 | |

| | |

| | | |

| | | |

| | |

| END OF PERIOD SHARES OUTSTANDING | |

| 29,679,248 | | |

| 29,669,019 | | |

| 29,572,783 | |

| | |

| | | |

| | | |

| | |

| TANGIBLE

BOOK VALUE PER SHARE (1) | |

$ | 16.97 | | |

$ | 15.82 | | |

$ | 14.01 | |

(1) Tangible

Book Value per Share is defined as Total Shareholders’ Equity less Goodwill and Other Intangible Assets divided by End of Period

Shares Outstanding.

| GERMAN

AMERICAN BANCORP, INC. |

| (unaudited,

dollars in thousands except per share data) |

| |

|

|

|

|

|

|

|

|

|

|

| Consolidated

Statements of Income |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30,

2024 | | |

March 31,

2024 | | |

June 30,

2023 | | |

June 30,

2024 | | |

June 30,

2023 | |

| INTEREST INCOME | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest and Fees on Loans | |

$ | 59,230 | | |

$ | 57,826 | | |

$ | 52,202 | | |

$ | 117,056 | | |

$ | 101,263 | |

| Interest on Short-term Investments | |

| 2,383 | | |

| 299 | | |

| 660 | | |

| 2,682 | | |

| 1,005 | |

| Interest and Dividends

on Investment Securities | |

| 9,964 | | |

| 10,133 | | |

| 10,652 | | |

| 20,097 | | |

| 21,735 | |

| TOTAL INTEREST

INCOME | |

| 71,577 | | |

| 68,258 | | |

| 63,514 | | |

| 139,835 | | |

| 124,003 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| INTEREST EXPENSE | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest on Deposits | |

| 23,385 | | |

| 20,989 | | |

| 13,357 | | |

| 44,374 | | |

| 22,328 | |

| Interest on Borrowings | |

| 2,221 | | |

| 2,275 | | |

| 1,899 | | |

| 4,496 | | |

| 4,408 | |

| TOTAL INTEREST

EXPENSE | |

| 25,606 | | |

| 23,264 | | |

| 15,256 | | |

| 48,870 | | |

| 26,736 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET INTEREST INCOME | |

| 45,971 | | |

| 44,994 | | |

| 48,258 | | |

| 90,965 | | |

| 97,267 | |

| Provision for Credit

Losses | |

| 625 | | |

| 900 | | |

| 550 | | |

| 1,525 | | |

| 1,650 | |

| NET INTEREST

INCOME AFTER PROVISION FOR CREDIT LOSSES | |

| 45,346 | | |

| 44,094 | | |

| 47,708 | | |

| 89,440 | | |

| 95,617 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| NON-INTEREST INCOME | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Gains on Sales of Loans | |

| 969 | | |

| 751 | | |

| 630 | | |

| 1,720 | | |

| 1,217 | |

| Net Gains (Losses) on Securities | |

| (34,893 | ) | |

| 35 | | |

| 38 | | |

| (34,858 | ) | |

| 40 | |

| Other Non-interest

Income | |

| 52,847 | | |

| 15,036 | | |

| 14,228 | | |

| 67,883 | | |

| 28,606 | |

| TOTAL NON-INTEREST

INCOME | |

| 18,923 | | |

| 15,822 | | |

| 14,896 | | |

| 34,745 | | |

| 29,863 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| NON-INTEREST EXPENSE | |

| | | |

| | | |

| | | |

| | | |

| | |

| Salaries and Benefits | |

| 20,957 | | |

| 21,178 | | |

| 20,103 | | |

| 42,135 | | |

| 41,949 | |

| Other Non-interest

Expenses | |

| 16,717 | | |

| 15,560 | | |

| 15,623 | | |

| 32,277 | | |

| 31,393 | |

| TOTAL NON-INTEREST

EXPENSE | |

| 37,674 | | |

| 36,738 | | |

| 35,726 | | |

| 74,412 | | |

| 73,342 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income before Income Taxes | |

| 26,595 | | |

| 23,178 | | |

| 26,878 | | |

| 49,773 | | |

| 52,138 | |

| Income Tax Expense | |

| 6,065 | | |

| 4,156 | | |

| 4,755 | | |

| 10,221 | | |

| 9,208 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET INCOME | |

$ | 20,530 | | |

$ | 19,022 | | |

$ | 22,123 | | |

$ | 39,552 | | |

$ | 42,930 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| BASIC EARNINGS PER SHARE | |

$ | 0.69 | | |

$ | 0.64 | | |

$ | 0.75 | | |

$ | 1.33 | | |

$ | 1.45 | |

| DILUTED EARNINGS PER SHARE | |

$ | 0.69 | | |

$ | 0.64 | | |

$ | 0.75 | | |

$ | 1.33 | | |

$ | 1.45 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE SHARES OUTSTANDING | |

| 29,667,770 | | |

| 29,599,491 | | |

| 29,573,042 | | |

| 29,633,631 | | |

| 29,540,425 | |

| DILUTED WEIGHTED AVERAGE SHARES OUTSTANDING | |

| 29,667,770 | | |

| 29,599,491 | | |

| 29,573,042 | | |

| 29,633,631 | | |

| 29,540,425 | |

GERMAN

AMERICAN BANCORP, INC.

(unaudited,

dollars in thousands except per share data)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30,

2024 | | |

March 31,

2024 | | |

June 30,

2023 | | |

June 30,

2024 | | |

June 30,

2023 | |

| EARNINGS PERFORMANCE RATIOS | |

| | | |

| | | |

| | | |

| | | |

| | |

| Annualized Return on Average

Assets | |

| 1.32 | % | |

| 1.25 | % | |

| 1.47 | % | |

| 1.28 | % | |

| 1.42 | % |

| Annualized Return on Average Equity | |

| 12.64 | % | |

| 11.58 | % | |

| 14.66 | % | |

| 12.11 | % | |

| 14.52 | % |

| Annualized

Return on Average Tangible Equity (1) | |

| 17.67 | % | |

| 16.17 | % | |

| 21.32 | % | |

| 16.92 | % | |

| 21.34 | % |

| Net Interest Margin | |

| 3.34 | % | |

| 3.35 | % | |

| 3.63 | % | |

| 3.34 | % | |

| 3.66 | % |

| Efficiency

Ratio (2) | |

| 36.66 | % | |

| 57.92 | % | |

| 54.08 | % | |

| 44.77 | % | |

| 55.09 | % |

| Net

Overhead Expense to Average Earning Assets (3) | |

| 1.31 | % | |

| 1.50 | % | |

| 1.51 | % | |

| 1.40 | % | |

| 1.57 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| ASSET QUALITY RATIOS | |

| | | |

| | | |

| | | |

| | | |

| | |

| Annualized Net Charge-offs to Average

Loans | |

| 0.04 | % | |

| 0.09 | % | |

| 0.06 | % | |

| 0.07 | % | |

| 0.08 | % |

| Allowance for Credit Losses to Period

End Loans | |

| 1.09 | % | |

| 1.10 | % | |

| 1.16 | % | |

| | | |

| | |

| Non-performing Assets to Period End

Assets | |

| 0.12 | % | |

| 0.16 | % | |

| 0.21 | % | |

| | | |

| | |

| Non-performing Loans to Period End

Loans | |

| 0.18 | % | |

| 0.25 | % | |

| 0.32 | % | |

| | | |

| | |

| Loans 30-89 Days Past Due to Period

End Loans | |

| 0.32 | % | |

| 0.29 | % | |

| 0.29 | % | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| SELECTED BALANCE SHEET &

OTHER FINANCIAL DATA | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average Assets | |

$ | 6,230,676 | | |

$ | 6,102,370 | | |

$ | 6,034,900 | | |

$ | 6,166,523 | | |

$ | 6,056,393 | |

| Average Earning Assets | |

$ | 5,709,014 | | |

$ | 5,590,835 | | |

$ | 5,509,535 | | |

$ | 5,649,925 | | |

$ | 5,529,510 | |

| Average Total Loans | |

$ | 4,022,612 | | |

$ | 3,972,232 | | |

$ | 3,787,436 | | |

$ | 3,997,422 | | |

$ | 3,780,650 | |

| Average Demand Deposits | |

$ | 1,421,710 | | |

$ | 1,426,239 | | |

$ | 1,545,455 | | |

$ | 1,423,975 | | |

$ | 1,590,544 | |

| Average Interest Bearing Liabilities | |

$ | 4,114,351 | | |

$ | 3,973,079 | | |

$ | 3,842,353 | | |

$ | 4,043,715 | | |

$ | 3,829,382 | |

| Average Equity | |

$ | 649,886 | | |

$ | 656,781 | | |

$ | 603,666 | | |

$ | 653,334 | | |

$ | 591,183 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Period

End Non-performing Assets (4) | |

$ | 7,322 | | |

$ | 9,983 | | |

$ | 12,423 | | |

| | | |

| | |

| Period

End Non-performing Loans (5) | |

$ | 7,289 | | |

$ | 9,983 | | |

$ | 12,423 | | |

| | | |

| | |

| Period

End Loans 30-89 Days Past Due (6) | |

$ | 12,766 | | |

$ | 11,485 | | |

$ | 11,045 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tax-Equivalent Net Interest Income | |

$ | 47,497 | | |

$ | 46,639 | | |

$ | 49,848 | | |

$ | 94,136 | | |

$ | 100,554 | |

| Net Charge-offs during Period | |

$ | 433 | | |

$ | 911 | | |

$ | 599 | | |

$ | 1,344 | | |

$ | 1,552 | |

| (1) |

Average Tangible Equity is defined as Average Equity

less Average Goodwill and Other Intangibles. |

| (2) |

Efficiency Ratio is defined as Non-interest Expense

less Intangible Amortization divided by the sum of Net Interest Income, on a tax-equivalent basis, and Non-interest Income less Net

Gains (Losses) on Securities. |

| (3) |

Net Overhead Expense is defined as Total Non-interest

Expense less Total Non-interest Income. |

| (4) |

Non-performing assets are defined as Non-accrual Loans,

Loans Past Due 90 days or more, and Other Real Estate Owned. |

| (5) |

Non-performing loans are defined as Non-accrual Loans

and Loans Past Due 90 days or more. |

| (6) |

Loans 30-89 days past due and still

accruing. |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

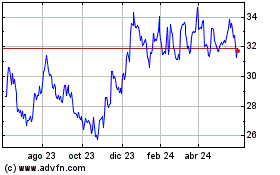

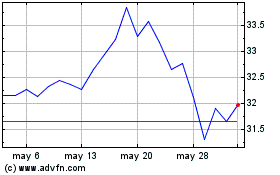

German American Bancorp (NASDAQ:GABC)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

German American Bancorp (NASDAQ:GABC)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024