Gambling.com Group Limited (Nasdaq: GAMB) (“Gambling.com Group”

or the “Company”), a leading provider of digital marketing services

for the global online gambling industry, today reported record

third quarter financial results for the three months ended

September 30, 2023. The Company also reiterated its guidance for

2023 full-year revenue and Adjusted EBITDA.

Three Months Ended September 30, 2023

vs. Three Months Ended September 30, 2022 Financial

Highlights

(USD in thousands, except per share data, unaudited)

Three Months Ended September

30,

Change

2023

2022

%

Revenue

23,458

19,649

19

%

Net income for the period attributable to

shareholders (1)

5,013

2,261

122

%

Net income per share attributable to

shareholders, diluted (1)

0.13

0.06

117

%

Net income margin (1)

21

%

12

%

Adjusted net income for the period

attributable to shareholders (1)(2)

5,407

6,035

(10

)%

Adjusted net income per share attributable

to shareholders, diluted (1)(2)

0.14

0.16

(13

)%

Adjusted EBITDA (1)(2)

6,054

6,413

(6

)%

Adjusted EBITDA Margin (1)(2)

26

%

33

%

Cash flows (used in) generated by

operating activities

(715

)

5,622

(113

)%

Free Cash Flow (2)

1,578

4,896

(68

)%

__________

(1) For the three months ended September

30, 2023, Net income and Net income per share include, and Adjusted

net income and Adjusted net income per share exclude, adjustments

related to the Company's 2022 acquisitions of RotoWire and

BonusFinder of $0.3 million, or $0.01 per share. Similarly, these

adjustments totaled $3.8 million, or $0.11 per share, for the three

months ended September 30, 2022. See “Supplemental Information -

Non-IFRS Financial Measures” and the tables at the end of this

release for an explanation of the adjustments.

(2) Represents a non-IFRS measure. See

“Supplemental Information - Non-IFRS Financial Measures” and the

tables at the end of this release for reconciliations to the

comparable IFRS numbers.

Charles Gillespie, Chief Executive Officer and Co-Founder of

Gambling.com Group, commented, “Our third quarter results highlight

our consistent performance driven by robust organic growth in North

America. Even in what is traditionally a seasonally slow quarter,

we grew new depositing customers 26% to surpass 86,000 which

contributed to 19% revenue growth to $23.5 million, Adjusted EBITDA

of $6.1 million and Free Cash Flow of $1.6 million.

“Third quarter North American revenue of $12.9 million includes

significant growth in our owned assets and a break-out performance

from our media partnerships at the start of the Fall sports season.

Our ability to quickly scale our strategic media partnerships

complements the growth from our influential owned websites. This

results in consistent year-over-year market share gains in existing

states even as we face tougher comparisons given the significant

organic growth we have already achieved. Our strong North American

growth was partially offset by a moderation in our U.K and Ireland

performance following seven consecutive quarters of average revenue

growth of 28% across these well-established markets. We are

confident that our growth opportunities in the U.K. and Ireland

markets will remain strong, including the expected benefit from the

ramping up of our recently launched media partnership with The

Independent for the U.K market.

“Gambling.com Group is expected to continue to benefit from many

near- and long-term opportunities to deliver profitable organic

growth. These include further market share gains in existing

markets, the benefit from expected future expansions of iGaming and

online sports betting in new markets in North America and around

the world, our ability to scale and optimize our media partnerships

and further growth in our more established European markets. We

expect that our ability to leverage these revenue drivers with our

business model, which generates attractive Adjusted EBITDA margins

and strong Free Cash Flow conversion, will continue to increase

shareholder value.”

Third Quarter 2023 and Recent Business

Highlights

- Grew North American revenue 42% to $12.9 million

- Delivered more than 86,000 new depositing customers

- Launched the all new Casinos.com in July

- Successfully launched the Company’s first international media

partnership in July with The Independent in the U.K.

- Successfully launched operations in Kentucky just before the

quarter end on September 28th

Elias Mark, Chief Financial Officer of Gambling.com Group,

added, “Third quarter revenue exceeded expectations and Adjusted

EBITDA was in line with expectations, reflecting the faster than

anticipated acceleration of our North American media partnerships.

We are very pleased with the performance of our media partnerships

and we expect them to continue to be a key contributor to revenue

and cash flow growth going forward. Our year-to-date revenue growth

combined with our disciplined focus on capital efficiency generated

Free Cash Flow for the first nine months of 2023 of $16.3 million,

already exceeding our full-year 2022 level. We remain on track to

deliver strong full year results as our reiterated guidance implies

year-over-year revenue and Adjusted EBITDA growth of more than 30%

and 50%, respectively.”

2023 Outlook

The Company confirmed its full-year 2023 revenue guidance as

follows:

Low

Midpoint

High

FY 2022

Revenue (millions)

100

102

104

76.5

Adjusted EBITDA (millions)

36

38

40

24.1

Adjusted EBITDA Margin

36

%

37

%

38

%

31

%

For 2023, revenue is expected to be between $100 million and

$104 million, which implies organic revenue growth of 31%-36%, and

Adjusted EBITDA is expected to be between $36 million and $40

million.

The Company’s guidance assumes:

- No revenue from any additional North American markets for the

balance of 2023

- No contribution from any new acquisitions

- Ongoing investments through the balance of 2023 for the

development of Casinos.com and to support the Company’s media

partners, including Gannett, McClatchy and The Independent

- An average EUR/USD exchange rate of 1.07 throughout the

remainder of 2023

Nine Months Ended September 30, 2023

vs. Nine Months Ended September 30, 2022 Financial

Highlights

(USD in thousands, except per share data, unaudited)

Nine Months Ended September

30,

Change

2023

2022

%

Revenue

76,122

55,158

38

%

Net income for the period attributable to

shareholders (1)

11,886

6,799

75

%

Net income per share attributable to

shareholders, diluted (1)

0.31

0.18

72

%

Net income margin (1)

16

%

12

%

Adjusted net income for the period

attributable to shareholders (1)(2)

19,493

13,582

44

%

Adjusted net income per share attributable

to shareholders, diluted (1)(2)

0.51

0.36

42

%

Adjusted EBITDA (1)(2)

26,146

17,214

52

%

Adjusted EBITDA Margin (1)(2)

34

%

31

%

Cash flows generated by operating

activities

10,950

12,567

(13

)%

Free Cash Flow (2)

16,306

9,083

80

%

__________

(1) For the nine months ended September

30, 2023, Net income and Net income per share include, and Adjusted

net income and Adjusted net income per share exclude, adjustments

related to the Company's 2022 acquisitions of RotoWire and

BonusFinder of $7.4 million, or $0.20 per share. Similarly, these

adjustments totaled $6.8 million, or $0.19 per share, for the nine

months ended September 30, 2022. See “Supplemental Information -

Non-IFRS Financial Measures” and the tables at the end of this

release for an explanation of the adjustments.

(2) Represents a non-IFRS measure. See

“Supplemental Information - Non-IFRS Financial Measures” and the

tables at the end of this release for reconciliations to the

comparable IFRS numbers.

Conference Call Details

Date/Time:

Wednesday, November 15, 2023, at 4:30 p.m.

ET

Webcast:

https://www.webcast-eqs.com/gamb20231115/en

U.S. Toll-Free Dial In:

877-407-0890

International Dial In:

1 201-389-0918

To access, please dial in approximately 10 minutes before the

start of the call. An archived webcast of the conference call will

also be available in the News & Events section of the Company’s

website at gambling.com/corporate/investors/news-events.

Information contained on the Company’s website is not incorporated

into this press release.

About Gambling.com Group Limited

Gambling.com Group Limited (Nasdaq: GAMB) (the "Group") is a

multi-award-winning performance marketing company and a leading

provider of digital marketing services active in the online

gambling industry. Founded in 2006, the Group has offices globally,

primarily operating in the United States and Ireland. Through its

proprietary technology platform, the Group publishes a portfolio of

premier branded websites including Gambling.com, Bookies.com,

Casinos.com and RotoWire.com. Gambling.com Group owns and operates

more than 50 websites in seven languages across 15 national markets

covering all aspects of the online gambling industry, including

iGaming and sports betting, and the fantasy sports industry.

Use of Non-IFRS Measures

This press release contains certain non-IFRS financial measures,

such as Adjusted Net Income, EBITDA, Adjusted EBITDA, Adjusted

EBITDA Margin, Free Cash Flow, and related ratios. See

“Supplemental Information - Non-IFRS Financial Measures” and the

tables at the end of this release for an explanation of the

adjustments and reconciliations to the comparable IFRS numbers.

Cautionary Note Concerning Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, Section 21E of the Securities Exchange Act of 1934, as

amended, and the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995, that relate to our

current expectations and views of future events. All statements

other than statements of historical facts contained in this press

release, including statements relating to our expectation of

continued growth in the North American market and other established

markets, our ability to scale and optimize our media partnerships,

the expected benefit from the ramp up of our recently launched

media partnership with The Independent for the U.K market, the

expected continuation to benefit from near- and long-term

opportunities to deliver profitable organic growth, whether our

ability to leverage revenue drivers with our business model will

continue to increase shareholder value, and our 2023 outlook, are

all forward-looking statements. These statements represent our

opinions, expectations, beliefs, intentions, estimates or

strategies regarding the future, which may not be realized. In some

cases, you can identify forward-looking statements by terms such as

“believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,”

“should,” “plan,” “expect,” “predict,” “potential,” “could,”

“will,” “would,” “ongoing,” “future” or the negative of these terms

or other similar expressions that are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. Forward-looking

statements are based largely on our current expectations and

projections about future events and financial trends that we

believe may affect our financial condition, results of operations,

business strategy, short-term and long-term business operations and

objectives and financial needs. These forward-looking statements

involve known and unknown risks, uncertainties, contingencies,

changes in circumstances that are difficult to predict and other

important factors that may cause our actual results, performance,

or achievements to be materially and/or significantly different

from any future results, performance or achievements expressed or

implied by the forward-looking statement. Important factors that

could cause actual results to differ materially from our

expectations are discussed under “Item 3. Key Information - Risk

Factors” in Gambling.com Group’s annual report filed on Form 20-F

for the year ended December 31, 2022 with the U.S. Securities and

Exchange Commission (the “SEC”) on March 23, 2023, and Gambling.com

Group’s other filings with the SEC as such factors may be updated

from time to time. Any forward-looking statements contained in this

press release speak only as of the date hereof and accordingly

undue reliance should not be placed on such statements.

Gambling.com Group disclaims any obligation or undertaking to

update or revise any forward-looking statements contained in this

press release, whether as a result of new information, future

events or otherwise, other than to the extent required by

applicable law.

Consolidated Statements of Comprehensive

Income (Loss) (Unaudited) (USD in thousands, except per share

amounts)

The following table details the consolidated statements of

comprehensive income for the three and nine months ended September

30, 2023 and 2022 in the Company's reporting currency and constant

currency.

Reporting Currency

Constant Currency

Reporting Currency

Constant Currency

Three Months Ended September

30,

Change

Change

Nine Months Ended September

30,

Change

Change

2023

2022

%

%

2023

2022

%

%

Revenue

23,458

19,649

19

%

11

%

76,122

55,158

38

%

35

%

Cost of sales

(2,136

)

(605

)

253

%

228

%

(4,023

)

(2,330

)

73

%

69

%

Gross profit

21,322

19,044

12

%

4

%

72,099

52,828

36

%

34

%

Sales and marketing expenses

(8,636

)

(8,523

)

1

%

(6

)%

(25,644

)

(24,339

)

5

%

3

%

Technology expenses

(2,525

)

(1,694

)

49

%

39

%

(7,229

)

(4,556

)

59

%

55

%

General and administrative expenses

(4,831

)

(4,686

)

3

%

(4

)%

(17,297

)

(14,318

)

21

%

18

%

Movements in credit losses allowance

(615

)

(299

)

106

%

91

%

(1,382

)

(898

)

54

%

51

%

Fair value movement on contingent

consideration

—

(3,686

)

(100

)%

(100

)%

(6,939

)

(6,535

)

6

%

4

%

Operating profit

4,715

156

2922

%

2707

%

13,608

2,182

524

%

510

%

Finance income

968

3,093

(69

)%

(71

)%

1,674

7,412

(77

)%

(78

)%

Finance expenses

(373

)

(648

)

(42

)%

(47

)%

(1,356

)

(1,955

)

(31

)%

(32

)%

Income before tax

5,310

2,601

104

%

90

%

13,926

7,639

82

%

78

%

Income tax charge

(297

)

(340

)

(13

)%

(19

)%

(2,040

)

(840

)

143

%

138

%

Net income for the period attributable

to shareholders

5,013

2,261

122

%

106

%

11,886

6,799

75

%

71

%

Other comprehensive income

(loss)

Exchange differences on translating

foreign currencies

(2,777

)

(5,961

)

(53

)%

(57

)%

(2,085

)

(13,888

)

(85

)%

(85

)%

Total comprehensive income (loss) for

the period attributable to shareholders

2,236

(3,700

)

160

%

156

%

9,801

(7,089

)

238

%

235

%

Consolidated Statements of

Financial Position (Unaudited)

(USD in thousands)

SEPTEMBER 30,

2023

DECEMBER 31,

2022

ASSETS

Non-current assets

Property and equipment

823

714

Right-of-use assets

1,557

1,818

Intangible assets

88,505

88,521

Deferred compensation cost

—

29

Deferred tax asset

6,113

5,832

Total non-current assets

96,998

96,914

Current assets

Trade and other receivables

17,600

12,222

Inventories

—

75

Cash and cash equivalents

26,884

29,664

Total current assets

44,484

41,961

Total assets

141,482

138,875

EQUITY AND LIABILITIES

Equity

Share capital

—

—

Capital reserve

74,166

63,723

Treasury shares

(1,107

)

(348

)

Share options and warrants reserve

6,597

4,411

Foreign exchange translation reserve

(9,160

)

(7,075

)

Retained earnings

38,284

26,398

Total equity

108,780

87,109

Non-current liabilities

Other payables

—

290

Deferred consideration

—

4,774

Contingent consideration

—

11,297

Lease liability

1,250

1,518

Deferred tax liability

2,171

2,179

Total non-current liabilities

3,421

20,058

Current liabilities

Trade and other payables

6,655

6,342

Deferred income

2,543

1,692

Deferred consideration

17,882

2,800

Contingent consideration

—

19,378

Other liability

290

226

Lease liability

571

554

Income tax payable

1,340

716

Total current liabilities

29,281

31,708

Total liabilities

32,702

51,766

Total equity and liabilities

141,482

138,875

Consolidated Statements of

Cash Flows (Unaudited)

(USD in thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2022

2023

2022

Cash flow from operating

activities

Income before tax

5,310

2,601

13,926

7,639

Finance income, net

(596

)

(2,445

)

(318

)

(5,457

)

Adjustments for non-cash items:

Depreciation and amortization

495

1,780

1,520

5,558

Movements in credit loss allowance

615

299

1,382

898

Fair value movement on contingent

consideration

—

3,686

6,939

6,535

Share-based payment expense

696

791

2,790

2,400

Warrants repurchased

—

—

—

(800

)

Income tax paid

26

(33

)

(1,763

)

(816

)

Payment of contingent consideration

—

—

(4,621

)

—

Payment of deferred consideration

(2,897

)

—

(2,897

)

—

Cash flows from operating activities

before changes in working capital

3,649

6,679

16,958

15,957

Changes in working capital

Trade and other receivables

(5,235

)

(2,292

)

(7,127

)

(4,931

)

Trade and other payables

858

1,235

1,044

1,541

Inventories

13

—

75

—

Cash flows (used in ) generated by

operating activities

(715

)

5,622

10,950

12,567

Cash flows from investing

activities

Acquisition of property and equipment

(90

)

(108

)

(294

)

(350

)

Acquisition of intangible assets

(514

)

(618

)

(1,868

)

(3,134

)

Acquisition of subsidiaries, net of cash

acquired

—

—

—

(23,411

)

Interest received from bank deposits

90

—

169

—

Payment of deferred consideration

(2,543

)

—

(4,933

)

—

Payment of contingent consideration

—

—

(5,557

)

—

Cash flows used in investing

activities

(3,057

)

(726

)

(12,483

)

(26,895

)

Cash flows from financing

activities

Exercise of share options

106

—

106

—

Treasury shares acquired

—

—

(759

)

—

Interest payment attributable to third

party borrowings

—

(239

)

—

(359

)

Interest payment attributable to deferred

consideration settled

—

—

(110

)

—

Principal paid on lease liability

(105

)

(75

)

(304

)

(240

)

Interest paid on lease liability

(40

)

(47

)

(127

)

(142

)

Cash flows used in financing

activities

(39

)

(361

)

(1,194

)

(741

)

Net movement in cash and cash

equivalents

(3,811

)

4,535

(2,727

)

(15,069

)

Cash and cash equivalents at the

beginning of the period

31,312

31,102

29,664

51,047

Net foreign exchange differences on

cash and cash equivalents

(616

)

(545

)

(53

)

(886

)

Cash and cash equivalents at the end of

the period

26,884

35,092

26,884

35,092

Earnings Per Share

Below is a reconciliation of basic and diluted earnings per

share as presented in the Consolidated Statement of Comprehensive

Income for the period specified, stated in USD thousands, except

per share amounts:

Three Months Ended September

30,

Reporting Currency

Change

Constant Currency

Change

Nine Months Ended September

30,

Reporting Currency

Change

Constant Currency

Change

2023

2022

%

%

2023

2022

%

%

Net income for the period attributable

to shareholders

5,013

2,261

122

%

106

%

11,886

6,799

75

%

71

%

Weighted-average number of ordinary

shares, basic

37,402,935

36,467,299

3

%

3

%

36,988,690

35,613,073

4

%

4

%

Net income per share attributable to

shareholders, basic

0.13

0.06

117

%

86

%

0.32

0.19

68

%

65

%

Net income for the period attributable

to shareholders

5,013

2,261

122

%

106

%

11,886

6,799

75

%

71

%

Weighted-average number of ordinary

shares, diluted

38,711,429

37,289,010

4

%

4

%

38,176,200

37,324,222

2

%

2

%

Net income per share attributable to

shareholders, diluted

0.13

0.06

117

%

86

%

0.31

0.18

72

%

68

%

Supplemental Information

Rounding

We have made rounding adjustments to some of the figures

included in the discussion and analysis of our financial condition

and results of operations together with our consolidated financial

statements and the related notes thereto. Accordingly, numerical

figures shown as totals in some tables may not be an arithmetic

aggregation of the figures that preceded them.

Non-IFRS Financial Measures

Management uses several financial measures, both IFRS and

non-IFRS financial measures in analyzing and assessing the overall

performance of the business and for making operational

decisions.

Adjusted Net Income and Adjusted Net Income Per Share

Adjusted net income is a non-IFRS financial measure defined as

net income attributable to equity holders excluding the fair value

gain or loss related to contingent consideration, unwinding of

deferred consideration, and certain employee bonuses related to

acquisitions. Adjusted net income per diluted share is a non-IFRS

financial measure defined as adjusted net income attributable to

equity holders divided by the diluted weighted average number of

common shares outstanding.

We believe adjusted net income and adjusted net income per

diluted share are useful to our management as a measure of

comparative performance from period to period as these measures

remove the effect of the fair value gain or loss related to the

contingent consideration, unwinding of deferred consideration, and

certain employee bonuses, all associated with our acquisitions,

during the limited period where these items are incurred. We expect

to incur gains or losses related to the contingent consideration

and expenses related to the unwinding of deferred consideration and

employee bonuses until December 2023. See Note 5 of the

consolidated financial statements for the three and nine months

ended September 30, 2023 for a description of the contingent and

deferred considerations associated with our acquisitions.

Below is a reconciliation to Adjusted net income attributable to

equity holders and Adjusted net income per share, diluted from net

income for the period attributable to the equity holders and net

income per share attributed to ordinary shareholders, diluted as

presented in the Consolidated Statements of Comprehensive Income

(Loss) and for the period specified stated in the Company's

reporting currency and constant currency:

Reporting Currency

Constant Currency

Reporting Currency

Constant Currency

Three months ended September

30,

Change

Change

Nine Months Ended September

30,

Change

Change

2023

2022

%

%

2023

2022

%

%

Revenue

23,458

19,649

19

%

11

%

76,122

55,158

38

%

35

%

Net income for the period attributable

to shareholders

5,013

2,261

122

%

106

%

11,886

6,799

75

%

71

%

Net income margin

21

%

12

%

16

%

12

%

Net income for the period attributable

to shareholders

5,013

2,261

122

%

106

%

11,886

6,799

75

%

71

%

Fair value movement on contingent

consideration (1)

—

3,686

(100

)%

(100

)%

6,939

6,535

6

%

4

%

Unwinding of deferred consideration

(1)

316

88

259

%

233

%

425

248

71

%

68

%

Employees' bonuses related to

acquisition(1)

78

—

100

%

100

%

243

—

100

%

100

%

Adjusted net income for the period

attributable to shareholders

5,407

6,035

(10

)%

(17

)%

19,493

13,582

44

%

40

%

Net income per share attributable to

shareholders, basic

0.13

0.06

117

%

86

%

0.32

0.19

68

%

65

%

Effect of adjustments for fair value

movements on contingent consideration, basic

0.00

0.10

(100

)%

(100

)%

0.19

0.18

6

%

—

%

Effect of adjustments for unwinding on

deferred consideration, basic

0.01

0.01

—

%

—

%

0.01

0.01

—

%

—

%

Effect of adjustments for bonuses related

to acquisition, basic

0.00

0.00

—

%

—

%

0.01

0.00

100

%

100

%

Adjusted net income per share

attributable to shareholders, basic

0.14

0.17

(12

)%

(22

)%

0.53

0.38

39

%

36

%

Net income per share attributable to

ordinary shareholders, diluted

0.13

0.06

117

%

86

%

0.31

0.18

72

%

68

%

Adjusted net income per share attributable

to shareholders, diluted

0.14

0.16

(13

)%

(18

)%

0.51

0.36

42

%

38

%

__________

(1) There is no tax impact from fair value

movement on contingent consideration, unwinding of deferred

consideration or employee bonuses related to acquisition.

EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin

EBITDA is a non-IFRS financial measure defined as earnings

excluding interest, income tax (charge) credit, depreciation, and

amortization. Adjusted EBITDA is a non-IFRS financial measure

defined as EBITDA adjusted to exclude the effect of non-recurring

items, significant non-cash items, share-based payment expense,

foreign exchange gains (losses), fair value of contingent

consideration, and other items that our board of directors believes

do not reflect the underlying performance of the business including

acquisition related expenses, such as acquisition related costs and

bonuses. Adjusted EBITDA Margin is a non-IFRS measure defined as

Adjusted EBITDA as a percentage of revenue.

We believe Adjusted EBITDA and Adjusted EBITDA Margin are useful

to our management team as a measure of comparative operating

performance from period to period as those measures remove the

effect of items not directly resulting from our core operations

including effects that are generated by differences in capital

structure, depreciation, tax effects and non-recurring events.

While we use Adjusted EBITDA and Adjusted EBITDA Margin as tools

to enhance our understanding of certain aspects of our financial

performance, we do not believe that Adjusted EBITDA and Adjusted

EBITDA Margin are substitutes for, or superior to, the information

provided by IFRS results. As such, the presentation of Adjusted

EBITDA and Adjusted EBITDA Margin is not intended to be considered

in isolation or as a substitute for any measure prepared in

accordance with IFRS. The primary limitations associated with the

use of Adjusted EBITDA and Adjusted EBITDA Margin as compared to

IFRS results are that Adjusted EBITDA and Adjusted EBITDA Margin as

we define them may not be comparable to similarly titled measures

used by other companies in our industry and that Adjusted EBITDA

and Adjusted EBITDA Margin may exclude financial information that

some investors may consider important in evaluating our

performance.

Below is a reconciliation to EBITDA, Adjusted EBITDA from net

income for the period attributable to shareholders as presented in

the Consolidated Statements of Comprehensive Income and for the

period specified:

Reporting Currency

Constant Currency

Reporting Currency

Constant Currency

Three Months Ended September

30,

Change

Change

Nine Months Ended September

30,

Change

Change

2023

2022

%

%

2023

2022

%

%

(USD in thousands)

(USD in thousands)

Net income for the period attributable

to shareholders

5,013

2,261

122

%

106

%

11,886

6,799

75

%

71

%

Add back (deduct):

Interest expenses on borrowings and lease

liability

40

131

(69

)%

(72

)%

127

496

(74

)%

(75

)%

Income tax charge

297

340

(13

)%

(17

)%

2,040

840

143

%

138

%

Depreciation expense

63

60

5

%

(2

)%

183

147

24

%

22

%

Amortization expense

432

1,720

(75

)%

(77

)%

1,337

5,411

(75

)%

(76

)%

EBITDA

5,845

4,512

30

%

20

%

15,573

13,693

14

%

11

%

Share-based payment expense

696

791

(12

)%

(18

)%

2,790

2,400

16

%

14

%

Fair value movement on contingent

consideration

—

3,686

(100

)%

(100

)%

6,939

6,535

6

%

4

%

Unwinding of deferred consideration

316

88

259

%

233

%

425

248

71

%

67

%

Foreign currency translation losses

(gains), net

(878

)

(2,784

)

(68

)%

(71

)%

(775

)

(6,390

)

(88

)%

(88

)%

Interest income from bank deposits

(90

)

—

100

%

100

%

(169

)

—

100

%

100

%

Other finance results

17

120

(86

)%

(87

)%

74

189

(61

)%

(61

)%

Secondary offering related costs

—

—

—

%

—

%

733

—

100

%

100

%

Acquisition related costs (1)

70

—

100

%

100

%

313

539

(42

)%

(43

)%

Employees' bonuses related to

acquisition

78

—

100

%

100

%

243

—

100

%

100

%

Adjusted EBITDA

6,054

6,413

(6

)%

(12

)%

26,146

17,214

52

%

49

%

__________

(1) The acquisition costs are related to

historical and potential business combinations of the Group.

Below is the Adjusted EBITDA Margin calculation for the period

specified stated in the Company's reporting currency and constant

currency:

Reporting Currency

Constant Currency

Reporting Currency

Constant Currency

Three Months Ended September

30,

Change

Change

Nine Months Ended September

30,

Change

Change

2023

2022

%

%

2023

2022

%

%

(USD in thousands, except

margin)

(in thousands USD, except

margin)

Revenue

23,458

19,649

19

%

11

%

76,122

55,158

38

%

35

%

Adjusted EBITDA

6,054

6,413

(6

)%

(12

)%

26,146

17,214

52

%

49

%

Adjusted EBITDA Margin

26

%

33

%

34

%

31

%

In regard to forward looking non-IFRS guidance, we are not able

to reconcile the forward-looking non-IFRS Adjusted EBITDA measure

to the closest corresponding IFRS measure without unreasonable

efforts because we are unable to predict the ultimate outcome of

certain significant items including, but not limited to, fair value

movements, share-based payments for future awards,

acquisition-related expenses and certain financing and tax

items.

Free Cash Flow

Free Cash Flow is a non-IFRS liquidity financial measure defined

as cash flow from operating activities adjusted for non-recurring

items within operating cash flow less capital expenditures.

We believe Free Cash Flow is useful to our management team as a

measure of financial performance as it measures our ability to

generate additional cash from our operations. While we use Free

Cash Flow as a tool to enhance our understanding of certain aspects

of our financial performance, we do not believe that Free Cash Flow

is a substitute for, or superior to, the information provided by

IFRS metrics. As such, the presentation of Free Cash Flow is not

intended to be considered in isolation or as a substitute for any

measure prepared in accordance with IFRS.

The primary limitation associated with the use of Free Cash Flow

as compared to IFRS metrics is that Free Cash Flow does not

represent residual cash flows available for discretionary

expenditures because the measure does not deduct the payments

required for debt service and other obligations or payments made

for business acquisitions. Free Cash Flow as we define it also may

not be comparable to similarly titled measures used by other

companies in the online gambling affiliate industry.

Below is a reconciliation to Free Cash Flow from cash flows

generated by operating activities as presented in the Consolidated

Statement of Cash Flows for the period specified in the Company's

reporting currency:

Three Months Ended September

30,

Change

Nine Months Ended September

30,

Change

2023

2022

%

2023

2022

%

(in thousands USD,

unaudited)

(USD in thousands,

unaudited)

Cash flows (used in) generated by

operating activities

(715

)

5,622

(113

)%

10,950

12,567

(13

)%

Adjustment for items presented in

operating activities:

Payment of contingent consideration

—

—

—

%

4,621

—

100

%

Payment of deferred consideration

2,897

—

100

%

2,897

—

100

%

Adjustment for items presenting in

investing activities:

Capital Expenditures (1)

(604

)

(726

)

(17

)%

(2,162

)

(3,484

)

38

%

Free Cash Flow

1,578

4,896

(68

)%

16,306

9,083

80

%

__________

(1) Capital expenditures are defined as

the acquisition of property and equipment and the acquisition of

intangible assets, and excludes cash flows related to business

combinations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231115011574/en/

For further information, please contact:

Investors: Peter McGough, Gambling.com Group,

investors@gdcgroup.com Richard Land, Norberto Aja, JCIR,

GAMB@jcir.com, 212-835-8500

Media: Eddie Motl, Gambling.com Group,

media@gdcgroup.com

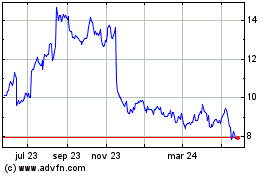

Gambling com (NASDAQ:GAMB)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

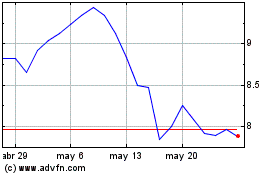

Gambling com (NASDAQ:GAMB)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025