Greene County Bancorp, Inc. (the “Company”) (NASDAQ: GCBC), the

holding company for the Bank of Greene County and its subsidiary

Greene County Commercial Bank, today reported net income for the

three and six months ended December 31, 2024, which is the second

quarter of the Company’s fiscal year ending June 30, 2025. Net

income for the three and six months ended December 31, 2024 was

$7.5 million, or $0.44 per basic and diluted share, and $13.8

million, or $0.81 per basic and diluted share, respectively, as

compared to $5.7 million, or $0.34 per basic and diluted share, and

$12.2 million, or $0.72 per basic and diluted share, for the three

and six months ended December 31, 2023, respectively. Net income

increased $1.6 million, or 12.9%, when comparing the six months

ended December 31, 2024 and 2023.

Highlights:

- Net Income: $13.8 million for the six months ended December 31,

2024

- Total Assets: $2.97 billion at December 31, 2024, a new record

high

- Net Loans: $1.53 billion at December 31, 2024, a new record

high

- Total Deposits $2.47 billion at December 31, 2024

- Return on Average Assets: 0.99% for the six months ended

December 31, 2024

- Return on Average Equity: 12.89% for the six months ended

December 31, 2024

“I am pleased to report another excellent

quarter of financial performance. Net income was $7.5 million for

the three months ended December 31, 2024, an increase of $1.8

million, or 31.2% as compared to net income of $5.7 million for the

three months ended December 31, 2023,” announced Company President

& CEO Donald Gibson. “Second fiscal quarter results reflect

solid performance across our key segments. The growth has been

driven by our talented employees, who are our most valuable

asset.”

Total consolidated assets for the Company were

$2.97 billion at December 31, 2024, primarily consisting of $1.5

billion of net loans and $1.1 billion of total securities

available-for-sale and held-to-maturity. Consolidated deposits

totaled $2.5 billion at December 31, 2024, consisting of retail,

business, municipal and private banking relationships.

Pre-provision net income was $14.9 million for

the six months ended December 31, 2024 as compared to pre-provision

net income of $12.8 million for the six months ended December 31,

2023, an increase of $2.1 million, or 16.1%. Pre-provision net

income measures the Company’s net income less the provision for

credit losses. Management believes that this non-GAAP measure

assists investors in comprehending the impact of the provision for

credit losses on the Company’s reported results, offering an

alternative view of the Company’s performance and the Company’s

ability to generate income in excess of its provision for credit

losses. The Company strategically managed their balance sheet by

focusing on higher-yielding loans and securities, and lowering

deposit rates to align with the Federal Reserve’s recent interest

rate cuts. This resulted in a higher net interest margin for the

three months ended December 31, 2024 as compared to the three

months ended December 31, 2023. The Company will continue to

monitor the Federal Reserve and interest rates paid on deposits,

while maintaining our long-term customer relationships.

Selected highlights for the three and six months

ended December 31, 2024 are as follows:

Net Interest Income and Margin

- Net interest

income increased $1.7 million to $14.1 million for the

three months ended December 31, 2024 from $12.4 million for the

three months ended December 31, 2023. Net interest income increased

$1.4 million to $27.2 million for the six months ended December 31,

2024 from $25.8 million for the six months ended December 31, 2023.

The increase in net interest income was due to an increase in the

average balance of interest-earning assets which increased $204.8

million and $129.8 million when comparing the three and six months

ended December 31, 2024 and 2023, respectively, and increases in

interest rates on interest-earning assets, which increased 26 and

33 basis points when comparing the three and six months ended

December 31, 2024 and 2023, respectively. The increase in net

interest income was offset by increases in the average balance of

interest-bearing liabilities, which increased $202.8 million and

$133.5 million when comparing the three and six months ended

December 31, 2024 and 2023, respectively, and increases in rates

paid on interest-bearing liabilities, which increased 16 and 34

basis points when comparing the three and six months ended December

31, 2024 and 2023, respectively.Average loan balances increased

$68.1 million and $64.3 million and the yield on loans increased 22

basis points and 29 basis points when comparing the three and six

months ended December 31, 2024 and 2023, respectively. The average

balance of securities increased $111.8 million and $62.7 million

and the yield on such securities increased 19 basis points and 42

basis points when comparing the three and six months ended December

31, 2024 and 2023, respectively. Average interest-bearing bank

balances and federal funds increased $24.9 million and $2.7 million

and the yield on interest-bearing bank balances and federal funds

decreased 8 basis points and 2 basis points when comparing the

three and six months ended December 31, 2024 and 2023,

respectively.The cost of NOW deposits increased 5 basis points and

29 basis points, the cost of certificates of deposit increased 37

basis points and 40 basis points, and the cost of savings and money

market deposits increased 11 basis points and 15 basis points when

comparing the three and six months ended December 31, 2024 and

2023, respectively. The increase in the cost of interest-bearing

liabilities was partially due to growth in the average balances of

interest-bearing liabilities of $202.8 million and $133.5 million

when comparing the three and six months ended December 31, 2024 and

2023, respectively. The growth in interest-bearing liabilities was

due to an increase in average NOW deposits of $136.7 million and

$92.2 million, an increase in average certificates of deposits of

$86.2 million and $58.6 million, an increase in average borrowings

of $1.7 million and $13.2 million, partially offset by a decrease

in average savings and money market deposits of $21.8 million and

$30.5 million when comparing the three and six months ended

December 31, 2024 and 2023, respectively. Yields on

interest-earning assets and costs of interest-bearing deposits

increased when comparing the three and six months ended December

31, 2024 and 2023, as the Company continued to reprice assets and

deposits into the higher interest rate environment. During the six

months ended December 31, 2024, the Company implemented a strategic

reduction in deposit rates that aligns with the Federal Reserve’s

rate cuts, while providing competitive financial solutions to the

Company’s customers that reflect the prevailing economic

conditions, while growing new relationships.

- Net interest rate

spread increased 10 basis points to 1.80% for the three

months ended December 31, 2024 compared to 1.70% for the three

months ended December 31, 2023. Net interest rate spread decreased

one basis point to 1.78% for the six months ended December 31,

2024, compared to 1.79% for the six months ended December 31,

2023.

- Net interest margin increased 10 basis points

to 2.04% for the three months ended December 31, 2024, compared to

1.94% for the three months ended December 31, 2023. Net interest

margin increased one basis point to 2.04% for the six months ended

December 31, 2024, compared to 2.03% for the six months ended

December 31, 2023. The increase in net interest rate spread and

margin during the three months ended December 31, 2024, was due to

increases in interest income on loans and securities, as they

continue to reprice at higher yields and the interest rates earned

on new balances were higher than the historic low levels from the

prior periods. This was partially offset by the increase in rates

paid on deposits as compared to the prior period.

- Net interest income on a

taxable-equivalent basis includes the additional amount of

interest income that would have been earned if the Company’s

investment in tax-exempt securities and loans had been subject to

federal and New York State income taxes yielding the same after-tax

income. Tax equivalent net interest margin was 2.31% and 2.19% for

the three months ended December 31, 2024 and 2023, respectively,

and was 2.30% and 2.28% for the six months ended December 31, 2024

and 2023, respectively.

Credit Quality and Provision for Credit Losses

on Loans

- Provision for credit losses

on loans amounted to $505,000 and $183,000 for the three

months ended December 31, 2024 and 2023, respectively, and $1.2

million and $645,000 for the six months ended December 31, 2024 and

2023, respectively. The loan provision for the six months ended

December 31, 2024 was primarily attributable to the increase in

loan volume and updated economic forecasts used in the quantitative

modeling as of December 31, 2024. The allowance for credit losses

on loans to total loans receivable was 1.30% at December 31, 2024

compared to 1.28% at June 30, 2024.

- Loans classified

as substandard and special mention totaled $54.2 million at

December 31, 2024 and $48.6 million at June 30, 2024, an increase

of $5.6 million. The increase in loans classified during the period

ended December 31, 2024 was primarily due to a downgrade of one

commercial loan relationship that was considered to be performing

and paying in accordance with the terms of their loan agreements.

Of the loans classified as substandard or special mention, $49.8

million were performing at December 31, 2024. There were no loans

classified as doubtful or loss at December 31, 2024 or June 30,

2024.

- Net charge-offs on

loans amounted to $95,000 and $123,000 for the three

months ended December 31, 2024 and 2023, respectively, a decrease

of $28,000. Net charge-offs totaled $209,000 and $216,000 for the

six months ended December 31, 2024 and 2023, respectively. There

were no material charge-offs in any loan segment during the three

and six months ended December 31, 2024.

- Nonperforming

loans amounted to $4.1 million at December 31, 2024 and

$3.7 million at June 30, 2024. The activity in nonperforming loans

during the period included $723,000 in loan repayments, $30,000 in

charge-offs or transfers to foreclosure, and $1.2 million of loans

placed into nonperforming status. At December 31, 2024,

nonperforming assets were 0.14% of total assets compared to 0.13%

at June 30, 2024. At December 31, 2024, nonperforming loans were

0.26% of net loans compared to 0.25% at June 30, 2024.

Noninterest Income and Noninterest Expense

- Noninterest income

increased $397,000, or 11.4%, to $3.9 million for the three months

ended December 31, 2024 compared to $3.5 million for the three

months ended December 31, 2023. The increase during the three

months ended December 31, 2024 was primarily due to an increase in

fee income earned on customer interest rate swap contracts of

$153,000 and loan fees of $115,000. Noninterest income increased

$835,000, or 12.3%, to $7.6 million for the six months ended

December 31, 2024 compared to $6.8 million for the six months ended

December 31, 2023. The increase during the six months ended

December 31, 2024 was primarily due to an increase in fee income

earned on customer interest rate swap contracts of $211,000, loan

fees of $174,000 and income from bank owned life insurance (“BOLI”)

of $349,000. During the quarter ended December 31, 2023, the

Company restructured $23.0 million of BOLI contracts, by

surrendering and simultaneously purchasing new higher-yielding

policies.

- Noninterest

expense increased $60,000, or 0.6%, to $9.4 million for

the three months ended December 31, 2024 compared to $9.3 million

for the three months ended December 31, 2023. Noninterest expense

increased $765,000 or 4.2%, to $18.9 million for the six months

ended December 31, 2024 as compared to $18.2 million for the six

months ended December 31, 2023. The increase during the six months

ended December 31, 2024 was primarily due to an increase of

$386,000 in salaries and employee benefit costs, as new positions

were created during the period to support the Company’s continued

growth, an increase of $335,000 in service and data processing fees

and an increase of $392,000 in the allowance for credit losses on

unfunded commitments, due to the Company’s increased contractual

obligations to extend credit. This was partially offset by a

decrease of $223,000 in computer software and support fees due to

vendor price negotiations, and a decrease of $191,000 in legal

expenses during the six months ended December 31, 2024.

Income Taxes

- Provision for income

taxes reflects the expected tax associated with the

pre-tax income generated for the given period and certain

regulatory requirements. The effective tax rate was 7.3% and 6.9%

for the three and six months ended December 31, 2024, and 10.4% and

11.8% for the three and six months ended December 31, 2023,

respectively. The statutory tax rate is impacted by the benefits

derived from tax-exempt bond and loan income, the Company’s real

estate investment trust subsidiary income, and income received on

the bank owned life insurance, to arrive at the effective tax rate.

The decrease in the effective tax rate during the three and six

months ended December 31, 2024 primarily reflects a higher mix of

tax-exempt income from municipal bonds, tax advantage loans, and

bank owned life insurance in proportion to pre-tax income, and

solar investment tax credits earned.

Balance Sheet Summary

- Total assets of

the Company were $2.97 billion at December 31, 2024 and $2.83

billion at June 30, 2024, an increase of $140.0 million, or

5.0%.

- Total cash and cash

equivalents for the Company were $166.4 million at

December 31, 2024 and $190.4 million at June 30, 2024. The Company

has continued to maintain strong capital and liquidity positions as

of December 31, 2024.

- Securities

available-for-sale and held-to-maturity increased $105.0

million, or 10.1%, to $1.1 billion at December 31, 2024 as compared

to $1.0 billion at June 30, 2024. Securities purchases totaled

$274.2 million during the six months ended December 31, 2024, and

consisted primarily of $167.9 million of state and political

subdivision securities, $72.4 million of mortgage-backed

securities, $24.7 million of U.S. Treasury securities, and $9.2

million of collateralized mortgage obligations. Principal pay-downs

and maturities during the six months ended December 31, 2024

amounted to $172.0 million, primarily consisting of $107.8 million

of state and political subdivision securities, $50.0 million of

U.S. Treasury securities, $12.6 million of mortgage-backed

securities, $1.4 million of collateralized mortgage obligations and

$250,000 of corporate debt securities.

- Net loans

receivable increased $51.0 million, or 3.4% to $1.53

billion at December 31, 2024 as compared to $1.48 billion at June

30, 2024. Loan growth experienced during the six months ended

December 31, 2024 consisted primarily of $46.4 million in

commercial real estate loans, $2.6 million in home equity loans,

$1.6 million in commercial loans, and $1.4 million in residential

real estate loans.

- Deposits totaled

$2.5 billion at December 31, 2024 and $2.4 billion at June 30,

2024, an increase of $78.0 million, or 3.3%. The Company had zero

brokered deposits at December 31, 2024 and June 30, 2024,

respectively. NOW deposits increased $75.7 million, or 4.3%, and

certificates of deposits increased $38.3 million, or 27.7%, when

comparing December 31, 2024 and June 30, 2024. Money market

deposits decreased $18.8 million, or 16.6%, noninterest bearing

deposits decreased $13.0 million, or 10.3%, and savings deposits

decreased $4.2 million, or 1.7%, when comparing December 31, 2024

and June 30, 2024.

- Borrowings

amounted to $250.9 million at December 31, 2024 compared to $199.1

million at June 30, 2024, an increase of $51.8 million. At December

31, 2024, borrowings included $194.1 million of overnight

borrowings with the Federal Home Loan Bank of New York (“FHLB”),

$49.8 million of Fixed-to-Floating Rate Subordinated Notes, and

$7.0 million of long-term borrowings with the FHLB.

- Shareholders’

equity increased to $218.4 million at December 31, 2024

compared to $206.0 million at June 30, 2024, resulting primarily

from net income of $13.8 million and a decrease in accumulated

other comprehensive loss of $1.8 million, partially offset by

dividends declared and paid of $3.1 million.

Corporate Overview

Greene County Bancorp, Inc. is the holding

company for the Bank of Greene County, and its subsidiary Greene

County Commercial Bank. The Company is the leading provider of

community-based banking services throughout the Hudson Valley and

Capital Region of New York State. Its customers include

individuals, businesses, municipalities and other institutions.

Greene County Bancorp, Inc. (GCBC) is publicly traded on the Nasdaq

Capital Market and is dedicated to promoting economic development

and a high quality of life in the communities it serves. For more

information on Greene County Bancorp, Inc., visit

www.tbogc.com.

Forward-Looking Statements

This earnings release contains statements about

future events that constitute forward-looking statements, as

defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by references to a

future period or periods or by the use of the words “believe,”

“expect,” “anticipate,” “intend,” “estimate,” “assume,” “will,”

“should,” “could,” “plan,” and other similar terms of expressions.

Forward-looking statements should not be relied on because they

involve known and unknown risks, uncertainties and other factors,

many of which are beyond the Company’s control. These risks,

uncertainties and other factors may cause the actual results,

performance or achievements expressed in, or implied by, the

forward-looking statements to differ materially from those

contemplated by the forward-looking statements. Factors that may

cause such a difference include, but are not limited to, local,

regional, national and international general economic conditions,

including actual or potential stress in the banking industry,

financial and regulatory changes, changes in interest rates,

regulatory considerations, competition, technological developments,

retention and recruitment of qualified personnel, changes in

customer deposit behavior, and market acceptance of the Company’s

pricing, products and services.

The Company cautions readers not to place undue

reliance on any forward-looking statements, which speak only as of

the date made, and advises readers that various factors, including,

but not limited to, those described above and other factors

discussed in the Company’s annual and quarterly reports previously

filed with the Securities and Exchange Commission, could affect the

Company’s financial performance and could cause the Company’s

actual results or circumstances for future periods to differ

materially from those anticipated or projected.

Unless required by law, the Company does not

undertake, and specifically disclaims any obligations to, publicly

release any revisions that may be made to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements.

For more information, please see our reports

filed with the United States Securities and Exchange Commission

(“SEC”), including our most recent annual report on Form 10-K and

quarterly reports on Form 10-Q.

Non-GAAP Measures

In addition to presenting information in

conformity with accounting principles generally accepted in the

United States of America (GAAP), this news release contains

financial information determined by methods other than GAAP

(non-GAAP). The following measures used in this release, which are

commonly utilized by financial institutions, have not been

specifically exempted by the Securities and Exchange Commission

("SEC") and may constitute "non-GAAP financial measures" within the

meaning of the SEC's rules.

The Company has provided in this news release

supplemental disclosures for the calculation of net interest margin

utilizing a fully taxable-equivalent adjustment and pre-provision

net income. Management believes that the non-GAAP financial

measures disclosed by the Company from time to time are useful in

evaluating the Company's performance and that such information

should be considered as supplemental in nature and not as a

substitute for or superior to the related financial information

prepared in accordance with GAAP. Our non-GAAP financial

measures may differ from similar measures presented by other

companies. Refer to the tables on page 9 for Non-GAAP to GAAP

reconciliations.

Greene County Bancorp, Inc.Consolidated

Statements of Income, and Selected Financial Ratios

(Unaudited)

| |

At or for the Three Months |

At or for the Six Months |

| |

Ended December 31, |

Ended December 31, |

|

Dollars in thousands, except share and per share data |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Interest income |

$ |

29,418 |

|

$ |

25,593 |

|

$ |

57,187 |

|

$ |

50,265 |

|

| Interest expense |

|

15,350 |

|

|

13,205 |

|

|

29,983 |

|

|

24,438 |

|

| Net interest income |

|

14,068 |

|

|

12,388 |

|

|

27,204 |

|

|

25,827 |

|

| Provision for credit

losses |

|

478 |

|

|

170 |

|

|

1,112 |

|

|

627 |

|

| Noninterest income |

|

3,875 |

|

|

3,478 |

|

|

7,612 |

|

|

6,777 |

|

| Noninterest expense |

|

9,386 |

|

|

9,326 |

|

|

18,936 |

|

|

18,171 |

|

| Income before taxes |

|

8,079 |

|

|

6,370 |

|

|

14,768 |

|

|

13,806 |

|

| Tax provision |

|

589 |

|

|

663 |

|

|

1,017 |

|

|

1,630 |

|

| Net income |

$ |

7,490 |

|

$ |

5,707 |

|

$ |

13,751 |

|

$ |

12,176 |

|

| |

|

|

|

|

| Basic and diluted EPS |

$ |

0.44 |

|

$ |

0.34 |

|

$ |

0.81 |

|

$ |

0.72 |

|

| Weighted average shares

outstanding |

|

17,026,828 |

|

|

17,026,828 |

|

|

17,026,828 |

|

|

17,026,828 |

|

| Dividends declared per share

(4) |

$ |

0.09 |

|

$ |

0.08 |

|

$ |

0.18 |

|

$ |

0.16 |

|

| |

|

|

|

|

| Selected Financial

Ratios |

|

|

|

|

| Return on average

assets(1) |

|

1.05 |

% |

|

0.86 |

% |

|

0.99 |

% |

|

0.92 |

% |

| Return on average

equity(1) |

|

13.84 |

% |

|

12.12 |

% |

|

12.89 |

% |

|

13.07 |

% |

| Net interest rate

spread(1) |

|

1.80 |

% |

|

1.70 |

% |

|

1.78 |

% |

|

1.79 |

% |

| Net interest margin(1) |

|

2.04 |

% |

|

1.94 |

% |

|

2.04 |

% |

|

2.03 |

% |

| Fully taxable-equivalent net

interest margin(2) |

|

2.31 |

% |

|

2.19 |

% |

|

2.30 |

% |

|

2.28 |

% |

| Efficiency ratio(3) |

|

52.31 |

% |

|

58.78 |

% |

|

54.39 |

% |

|

55.73 |

% |

| Non-performing assets to total

assets |

|

|

|

0.14 |

% |

|

0.22 |

% |

| Non-performing loans to net

loans |

|

|

|

0.26 |

% |

|

0.39 |

% |

| Allowance for credit losses on

loans to non-performing loans |

|

|

|

497.93 |

% |

|

359.58 |

% |

| Allowance for credit losses on

loans to total loans |

|

|

|

1.30 |

% |

|

1.39 |

% |

| Shareholders’ equity to total

assets |

|

|

|

7.37 |

% |

|

7.14 |

% |

| Dividend payout ratio(4) |

|

|

|

22.22 |

% |

|

22.22 |

% |

| Actual dividends paid to net

income(5) |

|

|

|

22.33 |

% |

|

16.35 |

% |

| Book value per share |

|

|

$ |

12.83 |

|

$ |

11.47 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Ratios are annualized when necessary.(2) Interest income

calculated on a taxable-equivalent basis (non-GAAP) includes the

additional interest income that would have been earned if the

Company’s investment in tax-exempt securities and loans had been

subject to federal and New York State income taxes yielding the

same after-tax income. (3) The efficiency ratio has been calculated

as noninterest expense divided by the sum of net interest income

and noninterest income.(4) The dividend payout ratio has been

calculated based on the dividends declared per share divided by

basic earnings per share. No adjustments have been made to account

for dividends waived by Greene County Bancorp, MHC (“MHC”), the

Company’s majority shareholder, owning 54.1% of the shares

outstanding. (5) Dividends declared divided by net income. The MHC

waived its right to receive dividends declared during the three

months ended December 31, 2022, March 31, 2023, June 30, 2023,

December 31, 2023, March 31, 2024 and June 30, 2024. Dividends

declared during the three months ended September 30, 2023,

September 30, 2024, and December 31, 2024 were paid to the

MHC. |

| |

|

|

|

Greene County Bancorp, Inc.Consolidated

Statements of Financial Condition (Unaudited)

| |

AtDecember 31, 2024 |

|

AtJune 30, 2024 |

| Dollars In thousands, except

share data |

|

|

|

|

Assets |

|

|

|

|

Cash and due from banks |

$ |

9,218 |

|

|

$ |

13,897 |

|

| Interest-bearing deposits |

|

157,225 |

|

|

|

176,498 |

|

|

Total cash and cash equivalents |

|

166,443 |

|

|

|

190,395 |

|

| |

|

|

|

| Long term certificate of

deposit |

|

2,577 |

|

|

|

2,831 |

|

| Securities available-for-sale,

at fair value |

|

374,453 |

|

|

|

350,001 |

|

| Securities held-to-maturity,

at amortized cost, net of allowance for credit losses of $439 and

$483 at December 31, 2024 and June 30, 2024 |

|

770,905 |

|

|

|

690,354 |

|

| Equity securities, at fair

value |

|

371 |

|

|

|

328 |

|

| Federal Home Loan Bank stock,

at cost |

|

10,669 |

|

|

|

7,296 |

|

| |

|

|

|

| Loans receivable |

|

1,551,400 |

|

|

|

1,499,473 |

|

| Less: Allowance for credit

losses on loans |

|

(20,191 |

) |

|

|

(19,244 |

) |

| Net loans receivable |

|

1,531,209 |

|

|

|

1,480,229 |

|

| |

|

|

|

| Premises and equipment,

net |

|

15,416 |

|

|

|

15,606 |

|

| Bank owned life insurance |

|

58,535 |

|

|

|

57,249 |

|

| Accrued interest

receivable |

|

16,623 |

|

|

|

14,269 |

|

| Prepaid expenses and other

assets |

|

18,570 |

|

|

|

17,230 |

|

|

Total assets |

$ |

2,965,771 |

|

|

$ |

2,825,788 |

|

| |

|

|

|

|

Liabilities and shareholders’ equity |

|

|

|

|

Noninterest bearing deposits |

$ |

112,470 |

|

|

$ |

125,442 |

|

| Interest bearing deposits |

|

2,354,788 |

|

|

|

2,263,780 |

|

|

Total deposits |

|

2,467,258 |

|

|

|

2,389,222 |

|

| |

|

|

|

| Borrowings, short-term |

|

194,100 |

|

|

|

115,300 |

|

| Borrowings, long-term |

|

6,976 |

|

|

|

34,156 |

|

| Subordinated notes payable,

net |

|

49,774 |

|

|

|

49,681 |

|

| Accrued expenses and other

liabilities |

|

29,214 |

|

|

|

31,429 |

|

|

Total liabilities |

|

2,747,322 |

|

|

|

2,619,788 |

|

| Total shareholders’

equity |

|

218,449 |

|

|

|

206,000 |

|

|

Total liabilities and shareholders’ equity |

$ |

2,965,771 |

|

|

$ |

2,825,788 |

|

| Common shares outstanding |

|

17,026,828 |

|

|

|

17,026,828 |

|

| Treasury shares |

|

195,852 |

|

|

|

195,852 |

|

| |

|

|

|

The above information is preliminary and based on the Company’s

data available at the time of presentation.

Non-GAAP to GAAP

Reconciliations

The following table summarizes the adjustments

made to arrive at the fully taxable-equivalent net interest

margins.

| |

For the three months ended December 31, |

For the six months ended December 31, |

|

(Dollars in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net interest income

(GAAP) |

$ |

14,068 |

|

$ |

12,388 |

|

$ |

27,204 |

|

$ |

25,827 |

|

| Tax-equivalent

adjustment(1) |

|

1,867 |

|

|

1,591 |

|

|

3,579 |

|

|

3,154 |

|

| Net interest income-fully

taxable-equivalent basis (non-GAAP) |

$ |

15,935 |

|

$ |

13,979 |

|

$ |

30,783 |

|

$ |

28,981 |

|

| |

|

|

|

|

| Average interest-earning

assets (GAAP) |

$ |

2,756,263 |

|

$ |

2,551,427 |

|

$ |

2,672,922 |

|

$ |

2,543,172 |

|

| Net interest margin-fully

taxable-equivalent basis (non-GAAP) |

|

2.31 |

% |

|

2.19 |

% |

|

2.30 |

% |

|

2.28 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

(1) Interest income calculated on a

taxable-equivalent basis (non-GAAP) includes the additional

interest income that would have been earned if the Company’s

investment in tax-exempt securities and loans had been subject to

federal and New York State income taxes yielding the same after-tax

income. The rate used for this adjustment was 21% for federal

income taxes for the three and six months ended December 31, 2024

and 2023, 4.44% for New York State income taxes for the three and

six months ended December 31, 2024 and 2023.

The following table summarizes the adjustments

made to arrive at pre-provision net income.

| |

For the three months ended December 31, |

|

(Dollars in thousands) |

|

2024 |

|

|

2023 |

|

| Net income (GAAP) |

$ |

7,490 |

|

$ |

5,707 |

|

| Provision for credit

losses |

|

478 |

|

|

170 |

|

| Pre-provision net income

(non-GAAP) |

$ |

7,968 |

|

$ |

5,877 |

|

| |

For the six months ended December 31, |

|

(Dollars in thousands) |

|

2024 |

|

|

2023 |

|

| Net income (GAAP) |

$ |

13,751 |

|

$ |

12,176 |

|

| Provision for credit

losses |

|

1,112 |

|

|

627 |

|

| Pre-provision net income

(non-GAAP) |

$ |

14,863 |

|

$ |

12,803 |

|

| |

|

|

|

|

|

|

The above information is preliminary and based on the Company’s

data available at the time of presentation.

For Further Information

Contact:Donald E. GibsonPresident & CEO(518)

943-2600donaldg@tbogc.com

Nick BarzeeSVP & CFO(518)

943-2600nickb@tbogc.com

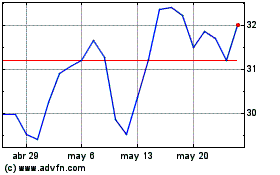

Greene County Bancorp (NASDAQ:GCBC)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

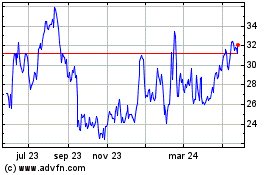

Greene County Bancorp (NASDAQ:GCBC)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025