Garrett Motion Announces Long-Term Capital Allocation Framework, Including New Quarterly Dividend and $250M Share Repurchase Program for 2025

05 Diciembre 2024 - 8:15AM

Garrett Motion Inc. (Nasdaq: GTX) ("Garrett" or the

"Company"), a leading differentiated automotive technology

provider, today announced the adoption of a long-term capital

allocation framework, under which the Company will target returning

75% or more of its Adjusted Free Cash Flow to shareholders over

time through a combination of share repurchases and a regular

quarterly cash dividend. As part of this framework, the Company’s

Board of Directors has approved a new dividend policy, pursuant to

which the Board intends to declare and pay quarterly dividends on

its common stock in an aggregate amount of approximately $50

million in 2025. The Board has declared the first quarter 2025 cash

dividend on the Company’s outstanding common stock of $0.06 per

share payable January 31, 2025, to all common shareholders of

record as of the close of business on January 15, 2025. The Board

has also approved a new share repurchase program for 2025, pursuant

to which the Company may repurchase up to $250 million of its

common stock throughout the course of the year.

“Garrett continues to demonstrate industry-leading free cash

flow generation. Initiating a dividend and launching a new

repurchase program will result in a progressive dividend yield over

time and underscores our commitment to delivering value to

shareholders while strategically investing in technologies that

drive future growth across both our turbo and zero-emission

offerings,” said Garrett President and CEO, Olivier Rabiller.

“These actions align with our long-term capital allocation

strategy, highlighting the strength of our balance sheet and our

confidence in being able to generate strong free cash flow through

industry cycles.”

The long-term capital allocation framework will be supported by

the Company’s flexible cost structure and strong cash generation

capabilities, and is consistent with the Company’s existing capital

allocation priorities, which remain unchanged:

- Investment in Differentiated Technology: The

Company remains committed to balanced R&D investments across

its portfolio, with a continued focus on advancing zero-emissions

solutions while expanding turbo offerings to support anticipated

growth in hybrid vehicles and industrial applications.

- Shareholder Returns: The new quarterly

dividend and repurchase authorization for 2025 build on the $438

million in stock repurchased by the Company since the conversion of

our Series A Preferred Stock through Q3 2024.

- Debt Management: The Company will continue to

prudently manage its leverage and cash interest expense, having

de-levered approximately $400 million since the conversion of our

Series A Preferred Stock.

The Company’s target to return 75% or more of its Adjusted Free

Cash Flow to shareholders is subject to various factors, including

industry and market conditions, the price of the Company’s common

stock, and alternative uses of capital, and actual returns to

shareholders may vary over time. There can be no guarantee as to

the timing of the declaration and payment of any dividends, or the

amount thereof, which is at the discretion of the Board. Moreover,

the new share repurchase plan authorizes management to repurchase

shares at such time and prices as it determines are beneficial to

the Company and its shareholders. Any repurchases of shares will be

made through open market purchases, block trades, or in

privately-negotiated transactions in accordance with applicable

rules and regulations. Under the share repurchase plan, there is no

minimum number of shares that the Company is required to

repurchase, and the Company may suspend or terminate the repurchase

plan at any time.

About Garrett Motion Inc.

Garrett Motion is a differentiated technology leader serving

automotive customers worldwide for nearly 70 years. Known for its

global leadership in turbocharging, the company develops

transformative technologies for vehicles to become cleaner and more

efficient. Its advanced technologies help reduce emissions and

reach zero emissions via passenger and commercial vehicle

applications – for on and off-highway use. Its portfolio includes

turbochargers, electric turbos (E-Turbo) and electric compressors

(E-Compressor) for both ICE and hybrid powertrains. In the

zero-emissions vehicle category, the company offers fuel cell

compressors for hydrogen fuel cell vehicles as well as electric

propulsion and thermal management systems for battery electric

vehicles. Garrett boasts five R&D centers, 13 manufacturing

sites and a team of more than 9000 people located in more than 20

countries. Its mission is to empower the transportation industry to

further advance motion through unique, differentiated innovations.

For more information, please visit www.garrettmotion.com.

Forward-Looking Statements

This press release and related comments by management include

“forward-looking statements” within the meaning of the U.S. federal

securities laws. Forward-looking statements are any statements

other than statements of historical fact and can be identified by

words such as “anticipate,” “believe,” “estimate,” “expect,”

“future,” “goal,” “intend,” “likely,” “may,” “plan,” “project,”

“seek,” “should,” “strategy,” and similar expressions.

Forward-looking statements represent our current judgment about

possible future activities, events, or developments that we

anticipate will or may occur in the future, and relate to, among

other things, our capital allocation plans, including our targeted

capital returns and dividend yields, the implementation of our

dividend policy, including the intention of our Board of Directors

to declare and pay quarterly dividends, our share repurchase

program, plans with respect to future investments, growth

opportunities including with respect to zero-emissions solutions,

turbo offerings, hybrid vehicles and industrial applications, our

cost structure and cash generation abilities, and plans with

respect to our indebtedness. In making these statement, we rely

upon assumptions and analysis based on our experience and

perception of historical trends, current conditions, and expected

future developments, as well as other factors we consider

appropriate under the circumstances. We believe these judgments are

reasonable, but these statements are not guarantees of any future

performance, events, or results, and actual performance, events, or

results may differ materially from those envisaged by our

forward-looking statements due to a variety of important factors,

many of which are described in our most recent Annual Report on

Form 10-K and our other filings with the U.S. Securities and

Exchange Commission, including risks related to our ability to

continue generating strong cash flows, among others. You are

cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date they are made, and we

undertake no obligation to update publicly or otherwise revise any

forward-looking statements, whether as a result of new information,

future events, or other factors that affect the subject of these

statement, except where we are expressly required to do so by

law.

Contacts:

INVESTOR RELATIONSCyril Grandjean+1 734 392 55

04investorrelations@garrettmotion.com

MEDIAAmanda Jones +41 79 601 07

87Amanda.jones@garrettmotion.com

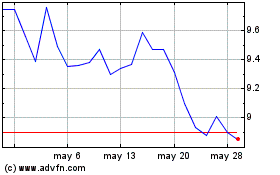

Garrett Motion (NASDAQ:GTX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Garrett Motion (NASDAQ:GTX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024