HomeTrust Announces the Sale of Knoxville Branches to Apex Bank

28 Enero 2025 - 7:00AM

HomeTrust Bancshares, Inc. (NASDAQ: HTBI) (“Company”), the holding

company of HomeTrust Bank (“HomeTrust”), and Apex Bank (“Apex”)

today announced that HomeTrust and Apex have entered into a

definitive purchase and assumption agreement (the “agreement”)

under which Apex will acquire HomeTrust’s two branches in

Knoxville, Tennessee. Under the terms of the agreement, Apex will

acquire the physical locations, related fixed assets, and

substantially all the customer deposit accounts which are currently

estimated at $42 million. HomeTrust will retain the loan accounts

associated with the branches.

“This transaction aligns with our strategic plan

to tighten our geographic footprint, improve our branch

efficiencies, and allocate our capital to support our long-term

growth in other core markets,” said Hunter Westbrook, HomeTrust’s

President and Chief Executive Officer.

Matt Daniels, President and CEO of

Apex Bank said, “Being locally owned and operated, we

are excited to expand our footprint in Knoxville. This

investment will allow us to better serve customers and support

the community. We will continue to look for opportunities to expand

our presence in the area and remain committed to providing

personalized financial solutions that help individuals and

businesses thrive.”

The proposed transaction, which is subject to

customary closing conditions, including approval by applicable

regulatory authorities, is currently anticipated to close in the

second quarter of 2025.

Piper Sandler & Co. served as HomeTrust’s

financial advisor for the transaction, while Silver, Freedman Taff

& Tiernan LLP provided legal counsel. Baker Donelson provided

legal counsel for Apex.

About HomeTrust Bancshares,

Inc.HomeTrust Bancshares, Inc. is the holding company for

HomeTrust Bank. As of December 31, 2024, the Company had assets of

$4.6 billion. The Bank, founded in 1926, is a North Carolina state

chartered, community-focused financial institution committed to

providing value added relationship banking with over 30 locations

as well as online/mobile channels. Locations include: North

Carolina (the Asheville metropolitan area, the “Piedmont” region,

Charlotte, and Raleigh/Cary), South Carolina (Greenville and

Charleston), East Tennessee (Kingsport/Johnson City, Knoxville, and

Morristown), Southwest Virginia (Roanoke Valley) and Georgia

(Greater Atlanta).

About Apex BankApex Bank was

founded in 1931 and is headquartered in Knoxville, Tennessee. Apex

Bank has experienced tremendous growth since 2008, increasing total

assets from $157 million to over $1.35 billion in 2025. The bank

currently has 20 retail locations and a Knoxville-based national

mortgage servicing center. Apex Bank has

consistently been ranked as one of the best-performing

community banks in the nation for the past 16 years, including the

award of Tennessee’s Top Community Bank from Independent Community

Bankers of America and other leading rankings in the financial

industry.

Forward-Looking Statements This

press release may include “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are not statements of historical fact,

but instead are based on certain assumptions including statements

with respect to the Company’s beliefs, plans, objectives, goals,

expectations, assumptions and statements about future economic

performance and projections of financial items. These

forward-looking statements are subject to known and unknown risks,

uncertainties and other factors that could cause actual results to

differ materially from the results anticipated or implied by

forward-looking statements. The factors that could result in

material differentiation include, but are not limited to, the

impact of bank failures or adverse developments involving other

banks and related negative press about the banking industry in

general on investor and depositor sentiment; the remaining effects

of the COVID-19 pandemic on general economic and financial market

conditions and on public health, both nationally and in the

Company’s market areas; natural disasters, including the effects of

Hurricane Helene; expected revenues, cost savings, synergies and

other benefits from merger and acquisition activities might not be

realized to the extent anticipated, within the anticipated time

frames, or at all, costs or difficulties relating to integration

matters, including but not limited to customer and employee

retention, might be greater than expected, and goodwill impairment

charges might be incurred; increased competitive pressures among

financial services companies; changes in the interest rate

environment; changes in general economic conditions, both

nationally and in our market areas; legislative and regulatory

changes; and the effects of inflation, a potential recession, and

other factors described in the Company’s latest Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q and other documents

filed with or furnished to the Securities and Exchange Commission –

which are available on the Company’s website

at www.htb.com and on the SEC’s website

at www.sec.gov. Any of the forward-looking statements that the

Company makes in this press release or in the documents the Company

files with or furnishes to the SEC are based upon management’s

beliefs and assumptions at the time they are made and may turn out

to be wrong because of inaccurate assumptions, the factors

described above or other factors that management cannot foresee.

The Company does not undertake, and specifically disclaims any

obligation, to revise any forward-looking statements to reflect the

occurrence of anticipated or unanticipated events or circumstances

after the date of such statements.

www.htb.comwww.apexbank.com

Contacts:

C. Hunter Westbrook

President & Chief Executive Officer

HomeTrust Bancshares, Inc.

828.365.7084

Santiago Cuccarese

Senior Vice President

Apex Bank

865.248.6789

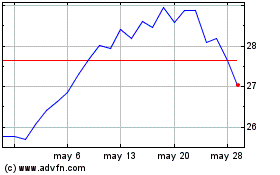

HomeTrust Bancshares (NASDAQ:HTBI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

HomeTrust Bancshares (NASDAQ:HTBI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025