false000083785200008378522024-06-172024-06-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 17, 2024

IDEANOMICS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Nevada | 001-35561 | 20-1778374 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S Employer

Identification No.) |

| | | | | |

114 Broadway, Suite 5116 | |

New York, NY | 10018 |

(Address of Principal Executive Offices) | (Zip Code) |

212-206-1216

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | IDEX | | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

April 25, 2024 Amended and Restated Promissory Note

As previously disclosed on the Company’s December 19, 2022 Form 8-K, on December 13, 2022, the Company promised to pay to the order of Tillou Management and Consulting LLC, a New Jersey Limited Liability Company (the “Noteholder” or “Tillou”), an entity controlled by Vince McMahon, the father of our Executive Chairman, the principal amount of $2,000,000, together with all accrued interest thereon as provided in the promissory note entered into between the Company and the Noteholder dated December 13, 2022 (the “Prior Note”).

On April 25, 2024, the Company executed an Amended and Restated Promissory Note and promised to pay to the order of Tillou the principal amount of $4,137,095 (the “Loan”), together with all accrued interest thereon, as provided in the promissory note entered into between the Company and the Noteholder dated as of April 25, 2024. The Noteholder agreed to make an additional advance to the Company on April 25, 2024 in the principal amount of $1,397,095. The Company further agreed to pay the aggregate unpaid principal amount of the December 13, 2022 Note as well as accrued and unpaid interest, fees, and expenses relating to the Prior Note which were $740,000.

The Company agreed to repay the principal balance of the Loan in weekly installments, commencing on the Initial Payment Date and continuing on the first Business Day of each calendar week thereafter. Each weekly installment shall be in an amount equal to the greater of (x) $250,000 and (y) 100% of the net proceeds received by the Borrower pursuant to the SEPA during the immediately preceding calendar week. For purposes of this Note, (A) the "Initial Payment Date" means the earlier of (I) the first Business Day of the first calendar week immediately following the first date on which the Borrower receives net proceeds under the SEPA (whether in connection with the sale of Shares (as defined in the SEPA) or otherwise) and (II) July 1, 2024, and (B) "SEPA" means the Standby Equity Purchase Agreement dated January 5, 2024 (as amended, restated, supplemented or otherwise modified from time to time) between the Borrower, as company, and YA II PN, LTD., as investor. The principal amount outstanding under this Amended and Restated Promissory Note has an interest rate at a flat rate equal to 16% per annum (the “Interest Rate”). If any amount payable under the Note is not paid when due, such overdue amount shall bear interest at the Interest Rate plus 2%. The Company may prepay the Loan in whole or in part at any time or from time to time without penalty or premium by paying the principal amount to be prepaid together with accrued interest thereon to the date of prepayment. The principal amount of the Note shall become due and payable in the event of a default pursuant to the Note.

May 29, 2024 Amended and Restated Promissory Note

Effective on May 29, 2024, the Company executed an Amended and Restated Promissory Note and promised to pay to the order of Tillou the principal amount of $7,217,095 which includes an additional advance to the Company in the principal amount of $3,000,000. It further includes $4,137,095 (the “Prior Existing Principal Balance”) and $80,000 of accrued unpaid fees and expenses.

The Company agreed to repay the principal balance of the Loan in weekly installments, commencing on the Initial Payment Date and continuing on the first Business Day of each calendar week thereafter. Each weekly installment shall be in an amount equal to the greater of (x) $250,000 and (y) 100% of the net proceeds received by the Borrower pursuant to the SEPA during the immediately preceding calendar week. For purposes of this Note, (A) the "Initial Payment Date" means the earlier of (I) the first Business Day of the first calendar week immediately following the first date on which the Borrower receives net proceeds under the SEPA (whether in connection with the sale of Shares (as defined in the SEPA) or otherwise) and (II) July 1, 2024, and (B) "SEPA" means the Standby Equity Purchase Agreement dated January 5, 2024 (as amended, restated, supplemented or otherwise modified from time to time) between the Borrower, as company, and YA II PN, LTD., as investor. The principal amount outstanding under this Amended and Restated Promissory Note has an interest rate at a flat rate equal to 16% per annum (the “Interest Rate”). If any amount payable under the Note s not paid when due, such overdue amount shall bear interest at the Interest Rate plus 2%. The Company may prepay the Loan in whole or in part at any time or from time to time without penalty or premium by paying the principal amount to be prepaid together with accrued

interest thereon to the date of prepayment. The principal amount of the Note shall become due and payable in the event of a default pursuant to the Note.

April 15, 2024 Amended and Restated SEPA Agreement

On January 10, 2024, Ideanomics entered into a standby equity purchase agreement (SEPA) with YA II PN, LTD. Pursuant to the SEPA, subject to certain conditions, the Company shall have the option, but not the obligation, to sell to YA II, and YA II shall purchase, an aggregate amount of up to 2,500,000 shares of the Company’s common stock, par value $0.001 per share, at the Company’s request any time during the commitment period commencing on the Effective Date and expiring upon the earlier of (i) the first day of the month next following the 24-month anniversary of the Effective Date or (ii) the date on which YA II shall have made payment of Advances (as defined below) for Common Stock equal to 2,500,000 shares. Each advance the Company requests shall not exceed an amount equal to 100% of the daily trading volume of the five trading days immediately preceding an Advance Notice, unless, subject to certain other limitations, both the Company and YA II mutually agree to an increased amount. The shares will be purchased at a purchase price equal to the lowest of the daily VWAPs of the Common Stock during the three consecutive trading days commencing on the date of the Advance Notice, multiplied by 94%.

On April 15, 2024 the standby equity purchase agreement was amended so that the Company shall have the option, but not the obligation, to sell to YA II, and YA II shall purchase, and aggregate amount of up to 10,000,000 shares of the Company's common stock at the Company's request any time during the commitment period as described above.

Item 5.02(e). Compensatory Arrangements of Certain Officers

In relation to the Tillou Promissory Notes, The Company has agreed Mr. Shane McMahon, the Executive Chairman of the Company, is entitled to a grant up to 7,217,095 shares of Common Stock.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| |

| |

| 104 | Cover page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | IDEANOMICS, INC. |

| | |

| | By: | /s/ Alfred P. Poor |

Date: June 17, 2024 | Name: Alfred P. Poor |

| | Title: Chief Executive Officer |

AMENDED AND RESTATED

PROMISSORY NOTE

| | | | | |

| $4,137,095 | New York, NY April 25, 2024 |

FOR VALUE RECEIVED, Ideanomics, Inc., a Nevada Corporation (the "Borrower") hereby unconditionally promises to pay to the order of Tillou Management and Consulting LLC, a New Jersey Limited Liability Company (the "Noteholder"), the principal amount of $4,137,095 (the "Loan"), together with all accrued interest thereon, as provided in this Amended and Restated Promissory Note (this "Note").

1.The Loan.

(a)Prior Funding. The Noteholder has made certain advances to the Borrower under the Prior Note (as defined below) (such advances, the "Prior Advances"). The Borrower acknowledges and agrees that, immediately prior to giving effect to this Note, (i) the outstanding principal balance of the Prior Advances was $2,000,000 (the "Existing Principal Balance"), (ii) the accrued and unpaid interest on the Prior Advances was $440,000 (the "Existing Accrued Interest"), and (iii) the accrued and unpaid fees and expenses relating to the Prior Note was $300,000 (the “Existing Accrued Fees”). The Borrower further acknowledges and agrees that, as of the date hereof, (x) the Existing Principal Balance shall automatically constitute a portion of the principal balance of the Loan (in an amount equal to the Existing Principal Balance), and (y) each of the Existing Accrued Interest and Existing Accrued Fees shall automatically be added to the principal balance of the Loan and shall be treated as principal for all purposes of this Note and shall bear interest. The Prior Advances have been fully funded, and the Borrower acknowledges and agrees that the Noteholder has no obligation to extend any further loan or advance any further funds with respect to the Prior Note.

(b)Funding. Subject to the terms and conditions set forth herein, the Noteholder agrees to make an advance to the Borrower on the date hereof in the principal amount of $1,397,095.

2.Repayment of Loan.

(a)Scheduled Repayment. The Borrower shall repay the principal balance of the Loan in weekly installments, commencing on the Initial Payment Date and continuing on the first Business Day of each calendar week thereafter. Each weekly installment shall be in an amount equal to the greater of (x) $250,000 and (y) 100% of the net proceeds received by the Borrower pursuant to the SEPA during the immediately preceding calendar week. For purposes of this Note, (A) the "Initial Payment Date" means the earlier of (I) the first Business Day of the first calendar week immediately following the first date on which the Borrower receives net proceeds under the SEPA (whether in connection with the sale of Shares (as defined in the SEPA) or otherwise) and (II) July 1, 2024, and (B) "SEPA" means the Standby Equity Purchase Agreement dated January 5, 2024 (as amended, restated, supplemented or otherwise modified from time to time) between the Borrower, as company, and YA II PN, LTD., as investor.

(b)Maturity Date. To the extent not previously paid, the aggregate unpaid principal amount of the Loan, all accrued and unpaid interest thereon, and all other amounts payable under this Note shall be paid in full in cash on January 25, 2025.

3.Interest.

(a)Interest Rate. Except as provided in Section 3(b), the principal amount outstanding under this Note from time to time shall bear interest at a flat rate (the "Interest Rate") equal to sixteen percent (16%) per annum.

(b)Default Interest. If any amount payable hereunder is not paid when due (without regard to any applicable grace period), whether at stated maturity, by acceleration, or otherwise, such overdue amount shall bear interest at the Interest Rate plus two percent (2%).

(c)Interest Rate Limitation. If at any time the Interest Rate payable on the Loan shall exceed the maximum rate of interest permitted under applicable law, such Interest Rate shall be reduced automatically to the maximum rate permitted.

4.Payment Mechanics.

(a)Manner of Payment. All payments of principal and interest shall be made in US dollars no later than 5:00 PM, New York, New York time on the date on which such payment is due. Such payments shall be made by cashier's check, certified check, or wire transfer of immediately available funds to the Noteholder's account at a bank specified by the Noteholder in writing to the Borrower from time to time.

(b)Application of Payments. All payments shall be applied, first, to fees or charges outstanding under this Note, second, to accrued interest, and, third, to principal outstanding under this Note.

(c)Business Day. Whenever any payment hereunder is due on a day that is not a Business Day, such payment shall be made on the next succeeding Business Day, and interest shall be calculated to include such extension. "Business Day" means a day other than Saturday, Sunday, or other day on which commercial banks in New York, NY are authorized or required by law to close.

(d)Evidence of Debt. The Borrower authorizes the Noteholder to record on the grid attached as Exhibit A the Loan made to the Borrower and the date and amount of each payment or prepayment of the Loan. The entries made by the Noteholder shall be prima facie evidence of the existence and amount of the obligations of the Borrower recorded therein in the absence of manifest error. No failure to make any such record, nor any errors in making any such records, shall affect the validity of the Borrower's obligation to repay the unpaid principal of the Loan with interest in accordance with the terms of this Note.

5.Prepayment of Loan.

(a)Voluntary Prepayment. The Borrower may, upon ten (10) days’ prior written notice to the Noteholder, prepay the Loan in whole or in part at any time or from time to time without penalty or premium by paying the principal amount to be prepaid together with accrued interest thereon to the date of prepayment.

(b)Mandatory Prepayment. In the event and on each occasion that any cash proceeds are received in respect of (i) any issuance by the Borrower of any equity interests (other than pursuant to the SEPA), (ii) the receipt by the Borrower of any capital contribution, (iii) the receipt by Borrower or any direct or indirect subsidiary of the Borrower (each, a “Subsidiary”) of any proceeds from the sale of any property or asset of the Borrower or any Subsidiary, (iv) the receipt by Borrower of any dividend or other distribution with respect to any equity interests in any Subsidiary, or (v) the repatriation of any funds from China or elsewhwere, the Borrower shall, as promptly as possible following receipt of such proceeds, apply 100% of such proceeds to the Loan in accordance with Section 4.

6.Pledge Agreement. As collateral for the Borrower’s obligations under this Note, Borrower hereby grants to Lender a security interest in the Collateral as that term is defined and as provided in the Pledge Agreement of even date herewith between the Borrower and the Noteholder (as amended, restated, supplemented or otherwise modified from time to time, the “Pledge Agreement”).

7.Representations and Warranties. The Borrower represents and warrants to the Noteholder to the best of its knowledge as follows:

(a)Existence. The Borrower is a corporation duly incorporated, validly existing, and in good standing under the laws of the state of its organization. The Borrower has the requisite power and authority to own, lease, and operate its property, and to carry on its business.

(b)Compliance with Law. The Borrower is in compliance with all laws, statutes, ordinances, rules, and regulations applicable to or binding on the Borrower, its property, and business.

(c)Power and Authority. The Borrower has the requisite power and authority to execute, deliver, and perform its obligations under this Note.

(d)Authorization; Execution and Delivery. The execution and delivery of this Note by the Borrower and the performance of its obligations hereunder have been duly authorized by all necessary corporate action in accordance with applicable law. The Borrower has duly executed and delivered this Note.

8.Covenants.

(a)Use of Proceeds. The proceeds of the Loan will be used only (i) to repay indebtedness of the Borrower owing to Therese Lee Carabillo, (ii) to pay premiums or other amounts necessary to make the Borrower’s insurance policies (including any and all directors and officers insurance) current and fully binding and effective, (iii) to pay costs, expenses and fees incurred in connection with this Note and the transactions effected hereby, and (iv) for ongoing working capital needs and general corporate purposes of the Borrower not in contravention of any law.

(b)Insurance. The Borrower will maintain, and will cause its Subsidiaries to maintain, with financially sound and reputable insurers, insurance policies and coverage amounts as are customarily maintained by companies engaged in the same or similar businesses operating in the same or similar locations.

(c)Inspections. The Borrower will, and will cause its Subsidiaries to, permit the Noteholder or any of its representatives (including outside auditors), at any times and intervals as the Noteholder determines in its sole discretion, to visit all of its offices, to discuss its financial matters with its officers and independent public accountant (and the Borrower hereby authorizes such independent public accountant to discuss the Borrower’s financial matters with the Noteholder or its representatives whether or not any representative of the Borrower is present) and to examine books or other corporate records (including computer records).

9.Events of Default. The occurrence and continuance of any of the following shall constitute an "Event of Default" hereunder:

(a)Failure to Pay. The Borrower fails to pay (i) any principal amount of the Loan when due; (ii) any interest on the Loan within ten (10) days after the date such amount is due; or (iii) any other amount due hereunder within ten (10) days after such amount is due.

(b)Breach of Representations and Warranties. Any representation or warranty made by the Borrower to the Noteholder herein contains an untrue or misleading statement of a material fact as of the date made; provided, however, no Event of Default shall be deemed to have occurred pursuant to this Section if, within thirty (30) days of the date on which the Borrower receives notice (from any source) of such untrue or misleading statement, Borrower shall have addressed the adverse effects of such untrue or misleading statement to the reasonable satisfaction of the Noteholder.

(c)Breach of a Covenant. The Borrower fails to observe or perform any covenants set forth in Section 8.

(d)Bankruptcy; Insolvency.

(i)The Borrower institutes a voluntary case seeking relief under any law relating to bankruptcy, insolvency, reorganization, or other relief for debtors.

(ii)An involuntary case is commenced seeking the liquidation or reorganization of the Borrower under any law relating to bankruptcy or insolvency, and such case is not dismissed or vacated within sixty (60) days of its filing.

(iii)The Borrower makes a general assignment for the benefit of its creditors.

(iv)The Borrower is unable, or admits in writing its inability, to pay its debts as they become due.

(v)A case is commenced against the Borrower or its assets seeking attachment, execution, or similar process against all or a substantial part of its assets, and such case is not dismissed or vacated within sixty (60) days of its filing.

(e)Failure to Give Notice. The Borrower fails to give the notice of Event of Default specified in Section 9.

(f)Material Adverse Change. There shall occur or be threatened any event, or there shall exist any fact or condition, that could result in any material adverse change in (i) the

business, condition (financial or otherwise), operations, properties or prospects of the Borrower, individually, or the Borrower and its Subsidiaries, taken as a whole, (ii) the binding nature, validity or enforceability of this Note or the Pledge Agreement, (iii) the ability of the Borrower to perform its obligations under this Note or the Pledge Agreement, or (iv) the validity, perfection, priority or enforceability of the Liens granted to Noteholder in respect of the Collateral (as defined in the Pledge Agreement) (any such event, fact or condition, a "Material Adverse Change").

10.Notice of Event of Default. As soon as possible after it becomes aware that an Event of Default has occurred, and in any event within five (5) Business Days, the Borrower shall notify the Noteholder in writing of the nature and extent of such Event of Default and the action, if any, it has taken or proposes to take with respect to such Event of Default.

11.Remedies. Upon the occurrence and during the continuance of an Event of Default, the Noteholder may, at its option, by written notice to the Borrower declare the outstanding principal amount of the Loan, accrued and unpaid interest thereon, and all other amounts payable hereunder immediately due and payable; provided, however, if an Event of Default described in Sections 9(c)(i), 9(c)(ii), 9(c)(iii) or 9(c)(iv) shall occur, the outstanding principal amount, accrued and unpaid interest, and all other amounts payable hereunder shall become immediately due and payable without notice, declaration, or other act on the part of the Noteholder.

12.Expenses. The Borrower shall reimburse the Noteholder on demand for all reasonable and documented out-of-pocket costs, expenses, and fees, including the reasonable fees and expenses of counsel, incurred by the Noteholder in connection with the negotiation, documentation, and execution of this Note and the enforcement of the Noteholder's rights hereunder.

13.Notices. All notices and other communications relating to this Note shall be in writing and shall be deemed given upon the first to occur of (x) deposit with the United States Postal Service or overnight courier service, properly addressed and postage prepaid; (y) transmittal by facsimile or e-mail properly addressed (with written acknowledgment from the intended recipient such as "return receipt requested" function, return e-mail, or other written acknowledgment); or (z) actual receipt by an employee or agent of the other party. Notices hereunder shall be sent to the following addresses, or to such other address as such party shall specify in writing:

(a)If to the Borrower:

1441 Broadway, Suite #5116

New York, NY 10018

Attention: Alf Poor

E-mail: apoor@ideanomics.com

With a copy to:

bwu@ideanomics.com

(b)If to the Noteholder:

c/o Skoller Law LLC

325 Tillou Rd.

South Orange, New Jersey 07079

Attention: Stephen Skoller

Facsimile: 973-763-4057

E-mail: stephen@skollerlaw.com

14.Governing Law. This Note and any claim, controversy, dispute, or cause of action (whether in contract, tort, or otherwise) based on, arising out of, or relating to this Note and the transactions contemplated hereby shall be governed by and construed in accordance with the laws of the State of New York.

15.Disputes.

(a)Submission to Jurisdiction.

(i)The Borrower irrevocably and unconditionally (A) agrees that any action, suit, or proceeding arising from or relating to this Note may be brought in the courts of the State of New York sitting in New York County, and in the United States District Court for the Southern District of New York, and (B) submits to the sole and exclusive jurisdiction of such courts in any such action, suit, or proceeding. Final judgment against the Borrower in any such action, suit, or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law.

(ii)Nothing in this Section shall affect the right of the Noteholder to bring any action, suit, or proceeding relating to this Note against the Borrower or its properties in the courts of any other jurisdiction.

(iii)Nothing in this Section shall affect the right of the Noteholder to serve process upon the Borrower in any manner authorized by the laws of any such jurisdiction.

(b)Venue. The Borrower irrevocably and unconditionally waives, to the fullest extent permitted by law, (i) any objection that it may now or hereafter have to the laying of venue in any action, suit, or proceeding relating to this Note in any court referred to in Section 15(a), and (ii) the defense of inconvenient forum to the maintenance of such action, suit, or proceeding in any such court.

(c)Waiver of Jury Trial. THE BORROWER HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY RELATING TO THIS NOTE OR THE TRANSACTIONS CONTEMPLATED HEREBY, WHETHER BASED ON CONTRACT, TORT, OR ANY OTHER THEORY.

16.Successors and Assigns. This Note may be assigned or transferred by the Noteholder to any individual, corporation, company, limited liability company, trust, joint venture, association, partnership, unincorporated organization, governmental authority, or other entity.

17.Integration. This Note constitutes the entire contract between the Borrower and the Noteholder with respect to the subject matter hereof and supersedes all previous agreements and understandings, oral or written, with respect thereto.

18.Amendments and Waivers. No term of this Note may be waived, modified, or amended, except by an instrument in writing signed by the Borrower and the Noteholder. Any waiver of the terms hereof shall be effective only in the specific instance and for the specific purpose given.

19.No Waiver; Cumulative Remedies. No failure by the Noteholder to exercise and no delay in exercising any right, remedy, or power hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right, remedy, or power hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, or power. The rights, remedies, and powers herein provided are cumulative and not exclusive of any other rights, remedies, or powers provided by law.

20.Severability. If any term or provision of this Note is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability shall not affect any other term or provision of this Note or render such term or provision invalid or unenforceable in any other jurisdiction.

21.Counterparts. This Note and any amendments, waivers, consents, or supplements hereto may be executed in counterparts, each of which shall constitute an original, but all of which taken together shall constitute a single contract. Delivery of an executed counterpart of a signature page to this Note by facsimile or in electronic ("pdf" or "tif") format shall be as effective as delivery of a manually executed counterpart of this Note.

22.Electronic Execution. The words "execution," "signed," "signature," and words of similar import in this Note shall be deemed to include electronic and digital signatures and the keeping of records in electronic form, each of which shall be of the same effect, validity, and enforceability as manually executed signatures and paper-based recordkeeping systems, to the extent and as provided for under applicable law, including the Electronic Signatures in Global and National Commerce Act of 2000 (15 U.S.C. § 7001 et seq.), the Electronic Signatures and Records Act of 1999 (N.Y. State Tech. Law §§ 301-309), and any other similar state laws based on the Uniform Electronic Transactions Act.

23.Amendment and Restatement. This Note amends, restates, and supersedes in its entirety the Note dated March 19, 2023 between the Borrower and the Noteholder (as amended, restated, supplemented or otherwise modified prior to the date hereof, the “Prior Note”), and the outstanding balance of principal, interest, and other charges due under the Prior Note shall now be evidenced by and payable pursuant to this Note. Execution and delivery of this Note is not intended and should not be construed (i) as a repayment or discharge of outstanding principal, interest or other amount due under the Prior Note, (ii) as a novation or release of the obligations of the Borrower or the extinguishment of the indebtedness under the Prior Note, or (iii) to cancel, terminate, or otherwise impair the status or priority of all or any part of any liens or security interests granted to the Noteholder as collateral security for the obligations of the Borrower under or in connection with the Prior Note.

[The remainder of this page is intentionally blank]

WITNESS WHEREOF, the Borrower has executed this Note as of the day and year first above written.

| | | | | |

| IDEANOMICS, INC. By______________________________ Name: Alfred P. Poor Title: Chief Executive Officer |

ACKNOWLEDGED AND ACCEPTED BY: TILLOU MANAGEMENT AND CONSULTING LLC

By______________________________ Name: Stephen Skoller Title: Assistant Treasurer | |

EXHIBIT A

PAYMENTS ON THE LOAN

| | | | | | | | | | | |

| Date | Principal Amount Paid | Unpaid Principal Balance | Name of Person Making Notation |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

AMENDED AND RESTATED

PROMISSORY NOTE

| | | | | |

$*[7,217,095]* | New York, NY May *[29]*, 2024 |

FOR VALUE RECEIVED, Ideanomics, Inc., a Nevada Corporation (the "Borrower") hereby unconditionally promises to pay to the order of Tillou Management and Consulting LLC, a New Jersey Limited Liability Company (the "Noteholder"), the principal amount of $*[7,217,095]* (the "Loan"), together with all accrued interest thereon, as provided in this Amended and Restated Promissory Note (this "Note").

1.The Loan.

(a)Prior Funding. The Noteholder has made certain advances to the Borrower under the Prior Note (as defined below) (such advances, the "Prior Advances"). The Borrower acknowledges and agrees that, immediately prior to giving effect to this Note, the outstanding principal balance of the Prior Advances was $4,137,095 (the "Existing Principal Balance"), and (ii) the accrued and unpaid fees and expenses relating to the Prior Note was $80,000 (the “Existing Accrued Fees”). The Borrower further acknowledges and agrees that, as of the date hereof, (x) the Existing Principal Balance shall automatically constitute a portion of the principal balance of the Loan (in an amount equal to the Existing Principal Balance), and (y) the Existing Accrued Fees shall automatically be added to the principal balance of the Loan and shall be treated as principal for all purposes of this Note and shall bear interest. The Prior Advances have been fully funded, and the Borrower acknowledges and agrees that the Noteholder has no obligation to extend any further loan or advance any further funds with respect to the Prior Note.

(b)Funding. Subject to the terms and conditions set forth herein, the Noteholder agrees to make an advance to the Borrower on the date hereof in the principal amount of $3,000,000.00. The proceeds shall be used in accordance with Exhibit A attached hereto.

2.Repayment of Loan.

(a)Scheduled Repayment. The Borrower shall repay the principal balance of the Loan in weekly installments, commencing on the Initial Payment Date and continuing on the first Business Day of each calendar week thereafter. Each weekly installment shall be in an amount equal to the greater of (x) $250,000 and (y) 100% of the net proceeds received by the Borrower pursuant to the SEPA during the immediately preceding calendar week. For purposes of this Note, (A) the "Initial Payment Date" means the earlier of (I) the first Business Day of the first calendar week immediately following the first date on which the Borrower receives net proceeds under the SEPA (whether in connection with the sale of Shares (as defined in the SEPA) or otherwise) and (II) August 15, 2024, and (B) "SEPA" means the Standby Equity Purchase Agreement dated January 5, 2024 (as amended, restated, supplemented or otherwise modified from time to time) between the Borrower, as company, and YA II PN, LTD., as investor.

(b)Maturity Date. To the extent not previously paid, the aggregate unpaid principal amount of the Loan, all accrued and unpaid interest thereon, and all other amounts payable under this Note shall be paid in full in cash on January 25, 2025.

3.Interest.

(a)Interest Rate. Except as provided in Section 3(b), the principal amount outstanding under this Note from time to time shall bear interest at a flat rate (the "Interest Rate") equal to sixteen percent (16%) per annum.

(b)Default Interest. If any amount payable hereunder is not paid when due (without regard to any applicable grace period), whether at stated maturity, by acceleration, or otherwise, such overdue amount shall bear interest at the Interest Rate plus two percent (2%).

(c)Interest Rate Limitation. If at any time the Interest Rate payable on the Loan shall exceed the maximum rate of interest permitted under applicable law, such Interest Rate shall be reduced automatically to the maximum rate permitted.

4.Payment Mechanics.

(a)Manner of Payment. All payments of principal and interest shall be made in US dollars no later than 5:00 PM, New York, New York time on the date on which such payment is due. Such payments shall be made by cashier's check, certified check, or wire transfer of immediately available funds to the Noteholder's account at a bank specified by the Noteholder in writing to the Borrower from time to time.

(b)Application of Payments. All payments shall be applied, first, to fees or charges outstanding under this Note, second, to accrued interest, and, third, to principal outstanding under this Note.

(c)Business Day. Whenever any payment hereunder is due on a day that is not a Business Day, such payment shall be made on the next succeeding Business Day, and interest shall be calculated to include such extension. "Business Day" means a day other than Saturday, Sunday, or other day on which commercial banks in New York, NY are authorized or required by law to close.

(d)Evidence of Debt. The Borrower authorizes the Noteholder to record on the grid attached as Exhibit A the Loan made to the Borrower and the date and amount of each payment or prepayment of the Loan. The entries made by the Noteholder shall be prima facie evidence of the existence and amount of the obligations of the Borrower recorded therein in the absence of manifest error. No failure to make any such record, nor any errors in making any such records, shall affect the validity of the Borrower's obligation to repay the unpaid principal of the Loan with interest in accordance with the terms of this Note.

5.Prepayment of Loan.

(a)Voluntary Prepayment. The Borrower may, upon ten (10) days’ prior written notice to the Noteholder, prepay the Loan in whole or in part at any time or from time to time without penalty or premium by paying the principal amount to be prepaid together with accrued interest thereon to the date of prepayment.

(b)Mandatory Prepayment. In the event and on each occasion that any cash proceeds are received in respect of (i) any issuance by the Borrower of any equity interests (other than pursuant to the SEPA), (ii) the receipt by the Borrower of any capital contribution, (iii) the receipt by Borrower or any direct or indirect subsidiary of the Borrower (each, a “Subsidiary”) of any proceeds from the sale of any property or asset of the Borrower or any Subsidiary, (iv) the receipt by Borrower of any dividend or other distribution with respect to any equity interests in any Subsidiary, or (v) the repatriation of any funds from China or elsewhwere, the Borrower shall, as promptly as possible following receipt of such proceeds, apply 100% of such proceeds to the Loan in accordance with Section 4.

6.Reaffirmation. Borrower hereby acknowledges, agrees and reaffirms that (a) all obligations under this Note are and continue to be secured by the liens granted to Noteholder pursuant to the Pledge Agreement dated April 25, 2024 (the “Pledge Agreement”) between the Borrower and the Noteholder and any other documents related thereto or hereto and (b) the liens created thereby or thereunder remain in full force and effect.

7.Representations and Warranties. The Borrower represents and warrants to the Noteholder to the best of its knowledge as follows:

(a)Existence. The Borrower is a corporation duly incorporated, validly existing, and in good standing under the laws of the state of its organization. The Borrower has the requisite power and authority to own, lease, and operate its property, and to carry on its business.

(b)Compliance with Law. The Borrower is in compliance with all laws, statutes, ordinances, rules, and regulations applicable to or binding on the Borrower, its property, and business.

(c)Power and Authority. The Borrower has the requisite power and authority to execute, deliver, and perform its obligations under this Note.

(d)Authorization; Execution and Delivery. The execution and delivery of this Note by the Borrower and the performance of its obligations hereunder have been duly authorized by all necessary corporate action in accordance with applicable law. The Borrower has duly executed and delivered this Note.

8.Covenants.

(a)Use of Proceeds. The proceeds of the Loan will be used only (i) in accordance with the payments set forth on Exhibit B, and (ii) to pay premiums or other amounts necessary to make the Borrower’s insurance policies (including any and all directors and officers insurance) current and fully binding and effective. For avoidance of doubt, under no circumstance with the proceeds of the Loan be used to fund any costs or expenses related to any Subsidiaries (including, without limitation, VIA Motors, Energica or Solectrac) or business units other than WAVES.

(b)Insurance. The Borrower will maintain, and will cause its Subsidiaries to maintain, with financially sound and reputable insurers, insurance policies and coverage amounts as are customarily maintained by companies engaged in the same or similar businesses operating in the same or similar locations.

(c)Inspections. The Borrower will, and will cause its Subsidiaries to, permit the Noteholder or any of its representatives (including outside auditors), at any times and intervals as the Noteholder determines in its sole discretion, to visit all of its offices, to discuss its financial matters with its officers and independent public accountant (and the Borrower hereby authorizes such independent public accountant to discuss the Borrower’s financial matters with the Noteholder or its representatives whether or not any representative of the Borrower is present) and to examine books or other corporate records (including computer records).

9.Events of Default. The occurrence and continuance of any of the following shall constitute an "Event of Default" hereunder:

(a)Failure to Pay. The Borrower fails to pay (i) any principal amount of the Loan when due; (ii) any interest on the Loan within ten (10) days after the date such amount is due; or (iii) any other amount due hereunder within ten (10) days after such amount is due.

(b)Breach of Representations and Warranties. Any representation or warranty made by the Borrower to the Noteholder herein contains an untrue or misleading statement of a material fact as of the date made; provided, however, no Event of Default shall be deemed to have occurred pursuant to this Section if, within thirty (30) days of the date on which the Borrower receives notice (from any source) of such untrue or misleading statement, Borrower shall have addressed the adverse effects of such untrue or misleading statement to the reasonable satisfaction of the Noteholder.

(c)Breach of a Covenant. The Borrower fails to observe or perform any covenants set forth in Section 8.

(d)Bankruptcy; Insolvency.

(i)The Borrower institutes a voluntary case seeking relief under any law relating to bankruptcy, insolvency, reorganization, or other relief for debtors.

(ii)An involuntary case is commenced seeking the liquidation or reorganization of the Borrower under any law relating to bankruptcy or insolvency, and such case is not dismissed or vacated within sixty (60) days of its filing.

(iii)The Borrower makes a general assignment for the benefit of its creditors.

(iv)The Borrower is unable, or admits in writing its inability, to pay its debts as they become due.

(v)A case is commenced against the Borrower or its assets seeking attachment, execution, or similar process against all or a substantial part of its assets, and such case is not dismissed or vacated within sixty (60) days of its filing.

(e)Failure to Give Notice. The Borrower fails to give the notice of Event of Default specified in Section 9.

(f)Material Adverse Change. There shall occur or be threatened any event, or there shall exist any fact or condition, that could result in any material adverse change in (i) the

business, condition (financial or otherwise), operations, properties or prospects of the Borrower, individually, or the Borrower and its Subsidiaries, taken as a whole, (ii) the binding nature, validity or enforceability of this Note or the Pledge Agreement, (iii) the ability of the Borrower to perform its obligations under this Note or the Pledge Agreement, or (iv) the validity, perfection, priority or enforceability of the Liens granted to Noteholder in respect of the Collateral (as defined in the Pledge Agreement) (any such event, fact or condition, a "Material Adverse Change").

10.Notice of Event of Default. As soon as possible after it becomes aware that an Event of Default has occurred, and in any event within five (5) Business Days, the Borrower shall notify the Noteholder in writing of the nature and extent of such Event of Default and the action, if any, it has taken or proposes to take with respect to such Event of Default.

11.Remedies. Upon the occurrence and during the continuance of an Event of Default, the Noteholder may, at its option, by written notice to the Borrower declare the outstanding principal amount of the Loan, accrued and unpaid interest thereon, and all other amounts payable hereunder immediately due and payable; provided, however, if an Event of Default described in Sections 9(c)(i), 9(c)(ii), 9(c)(iii) or 9(c)(iv) shall occur, the outstanding principal amount, accrued and unpaid interest, and all other amounts payable hereunder shall become immediately due and payable without notice, declaration, or other act on the part of the Noteholder.

12.Expenses. The Borrower shall reimburse the Noteholder on demand for all reasonable and documented out-of-pocket costs, expenses, and fees, including the reasonable fees and expenses of counsel, incurred by the Noteholder in connection with the negotiation, documentation, and execution of this Note and the enforcement of the Noteholder's rights hereunder.

13.Notices. All notices and other communications relating to this Note shall be in writing and shall be deemed given upon the first to occur of (x) deposit with the United States Postal Service or overnight courier service, properly addressed and postage prepaid; (y) transmittal by facsimile or e-mail properly addressed (with written acknowledgment from the intended recipient such as "return receipt requested" function, return e-mail, or other written acknowledgment); or (z) actual receipt by an employee or agent of the other party. Notices hereunder shall be sent to the following addresses, or to such other address as such party shall specify in writing:

(a)If to the Borrower:

1441 Broadway, Suite #5116

New York, NY 10018

Attention: Alf Poor

E-mail: apoor@ideanomics.com

With a copy to:

bwu@ideanomics.com

(b)If to the Noteholder:

c/o Skoller Law LLC

325 Tillou Rd.

South Orange, New Jersey 07079

Attention: Stephen Skoller

Facsimile: 973-763-4057

E-mail: stephen@skollerlaw.com

14.Governing Law. This Note and any claim, controversy, dispute, or cause of action (whether in contract, tort, or otherwise) based on, arising out of, or relating to this Note and the transactions contemplated hereby shall be governed by and construed in accordance with the laws of the State of New York.

15.Disputes.

(a)Submission to Jurisdiction.

(i)The Borrower irrevocably and unconditionally (A) agrees that any action, suit, or proceeding arising from or relating to this Note may be brought in the courts of the State of New York sitting in New York County, and in the United States District Court for the Southern District of New York, and (B) submits to the sole and exclusive jurisdiction of such courts in any such action, suit, or proceeding. Final judgment against the Borrower in any such action, suit, or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law.

(ii)Nothing in this Section shall affect the right of the Noteholder to bring any action, suit, or proceeding relating to this Note against the Borrower or its properties in the courts of any other jurisdiction.

(iii)Nothing in this Section shall affect the right of the Noteholder to serve process upon the Borrower in any manner authorized by the laws of any such jurisdiction.

(b)Venue. The Borrower irrevocably and unconditionally waives, to the fullest extent permitted by law, (i) any objection that it may now or hereafter have to the laying of venue in any action, suit, or proceeding relating to this Note in any court referred to in Section 15(a), and (ii) the defense of inconvenient forum to the maintenance of such action, suit, or proceeding in any such court.

(c)Waiver of Jury Trial. THE BORROWER HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY RELATING TO THIS NOTE OR THE TRANSACTIONS CONTEMPLATED HEREBY, WHETHER BASED ON CONTRACT, TORT, OR ANY OTHER THEORY.

16.Successors and Assigns. This Note may be assigned or transferred by the Noteholder to any individual, corporation, company, limited liability company, trust, joint venture, association, partnership, unincorporated organization, governmental authority, or other entity.

17.Integration. This Note constitutes the entire contract between the Borrower and the Noteholder with respect to the subject matter hereof and supersedes all previous agreements and understandings, oral or written, with respect thereto.

18.Amendments and Waivers. No term of this Note may be waived, modified, or amended, except by an instrument in writing signed by the Borrower and the Noteholder. Any waiver of the terms hereof shall be effective only in the specific instance and for the specific purpose given.

19.No Waiver; Cumulative Remedies. No failure by the Noteholder to exercise and no delay in exercising any right, remedy, or power hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right, remedy, or power hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, or power. The rights, remedies, and powers herein provided are cumulative and not exclusive of any other rights, remedies, or powers provided by law.

20.Severability. If any term or provision of this Note is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability shall not affect any other term or provision of this Note or render such term or provision invalid or unenforceable in any other jurisdiction.

21.Counterparts. This Note and any amendments, waivers, consents, or supplements hereto may be executed in counterparts, each of which shall constitute an original, but all of which taken together shall constitute a single contract. Delivery of an executed counterpart of a signature page to this Note by facsimile or in electronic ("pdf" or "tif") format shall be as effective as delivery of a manually executed counterpart of this Note.

22.Electronic Execution. The words "execution," "signed," "signature," and words of similar import in this Note shall be deemed to include electronic and digital signatures and the keeping of records in electronic form, each of which shall be of the same effect, validity, and enforceability as manually executed signatures and paper-based recordkeeping systems, to the extent and as provided for under applicable law, including the Electronic Signatures in Global and National Commerce Act of 2000 (15 U.S.C. § 7001 et seq.), the Electronic Signatures and Records Act of 1999 (N.Y. State Tech. Law §§ 301-309), and any other similar state laws based on the Uniform Electronic Transactions Act.

23.Amendment and Restatement. This Note amends, restates, and supersedes in its entirety the Amended and Restated Promissory Note dated April 25, 2024 between the Borrower and the Noteholder (as amended, restated, supplemented or otherwise modified prior to the date hereof, the “Prior Note”), and the outstanding balance of principal, interest, and other charges due under the Prior Note shall now be evidenced by and payable pursuant to this Note. Execution and delivery of this Note is not intended and should not be construed (i) as a repayment or discharge of outstanding principal, interest or other amount due under the Prior Note, (ii) as a novation or release of the obligations of the Borrower or the extinguishment of the indebtedness under the Prior Note, or any liens granted under the Prior Note, Pledge Agreement or any other documents related to the foregoing, or (iii) to cancel, terminate, or otherwise impair the status or priority of all or any part of any liens or security interests granted to the Noteholder as collateral security for the obligations of the Borrower under or in connection with the Prior Note.

[The remainder of this page is intentionally blank]

WITNESS WHEREOF, the Borrower has executed this Note as of the day and year first above written.

| | | | | |

| IDEANOMICS, INC. By______________________________ Name: Alfred P. Poor Title: Chief Executive Officer |

ACKNOWLEDGED AND ACCEPTED BY: TILLOU MANAGEMENT AND CONSULTING LLC

By______________________________ Name: Stephen Skoller Title: Assistant Treasurer | |

EXHIBIT A

PAYMENTS ON THE LOAN

| | | | | | | | | | | |

| Date | Principal Amount Paid | Unpaid Principal Balance | Name of Person Making Notation |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

EXHIBIT B – USE OF PROCEEDS

AMENDMENT TO STANDBY EQUITY PURCHASE AGREEMENT THIS AMENDMENT (the “Amendment”), dated as of April 15, 2024 to the Standby Equity Purchase Agreement (the “SEPA”), dated as of January 5, 2024, by and between YA II PN, Ltd., a Cayman Islands exempted company (the “Investor”), and Ideanomics, Inc., a company incorporated under the laws of the State of Nevada (the “Company”, and together with the Investor, the “Parties”), is being executed at the direction of the Parties. WHEREAS, Section 12.02 of the SEPA permits the Parties to amend the SEPA through an instrument in writing signed by the Parties. NOW, THEREFORE, in consideration of the foregoing and the agreements, provisions and covenants herein contained, the Parties agree as follows: 1. The first paragraph in the recitals of the SEPA is hereby deleted in its entirety and replaced with the following: WHEREAS, the parties desire that, upon the terms and subject to the conditions contained herein, the Company shall have the right to issue and sell to the Investor, from time to time as provided herein, and the Investor shall purchase from the Company, up to 10,000,000 of the Company’s shares of common stock, par value $0.001 per share (the “Common Shares”); and 2. The definition of the term “Commitment Amount” in Article I is hereby deleted in its entirety and replaced with the following: “Commitment Amount” shall mean 10,000,000 Common Shares. [REMAINDER OF PAGE INTENTIONALLY LEFT BLANK] DocuSign Envelope ID: B65A79CF-F42C-4F10-9428-99D41D63FA5C

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed by the undersigned, thereunto duly authorized, as of the date first set forth above. COMPANY: IDEANOMICS, INC. By: Name: Alf Poor Title: CEO INVESTOR: YA II PN, LTD. By: Yorkville Advisors Global, LP Its: Investment Manager By: Yorkville Advisors Global II, LLC Its: General Partner By: Name: Troy Rillo Title: Member DocuSign Envelope ID: B65A79CF-F42C-4F10-9428-99D41D63FA5C

v3.24.1.1.u2

Cover

|

Jun. 17, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 17, 2024

|

| Entity Registrant Name |

IDEANOMICS, INC.

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-35561

|

| Entity Tax Identification Number |

20-1778374

|

| Entity Address, Address Line One |

114 Broadway

|

| Entity Address, Address Line Two |

Suite 5116

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10018

|

| City Area Code |

212

|

| Local Phone Number |

206-1216

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

IDEX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000837852

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

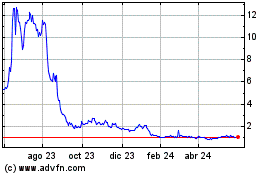

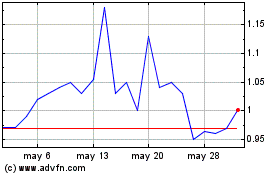

Ideanomics (NASDAQ:IDEX)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Ideanomics (NASDAQ:IDEX)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024