false

0001857044

0001857044

2024-05-08

2024-05-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) May 8, 2024

INDAPTUS

THERAPEUTICS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40652 |

|

86-3158720 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

3

Columbus Circle 15th Floor

New York, New York |

|

10019 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(646)

427-2727

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, $0.01 par value |

|

INDP |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

2.02. | Results

of Operations and Financial Condition. |

On

May 8, 2024, Indaptus Therapeutics, Inc. (the “Company”) issued a press release announcing its financial results for the

quarter ended March 31, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and

is incorporated herein by reference.

The

information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended,

or the Exchange Act, except as expressly set forth by specific reference in such filing.

| Item

9.01. | Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

May 8, 2024

| |

INDAPTUS

THERAPEUTICS, INC. |

| |

|

| |

By:

|

/s/

Nir Sassi |

| |

Name:

|

Nir

Sassi |

| |

Title:

|

Chief

Financial Officer |

Exhibit

99.1

Indaptus

Therapeutics Reports First Quarter 2024 Financial Results and Provides Corporate Update

Company

to present poster at American Society of Clinical Oncology (ASCO) Annual Meeting on June 1, 2024 highlighting initial results from its

Phase 1 clinical trial of Decoy20

NEW

YORK (May 8, 2024) - Indaptus Therapeutics, Inc. (Nasdaq: INDP) (“Indaptus” or the “Company”), a clinical

stage biotechnology company dedicated to pioneering innovative cancer and viral infection treatments, today announced financial results

for the first quarter ended March 31, 2024, and provided a corporate update.

Jeffrey

Meckler, Chief Executive Officer of Indaptus, commented, “We continue to make steady progress in our clinical development plans

and are receiving regular validation for results reported to date, both through a presentation in April at the American Association for

Cancer Research (AACR) annual meeting, and the acceptance of further data to be presented in a poster at the American Society of Clinical

Oncology (ASCO) annual meeting, which is considered among the top annual oncology conferences. We are encouraged by the results we have

reported, along with the early results we are seeing as we advance our trial, and believe they are indicative of the potential for Decoy20,

and indeed our platform as a whole. We look forward to reporting more about our progress as it develops.”

Key

recent highlights:

| ● | Presenting

poster, titled, “Preliminary results of a phase 1 study of Decoy20, an intravenous,

killed, multiple immune receptor agonist bacterial product in patients with advanced solid

tumors,” at the American Society of Clinical Oncology annual meeting on June 1, 2024,

in Chicago. |

| ● | Presented

poster outlining mechanism of action of Decoy platform at the American Association for Cancer

Research Annual Meeting in April 2024. |

| ● | Reported

preliminary positive results from second cohort of Phase 1 trial and initiated multi-dose

cohort in March 2024. |

| ● | Announced

granting of key patent that helped to further expand intellectual property portfolio in January

2024. |

Financial

Highlights for First Quarter ended March 31, 2024

Research

and development expenses for the three-month period ended March 31, 2024, were $1.6 million, a decrease of $0.3 million, or 15%, compared

with $1.9 million in the three-month period ended March 31, 2023. The decrease was primarily due to the manufacturing processes of Decoy20

that were conducted in the three months period ended March 31, 2023.

General

and administrative expenses for the three-month period ended March 31, 2024, were $2.4 million, a decrease of $0.2 million, or 9%, compared

with $2.6 million in the three-month period ended March 31, 2023. The decrease was primarily due to decreased legal fees, recruitment

costs and directors’ and officers’ insurance expenses, and was offset by an increase in payroll and related expenses and

investor relations expenses.

Loss

per share for the three-month period ended March 31, 2024 was $0.45, compared with $0.51 for the three-month period ended March 31, 2023.

As

of March 31, 2024, the Company had cash and cash equivalents of $9.7 million. As of December 31, 2023, the Company had cash and cash

equivalents of $13.4 million. The Company expects that its current cash and cash equivalents will support its ongoing operating activities

through the third quarter of 2024. This cash runway guidance is based on the Company’s current operational plans and excludes any

additional funding and any business development activities that may be undertaken. Indaptus continues to assess all financing options

that would support its corporate strategy.

Net

cash used in operating activities was $3.9 million for the three-month period ended March 31, 2024, compared with net cash used in operating

activities of $4.9 million for the three-month period ended March 31, 2023. The $1.0 million decrease in net cash used was primarily

attributable to a decrease in our research and development and general and administrative expenses and was also attributable to a settlement

fee that was paid in February 2023.

There

was no net cash provided by or used in investing activities in the three months ended March 31, 2024. Net cash provided by investing

activities was approximately $2.1 million for the three months ended March 31, 2023, which was related to the maturity of $9.0 million

in marketable securities, offset by net investment of approximately $6.9 million in marketable securities.

Net

cash provided by financing activities for the three months ended March 31, 2024 was approximately $0.3 million, which was provided by

issuance and sale of our common stock under the At The Market Offering Agreement. There was no net cash provided by or used in financing

activities in the three months ended March 31, 2023.

About

Indaptus Therapeutics

Indaptus

Therapeutics has evolved from more than a century of immunotherapy advances. The Company’s novel approach is based on the hypothesis

that efficient activation of both innate and adaptive immune cells and pathways and associated anti-tumor and anti-viral immune responses

will require a multi-targeted package of immune system-activating signals that can be administered safely intravenously (i.v.). Indaptus’

patented technology is composed of single strains of attenuated and killed, non-pathogenic, Gram-negative bacteria producing a multiple

Toll-like receptor (TLR), Nucleotide oligomerization domain (NOD)-like receptor (NLR) and Stimulator of interferon genes (STING) agonist

Decoy platform. The product candidates are designed to have reduced i.v. toxicity, but largely uncompromised ability to prime or activate

many of the cells and pathways of innate and adaptive immunity. Decoy product candidates represent an antigen-agnostic technology that

have produced single-agent activity against metastatic pancreatic and orthotopic colorectal carcinomas, single agent eradication of established

antigen-expressing breast carcinoma, as well as combination-mediated eradication of established hepatocellular carcinomas, pancreatic

and non-Hodgkin’s lymphomas in standard pre-clinical models, including syngeneic mouse tumors and human tumor xenografts. In pre-clinical

studies tumor eradication was observed with Decoy product candidates in combination with anti-PD-1 checkpoint therapy, low-dose chemotherapy,

a non-steroidal anti-inflammatory drug, or an approved, targeted antibody. Combination-based tumor eradication in pre-clinical models

produced innate and adaptive immunological memory, involved activation of both innate and adaptive immune cells, and was associated with

induction of innate and adaptive immune pathways in tumors after only one i.v. dose of Decoy product, with associated “cold”

to “hot” tumor inflammation signature transition. IND-enabling, nonclinical toxicology studies demonstrated i.v. administration

without sustained induction of hallmark biomarkers of cytokine release syndromes, possibly due to passive targeting to liver, spleen,

and tumor, followed by rapid elimination of the product. Indaptus’ Decoy product candidates have also produced significant single

agent activity against chronic hepatitis B virus (HBV) and chronic human immunodeficiency virus (HIV) infections in pre-clinical models.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act. These include statements

regarding management’s expectations, beliefs and intentions regarding, among other things: our expectations and plans regarding

our Phase 1 clinical trial of Decoy20, including the timing and design thereof; the anticipated effects of our product candidates, including

Decoy20; the plans and objectives of management for future operations; our research and development activities and costs; the sufficiency

of our cash and cash equivalents to fund our ongoing activities and our cash management strategy; and our assessment of financing options

to support our corporate strategy. Forward-looking statements can be identified by the use of forward-looking words such as “believe”,

“expect”, “intend”, “plan”, “may”, “should”, “could”, “might”,

“seek”, “target”, “will”, “project”, “forecast”, “continue” or

“anticipate” or their negatives or variations of these words or other comparable words or by the fact that these statements

do not relate strictly to historical matters. Because forward-looking statements relate to matters that have not yet occurred, these

statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future

results expressed or implied by the forward-looking statements. Many factors could cause actual activities or results to differ materially

from the activities and results anticipated in forward-looking statements, including, but not limited to the following: our limited operating

history; conditions and events that raise substantial doubt regarding our ability to continue as going concern; the need for, and our

ability to raise, additional capital given our lack of current cash flow; our clinical and preclinical development, which involves a

lengthy and expensive process with an uncertain outcome; our incurrence of significant research and development expenses and other operating

expenses, which may make it difficult for us to attain profitability; our pursuit of a limited number of research programs, product candidates

and specific indications and failure to capitalize on product candidates or indications that may be more profitable or have a greater

likelihood of success; our ability to obtain and maintain regulatory approval of any product candidate; the market acceptance of our

product candidates; our reliance on third parties to conduct our preclinical studies and clinical trials and perform other tasks; our

reliance on third parties for the manufacture of our product candidates during clinical development; our ability to successfully commercialize

Decoy20 or any future product candidates; our ability to obtain or maintain coverage and adequate reimbursement for our products; the

impact of legislation and healthcare reform measures on our ability to obtain marketing approval for and commercialize Decoy20 and any

future product candidates; product candidates of our competitors that may be approved faster, marketed more effectively, and better tolerated

than our product candidates; our ability to adequately protect our proprietary or licensed technology in the marketplace; the impact

of, and costs of complying with healthcare laws and regulations, and our failure to comply with such laws and regulations; information

technology system failures, cyberattacks or deficiencies in our cybersecurity; and unfavorable global economic conditions. These and

other important factors discussed under the caption “Risk Factors” included in our Quarterly Report on Form 10-Q for the

quarter ended March 31, 2024 to be filed with the SEC, our most recent Annual Report on Form 10-K filed with the SEC on March 13, 2024,

and our other filings with the SEC, could cause actual results to differ materially from those indicated by the forward-looking statements

made in this press release. All forward-looking statements speak only as of the date of this press release and are expressly qualified

in their entirety by the cautionary statements included in this press release. We undertake no obligation to update or revise forward-looking

statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, except

as required by applicable law.

Contact:

investors@indaptusrx.com

Investor

Relations Contact:

CORE

IR

Louie

Toma

louie@coreir.com

Media

Contact:

CORE

IR

Jules

Abraham

julesa@coreir.com

INDAPTUS

THERAPEUTICS, INC.

Unaudited

Condensed Consolidated Balance Sheets

| | |

March 31, 2024 | | |

December 31, 2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 9,741,638 | | |

$ | 13,362,053 | |

| Prepaid expenses and other current assets | |

| 551,031 | | |

| 633,156 | |

| | |

| | | |

| | |

| Total current assets | |

| 10,292,669 | | |

| 13,995,209 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| Property and equipment, net | |

| - | | |

| 735 | |

| Right-of-use asset | |

| 151,118 | | |

| 173,206 | |

| Other assets | |

| 504,728 | | |

| 754,728 | |

| | |

| | | |

| | |

| Total non-current assets | |

| 655,846 | | |

| 928,669 | |

| | |

| | | |

| | |

| Total assets | |

$ | 10,948,515 | | |

$ | 14,923,878 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and other current liabilities | |

$ | 1,434,828 | | |

$ | 2,672,327 | |

| Operating lease liability, current portion | |

| 102,464 | | |

| 101,705 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 1,537,292 | | |

| 2,774,032 | |

| | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | |

| Operating lease liability, net of current portion | |

| 50,664 | | |

| 73,348 | |

| | |

| | | |

| | |

| Total non-current liabilities | |

| 50,664 | | |

| 73,348 | |

| | |

| | | |

| | |

| Total liabilities | |

| 1,587,956 | | |

| 2,847,380 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock: $0.01 par value, 200,000,000 shares authorized as of March 31, 2024 and December 31, 2023; 8,538,883 shares issued and outstanding as of March 31, 2024 and 8,401,047 shares issued and outstanding as of December 31, 2023 | |

| 85,389 | | |

| 84,011 | |

| Additional paid in capital | |

| 58,499,003 | | |

| 57,409,643 | |

| Accumulated deficit | |

| (49,223,833 | ) | |

| (45,417,156 | ) |

| | |

| | | |

| | |

| Total stockholders’ equity | |

| 9,360,559 | | |

| 12,076,498 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 10,948,515 | | |

$ | 14,923,878 | |

Unaudited

Condensed Consolidated Statements of Operations and Comprehensive Loss

| | |

Three Months

Ended March 31, | |

| | |

2024 | | |

2023 | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

$ | 1,591,142 | | |

$ | 1,879,900 | |

| General and administrative | |

| 2,352,097 | | |

| 2,575,266 | |

| | |

| | | |

| | |

| Total operating expenses | |

| 3,943,239 | | |

| 4,455,166 | |

| | |

| | | |

| | |

| Loss from operations | |

| (3,943,239 | ) | |

| (4,455,166 | ) |

| | |

| | | |

| | |

| Other income, net | |

| 136,562 | | |

| 201,928 | |

| | |

| | | |

| | |

| Net loss | |

$ | (3,806,677 | ) | |

$ | (4,253,238 | ) |

| | |

| | | |

| | |

| Net loss available to common stockholders per share of common stock, basic and diluted | |

$ | (0.45 | ) | |

$ | (0.51 | ) |

| | |

| | | |

| | |

| Weighted average number of shares used in calculating net loss per share, basic and diluted | |

| 8,442,364 | | |

| 8,401,047 | |

| Net loss | |

$ | (3,806,677 | ) | |

$ | (4,253,238 | ) |

| Other comprehensive income: | |

| | | |

| | |

| Reclassification adjustment for interest earned on marketable securities included in net loss | |

| - | | |

| (129,229 | ) |

| Change in unrealized gain on marketable securities | |

| - | | |

| 210,252 | |

| Comprehensive loss | |

$ | (3,806,677 | ) | |

$ | (4,172,215 | ) |

Unaudited

Condensed Consolidated Statements of Cash Flows

| | |

For the three months | |

| | |

ended March 31, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (3,806,677 | ) | |

$ | (4,253,238 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation | |

| 735 | | |

| 321 | |

| Stock-based compensation | |

| 774,691 | | |

| 727,144 | |

| Interest earned on marketable securities | |

| - | | |

| (129,229 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses and other assets | |

| 332,125 | | |

| 324,205 | |

| Accounts payable and other current liabilities | |

| (1,237,499 | ) | |

| (1,630,225 | ) |

| Operating lease right-of-use asset and liability, net | |

| 163 | | |

| (1,200 | ) |

| Net cash used in operating activities | |

| (3,936,462 | ) | |

| (4,962,222 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Maturity of marketable securities | |

| - | | |

| 9,000,000 | |

| Purchase of marketable securities | |

| - | | |

| (6,859,432 | ) |

| Net cash provided by investing activities | |

| - | | |

| 2,140,568 | |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| - | |

| Issuance of shares of common stock | |

| 336,044 | | |

| | |

| Issuance costs | |

| (19,997 | ) | |

| - | |

| Net cash provided by financing activities | |

| 316,047 | | |

| - | |

| | |

| | | |

| | |

| Net decrease in cash and cash equivalents | |

| (3,620,415 | ) | |

| (2,821,654 | ) |

| | |

| | | |

| | |

| Cash and cash equivalents at beginning of period | |

| 13,362,053 | | |

| 9,626,800 | |

| | |

| | | |

| | |

| Cash and cash equivalents at end of period | |

$ | 9,741,638 | | |

$ | 6,805,146 | |

| | |

| | | |

| | |

| Noncash investing and financing activities | |

| | | |

| | |

| Change in accumulated other comprehensive income | |

$ | - | | |

$ | 81,023 | |

| ASC 842 lease renewal option exercise | |

$ | - | | |

$ | 236,506 | |

| Reclassification of security deposit | |

$ | - | | |

$ | 16,477 | |

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

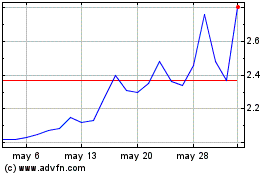

Indaptus Therapeutics (NASDAQ:INDP)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Indaptus Therapeutics (NASDAQ:INDP)

Gráfica de Acción Histórica

De May 2023 a May 2024