false

0001728328

A1

0001728328

2024-11-01

2024-11-01

0001728328

dei:FormerAddressMember

2024-11-01

2024-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 1, 2024

INMED PHARMACEUTICALS

INC.

(Exact Name of Company as Specified in Charter)

| British Columbia |

|

001-39685 |

|

98-1428279 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

InMed Pharmaceuticals Inc.

1445, 885 West Georgia St.

Vancouver, B.C.

Canada |

|

V6C 1B4 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Company’s telephone number, including

area code: (604) 669-7207

Not applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Shares, no par value |

|

INM |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

As previously reported

by InMed Pharmaceuticals Inc. (the “Company”) on its Current Report on Form 8-K, on September 17, 2024, the Listing Qualifications

Department (the “Nasdaq Staff”) of the Nasdaq Stock Market (“Nasdaq”) issued a determination to the Company, which

was communicated through a delisting notice (the “Delisting Notice”), indicating that the Company did not satisfy the minimum

$1.00 bid price per share requirement for the continued listing on Nasdaq, as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum

Bid Price Rule”) by September 16, 2024. The Company subsequently timely requested a hearing (the “Hearing”) before the

Nasdaq Listing Qualifications Panel (the “Panel”) to appeal the determination by the Nasdaq Staff, and present its plan to

regain and sustain compliance with the Minimum Bid Price Rule. On October 31, 2024, the Hearing was held before the Panel regarding the

Company’s request for (i) continued listing on Nasdaq and (ii) additional time to regain compliance with the Minimum Bid Price Rule.

During the Hearing, the Company presented an overview of its current and ongoing strategic initiatives aimed at enhancing shareholder

value and regaining compliance with the Minimum Bid Price Rule. On November 1, 2024, the Panel issued its determination (the “Panel

Determination Letter”) to the Company, granting the Company’s request for the continued listing of the Company’s common

shares, no par value, on Nasdaq, but subject to the Company’s evidencing compliance with the Minimum Bid Price Rule for ten consecutive

trading days as of December 2, 2024 (the “Requisite Compliance Date”), and of other conditions stipulated by the Panel Determination

Letter.

The Company’s Board

of Directors approved a reverse stock split proposal on October 29, 2024, and the Company is working diligently and taking definitive

steps to consummate such reverse stock split and regain compliance with the Minimum Bid Price Rule by the Requisite Compliance Date. There

can be no assurances, however, that the Company will be able to gain compliance with the Minimum Bid Price Rule by the Requisite Compliance

Date, if at all. The information set forth in the Press Release (as defined below) is hereby incorporated into this Item 3.01 by reference.

Item 7.01. Regulation FD Disclosure.

On November 5, 2024, the Company issued a press

release (the “Press Release”) announcing that it had received the Panel Determination Letter. A copy of the press release

is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information set forth in this Item 7.01, including

Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information set forth

in this Item 7.01, including Exhibit 99.1, shall not be deemed incorporated by reference into any other filing under the Securities Act

of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

The following exhibits shall be deemed to be furnished, and not filed:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

INMED PHARMACEUTICALS INC. |

| |

|

| Date: November 5, 2024 |

By: |

/s/ Eric A Adams |

| |

|

Eric A. Adams |

| |

|

President & CEO |

Exhibit 99.1

|

NASDAQ: INM

1445 – 885 West Georgia St.

Vancouver, BC, Canada V6C 3E8

Tel: +1.604.669.7207

Email: info@inmedpharma.com

www.inmedpharma.com |

InMed Pharmaceuticals Announces Decision by

Nasdaq Hearings Panel to Grant Exception to Implement Share Consolidation to Satisfy Nasdaq Listing Rules

Vancouver, British Columbia – November 5,

2024. InMed Pharmaceuticals Inc. (NASDAQ: INM) (“InMed” or the “Company”), a pharmaceutical company focused on

developing a pipeline of proprietary small molecule drug candidates for diseases with high unmet medical needs, today announced the decision

by the Nasdaq Listing Qualifications Panel (the “Panel”) to grant an exception until December 2, 2024, to implement a share

consolidation to satisfy the Nasdaq Listing Rules.

As previously reported by InMed on its current

report on Form 8-K, on September 17, 2024, the Listing Qualifications Department (the “Nasdaq Staff”) of the Nasdaq Stock

Market (“Nasdaq”) issued a determination to the Company, which was communicated through a delisting notice (the “Delisting

Notice”), indicating that the Company did not satisfy the minimum $1.00 bid price per share requirement for the continued listing

on Nasdaq, as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Rule”) by September 16, 2024. The Company

subsequently requested a hearing (the “Hearing”) before the Panel to appeal the determination by the Nasdaq Staff, and present

its plan to regain and sustain compliance with the Minimum Bid Price Rule.

On October 31, 2024, a hearing (the “Hearing”)

was held before the Panel regarding the Company’s request for (i) continued listing on Nasdaq and (ii) additional time to regain

compliance with the minimum $1.00 bid price per share requirement, as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum

Bid Price Rule”). During the Hearing, InMed presented an overview of its current and ongoing strategic initiatives aimed at enhancing

shareholder value and regaining compliance with the Minimum Bid Price Rule. On November 1, 2024, the Panel issued its determination (the

“Panel Determination Letter”) to the Company, granting the Company’s request for the continued listing of the Company’s

common shares, no par value, on Nasdaq, but subject to the Company’s evidencing compliance with (i) the Minimum Bid Price Rule for

ten consecutive trading days as of December 2, 2024 (the “Requisite Compliance Date”), and (ii) other conditions stipulated

by the Panel Determination Letter.

The Company’s Board of Directors approved

a proposal on October 29, 2024 to consolidate all of its issued and outstanding common shares, no par value (the “Common Shares”),

on the basis of one (1) post-consolidation share for each twenty (20) pre-consolidation Common Shares (the “Consolidation”)

in order to regain compliance with the Minimum Bid Price Rule.

Once deemed effective, the Consolidation will

result in the number of issued and outstanding Common Shares being reduced from 14,361,550 to approximately 718,078 Common Shares on a

non-diluted basis, and each of the Company’s shareholders will hold the same overall percentage of Common Shares outstanding immediately

after the Consolidation as such shareholder held immediately prior to the Consolidation.

The exercise price and number of Common Shares

issuable upon the exercise of outstanding stock options, warrants or other convertible securities will be proportionately adjusted to

reflect the Consolidation in accordance with the terms of such securities. No fractional shares will be issued as a result of the Consolidation.

The Company’s trading symbol “INM” will remain unchanged, while the Common Shares will begin trading with a new CUSIP

and ISIN number.

Registered shareholders holding physical share

certificates will receive by mail a letter of transmittal advising of the Consolidation and containing transmittal instructions. Holders

of Common Shares who hold uncertificated Common Shares (i.e., Common Shares held in book-entry form and not represented by a physical

share certificate), either as registered holders or beneficial owners, will have their existing book-entry account(s) electronically adjusted

by the Company’s transfer agent or, for beneficial shareholders, by their brokerage firms, banks, trusts or other nominees that

hold in “street name” for their benefit. Such holders do not need to take any additional actions to exchange their pre-Consolidation

Common Shares for post-Consolidation Common Shares.

The Company is working diligently and taking definitive

steps to consummate the Consolidation and regain compliance with the Minimum Bid Price Rule by the Requisite Compliance Date; however,

there can be no assurances that the Company will be able to regain compliance with the Minimum Bid Price Rule by the Requisite Compliance

Date, if at all.

About InMed:

InMed

Pharmaceuticals is a pharmaceutical company focused on developing a pipeline of proprietary small molecule drug candidates targeting the

CB1/CB2 receptors. InMed’s pipeline consists of three separate programs in the treatment of Alzheimer’s, ocular and dermatological

indications. For more information, visit www.inmedpharma.com.

Investor Contact:

Colin Clancy

Vice President, Investor Relations

and Corporate Communications

T: +1 604 416 0999

E:

ir@inmedpharma.com

Cautionary Note Regarding Forward-Looking Information:

This news release contains “forward-looking

information” and “forward-looking statements” (collectively, “forward-looking information”) within the meaning

of applicable securities laws. Forward-looking statements are frequently, but not always, identified by words such as “expects”,

“anticipates”, “believes”, “intends”, “potential”, “possible”, “would”

and similar expressions. Such statements, based as they are on current expectations of management, inherently involve numerous risks,

uncertainties and assumptions, known and unknown, many of which are beyond our control. Forward-looking information is based on management’s

current expectations and beliefs and is subject to a number of risks and uncertainties that could cause actual results to differ materially

from those described in the forward-looking statements. Without limiting the foregoing, forward-looking information in this news release

includes, but is not limited to, statements about the Company’s receipt of the Hearings Panel Determination, the Company’s

ability to comply with the conditions set forth in the Hearings Panel Determination, including the ability to timely perform the Consolidation

by the Requisite Compliance Date, the impact of the Consolidation on the liquidity of the Common Shares, whether the Common Shares will

trade above $1.00 per share by the Requisite Compliance Date, if at all, and whether the Company will be able to comply with the Nasdaq

Listing Rules more generally.

Additionally, there are known and unknown risk

factors which could cause InMed’s actual results, performance, or achievements to be materially different from any future results,

performance or achievements expressed or implied by the forward-looking information contained herein. A complete discussion of the risks

and uncertainties facing InMed’s stand-alone business is disclosed in InMed’s Annual Report on Form 10-K and other filings

made with the Securities and Exchange Commission on www.sec.gov.

All forward-looking information herein is qualified

in its entirety by this cautionary statement, and InMed disclaims any obligation to revise or update any such forward-looking information

or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results,

events or developments, except as required by law.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

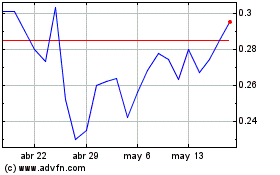

InMed Pharmaceuticals (NASDAQ:INM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

InMed Pharmaceuticals (NASDAQ:INM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024