false

0001446847

0001446847

2024-01-08

2024-01-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to

Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

January 8, 2024

IRONWOOD PHARMACEUTICALS, INC.

(Exact name of registrant as specified

in its charter)

| Delaware |

|

001-34620 |

|

04-3404176 |

| |

|

|

|

|

| (State

or other jurisdiction |

|

|

|

(I.R.S.

Employer |

| of incorporation) |

|

(Commission

File Number) |

|

Identification Number) |

| 100 Summer Street, |

|

|

|

|

| Boston, Massachusetts |

|

|

|

02110 |

| |

|

|

|

|

| (Address of principal |

|

|

|

|

| executive offices) |

|

|

|

(Zip code) |

(617) 621-7722

(Registrant’s telephone number,

including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which

registered |

| Class A common stock, $0.001 par value |

IRWD |

Nasdaq Global Select Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 2.02 Results of Operations and Financial Condition.

On January 8, 2024, Ironwood Pharmaceuticals, Inc.

(the “Company”) issued a press release (the “Press Release”) containing an update on its recent business activities.

In addition, beginning on January 8, 2024, the

Company intends to use the presentation (the “Corporate Presentation”) furnished herewith, or portions thereof, which provides

updates on the Company’s business activities, in one or more meetings with or presentations to investors.

The Press Release and Corporate Presentation contain

information regarding certain of the Company’s results of operations for 2023. Copies of the Press Release and Corporate Presentation

are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

The Press Release and Corporate Presentation are

being furnished pursuant to Item 2.02 of this Current Report on Form 8-K and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that Section, nor shall such document be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Ironwood Pharmaceuticals, Inc. |

| |

|

|

|

| |

|

|

|

| Dated: January 8, 2024 |

|

By: |

/s/ Sravan K. Emany |

| |

|

|

Name: Sravan K. Emany |

| |

|

|

Title: Senior Vice President,

Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Ironwood Pharmaceuticals

Maintains FY 2023 Financial Guidance and Announces FY 2024 Financial Guidance

– Expects

high-single digit percentage LINZESS® EUTRx prescription demand growth in 2024 –

– Expects

2024 adjusted EBITDA of greater than $150 million –

BOSTON, Mass., January 8, 2024 — Ironwood Pharmaceuticals, Inc.

(Nasdaq: IRWD), a GI-focused healthcare company, today announced financial guidance for full year 2024. The results were announced in

advance of the Company’s presentation at the 42nd Annual J.P. Morgan Healthcare Conference, which will take place on

Wednesday, January 10, 2024 at 11:15 a.m. PT / 2:15 p.m. ET.

“We believe the significant progress we made across our strategic

priorities last year has strengthened our position to be the leading GI healthcare company,” said Tom McCourt, chief executive

officer of Ironwood. “We are on track to deliver on our 2023 LINZESS U.S. net sales guidance, driven by continued strong prescription

demand and remain encouraged about the future growth potential of the brand. Furthermore in 2023, we strengthened our GI pipeline with

the addition of apraglutide, which we believe has blockbuster potential in short bowel syndrome requiring parenteral support, if approved.”

“Looking ahead in 2024, we remain committed to maximizing LINZESS,

advancing our GI development pipeline and delivering profits and cash flows. We expect to deliver another year of high-single digit percentage

LINZESS demand growth and maintain class-leading formulary access, which we believe will result in low-single digit percentage LINZESS

U.S. net sales growth in 2024. In addition, we expect to deliver greater than $150 million in adjusted EBITDA in 2024. We are looking

forward to an exciting and potentially transformational year for Ironwood with several catalysts ahead of us, highlighted by the topline

data from our STARS Phase 3 study expected in March in SBS-IF and topline data from the ongoing Phase 2 study for CNP-104 expected

in the third quarter. We believe the advancement of our pipeline programs, combined with continued strong LINZESS demand growth, uniquely

position our company for success in our mission to be the leader in GI.”

Full Year 2023 Financial Guidance and Full Year 2024 Financial

Guidance

Ironwood is maintaining its previous FY

2023 financial guidance and is providing FY 2024 financial guidance.

| | |

FY 2023 Guidance

(November 2023) | |

FY 2024 Guidance

(January 2024) |

| LINZESS U.S. net sales growth | |

6% - 8% | |

Low-single digits %

High-single digit prescription demand growth offset by mid to high-single digit price erosion primarily

due to Medicaid AMP cap removal |

| Total revenue | |

$435 - $450 million | |

$435 - $455 million |

Adjusted EBITDA1 | |

~($900) million

Reflects

~$1.1 billion one-time charge from acquisition of VectivBio | |

>$150 million

Excludes

potential CNP-104 option exercise |

J.P. Morgan Healthcare Conference Presentation

and Webcast Details

As previously announced, Ironwood

will present a corporate overview at the 42nd Annual J.P. Morgan Healthcare Conference on Wednesday, January 10, 2024

at 11:15 a.m. PT / 2:15 p.m. ET. A live audio webcast of Ironwood’s presentation is accessible through the Investors

section of the Company’s website at www.ironwoodpharma.com. To access the webcast, please log on to the Ironwood website

approximately 15 minutes prior to the start time to ensure adequate time for any software downloads that may be required. A replay of

the webcast will be available on Ironwood’s website after the event has completed.

1 Adjusted

EBITDA is calculated by subtracting mark-to-market adjustments on derivatives related to our 2022 Convertible Notes, restructuring expenses,

net interest expense, income taxes, depreciation and amortization, and acquisition-related costs from GAAP net income. For purposes of

the 2024 guidance, we have assumed that Ironwood will not incur material expenses related to business development activities in 2024. Ironwood

does not provide guidance on GAAP net income or a reconciliation of expected adjusted EBITDA to expected GAAP net income because,

without unreasonable efforts, it is unable to predict with reasonable certainty the non-GAAP adjustments used to calculate adjusted

EBITDA. These adjustments are uncertain, depend on various factors and could have a material impact on GAAP net income for the guidance

period. Management believes this non-GAAP information is useful for investors, taken in conjunction with Ironwood’s GAAP financial

statements, because it provides greater transparency and period-over-period comparability with respect to Ironwood’s operating

performance. These measures are also used by management to assess the performance of the business. Investors should consider these non-GAAP

measures only as a supplement to, not as a substitute for or as superior to, measures of financial performance prepared in accordance

with GAAP. In addition, these non-GAAP financial measures are unlikely to be comparable with non-GAAP information provided by other companies.

Full year 2023 adjusted EBITDA guidance reflects a one-time charge of approximately $1.1 billion related to acquired in-process research

and development from the acquisition of VectivBio in the second quarter of 2023. Full year 2024 adjusted EBITDA guidance also excludes

any costs associated with a potential CNP-104 option exercise.

About Ironwood Pharmaceuticals

Ironwood Pharmaceuticals (Nasdaq: IRWD), an S&P SmallCap 600®

company, is a leading global gastrointestinal (GI) healthcare company on a mission to advance the treatment of GI diseases and redefine

the standard of care for GI patients. We are pioneers in the development of LINZESS® (linaclotide), the U.S. branded prescription

market leader for adults with irritable bowel syndrome with constipation (IBS-C) or chronic idiopathic constipation (CIC). LINZESS is

also approved for the treatment of functional constipation in pediatric patients ages 6-17 years-old. Ironwood is also advancing apraglutide,

a next-generation, long-acting synthetic GLP-2 analog being developed for rare gastrointestinal diseases, including short bowel syndrome

with intestinal failure (SBS-IF) as well as several earlier stage assets. Building upon our history of GI innovation, we keep patients

at the heart of our R&D and commercialization efforts to reduce the burden of GI diseases and address significant unmet needs.

Founded in 1998, Ironwood Pharmaceuticals

is headquartered in Boston, Massachusetts, and has additional operations in Basel, Switzerland.

We routinely

post information that may be important to investors on our website at www.ironwoodpharma.com.

In addition, follow us on X and

on LinkedIn.

About LINZESS (Linaclotide)

LINZESS® is the #1 prescribed brand in the U.S. for the treatment

of adult patients with irritable bowel syndrome with constipation (“IBS-C”) or chronic idiopathic constipation (“CIC”),

based on IQVIA data.

LINZESS is a once-daily capsule that helps relieve the abdominal pain,

constipation, and overall abdominal symptoms of bloating, discomfort and pain associated with IBS-C, as well as the constipation, infrequent

stools, hard stools, straining, and incomplete evacuation associated with CIC. LINZESS relieves constipation in children and adolescents

aged 6 to 17 years with functional constipation. The recommended dose is 290 mcg for IBS-C patients and 145 mcg for CIC patients, with

a 72 mcg dose approved for use in CIC depending on individual patient presentation or tolerability. In children with functional constipation

aged 6 to 17 years, the recommended dose is 72 mcg.

LINZESS is not a laxative; it is the first medicine approved by the

FDA in a class called GC-C agonists. LINZESS contains a peptide called linaclotide that activates the GC-C receptor in the intestine.

Activation of GC-C is thought to result in increased intestinal fluid secretion and accelerated transit and a decrease in the activity

of pain-sensing nerves in the intestine. The clinical relevance of the effect on pain fibers, which is based on nonclinical studies,

has not been established.

In the United States, Ironwood and AbbVie co-develop and co-commercialize

LINZESS for the treatment of adults with IBS-C or CIC. In Europe, AbbVie markets linaclotide under the brand name CONSTELLA® for

the treatment of adults with moderate to severe IBS-C. In Japan, Ironwood's partner, Astellas, markets linaclotide under the brand

name LINZESS for the treatment of adults with IBS-C or CIC. Ironwood also has partnered with AstraZeneca for development and commercialization

of LINZESS in China, and with AbbVie for development and commercialization of linaclotide in all other territories worldwide.

LINZESS Important Safety Information

INDICATIONS AND USAGE

LINZESS® (linaclotide) is indicated for the treatment of both

irritable bowel syndrome with constipation (IBS-C) and chronic idiopathic constipation (CIC) in adults and functional constipation (FC)

in children and adolescents 6 to 17 years of age. It is not known if LINZESS is safe and effective in children with FC less than 6 years

of age or in children with IBS-C less than 18 years of age.

IMPORTANT SAFETY INFORMATION

WARNING: RISK OF SERIOUS DEHYDRATION IN PEDIATRIC PATIENTS

LESS THAN 2 YEARS OF AGE

LINZESS is contraindicated in patients less than 2 years of

age. In nonclinical studies in neonatal mice, administration of a single, clinically relevant adult oral dose of linaclotide caused

deaths due to dehydration. |

Contraindications

| ● | LINZESS is

contraindicated in patients less than 2 years of age due to the risk of serious dehydration. |

| ● | LINZESS is

contraindicated in patients with known or suspected mechanical gastrointestinal obstruction. |

Warnings and Precautions

| ● | LINZESS is

contraindicated in patients less than 2 years of age. In neonatal mice, linaclotide increased

fluid secretion as a consequence of age-dependent elevated guanylate cyclase (GC-C) agonism,

which was associated with increased mortality within the first 24 hours due to dehydration.

There was no age dependent trend in GC-C intestinal expression in a clinical study of children

2 to less than 18 years of age; however, there are insufficient data available on GC-C intestinal

expression in children less than 2 years of age to assess the risk of developing diarrhea

and its potentially serious consequences in these patients. |

Diarrhea

| ● | In adults,

diarrhea was the most common adverse reaction in LINZESS-treated patients in the pooled IBS-C

and CIC double-blind placebo-controlled trials. The incidence of diarrhea was similar in

the IBS-C and CIC populations. Severe diarrhea was reported in 2% of 145 mcg and 290 mcg

LINZESS-treated patients and in <1% of 72 mcg LINZESS-treated CIC patients. |

| ● | In children

and adolescents 6 to 17 years of age, diarrhea was the most common adverse reaction in 72

mcg LINZESS-treated patients in the FC double-blind placebo-controlled trial. Severe diarrhea

was reported in <1% of 72 mcg LINZESS treated patients. If severe diarrhea occurs, dosing

should be suspended and the patient rehydrated. |

Common Adverse Reactions (incidence ≥2% and greater than

placebo)

| ● | In IBS-C

or CIC adult patients: diarrhea, abdominal pain, flatulence, and abdominal distension. |

| ● | In FC pediatric

patients: diarrhea. |

Please see full Prescribing Information including Boxed Warning:

https://www.rxabbvie.com/pdf/linzess_pi.pdf

LINZESS® and CONSTELLA® are registered trademarks of Ironwood

Pharmaceuticals, Inc. Any other trademarks referred to in this press release are the property of their respective owners. All rights

reserved.

Forward-Looking Statements

This press release contains forward-looking statements. Investors

are cautioned not to place undue reliance on these forward-looking statements, including statements about Ironwood’s ability to

execute on its mission; Ironwood’s strategy, business, financial position and operations; Ironwood’s ability to drive growth

and profitability; the demand, development, commercial availability and commercial potential of linaclotide, including unlocking new

opportunities and maintaining class-leading formulary access for LINZESS, and the drivers, timing, impact and results thereof; the potential

indications for, and benefits of, linaclotide; our financial performance and results, and guidance and expectations related thereto;

LINZESS prescription demand growth, LINZESS U.S. net sales growth, total revenue and adjusted EBITDA in 2023 and 2024; the commercial

potential of apraglutide; Ironwood’s anticipation on reaching new clinical development milestones in 2024 and the belief that Ironwood

is positioned well for long term growth. These forward-looking statements speak only as of the date of this press release, and Ironwood

undertakes no obligation to update these forward-looking statements. Each forward-looking statement is subject to risks and uncertainties

that could cause actual results to differ materially from those expressed or implied in such statement. Applicable risks and uncertainties

include those related to the effectiveness of development and commercialization efforts by us and our partners; preclinical and clinical

development, manufacturing and formulation development of linaclotide, apraglutide, CNP-104, IW-3300, and our product candidates;

the risk that clinical programs and studies, including for the linaclotide pediatric program, apraglutide, IW-3300 and CNP-104,

may not progress or develop as anticipated, including that studies are delayed or discontinued for any reason, such as safety, tolerability,

enrollment, manufacturing, economic or other reasons; the risk that findings from our completed nonclinical and clinical studies may

not be replicated in later studies; the risk that peripheral T-cell immune responses evidenced in patients treated with CNP-104 may neither

support the mechanistic rationale for CNP-104 nor be predictive of the topline data from the clinical study for CNP-104 in primary biliary

cholangitis patients since the clinical relevance of such T-cell immune response has not been adequately established; the risk that we

or our partners are unable to obtain, maintain or manufacture sufficient LINZESS or our product candidates, or otherwise experience difficulties

with respect to supply or manufacturing; the efficacy, safety and tolerability of linaclotide and our product candidates; the risk that

the commercial and therapeutic opportunities for LINZESS or our product candidates are not as we expect; decisions by regulatory and

judicial authorities; the risk we may never get additional patent protection for linaclotide and other product candidates, that patents

for linaclotide or other products may not provide adequate protection from competition, or that we are not able to successfully protect

such patents; the risk that we are unable to manage our expenses or cash use, or are unable to commercialize our products as expected;

the risk that the development of any of our linaclotide pediatric programs, apraglutide, CNP-104 and/or IW-3300 are not successful or

that any of our product candidates is not successfully commercialized outcomes in legal proceedings to protect or enforce the patents

relating to our products and product candidates, including abbreviated new drug application litigation; the risk that financial and operating

results may differ from our projections; developments in the intellectual property landscape; challenges from and rights of competitors

or potential competitors; the risk that our planned investments do not have the anticipated effect on our company revenues; developments

in accounting guidance or practice; Ironwood’s or AbbVie’s accounting practices, including reporting and settlement practices

as between Ironwood and AbbVie; the risk that we are unable to manage our expenses or cash use, or are unable to commercialize our products

as expected; the impact of the COVID-19 pandemic; and the risks listed under the heading “Risk Factors” and elsewhere in

our Annual Report on Form 10-K for the year ended December 31, 2022, in our Quarterly Reports on Form 10-Q for the quarters

ended June 30, 2023 and September 30, 2023, and in our subsequent Securities and Exchange Commission filings.

Investors:

Greg Martini, 617-374-5230

gmartini@ironwoodpharma.com

Matt Roache, 617-621-8395

mroache@ironwoodpharma.com

Media:

Beth Calitri, 978-417-2031

bcalitri@ironwoodpharma.com

Exhibit 99.2

Ironwood Pharmaceuticals A Leading GI Healthcare Company 1 NASDAQ: IRWD

This presentation contains forward - looking statements. Investors are cautioned not to place undue reliance on these forward - loo king statements, including statements about our ability to execute on our vision; our strategy, business, financial position and operations, including with respect to our strategic pri ori ties; the demand, development, commercial availability and commercial potential of linaclotide and the drivers, timing, impact and results thereof; the potential indications for, and b ene fits of, linaclotide and our ability to drive LINZESS growth; the therapeutic potential of CNP - 104; the therapeutic and commercial potential of apraglutide; expectations regarding our financial performance and results, and guidance and expectations related thereto, including, without limitation, LINZESS U.S. net sales and growth, Ironwood revenue and adjusted EBITDA; the pro gress of ongoing clinical trials, the timing of related data readouts and the effects of such data on our business; the estimated size of the population affected by IBS - C/CIC, SBS - IF and PB C. These forward - looking statements speak only as of the date of this presentation, and Ironwood undertakes no obligation to update these forward - looking statements. Each forward - looki ng statement is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such statement. Applicable risks and uncerta inties include those related to the effectiveness of development and commercialization efforts by us and our partners; preclinical and clinical development, manufacturing and for mul ation development of linaclotide, apraglutide, IW - 3300, CNP - 104 and other product candidates; the risk that clinical programs and studies, inducing for the linaclotide pediatric progra m, apraglutide, CNP - 104 and IW - 3300, may not progress or develop as anticipated, including that studies are delayed or discontinued for any reason, such as safety, tolerability, enro llm ent, manufacturing, economic or other reasons; the risk that findings from our completed nonclinical and clinical studies may not be replicated in later studies; the risk that we or our par tners are unable to obtain, maintain or manufacture sufficient LINZESS or our product candidates, or otherwise experience difficulties with respect to supply or manufacturing; the efficacy , s afety and tolerability of linaclotide and our product candidates; the risk that the commercial and therapeutic opportunities for LINZESS, apraglutide, or our product candidates ar e n ot as we expect; the risk that peripheral T - cell immune responses evidenced in patients treated with CNP - 104 may neither support the mechanistic rationale for CNP - 104 nor be predictive of the topline data from the clinical study for CNP - 104 in PBC patients, since the clinical relevance of such T - cell immune response has not been adequately established; decisions by r egulatory and judicial authorities; the risk that we may never get additional patent protection for linaclotide, apraglutide, and other product candidates, that patents for linaclotide, ap rag lutide, or other products may not provide adequate protection from competition, or that we are not able to successfully protect such patents; the risk that we are unable to manage our exp ens es or cash use, or are unable to commercialize our products as expected; the risk that the development of the linaclotide pediatric program, apraglutide, CNP - 104 and/or IW - 3300 are not suc cessful or that any of our product candidates is not successfully commercialized; outcomes in legal proceedings to protect or enforce the patents relating to our products and pro duc t candidates, including abbreviated new drug application litigation; the risk that financial and operating results may differ from our projections; developments in the intellectual p rop erty landscape; challenges from and rights of competitors or potential competitors; the risk that our planned investments do not have the anticipated effect on our company revenues; deve lop ments in accounting guidance or practice; Ironwood’s or AbbVie’s accounting practices, including reporting and settlement practices as between Ironwood and AbbVie; the risk that we are unable to manage our expenses or cash use, or are unable to commercialize our products as expected; and the risks listed under the heading “Risk Factors” and elsewhere in our Annual Rep ort on Form 10 - K for the year ended December 31, 2022, in our Quarterly Reports on Form 10 - Q for the quarters ended June 30, 2023 and September 30, 2023, and in our subsequent Securit ies and Exchange Commission filings. Ironwood uses non - GAAP financial measures in this presentation, which should be considered only a supplement to, and not a subst itute for or superior to, GAAP measures. Refer to the Reconciliation of Non - GAAP Financial Measures to GAAP Results table and to the Reconciliation of Adjusted EBITDA to GAAP net inc ome table and related footnotes on pages 41 to 43 of this presentation. Further, Ironwood considers the net profit for the U.S. LINZESS brand collaboration with AbbVie in assessing the product’s performance and calculates it based on inputs from both Ironwood and AbbVie. This figure should not be considered a substitute for Ironwood’s GAAP financial results. An exp lanation of our calculation of this figure is provided in the U.S. LINZESS Brand Collaboration table and related footnotes on page 44 of this presentation. LINZESS® is a registered trademark of Ironwood Pharmaceuticals, Inc. Any other trademarks referred to in this presentation are the property of their respective owners. All rights reserved. 2 Safe Harbor Statement

3 Our vision is to be the leading GI healthcare company focused on advancing the treatment of GI diseases and redefining the standard of care for GI patients

Leading the Way in GI Innovation Ironwood is uniquely positioned to drive value as a GI - focused biotech with multiple 2024 development catalysts and strong LINZESS cash flows expected until generic entry in 2029 4 OUR FOCUSED PRIORITIES: Maximize LINZESS Advance GI pipeline Highlighted by apraglutide for SBS - IF 1 and CNP - 104 for PBC 2 Deliver sustained profits & cash flow 1 Short Bowel Syndrome with Intestinal Failure; SBS - IF is defined by an SBS patient’s dependence on parenteral support 2 Primary Biliary Cholangitis

$0.4B 1 YE 2023 YE 2028 Late 2030s LINZESS (2029 LOE) Apraglutide CNP-104 $1.5B+ 2 peak revenue potential ~$1.0B 2 $1.5B+ Revenue Potential through the 2030s Apraglutide and CNP - 104 have the potential to extend growth through the 2030s and drive value for patients and shareholders 5 Pro Forma Ironwood Long Term (Assuming Apraglutide and CNP - 104 Approval) Ironwood Today (LINZESS) 1 Reflects guidance for 2023 Ironwood collaborative arrangement revenue from LINZESS . 2 Ironwood management estimate, not risk - adjusted

6 Discovery Preclinical Phase 1 Phase 2 Phase 3 Marketed LINZESS IBS - C & Chronic Idiopathic Constipation (CIC) Pediatric Functional Constipation (FC) Ages 6 - 17 in the U.S. 1 Apraglutide 2 Adult Short Bowel Syndrome with Intestinal Failure (Intend to Initiate Pediatric SBS - IF Phase 3 After Topline Results in adults) Topline Results 3 : March 2024 Acute Graft Versus Host Disease (GvHD) Data 3 : Q1 2024 CNP - 104 Primary Biliary Cholangitis (PBC) Topline Results: Q3 2024 IW - 3300 Interstitial Cystitis / Bladder Pain Syndrome (IC/BPS) Actively evaluating partnership options Marketed Marketed STARS - Pivotal STARGAZE – Exploratory Study Proof of Concept Proof of Concept GI development programs 1 IBS - C post - marketing studies to continue 2 Rights to apraglutide in Japan have been exclusively licensed to Ashai Kasei Pharma Corporation (AKP) 3 Enrollment completed Other development programs Anticipated near - term catalysts We expect emerging data to create significant momentum as we strive to deliver value for patients and shareholders

The U.S. prescription market leader for adults with Irritable Bowel Syndrome with Constipation (IBS - C) and Chronic Idiopathic Constipation (CIC) 7 LINZESS

Leader in IBS - C and CIC LINZESS is a growing, market leading, blockbuster brand with a significant opportunity to address high unmet need 8 Impressive LINZESS Demand Growth Since Launch 1 EUTRx, total prescription extended units; IQVIA Weekly National Prescription Audit, December 2023 2 NBRx, new - to - brand prescriptions; IQVIA Weekly Patients Insights, December 2023 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 4,500,000 NBRx Volume EUTRx Volume LINZESS EUTRx LINZESS NBRx ~15% y/y NBRx growth in 2023 2 1 2

Estimated population of pediatric patients aged 6 - 17 with FC in the U.S. 2 LINZESS is the prescription market leader in the U.S. for adults with IBS - C/CIC with a large market opportunity 9 ~6M Estimated Adult CIC and IBS - C population in the U. S. 3 Unique Patients Since Launch of LINZESS 4 Significant opportunity to reach new patients ~40M ~5M Large Market Opportunity 1 IQVIA Weekly National Prescription Audit, December 2023 2 U.S. Census, 2017 National Population Projection Tables; Robin, Samantha G. et al “Prevalence of Pediatric Functional Gastrointestinal Disorders Utilizing the Rome IV Criteria,” The Journal of Pediatrics, December 2017; Koppen, I. J. N. et al “Pr evalence of functional defecation disorders in children: a systematic review and meta - analysis. J Pediatr. 2018 3 Lieberman GI Patient Landscape survey, 2010; U.S. Census data. 4 IQVIA Total Patient Tracker November 2023 0% 10% 20% 30% 40% 50% 60% TRx Share LINZESS LACTULOSE (molecule) All other (branded and generic) IBS - C/CIC TRx Market Share 1 (Combined Branded and Generic Market) LINZESS 46%

10 Significant unmet patient need and opportunity • Commercially available as of June 2023 with existing 72 mcg dose for patients aged 6 - 17 years - old; benefits from existing LINZESS class - leading payer access • Highly symptomatic condition with patients actively seeking care due to distressing symptoms • Efficient investment planned to realize opportunity First and only FDA approved Rx therapy to treat pediatric functional constipation for patients ages 6 - 17

Glucagon - like peptide 2 (GLP - 2) analog for Short Bowel Syndrome with Intestinal Failure (SBS - IF) 11 Apraglutide

Apraglutide advances Ironwood’s GI leadership and creates value for patients and shareholders • Apraglutide’s unique pharmacological properties support potential to be the only once weekly GLP - 2 for the whole spectrum of SBS - IF patients 1 12 • Leverages Ironwood’s GI capabilities and success with LINZESS • $1B+ Apraglutide peak net sales potential 2 • Potential to enhance Ironwood’s long - term financial profile through the 2030s Apraglutide has the potential to establish a new standard of care for SBS - IF patients and achieve blockbuster status, if approved 1 Agraglutide has not been proven effective or safe for its intended use and there is no guarantee that it will receive regulat ory approval to commercialize 2 Ironwood management estimate, not risk - adjusted

Duodenum Jejunocolonic Anastomosis Jejunum Colon Duodenum Jejunum Stoma (on abdominal surface) Stoma Bag SBS - IF Subtypes Stoma Colon - in - Continuity (CIC) Prevalence 2 <50% of patients >50% of patients Absorption deficits Fluids and nutrients Mainly nutrients Parenteral Support (PS) requirements Fluids + nutrients = high PS volume Mainly nutrients = lower PS volume SBS - IF Short Bowel Syndrome with Intestinal Failure (SBS - IF), defined by an SBS patient’s dependence on parenteral support, is a severe organ failure condition associated with increased mortality, morbidity and a reduced quality of life 13 Adult Patients impacted by SBS - IF 1 ~17k U.S. & Europe ~1k Japan 1 Based on market research commissioned by VectivBio and published literature 2 Company Phase 3 feasibility and CRA Market Research, Nov 2019 (U.S. and EU5) Adapted from: Jeppesen P et. al., Gastroenterology, 2018

STARS Phase 3 is the largest GLP - 2 trial ever conducted in SBS - IF 14 PRIMARY 24 - WEEK ENDPOINT PS volume reduction in aggregate population SECONDARY ENDPOINTS Aggregate and Anatomy - specific SECONDARY ENDPOINTS CIC - specific 2:1 randomization CIC Apraglutide Placebo Apraglutide Placebo STOMA Week 24 164 SBS - IF patients 2 Arms placebo and apraglutide ~2:1 apraglutide to placebo ~50/50 stratified CIC and Stoma Topline data expected in March 2024 Week 48 Apraglutide weekly dosing administration

15 Apraglutide Target Product Profile 1 Enabled by unique pharmacological properties and development strategy + PS volume reduction in stoma and CIC patients + Long half - life supports once - weekly dosing, 2,3 + Improved quality of life and symptoms + Demonstration of days off PS and potential to achieve enteral autonomy for some patients 1 Management expectations, based on clinical trials to date. Agraglutide has not been proven effective or safe for its intended us e and there is no guarantee that it will receive regulatory approval to commercialize 2 Eliasson J et al. JPEN J Parenter Enteral Nutr. 2021 3. Eliasson J et al. DDW ® 2021 Apragludtide has best - in - class potential Potential to significantly increase the number of GLP - 2 treated patients, if successfully developed and approved Opportunity to be the only once - weekly GLP - 2 analog for the whole spectrum of SBS - IF patients

Apraglutide has potential to achieve $1B+ in peak net sales 1 16 Apraglutide target product profile has the potential to: Apraglutide target product profile can enable market leadership position in SBS - IF ~14k (80%) SBS - IF patients remain untreated by GLP - 2s out of ~17k in U.S. and Europe 3 1 Ironwood management estimate, not risk - adjusted, if successfully developed and approved 2 Gattex estimated 2022 net sales of ~$750 million 3 Komodo Health claims data analysis (US), 2022; IQVIA MIDAS data analysis (EU), 2022 Increase utilization Improve persistency $1B+ Apraglutide Net Sales Potential 1 Current GLP-2 Market Untreated by GLP-2 SBS - IF Market 2

Potential disease - modifying therapy for the treatment of Primary Biliary Cholangitis (PBC) 17 CNP - 104

CNP - 104: a potentially new game - changing therapy for PBC patients COUR’s proprietary platform combines PDC - E2 with state - of - the - art pharmaceutical nanoparticles to tolerize the immune system and potentially eliminate the immune cell bile duct destruction present in PBC 18 • COUR’s platform has shown clinical proof of technology in other antigen specific autoimmune diseases • Scientifically established nanoparticle platform PDC - E2 Antigen • Well - characterized and common PBC autoantigen: PDC - E2 protein • T cell dependent autoimmune mechanisms drive PBC disease pathology Nanoparticle Platform Encapsulated Disease Specific Antigens Proprietary PLGA nanoparticle with PDC - E2 encapsulated 1 Lu et al., “Increasing Prevalence of Primary Biliary Cholangitis and Reduced Mortality With Treatment,” Clinical Gastroenterology and Hepatology 2018;16:1342 - 1350 PBC affects an estimated 130K patients in the U.S. 1

CNP - 104 has the potential to be the first PBC disease - modifying therapy CNP - 104 targets the root cause of PBC; there are no therapies on the market today that address the root cause of the autoimmune destruction of the bile ducts 19 Ironwood maintains an option to exclusively license CNP - 104 for continued development pending proof of concept and commercial viability Initial assessment provided evidence of favorable T - cell response in patients dosed with CNP - 104 Expect topline data from Phase 2 study in Q3 2024

20 Financial Guidance

We are on track to deliver on our FY 2023 financial guidance and are providing initial FY 2024 guidance 21 FY 2023 Guidance (November 2023) FY 2024 Guidance (January 2024) LINZESS U.S. net sales growth 6% – 8% Low - single digits % Ironwood revenue $435 – $450 million $435 – $455 million Adjusted EBITDA 1 ~($900) million >$150 million 1 Adjusted EBITDA is calculated by subtracting mark - to - market adjustments on derivatives related to Ironwood’s 2022 Convertible No tes, restructuring expenses, net interest expense, income taxes, depreciation and amortization and acquisition - related costs from GAAP net income. For purposes of the Full Year 2024 guidance, we have assumed that Ironwood will not incur material expenses related to business development activities in 2024. Ironwood does not provide guidance on GAAP net income or a reconciliation of expected adjusted EBITDA to expected GAAP net income because, without unreasonable efforts, it is unable to predict with reasonable certainty the non - GAAP adjustments used to calculate adjusted EBITDA. These adjustments are uncertain, depend on various factors and could have a material impac t o n GAAP net income for the guidance period. Full Year 2023 guidance reflects a one - time charge of approximately $1.1 billion related to acquired in - process research and development from the acquisition of VectivBio in the seco nd quarter of 2023. Full year 2024 adjusted EBITDA guidance also excludes any costs associated with potential CNP - 104 option exercise. Reflects ~$1.1 billion one - time charge from acquisition of VectivBio Excludes potential CNP - 104 option exercise High - single digit prescription demand growth offset by mid to high - single digit price erosion primarily due to Medicaid AMP cap removal

2024 has the potential to be transformational for Ironwood Ironwood is uniquely positioned to drive value as a GI - focused biotech with multiple 2024 development catalysts and strong LINZESS cash flows expected until generic entry in 2029 22 OUR FOCUSED PRIORITIES: Maximize LINZESS Advance GI pipeline Highlighted by apraglutide for SBS - IF 1 and CNP - 104 for PBC 2 Deliver sustained profits & cash flow 1 Short Bowel Syndrome with Intestinal Failure; SBS - IF is defined by an SBS patient’s dependence on parenteral support 2 Primary Biliary Cholangitis

Apraglutide SBS - IF 23 Appendix

9 SBS - IF adult patients with CIC Open label , baseline controlled Weekly apraglutide STARS Nutrition is the first - ever dedicated Phase 2 in adult patients with short bowel syndrome and colon - in - continuity (CIC) • GI, gastrointestinal; aGvHD , acute graft - versus - host disease; PK, pharmacokinetics; RR, response rate; DOR, duration of response; SS, systemic steroids; rux , ruxolitinib Study to demonstrate and quantify absorption benefits in CIC Apraglutide Week 24 Week 48 0 4 48 52 Intestinal Absorption PS reduction and wean off Week 4 - 1 STUDY OBJECTIVES Safety tolerability, PK 1 , and absorption parameters MB 3 MB AT 4 & 48 WEEKS Changes in absorption parameters • wet weight absorption • urine output • energy absorption Changes in stool output AT 24 & 52 WEEKS Changes in PS 2 needs • PS volume reduction • % patients achieving 1 day off PS Intestinal Absorption MB Week 52 1 PK = pharmacokinetics; 2 PS = parenteral support; 3 MB = metabolic balance assessment 24

Mean ± 95% Confidence Interval Baseline4W 8W 12W 16W 20W 24W 28W 32W 36W 40W 44W 48W 52W -100 -80 -60 -40 -20 0 P e r c e n t a g e c h a n g e i n W e e k l y P S v o l u m e f r o m B a s e l i n e No PS changes allowed until 4W 48 - week PS reduction phase p=0.0007 – 15 – 22 – 31 – 41 – 40 – 53 – 52 – 59 – 56 – 48 – 48 – 52 p=0.004 STARS Nutrition: PS volume reduction reached a statistically significant 40% at week 24 and the effect was maintained with a 52% volume reduction at week 52 25

0% 0% 33% 33% 56% 78% 78% 89% 100% 100% 100% 89% 100% 100% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 9/9 7/9 3/9 STARS Nutrition: All patients were clinical responders, achieving a PS volume reduction of at least 20% at week 52 26

Apraglutide GvHD Appendix

Acute GvHD is a life - threatening condition resulting from allogeneic hematopoietic stem cell transplant (HSCT) 1 Steroid - Refractory aGvHD 1 Goker H et al. Exp Hematol. 2001 2 D'Souza A et al. Blood Marrow Transplant. 2020 3 Baldomero H et al. EBMT activity survey 2018 4 Hematopoietic Cell Transplantation in Japan Annual Report of Nationwide Survey 2020. http://www.jdchct.or.jp/en/data/slide/2020 5 Martin PJ et al. Biol Blood Marrow Transplant. 2012 6 MacMillan ML et al. Biol Blood Marrow Transplant. 2002 7 Malard F et al. Leukemia. 2020 8 Zeiser R et al. N Engl J Med. 2020. 9 Naymagon S et al. Nat Rev Gastroenterol Hepatol. 2017 Significant unmet need for non - immunosuppressive treatments with greater efficacy and durability ~50% mortality at 6 months 7 ~70% of aGvHD have GI involvement 8 or GI damage is a leading cause of morbidity and mortality 9 Acute GvHD Donor immune cells attack the GI tract, skin and liver of the recipient 1 Corticosteroids are 1 st line standard of care 5 Allogeneic HSCT Bone marrow conditioning and transplantation ~26k patients/ yr U.S., Europe, Japan 2,3,4 ~30 - 50% develop aGvHD 4,5 ~50% become steroid refractory 6 28

Strong therapeutic rationale for a GLP - 2 treatment to protect and regenerate the GI tract 29 Results in… 1,2 1 Ghimire et al. Front Immunol. 2017 2 Fredricks DN. J Clin Invest. 2019 3 Drucker DJ. Gastroenterology. 2002 GI damage from conditioning, HSCT and GvHD 1,2 • Reduced intestinal barrier function • Intestinal inflammation • Microbiome disruption • Profound diarrhea and malnutrition • Sepsis GLP - 2 can restore GI function and reduce the need for immunosuppressive treatment Enterocyte Proliferation Intestinal Barrier Function Intestinal Blood Perfusion Epithelial Damage GI Dysbiosis Physiological properties of GLP - 2 3 GLP - 2 therapy may regenerate and protect the GI tract damaged by aGvHD

First - In - Class Phase 2 exploratory study in graft vs. host disease (GvHD) 30 STUDY OBJECTIVES Safety and tolerability; PK; efficacy measures including response rate, duration of response, survival - related outcomes Weekly Dose Level 1 Apraglutide + SS/ rux Weekly Dose Level 2 Apraglutide + SS/ rux External control Follow up to 2 years Patients with s teroid - refractory acute GI GvHD in combination with systemic steroids (SS) + ruxolitinib ( rux ) up to 34 patients >12 years and older Blinded to dose, externally - controlled Study designed to inform next steps towards pivotal study Up to 90 days treatment Data anticipated Q1 2024

CNP - 104 Appendix

CNP - 104 (8mg/kg) CNP - 104: Phase 2 proof of concept study in Primary Biliary Cholangitis (PBC) 32 CNP - 104 (4mg/kg) Placebo 45 patients with PBC Randomized, Double - blinded, placebo - controlled, parallel assignment Doses: Placebo, CNP - 104 4mg/kg , CNP - 104 8mg/kg IV Infusion on Days 1 and 8 CNP - 104 has potential for accelerated approval pathway with proof of concept STUDY OBJECTIVES Safety, tolerability, pharmacodynamics (PD), and efficacy of two doses of CNP - 104 20 month Long - Term Safety and Durability KEY OUTCOMES: • Immunological endpoints (e.g. T - cell response) • Markers of liver function Expect top - line data in Q3 2024 Day 120

IW - 3300 Appendix

IW - 3300: Phase 2 Proof of Concept Study in IC/BPS 34 Opportunity to test “cross - talk” hypothesis in humans for the first time STUDY OBJECTIVES Safety, tolerability, and efficacy in patients with IC/BPS 300 patients with Interstitial Cystitis / Bladder Pain Syndrome (IC/BPS) Randomized, double - blinded, placebo - controlled, parallel assignment Doses: Placebo, IW - 3300 100 µg, IW - 3300 300 µg Rectal foam administered daily to provide adequate target tissue engagement and exposure PRIMARY ENDPOINT Change from baseline in weekly average of worst daily bladder pain at Week 12 on an 11 - point pain numerical rating scale IW - 3300 100 µg IW - 3300 300 µg Placebo 12 weeks of treatment

• Strong pre - clinical evidence combined with sound scientific & commercial rationale supports POC study to explore potential impact of IW - 3300 on chronic visceral pain outside of GI tract • Strong pre - clinical data: – IW - 3300 demonstrated pain relief in bladder pre - clinical hypersensitivity model – IW - 3300 reversed endometriosis - induced vaginal hypersensitivity in a pre - clinical vaginal distension model • Very high unmet need in Interstitial Cystitis / Bladder Pain Syndrome (IC/BPS) and in Endometriosis – Limited number of treatment options available – Patients surveyed report experiencing a low QoL and many reported experiencing reduced productivity • Ironwood is continuing the Phase II proof of concept study in IC/BPS and actively evaluating partnership options IW - 3300: GC - C agonist for visceral pain conditions 35 Target indications are strategically linked to GC - C mechanism and supportive preclinical data, designed to address a significant medical need and have a defined path to POC • Represents drug

LINZESS Appendix

Q3 2023 LINZESS Total EUTRx Demand 1 +8% Y/Y LINZESS NBRx Volume / Growth Y/Y 2 1 IQVIA Monthly National Prescription Audit, Q3 2023 2 IQVIA Patient Insights, Q3 2023 +16% Y/Y in Q3 2023 10,000,000 11,000,000 12,000,000 13,000,000 14,000,000 15,000,000 16,000,000 17,000,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec EUTRx Volume 2023 2022 2021 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 110,000 120,000 130,000 140,000 150,000 160,000 170,000 Q4 2022 Q1 2023 Q2 2023 Q3 2023 NBRx NBRx Growth Y/Y Continued strong LINZESS demand growth in Q3, supported by robust new - to - brand prescription volume 37

$0 $200 $400 $600 $800 $1,000 $1,200 2015 2016 2017 2018 2019 2020 2021 2022 2023 LINZESS brand profitability (incl. R&D) LINZESS U.S. net sales LINZESS continues to generate strong brand profits LINZESS demand is increasing and fueling U.S. net sales and brand profitability 38 1 LINZESS U.S. net sales and brand profitability and Ironwood’s share of U.S. LINZESS profits reflects our FY 2023 guidance. LINZ ESS net sales are recognized using AbbVie’s revenue recognition accounting policies and reporting conventions. As a result, certain reb ates and discounts are classified as LINZESS U.S. commercial costs, expenses and other discounts within Ironwood’s calculation of coll abo rative arrangements revenue. LINZESS costs include certain discounts recognized and cost of goods sold incurred by AbbVie; also incl ude s commercial costs incurred by AbbVie and Ironwood that are attributable to the cost - sharing arrangement between the parties. See slide 44 for detailed breakdown. ~$375M 1 Ironwood’s share of expected 2023 U.S. LINZESS profits (in millions) 50/50 Profit share ~$1.1B 1 in 2023 1

Financials 39 Appendix

$14M GAAP Net Income $0.10/share – basic $0.09/share – diluted $49M Adjusted EBITDA 2 $114M Total Ironwood Revenues Primarily driven by $110M in U.S. LINZESS collaboration revenue $279M LINZESS U.S. Net Sales 1 1 LINZESS U.S. net sales are reported by AbbVie and LINZESS costs incurred by each of us and AbbVie are reported in our respect iv e financial statements. LINZESS costs include certain discounts recognized and cost of goods sold incurred by AbbVie, as well as commercial costs incurred by AbbVie and Ironwood that are attributable to the cost - sharing arrangement between the parties. See slide 44 for detailed breakdown. 2 Refer to the Reconciliation of GAAP net income to adjusted EBITDA on slide 43 of this presentation. 3 Ironwood repaid $75 million of the outstanding principal balance on its revolving credit facility in cash in Q3 2023. Ended Q3 2023 with $110 million of cash and cash equivalents 3 LINZESS U.S. net sales growth of 7%, driven by strong prescription demand growth of 8% LINZESS commercial margin: 72 % 1 Q3 2023 Financial Performance 40

Q3 2023 Financial Summary Three Months Ended September 30, 2023 Nine Months Ended September 30, 2023 (000s, except per share amounts) (000s, except per share amounts) GAAP net income (loss) 1,2 $13,950 ($1,029,814) Adjustments: Mark - to - market adjustments on the derivatives related to convertible notes , net 0 (19) Amortization of acquired intangible assets 207 211 Restructuring expenses 4,685 17,696 Acquisition - related costs 3,864 39,545 Tax effect of adjustments (904) (1,447) Non - GAAP net income (loss) 1,2 $21,802 ($973,828) GAAP net income (loss) attributable to Ironwood per share – basic $0.10 ($6.45) Plus: GAAP net income (loss) attributable to noncontrolling interests – basic (0.01) (0.18) Adjustments to GAAP net income (loss) (detailed above) 0.05 0.36 Non - GAAP net income (loss) per share – basic $0.14 ($6.27) Reconciliation of GAAP results to non - GAAP financial measures (page 1) 1 The company presents non - GAAP net income and non - GAAP net income per share to exclude the impact of net gains and losses on the derivatives related to our 2022 convertible notes that are required to be marked - to - market. Investors should consider these non - GAAP measures only as a supplement to, not as a substitute for or as superior to, measures o f financial performance prepared in accordance with GAAP. For a reconciliation of the company’s non - GAAP financial measures to the most comparable GAAP measures, please refer to the table above. Additional information regardi ng the non - GAAP financial measures is included in the company’s press release dated November 9, 2023. Management believes this non - GAAP information is useful for investors, taken in conjunction with Ironwood’s GAAP financial statements, because it provides greater transparency and period - over - period comparability with respect to Ironwood’s operating performance. These measures are also used by management to assess the performance of the business. In ad dition, these non - GAAP financial measures are unlikely to be comparable with non - GAAP information provided by other companies. 2 Non - GAAP net income (loss) for the nine months ended September 30, 2023 reflects a one - time charge of approximately $1.1 billion related to acquired in - process research and development from the acquisition of VectivBio in the second quarter of 2023. 41

Q3 2023 Financial Summary Three Months Ended September 30, 2023 Nine Months Ended September 30, 2023 (000s, except per share amounts) (000s, except per share amounts) GAAP net income (loss) attributable to Ironwood per share – diluted $0.09 ($6.45) Plus: GAAP net income (loss) attributable to noncontrolling interests – diluted (0.01) (0.18) Adjustments to GAAP net income (loss) (detailed above) 0.04 0.36 Non - GAAP net income (loss) per share – diluted 1,2 $0.12 ($6.27) Reconciliation of GAAP results to non - GAAP financial measures (page 2) 1 The company presents non - GAAP net income and non - GAAP net income per share to exclude the impact of net gains and losses on the derivatives related to our 2022 convertible notes that are required to be marked - to - market. Investors should consider these non - GAAP measures only as a supplement to, not as a substitute for or as superior to, measures o f financial performance prepared in accordance with GAAP. For a reconciliation of the company’s non - GAAP financial measures to the most comparable GAAP measures, please refer to the table above. Additional information regardi ng the non - GAAP financial measures is included in the company’s press release dated November 9, 2023. Management believes this non - GAAP information is useful for investors, taken in conjunction with Ironwood’s GAAP financial statements, because it provides greater transparency and period - over - period comparability with respect to Ironwood’s operating performance. These measures are also used by management to assess the performance of the business. In ad dition, these non - GAAP financial measures are unlikely to be comparable with non - GAAP information provided by other companies. 2 Non - GAAP net income (loss) for the nine months ended September 30, 2023 reflects a one - time charge of approximately $1.1 billion related to acquired in - process research and development from the acquisition of VectivBio in the second quarter of 2023. 42

Q3 2023 Financial Summary Three Months Ended September 30, 2023 Nine Months Ended September 30, 2023 (000s) (000s) GAAP net income (loss) 1,2 $13,950 ($1,029,814) Adjustments: Mark - to - market adjustments on the derivatives related to convertible notes , net 0 (19) Restructuring expenses 4,685 17,696 Interest expense 9,839 13,206 Interest and investment income (1,748) (17,777) Income tax expense 17,982 51,385 Depreciation and amortization 507 1,063 Acquisition - related costs 3,864 39,545 Adjusted EBITDA 1,2 $49,079 ($924,715) 1 Ironwood presents GAAP net income and adjusted EBITDA, a non - GAAP measure. Adjusted EBITDA is calculated by subtracting mark - to - market adjustments on derivatives related to Ironwood’s 2022 Convertible Notes, interest expense, interest and investment income, income tax expense, depreciation and amortization from GAAP net income. Investors should conside r these non - GAAP measures only as a supplement to, not as a substitute for or as superior to, measures of financial performance prepared in accordance with GAAP. In addition, these non - GAAP financial measures are unlikely to be compar able with non - GAAP information provided by other companies. For a reconciliation of the company’s non - GAAP financial measures to the most comparable GAAP measures, please refer to the table above. Additional information regardi ng the non - GAAP financial measures is included in the company’s press release dated November 9, 2023. Management believes this non - GAAP information is useful for investors, taken in conjunction with Ironwood’s GAAP financial statements, because it provides greater transparency and period - over - period comparability with respect to Ironwood’s operating performance. These measures are also used by management to assess the performance of the business. Inves tor s should consider these non - GAAP measures only as a supplement to, not as a substitute for or as superior to, measures of financial performance prepared in accordance with GAAP. In addition, these non - GAAP financial measures are unlikely to be comparable with non - GAAP information provided by other companies. 2 Adjusted EBITDA for nine months ended September 30, 2023 reflects a one - time charge of approximately $1.1 billion related to acquired in - process research and development from the acquisition of VectivBio in the second quarter of 2023. Reconciliation of GAAP net income (loss) to adjusted EBITDA 43

Q3 2023 Financial Summary LINZESS U.S. Brand Collaboration Three Months Ended September 30, 2023 Nine Months Ended September 30, 2023 (000s) (000s) LINZESS U.S. net product sales $278,954 $798,854 AbbVie & Ironwood commercial costs, expenses and other discounts 2 77,736 223,142 AbbVie & Ironwood R&D expenses 3 9,264 28,270 Total net profit on sales of LINZESS $191,954 $547,442 Commercial Profit & Collaboration Revenue 1 Ironwood & AbbVie Total Net Profit 1 The purpose of the Commercial Profit and Collaboration Revenue table is to present the calculation of Ironwood’s share of net p rofits generated from sales of LINZESS in the U.S. and Ironwood’s collaboration revenue / expense; 2 Includes certain discounts recognized and cost of goods sold incurred by AbbVie; also includes commercial costs incurred by A bb Vie and Ironwood that are attributable to the cost - sharing arrangement between the parties. 3 R&D expenses related to LINZESS in the U.S. are shared equally between Ironwood and AbbVie under the collaboration agreement. Three Months Ended September 30, 2023 Nine Months Ended September 30, 2023 (000s) (000s) LINZESS U.S. net product sales $278,954 $798,854 AbbVie & Ironwood commercial costs, expenses and other discounts 2 77,736 223,142 Commercial profit on sales of LINZESS $201,218 $575,712 Commercial Margin 72% 72% Ironwood’s share of net profit 100,609 287,856 Reimbursement for Ironwood’s commercial expenses 9,480 28,615 Ironwood’s collaboration revenue $110,089 $316,471 44

v3.23.4

Cover

|

Jan. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 08, 2024

|

| Entity File Number |

001-34620

|

| Entity Registrant Name |

IRONWOOD PHARMACEUTICALS, INC.

|

| Entity Central Index Key |

0001446847

|

| Entity Tax Identification Number |

04-3404176

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

100 Summer Street

|

| Entity Address, Address Line Two |

Suite 2300

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02110

|

| City Area Code |

617

|

| Local Phone Number |

621-7722

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.001 par value

|

| Trading Symbol |

IRWD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

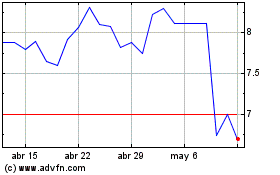

Ironwood Pharmaceuticals (NASDAQ:IRWD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ironwood Pharmaceuticals (NASDAQ:IRWD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024