false

0001879403

0001879403

2024-11-19

2024-11-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 19, 2024

| La Rosa Holdings Corp. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

001-41588 |

|

87-1641189 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

1420 Celebration Blvd., 2nd Floor

Celebration, Florida |

|

34747 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code:

(321) 250-1799

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

|

LRHC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On November 20, 2024, La Rosa Holdings Corp.,

a Nevada corporation (the “Company”), issued a press release announcing certain financial and business highlights for the

third quarter ended September 30, 2024.

Item

5.07 Submission of Matters to a Vote of Security Holders.

On November 19, 2024, the Company held its virtual

2024 Annual Stockholders’ Meeting (the “Meeting”).

At the close of business on September 20, 2024,

the Record Date, there were 17,818,571 shares of common stock and 2,000 shares of Series X Super Voting Preferred Stock of the Company

outstanding. Holders of our common stock are entitled to one vote per share. The Series X Super Voting Preferred Stock was entitled to

an aggregate of 20,000,000 votes. Pursuant to the Certificate of Designation of the Series X Super Voting Preferred Stock, the Series

X Super Voting Preferred Stock votes on all matters as the common stock and has 10,000 votes per share. Joseph La Rosa, the Company’s

Chief Executive Officer, President and Chairman of the Board of Directors of the Company (the “Board”), owns 100% of the outstanding

shares of Series X Super Voting Preferred Stock.

Due to an administrative error, the proxy statement for the Meeting, filed by the Company with the Securities and Exchange Commission

on October 7, 2024, misstated the number of shares of common stock issued and outstanding on the Record Date and entitled to vote at the

Meeting. The correct number is 17,818,571 shares of common stock, and not 17,791,571 shares as shown in the Proxy Statement.

At the Meeting, the combined holders of 22,498,317

shares of the voting stock entitled to notice of and to vote at the Meeting were represented in person or by proxy, representing approximately

59% of the outstanding voting shares. The presence of these shares, both common stock and Series X Super Voting Preferred Stock, constituted a quorum

pursuant to the Nevada Revised Statutes and the bylaws of the Company, allowing for the transaction of business at the Meeting.

The final results for each of the matters considered

at the Meeting were as follows:

| 1. | Election

of the five nominees to the Board: |

| Name | |

Votes For | | |

Withheld | | |

Broker

Non-Votes | |

| Joseph La Rosa | |

| 20,278,882 | | |

| 26,714 | | |

| 2,192,721 | |

| Michael La Rosa | |

| 20,278,979 | | |

| 26,617 | | |

| 2,192,721 | |

| Lourdes Felix | |

| 20,252,865 | | |

| 52,731 | | |

| 2,192,721 | |

| Siamack Alavi | |

| 20,269,110 | | |

| 36,486 | | |

| 2,192,721 | |

| Ned L. Siegel | |

| 20,267,374 | | |

| 38,222 | | |

| 2,192,721 | |

Each director nominee was elected to serve as

a director until the Company’s 2025 annual meeting of stockholders, or until such person’s successor is duly elected and qualified,

or until such person’s earlier resignation, death, or removal. Due to the fact that directors are elected by a plurality of the

votes cast, votes could only be cast in favor of or withheld from the nominees and thus votes against were not applicable.

| 2. | Ratification

of Appointment of Marcum LLP as the independent auditor of the Company for the fiscal year ending December 31, 2024: |

| Votes For | | |

Votes Against | | |

Abstentions | |

| | 22,195,746 | | |

| 301,549 | | |

| 1,022 | |

The affirmative vote of the holders of a majority

of the outstanding shares present in person, by remote communication, or represented by proxy at the Meeting and entitled to vote was

required for approval. The proposal was approved.

| 3. | Approval

of the Amended and Restated La Rosa Holdings Corp. 2022 Equity Incentive Plan: |

| Votes For | | |

Votes Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 20,246,851 | | |

| 56,944 | | |

| 1,801 | | |

| 2,192,721 | |

The affirmative vote of the holders of a majority

of the outstanding shares present in person, by remote communication, or represented by proxy at the Meeting and entitled to vote was

required for approval. The proposal was approved.

| 4. | Approval

of the Second Amended and Restated La Rosa Holdings Corp. 2022 Agent Incentive Plan: |

| Votes For | | |

Votes Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 20,250,365 | | |

| 53,769 | | |

| 1,462 | | |

| 2,192,721 | |

The affirmative vote of the holders of a majority

of the outstanding shares present in person, by remote communication, or represented by proxy at the Meeting and entitled to vote was

required for approval. The proposal was approved.

| 5. | Adjournment

of the meeting to permit further solicitation of proxies, if necessary or appropriate: |

| Votes For | | |

Votes Against | | |

Abstentions | |

| | 22,047,632 | | |

| 439,563 | | |

| 11,122 | |

The affirmative vote of the holders of a majority

of the outstanding shares present in person, by remote communication, or represented by proxy at the Meeting and entitled to vote was

required for approval. The proposal was approved.

Item 8.01 Other Events.

A copy of the press release referenced in Item

2.02 of this Current Report on Form 8-K is as Exhibit 99.1 to this Current Report on Form 8-K.

The disclosure under Item 8.01, including Exhibit

99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended, or otherwise subject to the liabilities of that section. The information provided herein shall not be deemed incorporated

by reference into any filing made under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in

such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are being filed herewith:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 25, 2024 |

LA ROSA HOLDINGS CORP. |

| |

|

|

| |

By: |

/s/ Joseph La Rosa |

| |

Name: |

Joseph La Rosa |

| |

Title: |

Chief Executive Officer |

4

Exhibit 99.1

La

Rosa Holdings Reports 155% Year-Over-Year Increase in Revenue to $51.7 Million for the First 9 Months of 2024; Surpassing Initial Revenue

Guidance by Approximately $6.7 Million

Revenue

for the Third Quarter of 2024 Increased 188% Year-Over-Year to $19.6 Million

Targeting

$100 Million Annualized Revenue as 2024 Exit Run Rate

Celebration,

FL – November 20, 2024 – La Rosa Holdings Corp. (NASDAQ: LRHC) (“La

Rosa” or the “Company”), a holding company for six agent-centric, technology-integrated, cloud-based, multi-service

real estate segments, today provided a business update and reported financial results for the third quarter ended September 30,

2024.

Key

Financial Highlights

| ● | Total

revenue increased 188% year-over-year to $19.6 million for the third quarter ended September

30, 2024 from $6.8 million for the third quarter ended September 30, 2023 |

| ● | Residential

real estate services revenue increased $12.6 million to $16.5 million, or 328%, for the third

quarter ended September 30, 2024 from $3.8 million for the third quarter ended September

30, 2023 |

| ● | Property

management revenue increased by approximately $341 thousand to $2.9 million, or 14%, for

the third quarter ended September 30, 2024 from $2.5 million for the third quarter ended

September 30, 2023 |

| ● | Real

Estate Brokerage Services (Commercial) revenue increased by approximately $34 thousand to

$64 thousand, or 110% for the third quarter ended September 30, 2024 from $31 thousand for

the third quarter ended September 30, 2023 |

| ● | Total

revenue increased approximately 155% year-over-year to $51.7 million for the nine months

ended September 30, 2024 from $20.3 million for the nine months ended September 30, 2023;

surpassing initial revenue guidance by approximately $6.7 Million |

| ● | Residential

real estate services revenue increased $30.7 million to $42.6 million, or 259%, for the nine

months ended September 30, 2024 from $11.9 million for the nine months ended September 30,

2023 |

| ● | Property

management revenue increased by approximately $986 thousand to $8.2 million, or approximately

14%, in the nine months ended September 30, 2024 from $7.2 million for the nine months ended

September 30, 2023 |

| ● | Real

Estate Brokerage Services (Commercial) revenue increased by approximately $149 thousand to

$249 thousand, or 148% for the nine months ended September 30, 2024 from $100 thousand for

the nine months ended September 30, 2023 |

Q3

2024 Operational Achievements

| ● | Acquired

seven real estate brokerage franchisees in the first nine months of 2024 fiscal year |

| ● | Completed

acquisition of Nona Title Agency LLC DBA Red Door Title |

| ● | Announced

intent to acquire real estate brokerage firm with over 950 agents and more than $19.0 million

in revenue for 2023 |

| ● | Completed

debt restructuring, improving the financial position and reducing debt under the notes by

approximately 9.5% |

Joe

La Rosa, CEO of La Rosa, commented, “We’re pleased to report that revenue grew an impressive 188% in Q3 2024 comparing to

Q3 2024 and approximately 155% for the first nine months of 2024 as compared to the same period of 2023. This performance was fueled

by acquisitions of real estate brokerage franchisees and an increase in agent count. During the third quarter, we acquired Nona Title

Agency, enabling us to offer title insurance services. We believe that this addition enhances our ability to provide seamless, end-to-end

experiences for homebuyers and sellers, while positioning title services as a high-margin revenue stream projected to grow significantly

in 2025.

“We

are developing a transformative proptech company that empowers agents with state-of-the-art tools to deliver exceptional service and

revolutionize the real estate experience through innovation and efficiency. At the heart of this initiative is our proprietary platform,

My Agent Account, which we continually refine to give our agents a competitive edge, enhance productivity, and set new industry benchmarks.

Our competitive revenue share model and agent-centric approach have been key drivers of our strong organic growth. Since June 1, 2024,

we have successfully onboarded over 400 agents in just three months. We believe that it is a testament to the strength of our model and

our ongoing commitment to empowering and supporting our expanding agent network. This growth underscores our focus on creating an environment

where agents can thrive and achieve success.

“We

are leveraging our momentum with ambitious plans for further growth. In addition to acquiring franchisees, we are exploring strategic

acquisitions, including a recent Letter of Intent (LOI) to acquire a real estate brokerage generating $19 million in revenue in 2023,

supported by a network of 950+ agents across multiple states. This aligns with our vision of providing technology-driven real estate

solutions, expanding market reach, and delivering greater value to agents.

“Looking

ahead, we anticipate an annualized revenue run rate of $100 million by the end of 2024, driven by scaling operations, expanding revenue

streams, and integrating new agents and technologies. We expect to achieve profitability in 2025, supported by disciplined cost management,

enhanced technology offerings, and continued focus on agent success and customer satisfaction,” concluded Mr. La Rosa.

The

closings of the acquisitions mentioned in this press release are subject to, and contingent upon, the parties entering into their respective

definitive agreements. There can be no assurances that these acquisitions will be consummated.

Financial

Results

Total

revenue for the third quarter ended September 30, 2024, was $19.6 million compared to $6.8 million for the third quarter ended September

30, 2023. Residential real estate services revenue increased $12.6 million to $16.5 million, or 328%, in the third quarter ended September

30, 2024, from $3.8 million for the third quarter ended September 30, 2023. The increase was driven by $12.2 million of revenue from

the six acquisitions completed in the fourth quarter of fiscal year 2023 and the seven acquisitions completed in the first nine months

of fiscal year 2024. We increased our transaction fee, monthly agent fee, and annual fee effective September 1, 2023, which, if volume

returns to 2023 levels, real estate brokerage services revenue, excluding incremental acquisition revenue, will increase in 2024. Selling,

general and administrative costs, excluding stock-based compensation, for the third quarter ended September 30, 2024, were approximately

$3.0 million, compared to $988 thousand for the third quarter ended September 30, 2023. A portion of this increase was driven by $1.1

million of additional costs from the thirteen acquisitions we completed since the Company’s initial public offering (IPO) in October

2023 in addition to increased payroll and benefits, insurance and training, and public company costs in connection with the IPO, compared

to the same period in 2023. Net loss was $3.4 million, or $(0.21) basic and diluted loss per share, for the third quarter ended September

30, 2024, compared to net loss of $344 thousand, or $(0.06) basic and diluted loss per share, for the third quarter ended September 30,

2023.

Total

revenue for the nine months ended September 30, 2024, was $51.7 million compared to $20.3 million for nine months ended September 30,

2023. Residential real estate services revenue increased $30.7 million to $42.6 million, or 259%, in the nine months ended September

30, 2024, from $11.9 million for the nine months ended September 30, 2023. The increase was driven by $32 million of revenue from the

six acquisitions completed in the fourth quarter of fiscal year 2023 and the seven acquisitions completed in the first nine months of

fiscal year 2024. Selling, general and administrative costs, excluding stock-based compensation, for the nine months ended September

30, 2024, were $8.5 million, compared to $2.9 million for the nine months ended September 30, 2023. A portion of this increase was driven

by $1.9 million of additional costs from the thirteen acquisitions we completed since the Company’s IPO in October 2023 in addition

to increased payroll and benefits, insurance and training, and public company costs in connection with the IPO, compared to the same

period in 2023. Net loss was $10.5 million, or $(0.70) basic and diluted loss per share, for the nine months ended September 30, 2024,

compared to net loss of $1.7 million, or $(0.29) basic and diluted loss per share, for the nine months ended September 30, 2023.

About

La Rosa Holdings Corp.

La

Rosa Holdings Corp. (Nasdaq: LRHC) is disrupting the real estate industry by offering agents a choice between a revenue share model or

an annual fee-based model with 100% agent commissions. Leveraging its proprietary technology platform, La Rosa empowers agents and franchisees

to deliver top-tier service to their clients. The Company provides both residential and commercial real estate brokerage services and

offers technology-based products and services to its sales agents and franchise agents.

La

Rosa’s business model is structured around internal services for agents and external services for the public, including residential and

commercial real estate brokerage, franchising, real estate brokerage education and coaching, and property management. The Company has

24 La Rosa Realty corporate real estate brokerage offices and branches located in Florida, California, Texas, Georgia, and Puerto Rico.

The Company also has 9 La Rosa Realty franchised real estate brokerage offices and branches and 3 affiliated real estate brokerage offices,

all within the United States and Puerto Rico.

For

more information, please visit: https://www.larosaholdings.com.

Stay

connected with La Rosa, sign up for news alerts here: larosaholdings.com/email-alerts.

Forward-Looking

Statements

This

press release contains forward-looking statements regarding the Company’s current expectations that are subject to various risks

and uncertainties. Such statements include statements regarding the Company’s ability to grow its business and other statements

that are not historical facts, including statements which may be accompanied by the words “intends,” “may,” “will,”

“plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,”

“aims,” “believes,” “hopes,” “potential” or similar words. These statements

are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict.

Actual results could differ materially from those described in these forward-looking statements due to certain factors, including without

limitation, the Company’s ability to achieve profitable operations, our ability to successfully integrate acquisitions into our business

operations, customer acceptance of new services, the demand for the Company’s services and the Company’s customers’ economic

condition, the impact of competitive services and pricing, general economic conditions, the successful integration of the Company’s

past and future acquired brokerages, the effect of the recent National Association of Realtors’ landmark settlement on our business operations,

and other risk factors detailed in the Company’s filings with the United States Securities and Exchange Commission (the “SEC”).

You are urged to carefully review and consider any cautionary statements and other disclosures, including the statements made under the

heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and other reports and

documents that we file from time to time with the SEC, including our Quarterly Report on Form 10-Q for the fiscal quarter ended September

30, 2024. Forward-looking statements contained in this press release are made only as of the date of this press release, and La Rosa

does not undertake any responsibility to update any forward-looking statements in this release, except as may be required by applicable

law. References and links to websites have been provided as a convenience, and the information contained on such websites has not been

incorporated by reference into this press release.

For

more information, contact: info@larosaholdings.com

Investor

Relations Contact:

Crescendo

Communications, LLC

David

Waldman/Natalya Rudman

Tel:

(212) 671-1020

Email:

LRHC@crescendo-ir.com

(Tables

follow)

La Rosa Holdings Corp. and Subsidiaries

Condensed Consolidated Balance Sheets

| | |

September 30,

2024 | | |

December 31,

2023 | |

| | |

(unaudited) | | |

(audited) | |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash | |

$ | 1,811,608 | | |

$ | 959,604 | |

| Restricted cash | |

| 2,148,148 | | |

| 1,484,223 | |

| Accounts receivable, net of allowance for credit losses of $165,554 and $83,456, respectively | |

| 817,391 | | |

| 826,424 | |

| Other current assets | |

| 1,188 | | |

| — | |

| Total current assets | |

| 4,778,335 | | |

| 3,270,251 | |

| | |

| | | |

| | |

| Noncurrent assets: | |

| | | |

| | |

| Property and equipment, net | |

| 17,739 | | |

| 14,893 | |

| Right-of-use asset, net | |

| 1,088,759 | | |

| 687,570 | |

| Intangible assets, net | |

| 5,673,222 | | |

| 4,632,449 | |

| Goodwill | |

| 8,102,089 | | |

| 5,702,612 | |

| Other long-term assets | |

| 26,853 | | |

| 21,270 | |

| Total noncurrent assets | |

| 14,908,662 | | |

| 11,058,794 | |

| Total assets | |

$ | 19,686,997 | | |

$ | 14,329,045 | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 2,093,563 | | |

$ | 1,147,073 | |

| Accrued expenses | |

| 729,043 | | |

| 227,574 | |

| Contract liabilities | |

| 72,365 | | |

| — | |

| Line of credit | |

| 75,697 | | |

| — | |

| Derivative liability | |

| 50,040 | | |

| — | |

| Advances on future receipts | |

| 262,263 | | |

| 77,042 | |

| Accrued acquisition cash consideration | |

| 341,404 | | |

| 300,000 | |

| Notes payable, current | |

| 2,095,692 | | |

| 4,400 | |

| Lease liability, current | |

| 526,609 | | |

| 340,566 | |

| Total current liabilities | |

| 6,246,676 | | |

| 2,096,655 | |

| | |

| | | |

| | |

| Noncurrent liabilities: | |

| | | |

| | |

| Note payable, net of current | |

| 643,734 | | |

| 615,127 | |

| Security deposits payable | |

| 1,821,582 | | |

| 1,484,223 | |

| Lease liability, noncurrent | |

| 581,622 | | |

| 363,029 | |

| Other liabilities | |

| 2,950 | | |

| 2,950 | |

| Total non-current liabilities | |

| 3,049,888 | | |

| 2,465,329 | |

| Total liabilities | |

| 9,296,564 | | |

| 4,561,984 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock - $0.0001 par value; 50,000,000 shares authorized; 2,000 Series X shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | |

| — | | |

| — | |

| Common stock - $0.0001 par value; 250,000,000 shares authorized; 18,560,199 and 13,406,480 issued and outstanding at September 30, 2024 and December 31, 2023, respectively | |

| 1,856 | | |

| 1,341 | |

| Additional paid-in capital | |

| 26,433,290 | | |

| 18,016,400 | |

| Accumulated deficit | |

| (21,478,792 | ) | |

| (12,107,756 | ) |

| Total stockholders’ equity – La Rosa Holdings Corp. shareholders | |

| 4,956,354 | | |

| 5,909,985 | |

| Noncontrolling interest in subsidiaries | |

| 5,434,079 | | |

| 3,857,076 | |

| Total stockholders’ equity | |

| 10,390,433 | | |

| 9,767,061 | |

| Total liabilities and stockholders’ equity | |

$ | 19,686,997 | | |

$ | 14,329,045 | |

La Rosa Holdings Corp. and Subsidiaries

Condensed Consolidated Statements of Operations

(unaudited)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue | |

$ | 19,593,036 | | |

$ | 6,792,250 | | |

$ | 51,733,355 | | |

$ | 20,320,606 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| 17,957,130 | | |

| 6,216,751 | | |

| 47,349,141 | | |

| 18,450,162 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 1,635,906 | | |

| 575,499 | | |

| 4,384,214 | | |

| 1,870,444 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| 246,369 | | |

| 49,277 | | |

| 691,704 | | |

| 242,548 | |

| General and administrative | |

| 2,747,616 | | |

| 938,634 | | |

| 7,809,627 | | |

| 2,672,372 | |

| Stock-based compensation — general and administrative | |

| 389,711 | | |

| 5,041 | | |

| 4,054,821 | | |

| 79,341 | |

| Total operating expenses | |

| 3,383,696 | | |

| 992,952 | | |

| 12,556,152 | | |

| 2,994,261 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (1,747,790 | ) | |

| (417,453 | ) | |

| (8,171,938 | ) | |

| (1,123,817 | ) |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (98,566 | ) | |

| (6,966 | ) | |

| (197,425 | ) | |

| (147,505 | ) |

| Loss on extinguishment of debt | |

| (722,729 | ) | |

| — | | |

| (722,729 | ) | |

| — | |

| Amortization of debt discount | |

| (135,185 | ) | |

| (207,887 | ) | |

| (455,289 | ) | |

| (882,781 | ) |

| Change in fair value of derivative liability | |

| 307,098 | | |

| 10,201 | | |

| 218,998 | | |

| 138,985 | |

| Other income, net | |

| 4,544 | | |

| 278,266 | | |

| 4,544 | | |

| 278,834 | |

| Net loss | |

| (2,392,628 | ) | |

| (343,839 | ) | |

| (9,323,839 | ) | |

| (1,736,284 | ) |

| Less: Net income (loss) attributable to noncontrolling interests in subsidiaries | |

| 59,540 | | |

| — | | |

| 47,197 | | |

| — | |

| Net loss after noncontrolling interest in subsidiaries | |

| (2,452,168 | ) | |

| (343,839 | ) | |

| (9,371,036 | ) | |

| (1,736,284 | ) |

| Less: Deemed dividend | |

| 920,038 | | |

| — | | |

| 1,150,706 | | |

| — | |

| Net loss attributable to common stockholders | |

$ | (3,372,206 | ) | |

$ | (343,839 | ) | |

$ | (10,521,742 | ) | |

$ | (1,736,284 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per share of common stock attributable to common stockholders | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | (0.21 | ) | |

$ | (0.06 | ) | |

$ | (0.70 | ) | |

$ | (0.29 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares used in computing net loss per

share of common stock attributable to common stockholders | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 16,358,452 | | |

| 6,180,633 | | |

| 14,970,099 | | |

| 6,063,056 | |

5

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

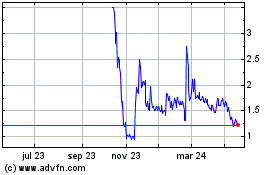

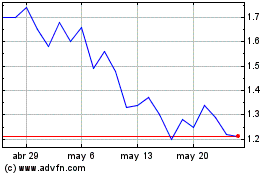

La Rosa (NASDAQ:LRHC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

La Rosa (NASDAQ:LRHC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024