UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material Pursuant to §240.14a-12 |

MASIMO CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Persons who are to respond to the collection of information contained

in this form are not required to respond unless the form displays a currently valid OMB control number.

On May 13, 2024, Craig Reynolds, the Lead Independent Director of

Masimo Corporation, sent the letter below to Quentin Koffey of Politan Capital Management LP:

Masimo Corporation

52 Discovery

Irvine, California 92618

VIA EMAIL

Quentin Koffey

Managing Partner

Politan Capital Management LP

106 West 52nd Street

New York, New York 10019

May 13, 2024

Quentin,

I write in response to your

May 9 letter in which you rejected our offer to appoint Mr. Jellison, your own nominee, to Masimo’s Board and to settle our differences

so that we could move past this dispute and focus on Masimo’s future.

I am disappointed you have once

again decided not to engage with us constructively. We have been open, honest and transparent about our plans for Masimo’s future

and our vision to maximize value for all of Masimo’s stockholders. Our settlement proposal was reasonable and it

addressed your express concerns – the ability for your Director nominees to approve the actions of the Masimo Board, including our

collective efforts to identify and agree on a new independent seventh member of the Board.

You claim in your response that

“seating one Politan nominee will simply deadlock the Board,” and then go on to say that Mr. Jellison is “unquestionably

independent.” We trust that Mr. Jellison will conduct himself independently as a director. That is our stockholders’ expectation

of all our independent directors.

With the addition of Mr. Jellison,

as we have proposed, five of six directors on the Masimo Board will be independent. Four of those directors will have been added to Masimo’s

Board in the last 11 months.

If you truly believe that the

Politan nominated directors will vote in lockstep with one another, then your proposal to add two additional Politan nominees –

along with last year’s election of two Politan nominees, including you – would effectively turn control of the Board

over to Politan. It would be irresponsible and a potential breach of the Board’s fiduciary responsibilities to give Politan control

of Masimo without a stockholder vote.

This is particularly worrisome

as Politan has yet to articulate any plan to enhance Masimo’s business or any benefit that a Politan controlled Board would bring

to Masimo’s stockholders. Mr. Kiani has built Masimo from a garage start up to a leading multi-billion dollar healthcare company,

and I believe he has the vision and the expertise to take Masimo to the next level and to continue to create stockholder value. In the

10 years I have been on Masimo’s Board, serving with 9 different independent directors excluding you and Ms. Brennan, we have consistently

worked to retain Mr. Kiani and encourage him to continue to lead the company. I view your efforts to oust Mr. Kiani as a threat to stockholder

value.

I also hope, Quentin, that you

are not making this a contest of wills or a personal campaign against Mr. Kiani. We, as directors and colleagues on the Board, remain

obliged to act in the best interests of all of our stockholders and not otherwise.

My sincere hope is that our

offer to have Mr. Jellison join our Board will move us past our current disagreements and avoid a prolonged and expensive proxy fight

that will deeply damage our brand, our Company and our ability to serve patients. Our proposal will require all of us to work together

and cooperate in implementing strategic plans and considering the separation of the Consumer Business.

I am making this reply public

so that our stockholders can see that we are genuinely working on a solution that will be beneficial to all of Masimo’s stockholders.

As you offered in your response, we should engage constructively and privately toward a solution from here forward.

Sincerely,

/s/ Craig Reynolds

Craig Reynolds

Lead Independent Director, Masimo

Corporation

# # #

Forward-Looking Statements

This communication includes forward-looking statements as defined in

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, in connection

with the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among others, statements regarding

the 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) of Masimo Corporation (“Masimo” or the “Company”),

the settlement offer made by Masimo to Quentin Koffey of Politan Capital Management LP (“Politan”), Masimo’s strategic

plans and the evaluation of the proposed separation of its Consumer Business and the potential benefits of such separation. These forward-looking

statements are based on current expectations about future events affecting Masimo and are subject to risks and uncertainties, all of which

are difficult to predict and many of which are beyond Masimo’s control and could cause its actual results to differ materially and

adversely from those expressed in its forward-looking statements as a result of various risk factors, including, but not limited to (i)

uncertainties regarding a potential separation of Masimo’s Consumer Business, (ii) uncertainties regarding future actions that may

be taken by Politan in furtherance of its nomination of director candidates for election at the 2024 Annual Meeting, (iii) the potential

cost and management distraction attendant to Politan’s nomination of director nominees at the 2024 Annual Meeting and (iv) factors

discussed in the “Risk Factors” section of Masimo’s most recent reports filed with the Securities and Exchange Commission

(“SEC”), which may be obtained for free at the SEC’s website at www.sec.gov. Although Masimo believes that the

expectations reflected in its forward-looking statements are reasonable, the Company does not know whether its expectations will prove

correct. All forward-looking statements included in this communication are expressly qualified in their entirety by the foregoing cautionary

statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of today’s date.

Masimo does not undertake any obligation to update, amend or clarify these statements or the “Risk Factors” contained in the

Company’s most recent reports filed with the SEC, whether as a result of new information, future events or otherwise, except as

may be required under the applicable securities laws.

Additional Information Regarding the 2024 Annual Meeting of Stockholders

and Where to Find It

The Company intends to file a proxy statement and GOLD proxy card with

the U.S. Securities and Exchange Commission (the “SEC”) in connection with its solicitation of proxies for its 2024 Annual

Meeting. THE COMPANY’S STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (AND ANY AMENDMENTS AND SUPPLEMENTS

THERETO) AND ACCOMPANYING GOLD PROXY CARD WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain

the proxy statement, any amendments or supplements to the proxy statement and other documents as and when filed by the Company with the

SEC without charge from the SEC’s website at www.sec.gov.

Certain Information Regarding Participants

The Company, its directors and certain of its executive officers and

employees may be deemed to be participants in connection with the solicitation of proxies from the Company’s stockholders in connection

with the matters to be considered at the 2024 Annual Meeting. Information regarding the direct and indirect interests, by security holdings

or otherwise, of the Company’s directors and executive officers in the Company is included in Amendment No. 1 to the Company’s

Annual Report on Form 10-K for the fiscal year ended December 30, 2023 under the heading “Security

Ownership of Certain Beneficial Owners and Management”, filed with the SEC on April 29, 2024, which can be found through

the SEC’s website at https://www.sec.gov/ix?doc=/Archives/edgar/data/937556/000093755624000027/masi-20231230.htm. Changes to the

direct or indirect interests of Masimo’s securities by directors and executive officers are set forth in SEC filings on Statements

of Change in Ownership on Form 4 filed with the SEC on April 30, 2024 and May 3, 2024, which can be found through the SEC’s website

at https://www.sec.gov/Archives/edgar/data/937556/000093755624000030/xslF345X05/wk-form4_1714522261.xml and https://www.sec.gov/Archives/edgar/data/937556/000093755624000032/xslF345X05/wk-form4_1714772837.xml,

respectively. More detailed and updated information regarding the identity of these potential participants, and their direct or indirect

interests of the Company, by security holdings or otherwise, will be set forth in the proxy statement for the 2024 Annual Meeting and

other materials to be filed with the SEC. These documents, when filed, can be obtained free of charge from the sources indicated above.

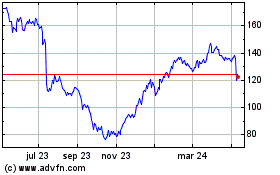

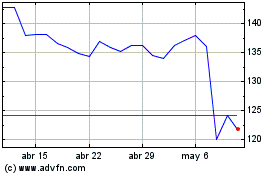

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De May 2023 a May 2024