UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material Pursuant to §240.14a-12 |

MASIMO CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Persons who are to respond to the collection of information contained

in this form are not required to respond unless the form displays a currently valid OMB control number.

On May 10, 2024, Kevin M. Gallagher of Richards, Layton & Finger,

P.A., counsel to Masimo Corporation (“Masimo”), sent the letter below to Michael E. Swartz of Schulte Roth & Zabel LLP,

counsel to Quentin Koffey of Politan Capital Management LP, in response to Mr. Koffey’s May 8, 2024 letter to Masimo demanding inspection

of certain Masimo books and records:

Kevin M. Gallagher

302-651-7692

Gallagher@rlf.com |

|

May 10, 2024

VIA EMAIL

Michael E. Swartz, Esquire

Schulte

Roth & Zabel LLP

919 Third Avenue

New York, New York 10022

| Re: | Response to Demand

to Inspect Books and Records of Masimo |

|

| | | Corporation Pursuant to 8 Del. C. §

220 |

|

Dear Michael:

I write on behalf of Masimo Corporation

(“Masimo” or the “Company”) in response to Quentin Koffey’s May 8, 2024 letter purporting to demand inspection

of certain books and records of Masimo pursuant to 8 Del. C. § 220(d) (the “Demand”).1

Mr. Koffey

delivered the Demand after receiving a request by the Company to schedule a Board meeting devoted to updating the Board regarding the

potential JV and while the Company was already in the process of preparing Board materials regarding the potential JV for distribution

to the Board, including Mr. Koffey. Indeed, the Demand is the first time Mr. Koffey requested any documents beyond those that the Company

was already preparing to provide to the Board. There is no basis whatsoever for this premature Demand. As planned, the Company will furnish

Board materials on this topic to Mr. Koffey and the other members of the Board no later than Monday, May 13.

| 1 | Capitalized terms not defined herein take the meanings given

in the Demand. |

Michael E. Swartz, Esquire

May 10, 2024

Page 2

As Mr. Koffey recognizes in

the Demand, these materials are being provided to Mr. Koffey subject to his fiduciary duties as a director of the Company and solely

for use in such capacity. The Company is troubled by Mr. Koffey’s unauthorized disclosure of non-public information relating

to the potential JV through his unnecessary public filing of the Demand contemporaneous with its delivery to the Company even though

no such filing was required under applicable SEC Rules. The Company must reserve all rights and remedies in this regard. As Mr.

Koffey is aware, the JV Partner is concerned about this type of unauthorized disclosure of non- public information regarding the

Company’s discussions with the JV Partner. The JV partner has emphasized that the transaction will be at risk if their

identity leaks. The Company therefore reminds Mr. Koffey that any disclosure of the name of the JV partner or other non-public

information regarding the JV discussions will constitute a breach of his duty of loyalty to Masimo. The Company must reserve all

rights and remedies in this regard.

The Demand

also states that Schulte Roth & Zabel LLP (“SRZ”) and Cadwalader, Wickersham & Taft LLP (“CWT”) represent

Mr. Koffey individually in this matter. The Company cannot authorize Mr. Koffey to provide the JV materials to SRZ and CWT absent written

confirmation that SRZ and CWT represent Mr. Koffey individually, that neither SRZ nor CWT will reference, disclose or use any of the JV

materials in connection with any representation of Politan, including in connection with Politan’s proxy contest seeking control

of the Masimo Board.

As confirmed

above, the Company will provide Mr. Koffey and the rest of the Board with Board materials regarding the potential JV as planned. For this

reason, the Demand is premature and unnecessary. Mr. Koffey will receive the same information regarding the JV that all other directors

will receive by Monday, May 13, 2024. The Company will also authorize Mr. Koffey to provide that information to SRZ and CWT subject to

receipt of the written confidentiality confirmation requested above.

| |

Sincerely, |

| |

|

| |

/s/ Kevin M. Gallagher |

| |

Kevin M. Gallagher |

| cc: |

Richard M. Brand, Esquire (via email) |

# # #

Forward-Looking Statements

This communication includes forward-looking statements as defined in

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, in connection

with the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among others, statements regarding

the 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) of Masimo Corporation (“Masimo” or the “Company”),

any potential joint venture involving Masimo and any potential partner to such joint venture and any materials to be provided to Masimo’s

board of directors regarding such potential joint venture, as well as the expected timing for delivering any such material to Masimo’s

board of directors. These forward-looking statements are based on current expectations about future events affecting Masimo and are subject

to risks and uncertainties, all of which are difficult to predict and many of which are beyond Masimo’s control and could cause

its actual results to differ materially and adversely from those expressed in its forward-looking statements as a result of various risk

factors, including, but not limited to (i) uncertainties regarding a potential separation of Masimo’s Consumer Business, including

any potential joint venture associated therewith, (ii) uncertainties regarding future actions that may be taken by Politan in furtherance

of its nomination of director candidates for election at the 2024 Annual Meeting, (iii) the potential cost and management distraction

attendant to Politan’s nomination of director nominees at the 2024 Annual Meeting and (iv) factors discussed in the “Risk

Factors” section of Masimo’s most recent reports filed with the Securities and Exchange Commission (“SEC”), which

may be obtained for free at the SEC’s website at www.sec.gov. Although Masimo believes that the expectations reflected in

its forward-looking statements are reasonable, the Company does not know whether its expectations will prove correct. All forward-looking

statements included in this communication are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned

not to place undue reliance on these forward-looking statements, which speak only as of today’s date. Masimo does not undertake

any obligation to update, amend or clarify these statements or the “Risk Factors” contained in the Company’s most recent

reports filed with the SEC, whether as a result of new information, future events or otherwise, except as may be required under the applicable

securities laws.

Additional Information Regarding the 2024 Annual Meeting of Stockholders

and Where to Find It

The Company intends to file a proxy statement and GOLD proxy card with

the U.S. Securities and Exchange Commission (the “SEC”) in connection with its solicitation of proxies for its 2024 Annual

Meeting. THE COMPANY’S STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (AND ANY AMENDMENTS AND SUPPLEMENTS

THERETO) AND ACCOMPANYING GOLD PROXY CARD WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain

the proxy statement, any amendments or supplements to the proxy statement and other documents as and when filed by the Company with the

SEC without charge from the SEC’s website at www.sec.gov.

Certain Information Regarding Participants

The Company, its directors and certain of its executive officers and

employees may be deemed to be participants in connection with the solicitation of proxies from the Company’s stockholders in connection

with the matters to be considered at the 2024 Annual Meeting. Information regarding the direct and indirect interests, by security holdings

or otherwise, of the Company’s directors and executive officers in the Company is included in Amendment No. 1 to the Company’s

Annual Report on Form 10-K for the fiscal year ended December 30, 2023 under the heading “Security

Ownership of Certain Beneficial Owners and Management”, filed with the SEC on April 29, 2024, which can be found through

the SEC’s website at https://www.sec.gov/ix?doc=/Archives/edgar/data/937556/000093755624000027/masi-20231230.htm. Changes to the

direct or indirect interests of Masimo’s securities by directors and executive officers are set forth in SEC filings on Statements

of Change in Ownership on Form 4 filed with the SEC on April 30, 2024 and May 3, 2024, which can be found through the SEC’s website

at https://www.sec.gov/Archives/edgar/data/937556/000093755624000030/xslF345X05/wk-form4_1714522261.xml and https://www.sec.gov/Archives/edgar/data/937556/000093755624000032/xslF345X05/wk-form4_1714772837.xml,

respectively. More detailed and updated information regarding the identity of these potential participants, and their direct or indirect

interests of the Company, by security holdings or otherwise, will be set forth in the proxy statement for the 2024 Annual Meeting and

other materials to be filed with the SEC. These documents, when filed, can be obtained free of charge from the sources indicated above.

3

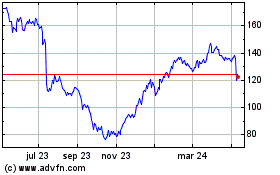

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

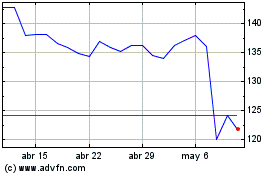

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De May 2023 a May 2024