UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Schedule

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

| Filed

by the Registrant |

|

☒ |

| |

|

|

| Filed

by a party other than the Registrant |

|

☐ |

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

For Use of the Commission Only (As Permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under Rule 14a-12 |

MGO

GLOBAL INC.

(Name

of Registrant as Specified in its Charter)

N/A

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☐ |

Fee

paid previously with preliminary materials. |

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

MGO

GLOBAL INC.

1515

SE 17th Street, Suite 121/#460236

Fort

Lauderdale, Florida 33346

347-913-3316

www.mgoglobalinc.com

January

[*], 2025

Dear

Stockholder:

We

are pleased to invite you to attend the 2025 Special Meeting of Stockholders of MGO Global Inc. (the “Special Meeting”).

The Special Meeting will be held at: 813 NE 17th Terrace, Unit A, Fort Lauderdale, Florida, 33304 on [*], January [*], 2025 at 11:00

a.m. Eastern Time.

Stockholders

will be able to attend the Special Meeting ONLY in person. Please see “Questions and Answers About the Meeting and Voting—How

Do I Vote At The Special Meeting?” in the proxy statement (the “Proxy Statement”) accompanying this letter for

information on how to attend, submit questions and vote at the Special Meeting.

We

are making available to you the accompanying Notice of Special Meeting (“Notice”), Proxy Statement and form of proxy card

or voting instruction form on or about December 23, 2024. We have elected to utilize the “full set delivery” option of providing

paper copies of all of our proxy materials by mail. Our proxy materials are also electronically available at www.proxyvote.com.

Additional details regarding admission to and the business to be conducted at the Special Meeting are described in the accompanying Notice

and Proxy Statement.

Only

stockholders of record at the close of business on December 13, 2024 are entitled to notice of, and to vote at, the Special Meeting.

Your

vote is important. Regardless of whether you plan to attend the Special Meeting, we hope that you will vote as soon as possible.

To ensure your representation at the meeting, please vote by signing and dating the enclosed proxy card and returning it promptly

in the enclosed postage-paid envelope or by submitting voting instructions via the Internet at www.proxyvote.com or telephone. Sending

in your proxy or submitting voting instructions via the Internet or by phone will not prevent you from voting in person at the Special

Meeting. If you vote in person by ballot at the Special Meeting, that vote will revoke any prior proxy or voting instructions that you

have submitted.

Thank

you for your on-going support of MGO Global Inc.

Sincerely,

| /s/

Maximiliano Ojeda |

|

| Maximiliano

Ojeda |

|

| Chairman

and Chief Executive Officer |

|

MGO

GLOBAL INC.

1515

SE 17TH STREET, SUITE 121/#460236

FORT

LAUDERDALE, FLORIDA 33346

347-913-3316

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

ON

[*],

JANUARY [*], 2025 AT 11:00 A.M. EASTERN TIME

ITEMS

OF BUSINESS:

The

2025 Special Meeting of Stockholders (the “Special Meeting”) of MGO Global Inc. (“MGO,” “MGO

Global,” or the “Company”) will be held at: 813 NE 17th Terrace, Unit A, Fort Lauderdale, Florida, 33304

on [*], January [*], 2025 at 11:00 a.m. Eastern Time for the following purposes:

| |

(1) |

to

approve, in accordance with Nasdaq Listing Rule 5635(d), the exercisability of common stock purchase warrants, and the issuance of

the common stock underlying such warrants, which warrants were issued in connection with an offering of securities of the Company

that occurred on December 24, 2024 (the “Warrant Exercise Proposal”); and |

| |

(2) |

to

transact any other business that may be properly brought before the meeting or any continuation, adjournment or postponement thereof |

These

items of business are more fully described in the proxy statement (“Proxy Statement”) accompanying this Notice of

Special Meeting of Stockholders (“Notice”).

After

careful consideration, the Board of Directors has determined that the proposal listed above is in the best interest of the Company and

its stockholders and has approved such proposal. The Board of Directors recommends a vote “FOR” the Warrant Exercise Proposal.

All

stockholders are invited to attend the Special Meeting in person, and no stockholder will be able to attend the Special Meeting virtually.

WHO

CAN VOTE?

You

can vote at the Special Meeting if you were a stockholder of record as of the close of business on December 13, 2024 (the “Record

Date”). Only stockholders of record on the Record Date are entitled to receive this Notice and to vote at the Special Meeting

or at any postponement(s) or continuations(s) or adjournment(s) of the Special Meeting.

FIRST

AMENDMENT TO THE BYLAWS

As

reported in the Current Report on Form 8-K filed by the Company with the SEC on November 22, 2024, on November 18, 2024, the Company’s

Board of Directors approved a First Amendment to the Amended and Restated Bylaws. In accordance with the amendment, (1) the holders of

33 1/3 % of the shares of stock issued and outstanding and entitled to vote, represented in person or by proxy, shall constitute

a quorum at all meetings of the stockholders for the transaction of business except as otherwise provided by statute or by the Certificate

of Incorporation, (2) a stockholder may vote at a meeting of stockholders either (i) in person, or (ii) by proxy that is either in writing

or filled in through electronic or telephonic means.

Accordingly,

in order for us to conduct our Special Meeting, 33 1/3 % of the outstanding shares of stock, as of the Record Date, entitled to

vote must be present or represented by proxy at the Special Meeting.

REVIEW

THE PROXY MATERIALS AND SPECIAL REPORT ON OUR WEBSITE

You

may also read this Notice and Proxy Statement at www.proxyvote.com.

AVAILABLE

DATE

This

Notice, the Proxy Statement and the form of proxy are collectively first being made available to stockholders on or about January [*],

2024.

YOUR

VOTE IS IMPORTANT. YOU MAY VOTE IN PERSON BY BALLOT, OR BY SUBMITTING VOTING INSTRUCTIONS VIA INTERNET, BY TELEPHONE OR BY MAILING BACK

A PROXY CARD. PLEASE REVIEW THE INSTRUCTIONS IN THE PROXY STATEMENT OR ON THE PROXY CARD OR VOTING INSTRUCTION FORM REGARDING EACH OF

THESE VOTING OPTIONS.

We

hope you are able to attend the Special Meeting. Whether or not you attend, it is important that your stock be represented and voted

at the meeting. I urge you to please complete, date and return the proxy card in the enclosed envelope, or submit your voting instructions

by telephone or via Internet using the information provided in the attached Proxy Statement prior to the Special Meeting date. The vote

of each stockholder is very important. You may revoke your written proxy at any time before it is voted at the Special Meeting by giving

written notice to the Company’s Chief Financial Officer, by submitting a properly executed paper proxy bearing a later date or

by attending the Special Meeting and voting by ballot during the meeting. Stockholders may also revoke their proxies by entering new

voting instructions by Internet or by telephone.

By

Order of the Board of Directors

| /s/

Maximiliano Ojeda |

|

| Maximiliano

Ojeda |

|

| Chairman

of the Board of Directors |

|

Important

Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to Be Held on [*], 2025: Pursuant to the

rules of the SEC, with respect to the Special Meeting, we have elected to utilize the “full set delivery” option of providing

paper copies of all of our proxy materials by mail.

The

Notice of the Special Meeting, the Special Report on Form 10-K, and the Proxy Statement are electronically available at www.proxyvote.com.

TABLE

OF CONTENTS

Important

Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to Be Held on [*], 2025: Pursuant to the

rules of the SEC, with respect to the Special Meeting, we have elected to utilize the “full set delivery” option of providing

paper copies of all of our proxy materials by mail.

The

Notice of the Special Meeting and Proxy Statement are also electronically available at www.proxyvote.com.

Forward-Looking

Statements. The Proxy Statement may contain “forward-looking statements” within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995, which statements are subject to substantial risks and uncertainties

and are based on estimates and assumptions. All statements other than statements of historical facts included in the Proxy Statement

are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “might,”

“will,” “objective,” “intend,” “should,” “could,” “can,” “would,”

“expect,” “believe,” “design,” “estimate,” “predict,” “potential,”

“plan” or the negative of these terms, and similar expressions intended to identify forward-looking statements. These statements

involve known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from the forward-looking

statements expressed or implied in the Proxy Statement. Such risks, uncertainties and other factors include those risks described in

“Risk Factors” section of in the Company’s Annual Report on Form 10-K, filed with the SEC on April 1, 2024 and other

subsequent documents that we file with the SEC. The Company expressly disclaims any obligation to update or alter any statements whether

as a result of new information, future events or otherwise, except as required by law.

MGO

GLOBAL INC.

1515

SE 17th Street, Suite 121/#460236

Fort

Lauderdale, Florida 33346

347-913-3316

www.mgoglobalinc.com

PROXY

STATEMENT

For

Special Meeting of Stockholders to Be Held on [*], 2025

The

Board of Directors (the “Board”) of MGO Global Inc., a Delaware corporation (“MGO,” “MGO

Global,” “Company,” “we,” “us” or “our”), solicits

the enclosed proxy for use at the 2025 Special Meeting of Stockholders of the Company (“Special Meeting”) to be held

on [*], 2025, at: 813 NE 17th Terrace, Unit A, Fort Lauderdale, Florida, 33304. This proxy statement (“Proxy Statement”)

and the accompanying Notice of Special Meeting of Stockholders (the “Notice”), and form of proxy are collectively

first being made available to stockholders on or about December 23, 2024.

The

executive offices of the Company are located at, and the mailing address of the Company is 1515 SE 17th Street, Suite 121/#460236, Fort

Lauderdale, Florida 33346.

This

Proxy Statement contains information about the matters to be voted on at the Special Meeting and the voting process, as well as information

about our directors and executive officers.

We

have opted to provide our materials pursuant to the “full set delivery option” in connection with the Special Meeting. Under

the full set delivery option, a company delivers paper copies of all proxy materials to each stockholder. The approximate date on which

the proxy materials will first be mailed to our stockholders is on or around December 23, 2024. Accordingly, you should have received

our proxy materials by mail. In addition to delivering proxy materials to our stockholders, we have posted all proxy materials on a publicly

accessible website. We are soliciting proxies pursuant to this Proxy Statement for use at the Special Meeting. Our Proxy Statement and

other proxy materials are electronically available at www.proxyvote.com

QUESTIONS

AND ANSWERS ABOUT THE MEETING AND VOTING

Q:

What is a proxy?

A:

A proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document,

that document is also called a “proxy” or a “proxy card.” By using the methods discussed below, you will be appointing

Maximiliano Ojeda, the Chief Executive Officer, and a Chairman of the Board, and Dana Perez, the Chief Financial Officer of the Company,

as your proxy. The proxy agent will vote on your behalf and will have the authority to appoint a substitute to act as proxy. If you are

unable to attend the Special Meeting, please vote by proxy so that your shares may be voted.

Q:

What is a proxy statement?

A:

A proxy statement is a document that regulations of the SEC require that we give to you when we ask you to sign a proxy card to vote

your stock at the Special Meeting.

Q:

What is the purpose of the Special Meeting?

A:

At our Special Meeting, stockholders will vote to approve: (i) in accordance with Nasdaq Listing Rule 5635(d), the exercisability

of certain common stock purchase warrants, and the issuance of the Common Stock underlying such warrants, which warrants were issued

in connection with an Offering of Securities of the Company that occurred on December 24, 2024, and (ii) such other matters as may come

before the meeting.

Q:

Why am I receiving these materials?

A:

The Board has made these materials available to you over the Internet at www.proxyvote.com and has delivered printed

versions of these materials to you by mail, in connection with the Board’s solicitation of proxies for use at the Special Meeting.

The Special Meeting is scheduled to be held at: 813 NE 17th Terrace, Unit A, Fort Lauderdale, Florida, 33304, on [*], January [*], 2025

at 11 a.m. Eastern Time. This solicitation by the Board is for proxies for use at the Special Meeting.

Q:

How do I obtain the materials for the Special Meeting?

A:

We have opted to provide our materials pursuant to the “full set delivery option” in connection with the Special Meeting.

Under the full set delivery option, a company delivers paper copies of all proxy materials to each stockholder. The approximate date

on which the proxy materials will first be mailed to our stockholders is on or around January [*], 2024. Accordingly, you should have

received our proxy materials by mail. In addition to delivering proxy materials to stockholders, we have posted all proxy materials on

a publicly accessible website. These proxy materials are also available electronically at www.proxyvote.com.

You

may also view the following proxy materials on the Company’s website at www.mgoglobalinc.com.

You

may not vote on the Company’s website.

Q:

Who may attend the Special Meeting?

A:

The Special Meeting is open to all stockholders of record as of close of business on December 13, 2024 (the “Record Date”),

or their duly appointed proxies.

Q:

What will I need in order to attend the Special Meeting in person?

A:

Attendance at the Special Meeting will be limited to stockholders as of the Record Date. Each stockholder may be asked to present

valid picture identification, such as a driver’s license or passport. Stockholders holding stock in brokerage accounts or by a

bank or other nominee may be required to show a brokerage statement or account statement reflecting stock ownership as of the Record

Date.

If

you are a stockholder of record as of the Record Date, you may vote your shares in person by ballot at the Special Meeting. If you hold

your shares of common stock in a stock brokerage account or through a bank or other nominee, you will not be able to vote in person at

the Special Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee

and present it at the Special Meeting.

Space

for the Special Meeting is limited. Therefore, admission will be on a first-come, first-serve basis. Registration will open at 10:30

a.m. Eastern Time and the Special Meeting will begin at 11:00 a.m. Eastern Time.

Use

of cameras, recording devices, computers and other electronic devices, such as smart phones and tablets, will not be permitted at the

Special Meeting. Please allow ample time for check-in. Parking is limited.

Q:

May stockholders ask questions?

A:

Yes. Representatives of the Company will answer stockholders’ questions of general interest after the adjournment of the Special

Meeting. Depending upon the number of persons asking questions, the Chairman of the meeting may limit the number of questions one person

may ask in order to give a greater number of stockholders an opportunity to ask questions. Questions will be answered as time allows.

Q:

Who may vote?

A:

You may vote if you owned MGO common stock as of the close of business on the Record Date. Each share of MGO common stock is entitled

to one vote. As of the Record Date, the Company had 2,904,001 shares of common stock outstanding.

Registered

Stockholders. If shares of our common stock are registered directly in your name with our transfer agent, you are considered the

stockholder of record with respect to those shares and a notice and proxy statement was provided to you directly by us. As the stockholder

of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or vote in person at the

Special Meeting. Throughout this proxy statement, we refer to these registered stockholders as “stockholders of record.”

Street

Name Stockholders. If shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you

are considered to be the beneficial owner of shares that are held in “street name,” and the notice and proxy statement was

forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. As the beneficial

owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares. Beneficial owners are also invited

to attend the Special Meeting. However, since a beneficial owner is not the stockholder of record, you may not vote your shares of our

common stock in person at the Special Meeting unless you follow your broker’s procedures for obtaining a legal proxy. Your broker,

bank or other nominee will provide a voting instruction form for you to use. Throughout this proxy statement, we refer to stockholders

who hold their shares through a broker, bank or other nominee as “street name stockholders.”

Q:

What am I voting on?

A:

You will be voting on the Warrant Exercise Proposal at the Special Meeting:

Q:

How does the Board recommend that I vote?

A:

Our Board recommends that you vote your shares “FOR” the approval of the Warrant Exercise Proposal;

Q.

How do I vote?

A:

Whether you plan to attend the Special Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that

we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card

or as instructed via the Internet or telephone. You may specify whether your shares should be voted for, against or abstain for

the nominee for director, and whether your shares should be voted for, against or abstain with respect to each of the other proposals.

If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board’s

recommendations as noted above. Voting by proxy will not affect your right to attend the Special Meeting.

If

your shares are registered directly in your name through our stock transfer agent, Transhare Corporation, or you have stock certificates

registered in your name, you may vote:

| |

● |

Voting

in Person. You may attend and vote in person at the Special Meeting at 813 NE 17th Terrace, Unit A, Fort Lauderdale, Florida,

33304 on Friday, January [*], 2025, at 11:00 a.m. Eastern Time. |

| |

● |

Voting

by Proxy. In order to vote by proxy, you have three ways to submit your voting instructions: |

| |

|

|

| |

|

Voting

by Mail. You may submit your proxy by mail by completing, signing and mailing the enclosed proxy card in the enclosed,

postage-paid envelope, or, for shares held in street name, by following the voting instructions provided by your broker, bank, trustee

or nominee. The proxy must be received by our transfer agent at least 48 hours prior to the appointed time of the Special Meeting

or at our principal office in Fort Lauderdale, Florida at least four (4) hours prior to the appointed time of the Special Meeting

to be validly included in the tally of common stock voted at the Special Meeting By mail. If you sign the proxy card but do not specify

how you want your shares voted, they will be voted in accordance with the Board’s recommendations as noted below. |

| |

|

Voting

by Internet. You can also choose to vote on the Internet by going to www.proxyvote.com. You will need your Control Number,

which can be found on your proxy card. Use the Internet to transmit your vote up until 11:59 p.m., Eastern Daylight Saving Time,

on [*], January [*], 2024 |

| |

|

|

| |

|

Voting

by Telephone. You can vote by calling 1-800-690-6903. You will need your Control Number, which can be found on your proxy

card. Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m., Eastern Daylight Saving Time, on [*],

January [*], 2024 |

Telephone

and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time

on December 19, 2024.

If

you are a street name stockholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the

voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee on how to

vote your shares. Street name stockholders should generally be able to vote by returning an instruction card, or by telephone or on the

Internet. However, the availability of telephone and Internet voting will depend on the voting process of your broker, bank or other

nominee. As discussed above, if you are a street name stockholder, you may not vote your shares in person at the Special Meeting unless

you obtain a legal proxy from your broker, bank or other nominee.

Q:

Can I change my mind after I vote?

A:

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Special Meeting by:

| |

● |

signing

another proxy card with a later date and returning it to us prior to the Special Meeting; |

| |

|

|

| |

● |

completing

and mailing a later-dated proxy card; |

| |

|

|

| |

● |

notifying

the Secretary of MGO, in writing, at 1515 SE 17th Street, Suite 121/#460236, Fort Lauderdale, Florida 33346; or |

| |

|

|

| |

● |

completing

a written ballot at the Special Meeting. |

Your

attendance at the Special Meeting will not have the effect of revoking a proxy unless you take any of the actions noted above.

If

you are a street name stockholder, your broker, bank or other nominee can provide you with instructions on how to change your vote.

Q:

Who will count the votes?

A:

Dana Perez, our Chief Financial Officer, will count the votes and will serve as the Inspector of Elections.

Q:

What if I return my proxy card but do not provide voting instructions?

A:

If you vote by proxy card, your shares will be voted as you instruct by the individuals named as proxies on the proxy card. If you

sign and return a proxy card but do not specify how your shares are to be voted, the persons named as proxies on the proxy card will

vote your shares in accordance with the recommendations of the Board. These recommendations are:

| |

● |

FOR

the Warrant Exercise Proposal; |

Q:

What does it mean if I receive more than one proxy card?

A:

It means that you have multiple accounts with brokers and/or our transfer agent. Please vote all of these shares. We recommend that

you contact your broker and/or our transfer agent to consolidate as many accounts as possible under the same name and address. Our transfer

agent is Transhare Corporation, which may be reached at (303) 662-1112.

Q:

Will my shares be voted if I do not provide my proxy?

A:

Your shares may be voted if they are held in the name of a brokerage firm, even if you do not provide the brokerage firm with voting

instructions. Brokerage firms have the authority under the rules of Nasdaq to vote shares for which their customers do not provide voting

instructions on certain “routine” matters. The Warrant Exercise Proposal is considered a routine matter for which brokerage

firms may vote shares for which they have not received voting instructions.

Q:

What is quorum? How many votes must be present to hold the Special Meeting?

A:

A quorum is the minimum number of shares required to be present at the Special Meeting for the Special Meeting to be properly held

under our amended and restated bylaws (“Bylaws”) and Delaware law. Your shares are counted as present at the Special

Meeting if you attend the Special Meeting or if you properly return a proxy by Internet, telephone or mail.

As

reported in our Current Report on Form 8-K filed with the SEC on November 22, 2024, on November 18, 2024, our Board approved First Amendment

to the Bylaws. In accordance with the amendment, the holders of 33 1/3 % of the shares of stock issued and outstanding and entitled

to vote, represented in person or by proxy, shall constitute a quorum at all meetings of the stockholders for the transaction of business

except as otherwise provided by statute or by the Certificate of Incorporation. Accordingly, in order for us to conduct our Special Meeting,

33 1/3% of the outstanding shares of stock, as of the Record Date, entitled to vote must be present or represented by proxy at

the Special Meeting.

Abstentions,

withhold votes and broker non-votes will be counted for purposes of establishing a quorum at the Special Meeting.

Q:

How many votes are needed to approve the Warrant Exercise Proposal?

A:

To approve the Warrant Exercise Proposal, holders of a majority of the votes properly cast on the matter must vote “For”

the proposal. Only “For” and “Against” votes will affect the outcome. Abstentions will be counted for purposes

of establishing a quorum and, if a quorum is present, will have no effect on the voting on the Warrant Exercise Proposal. The Warrant

Exercise Proposal is a routine matter. Therefore, if your shares are held by your bank, broker or other nominee in street name but you

do not vote your shares on this proposal, your bank, broker or other nominee may vote your shares on the Warrant Exercise Proposal. We

do not expect there to be any broker non-votes on this proposal.

Q:

Is voting confidential?

A:

We will keep all the proxies, ballots and voting tabulations private. We only let our Inspector of Elections, representatives of

our proxy advisory, Broadridge Financial Solutions, Inc. and its affiliates (collectively, “Broadridge”), examine

these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We

will, however, forward to management any written comments you make on the proxy card or that you otherwise provide.

Q:

When will the Company announce the voting results?

A:

The Company may announce preliminary voting results after the adjournment of the Special Meeting and will announce the final voting

results of the Special Meeting on a Current Report on Form 8-K filed with the SEC within four business days after the Special Meeting.

Q:

Do any directors or officers of the Company have a personal interest in the matter to be acted upon at the Special Meeting?

A:

No officer or director has any substantial interest, direct or indirect, by security holdings or otherwise, in the Warrant Exercise

Proposal that is not shared by all other stockholders.

Q:

What if other matters are presented for consideration at the Special Meeting?

A:

The Company knows of no other matters to be submitted to the stockholders at the Special Meeting, other than those described herein.

If other matters do arise, the Board has made no recommendation as to how the proxies will vote on such other matters. If any other matters

properly come before the stockholders at the Special Meeting, it is the intention of the persons named on the proxy card as proxies to

vote the shares represented thereby on such matters in their discretion and in accordance with their best judgment.

Q:

Whom do I call if I have questions?

A:

If you have any questions, need additional material, or need assistance in voting your shares, please feel free to contact Dodi Handy,

Director of Communications at the Company, via e-mail at dhandy@mgoteam.com or via telephone at 407-960-4636.

WARRANT

EXERCISE PROPOSAL

APPROVAL,

IN ACCORDANCE WITH NASDAQ LISTING RULE 5635(D), OF THE EXERCISABILITY OF THE COMMON STOCK PURCHASE WARRANTS, AND THE ISSUANCE OF THE

COMMON STOCK UNDERLYING SUCH WARRANTS, WHICH WARRANTS WERE ISSUED IN CONNECTION WITH AN OFFERING OF SECURITIES OF THE COMPANY THAT OCCURRED

ON DECEMBER 24, 2024

We

are seeking stockholder approval, for purposes of complying with Nasdaq Listing Rule 5635(d), for the exercisability of [*] common stock

purchase warrants (the “Warrants’), each to purchase one share of the Company’s Common Stock, and the issuance of our

common stock underlying such Warrants, which Warrants were issued in connection with an offering of securities of the Company that occurred

on December 24, 2024 (the “Offering”).

The

information set forth in this Warrant Exercise Proposal is qualified in its entirety by reference to the full text of the Securities

Purchase Agreement (the “Securities Purchase Agreement”) dated December 22, 2024 between Company and certain investors (the

“Investors”) and the form of Warrant, attached as exhibits 10.1 and 4.2, respectively, to our Current Report on Form 8-K

filed with the SEC on December [*], 2024.

Stockholders

are urged to carefully read these documents.

Background

On

December 22, 2024, the Company entered into the Securities Purchase Agreement pursuant to which the Investors agreed to purchase [*]

units (the “Units”), with each Unit consisting of either (A) one share of the Company’s Common Stock (collectively,

the “Shares”) and one Warrant or (B) one pre-funded warrant (each, a “Pre-Funded Warrant”) to purchase one share

of Common Stock and one Warrant. The Offering closed on December 24, 2024. The purchase price of each Unit was $[*], except for Units

which include Pre-Funded Warrants, which had a purchase price of $[*]. The Units had no stand-alone rights and were certificated or issued

as stand-alone securities.

Each

Warrant has an initial exercise price per share equal to $[*] (150% of the Unit offering price). The exercisability of the Warrants will

be available only upon the first trading day following the Company’s notice to warrantholders of receipt of such stockholder approval

as may be required by the applicable rules and regulations of the Nasdaq Capital Market (the “Warrant Stockholder Approval”

and the first trading day following the Company’s notice to warrantholders of receipt of Warrant Stockholder Approval being, the

“Warrant Stockholder Approval Date”). Each Warrant offered will become exercisable beginning on the Warrant Stockholder Approval

Date at an exercise price of $[*] per share of Common Stock, and will expire on the earlier of (x) five years from the Warrant Stockholder

Approval Date and (y) the closing of the transactions contemplated by the Business Combination Agreement dated June 18, 2024, among the

Company, Heidmar, Inc., Heidmar Maritime Holdings Corp., HMR Merger Sub Inc. and the shareholders of Heidmar. The Warrants contain a

one-time reset of the exercise price (subject to a floor of $[*] per share) to a price equal to the lower of (x) $[*] and (y) the lowest

volume weighted average price for our Common Stock during the period (the “Reset Period”) beginning four trading days immediately

prior to the effective date of the Warrant Stockholder approval and ending four trading days after the effective date of Warrant Stockholder

Approval (the “Reset Date”); provided that warrantholders have the right to exercise their Warrants on any date during the

Reset Period and have such exercise date be deemed the Reset Date for their warrants. Any reset of the exercise price of the Warrants

will occur on the Reset Date. If a reset of the exercise price of the Warrants occurs, the number of shares of our Common Stock underlying

the Warrants will also be increased on the Reset Date so that the reset exercise price multiplied by increased number of shares equal

the aggregate proceeds that would have resulted from the full exercise of the Warrants immediately prior to the Rest Date.

Under

the alternate cashless exercise option of the Warrants, on and after the Warrant Stockholder Approval Date, the holders of the Warrants

have the right to receive, without payment of additional consideration, an aggregate number of shares equal to the product of (x) the

aggregate number of shares of Common Stock that would be issuable upon a cash exercise of the Warrant2 and (y) 2.0. If the alternative

cashless exercise option is exercised (and assuming no reset of the warrant exercise price), as a result, the Company would issue [*]

shares of Common Stock and if the Warrants are reset to a lower exercise price, the number of shares required to be issued upon an

alternate cashless exercise could substantially increase.

We

are seeking approval for Warrant Exercise Proposal because, pursuant to the Securities Purchase Agreement and the Warrants, the Warrants

are not exercisable until we receive Warrant Stockholder Approval. In addition, pursuant to the Warrants, in the event the Company does

not obtain Warrant Stockholder Approval at the Special Meeting, it is obligated to call a meeting every ninety (90) days after the

Special Meeting until it obtains Warrant Stockholder Approval. If we are able to obtain approval for the Warrant Exercise Proposal at

the Special Meeting, we will save time and avoid the expense of having additional meetings to obtain approval.

Nasdaq

Stockholder Approval Requirement; Reasons for the Warrant Exercise Proposal

Nasdaq

Listing Rule 5635(d) requires stockholder approval in connection with a transaction, other than a public offering, involving the sale

or issuance by the issuer of common stock (or securities convertible into or exchangeable for common stock) equal to 20% or more of the

common stock or 20% or more of the voting power of such company outstanding before the issuance for a price that is less than the lower

of: (i) the closing price of the common stock immediately preceding the signing of the binding agreement for the issuance of such securities

and (ii) the average closing price of the common stock for the five trading days immediately preceding the signing of the binding agreement

for the issuance of such securities. Because of Nasdaq Listing Rule 5635(d), the Warrants provide that they may not be exercised, and

therefore have no value, unless stockholder approval of their exercise is obtained. In determining whether an offering qualifies as a

public offering, Nasdaq considers all relevant factors, including the extent of any discount to market price. In determining discount,

Nasdaq can attribute a value to each warrant that contains an alternative cashless exercise Nasdaq could attribute a value of for each

warrant that would fully discount the securities being offered. In order to ensure that the Offering qualified as a public offering under

Rule 5635 due to the value attributable to the Warrants, the Warrants provide that they may not be exercised — and

therefore have no value — until stockholder approval of their exercise is obtained. This proposal is included in

this proxy statement for purposes of seeking this approval.

The

Board of Directors Recommends That Stockholders Vote “For” The Warrant Exercise Proposal.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information, as of December 12, 2024 with respect to the holdings of (1) each person who is the beneficial

owner of more than 5% of Company voting stock, (2) each of our directors, (3) each executive officer, and (4) all of our current directors

and executive officers as a group.

Beneficial

ownership of the voting stock is determined in accordance with the rules of the SEC and includes any shares of company voting stock over

which a person exercises sole or shared voting or investment power, or of which a person has a right to acquire ownership at any time

within 60 days of December 12, 2024. Except as otherwise indicated, we believe that the persons named in this table have sole voting

and investment power with respect to all shares of voting stock held by them. Applicable percentage ownership in the following table

is based on 2,904,001 shares of common stock issued and outstanding on December 23, 2024, plus, for each individual, any securities that

individual has the right to acquire within 60 days of December 13, 2024.

To

the best of our knowledge, except as otherwise indicated, each of the persons named in the table has sole voting and investment power

with respect to the shares of our common stock beneficially owned by such person, except to the extent such power may be shared with

a spouse. To our knowledge, none of the shares listed below are held under a voting trust or similar agreement, except as noted. To our

knowledge, there is no arrangement, including any pledge by any person of securities of the Company, the operation of which may at a

subsequent date result in a change in control of the Company.

| Name and Address of Beneficial Owner (1) | |

Title | |

Beneficially

owned | |

Percentage

of Outstanding Shares |

| Officers and Directors | |

| |

| | | |

| | |

| Maximiliano Ojeda, Chairman, CEO(2) | |

Chief Executive Officer, Chairman | |

| 497,425 | (2) | |

| 17.13 | % |

| Virginia Hilfiger, Director, Chief Brand Officer(3) | |

Director, Chief Design Officer | |

| 496,577 | (3) | |

| 17.10 | % |

| Julian Groves, Director, COO(4) | |

Chief Operating Officer | |

| 168,664 | (4) | |

| 5.81 | % |

| Dana Perez, CFO | |

Chief Financial Officer | |

| 34,937 | | |

| 1.20 | % |

| Paul Wahlgren, Director | |

Chief Marketing Officer | |

| 12,019 | | |

| 0.41 | % |

| Ping Rawson, Director | |

Director | |

| 12,019 | | |

| 0.41 | % |

| Obie McKenzie, Director | |

Director | |

| 12,019 | | |

| 0.41 | % |

| Jeffrey Lerner, Director | |

Director | |

| 13,144 | | |

| 0.45 | % |

| All Officers and Directors as a Group (total of 9 persons) | |

| |

| 1,246,804 | | |

| 42.93 | % |

| | |

| |

| | | |

| | |

| 5% Beneficial Owners of a Class of Voting Stock | |

| |

| | | |

| | |

| Maximiliano Ojeda | |

| |

| 497,425 | (2) | |

| 17.13 | % |

| Virginia Hilfiger | |

| |

| 496,577 | (3) | |

| 17.10 | % |

| * |

Less

than 1% |

| |

|

| (1) |

Except

as noted below, the address for all beneficial owners in the table above is c/o MGO Global Inc., 1515 SE 17th Street,

Suite 121/#460596, Fort Lauderdale, Florida 33346. |

| |

|

| (2) |

Includes

(i) 39,400 shares of our common stock owned by MGOTEAM LLC of which Maximiliano Ojeda, our Chief Executive Officer, shares control

over voting and disposition with Virginia Hilfiger. |

| |

|

| (3) |

Includes

(i) 39,400 shares of our common stock owned by MGOTEAM LLC of which Virginia Hilfiger, our Chief Brand Officer, shares control over

voting and disposition with Maximiliano Ojeda. |

| |

|

| (4) |

Includes

(i) 15,000 shares of our common stock that are beneficially owned by Globally Digital Ltd., a company owned and controlled by our

Chief Operating Officer, Julian Groves. The address of Mr. Groves is c/o Globally Digital Ltd, 3 Hertford Avenue, East Sheen, London,

SW14 8EF. |

ADDITIONAL

INFORMATION

Solicitation

Expenses: Expenses in connection with the solicitation of proxies will be paid by the Company. Proxies are being solicited principally

by mail, by telephone and through the Internet. In addition, our directors, officers and regular employees, without additional

compensation, may solicit proxies personally, by e-mail, telephone, fax or special letter. We will reimburse brokerage firms and others

for their expenses in forwarding proxy materials to the beneficial owners of our shares.

How

To Receive Additional Paper Copies of the Proxy Statement: The Company has adopted a procedure called “householding”

which has been approved by the SEC. The Company and some brokers household proxy materials, delivering a single notice and, if applicable,

this Definitive Proxy Statement, to multiple stockholders sharing an address unless contrary instructions have been received from the

affected stockholders or they participate in electronic delivery of proxy materials. Stockholders who participate in householding will

continue to access and receive separate proxy cards. This process will help reduce our printing and postage fees, as well as save natural

resources. If at any time you no longer wish to participate in householding and would prefer to receive a separate Proxy Statement, or

if you are receiving multiple copies of the Proxy Statement and wish to receive only one, please notify your broker if your shares are

held in a brokerage account or us if you hold registered shares. You can notify us by sending a written request to MGO Global Inc., Investor

Relations 1515 SE 17th Street, Suite 121/#460596, Ft. Lauderdale, Florida 33346 or by calling Investor Relations at 407-960-4636 or by

sending an e-mail to dhandy@mgoteam.com.

Other

Matters To Be Considered At The Special Meeting: The Board is not aware of any other matters that are expected to come before the

2025 Special Meeting other than those referred to in this proxy statement and as set forth above. The Board has made no recommendation

as to how the proxies will vote on such other matters. If any other matter should come before the Special Meeting, the individuals named

on the proxy card intend to vote the proxies in accordance with their best judgment.

By

Order of the Board of Directors

| /s/

Maximiliano Ojeda |

|

| Maximiliano

Ojeda |

|

| Chairman

of the Board |

|

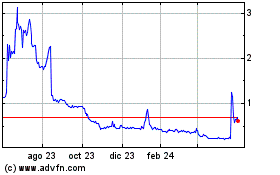

MGO Global (NASDAQ:MGOL)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

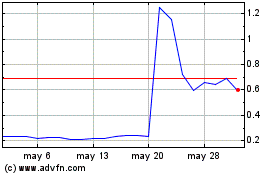

MGO Global (NASDAQ:MGOL)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025