UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 1)1

Milestone Pharmaceuticals Inc.

(Name

of Issuer)

Common Shares, no par value

(Title of Class of Securities)

59935V107

(CUSIP Number)

Gilbert Li

Alta Fundamental Advisers LLC

1500 Broadway, Suite 704

New York, NY 10036

(212) 319-1778

Kenneth Mantel, Esq.

Olshan Frome Wolosky LLP

1325

Avenue of the Americas

New

York, New York 10019

(212)

451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

July 14, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Alta Fundamental Advisers LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Delaware |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

2,658,589 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

2,658,589 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

2,658,589 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

4.99% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO, IA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Gilbert Li |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

United States of America |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

2,658,589 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

2,658,589 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

2,658,589 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

4.99% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN, HC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Jeremy Carton |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

United States of America |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

2,658,589 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

2,658,589 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

2,658,589 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

4.99% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN, HC |

|

The following constitutes

Amendment No. 1 to the Schedule 13D filed by the undersigned (“Amendment No. 1”). This Amendment No. 1 amends the Schedule

13D as specifically set forth herein.

| Item 3. | Source and Amount of Funds or Other Consideration. |

Item 3 is hereby amended and restated

to read as follows:

The Shares beneficially owned

by the Reporting Persons were purchased with the working capital of certain private funds and managed accounts for which Alta Advisers

serves as investment adviser (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business)

in open market purchases. The aggregate purchase price of the 2,658,589 Shares beneficially owned by the Reporting Persons is approximately

$7,605,230, excluding brokerage commissions.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended to add the following:

On July 14, 2024, Alta Advisers

entered into a Cooperation Agreement (the “Cooperation Agreement”) with the Issuer.

In accordance with the terms

of the Cooperation Agreement, effective as of the date of the Cooperation Agreement, the Issuer increased the size of its board of directors

(the “Board”) to nine (9) directors and appointed Stuart M. Duty and Andrew R. Saik (collectively, the “Initial New

Directors”) to the Board to fill the resulting vacancies, each with a term expiring at the Issuer’s 2024 annual meeting of

shareholders (the “2024 Annual Meeting”), or until their earlier death, disability, resignation, disqualification, or removal.

Under the terms of the Cooperation Agreement, Mr. Duty was appointed to the Nominating and Corporate Governance Committee of the Board

and Mr. Saik was appointed to the Audit Committee of the Board. Pursuant to the Cooperation Agreement, as soon as reasonably practicable

after the date of the Cooperation Agreement (and in any event prior to September 6, 2024), the Issuer will increase the size of the Board

and appoint an individual that is mutually agreeable to the Issuer and Alta Advisers as an independent director to the Board with a term

expiring at the next annual meeting of shareholders, or until his or her earlier death, disability, resignation, disqualification, or

removal. Pursuant to the Cooperation Agreement, Alta Fundamental Advisers Master L.P. irrevocably withdrew the notice it had provided

to the Issuer under Rule 14a-19 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) of its intention to

nominate five directors to stand for election at the 2024 Annual Meeting.

In accordance with the terms

of the Cooperation Agreement, the Issuer has agreed to include the Initial New Directors on its slate of director nominees for both the

2024 Annual Meeting and the Issuer’s 2025 annual meeting of shareholders (the “2025 Annual Meeting”) and to solicit

proxies for the election of, and support and recommend for the election of, the Initial New Directors at such meetings in the same manner

as for the Issuer’s other director nominees.

Pursuant to the Cooperation

Agreement, if either of the Initial New Directors resigns or otherwise ceases to be a director for any reason prior to the conclusion

of the 2025 Annual Meeting (the “Termination Date”), and at such time Alta Advisers holds a Net Long Position (as defined

in the Cooperation Agreement) at or above 4.0% of the Issuer’s then-outstanding Shares, the Issuer and Alta Advisers will cooperate

in good faith to select, and the Board will appoint, as promptly as practicable, a director mutually agreeable to the Issuer and Alta

Advisers, who must be independent under Nasdaq’s listing standards and may not be a principal, officer, manager, employee, affiliate

or associate of Alta Advisers.

Prior to the Termination

Date, Alta Advisers has agreed to vote all of its Shares in accordance with the Board’s recommendations on all proposals or business

that may be the subject of shareholder action at shareholder meetings held prior to the Termination Date, except (i) if either Institutional

Shareholder Services Inc. or Glass Lewis & Co., LLC recommends against the Board’s recommendation for a proposal (other than

with respect to director elections), Alta Advisers may follow such alternative recommendation, and (ii) Alta Advisers may vote in its

sole discretion with respect to any proposals with respect to an Extraordinary Transaction (as defined in the Cooperation Agreement) that

is subject to a vote of the Issuer’s shareholders.

The Cooperation Agreement

also contains customary standstill, non-disparagement and expense reimbursement provisions. The Cooperation Agreement remains in effect

until the Termination Date unless the Cooperation Agreement is earlier terminated in accordance with its terms.

The foregoing summary of

the Cooperation Agreement does not purport to be complete and is subject to, and qualified in its entirety, by the full text of the Cooperation

Agreement, which is attached hereto as Exhibit 99.1 and incorporated herein by reference.

| Item 5. | Interest in Securities of the Issuer. |

Item 5 is hereby amended and restated

to read as follows:

The aggregate percentage

of Shares reported owned by each person named herein is based upon 53,260,467 Shares outstanding as of May 13, 2024, which is the total

number of Shares outstanding as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission

on May 13, 2024.

| (a) | Alta Advisers, as the investment adviser to certain private funds and managed accounts, may be deemed

to beneficially own the 2,658,589 Shares held by such private funds and managed accounts. |

Percentage: Approximately 4.99%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 2,658,589

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 2,658,589 |

| (c) | Alta Advisers has not entered into any transactions in the Shares during the past 60 days. |

| (a) | As managing members of Alta Advisers, Messrs. Li and Carton may be deemed to beneficially own the 2,658,589

Shares beneficially owned by Alta Advisers. |

Percentage: Approximately 4.99%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 2,658,589

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 2,658,589 |

| (c) | Messrs. Li and Carton have not entered into any transactions in the Shares during the past 60 days. |

The filing of this Amendment

No. 1 to the Schedule 13D shall not be deemed an admission that the Reporting Persons are, for purposes of Section 13(d) of the Exchange

Act, the beneficial owners of any securities of the Issuer that he or it does not directly own. Each of the Reporting Persons specifically

disclaims beneficial ownership of the securities reported herein that he or it does not directly own.

| (d) | No person other than the Reporting Persons is known to have the right to receive, or the power to direct

the receipt of dividends from, or proceeds from the sale of, the Shares. |

| (e) | As of March 21, 2024, the Reporting Persons ceased to be the beneficial owners of more than 5% of the

Shares of the Issuer. |

| Item 6. | Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Item 6 is hereby amended to add the following:

On July 14, 2024, Alta Advisers

and the Issuer entered into the Cooperation Agreement, as defined and described in Item 4 above and attached as Exhibit 99.1 hereto.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended

to add the following exhibit:

| 99.1 | Cooperation Agreement, dated July 14, 2024 (incorporated by reference to Exhibit 10.1 to the Current Report

on Form 8-K filed by the Issuer on July 15, 2024). |

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: July 16, 2024

| |

ALTA FUNDAMENTAL ADVISERS LLC |

| |

|

| |

By: |

/s/ Gilbert Li |

| |

|

Name: |

Gilbert Li |

| |

|

Title: |

Managing Member |

| |

/s/ Gilbert Li |

| |

GILBERT LI

Individually and as attorney-in-fact for Jeremy Carton |

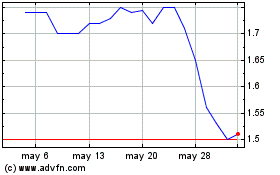

Milestone Pharmaceuticals (NASDAQ:MIST)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Milestone Pharmaceuticals (NASDAQ:MIST)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024