UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

| MARTIN MIDSTREAM PARTNERS L.P. |

(Name of Registrant as Specified In Its Charter)

|

| |

NUT TREE CAPITAL

MANAGEMENT L.P.

NUT TREE CAPITAL

MANAGEMENT GP, LLC

JARED R. NUSSBAUM

CASPIAN CAPITAL

L.P.

CASPIAN CAPITAL

GP LLC

ADAM COHEN

DAVID CORLETO

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Nut Tree Capital Management

L.P., a Delaware limited partnership (“Nut Tree”), and Caspian Capital L.P., a Delaware limited partnership (“Caspian”),

together with the other participants named herein, intend to file a preliminary proxy statement and accompanying proxy card with the Securities

and Exchange Commission (“SEC”) to be used to solicit votes in connection with their opposition to proposals to be presented

at a special meeting of common unitholders (the “Special Meeting”) of Martin Midstream Partners L.P., a Delaware limited partnership

(the “Company”), in connection with the Company’s agreement and plan of merger with Martin Resource Management Corporation

and certain of its affiliates.

Item 1: On October 22,

2024, Nut Tree and Caspian issued the following press release:

Nut Tree Capital Management and Caspian Capital

Oppose Martin Midstream Partners L.P. Sale to Martin Resource Management Corporation

Nut Tree and Caspian Believe Proposed Sale Significantly

Undervalues MMLP

and its Future Prospects

Nut Tree and Caspian Intend to File a Proxy Statement

and Solicit Proxies

to Vote “AGAINST” the Proposed Sale

Nut Tree and Caspian Launch www.ProtectMMLPValue.com

NEW YORK – October 22, 2024 – Nut Tree Capital Management

L.P. (“Nut Tree”) and Caspian Capital L.P. (“Caspian”), today announced that they intend to oppose the proposed

sale of Martin Midstream Partners L.P. (“MMLP” or the “Company”) (Nasdaq: MMLP) to Martin Resource Management

Corporation (“MRMC”), an affiliate of the Company’s General Partner, for $4.02 per MMLP common unit not already owned

by MRMC. Nut Tree and Caspian have combined economic exposure in the Company of approximately 13.2% of the outstanding common units through

certain cash-settled derivative agreements and are aligned with MMLP unitholders who are unaffiliated with MRMC in seeking to protect

the long-term value of the Company.

Nut Tree and Caspian believe that the proposed sale price significantly

undervalues the Company and its prospects, and that if the merger is completed on its current terms, MRMC will receive significant upside

for itself that rightfully belongs to all MMLP unitholders. Nut Tree and Caspian intend to file a proxy statement with the Securities

and Exchange Commission and solicit votes “AGAINST” the proposed transaction at the Company’s upcoming special meeting

to be held to approve the related merger agreement.

Additional information can be found at www.ProtectMMLPValue.com.

Nut Tree and Caspian’s serious concerns with the undervalued and

grossly conflicted sale of MMLP to MRMC are based on the following beliefs:

| · | MRMC’s latest acquisition proposal significantly undervalues MMLP and its future prospects. Comparable master limited

partnerships, as described in MMLP's own publicly available investor presentation from May 2024, traded at approximately 8.5x expected

2024 EBITDA, whereas MRMC's offer represents an Enterprise Value of only 5.1x management's expected 2024 EBITDA. Furthermore, when referencing

the same peers and the most recent equity research, that multiple has improved to 9.9x. At a 9.9x multiple, MMLP's common units would

be valued 450% of what MRMC has offered.1

Additionally, based on MMLP's own public disclosures, we believe a number of positive developments are likely to come to fruition in the

near and medium term, which will not only result in distributable cash flow above $1.00/common unit annually, but also likely result in

significant actual cash distributions to common unitholders—potentially as early as 2025. Nut Tree and Caspian’s views on

MMLP’s valuation were detailed in a July 29, 2024 letter to the Conflicts Committee and issued publicly via a press release the

same day.2 |

| · | The Conflicts Committee of the Board of Directors (the “Conflicts Committee”) of Martin Midstream GP LLC (the “General

Partner”) ran a sham process that did not fully explore potentially superior alternatives to the sale to MRMC. The Conflicts

Committee, which was formed to address conflicts of interest among MRMC and MMLP, failed to genuinely engage with us following our fully

financed offer to acquire MMLP for $4.50 per common unit in cash, which represented a 48% premium over the $3.05 per

common unit offer made by MRMC on May 24, 2024, nor did it respond to any of our diligence-related questions regarding the value

of MMLP. By failing to explore the potential value flowing to MMLP unitholders under our proposal, or even to seek our views on valuation,

the Conflicts Committee has brought into question its willingness to act in the best interests of MMLP common unitholders. |

| · | The Conflicts Committee is grossly conflicted. The General Partner is wholly owned and controlled by MRMC and its subsidiaries,

and Ruben Martin, III serves as Chairman of the Board of Directors of the General Partner and the President, Chief Executive Officer,

and Chairman of the Board of Directors of MRMC. The Conflicts Committee is comprised of Byron Kelley (Chairman), James M. Collingsworth

and C. Scott Massey, who have served with Mr. Martin on the General Partner's Board of Directors for approximately 12 years, 10 years

and 22 years, respectively. The actions of the Conflicts Committee indicate to us that its members are too closely tied to Mr. Martin

to protect the interests of MMLP's common unitholders. |

Advisors

Olshan Frome Wolosky LLP and Latham & Watkins LLP are serving as legal

counsel to Nut Tree and Caspian.

1

See Wells Fargo Midstream Energy Weekender: Q3’24 Midstream Earnings Preview October 11, 2024, pg. 7. Permission to use the

Wells Fargo Midstream Energy Update was neither sought nor obtained.

2

https://www.prnewswire.com/news-releases/nut-tree-capital-management-and-caspian-capital-increase-offer-to-purchase-martin-midstream-partners-lp-to-4-50-per-common-unit-in-cash-302208901.html

About Caspian Capital LP

Caspian Capital LP’s absolute return strategy was founded in 1997 and is focused on performing, stressed, distressed corporate

credit, and value equities. Caspian currently oversees $4.6 billion in assets under management.

About Nut Tree Capital Management LP

Nut Tree Capital, founded in 2015, implements a fundamentals-based strategy focused on distressed credit, stressed/event-driven credit

and value equities. Nut Tree currently oversees $4 billion in assets.

Contacts:

For Investors:

John Ferguson/Joe Mills

Saratoga Proxy Consulting LLC

(212) 257-1311

info@saratogaproxy.com

For Media:

Jonathan Gasthalter/Nathaniel Garnick

Gasthalter & Co.

(212) 257-4170

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Nut Tree Capital Management L.P., a Delaware limited

partnership (“Nut Tree”), and Caspian Capital L.P., a Delaware limited partnership (“Caspian”), together with

the other participants named herein, intend to file a preliminary proxy statement and accompanying proxy card with the Securities and

Exchange Commission (“SEC”) to be used to solicit votes in connection with their opposition to proposals to be presented at

a special meeting of common unitholders (the “Special Meeting”) of Martin Midstream Partners L.P., a Delaware limited partnership

(the “Company”), in connection with the Company’s agreement and plan of merger with Martin Resource Management Corporation

and certain of its affiliates.

NUT TREE AND CASPIAN STRONGLY ADVISE ALL COMMON UNITHOLDERS

OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV.

IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON

REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated

to be Nut Tree, Nut Tree Capital Management GP, LLC, a Delaware limited liability company (“Nut Tree GP”), Jared R. Nussbaum,

Caspian, Caspian Capital GP LLC, a Delaware limited liability company (“Caspian GP”), Adam Cohen and David Corleto (collectively,

the “Participants”).

As of the date hereof, the Participants have combined

economic exposure in the Company of approximately 13.2% of the outstanding common units representing limited partnership interests of

the Company (“Common Units”), through notional principal amount derivative agreements in the form of cash settled swaps with

respect to the Common Units (“Derivative Agreements”). Funds advised by Nut Tree are party to Derivative Agreements with

respect to an aggregate of 3,245,769 Common Units, and funds advised by Caspian are party to Derivative Agreements with respect to an

aggregate of 1,916,597 Common Units. Funds advised by Caspian also hold $93.15 million principal amount of the Company’s senior

secured second lien notes maturing on February 15, 2028. Nut Tree GP serves as the general partner of Nut Tree, which serves as the investment

advisor to certain funds. Mr. Nussbaum serves as the Chief Investment Officer and Managing Partner of Nut Tree and sole member of Nut

Tree GP. Caspian GP serves as the general partner of Caspian, which serves as the investment advisor to certain funds. Messrs. Cohen

and Corleto each serve as a control person of each of Caspian and Caspian GP.

Item 2: Also on October

22, 2024, Nut Tree and Caspian launched a website to communicate with the Company’s common unitholders regarding the Special Meeting.

The website address is www.protectMMLPvalue.com. The following materials were posted by Nut Tree

and Caspian to www.protectMMLPvalue.com:

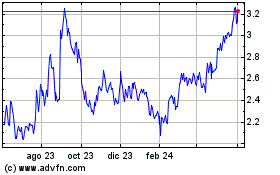

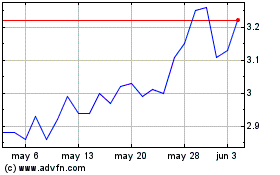

Martin Midstream Partners (NASDAQ:MMLP)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Martin Midstream Partners (NASDAQ:MMLP)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024