Mogo’s Digital Payments Subsidiary Carta Worldwide Reports 23% Increase in Quarterly Transaction Volume to Record $3.0 Billion

12 Noviembre 2024 - 7:17AM

Business Wire

Carta Worldwide (“Carta”), a global digital payment solutions

business owned and operated independently by Mogo Inc.

(NASDAQ:MOGO) (TSX:MOGO), today announced that it processed just

under $3.0 billion of payment volume in Q3 2024, an increase of 23%

compared to Q3 2023.

“Carta had another strong quarter and their payment volume is

now on an annual run rate of $12 billion as they continue to expand

with a number of large European customers,” said Greg Feller,

President & CFO of Mogo Inc. “We've been investing in Carta's

technology platform in the last year, giving us even more

confidence in the long-term prospects of this business in the large

global payments market.”

About Carta Worldwide

Carta is a digital payments software company which provides

technology and services that enable financial technology companies,

banks, and corporations to issue payment products to consumers via

multiple channels, including physical, virtual and tokenized cards,

as well as payment switching and routing services. Carta was

founded in 2008 with a vision to build a modern issuer processing

platform that could enable innovators around the globe to deploy a

new wave of payment products. The Carta platform provides the

infrastructure to help fintech and payments business build and

manage their payment systems, and it supports prepaid, debit, and

credit card issuer processing. Carta is certified as Visa and

MasterCard processor with active card programs in over 35

countries.

About Mogo

Mogo Inc. (NASDAQ:MOGO; TSX:MOGO) is a digital wealth and

payments company headquartered in Vancouver, Canada with more than

2 million members, $12.0B in annual payments volume and a ~13%

equity stake in Canada’s leading Crypto Exchange WonderFi

(TSX:WNDR). Mogo offers simple digital solutions to help its

members dramatically improve their path to wealth-creation and

financial freedom. MOGO offers commission-free stock trading that

helps users thoughtfully invest based on a Warren Buffett approach

to long-term investing – while also making a positive impact with

every investment. Moka offers Canadians a real alternative to

mutual funds and wealth managers that overcharge and underperform

with a fully managed investing solution based on the proven

outperformance of an S&P 500 strategy, and at a fraction of the

cost. Through its wholly owned digital payments subsidiary, Carta

Worldwide, Mogo also offers a low-cost payments platform that

powers next-generation card programs for companies across Europe

and Canada. The Company, which was founded in 2003, has

approximately 200 employees across its offices in Vancouver,

Toronto, London & Casablanca.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112896501/en/

For further information:

Investor Relations investors@mogo.ca

US Investor Relations Contact Lytham Partners, LLC Ben Shamsian

New York | Phoenix shamsian@lythampartners.com (646) 829-9701

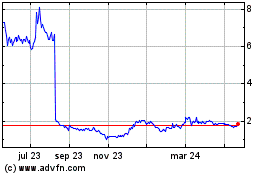

Mogo (NASDAQ:MOGO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

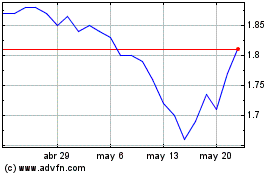

Mogo (NASDAQ:MOGO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024