Quarterly revenue of $17.6 million, up 10%

year-over-year

Adjusted EBITDA1 increased sequentially to

$1.4 million in Q2 2024

Quarterly payments volume increased 12%

year-over-year to $2.8 billion

Ended Q2 with $41.5 million of cash,

marketable securities & investments2

Mogo reports in Canadian dollars and in accordance with IFRS

Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) (“Mogo” or the “Company”), a

digital wealth and payments business, today announced its financial

and operational results for the second quarter ended June 30,

2024.

“During the second quarter, we generated 10% revenue growth and

solid profitability while continuing to invest in meaningful

improvements to our wealth platform,” said David Feller, Mogo’s

Founder and CEO. “As part of our go to market strategy, we’ve also

recently formed a key strategic partnership with Postmedia to

launch a new wealth section designed to help educate Canadians on

the pitfalls of existing solutions in the marketplace and the

impact that the right approach and strategy can have in terms of

your ability to achieve financial freedom. We also formed a

partnership with Tom Lee of Fundstrat who is a frequent CNBC

contributor and is widely considered one of the most thoughtful

strategists on Wall Street, to give our wealth members exclusive

access to his investment research and further establish us a

leading platform for serious investors.”

Key Financial Highlights for Q2 2024

- Revenue increased in Q2 2024 to $17.6 million, up 10%

over the prior year.

- Gross profit was $11.8 million in Q2 2024, versus $11.9

million in Q2 2023. Gross Margin increased 300 basis points

sequentially, from 64.5% in Q1 2024 to 67.5% in Q2 2024.

- Operating expenses for Q2 2024 remained level at $13.1

million, compared to Q2 2023, reflecting the Company’s operating

efficiency efforts which also resulted in a significant improvement

in revenue per employee of 4% during the same period.

- Cash flow from operating activities before investment in

gross loans receivable1 was positive for the seventh consecutive

quarter, reaching $3.8 million in Q2 2024, a 78% increase over Q2

2023.

- Cash flow from operating activities was positive $0.5 million

in Q2 2024, versus negative $1.8 million in Q2 2023.

- Adjusted EBITDA1 was $1.4 million in Q2 2024 (7.8%

margin), compared with $1.8 million (11.5% margin) in Q2 2023.

- Adjusted net loss1 was $3.6 million in Q2 2024 compared

with adjusted net loss of $3.0 million in Q2 2023.

- Net loss was $12.4 million in Q2 2024, driven primarily

by an $8.3 million non-operating revaluation loss on marketable

securities and investment portfolio, compared with net loss of

$10.0 million in Q2 2023.

- Cash, Marketable Securities & Investments totaled

$41.5 million as of June 30, 2024, versus $55.6 million at the end

of 2023. This included combined cash and restricted cash of $11.3

million, marketable securities of $18.6 million and investment

portfolio of $11.6 million.

“We continued to see strong improvement in cash flow in the

second quarter with cash flow from operations before investment in

loan book increasing 78% year-over-year to $3.8 million and we also

reached an important milestone of overall positive cash from

operations, reflecting our emphasis on operating efficiencies

across the company,” said Greg Feller, President & CFO.

“Looking ahead, we are investing to fuel growth in our Wealth and

Payments businesses while continuing to generate positive Adjusted

EBITDA. Our balance sheet remains strong, with cash, marketable

securities and investment portfolio of more than $41 million, from

which we expect to see monetization opportunities over the next 12

months.”

Business & Operations Highlights

- Continued growth in payments volume - Mogo’s digital

payment solutions business, Carta Worldwide, processed over $2.8

billion of payment volume in Q2 2024, an increase of 12% compared

to Q2 2023.

- Assets under management were just shy of $400 million -

Assets under management in the Company’s Wealth businesses

increased 15% year-over-year to $393 million, with assets within

our MogoTrade product up 105% year over year.

- Mogo members increased to 2.1 million at quarter end, up

5% from Q2 2023.

- Enhancements to wealth offerings – During the quarter,

Mogo continued its strong product improvement velocity with 20 app

update releases and over 100 individual improvements to its wealth

offerings, including:

- Introduced a new Moka leaderboard to elevate user engagement

and introduce new gamification elements into the wealth building

experience.

- Optimized the Moka user onboarding experience with redesigned

content and made improvements to the patent-pending wealth

calculator.

- Added shortform educational videos to the Mogo and Moka apps to

promote financial literacy.

- Launched an impact dashboard in the Mogo app to highlight the

positive collective environmental impact that users have created

through their use of the product.

- Introduced new pricing tiers for both products to reflect

continued improvements to the overall value proposition.

- Mogo announces partnership with Postmedia - In June

2024, Mogo announced a new strategic partnership with Postmedia

Network Inc., Canada’s largest news media company, to create a

go-to educational wealth content channel for Canadians. Mogo is a

founding sponsor and will contribute branded educational content

and tools on wealth-building.

- New partnership with Thomas Lee of Fundstrat - In July

2024, Mogo announced a new partnership to become the exclusive

Canadian partner of top-ranked Wall Street investment strategist

Tom Lee of Fundstrat. Mogo will provide members of the Company’s

digital wealth platform, Mogo and Moka, with exclusive access to

equity research and related products and services produced by a

division of Fundstrat.

Financial Outlook

The outlook that follows supersedes all prior financial outlook

statements made by Mogo, constitutes forward-looking information

within the meaning of applicable securities laws, and is based on a

number of assumptions and subject to a number of risks. Actual

results could vary materially as a result of numerous factors,

including certain risk factors, many of which are beyond Mogo’s

control. Please see "Forward-looking Statements" below for more

information.

- For Fiscal 2024, Mogo reiterated that it expects Subscription

& Services revenue growth in the mid-teens for the full

year.

- The Company also expects Adjusted EBITDA3 of $5.0 to $6.0

million in Fiscal 2024.

1 Non-IFRS measure. For more information regarding our use of

these non-IFRS measures and, where applicable, a reconciliation to

the most comparable IFRS measure, see “Non-IFRS Financial Measures”

in the Company’s MD&A for the period ended June 30, 2024.

2 Includes combined cash and restricted cash of $11.3 million,

marketable securities of $18.6 million, and investment portfolio of

$11.6 million. 3 Adjusted EBITDA is a non-IFRS measure.

Management has not reconciled this forward-looking non-IFRS measure

to its most directly comparable IFRS measure, net loss before tax.

This is because the Company cannot predict with reasonable

certainty and without unreasonable efforts the ultimate outcome of

certain IFRS components of such reconciliations due to

market-related assumptions that are not within our control as well

as certain legal or advisory costs, tax costs or other costs that

may arise. For these reasons, management is unable to assess the

probable significance of the unavailable information, which could

materially impact the amount of the future directly comparable IFRS

measures.

Conference Call & Webcast

Mogo will host a conference call to discuss its Q2 2024

financial results at 1:00 p.m. ET on August 8, 2024. The call will

be hosted by David Feller, Founder and CEO, and Greg Feller,

President and CFO. To participate in the call, dial (289) 514-5100

or (800) 717-1738 (International) using conference ID: 46724. The

webcast can be accessed at http://investors.mogo.ca. Listeners

should access the webcast or call 10-15 minutes before the start

time to ensure they are connected.

Non-IFRS Financial Measures

This press release makes reference to certain non-IFRS financial

measures. These measures are not recognized measures under IFRS, do

not have a standardized meaning prescribed by IFRS and are

therefore unlikely to be comparable to similar measures presented

by other companies. These measures are provided as additional

information to complement the IFRS financial measures contained

herein by providing further metrics to understand the Company’s

results of operations from management’s perspective. Accordingly,

they should not be considered in isolation nor as a substitute for

analysis of our financial information reported under IFRS. We use

non-IFRS financial measures, including Adjusted EBITDA, Adjusted

net loss and Cash provided by (used in) operating activities before

investment in gross loans receivable, to provide investors with

supplemental measures of our operating performance and thus

highlight trends in our core business that may not otherwise be

apparent when relying solely on IFRS financial measures. Our

management also uses non-IFRS financial measures in order to

facilitate operating performance comparisons from period to period,

prepare annual operating budgets and assess our ability to meet our

capital expenditure and working capital requirements. For more

information, please see “Non-IFRS Financial Measures” in our

Management’s Discussion and Analysis for the period ended June 30,

2024, which is available at www.sedarplus.com and at

www.sec.gov.

The following tables present a reconciliation of each non-IFRS

financial measure to the most comparable IFRS financial

measure.

Adjusted EBITDA

($000s)

Three months ended

Six months ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Net loss before tax

$

(12,443

)

$

(10,038

)

$

(16,137

)

$

(17,090

)

Depreciation and amortization

2,084

2,204

4,460

4,577

Stock-based compensation

584

801

1,145

1,094

Credit facility interest expense

1,733

1,493

3,388

2,948

Debenture and other financing expense

953

831

1,759

1,609

Accretion related to debentures

169

234

347

507

Share of loss in investment accounted for

using the equity method

—

5,088

—

8,267

Revaluation loss (gain)

8,301

(255

)

7,213

(1,508

)

Other non-operating expense

(9

)

1,486

245

2,457

Adjusted EBITDA

1,372

1,844

2,420

2,861

Adjusted Net Loss

($000s)

Three months ended

Six months ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Net loss before tax

$

(12,443

)

$

(10,038

)

$

(16,137

)

$

(17,090

)

Stock-based compensation

584

801

1,145

1,094

Share of loss in investment accounted for

using the equity method

—

5,088

—

8,267

Revaluation loss (gain)

8,301

(255

)

7,213

(1,508

)

Other non-operating expense

(9

)

1,486

245

2,457

Adjusted net loss

(3,567

)

(2,918

)

(7,534

)

(6,780

)

Cash Provided by (used in) Operations before Investment in

Gross Loans Receivable

($000s)

Three months ended

Six months ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Net cash provided by (used in) operating

activities

$

528

$

(1,813

)

$

(3,338

)

$

(2,812

)

Net issuance of loans receivable

(3,249

)

(3,939

)

(8,930

)

(5,007

)

Cash provided by operations before

investment in gross loans receivable

3,777

2,126

5,592

2,195

Forward-Looking Statements

This news release may contain “forward-looking statements”

within the meaning of applicable securities legislation, including

statements regarding the Company’s plan for accelerating revenue

growth in 2024, monetization opportunities in the next 12 months,

future investments to fuel growth and the Company’s financial

outlook for 2024. Forward-looking statements are typically

identified by words such as "may", "will", "could", "would",

"anticipate", "believe", "expect", "intend", "potential",

"estimate", "budget", "scheduled", "plans", "planned", "forecasts",

"goals" and similar expressions. Forward-looking statements are

necessarily based upon a number of estimates and assumptions that,

while considered reasonable by management at the time of

preparation, are inherently subject to significant business,

economic and competitive uncertainties and contingencies, and may

prove to be incorrect. Forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause

actual financial results, performance or achievements to be

materially different from the estimated future results, performance

or achievements expressed or implied by those forward-looking

statements and the forward-looking statements are not guarantees of

future performance. Mogo's growth, its ability to expand into new

products and markets and its expectations for its future financial

performance are subject to a number of conditions, many of which

are outside of Mogo's control, including the receipt of any

required regulatory approval. For a description of the risks

associated with Mogo's business please refer to the “Risk Factors”

section of Mogo’s current annual information form, which is

available at www.sedarplus.com and www.sec.gov. Except as required

by law, Mogo disclaims any obligation to update or revise any

forward-looking statements, whether as a result of new information,

events or otherwise.

About Mogo

Mogo Inc. (NASDAQ:MOGO; TSX:MOGO) is a digital wealth and

payments company headquartered in Vancouver, Canada with more than

2 million members, $9.9B in annual payments volume and a ~13%

equity stake in Canada’s leading Crypto Exchange WonderFi

(TSX:WNDR). Mogo offers simple digital solutions to help its

members dramatically improve their path to wealth-creation and

financial freedom. MOGO offers commission-free stock trading that

helps users thoughtfully invest based on a Warren Buffett approach

to long-term investing – while also making a positive impact with

every investment. Moka offers Canadians a real alternative to

mutual funds and wealth managers that overcharge and underperform

with a fully managed investing solution based on the proven

outperformance of an S&P 500 strategy, and at a fraction of the

cost. Through its wholly owned digital payments subsidiary, Carta

Worldwide, Mogo also offers a low-cost payments platform that

powers next-generation card programs for companies across Europe

and Canada. The Company, which was founded in 2003, has

approximately 200 employees across its offices in Vancouver,

Toronto, London & Casablanca.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808565883/en/

Craig Armitage Investor Relations investors@mogo.ca

US Investor Relations Contact Lytham Partners, LLC Ben Shamsian

New York | Phoenix shamsian@lythampartners.com (646) 829-9701

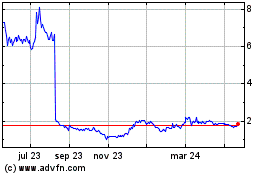

Mogo (NASDAQ:MOGO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

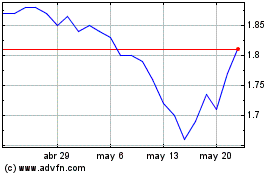

Mogo (NASDAQ:MOGO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024