- ZTALMY® (ganaxolone) Q3 net product revenue of $5.4 million;

2023 net product revenue guidance increased to between $18.5 and

$19 million

- Over 75% of patients required for the interim analysis are now

enrolled in the Phase 3 RAISE trial in refractory status

epilepticus; if the trial meets pre-defined stopping criteria at

the interim analysis, topline data now anticipated Q2 2024

- Initiated the Marinus Access Program to expand global

availability of ZTALMY

- Cash runway projected into Q4 2024 with cash, cash equivalents

and short-term investments of $176.4 million as of September 30,

2023

- Marinus to host conference call on November 7, 2023, at 8:30

a.m. ET

Marinus Pharmaceuticals, Inc. (Nasdaq: MRNS), a pharmaceutical

company dedicated to the development of innovative therapeutics to

treat seizure disorders, today reported business highlights and

financial results for the third quarter ended September 30,

2023.

“With strong quarter over quarter growth and robust payer

coverage one year into the launch of ZTALMY, we continue to

demonstrate our unique commercial capabilities in the orphan

epilepsy space and are enthused by the opportunity ZTALMY and the

ganaxolone franchise represent as an important long-term value

driver for Marinus,” said Scott Braunstein, M.D., Chairman and

Chief Executive Officer of Marinus.

Dr. Braunstein continued, “We remain acutely focused on

advancing our Phase 3 clinical trials in refractory status

epilepticus and tuberous sclerosis complex. While we’re

disappointed that we now project RAISE enrollment to conclude by

the end of the first quarter, we remain confident in the benefit

that IV ganaxolone could bring to critically ill RSE patients and

the significant commercial opportunity. We are committed to

successfully completing both the RAISE and TrustTSC trials in 2024

and continue to make the investments to prepare for these

commercial launches.”

ZTALMY®

- ZTALMY® (ganaxolone) oral suspension CV net product revenue of

$5.4 million for the third quarter of 2023

- Continued growth in commercial patients with approximately 140

patients active on therapy at the end of the third quarter

- Increased full year 2023 expected ZTALMY net product revenues

to between $18.5 and $19 million from a range of $17 to $18.5

million

CDKL5 Deficiency Disorder

- Initiated the Marinus Access Program expanding global

availability of ZTALMY for eligible patients with seizures

associated with CDKL5 deficiency disorder (CDD) in geographies

where the product is not commercially available and as supported by

local regulatory requirements

- The Center for Drug Evaluation (CDE) of the China National

Medical Products Administration (NMPA) has accepted and granted

priority review of a New Drug Application (NDA) for ZTALMY in CDD;

the NDA was submitted in China by Tenacia Biotechnology under the

terms of a collaboration agreement with Marinus

- Orion Corporation continues to prepare for commercial launches

of ZTALMY in select European countries in 2024

Clinical Pipeline

Status Epilepticus

- Over 75% of patients required for an interim analysis are now

enrolled in the Phase 3 RAISE trial of intravenous (IV) ganaxolone

in refractory status epilepticus (RSE)

- Enrollment for the interim analysis expected to conclude in the

first quarter of 2024 with topline data now anticipated in the

second quarter of 2024, assuming pre-defined stopping criteria for

an interim analysis are met

- 21 patients have now been treated for super refractory status

epilepticus (SRSE) under emergency investigational new drug (EIND)

applications

- Phase 3 RAISE II trial in RSE (for European registration)

enrollment anticipated to begin before year end 2023

- To focus additional resources on the expansion of RSE clinical

programs, including further investigation of potential development

opportunities in SRSE, Marinus voluntarily discontinued the Phase 2

RESET trial in established status epilepticus

Ganaxolone development in the RAISE trial is being funded in

part by the Biomedical Advanced Research and Development Authority

(BARDA), part of the Administration for Strategic Preparedness and

Response at the U.S. Department of Health and Human Services, under

contract number 75A50120C00159.

Tuberous Sclerosis Complex

- Continue to enroll patients in the global Phase 3 TrustTSC

trial of oral ganaxolone in tuberous sclerosis complex with topline

data anticipated mid-2024

Second Generation Product

Development

- Enrollment in the multiple ascending dose (MAD) trial is well

underway with preliminary data expected by year end 2023

- Planning to finalize clinical program design for Lennox-Gastaut

syndrome in the first half of 2024, pending results of the MAD

trial

General Business and Financial

Update

- For the fiscal year 2023, the Company is updating its revenue

and operating expense guidance:

- The Company now expects ZTALMY net product revenues of between

$18.5 and $19 million; this represents an increase from the

previous guidance of between $17 and $18.5 million

- The Company now expects GAAP operating expenses, inclusive of

G&A and R&D, to be in the range of $158 to $162 million, of

which the Company expects stock-based compensation to be

approximately $16 million; this represents a decrease from the

prior guidance range of $160 to $165 million

- Expect that cash, cash equivalents, and short-term investments

of $176.4 million as of September 30, 2023, will be sufficient to

fund the Company’s operating expenses, capital expenditure

requirements, and maintain the minimum cash balance of $15 million

required under the Company’s debt facility into the fourth quarter

of 2024

- During the quarter, a total of 3.7 million shares were sold

through the Company’s at-the-market (ATM) facility contributing net

proceeds of $25.9 million

Financial Results

- Recognized $5.4 million and $13.0 million in net product

revenues for the three and nine months ended September 30, 2023,

respectively, as compared to $0.6 million in each of the same

periods in the prior year. Net product revenue consists of ZTALMY

product sales, which was launched in the U.S. in the third quarter

of 2022.

- Recognized $1.9 million and $10.8 million in Biomedical

Advanced Research and Development Authority (BARDA) federal

contract revenue for the three and nine months ended September 30,

2023, respectively, as compared to $1.8 million and $5.1 million

for the same periods in the prior year, respectively. The increase

on a year-to-date basis was primarily driven by activities

associated with the startup of the API onshoring initiative.

- Research and development (R&D) expenses were $23.7 million

and $73.0 million for the three and nine months ended September 30,

2023, respectively, as compared to $19.0 million and $58.5 million,

respectively, for the same periods in the prior year; the increase

on a year-to-date basis was due primarily to increased investment

associated with our API onshoring effort, increased TSC and RSE

clinical trial activity, and increased headcount.

- Selling, general and administrative (SG&A) expenses were

$14.9 million and $45.8 million for the three and nine months ended

September 30, 2023, respectively, as compared to $13.4 million and

$42.2 million, respectively, for the same periods in the prior

year; the increase on a year-to-date basis was due primarily to

increased headcount associated with the U.S. launch of ZTALMY.

- The Company had net losses of $33.0 million and $99.6 million

for the three and nine months ended September 30, 2023,

respectively; cash used in operating activities was $91.0 million

for each of the nine months ended September 30, 2023 and 2022

- At September 30, 2023, the Company had cash, cash equivalents,

and short-term investments of $176.4 million, compared to $240.6

million at December 31, 2022.

Readers are referred to, and encouraged to read in its entirety,

the Company’s Quarterly Report on Form 10-Q for the nine months

ended September 30, 2023, to be filed with the Securities and

Exchange Commission, which includes further detail on the company’s

business plans, operations, financial condition, and results of

operations.

Financial Results

Selected Financial Data (in thousands, except share and per

share amounts)

September 30, 2023

(unaudited)

December 31, 2022

ASSETS

Cash and cash equivalents

$

140,437

$

240,551

Short-term investments

35,919

-

Other assets

24,450

18,967

Total assets

$

200,806

$

259,518

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities

$

30,555

$

25,017

Long term debt, net

64,783

71,018

Revenue interest financing payable,

net

32,855

29,857

Other long-term liabilities

18,076

17,626

Total liabilities

146,269

143,518

Total stockholders’ equity

54,537

116,000

Total liabilities and stockholders’

equity

$

200,806

$

259,518

Three Months Ended September

30,

(unaudited)

Nine Months Ended September

30,

(unaudited)

2023

2022

2023

2022

Revenue:

Product revenue, net

$

5,429

$

555

$

13,010

$

555

Federal contract revenue

1,891

1,785

10,753

5,088

Collaboration revenue

18

—

36

12,673

Total revenue

7,338

2,340

23,799

18,316

Expenses:

Research and development

23,661

19,002

73,006

58,488

Selling, general and administrative

14,868

13,389

45,794

42,187

Cost of product revenue

455

48

1,047

48

Cost of IP license fee

—

—

—

1,169

Total expenses:

38,984

32,439

119,847

101,892

Loss from operations

(31,646)

(30,099

)

(96,048)

(83,576

)

Interest income

1,895

514

6,366

610

Interest expense

(4,242)

(2,634

)

(12,597)

(6,982

)

Gain from sale of priority review voucher,

net

—

107,375

—

107,375

Other income (expense), net

1,021

(114

)

1,105

(1,179

)

(Loss) income before income taxes

(32,972)

75,042

(101,174)

16,248

(Provision) benefit for income taxes

—

(1,752

)

1,538

(1,752

)

Net (loss) income

$

(32,972)

$

73,290

$

(99,636)

$

14,496

Net income allocated to preferred

shareholders

—

1,656

—

336

Net (loss) income applicable to common

shareholders

(32,972)

71,634

(99,636)

14,160

Per share information:

Net (loss) income per share of common

stock—basic

$

(0.61)

$

1.93

$

(1.89)

$

0.38

Net (loss) income per share of common

stock—diluted

$

(0.61)

$

1.89

$

(1.89)

$

0.37

Basic weighted average shares

outstanding

53,920,109

37,202,269

52,755,114

37,084,060

Diluted weighted average shares

outstanding

53,920,109

37,910,511

52,755,114

38,393,754

Other comprehensive income (loss)

Unrealized gain (loss) on

available-for-sale securities

43

—

(71)

—

Total comprehensive (loss) income

$

(32,929)

73,290

(99,707)

14,496

Conference Call Information

Participants may access the conference call via webcast on the

Investor page of Marinus’ website at

ir.marinuspharma.com/events-and-presentations. An archived version

of the call will be available approximately two hours after the

completion of the event on the website.

About Marinus Pharmaceuticals

Marinus is a commercial-stage pharmaceutical company dedicated

to the development of innovative therapeutics for seizure

disorders. The Company first introduced FDA-approved prescription

medication ZTALMY® (ganaxolone) oral suspension CV in the U.S. in

2022 and continues to invest in the potential of ganaxolone in IV

and oral formulations to maximize therapeutic reach for adult and

pediatric patients in acute and chronic care settings. For more

information visit www.marinuspharma.com.

Forward-Looking Statements

To the extent that statements contained in this press release

are not descriptions of historical facts regarding Marinus, they

are forward-looking statements reflecting the current beliefs and

expectations of management made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Words such as "may", "will", "expect", "anticipate", "estimate",

"intend", "believe", and similar expressions (as well as other

words or expressions referencing future events, conditions or

circumstances) are intended to identify forward-looking statements.

Examples of forward-looking statements contained in this press

release include, among others, statements regarding our

commercialization and marketing plans for ZTALMY; our net product

revenue guidance; the potential benefits ZTALMY will provide for

physicians and patients; the potential benefits from the U.S.

onshoring of the manufacturing capabilities for ganaxolone API;

statements regarding our expected clinical development plans,

enrollment in our clinical trials, regulatory communications and

submissions for ganaxolone, and the timing thereof; our expected

data readouts; our expected cash runway; our expectations and

beliefs regarding the FDA and EMA with respect to our product

candidates; our expectations regarding the development of new

formulations and prodrug candidates; our expectations regarding our

strategic partners; our financial projections; the potential safety

and efficacy of ganaxolone, as well as its therapeutic potential in

a number of indications; and other statements regarding the

company's future operations, financial performance, financial

position, prospects, objectives and other future event.

Forward-looking statements in this press release involve

substantial risks and uncertainties that could cause our clinical

development programs, future results, performance or achievements

to differ significantly from those expressed or implied by the

forward-looking statements. Such risks and uncertainties include,

among others, unexpected results or delays in the commercialization

of ZTALMY; unexpected market acceptance, payor coverage or future

prescriptions and revenue generated by ZTALMY; unexpected actions

by the FDA or other regulatory agencies with respect to our

products; competitive conditions and unexpected adverse events or

patient outcomes from being treated with ZTALMY, uncertainties and

delays relating to the design, enrollment, completion, and results

of clinical trials; unanticipated costs and expenses; the varying

interpretation of clinical data; our ability to comply with the

FDA’s requirement for additional post-marketing studies in the

required time frames; the timing of regulatory filings for our

other product candidates; the potential that regulatory

authorities, including the FDA and EMA, may not grant or may delay

approval for our product candidates; early clinical trials may not

be indicative of the results in later clinical trials; clinical

trial results may not support regulatory approval or further

development in a specified indication or at all; actions or advice

of the FDA or EMA may affect the design, initiation, timing,

continuation and/or progress of clinical trials or result in the

need for additional clinical trials; our ability to obtain and

maintain regulatory approval for our product candidate; our ability

to develop new formulations of ganaxolone or prodrugs; our ability

to obtain, maintain, protect and defend intellectual property for

our product candidates; the potential negative impact of third

party patents on our or our collaborators’ ability to commercialize

ganaxolone; delays, interruptions or failures in the manufacture

and supply of our product candidate; the size and growth potential

of the markets for the company’s product candidates, and the

company’s ability to service those markets; the company’s cash and

cash equivalents may not be sufficient to support its operating

plan for as long as anticipated; the company’s expectations,

projections and estimates regarding expenses, future revenue,

capital requirements, and the availability of and the need for

additional financing; the company’s ability to obtain additional

funding to support its clinical development and commercial

programs; the potential for our ex-US partners to breach their

obligations under their respective agreements with us or terminate

such agreements in accordance with their respective terms; the risk

that drug product quality requirements may not support continued

clinical investigation of our product candidates and result in

delays or termination of such clinical studies and product

approvals; the effect of the COVID-19 pandemic on our business, the

medical community, regulators and the global economy; and the

availability or potential availability of alternative products or

treatments for conditions targeted by us that could affect the

availability or commercial potential of our product candidate. This

list is not exhaustive and these and other risks are described in

our periodic reports, including the annual report on Form 10-K,

quarterly reports on Form 10-Q and current reports on Form 8-K,

filed with or furnished to the Securities and Exchange Commission

and available at www.sec.gov. Any forward-looking statements that

we make in this press release speak only as of the date of this

press release. We assume no obligation to update forward-looking

statements whether as a result of new information, future events or

otherwise, after the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231107561480/en/

Investors Jim DeNike Senior

Director, Investor Relations Marinus Pharmaceuticals, Inc.

jdenike@marinuspharma.com

Media Molly Cameron Director,

Corporate Communications & Investor Relations Marinus

Pharmaceuticals, Inc. mcameron@marinuspharma.com

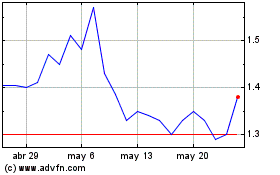

Marinus Pharmaceuticals (NASDAQ:MRNS)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Marinus Pharmaceuticals (NASDAQ:MRNS)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025