UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

| NanoVibronix,

Inc. |

| (Name

of Registrant as Specified In Its Charter) |

|

|

| |

|

| (Name

of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment

of Filing Fee (Check all boxes that apply): |

| |

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

969

Pruitt Place

Tyler

TX 75703

(914)

233-3004

October

29, 2024

Dear

Stockholder:

You

are cordially invited to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of NanoVibronix, Inc., a Delaware

corporation (“we,” “us,” “our” or the “Company”), which will be held on December 19,

2024, at 10:00 a.m. Eastern Time at www.virtualshareholdermeeting.com/NAOV2024. To provide access to our stockholders regardless of geographic

location, the Company has determined that the Annual Meeting will be a virtual meeting conducted exclusively via live webcast. You or

your proxyholder will be able to attend the virtual Annual Meeting online, vote, and submit questions during the Annual Meeting by visiting

www.virtualshareholdermeeting.com/NAOV2024 and entering the 16-digit control number included on the proxy card or voting instruction

form, as applicable. To receive access to the virtual Annual Meeting, registered stockholders and beneficial stockholders (those holding

shares through a stock brokerage account or by a bank or other holder of record) will need to follow the instructions applicable to them

provided in the accompanying proxy statement. Details regarding the Annual Meeting and the business to be conducted at the Annual Meeting

are more fully described in the accompanying Notice of Annual Stockholders Meeting and proxy statement. You are entitled to vote at our

Annual Meeting and any adjournments, continuations or postponements thereof only if you were a stockholder as of October 28, 2024.

We

are distributing our proxy materials to certain stockholders via the Internet under the U.S. Securities and Exchange Commission (the

“SEC”) “Notice and Access” rules. We believe this approach allows us to provide stockholders with a timely and

convenient way to receive proxy materials and vote, while lowering the costs of delivery and reducing the environmental impact of our

Annual Meeting. We are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet

Availability”) beginning on or about October 29, 2024, rather than a paper copy of the proxy statement, the proxy card and

our 2023 Annual Report, which includes our annual report on Form 10-K, as amended, for the fiscal year ended December 31, 2023. The Notice

of Internet Availability contains instructions on how to access the proxy materials, vote and obtain, if desired, a paper copy of the

proxy materials.

Your

vote is very important, regardless of the number of shares of our voting securities that you own. Whether or not you expect to attend

the Annual Meeting online, after receiving the Notice of Internet Availability, please vote as promptly as possible to ensure your representation

and the presence of a quorum at the Annual Meeting. As an alternative to voting online during the Annual Meeting, you may vote via the

Internet, by telephone, or by signing, dating and returning the proxy card that is mailed to those that request paper copies

of the proxy statement and the other proxy materials.

If

your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through

another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or

such other intermediary, or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to virtually

attend the meeting and vote online during the meeting. Failure to do so may result in your shares not being eligible to be voted by proxy

at the meeting.

On

behalf of the board of directors, I urge you to submit your vote as soon as possible, even if you currently plan to attend the Annual

Meeting online.

Thank

you for your support of our company. I look forward to seeing you online at the Annual Meeting via remote communication.

| Sincerely, |

|

|

| |

|

|

| /s/

Brian Murphy |

|

|

| Brian

Murphy |

|

|

| Chief

Executive Officer and Director |

|

|

NanoVibronix,

Inc.

969

Pruitt Place

Tyler

TX 75703

(914)

233-3004

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To

Be Held on December 19, 2024

The

2024 Annual Meeting of Stockholders (the “Annual Meeting”) of NanoVibronix, Inc., a Delaware corporation (“we,”

“us,” “our” or the “Company”), will be held on December 19, 2024, at 10:00 a.m. Eastern Time, via

a live webcast on the Internet. You will be able to virtually attend the Annual Meeting online, vote and submit questions during the

Annual Meeting by visiting www.virtualshareholdermeeting.com/NAOV2024. Only stockholders of record of our common stock, as of the close

of business on October 28, 2024 (the “Record Date”), will be entitled to vote at the Annual Meeting and any adjournments,

continuations or postponements thereof that may take place.

We

will consider and act on the following items of business at the Annual Meeting:

| |

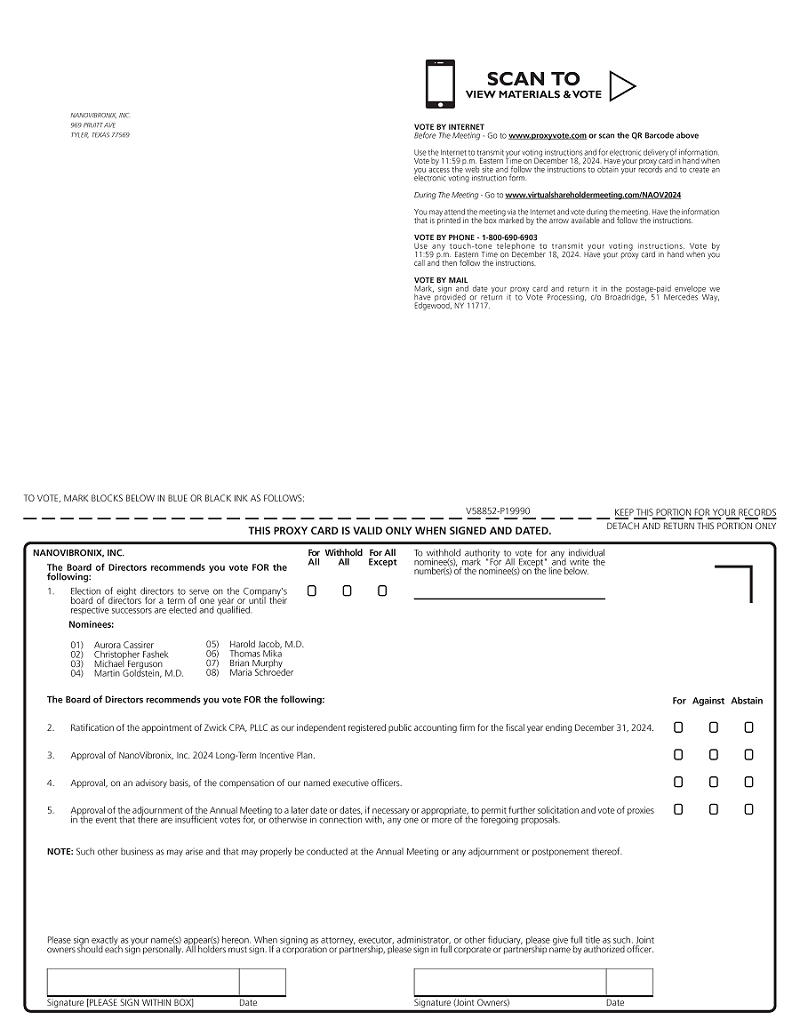

(1) |

Election

of the eight nominees to serve on the Company’s board of directors (the “Board”) for a term of one year or until

their respective successors are elected and qualified, for which the following are nominees: Aurora Cassirer, Christopher Fashek,

Michael Ferguson, Martin Goldstein, M.D., Harold Jacob, M.D., Thomas Mika, Brian Murphy, and Maria Schroeder (“Proposal 1”); |

| |

|

|

| |

(2) |

Ratification

of the appointment of Zwick CPA, PLLC as our independent registered public accounting firm for the fiscal year ending December 31,

2024 (“Proposal 2”); |

| |

|

|

| |

(3) |

Approval

of the NanoVibronix, Inc. 2024 Long-Term Incentive Plan (“Proposal 3”); |

| |

|

|

| |

(4) |

Approval,

on an advisory basis, of the compensation paid to our named executive officers (“Proposal 4”); |

| |

|

|

| |

(5) |

Approval

of a proposal to adjourn the Annual Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation

and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of any one

or more of the foregoing proposals (“Proposal 5”); and |

| |

|

|

| |

(6) |

Such

other business as may arise and that may properly be conducted at the Annual Meeting or any adjournment or postponement thereof. |

Stockholders

are referred to the proxy statement accompanying this notice for more detailed information with respect to the matters to be considered

at the Annual Meeting. After careful consideration, the “Board has determined that each proposal listed above is in the best interests

of the Company and its stockholders and has approved each proposal. The Board recommends a vote “FOR” the election of

each of the nominees for director listed in Proposal 1 and “FOR” Proposals 2, 3, 4 and 5.

The

Board has fixed the close of business on October 28, 2024, as the record date (the “Record Date”) for the Annual Meeting.

Only stockholders of record of our common stock on the Record Date are entitled to receive notice of the Annual Meeting and vote at the

Annual Meeting. A complete list of registered stockholders entitled to vote at the Annual Meeting will be available for inspection at

the principal executive offices of the Company (upon request to us by mail at NanoVibronix, Inc., 969 Pruitt Place, Tyler TX 75703, Attn:

Stephen Brown or by calling 914-233-3004 and asking for Stephen Brown) during regular business hours for the 10 calendar days prior to

the Annual Meeting.

YOUR

VOTE AND PARTICIPATION IN THE COMPANY’S AFFAIRS ARE IMPORTANT.

Whether

or not you plan to attend the Annual Meeting online, we urge you to vote your shares as promptly as possible by Internet, telephone or

mail. For specific instructions on how to vote your shares, please see the section entitled “About the Annual Meeting” beginning

on page 7 of the proxy statement.

If

your shares are registered in your name, even if you plan to attend the Annual Meeting (or any postponement or adjournment of the

Annual Meeting) online, we request that you complete, date, sign and mail the proxy card in accordance with the instructions

set out in the form of proxy and in the proxy statement to ensure that your shares will be represented at the Annual Meeting.

If

your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or

through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker

or such other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to virtually

attend the Annual Meeting and vote online. Failure to do so may result in your shares not being eligible to be voted by proxy at the

Annual Meeting online.

| By

Order of the Board, |

|

|

| |

|

|

| /s/

Brian Murphy |

|

|

| Brian

Murphy |

|

|

| Chief

Executive Officer and Director |

|

|

| October

29, 2024 |

|

|

TABLE

OF CONTENTS

NanoVibronix,

Inc.

969

Pruitt Place

Tyler

TX 75703

(914)

233-3004

PROXY

STATEMENT

FOR

ANNUAL

MEETING OF STOCKHOLDERS

To

Be Held on December 19, 2024

Unless

the context otherwise requires, references in this proxy statement (this “Proxy Statement”) to “we,” “us,”

“our,” “the Company,” or “NanoVibronix” refer to NanoVibronix, Inc., a Delaware corporation, and

its consolidated subsidiary as a whole. In addition, unless the context otherwise requires, references to “stockholders”

are to the holders of our common stock.

The

accompanying proxy is solicited by the board of directors of the Company (the “Board”) on behalf of NanoVibronix, Inc. to

be voted at the 2024 annual meeting of stockholders of the Company (the “Annual Meeting”) to be held virtually via a live

webcast on the Internet on December 19, 2024 at 10:00 a.m. Eastern Time, at the Internet address and for the purposes set forth in the

accompanying Notice of Annual Meeting of Stockholders (the “Notice”). This Proxy Statement and accompanying form of proxy

are dated October 29, 2024, and are expected to be first sent, given or made available to stockholders on or about October 29, 2024.

If

you held shares of our common stock at the close of business on October 28, 2024 (the “Record Date”), you are invited to

attend the Annual Meeting virtually at www.virtualshareholdermeeting.com/NAOV2024 and vote on the proposals described in this Proxy Statement.

The

Company will pay the costs of soliciting proxies from stockholders. Our directors, officers and employees will solicit proxies on behalf

of the Company, without additional compensation, by telephone, facsimile, mail, on the Internet or in person.

The

executive offices of the Company are located at, and the mailing address of the Company, is 969 Pruitt Place, Tyler TX 75703.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 19, 2024:

As

permitted by the “Notice and Access” rules of the U.S. Securities and Exchange Commission (the “SEC”), we are

making this proxy statement, the proxy card and our 2023 Annual Report, which includes our annual report on Form 10-K, as amended, for

the fiscal year ended December 31, 2023 available to stockholders electronically via the Internet at the following website: www.proxyvote.com.

On or about October 29, 2024, we will begin mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice

of Internet Availability”) that contains instructions on how stockholders may access and review all of the proxy materials and

how to vote. Also, on or about October 29, 2024, we will begin mailing printed copies of the proxy materials to stockholders that previously

requested printed copies. If you received a Notice of Internet Availability by mail, you will not receive a printed copy of the proxy

materials in the mail unless you request a copy. If you received a Notice of Internet Availability by mail and would like to receive

a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet

Availability.

ABOUT

THE ANNUAL MEETING

What

is a proxy?

A

proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document,

that document is also called a “proxy” or a “proxy card.”

What

is a proxy statement?

A

proxy statement is a document that regulations of the SEC require that we give to you when we ask you to sign a proxy card to vote your

stock at the Annual Meeting.

Why

did I receive a Notice of Internet Availability of Proxy Materials instead of paper copies of the proxy

materials?

We

are using the SEC’s Notice and Access model, which allows us to deliver proxy materials over the Internet, as the primary means

of furnishing proxy materials. We believe Notice and Access provides stockholders with a convenient method to access the proxy materials

and vote, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. On or

about October 29, 2024, we expect to begin mailing to stockholders a Notice of Internet Availability containing instructions on how to

access our proxy materials on the Internet and how to vote online. The Notice of Internet Availability is not a proxy card and cannot

be used to vote your shares. If you received a Notice of Internet Availability this year, you will not receive paper copies of the proxy

materials unless you request the materials by following the instructions on the Notice of Internet Availability.

What

is the purpose of the Annual Meeting?

At

our Annual Meeting, stockholders will act upon the matters outlined in the Notice, which include the following:

| |

(7) |

Election

of the eight nominees to serve on the Company’s Board for a term of one year or until their respective successors are elected

and qualified, for which the following are nominees: Aurora Cassirer, Christopher Fashek, Michael Ferguson, Martin Goldstein, M.D.,

Harold Jacob, M.D., Thomas Mika, Brian Murphy, and Maria Schroeder (“Proposal 1”); |

| |

|

|

| |

(8) |

Ratification

of the appointment of Zwick CPA, PLLC as our independent registered public accounting firm for the fiscal year ending December 31,

2024 (“Proposal 2”); |

| |

|

|

| |

(9) |

Approval

of the NanoVibronix, Inc. 2024 Long-Term Incentive Plan (“Proposal 3”); |

| |

|

|

| |

(10) |

Approval,

on an advisory basis, of the compensation paid to our named executive officers (“Proposal 4”); |

| |

|

|

| |

(11) |

Approval

of a proposal to adjourn the Annual Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation

and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of any one

or more of the foregoing proposals (“Proposal 5”); and |

| |

|

|

| |

(12) |

Such

other business as may arise and that may properly be conducted at the Annual Meeting or any adjournment or postponement thereof. |

What

should I do if I receive more than one set of voting materials?

You

may receive more than one Notice of Internet Availability (or, if you requested a printed copy of the proxy materials, including multiple

copies of this Proxy Statement and multiple proxy cards or voting instruction cards). For example, if you hold your shares in more than

one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly,

if you are a stockholder of record and hold shares in a brokerage account, you will receive a Notice of Internet Availability (or, if

you requested a printed copy of the proxy materials, a proxy card) for shares held in your name and a voting instruction card for shares

held in “street name.” Please follow the separate voting instructions that you received for your shares of common stock held

in each of your different accounts to ensure that all your shares are voted.

What

is the record date and what does it mean?

The

record date to determine the stockholders entitled to notice of and to vote at the Annual Meeting is the close of business on October

28, 2024 (the “Record Date”). The Record Date is established by the Board as required by Delaware law. On the Record Date,

3,752,354 shares of common stock were issued and outstanding. See “What are the voting rights of the stockholders?”

below.

Who

is entitled to vote at the Annual Meeting and how many votes do they have?

Holders

of common stock at the close of business on the Record Date may vote at the Annual Meeting. There were 3,752,354 shares of common stock,

and no shares of any series of preferred stock outstanding on the Record Date. A complete list of registered stockholders entitled to

vote at the Annual Meeting will be available for inspection at the principal executive offices of the Company during regular business

hours for the 10 calendar days prior to the Annual Meeting.

Pursuant

to the rights of our stockholders contained in our charter documents, each share of our common stock is entitled to one vote on all matters

listed in this Proxy Statement. There is no cumulative voting.

What

is the difference between a stockholder of record and a “street name” holder?

If

your shares are registered directly in your name with VStock Transfer, LLC, the Company’s stock transfer agent, you are considered

the stockholder of record with respect to those shares. The Notice of Internet Availability has been sent directly to you by the Company.

If

your shares are held in a stock brokerage account or by a bank or other nominee, the nominee is considered the record holder of those

shares. You are considered the beneficial owner of these shares, and your shares are held in “street name.” The Notice of

Internet Availability has been forwarded to you by your nominee. As the beneficial owner, you have the right to direct your nominee concerning

how to vote your shares by using the voting instructions the nominee included in the mailing or by following such nominee’s instructions

for voting.

What

is a broker non-vote?

Broker

non-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred

to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not received

voting instructions from the beneficial owner and (i) the broker does not have discretionary voting authority on the matter or (ii) the

broker chooses not to vote on a matter for which it has discretionary voting authority.

With

respect to the ratification of the independent registered public accounting firm (Proposal 2) and adjournment of the Annual Meeting to

a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient

votes for, or otherwise in connection with, the approval of any one or more of the proposals presented at the Annual Meeting (Proposal

5), your broker will have the discretion to vote your shares and, therefore, will be able to vote your shares with respect to such proposals

even if you do not provide your broker with instructions on those proposals.

If

I am a beneficial owner of shares, can my brokerage firm vote my shares?

If

you are a beneficial owner and do not vote via the Internet or telephone or by returning a signed voting instruction card to your broker,

your shares may be voted only with respect to so-called “routine” matters where your broker has discretionary voting authority

over your shares. Under the rules of the New York Stock Exchange (the “NYSE”) that govern how brokers may vote shares for

which they have not received voting instructions from the beneficial owner, brokers will have such discretionary authority to vote on

the ratification of the independent registered public accounting firm (Proposal 2) and adjournment of the Annual Meeting to a later date

or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes

for, or otherwise in connection with, the approval of any one or more of the proposals presented at the Annual Meeting (Proposal 5),

and may vote “FOR” such proposals. In the absence of specific instructions from you, your broker does not have discretionary

authority to vote your shares with respect to the election of directors (Proposal 1), the approval of the NanoVibronix, Inc. 2024 Long-Term

Incentive (Proposal 3), or the non-binding advisory vote on the compensation of our named executive officers (Proposal 4).

We

encourage you to provide instructions to your brokerage firm via the Internet or telephone or by returning your signed voting instruction

card. This ensures that your shares will be voted at the Annual Meeting with respect to all of the proposals described in this Proxy

Statement.

When

and where is the Annual Meeting and what do I need to be able to attend online?

The

Annual Meeting will be held on December 19, 2024, at 10:00 a.m. Eastern Time at www.virtualshareholdermeeting.com/NAOV2024. Any stockholder

who owns our common stock on the Record Date can attend the Annual Meeting online.

You

will be able to attend the Annual Meeting online, vote, and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/NAOV2024.

To participate in the virtual meeting, you will need the 16-digit control number included on your proxy card or voting instruction form,

as applicable. The meeting webcast will begin promptly at 10:00 a.m. Eastern Time. We encourage you to access the meeting prior to the

start time and you should allow ample time for the check-in procedures. Because the Annual Meeting will be a completely virtual meeting,

there will be no physical location for stockholders to attend.

What

Constitutes a Quorum for the Annual Meeting?

The

presence, by virtual attendance or by proxy, of the holders of one-third of the voting power of all of the shares of the stock entitled

to vote at the Annual Meeting, is necessary to constitute a quorum at the Annual Meeting. Votes of stockholders of record who are present

at the Annual Meeting by virtual attendance or by proxy, abstentions and broker non-votes are counted for purposes of determining whether

a quorum exists.

How

do I vote my shares?

If

you are a record holder, you may choose one of the following methods to vote your shares:

| ● |

Via

Internet: as prompted by the menu found at www.proxyvote.com, follow the instructions to obtain your records and submit an electronic

ballot. Please have your Stockholder Control Number, which can be found on your proxy card, when you access this voting site. You

may vote via the Internet until 11:59 p.m., Eastern Time on December 18, 2024. |

| |

|

| ● |

Via

telephone: call 1-800-690-6903 and then follow the voice instructions. Please have your Stockholder Control Number, which can

be found on your proxy card, when you call. You may vote by telephone until 11:59 p.m., Eastern Time on December 18, 2024. |

| |

|

| ● |

Via

mail: You may vote by proxy by completing, signing, dating and promptly returning the proxy card in the postage-paid

envelope. If you submit a signed proxy without indicating your vote, the person voting the proxy will vote your shares according

to the Board’s recommendation. |

| |

|

| ● |

Online:

Online during the Annual Meeting at www.virtualshareholdermeeting.com/NAOV2024. You will need your Stockholder Control Number, which

can be found on your proxy card, in hand when you vote online during the Annual Meeting. |

The

proxy is fairly simple to complete, with specific instructions on the electronic ballot, telephone or card. By completing and submitting

it, you will direct the designated persons (known as “proxies”) to vote your stock at the Annual Meeting in accordance with

your instructions. The Board has appointed Brian Murphy, our chief executive officer and director and Stephen Brown, our chief financial

officer, to serve as the proxies for the Annual Meeting. Your proxy will be valid only if you complete and return it before the Annual

Meeting. If you properly complete and transmit your proxy but do not provide voting instructions with respect to a proposal, then the

designated proxies will vote your shares “FOR” the election of each of the nominees for director listed in Proposal

1 and “FOR” Proposal 2, Proposal 3, Proposal 4 and Proposal 5 to which you provided no voting instructions. We do

not anticipate that any other matters will come before the Annual Meeting, but if any other matters properly come before the meeting,

then the proxies will vote your shares in accordance with applicable law and their judgment.

If

you hold your shares in “street name,” your bank, broker or other nominee should provide to you a request for voting instructions

along with the Company’s proxy solicitation materials. By completing the voting instruction card, you may direct your nominee how

to vote your shares. If you partially complete the voting instruction but fail to complete one or more of the voting instructions, then

your nominee may be unable to vote your shares with respect to the proposal as to which you provided no voting instructions. See “What

is a broker non-vote?” Alternatively, if you want to vote your shares during the virtual Annual Meeting, you must contact your

nominee directly in order to obtain a proxy issued to you by your nominee holder. Note that a broker letter that identifies you as a

stockholder is not the same as a nominee-issued proxy. If you fail to obtain a nominee-issued proxy prior to the Annual Meeting, you

will not be able to vote your nominee-held shares during the Annual Meeting.

Who

counts the votes?

All

votes will be tabulated by the Inspector of Election appointed for the Annual Meeting. Each proposal will be tabulated separately.

Can

I vote my shares at the Annual Meeting?

Yes.

If you are a stockholder of record, you may vote your shares during the meeting by submitting your vote electronically at the Annual

Meeting.

If

you hold your shares in “street name,” you may vote your shares during the Annual Meeting only if you obtain a proxy issued

by your bank, broker or other nominee giving you the right to vote the shares.

Even

if you currently plan to attend the virtual Annual Meeting, we recommend that you also return your proxy or voting instructions as described

above so that your votes will be counted if you later decide not to attend the Annual Meeting or are unable to attend.

What

are my choices when voting?

When

you cast your vote on:

Proposal

1: You may vote for all director nominees or may withhold your vote as to one or more director nominees.

Proposal

2: You may vote for the proposal, against the proposal or abstain from voting on the proposal.

Proposal

3: You may vote for the proposal, against the proposal or abstain from voting on the proposal.

Proposal

4: You may vote for the proposal, against the proposal or abstain from voting on the proposal.

Proposal

5: You may vote for the proposal, against the proposal or abstain from voting on the proposal.

What

are the Board’s recommendations on how I should vote my shares?

The

Board recommends that you vote your shares as follows:

“FOR”

the election of each of the nominees listed in Proposal 1.

“FOR”

Proposals 2, 3, 4 and 5.

What

if I do not specify how I want my shares voted?

If

you are a record holder who returns a completed proxy that does not specify how you want to vote your shares on one or more proposals,

the proxies will vote your shares for each proposal as to which you provided no voting instructions, and such shares will be voted in

the following manner:

“FOR”

the election of each of the nominees listed in Proposal 1.

“FOR”

Proposals 2, 3, 4 and 5.

If

you are a “street name” holder and do not provide voting instructions on one or more proposals, your bank, broker or other

nominee will be unable to vote those shares with respect to the election of directors (Proposal 1), the approval of the NanoVibronix,

Inc. 2024 Long-Term Incentive (Proposal 3), or the non-binding advisory vote on the compensation of our named executive officers (Proposal

4). See “What is a broker non-vote?”

Can

I change my vote?

Yes.

If you are a record holder, you may revoke your proxy at any time by any of the following means:

| ● |

Attending

the virtual Annual Meeting and submitting your vote electronically. Your attendance at the Annual Meeting will not by itself revoke

a proxy. You must vote your shares by ballot at the virtual Annual Meeting to revoke your proxy. |

| |

|

| ● |

Completing

and submitting a new valid proxy bearing a later date. |

| |

|

| ● |

Giving

written notice of revocation to the Company addressed to Brian Murphy, our Chief Executive Officer and a director, at the Company’s

address above, which notice must be received before 6:00 p.m., Eastern Time on December 18, 2024. |

If

you are a “street name” holder, your bank, broker or other nominee should provide instructions explaining how you may change

or revoke your voting instructions.

What

votes are required to approve each proposal?

Assuming

the presence of a quorum, the following sets forth the voting requirement with respect to each Proposal:

| Proposal

1 — Election of Directors |

|

The

affirmative “FOR” vote of the holders of a plurality of the votes cast at the Annual Meeting is required for the election

of the director nominees, i.e., the eight director nominees who receive the most votes will be elected.

|

| |

|

|

Proposal

2 — Ratification of Appointment of Auditor

|

|

The

affirmative “FOR” vote of a majority of the votes cast “FOR” or “AGAINST” the proposal. |

| |

|

|

Proposal

3 – Approval of the NanoVibronix, Inc. 2024 Long-Term Incentive Plan

|

|

The

affirmative “FOR” vote of a majority of the votes cast “FOR” or “AGAINST” the proposal. |

| |

|

|

| Proposal

4- Approval, on an advisory basis, of the compensation paid to our named executive officers |

|

The

affirmative “FOR” vote of a majority of the votes cast “FOR” or “AGAINST” the proposal. |

| |

|

|

| Proposal

5- Approval to adjourn the Annual Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and

vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of any one or more

of the foregoing proposals |

|

The

affirmative “FOR” vote of a majority of the votes cast “FOR” or “AGAINST” the proposal. |

How

are abstentions and broker non-votes treated?

Abstentions

are included in the determination of the number of shares present at the Annual Meeting for determining a quorum at the meeting. Withholding

authority to vote your shares with respect to one or more director nominees will have no effect on the election of those nominees, and

abstentions will have no effect on the ratification of the independent registered public accounting firm (Proposal 2), the approval of

the NanoVibronix, Inc. 2024 Long-Term Incentive Plan (Proposal 3), the approval, on an advisory basis, the compensation paid to our named

executive officers (Proposal 4) or the approval to adjourn the Annual Meeting to a later date or dates, if necessary or appropriate,

to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with,

the approval of any one or more of the foregoing proposals (Proposal 5).

Broker

non-votes are included in the determination of the number of shares present at the Annual Meeting for determining a quorum at the meeting.

Failure to instruct your broker how to vote with respect to the election of directors (Proposal 1), the ratification of the independent

registered public accounting firm (Proposal 2), the approval of the NanoVibronix, Inc. 2024 Long-Term Incentive Plan (Proposal 3), the

approval, on an advisory basis, the compensation paid to our named executive officers (Proposal 4) or the approval to adjourn the Annual

Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there

are insufficient votes for, or otherwise in connection with, the approval of any one or more of the foregoing proposals (Proposal 5)

will have no effect on the outcome of the votes because broker non-votes are not considered shares entitled to vote. However, if you

do not give your broker specific instructions on how to vote your shares with respect to the ratification of the independent registered

public accounting firm (Proposal 2) or the approval to adjourn the Annual Meeting to a later date or dates, if necessary or appropriate,

to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with,

the approval of any one or more of the foregoing proposals (Proposal 5), your broker may vote your shares at its discretion.

What

are the solicitation expenses and who pays the cost of this proxy solicitation?

Our

Board is asking for your proxy and we will pay all of the costs of asking for stockholder proxies. The Company will pay the costs of

soliciting proxies from stockholders. Our directors, officers and employees will solicit proxies on behalf of the Company, without additional

compensation, by telephone, facsimile, mail, on the Internet or in person. We will reimburse brokerage houses and other custodians, nominees

and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of common stock

and collecting voting instructions.

Is

this Proxy Statement the only way that proxies are being solicited?

No.

In addition to the solicitation of proxies by use of the Notice of Internet Availability, officers and employees of the Company may solicit

the return of proxies, either by mail, telephone, telecopy, e-mail or through personal contact. Our officers and employees will not receive

additional compensation for their efforts but will be reimbursed for out-of-pocket expenses. Brokerage houses and other custodians, nominees

and fiduciaries, in connection with shares of the common stock registered in their names, will be requested to forward solicitation material

to the beneficial owners of shares of common stock.

When

will the next shareholder advisory vote on executive compensation occur?

At

our 2021 annual meeting of stockholders, we submitted to stockholders an advisory vote on whether an advisory vote on executive compensation

should be held every one, two, or three years. “Three years” was the frequency that received the highest number of votes.

In light of such outcome, we hold an advisory vote on executive compensation every three years (including this year, with the last vote

having occurred in 2021). The next “say-on-pay” vote is expected to occur at the annual meeting of our stockholders in 2027.

The

next time we will submit to stockholders an advisory vote on the frequency of the advisory vote on executive compensation will be at

the annual meeting of our shareholders in 2027 as well.

Are

there any other matters to be acted upon at the Annual Meeting?

Management

does not intend to present any business at the Annual Meeting for a vote other than the matters set forth in the Notice and has no information

that others will do so. If other matters requiring a vote of the stockholders properly come before the Annual Meeting, it is the intention

of the persons named in the form of proxy to vote the shares represented by the proxies held by them in accordance with applicable law

and their judgment on such matters.

Where

can I find voting results?

We

expect to publish the voting results in a current report on Form 8-K, which we expect to file with the SEC within four business days

after the Annual Meeting.

Who

can help answer my questions?

The

information provided above in this “Question and Answer” format is for your convenience only and is merely a summary of the

information contained in this Proxy Statement. We urge you to carefully read this entire proxy statement, including the documents we

refer to in this Proxy Statement. If you have any questions, or need additional materials, please feel free to contact Stephen Brown

by email at steve@nanovibronix.com or phone at 914-233-3004. You will also be able to submit questions during the Annual Meeting.

What

is “householding” and how does it affect me?

With

respect to eligible stockholders who share a single address, we may send a single copy of the proxy materials to that address unless

we received instructions to the contrary from any stockholder at that address. This practice, known as “householding,” is

designed to reduce our printing and postage costs. However, if a stockholder of record residing at such address wishes to receive a separate

proxy statement and other proxy materials in the future, he or she may contact us by mail at NanoVibronix, Inc., 969 Pruitt Place, Tyler

TX 75703, Attn: Brian Murphy or by calling 914-233-3004 and asking for Brian Murphy. Eligible stockholders of record receiving multiple

copies of our proxy materials can request householding by contacting us in the same manner. Stockholders who own shares through a bank,

broker or other nominee can request householding by contacting such nominee.

We

hereby undertake to deliver promptly, upon written or oral request, a copy of the proxy materials to a stockholder at a shared address

to which a single copy of the document was delivered. Requests should be directed to Brian Murphy at the address or phone number set

forth above.

PROPOSAL

1: ELECTION OF DIRECTORS

The

Board has nominated eight directors for election at the Annual Meeting by the stockholders (each referred to herein as a “Company

Nominee” and, collectively as the “Company Nominees”). The Board manages our company’s business and affairs,

exercises all corporate powers and establishes corporate policies. Our Certificate of Incorporation and Bylaws provide that the Board

will consist of such number of directors as may be determined from time to time by resolution of the majority of the whole Board. Proxies

cannot be voted for a greater number of persons than the number of Company Nominees named in the proxy statement.

Each

member of our Board is elected for a one-year term and is elected at each annual meeting of stockholders. If a quorum is present, the

Company Nominees will be elected by a plurality of the voting power of the shares present in person or represented by proxy at the meeting

and entitled to vote on the election of directors. Abstentions and broker non-votes have no effect on the vote. The eight Company Nominees

receiving the highest number of affirmative votes will be elected directors of the Company. Shares of common stock entitled to vote at

the Annual Meeting represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the eight

nominees named below. Should any Company Nominee become unable or unwilling to accept nomination or election, the proxy holders may vote

the proxies for the election, in his or her stead, of any other person the Board may nominate or designate. Each Company Nominee has

agreed to serve, if elected, and the Board has no reason to believe that any Company Nominee will be unable to serve.

Nominee

Biographies and Qualifications

The

following table sets forth the name, age and position of each director currently serving on the Board and each Company Nominee for election

as a director as of the Record Date:

The

biographies for the Company Nominees are as follows:

| Name |

|

Age |

|

Position

with the Company |

| Brian

Murphy |

|

67 |

|

Chief

Executive Officer and Director |

| Harold

Jacob, M.D. |

|

71 |

|

Chief

Medical Officer and Director |

| Christopher

Fashek |

|

75 |

|

Chairman

of the Board |

| Martin

Goldstein, M.D. |

|

56 |

|

Director |

| Michael

Ferguson |

|

54 |

|

Director |

| Thomas

R. Mika |

|

73 |

|

Director |

| Aurora

Cassirer |

|

72 |

|

Director |

| Maria

Schroeder |

|

66 |

|

Director

|

The

following sets forth biographical information and the qualifications and skills for each director:

Brian

Murphy, Chief Executive Officer and Director. Mr. Murphy has served as our chief executive officer and director since October

2016. Mr. Murphy has over 25 years of senior sales, operations and general management experience in medical device and medical technology

companies, including ATI Medical Equipment Corporation, Mountain Medical Equipment Inc. and Healthdyne Technologies Inc. From 2012 to

2016, Mr. Murphy served in various roles at MiMedx Group, Inc., where he initiated and managed the commercial sales and national accounts

efforts within the advanced wound care segment. From 2010 to 2012, Mr. Murphy was the chief executive officer of O2 Insights, Inc., a

start-up wound care diagnostics company, and led the sale of the company to Systagenix Ltd. in June 2012. From 2008 to 2010, Mr. Murphy

served as vice president of sales for ConvaTec and led the negative pressure wound therapy business. From 1992 to 2008, Mr. Murphy served

a total of 17 years at Kinetic Concepts, Inc. (KCI) in various positions overseeing sales, operations and general management. Mr. Murphy

holds a bachelor of arts degree in communications from Southern Illinois University. Mr. Murphy’s qualifications to serve on our

Board include his significant sales, operations and general management experience in medical device and medical technology companies.

Harold

Jacob, M.D., Chief Medical Officer and Director. Dr. Jacob has served as our chief medical officer since March 1, 2014, and as

our director since September 2003. From September 2003 to February 4, 2014, Dr. Jacob served as chairman of the board of directors of

the Company (the “Board”), and from September 2003 to March 1, 2014, Dr. Jacob served as our chief executive officer. Dr.

Jacob also performed the functions of a principal financial officer until April 1, 2014. Dr. Jacob is our co-founder and has worked extensively

in medical device development. Dr. Jacob also served part-time as an attending gastroenterologist at Shaare Zedek Medical Center in Jerusalem,

Israel from 2004 to March 2011. Since April 2011, he has been an attending physician in Gastroenterology at Hadassah University Hospital

in Jerusalem, Israel. From 1999 to the present, Dr. Jacob has served as the president of Medical Instrument Development Inc., which provides

consulting services to start-up and early stage companies and patents its own proprietary medical devices. From 1997 to 2003, Dr. Jacob

served as director of medical affairs at Given Imaging Ltd., a company that developed the first swallowable wireless pill camera for

inspection of the intestines. Dr. Jacob also formerly served as a director for Oramed Pharmaceuticals Inc., a pharmaceutical company

focused on the development of innovative orally ingestible capsule medication. We believe that Dr. Jacob’s qualifications to serve

on our Board include his years of experience in the biomedical industry and with us and his experience serving in management roles of

various companies.

Christopher

Fashek, Chairman of the Board. Mr. Fashek has served as our director and chairman of the

Board since November 2016. Mr. Fashek is an accomplished healthcare executive with a record of leading global medical-device and pharmaceutical

businesses. Mr. Fashek led the team that introduced V.A.C.® therapy, a negative pressure wound therapy, to both the clinical community,

and patients with serious or complex wounds. From June 2018, to 2020, Mr. Fashek has served as Chief Executive Officer and Director of

Brain Sentinel, Inc. Mr. Fashek currently serves as a Director of the Wound Healing Foundation (WHF), and Bravida Medical. From 1995

to 2007, Mr. Fashek served as the Vice Chairman, Chief Executive Officer, and President of KCI USA. From 2008 to 2011, Mr. Fashek was

the Chairman of the Board of Directors at Systagenix, Ltd. From 2014 to 2015, Mr. Fashek was the Chairman of the Board of Directors and

Chief Executive Officer of Spiracur, Inc. Mr. Fashek currently serves as Chairman of MedTech Solutions Group, LLC, a global commercial

Medsurge business in San Antonio, Texas. Mr. Fashek has a Bachelor of Arts degree from Upsala College and Master of Business Administration

from Fairleigh Dickinson University. Mr. Fashek is recognized as developing highly productive and profitable leadership teams and corporate

cultures, while taking multiple healthcare products from idealization to commercialization, as well as turning around under-performing

corporations to profitability. Mr. Fashek’s extensive experience as an executive and leadership positions in the global medical

device and pharmaceutical businesses, as well as his network of industry partners, provide him the appropriate experience to serve on

our Board.

Martin

Goldstein, M.D., Director. Dr. Goldstein has served as our director since March 25, 2015 and is on our Corporate Governance Committee.

He has been a practicing urologist for more than 20 years and is also an accomplished healthcare entrepreneur. For more than ten years

Dr Goldstein presided over New Jersey Urology, one the largest urology group practices in the country. As President, he successfully

navigated New Jersey Urology through two private equity transactions and the subsequent acquisition by Village MD. He now serves as the

National Urology Service Line Chief for Village MD/Summit Health, a Walgreens & Cigna backed healthcare company. Previously, he served

as Senior Vice President of Corporate Development and Acquisitions of Urology Management Associates, a private equity backed entity providing

administrative practice management services to independent urology groups. Dr. Goldstein is a co-founder and executive board member of

Metropolitan Surgery Center, a large multispecialty ambulatory surgery center. Dr. Goldstein brings to our Board his medical practice

and healthcare business expertise. He is expected to make a valuable contribution in connection with marketing and facilitating the acceptance

of our product offerings within the medical community. He has provided assistance with the U.S. Food and Drug Administration regulatory

approval process of our products, particularly our urology offerings, and will continue to advise on new product development and innovations.

Michael

Ferguson, Director. The Honorable Mr. Ferguson has served as our director since April 27, 2015. Since November 2023, Mr. Ferguson

has served as executive vice president for federal legislative relations at AT&T. In addition, Mr. Ferguson founded Ferguson Strategies,

LLC, a government affairs and strategic business consulting firm, where he served as the chief executive officer and chairman. Before

joining AT&T, Mr. Ferguson served as a senior advisor at BakerHostetler, serving as the leader of their Federal Policy team. From

2001 to January 2009, he served in the U.S. House of Representatives, representing New Jersey’s 7th congressional district. While

in Congress, he was a member of the House Energy and Commerce Committee, which has wide jurisdiction over the healthcare, telecommunications

and energy industries. He served as vice chairman of the panel’s Health Subcommittee, where he became a key member on health care

issues and helped to ensure passage of the Medicare Part D prescription drug benefit in 2003. In addition, he served as a member of the

Telecommunications and Internet Subcommittee as well as the Oversight and Investigations Subcommittee. Mr. Ferguson was also a member

of the House Financial Services Committee, where he cosponsored the Sarbanes-Oxley Act of 2002 and helped enact the initial terrorism

risk insurance law. Mr. Ferguson was the former chairman of the Board of Commissioners of the New Jersey Sports and Exhibition Authority

and also serves as a senior fellow of the Center for Medicine in the Public Interest’s Odyssey Initiative for Biomedical Innovation

and Human Health. He has also served on various corporate advisory boards and committees, including for Pfizer, Inc., the National Italian

American Foundation and the United States Golf Association. Mr. Ferguson received a bachelor’s degree in government from the University

of Notre Dame and a master’s of public policy degree with a specialization in education policy from Georgetown University. Mr.

Ferguson also formerly served as the Chairman of the Board of Ohr Pharmaceutical Inc. and brings to the Board his extensive background

in government affairs, health care policy, and business strategy gained from his experiences in Congress and business consulting, which

we believe will assist in strengthening and advancing our strategic focus and regulatory compliance.

Thomas

R. Mika, Director. Mr. Mika has served as our director since April 27, 2015. Mr. Mika has over 30 years of senior management,

finance and consulting experience. Mr. Mika is currently executive vice president and chief financial officer of POET Technologies, Inc.

(TSX Venture: PTK, NASDAQ:POET) and previously served as chief executive officer of CollabRx, Inc. (NASDAQ: CLRX) and its predecessor,

Tegal Corporation (NASDAQ: TGAL). CollabRx was a pioneer in clinical decision-support and precision oncology based on genomic testing.

Mr. Mika was the chairman and chief executive officer of Tegal since March 2005, which became CollabRx in 2012, and served as its Chief

Financial Officer since 2002. From 1992 to 2002, Mr. Mika served on the Company’s Board, which included periods of service as the

chairman of the compensation committee and a member of the audit committee. Previously, Mr. Mika co-founded IMTEC, a boutique investment

and consulting firm whose areas of focus included health care, pharmaceuticals, media and information technology. As a partner of IMTEC,

Mr. Mika served clients in the United States, Europe and Japan over a period of 20 years, taking on the role of chief executive officer

in several ventures. Earlier in his career, Mr. Mika was a managing consultant with Cresap, McCormick & Paget and a policy analyst

for the National Science Foundation. Mr. Mika holds a bachelor of science degree in Microbiology from the University of Illinois at Urbana-Champaign

and a master of business administration degree from the Harvard Graduate School of Business. Mr. Mika’s qualifications to serve

on our Board include his significant strategic and business insight from his prior service on the Board of other publicly held companies,

as well as his substantial senior management, finance and consulting experience.

Aurora

Cassirer, Director. Ms. Cassirer has served on the Board since January 2022 and serves as the chair of the corporate governance

committee. Ms. Cassirer is also a member of our compensation committee. Ms. Cassirer is a highly experienced attorney, currently practicing

at Pierson Ferdinand LLP in the Business Litigation Section. She has previously served as a partner in other prominent law firms for

more than 30 years, including at Troutman Pepper Hamilton Sanders LLP, where she served on the Executive and Compensation Committee and

was the Managing Partner of its New York office for many years. Ms. Cassirer has a sophisticated practice focusing on business litigation

and corporate governance issues, as well as securities fraud and derivative litigation. Ms. Cassirer has developed a particular niche

in dealing with publicly and privately held biotech/healthtech and biopharma companies. Ms. Cassirer has been listed as AV Preeminent

by Martindale-Hubbell consistently for the last 20 years as well as being listed in Law & Politics’ New York Super Lawyers

for excellence in Business Litigation every year since 2008. Previously, Ms. Cassirer served as Chair of the Advisory Board of ReferWell,

f/k/a Urgent Consult, LLC, a start-up in the health tech business, and served on the Board of Advisors of Live Care LLC, a start-up engaged

in the remote monitoring of patients. Ms. Cassirer also served on the Board of Directors of Kids in Need of Defense (KIND), a not-for-profit

organization where she served on its Compensation Committee. Ms. Cassirer is also a member of the Board of Friends of Jerusalem College

of Technology and serves on its Development Committee. Ms. Cassirer currently serves as co-chair of the New York State Bar Association

International Corporate Compliance Committee. Ms. Cassirer received her JD from New York University. Ms. Cassirer’s extensive legal

experience and deep knowledge of corporate governance make her well-qualified to serve on our Board.

Maria

Schroeder, Director. Ms. Schroeder has served as our director since January 2022. Ms. Schroeder

has been a key Financial Executive at a number of public and privately-held companies including CST Brands, KCI and Brain Sentinel, where

she recently served as Chief Financial Officer. Prior to Brain Sentinel, Ms. Schroeder served as Vice President, Global Tax of CST Brands,

a Fortune 250 retail Oil and Gas company. Prior to that, she served as Vice President and Treasurer & Head of Tax at Kinetic Concepts,

Inc. (“KCI”) a $1.5 billion MedTech company, which was recently purchased by 3M for $6.7 billion. At KCI, she held key roles

in a number of strategic transactions, including two leveraged buyouts and an initial public offering. Ms. Schroeder began her career

at Ernst & Whinney before joining Deloitte Haskins & Sells. Ms. Schroeder is an alumnus of San Antonio Leadership, a premier

leadership program of the San Antonio Chamber of Commerce and has served on the Audit Committee for The University of Texas at San Antonio,

as Treasurer of Girls, Inc. of San Antonio and as a board member of KLRN, San Antonio’s public television station. Ms. Schroeder

is a Certified Public Accountant and Chartered Global Management Accountant with a B.B.A. in Accounting from the University of Texas

at San Antonio. Ms. Schroeder’s financial expertise and leadership experience make her well-qualified to serve on our Board.

Required

Vote and Board Recommendation

If

a quorum is present and voting, the eight Company Nominees receiving the highest number of votes will be elected as directors. Proxies

cannot be voted for a greater number of persons than the number of nominees named or for persons other than the named nominees. “WITHHOLD”

votes and broker non-votes will have no effect on the results for this proposal. If your shares are held by a broker and you do not give

the broker specific instructions on how to vote your shares, your broker may not vote your shares at its discretion.

| THE

BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH COMPANY NOMINEE (PROPOSAL 1) AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED

IN FAVOR OF EACH DIRECTOR NOMINEE UNLESS A STOCKHOLDER HAS INDICATED OTHERWISE ON THE PROXY CARD. |

CORPORATE

GOVERNANCE

NanoVibronix,

Inc., with the oversight of the Board and its committees, operates within a comprehensive plan of corporate governance for the purpose

of defining independence, assigning responsibilities, setting high standards of professional and personal conduct and assuring compliance

with such responsibilities and standards. We regularly monitor developments in the area of corporate governance.

Code

of Business Conduct and Ethics

We

have adopted a code of business conduct and ethics that applies to all of our officers, directors and employees. The code of business

conduct and ethics addresses, among other things, competition and fair dealing, conflicts of interest, financial matters and external

reporting, our funds and assets, confidentiality and corporate opportunity requirements and the process for reporting violations of the

code of business conduct and ethics, employee misconduct, improper conflicts of interest or other violations. A copy of the code of ethics

was attached as Exhibit 14.1 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, and filed with the Securities

and Exchange Commission on March 31, 2017. If we amend or grant a waiver of one or more of the provisions of our code of business conduct

and ethics, we intend to satisfy the requirements under Item 5.05 of Form 8-K regarding the disclosure of amendments to, or waivers from,

provisions of our code of business conduct and ethics that apply to our principal executive, financial and accounting officers by posting

the required information on our website at www.nanovibronix.com within four business days following the date of such amendment or waiver.

Board

Composition

Our

Certificate of Incorporation and Bylaws provide that our Board will consist of such number of directors as determined from time to time

by resolution adopted by our Board. The size of our Board is currently fixed at eight directors. Subject to any rights applicable to

any then outstanding preferred stock, any vacancies or newly created directorships resulting from an increase in the authorized number

of directors may be filled by a majority of the directors then in office. Each member of our Board is elected for a one-year term and

is elected at each annual meeting of stockholders.

Board

Diversity and Board Diversity Matrix

We

have no formal policy regarding Board diversity. Our Board believes that each director should have a basic understanding of our principal

operational and financial objectives and plans and strategies, our results of operations and financial condition and relative standing

in relation to our competitors. We take into consideration the overall composition and diversity of the Board and areas of expertise

that director nominees may be able to offer, including business experience, knowledge, abilities and customer relationships. Generally,

we will strive to assemble a Board that brings to us a variety of perspectives and skills derived from business and professional experience

as we may deem are in our and our stockholders’ best interests. In doing so, we will also consider candidates with appropriate

non-business backgrounds.

The

following Board Diversity Matrix presents certain diversity statistics, as voluntarily self-identified by our directors, in accordance

with Nasdaq Listing Rule 5606.

Our

current board composition is reflected in the following matrix:

| Board

Diversity Matrix as of October 28, 2024 |

| Total

Number of Directors |

|

8 |

| |

|

Female |

|

Male |

|

Non-Binary |

|

Did

Not Disclose Gender |

| Part

I: Gender Identity |

| Directors |

|

2 |

|

6 |

|

0 |

|

0 |

| Part

II: Demographic Background |

| African

American or Black |

|

0 |

|

0 |

|

0 |

|

0 |

| Alaskan

Native or American Indian |

|

0 |

|

0 |

|

0 |

|

0 |

| Asian |

|

0 |

|

0 |

|

0 |

|

0 |

| Hispanic

or Latinx |

|

1 |

|

0 |

|

0 |

|

0 |

| Native

Hawaiian or Pacific Islander |

|

0 |

|

0 |

|

0 |

|

0 |

| White |

|

1 |

|

6 |

|

0 |

|

0 |

| Two

or More Races or Ethnicities |

|

0 |

|

0 |

|

0 |

|

0 |

| LGBTQ+ |

|

0 |

| Did

Not Disclose Demographic Background |

|

0 |

As

a Smaller Reporting Company subject to the additional flexibility provided under Nasdaq’s Diversity Rule, we currently meet the

diversity objectives promulgated under this rule by having two female directors as well as a Hispanic or Latinx member as reflected in

the above matrix. The current two female directors are Company Nominees to serve as directors of the Company until the next Annual Meeting

or until the appointment or election and qualification of her successor.

Director

Independence

We

are currently listed on The Nasdaq Capital Market and therefore rely on the definition of independence set forth in the Nasdaq Listing

Rules (“Nasdaq Rules”). Under the Nasdaq Rules, a director only qualifies as an “independent director” if, in

the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise

of independent judgment in carrying out the responsibilities of a director.

In

order to be considered to be independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other

than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee: (1) accept, directly

or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (2) be an affiliated

person of the listed company or any of its subsidiaries.

Our

Board undertook a review of its composition, the composition of its committees and the independence of each director. Based upon information

requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships,

our Board has determined that Christopher Fashek, Michael Ferguson, Martin Goldstein, M.D., Thomas R. Mika, Aurora Cassirer, and Maria

Schroeder or six of our eight directors, do not have a relationship (other than being a director and/or a stockholder) that would interfere

with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent”

as that term is defined under the Nasdaq Rules.

Our

Board also determined that (i) Messrs. Thomas Mika and Michael Ferguson and Ms. Maria Schroeder, who compose our audit committee, (ii)

Ms. Aurora Cassirer and Messrs. Thomas Mika and Michael Ferguson, who compose our compensation committee, and (iii) Messrs. Martin Goldstein

and Christopher Fashek and Ms. Aurora Cassirer, who compose our nominating and corporate governance committee, each satisfy the independence

standards for those committees established by the applicable rules and regulations of the SEC and the Nasdaq Rules. In making this determination,

our Board considered the relationships that each non-employee director has with us and all other facts and circumstances our Board deemed

relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director. We

intend to comply with all size and independence requirements for committees within the applicable time periods.

Board

Committees, Meetings and Attendance

During

the year ended December 31, 2023, the Board held four meetings. We expect our directors to attend Board meetings, meetings of any committees

and subcommittees on which they serve and each annual meeting of stockholders, either in person or by teleconference. During the year

ended December 31, 2023, each director attended at least 75% of the total number of meetings held by the Board and Board committees of

which such director was a member. Last year’s annual meeting was not attended by any directors.

Our

Board currently has three standing committees which consist of an audit committee, a nominating and corporate governance committee and

a compensation committee, each of which has the composition and responsibilities described below.

Each

of these committees operates under a charter that has been approved by our Board. The current charter of each of these committees is

available on our website at www.nanovibronix.com in the “Governance” section under “Investors.” The reference

to our website address does not constitute incorporation by reference of the information contained at or available through our website,

and you should not consider it to be a part of this Proxy Statement.

Audit

Committee. The audit committee consists of Messrs. Thomas Mika (chair) and Michael Ferguson and Ms. Maria Schroeder, each of whom our

Board has determined to be financially literate and qualify as an independent director under Sections 5605(a)(2) and 5605(c)(2) of the

Nasdaq Rules and Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, Mr.

Thomas Mika qualifies as an “audit committee financial expert,” as defined in Item 407(d)(5)(ii) of Regulation S-K. Our Board

also determined that each member of our audit committee can read and understand fundamental financial statements in accordance with applicable

requirements. In arriving at these determinations, the Board examined each audit committee member’s scope of experience and the

nature of their employment in the corporate finance sector.

The

function of the audit committee is to assist the Board in its oversight of (1) the integrity of our financial statements, (2) our compliance

with legal and regulatory requirements, (3) the qualifications, independence and performance of our independent auditors and (4) audit

and non-audit fees and services.

The

audit committee met five times during the year ended December 31, 2023.

Nominating

and Corporate Governance Committee. The nominating and corporate governance committee consist of Ms. Aurora Cassirer (chair) and Martin

Goldstein, Christofer Fashek and Ms. Maria Schroeder, each of whom our Board has determined qualifies as an independent director under

Section 5605(a)(2) of the Nasdaq Rules.

The

primary function of the nominating and corporate governance committee is to identify individuals qualified to become board members, consistent

with criteria approved by the Board, and select the director nominees for election at each annual meeting of stockholders as well as

reviewing the Company’s corporate governance policies and any related matters.

The

nominating and corporate governance committee met three times during the year ended December 31, 2023.

Compensation

Committee. The compensation committee consists of Messrs. Michael Ferguson (chair) and Thomas Mika and Ms. Aurora Cassirer, each of whom

our Board has determined qualifies as an independent director under Sections 5605(a)(2) and 5605(d)(2) of the Nasdaq Rules, as an “outside

director” for purposes of Section 162(m) of the Internal Revenue Code and as a “non-employee director” for purposes

of Section 16b-3 under the Exchange Act. The function of the compensation committee is to discharge the Board’s responsibilities

relating to compensation of our directors and executives and our overall compensation programs.

The

primary objective of the compensation committee is to develop and implement compensation policies and plans that are appropriate for

us in light of all relevant circumstances and which provide incentives that further our long-term strategic plan and are consistent with

our culture and the overall goal of enhancing enduring stockholder value.

The

compensation committee met four times during the year ended December 31, 2023.

Family

Relationships

There

are no family relationships among our directors and executive officers, or person nominated or chosen by the Company to become a director

or executive officer.

Involvement

in Certain Legal Proceedings

None

of our directors or executive officers, or person nominated to become a director, has been involved in any of the following events during

the past ten years:

●

any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at

the time of the bankruptcy or within two years prior to that time;

●

any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other

minor offences);

●

being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent

jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of

business, securities or banking activities; or

●

being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodity Futures Trading Commission to have

violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated.

Director

Nominations

Our

nominating and corporate governance committee considers all qualified candidates identified by members of the Board, by senior management

and by stockholders. The nominating and corporate governance committee follows the same process and uses the same criteria for evaluating

candidates proposed by stockholders, members of the Board and members of senior management. We did not pay fees to any third party to

assist in the process of identifying or evaluating director candidates during the year ended December 31, 2023.

Our

Bylaws contain provisions that address the process by which a stockholder may nominate an individual to stand for election to the Board

at our Annual Meeting. To recommend a nominee for election to the Board, a stockholder must submit his or her recommendation to the Secretary

at our corporate offices at 969 Pruitt Place, Tyler TX 75703. Such nomination must satisfy the notice, information and consent requirements

set forth in our Bylaws and must be received by us prior to the date set forth under “Stockholder Proposals” below. A stockholder’s

recommendation must be accompanied by the information with respect to stockholder nominees as specified in our Bylaws, including among

other things, the name, age, address and occupation of the recommended person, the proposing stockholder’s name and address, the

ownership interests of the proposing stockholder and any beneficial owner on whose behalf the nomination is being made (including the

number of shares beneficially owned, any hedging, derivative, short or other economic interests and any rights to vote any shares) and

any material monetary or other relationships between the recommended person and the proposing stockholder and/or the beneficial owners,

if any, on whose behalf the nomination is being made.

In

evaluating director nominees, the nominating and corporate governance committee considers the following factors:

●

the appropriate size and diversity of our Board;

●

our needs with respect to the particular knowledge, skills and experience of nominees, including experience in corporate finance, technology,

business, administration and sales, in light of the prevailing business conditions and the knowledge, skills and experience already possessed

by other members of the Board;

●

experience with accounting rules and practices, and whether such a person qualifies as an “audit committee financial expert”

pursuant to SEC rules; and

●

balancing continuity of our Board with periodic injection of fresh perspectives provided by new Board members.

Our

Board believes that each director should have a basic understanding of our principal operational and financial objectives and plans and

strategies, our results of operations and financial condition and our relative standing in relation to our competitors.

In

identifying director nominees, the Board will first evaluate the current members of the Board willing to continue in service. Current

members of the Board with skills and experience that are relevant to our business and who are willing to continue in service will be

considered for re-nomination.

If

any member of the Board does not wish to continue in service or if the Board decides not to re-nominate a member for re-election, the

Board will identify another nominee with the desired skills and experience described above. The Board takes into consideration the overall

composition and diversity of the Board and areas of expertise that director nominees may be able to offer, including business experience,

knowledge, abilities and customer relationships. Generally, the Board will strive to assemble a Board that brings to us a variety of

perspectives and skills derived from business and professional experience as it may deem are in our and our stockholders’ best

interests. In doing so, the Board will also consider candidates with appropriate non-business backgrounds.

Board

Leadership Structure

The