Northern Trust Pension Universe Data: Canadian Pension Plan Returns Advanced in Q2 as Global Equities Gained Momentum

30 Julio 2024 - 10:00AM

Business Wire

Canadian pension plans witnessed a positive finish to the second

quarter, according to the Northern Trust Canada Universe. The

median Canadian Pension Plan returned 1.1 percent for the quarter

and 3.5 percent year-to-date.

The second quarter marked a pivotal shift in monetary policy to

a less restrictive tone in some developed regions, led by the Bank

of Canada (BoC) and followed by the European Central Bank (ECB). As

these two monetary authorities gained confidence in the path and

level of inflation, most other major central banks maintained a

cautious narrative as they continued to monitor progress in

bringing down inflation in a sustainable manner and in line with

their respective targets and mandates.

Financial markets were challenged with volatility early in the

period as geopolitical tensions mounted, combined with the release

of stronger economic data supportive of persistent inflation.

Despite the uncertainty, global equities marched higher throughout

the quarter, led by emerging markets, concluding the period with

attractive returns. Although Canadian equities posted a modest

decline as pockets of softer economic data emerged, the Canadian

bond market benefited from the BoC interest rate cut, resulting in

a rebound into positive territory for the quarter. The current

divergence in major central bank policies coupled with the Federal

Reserve’s (Fed) consistent messaging regarding the direction of

interest rates led to a modest strengthening of the U.S. dollar

over the quarter.

“As we conclude the first half of 2024, a theme of

sustainability permeated across the globe. We have seen it through

central bank actions as policymakers seek a sustainable path of

inflation in an effort to normalize monetary policy. This theme

continues to echo across the Canadian pension plan landscape as

plan sponsors demonstrate resilience and agility while navigating

the economic elements of high interest rates, persistent inflation

and waves of volatility,” said Katie Pries, President and CEO of

Northern Trust Canada.

The Northern Trust Canada universe tracks the performance of

Canadian institutional defined benefit plans that subscribe to

performance measurement services as part of Northern Trust’s asset

service offerings.

Despite a challenging economic backdrop in the second quarter,

corporate earnings remained strong and investor optimism prevailed,

leading to solid returns for global equities for the period.

Although the Canadian equity market witnessed weaker results

relative to its global peers, the Canadian bond universe welcomed

the first interest rate cut by the Bank of Canada (BoC) and closed

the quarter with a positive tone.

- Canadian Equities, as measured by the S&P/TSX Composite

Index, declined -0.5% for the quarter. The Materials and Consumer

Staples sectors were the top performers for the period. The Health

Care sector posted the weakest performance followed by the Real

Estate and Information Technology sectors.

- U.S. Equities, as measured by the S&P 500 Index returned

5.4% in CAD for the quarter, with the Information Technology and

Communication Services sectors leading performance with double

digit returns. The Materials, Industrials, Energy, Financials and

Real Estate sectors retreated during the period.

- International developed markets, as measured by the MSCI EAFE

Index, generated 0.9% in CAD for the quarter. Most sectors observed

positive returns led by the Health Care and the Financials sectors,

while the Consumer Discretionary and Real Estate sectors were the

most notable laggards during the period.

- The MSCI Emerging Markets Index advanced 6.3% in CAD for the

quarter. Most sectors achieved positive returns with the

Information Technology sector leading the index with strong

performance, while the Health Care, Consumer Staples and the

Materials sectors produced negative returns for the period.

The Canadian economy witnessed some early signs of slower

economic growth, disinflationary pressures along with softening

employment. Unemployment hit its highest level since early 2022,

rising to 6.4% in June, up from 6.1% in March. Although inflation

nudged higher in May relative to the previous month, the most

recent year over year figure in June of 2.7% highlighted that

Canadian inflation continues to cool.

The U.S. economy continued to exhibit strength during the

quarter despite softer patches of growth data. Progress on

inflation emerged, as CPI rose 3.0% in June (y/y) down from 3.5%

(y/y) in March. Despite the solid number of jobs added in the month

of June, the unemployment rate witnessed an unexpected rise to

4.1%, the highest since November 2021. The Federal Reserve (Fed)

maintained the Federal Funds Target Rate at 5.25% - 5.50%. The Fed

Chair emphasized the bank’s intention to only cut interest rates

once it has “gained greater confidence that inflation is moving

sustainably toward the committee’s 2% objective.”

International markets observed progress in efforts to bring

inflation closer to central bank targets. The European Central Bank

(ECB) lowered interest rates by 25 bps, marking the start of an

easing cycle for the ECB. Although inflation eased in June, the

committee remains cautious regarding its inflation outlook and

suggested further rate cuts would only come slowly. The Bank of

England (BoE) maintained its benchmark rate at 5.25%, despite

headline inflation dropping. The BoE justified its decision as it

“needs to be sure inflation will stay low” but signaled a rate cut

could be possible at its August meeting. The Bank of Japan (BoJ)

held rates steady at 0%-0.1% after hiking rates the previous

quarter.

Emerging markets gained momentum during the second quarter,

outperforming developed markets. Much of the outperformance was

attributed to investor interest in the AI/Chips space. The People’s

Bank of China (PBoC) held the one-year and five-year Loan Prime

Rates (LPR) steady at 3.45% and 3.95% respectively. The Central

Bank of Brazil dropped the key Selic rate by 25bps in May to 10.5%.

The Reserve Bank of India (RBI) also chose to keep rates steady at

6.5%.

The Bank of Canada (BoC) announced at its June meeting that

monetary policy “no longer needs to be as restrictive” and lowered

its benchmark policy rate by 25 bps to 4.75%. The BoC was the first

of G7 nations to cut rates, having held its policy rate at 5% since

July 2023.

The Canadian Fixed Income market, as measured by the FTSE Canada

Universe Bond Index, generated a gain of 0.9% for the quarter.

Corporate bonds outpaced Federal and Provincial bonds with all

three segments generating positive performance. All bond durations

witnessed gains for the quarter, with short-term bonds leading mid

and long-term bonds.

About Northern Trust

Northern Trust Corporation (Nasdaq: NTRS) is a leading provider

of wealth management, asset servicing, asset management and banking

to corporations, institutions, affluent families and individuals.

Founded in Chicago in 1889, Northern Trust has a global presence

with offices in 24 U.S. states and Washington, D.C., and across 22

locations in Canada, Europe, the Middle East and the Asia-Pacific

region. As of June 30, 2024, Northern Trust had assets under

custody/administration of US$16.6 trillion, and assets under

management of US$1.5 trillion. For more than 130 years, Northern

Trust has earned distinction as an industry leader for exceptional

service, financial expertise, integrity and innovation. Visit us on

northerntrust.com. Follow us on X (formerly Twitter) @NorthernTrust

or Northern Trust Corporation on LinkedIn.

Northern Trust Corporation, Head Office: 50 South La Salle

Street, Chicago, Illinois 60603 U.S.A., incorporated with limited

liability in the U.S. Global legal and regulatory information can

be found at https://www.northerntrust.com/terms-and-conditions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730366224/en/

Doug Holt (312) 557-1571 Dh124@ntrs.com

http://www.northerntrust.com

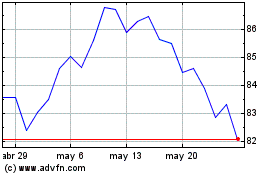

Northern (NASDAQ:NTRS)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Northern (NASDAQ:NTRS)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024