0001045810false00010458102024-05-222024-05-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 22, 2024

NVIDIA CORPORATION | | |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | 0-23985 | 94-3177549 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

2788 San Tomas Expressway, Santa Clara, CA 95051

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (408) 486-2000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | NVDA | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 22, 2024, NVIDIA Corporation, or the Company, issued a press release announcing its results for the quarter ended April 28, 2024. The press release is attached as Exhibit 99.1 and is incorporated herein by reference.

Attached hereto as Exhibit 99.2 and incorporated by reference herein is financial information and commentary by Colette M. Kress, Executive Vice President and Chief Financial Officer of the Company, regarding results for the quarter ended April 28, 2024, or the CFO Commentary. The CFO Commentary will be posted to http://investor.nvidia.com immediately after the filing of this Current Report.

The press release and CFO Commentary are furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information in this Current Report shall not be incorporated by reference in any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 8.01. Other Events.

On May 22, 2024, the Company announced a ten-for-one forward stock split, or the Stock Split, of the Company’s issued common stock to be effected through the filing of an amendment to the Company's Restated Certificate of Incorporation, or the Amendment, with the Secretary of the State of Delaware. The Amendment will result in a proportionate increase in the number of shares of authorized common stock. As a result of the Stock Split, each record holder of common stock as of the close of market on Thursday, June 6, 2024 will receive nine additional shares of common stock, to be distributed after the close of market on Friday, June 7, 2024. Trading is expected to commence on a split-adjusted basis at market open on Monday, June 10, 2024.

The Company also increased its quarterly cash dividend by 150 percent from $0.04 per share to $0.10 per share of common stock. The increased dividend is equivalent to $0.01 per share on a post-Stock Split basis and will be paid on Friday, June 28, 2024, to all shareholders of record on Tuesday, June 11, 2024.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | The cover page of this Current Report on Form 8-K, formatted in inline XBRL (included as Exhibit 101) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | NVIDIA Corporation |

| Date: May 22, 2024 | | By: /s/ Colette M. Kress |

| | | Colette M. Kress |

| | | Executive Vice President and Chief Financial Officer |

FOR IMMEDIATE RELEASE:

NVIDIA Announces Financial Results for First Quarter Fiscal 2025

•Record quarterly revenue of $26.0 billion, up 18% from Q4 and up 262% from a year ago

•Record quarterly Data Center revenue of $22.6 billion, up 23% from Q4 and up 427% from a year ago

•Ten-for-one forward stock split effective June 7, 2024

•Quarterly cash dividend raised 150% to $0.01 per share on a post-split basis

SANTA CLARA, Calif.—May 22, 2024―NVIDIA (NASDAQ: NVDA) today reported revenue for the first quarter ended April 28, 2024, of $26.0 billion, up 18% from the previous quarter and up 262% from a year ago.

For the quarter, GAAP earnings per diluted share was $5.98, up 21% from the previous quarter and up 629% from a year ago. Non-GAAP earnings per diluted share was $6.12, up 19% from the previous quarter and up 461% from a year ago.

“The next industrial revolution has begun — companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center — AI factories — to produce a new commodity: artificial intelligence,” said Jensen Huang, founder and CEO of NVIDIA. “AI will bring significant productivity gains to nearly every industry and help companies be more cost- and energy-efficient, while expanding revenue opportunities.

“Our data center growth was fueled by strong and accelerating demand for generative AI training and inference on the Hopper platform. Beyond cloud service providers, generative AI has expanded to consumer internet companies, and enterprise, sovereign AI, automotive and healthcare customers, creating multiple multibillion-dollar vertical markets.

“We are poised for our next wave of growth. The Blackwell platform is in full production and forms the foundation for trillion-parameter-scale generative AI. Spectrum-X opens a brand-new market for us to bring large-scale AI to Ethernet-only data centers. And NVIDIA NIM is our new software offering that delivers enterprise-grade, optimized generative AI to run on CUDA everywhere — from the cloud to on-prem data centers and RTX AI PCs — through our expansive network of ecosystem partners.”

NVIDIA also announced a ten-for-one forward stock split of NVIDIA’s issued common stock to make stock ownership more accessible to employees and investors. The split will be effected through an amendment to NVIDIA’s Restated Certificate of Incorporation, which will result in a proportionate increase in the number of shares of authorized common stock. Each record holder of common stock as of the close of market on Thursday, June 6, 2024, will receive nine additional shares of common stock, to be distributed after the close of market on Friday, June 7, 2024. Trading is expected to commence on a split-adjusted basis at market open on Monday, June 10, 2024.

NVIDIA is increasing its quarterly cash dividend by 150% from $0.04 per share to $0.10 per share of common stock. The increased dividend is equivalent to $0.01 per share on a post-split basis and will be paid on Friday, June 28, 2024, to all shareholders of record on Tuesday, June 11, 2024.

Q1 Fiscal 2025 Summary

| | | | | | | | | | | | | | | | | |

| GAAP |

| ($ in millions, except earnings per share) | Q1 FY25 | Q4 FY24 | Q1 FY24 | Q/Q | Y/Y |

| Revenue | $26,044 | $22,103 | $7,192 | Up 18% | Up 262% |

| Gross margin | 78.4 | % | 76.0 | % | 64.6 | % | Up 2.4 pts | Up 13.8 pts |

| Operating expenses | $3,497 | $3,176 | $2,508 | Up 10% | Up 39% |

| Operating income | $16,909 | $13,615 | $2,140 | Up 24% | Up 690% |

| Net income | $14,881 | $12,285 | $2,043 | Up 21% | Up 628% |

| Diluted earnings per share | $5.98 | $4.93 | $0.82 | Up 21% | Up 629% |

| | | | | | | | | | | | | | | | | |

| Non-GAAP |

| ($ in millions, except earnings per share) | Q1 FY25 | Q4 FY24 | Q1 FY24 | Q/Q | Y/Y |

| Revenue | $26,044 | $22,103 | $7,192 | Up 18% | Up 262% |

| Gross margin | 78.9 | % | 76.7 | % | 66.8 | % | Up 2.2 pts | Up 12.1 pts |

| Operating expenses | $2,501 | $2,210 | $1,750 | Up 13% | Up 43% |

| Operating income | $18,059 | $14,749 | $3,052 | Up 22% | Up 492% |

| Net income | $15,238 | $12,839 | $2,713 | Up 19% | Up 462% |

| Diluted earnings per share | $6.12 | $5.16 | $1.09 | Up 19% | Up 461% |

Outlook

NVIDIA’s outlook for the second quarter of fiscal 2025 is as follows:

•Revenue is expected to be $28.0 billion, plus or minus 2%.

•GAAP and non-GAAP gross margins are expected to be 74.8% and 75.5%, respectively, plus or minus 50 basis points. For the full year, gross margins are expected to be in the mid-70% range.

•GAAP and non-GAAP operating expenses are expected to be approximately $4.0 billion and $2.8 billion, respectively. Full-year operating expenses are expected to grow in the low-40% range.

•GAAP and non-GAAP other income and expense are expected to be an income of approximately $300 million, excluding gains and losses from non-affiliated investments.

•GAAP and non-GAAP tax rates are expected to be 17%, plus or minus 1%, excluding any discrete items.

Highlights

NVIDIA achieved progress since its previous earnings announcement in these areas:

Data Center

•First-quarter revenue was a record $22.6 billion, up 23% from the previous quarter and up 427% from a year ago.

•Unveiled the NVIDIA Blackwell platform to fuel a new era of AI computing at trillion-parameter scale and the Blackwell-powered DGX SuperPOD™ for generative AI supercomputing.

•Announced NVIDIA Quantum and NVIDIA Spectrum™ X800 series switches for InfiniBand and Ethernet, respectively, optimized for trillion-parameter GPU computing and AI infrastructure.

•Launched NVIDIA AI Enterprise 5.0 with NVIDIA NIM inference microservices to speed enterprise app development.

•Announced TSMC and Synopsys are going into production with NVIDIA cuLitho to accelerate computational lithography, the semiconductor manufacturing industry’s most compute-intensive workload.

•Announced that nine new supercomputers worldwide are using Grace Hopper Superchips to ignite new era of AI supercomputing.

•Unveiled that Grace Hopper Superchips power the top three machines on the Green500 list of the world’s most energy-efficient supercomputers.

•Expanded collaborations with AWS, Google Cloud, Microsoft and Oracle to advance generative AI innovation.

•Worked with Johnson & Johnson MedTech to bring AI capabilities to support surgery.

Gaming and AI PC

•First-quarter Gaming revenue was $2.6 billion, down 8% from the previous quarter and up 18% from a year ago.

•Introduced new AI gaming technologies at GDC for NVIDIA ACE and Neural Graphics.

•Unveiled new AI performance optimizations and integrations for Windows to deliver maximum performance on NVIDIA GeForce RTX AI PCs and workstations.

•Announced more blockbuster games that will incorporate RTX technology, including Star Wars Outlaws and Black Myth Wukong.

•Added support for new models, including Google’s Gemma, for ChatRTX, which brings chatbot capabilities to RTX-powered Windows PCs and workstations.

Professional Visualization

•First-quarter revenue was $427 million, down 8% from the previous quarter and up 45% from a year ago.

•Introduced NVIDIA RTX™ 500 and 1000 professional Ada generation laptop GPUs for AI-enhanced workflows.

•Unveiled NVIDIA RTX A400 and A1000 GPUs for desktop workstations, based on the NVIDIA Ampere architecture, to bring AI to design and productivity workflows.

•Introduced NVIDIA Omniverse™ Cloud APIs to power industrial digital twin software tools, including an expanded Siemens partnership, and a new framework for the Apple Vision Pro.

•Announced the adoption of the new Earth-2 cloud APIs by The Weather Company and the Central Weather Administration of Taiwan for high-resolution global climate simulations.

Automotive and Robotics

•First-quarter Automotive revenue was $329 million, up 17% from the previous quarter and up 11% from a year ago.

•Announced BYD, XPENG, GAC’s AION Hyper, Nuro and others have chosen the next-generation NVIDIA DRIVE Thor™ platform, which now features Blackwell GPU architecture, to power their next-generation consumer and commercial electric vehicle fleets.

•Revealed U.S. and China electric vehicle makers Lucid and IM Motors are using the NVIDIA DRIVE Orin™ platform for vehicle models targeting the European market.

•Announced an array of partners are using NVIDIA generative AI technologies to transform in-vehicle experiences.

•Introduced the Project GR00T foundation model for humanoid robots and major Isaac robotics platform updates.

CFO Commentary

Commentary on the quarter by Colette Kress, NVIDIA’s executive vice president and chief financial officer, is available at https://investor.nvidia.com.

Conference Call and Webcast Information

NVIDIA will conduct a conference call with analysts and investors to discuss its first quarter fiscal 2025 financial results and current financial prospects today at 2 p.m. Pacific time (5 p.m. Eastern time). A live webcast (listen-only mode) of the conference call will be accessible at NVIDIA’s investor relations website, https://investor.nvidia.com. The webcast will be recorded and available for replay until NVIDIA’s conference call to discuss its financial results for its second quarter of fiscal 2025.

Non-GAAP Measures

To supplement NVIDIA’s condensed consolidated financial statements presented in accordance with GAAP, the company uses non-GAAP measures of certain components of financial performance. These non-GAAP measures include non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP income from operations, non-GAAP other income (expense), net, non-GAAP net income, non-GAAP net income, or earnings, per diluted share, and free cash flow. For NVIDIA’s investors to be better able to compare its current results with those of previous periods, the company has shown a reconciliation of GAAP to non-GAAP financial measures. These reconciliations adjust the related GAAP financial measures to exclude stock-based compensation expense, acquisition-related and other costs, other, gains and losses from non-affiliated investments, interest expense related to amortization of debt discount, and the associated tax impact of these items where applicable. Free cash flow is calculated as GAAP net cash provided by operating activities less both purchases related to property and equipment and intangible assets and principal payments on property and equipment and intangible assets. NVIDIA believes the presentation of its non-GAAP financial measures enhances the user’s overall understanding of the company’s historical financial performance. The presentation of the company’s non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the company’s financial results prepared in accordance with GAAP, and the company’s non-GAAP measures may be different from non-GAAP measures used by other companies.

About NVIDIA

NVIDIA (NASDAQ: NVDA) is the world leader in accelerated computing.

###

For further information, contact:

| | | | | | | | |

| Simona Jankowski | | Mylene Mangalindan |

| Investor Relations | | Corporate Communications |

| NVIDIA Corporation | | NVIDIA Corporation |

| sjankowski@nvidia.com | | mmangalindan@nvidia.com |

Certain statements in this press release including, but not limited to, statements as to: companies and countries building AI factories with NVIDIA accelerated computing to produce artificial intelligence; accelerating demand for generative AI training and inference on the Hopper platform; the expanding reach of generative AI; generative AI expanding to consumer internet companies, and enterprise, sovereign AI, automotive, and healthcare customers, creating multiple multibillion-dollar vertical markets; NVIDIA being poised for the next wave of growth; the Blackwell platform in full production and forming the foundation for trillion-parameter-scale generative AI; Spectrum-X opening a brand-new market for NVIDIA to bring large-scale AI to Ethernet-only data centers; NVIDIA NIM as NVIDIA’s new software offering that delivers enterprise-grade, optimized generative AI run on CUDA everywhere — from the cloud, to on-prem data centers and RTX AI PCs — through NVIDIA’s expansive network of ecosystem partners; NVIDIA's forward stock split; NVIDIA’s next quarterly cash dividend; gross margins being in the mid-70% range for the full year; full-year operating expenses growing in the low-40% range; and NVIDIA’s financial outlook and expected tax rates for the second quarter of fiscal 2025 are forward-looking statements that are subject to risks and uncertainties that could cause results to be materially different than expectations. Important factors that could cause actual results to differ materially include: global economic conditions; our reliance on third parties to manufacture, assemble, package and test our products; the impact of technological development and competition; development of new products and technologies or enhancements to our existing product and technologies; market acceptance of our products or our partners’ products; design, manufacturing or software defects; changes in consumer preferences or demands; changes in industry standards and interfaces; and unexpected loss of performance of our products or technologies when integrated into systems, as well as other factors detailed from time to time in the most recent reports NVIDIA files with the Securities and Exchange Commission, or SEC, including, but not limited to, its annual report on Form 10-K and quarterly reports on Form 10-Q. Copies of reports filed with the SEC are posted on the company’s website and are available from NVIDIA without charge. These forward-looking statements are not guarantees of future performance and speak only as of the date hereof, and, except as required by law, NVIDIA disclaims any obligation to update these forward-looking statements to reflect future events or circumstances.

© 2024 NVIDIA Corporation. All rights reserved. NVIDIA, the NVIDIA logo, GeForce NOW, NVIDIA DGX SuperPOD, NVIDIA DRIVE, NVIDIA DRIVE Orin, NVIDIA DRIVE Thor, NVIDIA RTX and NVIDIA Spectrum are trademarks and/or registered trademarks of NVIDIA Corporation in the U.S. and/or other countries. Other company and product names may be trademarks of the respective companies with which they are associated. Features, pricing, availability and specifications are subject to change without notice.

NVIDIA CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In millions, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | |

| | | April 28, | | April 30, | | | | |

| | | 2024 | | 2023 | | | | |

| | | | | | | | | |

| Revenue | $ | 26,044 | | | $ | 7,192 | | | | | |

| Cost of revenue | 5,638 | | | 2,544 | | | | | |

| Gross profit | 20,406 | | | 4,648 | | | | | |

| | | | | | | | | |

| Operating expenses | | | | | | | |

| Research and development | 2,720 | | | 1,875 | | | | | |

| Sales, general and administrative | 777 | | | 633 | | | | | |

| | Total operating expenses | 3,497 | | | 2,508 | | | | | |

| | | | | | | | | |

| Operating income | 16,909 | | | 2,140 | | | | | |

| Interest income | 359 | | | 150 | | | | | |

| Interest expense | (64) | | | (66) | | | | | |

| Other, net | 75 | | | (15) | | | | | |

| | Other income (expense), net | 370 | | | 69 | | | | | |

| | | | | | | | | |

| Income before income tax | 17,279 | | | 2,209 | | | | | |

| Income tax expense | 2,398 | | | 166 | | | | | |

| Net income | $ | 14,881 | | | $ | 2,043 | | | | | |

| | | | | | | | | |

| Net income per share: | | | | | | | |

| Basic | $ | 6.04 | | | $ | 0.83 | | | | | |

| Diluted | $ | 5.98 | | | $ | 0.82 | | | | | |

| | | | | | | | | |

| Weighted average shares used in per share computation: | | | | | | | |

| Basic | 2,462 | | | 2,470 | | | | | |

| Diluted | 2,489 | | | 2,490 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| NVIDIA CORPORATION |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (In millions) |

| (Unaudited) |

| | | | | | |

| | | | April 28, | | January 28, |

| | | | 2024 | | 2024 |

| ASSETS | | | | |

| | | | | | |

| Current assets: | | | | |

| Cash, cash equivalents and marketable securities | | $ | 31,438 | | | $ | 25,984 | |

| Accounts receivable, net | | 12,365 | | | 9,999 | |

| Inventories | | 5,864 | | | 5,282 | |

| Prepaid expenses and other current assets | | 4,062 | | | 3,080 | |

| | Total current assets | | 53,729 | | | 44,345 | |

| | | | | | |

| Property and equipment, net | | 4,006 | | | 3,914 | |

| Operating lease assets | | 1,532 | | | 1,346 | |

| Goodwill | | 4,453 | | | 4,430 | |

| Intangible assets, net | | 986 | | | 1,112 | |

| Deferred income tax assets | | 7,798 | | | 6,081 | |

| Other assets | | 4,568 | | | 4,500 | |

| | Total assets | | $ | 77,072 | | | $ | 65,728 | |

| | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| | | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 2,715 | | | $ | 2,699 | |

| Accrued and other current liabilities | | 11,258 | | | 6,682 | |

| Short-term debt | | 1,250 | | | 1,250 | |

| | Total current liabilities | | 15,223 | | | 10,631 | |

| | | | | | |

| Long-term debt | | 8,460 | | | 8,459 | |

| Long-term operating lease liabilities | | 1,281 | | | 1,119 | |

| Other long-term liabilities | | 2,966 | | | 2,541 | |

| | Total liabilities | | 27,930 | | | 22,750 | |

| | | | | | |

| Shareholders' equity | | 49,142 | | | 42,978 | |

| | Total liabilities and shareholders' equity | | $ | 77,072 | | | $ | 65,728 | |

| | | | | | | | | | | | | | | |

| NVIDIA CORPORATION |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (In millions) |

| (Unaudited) |

| | | | | | | |

| Three Months Ended | | |

| April 28, | | April 30, | | | | |

| 2024 | | 2023 | | | | |

| | | | | | | |

| Cash flows from operating activities: | | | | | | | |

| Net income | $ | 14,881 | | | $ | 2,043 | | | | | |

| Adjustments to reconcile net income to net cash | | | | | | | |

| provided by operating activities: | | | | | | | |

| Stock-based compensation expense | 1,011 | | | 735 | | | | | |

| Depreciation and amortization | 410 | | | 384 | | | | | |

| Realized and unrealized (gains) losses on investments in non-affiliated entities, net | (69) | | | 14 | | | | | |

| Deferred income taxes | (1,577) | | | (1,135) | | | | | |

| | | | | | | |

| Other | (145) | | | (34) | | | | | |

| Changes in operating assets and liabilities, net of acquisitions: | | | | | | | |

| Accounts receivable | (2,366) | | | (252) | | | | | |

| Inventories | (577) | | | 566 | | | | | |

| Prepaid expenses and other assets | (726) | | | (215) | | | | | |

| Accounts payable | (22) | | | 11 | | | | | |

| Accrued and other current liabilities | 4,202 | | | 689 | | | | | |

| Other long-term liabilities | 323 | | | 105 | | | | | |

| Net cash provided by operating activities | 15,345 | | | 2,911 | | | | | |

| | | | | | | |

| Cash flows from investing activities: | | | | | | | |

| Proceeds from maturities of marketable securities | 4,004 | | | 2,512 | | | | | |

| Proceeds from sales of marketable securities | 149 | | | — | | | | | |

| Purchases of marketable securities | (9,303) | | | (2,801) | | | | | |

| Purchase related to property and equipment and intangible assets | (369) | | | (248) | | | | | |

| Acquisitions, net of cash acquired | (39) | | | (83) | | | | | |

| Investments in non-affiliated entities | (135) | | | (221) | | | | | |

| Net cash used in investing activities | (5,693) | | | (841) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | |

|

|

|

|

| | | | | | | |

| Three Months Ended | | |

| April 28, | | April 30, | | | | |

| 2024 | | 2023 | | | | |

| | | | | | | |

| Cash flows from financing activities: | | | | | | | |

| Proceeds related to employee stock plans | 285 | | | 246 | | | | | |

| Payments related to repurchases of common stock | (7,740) | | | — | | | | | |

| | | | | | | |

| Payments related to tax on restricted stock units | (1,752) | | | (507) | | | | | |

| Dividends paid | (98) | | | (99) | | | | | |

| Principal payments on property and equipment and intangible assets | (40) | | | (20) | | | | | |

| | | | | | | |

| Net cash used in financing activities | (9,345) | | | (380) | | | | | |

| | | | | | | |

| Change in cash and cash equivalents | 307 | | | 1,690 | | | | | |

| Cash and cash equivalents at beginning of period | 7,280 | | | 3,389 | | | | | |

| Cash and cash equivalents at end of period | $ | 7,587 | | | $ | 5,079 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NVIDIA CORPORATION |

| RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES |

| (In millions, except per share data) |

| (Unaudited) |

| | | | | | | |

| | | Three Months Ended | | |

| | | April 28, | | January 28, | | April 30, | | | | |

| | | 2024 | | 2024 | | 2023 | | | | |

| | | | | | | | | | | |

| GAAP gross profit | | $ | 20,406 | | | $ | 16,791 | | | $ | 4,648 | | | | | |

| GAAP gross margin | | 78.4 | % | | 76.0 | % | | 64.6 | % | | | | |

| Acquisition-related and other costs (A) | | 119 | | | 119 | | | 119 | | | | | |

| Stock-based compensation expense (B) | | 36 | | | 45 | | | 27 | | | | | |

| Other (C) | | (1) | | | 4 | | | 8 | | | | | |

| Non-GAAP gross profit | | $ | 20,560 | | | $ | 16,959 | | | $ | 4,802 | | | | | |

| Non-GAAP gross margin | | 78.9 | % | | 76.7 | % | | 66.8 | % | | | | |

| | | | | | | | | | | |

| GAAP operating expenses | | $ | 3,497 | | | $ | 3,176 | | | $ | 2,508 | | | | | |

| Stock-based compensation expense (B) | | (975) | | | (948) | | | (708) | | | | | |

| Acquisition-related and other costs (A) | | (21) | | | (18) | | | (54) | | | | | |

| | | | | | | | | | | |

| Other (C) | | — | | | — | | | 4 | | | | | |

| Non-GAAP operating expenses | | $ | 2,501 | | | $ | 2,210 | | | $ | 1,750 | | | | | |

| | | | | | | | | | | |

| GAAP operating income | | $ | 16,909 | | | $ | 13,615 | | | $ | 2,140 | | | | | |

| Total impact of non-GAAP adjustments to operating income | | 1,150 | | | 1,134 | | | 912 | | | | | |

| Non-GAAP operating income | | $ | 18,059 | | | $ | 14,749 | | | $ | 3,052 | | | | | |

| | | | | | | | | | | |

| GAAP other income (expense), net | | $ | 370 | | | $ | 491 | | | $ | 69 | | | | | |

| (Gains) losses from non-affiliated investments | | (69) | | | (260) | | | 14 | | | | | |

| Interest expense related to amortization of debt discount | | 1 | | | 1 | | | 1 | | | | | |

| Non-GAAP other income (expense), net | | $ | 302 | | | $ | 232 | | | $ | 84 | | | | | |

| | | | | | | | | | | |

| GAAP net income | | $ | 14,881 | | | $ | 12,285 | | | $ | 2,043 | | | | | |

| Total pre-tax impact of non-GAAP adjustments | | 1,082 | | | 875 | | | 927 | | | | | |

| Income tax impact of non-GAAP adjustments (D) | | (725) | | | (321) | | | (257) | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Non-GAAP net income | | $ | 15,238 | | | $ | 12,839 | | | $ | 2,713 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | |

| | | April 28, | | January 28, | | April 30, | | | | |

| | | 2024 | | 2024 | | 2023 | | | | |

| Diluted net income per share | | | | | | | | | | |

| GAAP | | $ | 5.98 | | | $ | 4.93 | | | $ | 0.82 | | | | | |

| Non-GAAP | | $ | 6.12 | | | $ | 5.16 | | | $ | 1.09 | | | | | |

| | | | | | | | | | | |

| Weighted average shares used in diluted net income per share computation | | 2,489 | | | 2,490 | | | 2,490 | | | | | |

| | | | | | | | | | | |

| GAAP net cash provided by operating activities | | $ | 15,345 | | | $ | 11,499 | | | $ | 2,911 | | | | | |

| Purchases related to property and equipment and intangible assets | | (369) | | | (253) | | | (248) | | | | | |

| Principal payments on property and equipment and intangible assets | | (40) | | | (29) | | | (20) | | | | | |

| Free cash flow | | $ | 14,936 | | | $ | 11,217 | | | $ | 2,643 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (A) Acquisition-related and other costs are comprised of amortization of intangible assets and transaction costs, and are included in the following line items: |

| | | Three Months Ended | | |

| | | April 28, | | January 28, | | April 30, | | | | |

| | | 2024 | | 2024 | | 2023 | | | | |

| Cost of revenue | | $ | 119 | | | $ | 119 | | | $ | 119 | | | | | |

| Research and development | | $ | 12 | | | $ | 12 | | | $ | 12 | | | | | |

| Sales, general and administrative | | $ | 8 | | | $ | 6 | | | $ | 42 | | | | | |

| | | | | | | | | | | |

| (B) Stock-based compensation consists of the following: |

| | | Three Months Ended | | |

| | | April 28, | | January 28, | | April 30, | | | | |

| | | 2024 | | 2024 | | 2023 | | | | |

| Cost of revenue | | $ | 36 | | | $ | 45 | | | $ | 27 | | | | | |

| Research and development | | $ | 727 | | | $ | 706 | | | $ | 524 | | | | | |

| Sales, general and administrative | | $ | 248 | | | $ | 242 | | | $ | 184 | | | | | |

| | | | | | | | | | | |

| (C) Other consists of IP-related costs and assets held for sale related adjustments. |

| | | | | | | | | | | |

| (D) Income tax impact of non-GAAP adjustments, including the recognition of excess tax benefits or deficiencies related to stock-based compensation under GAAP accounting standard (ASU 2016-09). |

| | | | | | | | | | | |

| NVIDIA CORPORATION |

| RECONCILIATION OF GAAP TO NON-GAAP OUTLOOK |

| |

| | | Q2 FY2025 |

| | | Outlook |

| | | ($ in millions) |

| GAAP gross margin | | 74.8 | % |

| Impact of stock-based compensation expense, acquisition-related costs, and other costs | 0.7 | % |

| Non-GAAP gross margin | | 75.5 | % |

| | | |

| GAAP operating expenses | | $ | 3,950 | |

| Stock-based compensation expense, acquisition-related costs, and other costs | (1,150) | |

| Non-GAAP operating expenses | | $ | 2,800 | |

| | | |

| | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | | |

| | |

| | | |

| | |

CFO Commentary on First Quarter Fiscal 2025 Results

Q1 Fiscal 2025 Summary

| | | | | | | | | | | | | | | | | |

| GAAP |

| ($ in millions, except earnings per share) | Q1 FY25 | Q4 FY24 | Q1 FY24 | Q/Q | Y/Y |

| Revenue | $26,044 | $22,103 | $7,192 | Up 18% | Up 262% |

| Gross margin | 78.4 | % | 76.0 | % | 64.6 | % | Up 2.4 pts | Up 13.8 pts |

| Operating expenses | $3,497 | $3,176 | $2,508 | Up 10% | Up 39% |

| Operating income | $16,909 | $13,615 | $2,140 | Up 24% | Up 690% |

| Net income | $14,881 | $12,285 | $2,043 | Up 21% | Up 628% |

| Diluted earnings per share | $5.98 | $4.93 | $0.82 | Up 21% | Up 629% |

| | | | | | | | | | | | | | | | | |

| Non-GAAP |

| ($ in millions, except earnings per share) | Q1 FY25 | Q4 FY24 | Q1 FY24 | Q/Q | Y/Y |

| Revenue | $26,044 | $22,103 | $7,192 | Up 18% | Up 262% |

| Gross margin | 78.9 | % | 76.7 | % | 66.8 | % | Up 2.2 pts | Up 12.1 pts |

| Operating expenses | $2,501 | $2,210 | $1,750 | Up 13% | Up 43% |

| Operating income | $18,059 | $14,749 | $3,052 | Up 22% | Up 492% |

| Net income | $15,238 | $12,839 | $2,713 | Up 19% | Up 462% |

| Diluted earnings per share | $6.12 | $5.16 | $1.09 | Up 19% | Up 461% |

| | | | | | | | | | | | | | | | | |

| Revenue by Reportable Segments |

| ($ in millions) | Q1 FY25 | Q4 FY24 | Q1 FY24 | Q/Q | Y/Y |

| Compute & Networking | $22,675 | $17,898 | $4,460 | Up 27% | Up 408% |

| Graphics | 3,369 | 4,205 | 2,732 | Down 20% | Up 23% |

| Total | $26,044 | $22,103 | $7,192 | Up 18% | Up 262% |

| | | | | | | | | | | | | | | | | |

| Revenue by Market Platform |

| ($ in millions) | Q1 FY25 | Q4 FY24 | Q1 FY24 | Q/Q | Y/Y |

| Data Center | $22,563 | $18,404 | $4,284 | Up 23% | Up 427% |

| Compute | 19,392 | 15,073 | 3,357 | Up 29% | Up 478% |

| Networking | 3,171 | 3,331 | 927 | Down 5% | Up 242% |

| Gaming | 2,647 | 2,865 | 2,240 | Down 8% | Up 18% |

| Professional Visualization | 427 | 463 | 295 | Down 8% | Up 45% |

| Automotive | 329 | 281 | 296 | Up 17% | Up 11% |

| OEM and Other | 78 | 90 | 77 | Down 13% | Up 1% |

| Total | $26,044 | $22,103 | $7,192 | Up 18% | Up 262% |

We specialize in markets where our computing platforms can provide tremendous acceleration for applications. These platforms incorporate processors, interconnects, software, algorithms, systems and services to deliver unique value. Our platforms address four large markets where our expertise is critical: Data Center, Gaming, Professional Visualization, and Automotive.

Revenue

Revenue was a record $26.0 billion, up 262% from a year ago and up 18% sequentially.

Data Center revenue was a record, up 427% from a year ago and up 23% sequentially. Data Center compute revenue was $19.4 billion, up 478% from a year ago and up 29% sequentially. These increases reflect higher shipments of the NVIDIA Hopper GPU computing platform used for training and inferencing with large language models, recommendation engines, and generative AI applications. Networking revenue was $3.2 billion, up 242% from a year ago on strong growth of InfiniBand end-to-end solutions, and down 5% sequentially due to the timing of supply. Strong sequential Data Center growth was driven by all customer types, led by Enterprise and Consumer Internet companies. Large cloud providers continued to drive strong growth as they deploy and ramp NVIDIA AI infrastructure at scale, representing mid-40% of our Data Center revenue.

Gaming revenue was up 18% from a year ago and down 8% sequentially. The year-on-year increase primarily reflects higher demand. The sequential decrease reflects seasonally lower GPU sales for laptops.

Professional Visualization revenue was up 45% from a year ago and down 8% sequentially. The year-on-year increase primarily reflects higher sell-in to partners following the normalization of channel inventory levels. The sequential decrease was primarily due to desktop workstation GPUs.

Automotive revenue was up 11% from a year ago and up 17% sequentially. The year-on-year increase was driven primarily by self-driving platforms. The sequential increase was driven by AI Cockpit solutions and self-driving platforms.

Gross Margin

GAAP and non-GAAP gross margins for the first quarter increased significantly from a year ago on strong Data Center revenue growth primarily driven by our Hopper GPU computing platform. Sequentially, GAAP and non-GAAP gross margins benefited from lower inventory charges. As noted last quarter, both the fourth quarter of fiscal 2024 and the first quarter of fiscal 2025 benefited from favorable component costs.

Expenses

GAAP operating expenses were up 39% from a year ago and up 10% sequentially, and non-GAAP operating expenses were up 43% from a year ago and up 13% sequentially. The increases were primarily driven by compensation and benefits, reflecting growth in employees and compensation.

Other Income & Expense and Income Tax

GAAP other income and expense (OI&E) includes interest income, interest expense, gains and losses from non-affiliated investments and other. Non-GAAP OI&E excludes the gains or losses from non-affiliated investments and the portion of interest expense from the amortization of the debt discount.

Interest income was $359 million, up from a year ago and sequentially, primarily reflecting higher cash balances. Net realized and unrealized gains from non-affiliated investments were $69 million, reflecting fair value adjustments.

GAAP effective tax rate was 13.9%, an increase from a year ago reflecting the lower effect of tax benefits from the foreign derived intangible income deduction and stock-based compensation

relative to the increase in pre-tax income. Non-GAAP effective tax rate for the first quarter was 17.0%.

Balance Sheet and Cash Flow

Cash, cash equivalents and marketable securities were $31.4 billion, up from $15.3 billion a year ago and $26.0 billion a quarter ago. The increases primarily reflect higher revenue partially offset by stock repurchases.

Accounts receivable was $12.4 billion with days sales outstanding (DSO) of 43. Accounts receivable reflects $429 million of customer payments received prior to next quarter’s invoice due date.

Inventory was $5.9 billion with days sales of inventory (DSI) of 95. Purchase commitments and obligations for inventory and manufacturing capacity were $18.8 billion. Prepaid supply agreements were $5.6 billion.

Other non-inventory purchase obligations were $10.6 billion, including $8.8 billion of multi-year cloud service agreements. We expect cloud service agreements to be used to support our research and development efforts and our DGX Cloud offerings. As of the end of the first quarter, we had additional commitments of approximately $1.2 billion to complete business combinations and purchase assets, subject to closing conditions.

Cash flow from operating activities was $15.3 billion, up from $2.9 billion a year ago and $11.5 billion a quarter ago. The year-on-year increase reflects higher revenue, and the sequential increase reflects higher revenue and lower cash taxes. We expect a substantial increase in cash taxes in the second quarter related to federal and state estimated tax payments.

We utilized cash of $7.8 billion towards shareholder returns, including $7.7 billion in share repurchases and $98 million in cash dividends.

We announced a ten-for-one forward stock split of our issued common stock to make stock ownership more accessible to employees and investors. The split will be effected through an amendment to our Restated Certificate of Incorporation, which will result in a proportionate increase in the number of shares of authorized common stock. Each record holder of common stock as of the close of market on Thursday, June 6, 2024 will receive nine additional shares of common stock, to be distributed after the close of market on Friday, June 7, 2024. Trading is expected to commence on a split-adjusted basis at market open on Monday, June 10, 2024.

We also announced a 150% increase in our quarterly cash dividend from $0.04 per share to $0.10 per share of common stock. The increased dividend is equivalent to $0.01 per share on a post-split basis and will be paid on Friday, June 28, 2024, to all shareholders of record on Tuesday, June 11, 2024.

Second Quarter of Fiscal 2025 Outlook

Outlook for the second quarter of fiscal 2025 is as follows:

•Revenue is expected to be $28.0 billion, plus or minus 2%.

•GAAP and non-GAAP gross margins are expected to be 74.8% and 75.5%, respectively, plus or minus 50 basis points. For the full year, gross margins are expected to be in the mid-70% range.

•GAAP and non-GAAP operating expenses are expected to be approximately $4.0 billion and $2.8 billion, respectively. Full-year operating expenses are expected to grow in the low-40% range.

•GAAP and non-GAAP other income and expense are expected to be an income of approximately $300 million, excluding gains and losses from non-affiliated investments.

•GAAP and non-GAAP tax rates are expected to be 17%, plus or minus 1%, excluding any discrete items.

___________________________

For further information, contact:

| | | | | | | | |

| Simona Jankowski | | Mylene Mangalindan |

| Investor Relations | | Corporate Communications |

| NVIDIA Corporation | | NVIDIA Corporation |

| sjankowski@nvidia.com | | mmangalindan@nvidia.com |

Non-GAAP Measures

To supplement NVIDIA’s condensed consolidated financial statements presented in accordance with GAAP, the company uses non-GAAP measures of certain components of financial performance. These non-GAAP measures include non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP income from operations, non-GAAP other income (expense), net, non-GAAP net income, non-GAAP net income, or earnings, per diluted share, and free cash flow. In order for NVIDIA’s investors to be better able to compare its current results with those of previous periods, the company has shown a reconciliation of GAAP to non-GAAP financial measures. These reconciliations adjust the related GAAP financial measures to exclude stock-based compensation expense, acquisition-related and other costs, other, gains and losses from non-affiliated investments, interest expense related to amortization of debt discount, and the associated tax impact of these items where applicable. Free cash flow is calculated as GAAP net cash provided by operating activities less both purchases related to property and equipment and intangible assets and principal payments on property and equipment and intangible assets. NVIDIA believes the presentation of its non-GAAP financial measures enhances the user's overall understanding of the company’s historical financial performance. The presentation of the company’s non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the company’s financial results prepared in accordance with GAAP, and the company’s non-GAAP measures may be different from non-GAAP measures used by other companies.

Certain statements in this CFO Commentary including, but not limited to, statements as to: our computing platforms providing tremendous acceleration for applications and delivering unique value; markets where our expertise is critical; cloud service agreements being used to support our research and development efforts and our DGX Cloud offerings; a substantial increase in cash taxes in the second quarter being related to federal and state estimated tax payments; our forward stock split; our next quarterly cash dividend; gross margins being in the mid-70% range for the full year; our full-year operating expenses growing in the low-40% range; and our financial outlook and expected tax rates for the second quarter of fiscal 2025 are forward-looking statements that are subject to risks and uncertainties that could cause results to be materially different than expectations. Important factors that could cause actual results to differ materially include: global economic conditions; our reliance on third parties to manufacture, assemble, package and test our products; the impact of technological development and competition; development of new products and technologies or enhancements to our existing product and technologies; market acceptance of our products or our partners’ products; design, manufacturing or software defects; changes in consumer preferences or demands; changes in industry standards and interfaces; and unexpected loss of performance of our products or technologies when integrated into systems; as well as other factors detailed from time to time in the most recent reports NVIDIA files with the Securities and Exchange Commission, or SEC, including, but not limited to, its annual report on Form 10-K and quarterly reports on Form 10-Q. Copies of reports filed with the SEC are posted on the company’s website and are available from NVIDIA without charge. These forward-looking statements are not guarantees of future performance and speak only as of the date hereof, and, except as required by law, NVIDIA disclaims any obligation to update these forward-looking statements to reflect future events or circumstances.

# # #

© 2024 NVIDIA Corporation. All rights reserved. NVIDIA and the NVIDIA logo are trademarks and/or registered trademarks of NVIDIA Corporation in the U.S. and/or other countries. Other company and product names may be trademarks of the respective companies with which they are associated. Features, pricing, availability, and specifications are subject to change without notice.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NVIDIA CORPORATION |

| RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES |

| (In millions, except per share data) |

| (Unaudited) |

| | | | | | | |

| | | Three Months Ended | | |

| | | April 28, | | January 28, | | April 30, | | | | |

| | | 2024 | | 2024 | | 2023 | | | | |

| | | | | | | | | | | |

| GAAP gross profit | | $ | 20,406 | | | $ | 16,791 | | | $ | 4,648 | | | | | |

| GAAP gross margin | | 78.4 | % | | 76.0 | % | | 64.6 | % | | | | |

| Acquisition-related and other costs (A) | | 119 | | | 119 | | | 119 | | | | | |

| Stock-based compensation expense (B) | | 36 | | | 45 | | | 27 | | | | | |

| Other (C) | | (1) | | | 4 | | | 8 | | | | | |

| Non-GAAP gross profit | | $ | 20,560 | | | $ | 16,959 | | | $ | 4,802 | | | | | |

| Non-GAAP gross margin | | 78.9 | % | | 76.7 | % | | 66.8 | % | | | | |

| | | | | | | | | | | |

| GAAP operating expenses | | $ | 3,497 | | | $ | 3,176 | | | $ | 2,508 | | | | | |

| Stock-based compensation expense (B) | | (975) | | | (948) | | | (708) | | | | | |

| Acquisition-related and other costs (A) | | (21) | | | (18) | | | (54) | | | | | |

| | | | | | | | | | | |

| Other (C) | | — | | | — | | | 4 | | | | | |

| Non-GAAP operating expenses | | $ | 2,501 | | | $ | 2,210 | | | $ | 1,750 | | | | | |

| | | | | | | | | | | |

| GAAP operating income | | $ | 16,909 | | | $ | 13,615 | | | $ | 2,140 | | | | | |

| Total impact of non-GAAP adjustments to operating income | | 1,150 | | | 1,134 | | | 912 | | | | | |

| Non-GAAP operating income | | $ | 18,059 | | | $ | 14,749 | | | $ | 3,052 | | | | | |

| | | | | | | | | | | |

| GAAP other income (expense), net | | $ | 370 | | | $ | 491 | | | $ | 69 | | | | | |

| (Gains) losses from non-affiliated investments | | (69) | | | (260) | | | 14 | | | | | |

| Interest expense related to amortization of debt discount | | 1 | | | 1 | | | 1 | | | | | |

| Non-GAAP other income (expense), net | | $ | 302 | | | $ | 232 | | | $ | 84 | | | | | |

| | | | | | | | | | | |

| GAAP net income | | $ | 14,881 | | | $ | 12,285 | | | $ | 2,043 | | | | | |

| Total pre-tax impact of non-GAAP adjustments | | 1,082 | | | 875 | | | 927 | | | | | |

| Income tax impact of non-GAAP adjustments (D) | | (725) | | | (321) | | | (257) | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Non-GAAP net income | | $ | 15,238 | | | $ | 12,839 | | | $ | 2,713 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | |

| | | April 28, | | January 28, | | April 30, | | | | |

| | | 2024 | | 2024 | | 2023 | | | | |

| Diluted net income per share | | | | | | | | | | |

| GAAP | | $ | 5.98 | | | $ | 4.93 | | | $ | 0.82 | | | | | |

| Non-GAAP | | $ | 6.12 | | | $ | 5.16 | | | $ | 1.09 | | | | | |

| | | | | | | | | | | |

| Weighted average shares used in diluted net income per share computation | | 2,489 | | | 2,490 | | | 2,490 | | | | | |

| | | | | | | | | | | |

| GAAP net cash provided by operating activities | | $ | 15,345 | | | $ | 11,499 | | | $ | 2,911 | | | | | |

| Purchases related to property and equipment and intangible assets | | (369) | | | (253) | | | (248) | | | | | |

| Principal payments on property and equipment and intangible assets | | (40) | | | (29) | | | (20) | | | | | |

| Free cash flow | | $ | 14,936 | | | $ | 11,217 | | | $ | 2,643 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (A) Acquisition-related and other costs are comprised of amortization of intangible assets and transaction costs, and are included in the following line items: |

| | | Three Months Ended | | |

| | | April 28, | | January 28, | | April 30, | | | | |

| | | 2024 | | 2024 | | 2023 | | | | |

| Cost of revenue | | $ | 119 | | | $ | 119 | | | $ | 119 | | | | | |

| Research and development | | $ | 12 | | | $ | 12 | | | $ | 12 | | | | | |

| Sales, general and administrative | | $ | 8 | | | $ | 6 | | | $ | 42 | | | | | |

| | | | | | | | | | | |

| (B) Stock-based compensation consists of the following: |

| | | Three Months Ended | | |

| | | April 28, | | January 28, | | April 30, | | | | |

| | | 2024 | | 2024 | | 2023 | | | | |

| Cost of revenue | | $ | 36 | | | $ | 45 | | | $ | 27 | | | | | |

| Research and development | | $ | 727 | | | $ | 706 | | | $ | 524 | | | | | |

| Sales, general and administrative | | $ | 248 | | | $ | 242 | | | $ | 184 | | | | | |

| | | | | | | | | | | |

| (C) Other consists of IP-related costs and assets held for sale related adjustments. |

| | | | | | | | | | | |

| (D) Income tax impact of non-GAAP adjustments, including the recognition of excess tax benefits or deficiencies related to stock-based compensation under GAAP accounting standard (ASU 2016-09). |

| | | | | | | | | | | |

| NVIDIA CORPORATION |

| RECONCILIATION OF GAAP TO NON-GAAP OUTLOOK |

| |

| | | Q2 FY2025 |

| | | Outlook |

| | | ($ in millions) |

| GAAP gross margin | | 74.8 | % |

| Impact of stock-based compensation expense, acquisition-related costs, and other costs | 0.7 | % |

| Non-GAAP gross margin | | 75.5 | % |

| | | |

| GAAP operating expenses | | $ | 3,950 | |

| Stock-based compensation expense, acquisition-related costs, and other costs | (1,150) | |

| Non-GAAP operating expenses | | $ | 2,800 | |

| | | |

| | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | | |

| | |

| | | |

| | |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

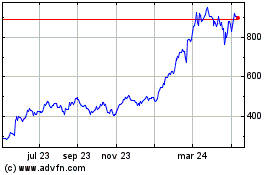

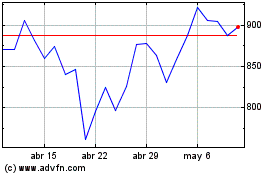

NVIDIA (NASDAQ:NVDA)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

NVIDIA (NASDAQ:NVDA)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024