Opendoor Technologies Inc. (Nasdaq: OPEN), a leading e-commerce

platform for residential real estate transactions, today reported

financial results for its third quarter ended September 30,

2024. Opendoor’s third quarter 2024 financial results and

management commentary can be accessed through the Company’s

shareholder letter on the “Quarterly Reports” page of Opendoor’s

investor relations website at

https://investor.opendoor.com/financials-filings/quarterly-reports.

“Opendoor’s third quarter acquisition volumes, revenue,

Contribution Profit, and Adjusted EBITDA all exceeded our guidance,

notwithstanding persistent housing market headwinds. In August,

many anticipated that interest rate cuts would bring buyers and

sellers back to the market. However, mortgage rates remain

stubbornly high and the housing market continues to be challenged

by high delistings, low clearance, and strained affordability,”

said Carrie Wheeler, CEO of Opendoor.

Wheeler continued, “We are focused on what we can control,

operating our business as efficiently as possible, and streamlining

our cost structure while managing risk. The combination of the

actions we took in the second half of this year will result in

annualized savings of approximately $85 million as we enter

2025. With a simplified organization and ongoing enhancements in

our core products, we are well-positioned to rescale the business

as conditions improve.”

Third Quarter

2024 Key Highlights

- Revenue of $1.4 billion, up 41%

versus 3Q23 and down (9)% versus 2Q24; with 3,615 total homes sold,

up 35% versus 3Q23 and down (11)% versus 2Q24

- Gross profit of $105 million,

versus $96 million in 3Q23 and $129 million in 2Q24;

Gross Margin of 7.6%, versus 9.8% in 3Q23 and 8.5% in 2Q24

- Net loss of $(78) million, versus

$(106) million in 3Q23 and $(92) million in 2Q24

- Inventory balance of $2.1 billion,

representing 6,288 homes, up 64% versus 3Q23 and down (4)% versus

2Q24

- Purchased 3,504 homes, up 12% versus

3Q23 and down (27)% versus 2Q24

- Ended the quarter with 1,006 homes

under contract for purchase, down (39)% versus 3Q23 and down (44)%

versus 2Q24

Non-GAAP Key Highlights*

- Contribution Profit of

$52 million, versus $43 million in 3Q23 and

$95 million in 2Q24; Contribution Margin of 3.8%, versus 4.4%

in 3Q23 and 6.3% in 2Q24

- Adjusted EBITDA of $(38) million,

versus $(49) million in 3Q23 and $(5) million in 2Q24;

Adjusted EBITDA Margin of (2.8)%, versus (5.0)% in 3Q23 and (0.3)%

in 2Q24

- Adjusted Net Loss of

$(70) million, versus $(75) million in 3Q23 and

$(31) million in 2Q24

*See “—Use of Non-GAAP Financial Measures” below for further

details and a reconciliation of such non-GAAP measures to their

nearest comparable GAAP measures.

Fourth Quarter

2024 Financial Outlook

- 4Q24 revenue guidance of $925 million

to $975 million

- 4Q24 Contribution Profit1 guidance of

$15 million to $25 million

- 4Q24 Adjusted EBITDA1 guidance of $(70)

million to $(60) million

Conference Call and Webcast Details

Opendoor will host a conference call to discuss its financial

results on November 7, 2024, at 2:00 p.m. Pacific Time. A live

webcast of the call can be accessed from Opendoor’s Investor

Relations website at https://investor.opendoor.com. An archived

version of the webcast will be available from the same website

after the call.

About Opendoor

Opendoor is a leading e-commerce platform for residential real

estate transactions whose mission is to power life’s progress, one

move at a time. Since 2014, Opendoor has provided people across the

U.S. with a simple and certain way to sell and buy a home. Opendoor

is a team of problem solvers, innovators, and operators who are

leading the future of real estate. Opendoor currently operates in

markets nationwide.

For more information, please visit www.opendoor.com

Forward Looking StatementsThis press release

contains certain forward-looking statements within the meaning of

Section 27A the Private Securities Litigation Reform Act of 1995,

as amended. All statements contained in this press release that do

not relate to matters of historical fact should be considered

forward-looking, including statements regarding the current and

future health and stability of the real estate housing market and

general economy; anticipated future results of operations and

financial performance, including our fourth quarter 2024 and 2025

financial outlook; our ability to operate efficiently and

proactively manage our cost structure in a challenging housing

market; our ability to realize cost savings as a result of certain

streamlining initiatives; the volatility of mortgage interest

rates, changes in resale clearance rates and delistings; our

product offerings and improvements; the health and status of our

financial condition and whether we will be able to rescale when

housing market conditions improve; whether efficiencies we have

implemented across our platform will result in future benefits; our

competitive positioning; and business strategy and plans, including

plans to continue to invest in and enhance our products. These

forward-looking statements generally are identified by the words

“anticipate”, “believe”, “contemplate”, “continue”, “could”,

“estimate”, “expect”, “forecast”, “future”, “guidance”, “intend”,

“may”, “might”, “opportunity”, “outlook”, “plan”, “possible”,

“potential”, “predict”, “project”, “should”, “strategy”, “strive”,

“target”, “vision”, “will”, or “would”, any negative of these words

or other similar terms or expressions. The absence of these words

does not mean that a statement is not forward-looking.

Forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties that can cause actual results to differ

materially from those in such forward-looking statements. The

factors that could cause or contribute to actual future events to

differ materially from the forward-looking statements in this press

release include but are not limited to: the current and future

health and stability of the economy, financial conditions and

residential housing market, including any extended downturn or

slowdown; changes in general economic and financial conditions

(including federal monetary policy, interest rates, inflation,

actual or anticipated recession, home price fluctuations, and

housing inventory), as well as the probability of such changes

occurring, that may impact demand for our products and services,

lower our profitability or reduce our access to future financings;

actual or anticipated fluctuations in our financial condition and

results of operations; changes in projected operational and

financial results; our real estate assets and increased competition

in the U.S. residential real estate industry; our ability to

operate and grow our core business products, including the ability

to obtain sufficient financing and resell purchased homes;

investment of resources to pursue strategies and develop new

products and services that may not prove effective or that are not

attractive to customers and/or partners or that do not allow us to

compete successfully; our ability to acquire and resell homes

profitably; our ability to grow market share in our existing

markets or any new markets we may enter; our ability to manage our

growth effectively; our ability to expeditiously sell and

appropriately price our inventory; our ability to access sources of

capital, including debt financing and securitization funding to

finance our real estate inventories and other sources of capital to

finance operations and growth; our ability to maintain and enhance

our products and brand, and to attract customers; our ability to

manage, develop and refine our digital platform, including our

automated pricing and valuation technology; our ability to comply

with multiple listing service rules and requirements to access and

use listing data, and to maintain or establish relationships with

listings and data providers; our ability to obtain or maintain

licenses and permits to support our current and future business

operations; acquisitions, strategic partnerships, joint ventures,

capital-raising activities or other corporate transactions or

commitments by us or our competitors; actual or anticipated changes

in technology, products, markets or services by us or our

competitors; our ability to protect our brand and intellectual

property; our success in retaining or recruiting, or changes

required in, our officers, key employees and/or directors; the

impact of the regulatory environment within our industry and

complexities with compliance related to such environment; any

future impact of pandemics or epidemics, including any future

resurgences of COVID-19 and its variants, or other public health

crises on our ability to operate, demand for our products and

services, or general economic conditions; changes in laws or

government regulation affecting our business; and the impact of

pending or future litigation or regulatory actions. The foregoing

list of factors is not exhaustive. You should carefully consider

the foregoing factors and the other risks and uncertainties

described under the caption “Risk Factors” in our most recent

Annual Report on Form 10-K filed with the Securities and Exchange

Commission (the “SEC”) on February 15, 2024, as updated by our

periodic reports and other filings with the SEC. These filings

identify and address other important risks and uncertainties that

could cause actual events and results to differ materially from

those contained in the forward-looking statements. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and, except as required by law, we assume no obligation and do not

intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or

otherwise. We do not give any assurance that we will achieve our

expectations.

Contact Information

Investors:investors@opendoor.com

Media:press@opendoor.com

|

OPENDOOR TECHNOLOGIES INC.FINANCIAL

HIGHLIGHTS AND OPERATING METRICS(In millions, except

percentages, homes sold, number of markets, homes purchased, and

homes in inventory)(Unaudited) |

| |

|

Three Months Ended |

| |

|

September 30,2024 |

|

June 30,2024 |

|

March 31,2024 |

|

December 31,2023 |

|

September 30,2023 |

|

Revenue |

|

$ |

1,377 |

|

|

|

$ |

1,511 |

|

|

|

$ |

1,181 |

|

|

|

$ |

870 |

|

|

|

$ |

980 |

|

|

| Gross profit |

|

$ |

105 |

|

|

|

$ |

129 |

|

|

|

$ |

114 |

|

|

|

$ |

72 |

|

|

|

$ |

96 |

|

|

| Gross Margin |

|

|

7.6 |

|

% |

|

|

8.5 |

|

% |

|

|

9.7 |

|

% |

|

|

8.3 |

|

% |

|

|

9.8 |

|

% |

| Net loss |

|

$ |

(78 |

) |

|

|

$ |

(92 |

) |

|

|

$ |

(109 |

) |

|

|

$ |

(91 |

) |

|

|

$ |

(106 |

) |

|

| Number of markets (at period

end) |

|

|

50 |

|

|

|

|

50 |

|

|

|

|

50 |

|

|

|

|

50 |

|

|

|

|

53 |

|

|

| Homes sold |

|

|

3,615 |

|

|

|

|

4,078 |

|

|

|

|

3,078 |

|

|

|

|

2,364 |

|

|

|

|

2,687 |

|

|

| Homes purchased |

|

|

3,504 |

|

|

|

|

4,771 |

|

|

|

|

3,458 |

|

|

|

|

3,683 |

|

|

|

|

3,136 |

|

|

| Homes in inventory (at period

end) |

|

|

6,288 |

|

|

|

|

6,399 |

|

|

|

|

5,706 |

|

|

|

|

5,326 |

|

|

|

|

4,007 |

|

|

| Inventory (at period end) |

|

$ |

2,145 |

|

|

|

$ |

2,234 |

|

|

|

$ |

1,881 |

|

|

|

$ |

1,775 |

|

|

|

$ |

1,311 |

|

|

| Percentage of homes “on the

market” for greater than 120 days (at period end) |

|

|

23 |

|

% |

|

|

14 |

|

% |

|

|

15 |

|

% |

|

|

18 |

|

% |

|

|

12 |

|

% |

| Non-GAAP Financial

Highlights (1) |

|

|

|

|

|

|

|

|

|

|

| Contribution Profit |

|

$ |

52 |

|

|

|

$ |

95 |

|

|

|

$ |

57 |

|

|

|

$ |

30 |

|

|

|

$ |

43 |

|

|

| Contribution Margin |

|

|

3.8 |

|

% |

|

|

6.3 |

|

% |

|

|

4.8 |

|

% |

|

|

3.4 |

|

% |

|

|

4.4 |

|

% |

| Adjusted EBITDA |

|

$ |

(38 |

) |

|

|

$ |

(5 |

) |

|

|

$ |

(50 |

) |

|

|

$ |

(69 |

) |

|

|

$ |

(49 |

) |

|

| Adjusted EBITDA Margin |

|

|

(2.8 |

) |

% |

|

|

(0.3 |

) |

% |

|

|

(4.2 |

) |

% |

|

|

(7.9 |

) |

% |

|

|

(5.0 |

) |

% |

| Adjusted Net Loss |

|

$ |

(70 |

) |

|

|

$ |

(31 |

) |

|

|

$ |

(80 |

) |

|

|

$ |

(97 |

) |

|

|

$ |

(75 |

) |

|

(1) See “—Use of Non-GAAP Financial Measures” for further

details and a reconciliation of such non-GAAP measures to their

nearest comparable GAAP measures.

|

OPENDOOR TECHNOLOGIES

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(In millions, except share amounts

which are presented in thousands, and per share

amounts)(Unaudited) |

| |

Three Months Ended |

|

Nine Months

EndedSeptember 30, |

| |

September 30,2024 |

|

June 30,2024 |

|

September 30,2023 |

|

|

2024 |

|

|

|

2023 |

|

|

REVENUE |

$ |

1,377 |

|

|

$ |

1,511 |

|

|

$ |

980 |

|

|

$ |

4,069 |

|

|

$ |

6,076 |

|

| COST OF REVENUE |

|

1,272 |

|

|

|

1,382 |

|

|

|

884 |

|

|

|

3,721 |

|

|

|

5,661 |

|

| GROSS PROFIT |

|

105 |

|

|

|

129 |

|

|

|

96 |

|

|

|

348 |

|

|

|

415 |

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

Sales, marketing and operations |

|

96 |

|

|

|

116 |

|

|

|

85 |

|

|

|

325 |

|

|

|

397 |

|

|

General and administrative |

|

46 |

|

|

|

48 |

|

|

|

48 |

|

|

|

141 |

|

|

|

158 |

|

|

Technology and development |

|

30 |

|

|

|

37 |

|

|

|

42 |

|

|

|

108 |

|

|

|

121 |

|

|

Restructuring |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

10 |

|

|

Total operating expenses |

|

172 |

|

|

|

201 |

|

|

|

175 |

|

|

|

574 |

|

|

|

686 |

|

| LOSS FROM OPERATIONS |

|

(67 |

) |

|

|

(72 |

) |

|

|

(79 |

) |

|

|

(226 |

) |

|

|

(271 |

) |

| (LOSS) GAIN ON EXTINGUISHMENT

OF DEBT |

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

182 |

|

| INTEREST EXPENSE |

|

(34 |

) |

|

|

(30 |

) |

|

|

(47 |

) |

|

|

(101 |

) |

|

|

(174 |

) |

| OTHER INCOME – Net |

|

23 |

|

|

|

12 |

|

|

|

20 |

|

|

|

50 |

|

|

|

80 |

|

| LOSS BEFORE INCOME TAXES |

|

(78 |

) |

|

|

(91 |

) |

|

|

(106 |

) |

|

|

(278 |

) |

|

|

(183 |

) |

| INCOME TAX EXPENSE |

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

(1 |

) |

| NET LOSS |

$ |

(78 |

) |

|

$ |

(92 |

) |

|

$ |

(106 |

) |

|

$ |

(279 |

) |

|

$ |

(184 |

) |

| Net loss per share

attributable to common shareholders: |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.11 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.40 |

) |

|

$ |

(0.28 |

) |

|

Diluted |

$ |

(0.11 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.40 |

) |

|

$ |

(0.28 |

) |

| Weighted-average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

705,359 |

|

|

|

693,445 |

|

|

|

662,149 |

|

|

|

693,796 |

|

|

|

651,939 |

|

|

Diluted |

|

705,359 |

|

|

|

693,445 |

|

|

|

662,149 |

|

|

|

693,796 |

|

|

|

651,939 |

|

|

OPENDOOR TECHNOLOGIES

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(In millions, except share

data)(Unaudited) |

| |

|

September 30,2024 |

|

December 31,2023 |

| ASSETS |

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

829 |

|

|

$ |

999 |

|

|

Restricted cash |

|

|

225 |

|

|

|

541 |

|

|

Marketable securities |

|

|

8 |

|

|

|

69 |

|

|

Escrow receivable |

|

|

15 |

|

|

|

9 |

|

|

Real estate inventory, net |

|

|

2,145 |

|

|

|

1,775 |

|

|

Other current assets |

|

|

41 |

|

|

|

52 |

|

|

Total current assets |

|

|

3,263 |

|

|

|

3,445 |

|

| PROPERTY AND

EQUIPMENT – Net |

|

|

59 |

|

|

|

66 |

|

| RIGHT OF USE ASSETS |

|

|

25 |

|

|

|

25 |

|

| GOODWILL |

|

|

3 |

|

|

|

4 |

|

| INTANGIBLES – Net |

|

|

— |

|

|

|

5 |

|

| OTHER ASSETS |

|

|

61 |

|

|

|

22 |

|

| TOTAL ASSETS |

|

$ |

3,411 |

|

|

$ |

3,567 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

Accounts payable and other accrued liabilities |

|

$ |

71 |

|

|

$ |

64 |

|

|

Non-recourse asset-backed debt – current portion |

|

|

643 |

|

|

|

— |

|

|

Interest payable |

|

|

3 |

|

|

|

1 |

|

|

Lease liabilities – current portion |

|

|

4 |

|

|

|

5 |

|

|

Total current liabilities |

|

|

721 |

|

|

|

70 |

|

| NON-RECOURSE ASSET-BACKED

DEBT – Net of current portion |

|

|

1,491 |

|

|

|

2,134 |

|

| CONVERTIBLE SENIOR NOTES |

|

|

377 |

|

|

|

376 |

|

| LEASE LIABILITIES – Net of

current portion |

|

|

19 |

|

|

|

19 |

|

| OTHER LIABILITIES |

|

|

2 |

|

|

|

1 |

|

| Total liabilities |

|

|

2,610 |

|

|

|

2,600 |

|

| SHAREHOLDERS’ EQUITY: |

|

|

|

|

|

Common stock, $0.0001 par value; 3,000,000,000 shares authorized;

711,660,871 and 677,636,163 shares issued,

respectively; 711,660,871 and 677,636,163 shares outstanding,

respectively |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

4,413 |

|

|

|

4,301 |

|

|

Accumulated deficit |

|

|

(3,612 |

) |

|

|

(3,333 |

) |

|

Accumulated other comprehensive loss |

|

|

— |

|

|

|

(1 |

) |

|

Total shareholders’ equity |

|

|

801 |

|

|

|

967 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

$ |

3,411 |

|

|

$ |

3,567 |

|

|

OPENDOOR TECHNOLOGIES

INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(In millions)(Unaudited) |

| |

Nine Months

EndedSeptember 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

Net loss |

$ |

(279 |

) |

|

$ |

(184 |

) |

|

Adjustments to reconcile net loss to cash, cash equivalents, and

restricted cash (used in) provided by operating activities: |

|

|

|

|

Depreciation and amortization |

|

37 |

|

|

|

50 |

|

|

Amortization of right of use asset |

|

4 |

|

|

|

5 |

|

|

Stock-based compensation |

|

91 |

|

|

|

94 |

|

|

Inventory valuation adjustment |

|

51 |

|

|

|

54 |

|

|

Change in fair value of equity securities |

|

7 |

|

|

|

4 |

|

|

Other |

|

6 |

|

|

|

6 |

|

|

Proceeds from sale and principal collections of mortgage loans held

for sale |

|

— |

|

|

|

1 |

|

|

Loss (gain) on extinguishment of debt |

|

1 |

|

|

|

(182 |

) |

|

Gain on deconsolidation, net |

|

(14 |

) |

|

|

— |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Escrow receivable |

|

(6 |

) |

|

|

19 |

|

|

Real estate inventory |

|

(422 |

) |

|

|

3,082 |

|

|

Other assets |

|

9 |

|

|

|

(15 |

) |

|

Accounts payable and other accrued liabilities |

|

4 |

|

|

|

(29 |

) |

|

Interest payable |

|

1 |

|

|

|

(10 |

) |

|

Lease liabilities |

|

(5 |

) |

|

|

(9 |

) |

|

Net cash (used in) provided by operating

activities |

|

(515 |

) |

|

|

2,886 |

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

Purchase of property and equipment |

|

(22 |

) |

|

|

(28 |

) |

|

Proceeds from sales, maturities, redemptions and paydowns of

marketable securities |

|

55 |

|

|

|

75 |

|

|

Proceeds from sale of non-marketable equity securities |

|

— |

|

|

|

1 |

|

|

Cash impact of deconsolidation of subsidiaries |

|

(2 |

) |

|

|

— |

|

|

Net cash provided by investing activities |

|

31 |

|

|

|

48 |

|

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

Repurchase of convertible senior notes |

|

— |

|

|

|

(270 |

) |

|

Proceeds from exercise of stock options |

|

— |

|

|

|

2 |

|

|

Proceeds from issuance of common stock for ESPP |

|

5 |

|

|

|

2 |

|

|

Proceeds from non-recourse asset-backed debt |

|

417 |

|

|

|

238 |

|

|

Principal payments on non-recourse asset-backed debt |

|

(424 |

) |

|

|

(2,315 |

) |

|

Payment for early extinguishment of debt |

|

— |

|

|

|

(4 |

) |

|

Net cash used in financing activities |

|

(2 |

) |

|

|

(2,347 |

) |

|

NET (DECREASE) INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED

CASH |

|

(486 |

) |

|

|

587 |

|

|

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – Beginning of

period |

|

1,540 |

|

|

|

1,791 |

|

|

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – End of period |

$ |

1,054 |

|

|

$ |

2,378 |

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION – Cash paid during

the period for interest |

$ |

93 |

|

|

$ |

169 |

|

|

DISCLOSURES OF NONCASH INVESTING AND FINANCING ACTIVITIES: |

|

|

|

|

Stock-based compensation expense capitalized for internally

developed software |

$ |

15 |

|

|

$ |

17 |

|

|

Investment in non-marketable equity securities due to

deconsolidation |

$ |

39 |

|

|

$ |

— |

|

|

RECONCILIATION TO CONDENSED CONSOLIDATED BALANCE SHEETS: |

|

|

|

|

Cash and cash equivalents |

$ |

829 |

|

|

$ |

1,154 |

|

|

Restricted cash |

|

225 |

|

|

|

1,224 |

|

|

Cash, cash equivalents, and restricted cash |

$ |

1,054 |

|

|

$ |

2,378 |

|

Use of Non-GAAP Financial Measures

To provide investors with additional information regarding the

Company’s financial results, this press release includes references

to certain non-GAAP financial measures that are used by management.

The Company believes these non-GAAP financial measures including

Adjusted Gross Profit (Loss), Contribution Profit (Loss), Adjusted

Net Loss, Adjusted EBITDA, and any such non-GAAP financial measures

expressed as a Margin, are useful to investors as supplemental

operational measurements to evaluate the Company’s financial

performance.

The non-GAAP financial measures should not be considered in

isolation or as a substitute for the Company’s reported GAAP

results because they may include or exclude certain items as

compared to similar GAAP-based measures, and such measures may not

be comparable to similarly-titled measures reported by other

companies. Management uses these non-GAAP financial measures for

financial and operational decision-making and as a means to

evaluate period-to-period comparisons. Management believes that

these non-GAAP financial measures provide meaningful supplemental

information regarding the Company’s performance by excluding

certain items that may not be indicative of the Company’s recurring

operating results.

Adjusted Gross Profit (Loss) and Contribution Profit (Loss)

To provide investors with additional information regarding our

margins and return on inventory acquired, we have included Adjusted

Gross Profit (Loss) and Contribution Profit (Loss), which are

non-GAAP financial measures. We believe that Adjusted Gross Profit

(Loss) and Contribution Profit (Loss) are useful financial measures

for investors as they are supplemental measures used by management

in evaluating unit level economics and our operating performance.

Each of these measures is intended to present the economics related

to homes sold during a given period. We do so by including revenue

generated from homes sold (and adjacent services) in the period and

only the expenses that are directly attributable to such home

sales, even if such expenses were recognized in prior periods, and

excluding expenses related to homes that remain in inventory as of

the end of the period. Contribution Profit (Loss) provides

investors a measure to assess Opendoor’s ability to generate

returns on homes sold during a reporting period after considering

home purchase costs, renovation and repair costs, holding costs and

selling costs.

Adjusted Gross Profit (Loss) and Contribution Profit (Loss) are

supplemental measures of our operating performance and have

limitations as analytical tools. For example, these measures

include costs that were recorded in prior periods under GAAP and

exclude, in connection with homes held in inventory at the end of

the period, costs required to be recorded under GAAP in the same

period. Accordingly, these measures should not be considered in

isolation or as a substitute for analysis of our results as

reported under GAAP. We include a reconciliation of these measures

to the most directly comparable GAAP financial measure, which is

gross profit.

Adjusted Gross Profit (Loss) / Margin

We calculate Adjusted Gross Profit (Loss) as gross profit under

GAAP adjusted for (1) inventory valuation adjustment in the

current period, and (2) inventory valuation adjustment in prior

periods. Inventory valuation adjustment in the current period is

calculated by adding back the inventory valuation adjustments

recorded during the period on homes that remain in inventory at

period end. Inventory valuation adjustment in prior periods is

calculated by subtracting the inventory valuation adjustments

recorded in prior periods on homes sold in the current period.

Adjusted Gross Margin is Adjusted Gross Profit (Loss) as a

percentage of revenue.

We view this metric as an important measure of business

performance as it captures gross margin performance isolated to

homes sold in a given period and provides comparability across

reporting periods. Adjusted Gross Profit (Loss) helps management

assess home pricing, service fees and renovation performance for a

specific resale cohort.

Contribution Profit (Loss) / Margin

We calculate Contribution Profit (Loss) as Adjusted Gross Profit

(Loss), minus certain costs incurred on homes sold during the

current period including: (1) holding costs incurred in the

current period, (2) holding costs incurred in prior periods,

and (3) direct selling costs. The composition of our holding

costs is described in the footnotes to the reconciliation table

below. Contribution Margin is Contribution Profit (Loss) as a

percentage of revenue.

We view this metric as an important measure of business

performance as it captures the unit level performance isolated to

homes sold in a given period and provides comparability across

reporting periods. Contribution Profit (Loss) helps management

assess inflows and outflows directly associated with a specific

resale cohort.

OPENDOOR TECHNOLOGIES

INC.RECONCILIATION OF GAAP TO NON-GAAP

MEASURES(In millions, except percentages, and homes

sold)(Unaudited)

The following table presents a reconciliation of our Adjusted

Gross Profit (Loss) and Contribution Profit (Loss) to our gross

profit, which is the most directly comparable GAAP measure, for the

periods indicated:

| |

|

Three Months Ended |

|

Nine Months

EndedSeptember 30, |

| (in millions,

except percentages and homes sold, or as noted) |

|

September 30, 2024 |

|

June 30, 2024 |

|

March 31, 2024 |

|

December 31, 2023 |

|

September 30, 2023 |

|

|

2024 |

|

|

|

2023 |

|

|

|

Revenue (GAAP) |

|

$ |

1,377 |

|

|

$ |

1,511 |

|

|

$ |

1,181 |

|

|

$ |

870 |

|

|

$ |

980 |

|

|

$ |

4,069 |

|

|

$ |

6,076 |

|

|

| Gross profit

(GAAP) |

|

$ |

105 |

|

|

$ |

129 |

|

|

$ |

114 |

|

|

$ |

72 |

|

|

$ |

96 |

|

|

$ |

348 |

|

|

$ |

415 |

|

|

| Gross Margin |

|

|

7.6 |

% |

|

|

8.5 |

% |

|

|

9.7 |

% |

|

|

8.3 |

% |

|

|

9.8 |

% |

|

|

8.6 |

% |

|

|

6.8 |

|

% |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inventory valuation adjustment – Current Period(1)(2) |

|

|

10 |

|

|

|

34 |

|

|

|

7 |

|

|

|

11 |

|

|

|

17 |

|

|

|

33 |

|

|

|

24 |

|

|

|

Inventory valuation adjustment – Prior Periods(1)(3) |

|

|

(16 |

) |

|

|

(9 |

) |

|

|

(17 |

) |

|

|

(17 |

) |

|

|

(29 |

) |

|

|

(24 |

) |

|

|

(450 |

) |

|

| Adjusted Gross Profit

(Loss) |

|

$ |

99 |

|

|

$ |

154 |

|

|

$ |

104 |

|

|

$ |

66 |

|

|

$ |

84 |

|

|

$ |

357 |

|

|

$ |

(11 |

) |

|

| Adjusted Gross Margin |

|

|

7.2 |

% |

|

|

10.2 |

% |

|

|

8.8 |

% |

|

|

7.6 |

% |

|

|

8.6 |

% |

|

|

8.8 |

% |

|

|

(0.2 |

) |

% |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct selling costs(4) |

|

|

(32 |

) |

|

|

(43 |

) |

|

|

(34 |

) |

|

|

(26 |

) |

|

|

(28 |

) |

|

|

(109 |

) |

|

|

(171 |

) |

|

|

Holding costs on sales – Current Period(5)(6) |

|

|

(6 |

) |

|

|

(5 |

) |

|

|

(5 |

) |

|

|

(3 |

) |

|

|

(4 |

) |

|

|

(30 |

) |

|

|

(41 |

) |

|

|

Holding costs on sales – Prior Periods(5)(7) |

|

|

(9 |

) |

|

|

(11 |

) |

|

|

(8 |

) |

|

|

(7 |

) |

|

|

(9 |

) |

|

|

(14 |

) |

|

|

(65 |

) |

|

| Contribution Profit

(Loss) |

|

$ |

52 |

|

|

$ |

95 |

|

|

$ |

57 |

|

|

$ |

30 |

|

|

$ |

43 |

|

|

$ |

204 |

|

|

$ |

(288 |

) |

|

| Homes sold in period |

|

|

3,615 |

|

|

|

4,078 |

|

|

|

3,078 |

|

|

|

2,364 |

|

|

|

2,687 |

|

|

|

10,771 |

|

|

|

16,344 |

|

|

| Contribution Profit

(Loss) per Home Sold (in thousands) |

|

$ |

14 |

|

|

$ |

23 |

|

|

$ |

19 |

|

|

$ |

13 |

|

|

$ |

16 |

|

|

$ |

19 |

|

|

$ |

(18 |

) |

|

|

Contribution Margin |

|

|

3.8 |

% |

|

|

6.3 |

% |

|

|

4.8 |

% |

|

|

3.4 |

% |

|

|

4.4 |

% |

|

|

5.0 |

% |

|

|

(4.7 |

) |

% |

________________

|

(1) |

Inventory valuation adjustment includes adjustments to record real

estate inventory at the lower of its carrying amount or its net

realizable value. |

| (2) |

Inventory valuation

adjustment — Current Period is the inventory valuation adjustments

recorded during the period presented associated with homes that

remain in inventory at period end. |

| (3) |

Inventory valuation

adjustment — Prior Periods is the inventory valuation adjustments

recorded in prior periods associated with homes that sold in the

period presented. |

| (4) |

Represents selling costs incurred

related to homes sold in the relevant period. This primarily

includes broker commissions, external title and escrow-related fees

and transfer taxes. |

| (5) |

Holding costs include mainly

property taxes, insurance, utilities, homeowners association dues,

cleaning and maintenance costs. Holding costs are included in

Sales, marketing, and operations on the Condensed Consolidated

Statements of Operations. |

| (6) |

Represents holding costs incurred

in the period presented on homes sold in the period presented. |

| (7) |

Represents holding costs

incurred in prior periods on homes sold in the period

presented. |

Adjusted Net Loss and Adjusted EBITDA

We also present Adjusted Net Loss and Adjusted EBITDA, which are

non-GAAP financial measures that management uses to assess our

underlying financial performance. These measures are also commonly

used by investors and analysts to compare the underlying

performance of companies in our industry. We believe these measures

provide investors with meaningful period over period comparisons of

our underlying performance, adjusted for certain charges that are

non-cash, not directly related to our revenue-generating

operations, not aligned to related revenue, or not reflective of

ongoing operating results that vary in frequency and amount.

Adjusted Net Loss and Adjusted EBITDA are supplemental measures

of our operating performance and have important limitations. For

example, these measures exclude the impact of certain costs

required to be recorded under GAAP. These measures also include

inventory valuation adjustments that were recorded in prior periods

under GAAP and exclude, in connection with homes held in inventory

at the end of the period, inventory valuation adjustments required

to be recorded under GAAP in the same period. These measures could

differ substantially from similarly titled measures presented by

other companies in our industry or companies in other industries.

Accordingly, these measures should not be considered in isolation

or as a substitute for analysis of our results as reported under

GAAP. We include a reconciliation of these measures to the most

directly comparable GAAP financial measure, which is net loss.

Adjusted Net Loss

We calculate Adjusted Net Loss as GAAP net loss adjusted to

exclude non-cash expenses of stock-based compensation, equity

securities fair value adjustment, and intangibles amortization

expense. It excludes expenses that are not directly related to our

revenue-generating operations such as restructuring. It excludes

loss (gain) on extinguishment of debt as these expenses or gains

were incurred as a result of decisions made by management to repay

portions of our outstanding credit facilities and the 0.25%

convertible senior notes due in 2026 (the "2026 Notes") early;

these expenses are not reflective of ongoing operating results and

vary in frequency and amount. Adjusted Net Loss also aligns the

timing of inventory valuation adjustments recorded under GAAP to

the period in which the related revenue is recorded in order to

improve the comparability of this measure to our non-GAAP financial

measures of unit economics, as described above. Our calculation of

Adjusted Net Loss does not currently include the tax effects of the

non-GAAP adjustments because our taxes and such tax effects have

not been material to date.

Adjusted EBITDA / Margin

We calculated Adjusted EBITDA as Adjusted Net Loss adjusted for

depreciation and amortization, property financing and other

interest expense, interest income, and income tax expense. Adjusted

EBITDA is a supplemental performance measure that our management

uses to assess our operating performance and the operating leverage

in our business. Adjusted EBITDA Margin is Adjusted EBITDA as a

percentage of revenue.

The following table presents a reconciliation of our Adjusted

Net Loss and Adjusted EBITDA to our net loss, which is the most

directly comparable GAAP measure, for the periods indicated:

| |

|

Three Months Ended |

|

Nine Months

EndedSeptember 30, |

| (in millions,

except percentages) |

|

September 30, 2024 |

|

June 30, 2024 |

|

March 31, 2024 |

|

December 31, 2023 |

|

September 30, 2023 |

|

|

2024 |

|

|

|

|

2023 |

|

|

|

Revenue (GAAP) |

|

$ |

1,377 |

|

|

|

$ |

1,511 |

|

|

|

$ |

1,181 |

|

|

|

$ |

870 |

|

|

|

$ |

980 |

|

|

|

$ |

4,069 |

|

|

|

$ |

6,076 |

|

|

| Net loss

(GAAP) |

|

$ |

(78 |

) |

|

|

$ |

(92 |

) |

|

|

$ |

(109 |

) |

|

|

$ |

(91 |

) |

|

|

$ |

(106 |

) |

|

|

$ |

(279 |

) |

|

|

$ |

(184 |

) |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

25 |

|

|

|

|

33 |

|

|

|

|

33 |

|

|

|

|

32 |

|

|

|

|

31 |

|

|

|

|

91 |

|

|

|

|

94 |

|

|

|

Equity securities fair value adjustment(1) |

|

|

3 |

|

|

|

|

2 |

|

|

|

|

2 |

|

|

|

|

(3 |

) |

|

|

|

11 |

|

|

|

|

7 |

|

|

|

|

4 |

|

|

|

Intangibles amortization expense(2) |

|

|

1 |

|

|

|

|

1 |

|

|

|

|

2 |

|

|

|

|

2 |

|

|

|

|

2 |

|

|

|

|

4 |

|

|

|

|

5 |

|

|

|

Inventory valuation adjustment – Current Period(3)(4) |

|

|

10 |

|

|

|

|

34 |

|

|

|

|

7 |

|

|

|

|

11 |

|

|

|

|

17 |

|

|

|

|

33 |

|

|

|

|

24 |

|

|

|

Inventory valuation adjustment — Prior Periods(3)(5) |

|

|

(16 |

) |

|

|

|

(9 |

) |

|

|

|

(17 |

) |

|

|

|

(17 |

) |

|

|

|

(29 |

) |

|

|

|

(24 |

) |

|

|

|

(450 |

) |

|

|

Restructuring(6) |

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

4 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

10 |

|

|

|

Loss (gain) on extinguishment of debt |

|

|

— |

|

|

|

|

1 |

|

|

|

|

— |

|

|

|

|

(34 |

) |

|

|

|

— |

|

|

|

|

1 |

|

|

|

|

(182 |

) |

|

|

Other(7) |

|

|

(15 |

) |

|

|

|

(1 |

) |

|

|

|

2 |

|

|

|

|

(1 |

) |

|

|

|

(1 |

) |

|

|

|

(14 |

) |

|

|

|

(2 |

) |

|

| Adjusted Net

Loss |

|

$ |

(70 |

) |

|

|

$ |

(31 |

) |

|

|

$ |

(80 |

) |

|

|

$ |

(97 |

) |

|

|

$ |

(75 |

) |

|

|

$ |

(181 |

) |

|

|

$ |

(681 |

) |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization, excluding amortization of

intangibles |

|

|

10 |

|

|

|

|

7 |

|

|

|

|

11 |

|

|

|

|

15 |

|

|

|

|

9 |

|

|

|

|

28 |

|

|

|

|

30 |

|

|

|

Property financing(8) |

|

|

30 |

|

|

|

|

26 |

|

|

|

|

32 |

|

|

|

|

32 |

|

|

|

|

38 |

|

|

|

|

88 |

|

|

|

|

142 |

|

|

|

Other interest expense(9) |

|

|

4 |

|

|

|

|

4 |

|

|

|

|

5 |

|

|

|

|

5 |

|

|

|

|

9 |

|

|

|

|

13 |

|

|

|

|

32 |

|

|

|

Interest income(10) |

|

|

(12 |

) |

|

|

|

(12 |

) |

|

|

|

(18 |

) |

|

|

|

(24 |

) |

|

|

|

(30 |

) |

|

|

|

(42 |

) |

|

|

|

(82 |

) |

|

|

Income tax expense |

|

|

— |

|

|

|

|

1 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

1 |

|

|

|

|

1 |

|

|

| Adjusted

EBITDA |

|

$ |

(38 |

) |

|

|

$ |

(5 |

) |

|

|

$ |

(50 |

) |

|

|

$ |

(69 |

) |

|

|

$ |

(49 |

) |

|

|

$ |

(93 |

) |

|

|

$ |

(558 |

) |

|

| Adjusted EBITDA Margin |

|

|

(2.8 |

) |

% |

|

|

(0.3 |

) |

% |

|

|

(4.2 |

) |

% |

|

|

(7.9 |

) |

% |

|

|

(5.0 |

) |

% |

|

|

(2.3 |

) |

% |

|

|

(9.2 |

) |

% |

________________

|

(1) |

Represents the gains and losses on certain financial instruments,

which are marked to fair value at the end of each period. |

| (2) |

Represents amortization of

acquisition-related intangible assets. The acquired intangible

assets have useful lives ranging from 1 to 5 years and

amortization is expected until the intangible assets are fully

amortized. |

| (3) |

Inventory valuation adjustment

includes adjustments to record real estate inventory at the lower

of its carrying amount or its net realizable value. |

| (4) |

Inventory valuation

adjustment — Current Period is the inventory valuation adjustments

recorded during the period presented associated with homes that

remain in inventory at period end. |

| (5) |

Inventory valuation

adjustment — Prior Periods is the inventory valuation adjustments

recorded in prior periods associated with homes that sold in the

period presented. |

| (6) |

Restructuring costs consist

primarily of severance and employee termination benefits and

bonuses incurred in connection with employees’ roles being

eliminated. |

| (7) |

Includes primarily gain on

deconsolidation, net, sublease income, and income from equity

method investments. |

| (8) |

Includes interest expense on our

non-recourse asset-backed debt facilities. |

| (9) |

Includes amortization of debt

issuance costs and loan origination fees, commitment fees, unused

fees, other interest related costs on our asset-backed debt

facilities, and interest expense related to the 2026 Notes

outstanding. |

| (10) |

Consists mainly of interest

earned on cash, cash equivalents, restricted cash and marketable

securities. |

1 Opendoor has not provided a quantitative reconciliation of

forecasted Contribution Profit (Loss) to forecasted GAAP gross

profit (loss) nor a reconciliation of forecasted Adjusted EBITDA to

forecasted GAAP net income (loss) within this press release because

the Company is unable, without making unreasonable efforts, to

calculate certain reconciling items with confidence. These items

include, but are not limited to, inventory valuation adjustment and

equity securities fair value adjustment. These items, which could

materially affect the computation of forward-looking GAAP gross

profit (loss) and net income (loss), are inherently uncertain and

depend on various factors, some of which are outside of the

Company’s control. For more information regarding the non-GAAP

financial measures discussed in this press release, please see “Use

of Non-GAAP Financial Measures” following the financial tables

below.

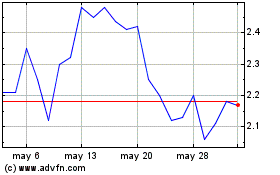

Opendoor Technologies (NASDAQ:OPEN)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Opendoor Technologies (NASDAQ:OPEN)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025