false

0001490349

0001490349

2024-08-06

2024-08-06

0001490349

PFX:CommonStockParValue0.001PerShareMember

2024-08-06

2024-08-06

0001490349

PFX:Sec5.25NotesDue2028Member

2024-08-06

2024-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 6, 2024

PHENIXFIN CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

|

814-00818 |

|

27-4576073 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission file number) |

|

(I.R.S. employer

identification no.) |

| 445

Park Avenue, 10th

Floor, New

York, NY |

|

10022 |

| (Address of principal executive

offices) |

|

(Zip code) |

Registrant’s telephone number, including

area code: (212) 859-0390

Not Applicable

(Former Name

or Former Address, if Changed Since Last Report)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common Stock, par value $0.001 per share |

|

PFX |

|

The NASDAQ Global Market |

| 5.25% Notes due 2028 |

|

PFXNZ |

|

The NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and

Financial Condition.

On August 6, 2024, PhenixFIN Corporation issued

a press release announcing its financial results for the quarter ended June 30, 2024. The press release is included as Exhibit 99.1 to

this Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, PhenixFIN Corporation has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| DATE: August 6, 2024 |

PHENIXFIN CORPORATION |

| |

|

|

| |

/s/ David Lorber |

|

Name: |

David Lorber |

|

Title: |

Chief Executive Officer |

2

Exhibit 99.1

PhenixFIN

Corporation Announces Fiscal Third Quarter 2024 Financial Results

NAV Per Share Grew

14% In Last 12 Months (taking into account the distribution of the Special Dividend)

Expanded Credit Facility

To $87.5 Million

New York, NY, August

6, 2024 -- PhenixFIN Corporation (NASDAQ: PFX, PFXNZ) (the “Company”), a publicly traded business development company, today

announced its financial results for the fiscal third quarter of 2024.

Highlights

| ● | Third

quarter total investment income of $6.2 million; net investment income of $2.0 million |

| ● | Net

asset value (NAV) of $154.2 million, or $76.35 per share as of June 30, 2024, taking into

account the distribution of the special dividend |

| ● | Weighted

average yield is 13.8% on debt and other income producing investments |

| ● | On

August 5, 2024, the Credit Facility was amended to increase the principal amount available

to $87.5 million |

| ● | On

May 9, 2024 the Board of Directors declared a special dividend of $1.31 per share which was

paid on June 10, 2024 to stockholders of record as of May 27, 2024 |

David

Lorber, Chief Executive Officer of the Company, stated:

“We

had a strong quarter with increased investment activity, continued strong credit fundamentals, and a robust weighted average yield for

income producing investments. Our flexible capital solutions continue to provide opportunities for our portfolio companies while we diligently

seek to grow our investment portfolio. This approach allows for a unique portfolio of investments which we believe is well-positioned

to grow our NAV per share.”

Selected

Third Quarter 2024 Financial Results for the Quarter Ended June 30, 2024:

Total investment income

was $6.2 million which was attributable to portfolio interest and dividend income.

Total expenses

were $4.2 million and total net investment income was $2.0 million.

The

Company recorded total realized and unrealized gains of $0.5 million due to the sale of Kemmerer Holdings, LLC.

Portfolio

and Investment Activities for the Quarter Ended June 30, 2024:

The

fair value of the Company’s investment portfolio totaled $233.7 million and consisted of

43 portfolio companies.

Liquidity

and Capital Resources

At

June 30, 2024, the Company had $8.9 million in cash and cash equivalents, $59.1

million in aggregate principal amount of its 5.25% unsecured notes due 2028 and $27.6 million

outstanding under the Credit Facility.

ABOUT

PHENIXFIN CORPORATION

PhenixFIN

Corporation is a non-diversified, internally managed closed-end management investment company incorporated in Delaware that has elected

to be regulated as a business development company under the Investment Company Act of 1940, as amended. We completed our initial public

offering and commenced operations on January 20, 2011. The Company has elected, and intends to qualify annually, to be treated, for U.S.

federal income tax purposes, as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended. Effective

January 1, 2021, the Company operates under an internalized management structure.

Safe

Harbor Statement and Other Disclosures

This

press release contains “forward-looking” statements. Such forward-looking statements reflect current views with respect to

future events and financial performance, and the Company may make related oral forward-looking statements on or following the date hereof.

These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors

could cause actual results and conditions to differ materially from those projected in these forward-looking statements, including among

other things, PhenixFIN’s ability to deliver value to shareholders, make additional acquisitions that provide additional growth

opportunities, increase investment activity, grow the Company, increase net investment income, reduce operating expenses, implement its

investment objective, source and capitalize on investment opportunities, grow its net asset value (NAV) and NAV per share and perform

well in the prevailing market environment, the ability of our portfolio companies to perform well and generate income and other factors

that are enumerated in the Company’s periodic filings with the Securities and Exchange Commission. PhenixFIN Corporation disclaims

and does not undertake any obligation to update or revise any forward-looking statement in this press release.

Past

performance is not a guarantee of future results. The press release contains unaudited financial results. For ease of review, we have

excluded the word “approximately” when rounding the results. This press release is for informational purposes only and is not

an offer to purchase or a solicitation of an offer to sell shares of PhenixFIN Corporation’s common stock. There can be no assurance

that PhenixFIN Corporation will achieve its investment objective.

For PhenixFIN investor relations, please

call 212-859-0390. For media inquiries, please contact info@phenixfc.com.

PHENIXFIN CORPORATION

Consolidated Statements of Assets and Liabilities

| | |

June 30,

2024

(Unaudited) | | |

September 30,

2023 | |

| Assets: | |

| | |

| |

| Investments at fair value | |

| | |

| |

| Non-controlled, non-affiliated investments (amortized cost of $152,515,155 and $134,339,121 respectively) | |

$ | 148,691,260 | | |

$ | 125,531,031 | |

| Affiliated investments (amortized cost of $20,564,242 and $48,233,910, respectively) | |

| 14,407,827 | | |

| 37,289,617 | |

| Controlled investments (amortized cost of $98,034,975 and $82,437,692, respectively) | |

| 70,582,278 | | |

| 63,640,043 | |

| Total Investments at fair value | |

| 233,681,365 | | |

| 226,460,691 | |

| Cash and cash equivalents | |

| 8,866,519 | | |

| 5,988,223 | |

| Receivables: | |

| | | |

| | |

| Interest receivable | |

| 1,715,284 | | |

| 971,115 | |

| Dividends receivable | |

| 215,705 | | |

| 161,479 | |

| Other receivable | |

| 205,984 | | |

| 31,425 | |

| Deferred financing costs | |

| 649,042 | | |

| 699,124 | |

| Due from Affiliate | |

| 451,178 | | |

| 409,214 | |

| Other assets | |

| 410,565 | | |

| 833,000 | |

| Prepaid share repurchase | |

| 101,115 | | |

| 199,019 | |

| Receivable for investments sold | |

| - | | |

| 3,940,175 | |

| Total Assets | |

$ | 246,296,757 | | |

$ | 239,693,465 | |

| | |

| | | |

| | |

| Liabilities: | |

| | | |

| | |

| Credit facility and notes payable (net of debt issuance costs of $1,439,916 and $1,688,835, respectively) | |

$ | 85,294,535 | | |

$ | 84,253,106 | |

| Payable for investments purchased | |

| 1,834,831 | | |

| 4,123,059 | |

| Accounts payable and accrued expenses | |

| 3,789,402 | | |

| 3,066,984 | |

| Interest and fees payable | |

| 520,057 | | |

| 690,398 | |

| Other liabilities | |

| 327,045 | | |

| 432,698 | |

| Administrator expenses payable (see Note 6) | |

| 143,936 | | |

| - | |

| Due to Affiliate | |

| 183,548 | | |

| - | |

| Deferred revenue | |

| - | | |

| 421,685 | |

| Total Liabilities | |

| 92,093,354 | | |

| 92,987,930 | |

| | |

| | | |

| | |

| Commitments and Contingencies (see Note 8) | |

| | | |

| | |

| | |

| | | |

| | |

| Net Assets: | |

| | | |

| | |

| Common Shares, $0.001 par value; 5,000,000 shares authorized; 2,723,709 shares issued; 2,019,778 and 2,073,713 common shares outstanding, respectively | |

| 2,021 | | |

| 2,074 | |

| Capital in excess of par value | |

| 692,441,333 | | |

| 694,812,239 | |

| Total distributable earnings (loss) | |

| (538,239,951 | ) | |

| (548,108,778 | ) |

| Total Net Assets | |

| 154,203,403 | | |

| 146,705,535 | |

| Total Liabilities and Net Assets | |

$ | 246,296,757 | | |

$ | 239,693,465 | |

| | |

| | | |

| | |

| Net Asset Value Per Common Share | |

$ | 76.35 | | |

$ | 70.75 | |

PHENIXFIN CORPORATION

Consolidated Statements of Operations

(Unaudited)

| | |

For the Three Months Ended

June 30, | | |

For the Nine Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Interest Income: | |

| | |

| | |

| | |

| |

| Interest from investments | |

| | |

| | |

| | |

| |

| Non-controlled, non-affiliated investments: | |

| | |

| | |

| | |

| |

| Cash | |

$ | 2,971,965 | | |

$ | 1,794,974 | | |

$ | 7,605,006 | | |

$ | 5,827,756 | |

| Payment in-kind | |

| 231,113 | | |

| 110,477 | | |

| 412,317 | | |

| 336,257 | |

| Affiliated investments: | |

| | | |

| | | |

| | | |

| | |

| Cash | |

| 10,682 | | |

| 652,304 | | |

| 742,858 | | |

| 1,111,785 | |

| Payment in-kind | |

| - | | |

| - | | |

| - | | |

| - | |

| Controlled investments: | |

| | | |

| | | |

| | | |

| | |

| Cash | |

| 650,244 | | |

| 30,610 | | |

| 1,230,510 | | |

| 282,425 | |

| Payment in-kind | |

| 334,398 | | |

| 134,550 | | |

| 603,229 | | |

| 380,287 | |

| Total interest income | |

| 4,198,402 | | |

| 2,722,915 | | |

| 10,593,920 | | |

| 7,938,510 | |

| Dividend income | |

| | | |

| | | |

| | | |

| | |

| Non-controlled, non-affiliated investments | |

| 531,151 | | |

| 1,216,137 | | |

| 1,963,744 | | |

| 2,824,666 | |

| Affiliated investments | |

| - | | |

| - | | |

| - | | |

| - | |

| Controlled investments | |

| 982,903 | | |

| 709,912 | | |

| 3,216,298 | | |

| 2,637,116 | |

| Total dividend income | |

| 1,514,054 | | |

| 1,926,049 | | |

| 5,180,042 | | |

| 5,461,782 | |

| Interest from cash and cash equivalents | |

| 147,127 | | |

| 95,356 | | |

| 387,501 | | |

| 313,053 | |

| Fee income (see Note 9) | |

| 375,363 | | |

| 94,482 | | |

| 453,988 | | |

| 339,136 | |

| Other income | |

| - | | |

| - | | |

| 22 | | |

| 401,986 | |

| Total Investment Income | |

| 6,234,946 | | |

| 4,838,802 | | |

| 16,615,473 | | |

| 14,454,467 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Interest and financing expenses | |

| 1,721,767 | | |

| 1,415,102 | | |

| 4,831,180 | | |

| 4,029,874 | |

| Salaries and benefits | |

| 1,514,872 | | |

| 1,277,797 | | |

| 4,464,372 | | |

| 2,937,420 | |

| Professional fees, net | |

| 432,416 | | |

| 310,878 | | |

| 1,133,120 | | |

| 1,036,024 | |

| General and administrative expenses | |

| 226,903 | | |

| 253,298 | | |

| 862,740 | | |

| 674,456 | |

| Directors fees | |

| 187,500 | | |

| 170,833 | | |

| 562,500 | | |

| 541,333 | |

| Insurance expenses | |

| 95,983 | | |

| 115,654 | | |

| 290,433 | | |

| 361,125 | |

| Administrator expenses (see Note 6) | |

| 75,351 | | |

| 76,351 | | |

| 210,753 | | |

| 232,172 | |

| Total expenses | |

| 4,254,792 | | |

| 3,619,913 | | |

| 12,355,098 | | |

| 9,812,404 | |

| Net Investment Income | |

| 1,980,154 | | |

| 1,218,889 | | |

| 4,260,375 | | |

| 4,642,063 | |

| | |

| | | |

| | | |

| | | |

| | |

| Realized and unrealized gains (losses) on investments | |

| | | |

| | | |

| | | |

| | |

| Non-controlled, non-affiliated investments | |

| 155,419 | | |

| (1,374,437 | ) | |

| 585,977 | | |

| (2,199,059 | ) |

| Affiliated investments | |

| - | | |

| 30,211 | | |

| (1,991,456 | ) | |

| 30,211 | |

| Controlled investments | |

| 8,542,831 | | |

| 858 | | |

| 8,542,831 | | |

| 24,131 | |

| Total net realized gains (losses) | |

| 8,698,250 | | |

| (1,343,368 | ) | |

| 7,137,352 | | |

| (2,144,717 | ) |

| Net change in unrealized gains (losses): | |

| | | |

| | | |

| | | |

| | |

| Non-controlled, non-affiliated investments | |

| 1,823,185 | | |

| 3,907,130 | | |

| 4,984,195 | | |

| 6,233,742 | |

| Affiliated investments | |

| 73,960 | | |

| 2,322,910 | | |

| 4,787,878 | | |

| 3,312,510 | |

| Controlled investments | |

| (9,966,938 | ) | |

| 2,811,099 | | |

| (8,655,048 | ) | |

| 7,533,196 | |

| Total net change in unrealized gains (losses) | |

| (8,069,793 | ) | |

| 9,041,139 | | |

| 1,117,025 | | |

| 17,079,448 | |

| Total realized and unrealized gains (losses) | |

| 628,457 | | |

| 7,697,771 | | |

| 8,254,377 | | |

| 14,934,731 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | |

$ | 2,608,611 | | |

$ | 8,916,660 | | |

$ | 12,514,752 | | |

$ | 19,576,794 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average basic and diluted earnings per common share | |

$ | 1.29 | | |

$ | 4.26 | | |

$ | 6.11 | | |

$ | 9.34 | |

| Weighted average common shares outstanding - basic and diluted (see Note 11) | |

| 2,019,786 | | |

| 2,090,691 | | |

| 2,047,127 | | |

| 2,095,591 | |

4

v3.24.2.u1

Cover

|

Aug. 06, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 06, 2024

|

| Entity File Number |

814-00818

|

| Entity Registrant Name |

PHENIXFIN CORPORATION

|

| Entity Central Index Key |

0001490349

|

| Entity Tax Identification Number |

27-4576073

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

445

Park Avenue

|

| Entity Address, Address Line Two |

10th

Floor

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10022

|

| City Area Code |

212

|

| Local Phone Number |

859-0390

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

PFX

|

| Security Exchange Name |

NASDAQ

|

| 5.25% Notes due 2028 |

|

| Title of 12(b) Security |

5.25% Notes due 2028

|

| Trading Symbol |

PFXNZ

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PFX_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PFX_Sec5.25NotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

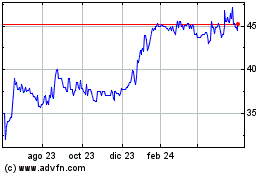

PhenixFIN (NASDAQ:PFX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

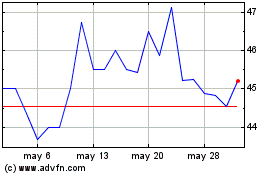

PhenixFIN (NASDAQ:PFX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025