Ultragenyx Pharmaceutical Inc. (NASDAQ: RARE), a biopharmaceutical

company focused on the development and commercialization of novel

therapies for serious rare and ultrarare genetic diseases, today

reported its financial results for the quarter ended June 30, 2024.

“Our strong financial performance in the second quarter was

driven by growing revenue across our commercial therapies from

increasing global demand, leading us to raise our total revenue

guidance for this year,” said Emil D. Kakkis, M.D., Ph.D., chief

executive officer and president of Ultragenyx. “In the quarter, we

also reported positive data from our Phase 1/2 study in Angelman

syndrome, our Phase 2/3 study in osteogenesis imperfecta, and our

Phase 3 study in GSDIa. We are in an excellent position to achieve

additional key milestones in the second half of the year including

initiating our Phase 3 Angelman study and filing for accelerated

approval for UX111 in Sanfilippo syndrome type A.”

Second Quarter 2024 Selected Financial Data Tables and

Financial Results

|

Revenues (dollars in thousands), (unaudited) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Crysvita |

|

|

|

|

|

|

|

|

|

Product sales |

$ |

40,449 |

|

|

$ |

16,884 |

|

|

$ |

76,690 |

|

|

$ |

38,118 |

|

|

Revenue in Profit-Share Territory |

|

67,045 |

|

|

|

61,314 |

|

|

|

107,447 |

|

|

|

111,220 |

|

|

Royalty revenue in European Territory |

|

6,176 |

|

|

|

4,816 |

|

|

|

12,118 |

|

|

|

9,698 |

|

|

Total Crysvita Revenue |

|

113,670 |

|

|

|

83,014 |

|

|

|

196,255 |

|

|

|

159,036 |

|

| Dojolvi |

|

19,355 |

|

|

|

16,491 |

|

|

|

35,717 |

|

|

|

30,794 |

|

| Mepsevii |

|

6,145 |

|

|

|

8,439 |

|

|

|

12,756 |

|

|

|

16,919 |

|

| Evkeeza |

|

7,856 |

|

|

|

365 |

|

|

|

11,131 |

|

|

|

577 |

|

| Daiichi Sankyo |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,479 |

|

|

Total revenues |

$ |

147,026 |

|

|

$ |

108,309 |

|

|

$ |

255,859 |

|

|

$ |

208,805 |

|

| |

|

|

|

|

|

|

|

|

Total RevenuesUltragenyx reported $147 million in total revenue

for the second quarter of 2024, which represents 36% growth

compared to the same period in 2023. Second quarter 2024 Crysvita

revenue was $114 million, which represents 37% growth compared to

the same period in 2023. This includes product sales of $40 million

from Latin America and Turkey, which represents 140% growth

compared to the same period in 2023. Dojolvi revenue in the second

quarter 2024 was $19 million, which represents 17% growth compared

to the same period in 2023. Evkeeza revenue in the second quarter

2024 was $8 million, as demand continues to build in the company’s

territories outside of the United States.

|

|

|

Selected Financial Data (dollars in thousands, except per share

amounts), (unaudited) |

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Total revenues |

$ |

147,026 |

|

|

$ |

108,309 |

|

|

$ |

255,859 |

|

|

$ |

208,805 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Cost of sales |

|

21,280 |

|

|

|

9,914 |

|

|

|

38,813 |

|

|

|

22,171 |

|

|

Research and development |

|

161,503 |

|

|

|

164,949 |

|

|

|

339,990 |

|

|

|

330,647 |

|

|

Selling, general and administrative |

|

80,604 |

|

|

|

81,403 |

|

|

|

158,764 |

|

|

|

158,049 |

|

|

Total operating expenses |

|

263,387 |

|

|

|

256,266 |

|

|

|

537,567 |

|

|

|

510,867 |

|

| Net loss |

$ |

(131,598 |

) |

|

$ |

(159,828 |

) |

|

$ |

(302,282 |

) |

|

$ |

(323,800 |

) |

| Net loss per share, basic and

diluted |

$ |

(1.52 |

) |

|

$ |

(2.25 |

) |

|

$ |

(3.54 |

) |

|

$ |

(4.58 |

) |

|

|

|

|

|

|

|

|

|

Operating Expenses Total operating expenses for the second

quarter of 2024 were $263 million, including non-cash stock-based

compensation of $39 million. In 2024, annual operating expenses are

expected to be stable or to decrease as the company continues to

manage its costs and focus its investment on advancing multiple

Phase 3 programs and executing on commercial product launches.

Net Loss For the second quarter of 2024, Ultragenyx reported net

loss of $132 million, or $1.52 per share basic and diluted,

compared with a net loss for the second quarter of 2023 of $160

million, or $2.25 per share basic and diluted.

Net Cash Used in Operations and Cash BalanceFor the three months

ended June 30, 2024, net cash used in operations was $77 million

and for the six months ended June 30, 2024 it was $268 million.

Cash, cash equivalents, and marketable debt securities were $874

million as of June 30, 2024, which includes $381 million of net

proceeds from issuance of common stock and pre-funded warrants in

connection with an underwritten public offering in June 2024.

2024 Full Year Financial Guidance

- Total revenue guidance increased to be in the range of $530

million to $550 million (previously $500 million to $530

million)

- Crysvita revenue expected to be towards the upper end of the

range of $375 million to $400 million. This includes all regions

where Ultragenyx will recognize revenue: product sales in Latin

America and Turkey, royalties in Europe, which have been ongoing,

and royalties in North America, which began in April 2023.

- Dojolvi revenue in the range of $75 million to $80 million

- Net Cash Used in Operations less than $400 million

Recent Updates and Clinical Milestones

UX143 (setrusumab) monoclonal antibody for Osteogenesis

Imperfecta (OI): 14-month data resulted in a large, sustained 67%

reduction in annualized fracture rate and persistent median

annualized fracture rate of 0.00 (p=0.0014)Positive

14-month results from the Phase 2 portion of the ongoing Phase 2/3

Orbit study demonstrated that, as of the May 24, 2024 data cut-off

date, treatment with setrusumab continued to significantly reduce

incidence of fractures in patients with OI. Treatment with

setrusumab also resulted in ongoing and meaningful improvements in

lumbar spine bone mineral density (BMD) at month 12 without

evidence of plateau.

The median annualized rate of radiologically confirmed fractures

across all 24 patients in the 2 years prior to treatment was 0.72.

Following a mean treatment duration period of 16 months, the median

annualized fracture rate was reduced 67% to 0.00 (p=0.0014; n=24).

The reduction in annualized fracture rates was associated with

continued, clinically meaningful increases in BMD. Treatment with

setrusumab at 12-month demonstrated a mean increase in lumbar spine

BMD from baseline of 22% (p<0.0001, n=19) and an improvement of

mean baseline lumbar spine BMD Z-score from -1.73 to -0.49 at 12

months. The improvements in BMD and Z-scores were significant and

consistent across all OI sub-types studied.

As of the data cut-off, there were no treatment-related serious

adverse events observed in the study and there were no reported

hypersensitivity reactions related to setrusumab.

More detailed 14-month data will be presented at a future

scientific meeting.

GTX-102 antisense oligonucleotide for Angelman syndrome:

Successful End-of-Phase 2 (EOP2) meeting with Food and Drug

Administration (FDA); on track to initiate Phase 3 by the end of

the yearIn July 2024, Ultragenyx completed a successful

EOP2 meeting with the FDA supporting the pivotal Phase 3 Aspire

study design, which will be a global, randomized, double-blind,

sham-controlled trial and will include a 48-week primary efficacy

analysis period enrolling approximately 120 patients with Angelman

syndrome with a genetically confirmed diagnosis of full maternal

UBE3A gene deletion. The primary endpoint will be improvement in

cognition assessed by Bayley-4 cognitive raw score. The key

secondary endpoint will be the Multi-domain Responder Index (MDRI)

across all five domains of cognition, receptive communication,

behavior, gross motor function, and sleep. Individual secondary

endpoints were also discussed and aligned on with the FDA for the

domains of communication, behavior, motor function and sleep.

Additionally, the company plans to initiate Aurora, an open-label

clinical study, to evaluate the safety and efficacy of GTX-102 for

the treatment of patients with other Angelman syndrome genotypes

and in other age groups.

The company has also participated in a PRIME meeting with the

European Medicines Agency, receiving acceptance of the overall

Phase 3 study design, dosing and evaluations and has met with

Japan’s Pharmaceuticals and Medical Devices Agency to inform and

discuss its Phase 3 study design.

The company expects the pivotal Phase 3 Aspire study to start by

the end of 2024 and the Aurora study to start in 2025.

UX701 AAV gene therapy for Wilson disease: Last patient

in Cohort 3 dosed; expect interim Stage 1 data in the second half

of 2024All patients in the three dose-escalation cohorts

of Stage 1 have been dosed. During Stage 1, the safety and efficacy

of UX701 will be evaluated and a dose will be selected for further

evaluation in Stage 2, which is the pivotal, randomized,

placebo-controlled stage of the study. Data from Stage 1 are

expected in the second half of 2024, which will be followed by dose

selection and initiation of Stage 2.

UX111 AAV gene therapy for Sanfilippo syndrome type A

(MPS IIIA): Agreement reached with FDA that cerebral spinal fluid

(CSF) heparan sulfate (HS) can be used as a reasonable surrogate

endpoint for accelerated approvalIn June 2024, Ultragenyx

announced a successful meeting with the FDA during which the

company reached agreement with the FDA that CSF HS is a reasonable

surrogate endpoint that could support submission of a biologics

license application, or BLA, seeking accelerated approval for

UX111. As discussed with the FDA, the BLA filing will be based on

the available data including from the ongoing pivotal Transpher A

study evaluating the safety and efficacy of UX111 in children with

MPS IIIA. The details of a BLA will be finalized with the FDA in a

pre-BLA meeting that is expected to happen in the second half of

2024, with the intent to file the application late this year or

early next year.

DTX401 AAV gene therapy for Glycogen Storage Disease

Type Ia (GSDIa): Positive top-line results from Phase 3 Study

resulted in a statistically significant reduction in daily

cornstarch intake at Week 48 (p<0.0001) with maintenance of

glucose control

In May 2024, Ultragenyx announced positive topline results from

the Phase 3 GlucoGene study for the treatment of patients aged

eight years and older. The study achieved its primary endpoint,

demonstrating that treatment with DTX401 resulted in a

statistically significant and clinically meaningful reduction in

daily cornstarch intake compared with placebo at Week 48. The mean

percent reduction was 41.3% in the DTX401 group (n=20) compared

with 10.3% in the placebo group (n=24) at Week 48 (p<0.0001).

Across patients treated with DTX401, the mean reduction in

cornstarch continued to decline over the 48-week period. In the

treatment group, all patients achieved a reduction in cornstarch,

with 68% achieving ≥30% reduction and 37% achieving ≥50% reduction

compared to the placebo group, which achieved the same reductions

in 13% and 4% of patients, respectively, at Week 48. The study also

successfully met key secondary endpoints of reduction in the number

of cornstarch doses per day and maintenance of glucose control at

Week 48.

Full 48 Week data from the Phase 3 study will be presented at a

scientific conference later this year. These results will be

discussed with regulatory authorities to support a marketing

application in 2025.

DTX301 AAV gene therapy for Ornithine Transcarbamylase

(OTC) Deficiency: Phase 3 study dosing patients; expect enrollment

to be completed in the second half of 2024Ultragenyx is

randomizing and dosing patients in the ongoing Phase 3 study. The

pivotal, 64-week study will include approximately 50 patients,

randomized 1:1 to DTX301 or placebo. The primary endpoints are

response as measured by removal of ammonia-scavenger medications

and protein-restricted diet and change in 24-hour ammonia levels.

Enrollment is currently expected to be completed in the second half

of 2024.

Conference Call and Webcast Information

Ultragenyx will host a conference call today, Thursday, August

1, 2024, at 2 p.m. PT/5 p.m. ET to discuss the second quarter 2024

financial results and provide a corporate update. The live and

replayed webcast of the call will be available through the

company’s website at

https://ir.ultragenyx.com/events-presentations. The replay of the

call will be available for one year.

About Ultragenyx

Ultragenyx is a biopharmaceutical company committed to bringing

novel therapies to patients for the treatment of serious rare and

ultrarare genetic diseases. The company has built a diverse

portfolio of approved medicines and treatment candidates aimed at

addressing diseases with high unmet medical need and clear biology,

for which there are typically no approved therapies treating the

underlying disease.

The company is led by a management team experienced in the

development and commercialization of rare disease therapeutics.

Ultragenyx’s strategy is predicated upon time- and cost-efficient

drug development, with the goal of delivering safe and effective

therapies to patients with the utmost urgency.

For more information on Ultragenyx, please visit the company's

website at: www.ultragenyx.com.

Forward-Looking Statements and Use of Digital

Media

Except for the historical information contained herein, the

matters set forth in this press release, including statements

related to Ultragenyx's expectations and projections regarding its

future operating results and financial performance, anticipated

cost or expense reductions, the timing, progress and plans for its

clinical programs and clinical studies, future regulatory

interactions, and the components and timing of regulatory

submissions are forward-looking statements within the meaning of

the "safe harbor" provisions of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements involve

substantial risks and uncertainties that could cause our clinical

development programs, collaboration with third parties, future

results, performance or achievements to differ significantly from

those expressed or implied by the forward-looking statements. Such

risks and uncertainties include, among others, the uncertainty of

clinical drug development and unpredictability and lengthy process

for obtaining regulatory approvals, risks related to serious or

undesirable side effects of our product candidates, the company’s

ability to achieve its projected development goals in its expected

timeframes, risks related to reliance on third party partners to

conduct certain activities on the company’s behalf, our limited

experience in generating revenue from product sales, risks related

to product liability lawsuits, our dependence on Kyowa Kirin for

the commercial supply of Crysvita, fluctuations in buying or

distribution patterns from distributors and specialty pharmacies,

the transition back to Kyowa Kirin of our exclusive rights to

promote Crysvita in the United States and Canada and unexpected

costs, delays, difficulties or adverse impact to revenue related to

such transition, smaller than anticipated market opportunities for

the company’s products and product candidates, manufacturing risks,

competition from other therapies or products, and other matters

that could affect sufficiency of existing cash, cash equivalents

and short-term investments to fund operations, the company’s future

operating results and financial performance, the timing of clinical

trial activities and reporting results from same, and the

availability or commercial potential of Ultragenyx’s products and

drug candidates. Ultragenyx undertakes no obligation to update or

revise any forward-looking statements.

For a further description of the risks and uncertainties that

could cause actual results to differ from those expressed in these

forward-looking statements, as well as risks relating to the

business of Ultragenyx in general, see Ultragenyx's Quarterly

Report on Form 10-Q filed with the Securities and Exchange

Commission (SEC) on May 3, 2024, and its subsequent periodic

reports filed with the SEC.

In addition to its SEC filings, press releases and public

conference calls, Ultragenyx uses its investor relations website

and social media outlets to publish important information about the

company, including information that may be deemed material to

investors, and to comply with its disclosure obligations under

Regulation FD. Financial and other information about Ultragenyx is

routinely posted and is accessible on Ultragenyx’s Investor

Relations website (https://ir.ultragenyx.com/) and LinkedIn website

(https://www.linkedin.com/company/ultragenyx-pharmaceutical-inc-/mycompany/).

Contacts Ultragenyx Pharmaceutical

Inc.InvestorsJoshua

Higair@ultragenyx.com

|

Ultragenyx Pharmaceutical Inc. |

|

Selected Statement of Operations Financial

Data |

|

(in thousands, except share and per share

amounts) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Statement of Operations Data: |

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

Product sales |

$ |

73,805 |

|

|

$ |

42,179 |

|

|

$ |

136,294 |

|

|

$ |

86,408 |

|

|

Royalty revenue |

|

73,221 |

|

|

|

46,331 |

|

|

|

119,565 |

|

|

|

51,213 |

|

|

Collaboration and license |

|

— |

|

|

|

19,799 |

|

|

|

— |

|

|

|

71,184 |

|

|

Total revenues |

|

147,026 |

|

|

|

108,309 |

|

|

|

255,859 |

|

|

|

208,805 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Cost of sales |

|

21,280 |

|

|

|

9,914 |

|

|

|

38,813 |

|

|

|

22,171 |

|

|

Research and development |

|

161,503 |

|

|

|

164,949 |

|

|

|

339,990 |

|

|

|

330,647 |

|

|

Selling, general and administrative |

|

80,604 |

|

|

|

81,403 |

|

|

|

158,764 |

|

|

|

158,049 |

|

|

Total operating expenses |

|

263,387 |

|

|

|

256,266 |

|

|

|

537,567 |

|

|

|

510,867 |

|

|

Loss from operations |

|

(116,361 |

) |

|

|

(147,957 |

) |

|

|

(281,708 |

) |

|

|

(302,062 |

) |

|

Change in fair value of equity investments |

|

(3,991 |

) |

|

|

261 |

|

|

|

(245 |

) |

|

|

(73 |

) |

|

Non-cash interest expense on liabilities for sales of future

royalties |

|

(15,960 |

) |

|

|

(15,375 |

) |

|

|

(31,807 |

) |

|

|

(31,011 |

) |

|

Other income, net |

|

5,572 |

|

|

|

3,975 |

|

|

|

12,791 |

|

|

|

10,573 |

|

|

Loss before income taxes |

|

(130,740 |

) |

|

|

(159,096 |

) |

|

|

(300,969 |

) |

|

|

(322,573 |

) |

|

Provision for income taxes |

|

(858 |

) |

|

|

(732 |

) |

|

|

(1,313 |

) |

|

|

(1,227 |

) |

|

Net loss |

$ |

(131,598 |

) |

|

$ |

(159,828 |

) |

|

$ |

(302,282 |

) |

|

$ |

(323,800 |

) |

|

Net loss per share, basic and diluted |

$ |

(1.52 |

) |

|

$ |

(2.25 |

) |

|

$ |

(3.54 |

) |

|

$ |

(4.58 |

) |

|

Shares used in computing net loss per share, basic and diluted |

|

86,580,516 |

|

|

|

70,897,991 |

|

|

|

85,433,443 |

|

|

|

70,639,015 |

|

| |

|

|

|

|

|

|

|

|

Ultragenyx Pharmaceutical Inc.Selected

Activity included in Operating Expenses(in

thousands)(unaudited) |

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Non-cash stock-based

compensation |

$ |

39,363 |

|

|

$ |

34,653 |

|

|

$ |

76,297 |

|

|

$ |

66,592 |

|

| UX143 clinical milestone |

|

— |

|

|

$ |

9,000 |

|

|

|

— |

|

|

$ |

9,000 |

|

|

Ultragenyx Pharmaceutical Inc. |

|

Selected Balance Sheet Financial Data |

|

(in thousands) |

|

(unaudited) |

|

|

|

June 30, |

|

December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Balance Sheet Data: |

|

|

|

|

|

Cash, cash equivalents, and marketable debt securities |

|

$ |

874,490 |

|

|

$ |

777,110 |

|

|

Working capital |

|

|

691,774 |

|

|

|

451,747 |

|

|

Total assets |

|

|

1,618,437 |

|

|

|

1,491,013 |

|

|

Total stockholders' equity |

|

|

432,418 |

|

|

|

275,414 |

|

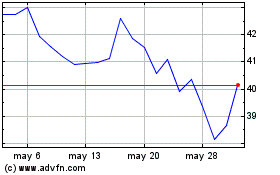

Ultragenyx Pharmaceutical (NASDAQ:RARE)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Ultragenyx Pharmaceutical (NASDAQ:RARE)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024