false000151567300015156732024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 01, 2024 |

Ultragenyx Pharmaceutical Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36276 |

27-2546083 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

60 Leveroni Court |

|

Novato, California |

|

94949 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 415 483-8800 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

RARE |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 1, 2024, Ultragenyx Pharmaceutical Inc. issued a press release announcing its financial results for the three months ended June 30, 2024 (the “Press Release”). A copy of the Press Release is furnished herewith as Exhibit 99.1

The information set forth under Item 2.02 and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Ultragenyx Pharmaceutical Inc. |

|

|

|

|

Date: |

August 1, 2024 |

By: |

/s/ Howard Horn |

|

|

|

Howard Horn

Executive Vice President, Chief Financial Officer, Corporate Strategy |

Exhibit 99.1

Contacts Ultragenyx Pharmaceutical Inc.

Investors

Joshua Higa

ir@ultragenyx.com

Ultragenyx Reports Second Quarter 2024 Financial Results and Corporate Update

Second quarter total revenue of $147 million, Crysvita® revenue of $114 million and Dojolvi® revenue of $19 million

Increased 2024 expected total revenue guidance to $530 million to $550 million

NOVATO, Calif. – August 01, 2024 – Ultragenyx Pharmaceutical Inc. (NASDAQ: RARE), a biopharmaceutical company focused on the development and commercialization of novel therapies for serious rare and ultrarare genetic diseases, today reported its financial results for the quarter ended June 30, 2024.

“Our strong financial performance in the second quarter was driven by growing revenue across our commercial therapies from increasing global demand, leading us to raise our total revenue guidance for this year,” said Emil D. Kakkis, M.D., Ph.D., chief executive officer and president of Ultragenyx. “In the quarter, we also reported positive data from our Phase 1/2 study in Angelman syndrome, our Phase 2/3 study in osteogenesis imperfecta, and our Phase 3 study in GSDIa. We are in an excellent position to achieve additional key milestones in the second half of the year including initiating our Phase 3 Angelman study and filing for accelerated approval for UX111 in Sanfilippo syndrome type A.”

Second Quarter 2024 Selected Financial Data Tables and Financial Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues (dollars in thousands), (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Crysvita |

|

|

|

|

|

|

|

|

|

|

|

Product sales |

$ |

40,449 |

|

|

$ |

16,884 |

|

|

$ |

76,690 |

|

|

$ |

38,118 |

|

Revenue in Profit-Share Territory |

|

67,045 |

|

|

|

61,314 |

|

|

|

107,447 |

|

|

|

111,220 |

|

Royalty revenue in European Territory |

|

6,176 |

|

|

|

4,816 |

|

|

|

12,118 |

|

|

|

9,698 |

|

Total Crysvita Revenue |

|

113,670 |

|

|

|

83,014 |

|

|

|

196,255 |

|

|

|

159,036 |

|

Dojolvi |

|

19,355 |

|

|

|

16,491 |

|

|

|

35,717 |

|

|

|

30,794 |

|

Mepsevii |

|

6,145 |

|

|

|

8,439 |

|

|

|

12,756 |

|

|

|

16,919 |

|

Evkeeza |

|

7,856 |

|

|

|

365 |

|

|

|

11,131 |

|

|

|

577 |

|

Daiichi Sankyo |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,479 |

|

Total revenues |

$ |

147,026 |

|

|

$ |

108,309 |

|

|

$ |

255,859 |

|

|

$ |

208,805 |

|

Total Revenues

Ultragenyx reported $147 million in total revenue for the second quarter of 2024, which represents 36% growth compared to the same period in 2023. Second quarter 2024 Crysvita revenue was $114 million, which represents 37% growth compared to the same period in 2023. This includes product sales of $40 million from Latin America and Turkey, which represents 140% growth compared to the same period in 2023. Dojolvi revenue in the second quarter 2024 was $19 million, which represents 17% growth compared to the same period in 2023. Evkeeza revenue in the second quarter 2024 was $8 million, as demand continues to build in the company's territories outside of the United States.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Financial Data (dollars in thousands, except per share amounts), (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Total revenues |

$ |

147,026 |

|

|

$ |

108,309 |

|

|

$ |

255,859 |

|

|

$ |

208,805 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

21,280 |

|

|

|

9,914 |

|

|

|

38,813 |

|

|

|

22,171 |

|

Research and development |

|

161,503 |

|

|

|

164,949 |

|

|

|

339,990 |

|

|

|

330,647 |

|

Selling, general and administrative |

|

80,604 |

|

|

|

81,403 |

|

|

|

158,764 |

|

|

|

158,049 |

|

Total operating expenses |

|

263,387 |

|

|

|

256,266 |

|

|

|

537,567 |

|

|

|

510,867 |

|

Net loss |

$ |

(131,598 |

) |

|

$ |

(159,828 |

) |

|

$ |

(302,282 |

) |

|

$ |

(323,800 |

) |

Net loss per share, basic and diluted |

$ |

(1.52 |

) |

|

$ |

(2.25 |

) |

|

$ |

(3.54 |

) |

|

$ |

(4.58 |

) |

Operating Expenses

Total operating expenses for the second quarter of 2024 were $263 million, including non-cash stock-based compensation of $39 million. In 2024, annual operating expenses are expected to be stable or to decrease as the company continues to manage its costs and focus its investment on advancing multiple Phase 3 programs and executing on commercial product launches.

Net Loss

For the second quarter of 2024, Ultragenyx reported net loss of $132 million, or $1.52 per share basic and diluted, compared with a net loss for the second quarter of 2023 of $160 million, or $2.25 per share basic and diluted.

Net Cash Used in Operations and Cash Balance

For the three months ended June 30, 2024, net cash used in operations was $77 million and for the six months ended June 30, 2024 it was $268 million. Cash, cash equivalents, and marketable debt securities were $874 million as of June 30, 2024, which includes $381 million of net proceeds from issuance of common stock and pre-funded warrants in connection with an underwritten public offering in June 2024.

2024 Full Year Financial Guidance

•Total revenue guidance increased to be in the range of $530 million to $550 million (previously $500 million to $530 million)

•Crysvita revenue expected to be towards the upper end of the range of $375 million to $400 million. This includes all regions where Ultragenyx will recognize revenue: product sales in Latin America and Turkey, royalties in Europe, which have been ongoing, and royalties in North America, which began in April 2023.

•Dojolvi revenue in the range of $75 million to $80 million

•Net Cash Used in Operations less than $400 million

Recent Updates and Clinical Milestones

UX143 (setrusumab) monoclonal antibody for Osteogenesis Imperfecta (OI): 14-month data resulted in a large, sustained 67% reduction in annualized fracture rate and persistent median annualized fracture rate of 0.00 (p=0.0014)

Positive 14-month results from the Phase 2 portion of the ongoing Phase 2/3 Orbit study demonstrated that, as of the May 24, 2024 data cut-off date, treatment with setrusumab continued to significantly reduce incidence of fractures in patients with OI. Treatment with setrusumab also resulted in ongoing and meaningful improvements in lumbar spine bone mineral density (BMD) at month 12 without evidence of plateau.

The median annualized rate of radiologically confirmed fractures across all 24 patients in the 2 years prior to treatment was 0.72. Following a mean treatment duration period of 16 months, the median annualized fracture rate was reduced 67% to 0.00 (p=0.0014; n=24). The reduction in annualized fracture rates was associated with continued, clinically meaningful increases in BMD. Treatment with setrusumab at 12-month demonstrated a mean increase in lumbar spine BMD from baseline of 22% (p<0.0001, n=19) and an improvement of mean baseline lumbar spine BMD Z-score from -1.73 to -0.49 at 12 months. The improvements in BMD and Z-scores were significant and consistent across all OI sub-types studied.

As of the data cut-off, there were no treatment-related serious adverse events observed in the study and there were no reported hypersensitivity reactions related to setrusumab.

More detailed 14-month data will be presented at a future scientific meeting.

GTX-102 antisense oligonucleotide for Angelman syndrome: Successful End-of-Phase 2 (EOP2) meeting with Food and Drug Administration (FDA); on track to initiate Phase 3 by the end of the year

In July 2024, Ultragenyx completed a successful EOP2 meeting with the FDA supporting the pivotal Phase 3 Aspire study design, which will be a global, randomized, double-blind, sham-controlled trial and will include a 48-week primary efficacy analysis period enrolling

approximately 120 patients with Angelman syndrome with a genetically confirmed diagnosis of full maternal UBE3A gene deletion. The primary endpoint will be improvement in cognition assessed by Bayley-4 cognitive raw score. The key secondary endpoint will be the Multi-domain Responder Index (MDRI) across all five domains of cognition, receptive communication, behavior, gross motor function, and sleep. Individual secondary endpoints were also discussed and aligned on with the FDA for the domains of communication, behavior, motor function and sleep. Additionally, the company plans to initiate Aurora, an open-label clinical study, to evaluate the safety and efficacy of GTX-102 for the treatment of patients with other Angelman syndrome genotypes and in other age groups.

The company has also participated in a PRIME meeting with the European Medicines Agency, receiving acceptance of the overall Phase 3 study design, dosing and evaluations and has met with Japan’s Pharmaceuticals and Medical Devices Agency to inform and discuss its Phase 3 study design.

The company expects the pivotal Phase 3 Aspire study to start by the end of 2024 and the Aurora study to start in 2025.

UX701 AAV gene therapy for Wilson disease: Last patient in Cohort 3 dosed; expect interim Stage 1 data in the second half of 2024

All patients in the three dose-escalation cohorts of Stage 1 have been dosed. During Stage 1, the safety and efficacy of UX701 will be evaluated and a dose will be selected for further evaluation in Stage 2, which is the pivotal, randomized, placebo-controlled stage of the study. Data from Stage 1 are expected in the second half of 2024, which will be followed by dose selection and initiation of Stage 2.

UX111 AAV gene therapy for Sanfilippo syndrome type A (MPS IIIA): Agreement reached with FDA that cerebral spinal fluid (CSF) heparan sulfate (HS) can be used as a reasonable surrogate endpoint for accelerated approval

In June 2024, Ultragenyx announced a successful meeting with the FDA during which the company reached agreement with the FDA that CSF HS is a reasonable surrogate endpoint that could support submission of a biologics license application, or BLA, seeking accelerated approval for UX111. As discussed with the FDA, the BLA filing will be based on the available data including from the ongoing pivotal Transpher A study evaluating the safety and efficacy of UX111 in children with MPS IIIA. The details of a BLA will be finalized with the FDA in a pre-BLA meeting that is expected to happen in the second half of 2024, with the intent to file the application late this year or early next year.

DTX401 AAV gene therapy for Glycogen Storage Disease Type Ia (GSDIa): Positive top-line results from Phase 3 Study resulted in a statistically significant reduction in daily cornstarch intake at Week 48 (p<0.0001) with maintenance of glucose control

In May 2024, Ultragenyx announced positive topline results from the Phase 3 GlucoGene study for the treatment of patients aged eight years and older. The study achieved its primary endpoint, demonstrating that treatment with DTX401 resulted in a statistically significant and clinically meaningful reduction in daily cornstarch intake compared with placebo at Week 48. The mean percent reduction was 41.3% in the DTX401 group (n=20) compared with 10.3% in the placebo group (n=24) at Week 48 (p<0.0001). Across patients treated with DTX401, the mean reduction in cornstarch continued to decline over the 48-week period. In the treatment group, all patients achieved a reduction in cornstarch, with 68% achieving ≥30% reduction and 37% achieving ≥50% reduction compared to the placebo group, which achieved the same reductions in 13% and 4% of patients, respectively, at Week 48. The study also successfully met key secondary endpoints of reduction in the number of cornstarch doses per day and maintenance of glucose control at Week 48.

Full 48 Week data from the Phase 3 study will be presented at a scientific conference later this year. These results will be discussed with regulatory authorities to support a marketing application in 2025.

DTX301 AAV gene therapy for Ornithine Transcarbamylase (OTC) Deficiency: Phase 3 study dosing patients; expect enrollment to be completed in the second half of 2024

Ultragenyx is randomizing and dosing patients in the ongoing Phase 3 study. The pivotal, 64-week study will include approximately 50 patients, randomized 1:1 to DTX301 or placebo. The primary endpoints are response as measured by removal of ammonia-scavenger medications and protein-restricted diet and change in 24-hour ammonia levels. Enrollment is currently expected to be completed in the second half of 2024.

Conference Call and Webcast Information

Ultragenyx will host a conference call today, Thursday, August 1, 2024, at 2 p.m. PT/5 p.m. ET to discuss the second quarter 2024 financial results and provide a corporate update. The live and replayed webcast of the call will be available through the company’s website at https://ir.ultragenyx.com/events-presentations. The replay of the call will be available for one year.

About Ultragenyx

Ultragenyx is a biopharmaceutical company committed to bringing novel therapies to patients for the treatment of serious rare and ultrarare genetic diseases. The company has built a diverse portfolio of approved medicines and treatment candidates aimed at addressing diseases with high unmet medical need and clear biology, for which there are typically no approved therapies treating the underlying disease.

The company is led by a management team experienced in the development and commercialization of rare disease therapeutics. Ultragenyx’s strategy is predicated upon time- and cost-efficient drug development, with the goal of delivering safe and effective therapies to patients with the utmost urgency.

For more information on Ultragenyx, please visit the company's website at: www.ultragenyx.com.

Forward-Looking Statements and Use of Digital Media

Except for the historical information contained herein, the matters set forth in this press release, including statements related to Ultragenyx's expectations and projections regarding its future operating results and financial performance, anticipated cost or expense reductions, the timing, progress and plans for its clinical programs and clinical studies, future regulatory interactions, and the components and timing of regulatory submissions are forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve substantial risks and uncertainties that could cause our clinical development programs, collaboration with third parties, future results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, the uncertainty of clinical drug development and unpredictability and lengthy process for obtaining regulatory approvals, risks related to serious or undesirable side effects of our product candidates, the company’s ability to achieve its projected development goals in its expected timeframes, risks related to reliance on third party partners to conduct certain activities on the company’s behalf, our limited experience in generating revenue from product sales, risks related to product liability lawsuits, our dependence on Kyowa Kirin for the commercial supply of Crysvita, fluctuations in buying or distribution patterns from distributors and specialty pharmacies, the transition back to Kyowa Kirin of our exclusive rights to promote Crysvita in the United States and Canada and unexpected costs, delays, difficulties or adverse impact to revenue related to such transition, smaller than anticipated market opportunities for the company’s products and product candidates, manufacturing risks, competition from other therapies or products, and other matters that could affect sufficiency of existing cash, cash equivalents and short-term investments to fund operations, the company’s future operating results and financial performance, the timing of clinical trial activities and reporting results from same, and the availability or commercial potential of Ultragenyx’s products and drug candidates. Ultragenyx undertakes no obligation to update or revise any forward-looking statements.

For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of Ultragenyx in general, see Ultragenyx's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (SEC) on May 3, 2024, and its subsequent periodic reports filed with the SEC.

In addition to its SEC filings, press releases and public conference calls, Ultragenyx uses its investor relations website and social media outlets to publish important information about the company, including information that may be deemed material to investors, and to comply with its disclosure obligations under Regulation FD. Financial and other information about Ultragenyx is routinely posted and is accessible on Ultragenyx’s Investor Relations website (https://ir.ultragenyx.com/) and LinkedIn website (https://www.linkedin.com/company/ultragenyx-pharmaceutical-inc-/mycompany/).

###

Ultragenyx Pharmaceutical Inc.

Selected Statement of Operations Financial Data

(in thousands, except share and per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

2024 |

|

|

2023 |

|

2024 |

|

|

2023 |

|

Statement of Operations Data: |

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

Product sales |

$ |

73,805 |

|

|

$ |

42,179 |

|

$ |

136,294 |

|

|

$ |

86,408 |

|

Royalty revenue |

|

73,221 |

|

|

|

46,331 |

|

|

119,565 |

|

|

|

51,213 |

|

Collaboration and license |

|

— |

|

|

|

19,799 |

|

|

— |

|

|

|

71,184 |

|

Total revenues |

|

147,026 |

|

|

|

108,309 |

|

|

255,859 |

|

|

|

208,805 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

21,280 |

|

|

|

9,914 |

|

|

38,813 |

|

|

|

22,171 |

|

Research and development |

|

161,503 |

|

|

|

164,949 |

|

|

339,990 |

|

|

|

330,647 |

|

Selling, general and administrative |

|

80,604 |

|

|

|

81,403 |

|

|

158,764 |

|

|

|

158,049 |

|

Total operating expenses |

|

263,387 |

|

|

|

256,266 |

|

|

537,567 |

|

|

|

510,867 |

|

Loss from operations |

|

(116,361 |

) |

|

|

(147,957 |

) |

|

(281,708 |

) |

|

|

(302,062 |

) |

Change in fair value of equity investments |

|

(3,991 |

) |

|

|

261 |

|

|

(245 |

) |

|

|

(73 |

) |

Non-cash interest expense on liabilities for sales of future royalties |

|

(15,960 |

) |

|

|

(15,375 |

) |

|

(31,807 |

) |

|

|

(31,011 |

) |

Other income, net |

|

5,572 |

|

|

|

3,975 |

|

|

12,791 |

|

|

|

10,573 |

|

Loss before income taxes |

|

(130,740 |

) |

|

|

(159,096 |

) |

|

(300,969 |

) |

|

|

(322,573 |

) |

Provision for income taxes |

|

(858 |

) |

|

|

(732 |

) |

|

(1,313 |

) |

|

|

(1,227 |

) |

Net loss |

$ |

(131,598 |

) |

|

$ |

(159,828 |

) |

$ |

(302,282 |

) |

|

$ |

(323,800 |

) |

Net loss per share, basic and diluted |

$ |

(1.52 |

) |

|

$ |

(2.25 |

) |

$ |

(3.54 |

) |

|

$ |

(4.58 |

) |

Shares used in computing net loss per share, basic and diluted |

|

86,580,516 |

|

|

|

70,897,991 |

|

|

85,433,443 |

|

|

|

70,639,015 |

|

Ultragenyx Pharmaceutical Inc.

Selected Activity included in Operating Expenses

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Non-cash stock-based compensation |

$ |

39,363 |

|

|

$ |

34,653 |

|

|

$ |

76,297 |

|

|

$ |

66,592 |

|

UX143 clinical milestone |

|

— |

|

|

$ |

9,000 |

|

|

|

— |

|

|

$ |

9,000 |

|

Ultragenyx Pharmaceutical Inc.

Selected Balance Sheet Financial Data

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

2024 |

|

|

2023 |

|

Balance Sheet Data: |

|

|

|

|

|

Cash, cash equivalents, and marketable debt securities |

$ |

874,490 |

|

|

$ |

777,110 |

|

Working capital |

|

691,774 |

|

|

|

451,747 |

|

Total assets |

|

1,618,437 |

|

|

|

1,491,013 |

|

Total stockholders' equity |

|

432,418 |

|

|

|

275,414 |

|

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

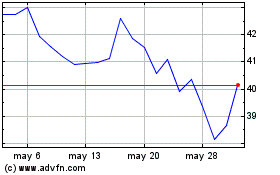

Ultragenyx Pharmaceutical (NASDAQ:RARE)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Ultragenyx Pharmaceutical (NASDAQ:RARE)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024