0001637715false00016377152024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 7, 2024 |

Reneo Pharmaceuticals, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40315 |

47-2309515 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

18575 Jamboree Road, Suite 275-S |

|

Irvine, California |

|

92612 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 858 283-0280 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.0001 per share |

|

RPHM |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 7, 2024, Reneo Pharmaceuticals, Inc. (the "Company") issued a press release reporting the Company’s financial results for the first quarter ended March 31, 2024 and providing a business update. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 of this Current Report on 8-K (including Exhibit 99.1) is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information shall not be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company, whether made before or after today’s date, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific references in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Reneo Pharmaceuticals, Inc. |

|

|

|

|

Date: |

May 7, 2024 |

By: |

/s/ Gregory J. Flesher |

|

|

|

Gregory J. Flesher

President and Chief Executive Officer

(Principal Executive Officer) |

Exhibit 99.1

Reneo Pharmaceuticals Reports First Quarter 2024 Financial Results

IRVINE, Calif., May 7, 2024 (GLOBE NEWSWIRE) -- Reneo Pharmaceuticals, Inc. (Nasdaq: RPHM), a pharmaceutical company historically focused on the development and commercialization of therapies for patients with rare genetic mitochondrial diseases, today reported financial results for the first quarter ended March 31, 2024.

First Quarter and Recent Highlights

•In December 2023, the pivotal STRIDE study of mavodelpar in adult patients with primary mitochondrial myopathies did not meet its primary efficacy or secondary efficacy endpoints

•The Company implemented cost savings initiatives, including suspension of all mavodelpar development activities and a total workforce reduction of approximately 90%

•The Company retained an independent financial advisor to initiate a formal process to evaluate potential strategic alternatives

Financial Results for Three Months Ended March 31, 2024

We reported a net loss of $8.4 million, or $0.25 per share, during the first quarter of 2024, compared to a net loss of $15.1 million, or $0.60 per share, for the same period in 2023. We had $82.8 million in cash, cash equivalents, and short-term investments as of March 31, 2024.

Research and development expenses were $4.9 million during the first quarter of 2024, compared to $11.0 million for the same period in 2023. This decrease was primarily due to the suspension of development activities for mavodelpar and cash preservation activities, including workforce reductions December 2023 and February 2024.

General and administrative expenses were $4.6 million during the first quarter of 2024, compared to $5.1 million for the same period in 2023. This decrease was primarily due to the workforce reductions in December 2023 and February 2024.

About Reneo Pharmaceuticals

Reneo is a pharmaceutical company historically focused on the development and commercialization of therapies for patients with rare genetic mitochondrial diseases, which are often associated with the inability of mitochondria to produce adenosine triphosphate. For additional information, please see reneopharma.com.

Forward-Looking Statements

Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include statements regarding, among other things, the evaluation of strategic alternatives and the implementation of cost savings initiatives. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “plans,” “will,” “believes,” “anticipates,” “expects,” “intends,” “goal,” “potential” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon Reneo’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, risks and uncertainties associated with Reneo’s business in general, and the other risks described in Reneo’s filings with the Securities and Exchange Commission. All forward-looking statements contained in this press release speak only as of the date on which they were made. Reneo undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

RENEO PHARMACEUTICALS, INC.

Consolidated Balance Sheets

(In thousands, except share and par value data)

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

|

|

(Unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

20,375 |

|

|

$ |

27,632 |

|

Short-term investments |

|

|

62,460 |

|

|

|

75,331 |

|

Prepaid expenses and other current assets |

|

|

1,092 |

|

|

|

3,659 |

|

Total current assets |

|

|

83,927 |

|

|

|

106,622 |

|

Property and equipment, net |

|

|

102 |

|

|

|

134 |

|

Right-of-use assets |

|

|

546 |

|

|

|

599 |

|

Other non-current assets |

|

|

64 |

|

|

|

81 |

|

Total assets |

|

$ |

84,639 |

|

|

$ |

107,436 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

676 |

|

|

$ |

8,717 |

|

Accrued expenses |

|

|

1,807 |

|

|

|

9,129 |

|

Operating lease liabilities, current portion |

|

|

331 |

|

|

|

331 |

|

Total current liabilities |

|

|

2,814 |

|

|

|

18,177 |

|

Operating lease liabilities, less current portion |

|

|

576 |

|

|

|

642 |

|

Performance award |

|

|

7 |

|

|

|

7 |

|

Total liabilities |

|

|

3,397 |

|

|

|

18,826 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Common stock, $0.0001 par value; 200,000,000 shares authorized at

March 31, 2024 and December 31, 2023; 33,420,808 shares

issued and outstanding at March 31, 2024 and December 31, 2023 |

|

|

3 |

|

|

|

3 |

|

Additional paid-in capital |

|

|

308,151 |

|

|

|

307,073 |

|

Accumulated deficit |

|

|

(226,900 |

) |

|

|

(218,474 |

) |

Accumulated other comprehensive (loss) income |

|

|

(12 |

) |

|

|

8 |

|

Total stockholders’ equity |

|

|

81,242 |

|

|

|

88,610 |

|

Total liabilities and stockholders’ equity |

|

$ |

84,639 |

|

|

$ |

107,436 |

|

RENEO PHARMACEUTICALS, INC.

Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

$ |

4,942 |

|

|

$ |

10,991 |

|

General and administrative |

|

|

4,622 |

|

|

|

5,132 |

|

Total operating expenses |

|

|

9,564 |

|

|

|

16,123 |

|

Loss from operations |

|

|

(9,564 |

) |

|

|

(16,123 |

) |

Other income |

|

|

1,138 |

|

|

|

1,016 |

|

Net loss |

|

|

(8,426 |

) |

|

|

(15,107 |

) |

Unrealized (loss) gain on short-term investments |

|

|

(20 |

) |

|

|

55 |

|

Comprehensive loss |

|

$ |

(8,446 |

) |

|

$ |

(15,052 |

) |

Net loss per share attributable to common stockholders,

basic and diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.60 |

) |

Weighted-average shares used in computing net

loss per share, basic and diluted |

|

|

33,420,808 |

|

|

|

25,036,410 |

|

RENEO PHARMACEUTICALS, INC.

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities |

|

|

|

|

|

|

Net loss |

|

$ |

(8,426 |

) |

|

$ |

(15,107 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Stock-based compensation |

|

|

1,078 |

|

|

|

1,157 |

|

Depreciation and amortization |

|

|

16 |

|

|

|

41 |

|

Amortization/accretion on short-term investments |

|

|

(906 |

) |

|

|

(770 |

) |

Changes in the fair value of performance award |

|

|

— |

|

|

|

295 |

|

Non-cash lease expense |

|

|

67 |

|

|

|

120 |

|

Loss on disposal of fixed asset |

|

|

16 |

|

|

|

3 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Prepaid and other assets |

|

|

2,584 |

|

|

|

1,952 |

|

Accounts payable and accrued expenses |

|

|

(15,363 |

) |

|

|

3,398 |

|

Operating lease liabilities |

|

|

(80 |

) |

|

|

(137 |

) |

Net cash used in operating activities |

|

|

(21,014 |

) |

|

|

(9,048 |

) |

Cash flows from investing activities |

|

|

|

|

|

|

Purchases of property and equipment |

|

|

— |

|

|

|

(172 |

) |

Purchase of available-for-sale short-term investments |

|

|

(45,243 |

) |

|

|

(28,321 |

) |

Proceeds from maturities of available-for-sale short-term investments |

|

|

59,000 |

|

|

|

47,000 |

|

Net cash provided by investing activities |

|

|

13,757 |

|

|

|

18,507 |

|

Cash flows from financing activities |

|

|

|

|

|

|

Proceeds from issuance of common stock under the at-the-market

facility, net of offering costs |

|

|

— |

|

|

|

1,009 |

|

Net cash provided by financing activities |

|

|

— |

|

|

|

1,009 |

|

Net (decrease) increase in cash and cash equivalents |

|

|

(7,257 |

) |

|

|

10,468 |

|

Cash and cash equivalents, beginning of period |

|

|

27,632 |

|

|

|

19,927 |

|

Cash and cash equivalents, end of period |

|

$ |

20,375 |

|

|

$ |

30,395 |

|

Contact:

Danielle Spangler

Investor Relations

Reneo Pharmaceuticals, Inc.

dspangler@reneopharma.com

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

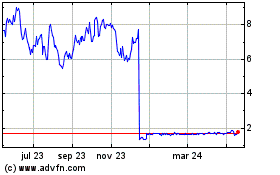

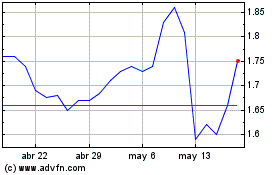

Reneo Pharmaceuticals (NASDAQ:RPHM)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Reneo Pharmaceuticals (NASDAQ:RPHM)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024