Current Report Filing (8-k)

12 Junio 2023 - 6:30AM

Edgar (US Regulatory)

false

0000743238

0000743238

2023-06-07

2023-06-07

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 7, 2023

THE SHYFT GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Michigan

|

001-33582

|

38-2078923

|

|

(State or Other Jurisdiction

|

(Commission File No.)

|

(IRS Employer

|

|

of Incorporation)

|

|

Identification No.)

|

| |

|

|

41280 Bridge Street, Novi, Michigan

|

48375

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

| |

517-543-6400

|

|

| |

(Registrant's Telephone Number, Including Area Code)

|

|

Not Applicable

(Former Name or Former Address, if changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Section Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a‑12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

SHYF

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

The Shyft Group, Inc. (“Shyft” or the “Company”) is implementing a transition process for the office of President and Chief Executive Officer (“CEO”). On June 7, 2023, the Company and its current CEO, Daryl M. Adams, reached agreement on the commencement of the CEO succession process and Mr. Adams’ role in the transition process.

The Company’s Board of Directors has initiated a search for the Company’s next CEO. Mr. Adams is expected to continue to serve as CEO until his successor joins the Company, at which time Mr. Adams will resign from the Company’s Board of Directors and will transition to non-executive employment with the Company as a special advisor to assist the CEO successor with transition matters for six months. After the conclusion of his special advisor service, Mr. Adams’ employment with the Company will end in a manner constituting a “Qualifying Termination” for purposes of the Company’s Executive Severance Plan.

In connection with this executive transition, Mr. Adams will receive base salary for his special advisor service equal to 50% of his CEO base salary rate. After the end of Mr. Adams’ special advisor service, he will receive (in exchange for a release of claims and continued compliance with applicable restrictive covenants) the compensation and benefits that the Company is obligated to provide to him under its existing severance arrangements, including: 18 months of CEO-level base salary continuation; pro-rata annual cash incentive payout at target for the applicable year (if at least threshold achievement is attained); up to 18 months of COBRA premium coverage; accelerated vesting of his time-based restricted stock unit awards; pro-rata continued vesting based on actual performance of his performance-based restricted stock unit awards; and 12 months of outplacement services. Mr. Adams will also be reimbursed for reasonable legal fees and expenses in connection with this arrangement up to $25,000. On June 9, 2023, the Company and Mr. Adams entered into a Transition and Separation Agreement to memorialize the terms of this arrangement.

Item 7.01 Regulation FD Disclosure

A copy of the Company’s press release regarding the implementation of a transition process for the CEO is attached hereto as Exhibit 99.1. The information furnished herewith pursuant to this Item 7.01 of this Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

| |

|

|

| |

99.1

|

|

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

THE SHYFT GROUP, INC.

|

|

Dated: June 12, 2023

|

|

/s/ Joshua A. Sherbin

|

| |

|

By: Joshua A. Sherbin

|

| |

|

Its: Chief Legal Officer and Corporate Secretary

|

| |

|

|

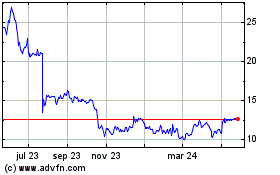

Shyft (NASDAQ:SHYF)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

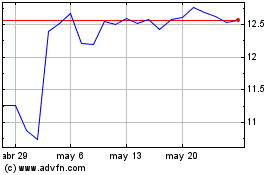

Shyft (NASDAQ:SHYF)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024