0000876883false00008768832024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported) — November 7, 2024

Stagwell Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 001-13718 | 86-1390679 |

| (Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

One World Trade Center, Floor 65, New York, NY 10007

(Address of principal executive offices and zip code)

(646) 429-1800

(Registrant’s Telephone Number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

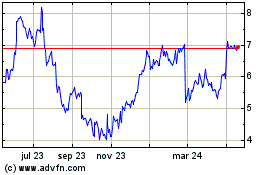

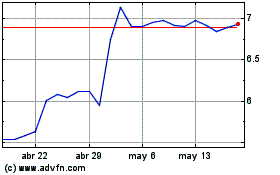

Class A Common Stock, $0.001 par value | STGW | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On November 7, 2024, Stagwell Inc. (the “Company”) issued an earnings release reporting its financial results for the three and nine months ended September 30, 2024. A copy of this earnings release is attached as Exhibit 99.1 hereto. Following the issuance of this earnings release, the Company will host an earnings call in which its financial results for the three and nine months ended September 30, 2024 will be discussed. The investor presentation to be used for the call is attached as Exhibit 99.2 hereto.

The Company has posted the materials attached as Exhibit 99.1, and 99.2 on its website (www.stagwellglobal.com). The information found on, or otherwise accessible through, the Company’s website is not incorporated into, and does not form a part of, this Current Report on Form 8-K.

The foregoing information (including the exhibits hereto) is being furnished under “Item 2.02 - Results of Operations and Financial Condition”. Such information (including the exhibits hereto) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

The foregoing information and the exhibits hereto contain forward-looking statements within the meaning of the federal securities laws. These statements are based on present expectations, and are subject to the limitations listed therein and in the Company’s other SEC reports, including that actual events or results may differ materially from those in the forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: November 7, 2024 | Stagwell Inc. |

| | |

| By: | /s/ Frank Lanuto |

| | Frank Lanuto |

| | Chief Financial Officer |

`

`

FOR IMMEDIATE ISSUE

STAGWELL INC. (NASDAQ: STGW) REPORTS RESULTS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024

Q3 YoY Revenue Growth of 15%, With 25% Growth in Digital Transformation

Q3 YoY Net Revenue Growth of 8%, Organic Net Revenue Growth of 8%, Digital Transformation Net Revenue Growth of 18%

Q3 Net Income Attributable to Stagwell Inc. Common Shareholders of $3 million

Q3 Adjusted EBITDA of $111 million; Adjusted EBITDA Margin of 19%

Q3 EPS of $0.03; Adjusted EPS of $0.22

Seventh Consecutive Quarter of Record LTM Net New Business

Net New Business of $101 million in Q3; LTM Net New Business of $345 million

Reaffirm Guidance for 2024 of Organic Net Revenue Growth of 5% to 7%; Adjusted EBITDA of $400 million to $450 million; Free Cash Flow Conversion of ~50%

Company Announces $125 Million Increase in Stock Repurchase Program

New York, NY, November 7, 2024 (NASDAQ: STGW) – Stagwell Inc. (“Stagwell”) today announced financial results for the three and nine months ended September 30, 2024.

THIRD QUARTER RESULTS:

•Q3 Revenue of $711 million, an increase of 15% versus the prior year period; YTD Revenue of $2.1 billion, an increase of 10% versus the prior year period

•Q3 Net Revenue of $580 million, an increase of 8% versus the prior year period; YTD Net Revenue of $1.7 billion, an increase of 4% versus the prior year period

•Q3 Organic Net Revenue increased 8% versus the prior year period; YTD Organic Net Revenue increased 4% versus the prior year period

•Q3 Net Income attributable to Stagwell Inc. Common Shareholders of $3 million versus $1 million in the prior year period; YTD Net Loss attributable to Stagwell Inc. Common Shareholders of $1 million versus $1 million in the prior year period

•Q3 Adjusted EBITDA of $111 million, an increase of 9% versus the prior year period; YTD Adjusted EBITDA of $288 million, an increase of 8% versus the prior year period

`

`•Q3 Adjusted EBITDA Margin of 19% on net revenue; YTD Adjusted EBITDA Margin of 17% on net revenue

•Q3 Earnings Per Share Attributable to Stagwell Inc. Common Shareholders of $0.03 versus $0.00 in the prior year period; YTD Earnings Per Share Attributable to Stagwell Inc. Common Shareholders of $(0.01) versus $(0.01) in the prior year period

•Q3 Adjusted Earnings Per Share attributable to Stagwell Inc. Common Shareholders of $0.22 versus $0.18 in the prior year period; YTD Adjusted Earnings Per Share attributable to Stagwell Inc. Common Shareholders of $0.52 versus $0.45 in the prior year period

•Net new business of $101 million in the third quarter, last twelve-month net new business of $345 million

See “Non-GAAP Financial Measures” below for explanations and reconciliations of the Company’s non-GAAP financial measures.

Mark Penn, Chairman and CEO, said, “Stagwell delivered 15% year-over-year revenue growth in the third quarter, led by a return to double-digit growth from our Digital Transformation capability as AI has required companies to rethink the ways they engage with consumers. On the heels of our single largest deal to date with Adobe and expanded relationships with leading brands like United and Microsoft, net new business of over $100 million in the third quarter brings our last twelve-month net new business figure to $345 million, another record for Stagwell.

"New business momentum, robust performance from Digital Transformation, and the culmination of a political season that broke fundraising records, gives us confidence that our vision is resonating with customers, and sets the stage for a strong close to H2," added Penn.

Frank Lanuto, Chief Financial Officer, commented: "Stagwell posted growth across all our principal capabilities in the third quarter, as the inflection we anticipated played out. Driven by double-digit growth in both Digital Transformation and the Stagwell Marketing Cloud, we delivered third quarter revenue of $711 million. Simultaneously, we grew our adjusted EBITDA to $111 million, representing a 19% margin on net revenue, an improvement of approximately 15 bps over the prior year. These results give us confidence to reiterate our full-year guidance.”

Financial Outlook

2024 financial guidance is reiterated as follows:

•Organic Net Revenue growth of 5% to 7%

•Organic Net Revenue excluding Advocacy growth of 4% to 5%

•Adjusted EBITDA of $400 million to $450 million

•Free Cash Flow Conversion of approximately 50%

•Adjusted EPS of $0.75 - $0.88

•Guidance assumes no impact from foreign exchange, acquisitions or dispositions.

| | | | | |

| |

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

|

|

|

| |

| |

| * The Company has excluded a quantitative reconciliation with respect to the Company’s 2024 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See "Non-GAAP Financial Measures" below for additional information. |

`

`Stock Repurchase Program

On November 6, 2024, the Board of Directors authorized an extension and a $125,000,000 increase in the size of Stagwell's previously approved stock repurchase program (the “Repurchase Program”). Under the Repurchase Program, as amended, Stagwell may repurchase up to an aggregate of $375,000,000 of shares of its outstanding Class A common stock, with any previous purchases under the Repurchase Program continuing to count against that limit. The Repurchase Program will expire on November 6, 2027.

Video Webcast

Management will host a video webcast on Thursday, November 7, 2024, at 8:30 a.m. (ET) to discuss results for Stagwell Inc. for the three and nine months ended September 30, 2024. The video webcast will be accessible at https://stgw.io/Earnings. An investor presentation has been posted on our website at www.stagwellglobal.com and may be referred to during the webcast.

A recording of the webcast will be accessible one hour after the webcast and available for ninety days at www.stagwellglobal.com.

Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world's most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Contacts

For Investors:

Ben Allanson

IR@stagwellglobal.com

For Press:

Beth Sidhu

PR@stagwellglobal.com

Non-GAAP Financial Measures

In addition to its reported results, Stagwell Inc. has included in this earnings release certain financial results that the Securities and Exchange Commission (SEC) defines as "non-GAAP Financial Measures." Management believes that such non-GAAP financial measures, when read in conjunction with the Company's reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company's results. Such non-GAAP financial measures include the following:

(1) Organic Net Revenue: “Organic net revenue growth” and “Organic net revenue decline” reflects the year-over-year change in the Company's reported net revenue attributable to the Company's management of the entities it owns. We calculate organic net revenue growth (decline) by subtracting the net impact of acquisitions (divestitures) and the impact of foreign currency exchange fluctuations from the aggregate year-over-year increase or decrease in the Company's reported net revenue. The net impact of acquisitions (divestitures) reflects the year-over-year change in the Company’s reported net revenue attributable to the impact of all individual entities that were acquired or divested in the current and prior year. We calculate impact of an acquisition as follows: (a) for an entity acquired during the current year, we present the entity’s prior year net revenue for the same period during

`

`which we owned it in the current year as impact of the acquisition in the current year; and (b) for an entity acquired in the prior year, we present the entity’s prior year net revenue for the period during which we did not own the entity in the prior year as impact of the acquisition in the current year. We calculate impact of a divestiture as follows: (a) for a divestiture in the current year, we present the entity’s prior year net revenue for the same period during which we no longer owned it in the current year as impact of the divestiture in the current year; and (b) for a divestiture in the prior year, we present the entity’s prior year net revenue for the period during which we owned it in the prior year as impact of the divestiture in the current year. We calculate the impact of any acquisition or divestiture without adjusting for foreign currency exchange fluctuations. The impact of foreign currency exchange fluctuations reflects the year-over-year change in the Company’s reported net revenue attributable to changes in foreign currency exchange rates. We calculate the impact of foreign currency exchange fluctuations for the portion of the reporting period in which we recognized revenue from a foreign entity in both the current year and the prior year. The impact is calculated as the difference between (1) reported prior period net revenue (converted to U.S. dollars at historical foreign currency exchange rates) and (2) prior period net revenue converted to U.S. dollars at current period foreign exchange rates.

(2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period.

(3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and non-recurring items.

(4) Adjusted Diluted EPS is defined as (i) Net income (loss) attributable to Stagwell Inc. common shareholders, plus net income attributable to Class C shareholders, excluding amortization expense, impairment and other losses, stock-based compensation, deferred acquisition consideration adjustments, discrete tax items, and other items, divided by (ii) (a) the per weighted average number of common shares outstanding plus (b) the weighted average number of Class C shares outstanding, (if dilutive). Other items includes restructuring costs, acquisition-related expenses, and non-recurring items, and subject to the anti-dilution rules.

(5) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments. Free Cash Flow Conversion is the percentage of adjusted EBITDA.

Included in this earnings release are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

`

`This document contains forward-looking statements. within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company’s representatives may also make forward-looking statements orally or in writing from time to time. Statements in this document that are not historical facts, including, statements about the Company’s beliefs and expectations, future financial performance, growth, and future prospects, the Company’s strategy, business and economic trends and growth, technological leadership and differentiation, potential and completed acquisitions, anticipated operating efficiencies and synergies and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Forward-looking statements, which are generally denoted by words such as “aim,” “anticipate,” “assume,” “believe,” “continue,” “could,” “create,” “develop,” “estimate,” “expect,” “focus,” “forecast,” “foresee,” “future,” “goal,” “guidance,” “in development,” “intend,” “likely,” “look,” “maintain,” “may,” “ongoing,” “opportunity,” “outlook,” “plan,” “possible,” “potential,” “predict,” “probable,” “project,” “should,” “target,” “will,” “would” or the negative of such terms or other variations thereof and terms of similar substance used in connection with any discussion of current plans, estimates and projections are subject to change based on a number of factors, including those outlined in this section.

Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company. Although the management of the Company believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. The material assumptions upon which such forward-looking statements are based include, among others, assumptions with respect to general business, economic and market conditions, the competitive environment, anticipated and unanticipated tax consequences and anticipated and unanticipated costs. These forward-looking statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any.

Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following:

•risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients;

•demand for the Company’s services, which may precipitate or exacerbate other risks and uncertainties;

•inflation and actions taken by central banks to counter inflation;

•the Company’s ability to attract new clients and retain existing clients;

•the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements;

•financial failure of the Company’s clients;

•the Company’s ability to retain and attract key employees;

•the Company’s ability to compete in the markets in which it operates;

•the Company’s ability to achieve its cost saving initiatives;

•the Company’s implementation of strategic initiatives;

•the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration;

•the Company’s ability to manage its growth effectively;

•the Company’s ability to identify, complete and integrate acquisitions that complement and expand the Company’s business capabilities and realize cost savings, synergies or other anticipated benefits of newly acquired businesses, or that even if realized, such benefits may take longer to realize than expected;

•the Company’s ability to identify and complete divestitures and to achieve the anticipated benefits therefrom;

•the Company’s ability to develop products incorporating new technologies, including augmented reality, artificial intelligence, and virtual reality, and realize benefits from such products;

•the Company’s use of artificial intelligence, including generative artificial intelligence;

•adverse tax consequences for the Company, its operations and its stockholders, that may differ from the expectations of the Company, including that future changes in tax laws, potential increases to corporate tax rates in the United States and disagreements with tax authorities on the Company’s determinations that may result in increased tax costs;

•adverse tax consequences in connection with the Transactions, including the incurrence of material Canadian federal income tax (including material “emigration tax”);

•the Company’s unremediated material weaknesses in internal control over financial reporting and its ability to establish and maintain an effective system of internal control over financial reporting, including the risk that the Company’s internal controls will fail to detect misstatements in its financial statements;

•the Company’s ability to accurately forecast its future financial performance and provide accurate guidance;

`

`•the Company’s ability to protect client data from security incidents or cyberattacks;

•economic disruptions resulting from war and other geopolitical tensions (such as the ongoing military conflicts between Russia and Ukraine and in the Middle East), terrorist activities and natural disasters;

•stock price volatility; and

•foreign currency fluctuations.

Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2023 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 11, 2024, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings.

`

`SCHEDULE 1

STAGWELL INC.

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

(amounts in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 711,281 | | | $ | 617,573 | | | $ | 2,052,508 | | | $ | 1,872,282 | |

| Operating Expenses | | | | | | | |

| Cost of services | 457,018 | | | 384,980 | | | 1,340,456 | | | 1,201,309 | |

| Office and general expenses | 176,440 | | | 160,021 | | | 507,916 | | | 481,379 | |

| Depreciation and amortization | 36,044 | | | 38,830 | | | 112,881 | | | 107,795 | |

| Impairment and other losses | — | | | — | | | 1,715 | | | 10,562 | |

| 669,502 | | | 583,831 | | | 1,962,968 | | | 1,801,045 | |

| Operating Income (Loss) | 41,779 | | | 33,742 | | | 89,540 | | | 71,237 | |

| Other income (expenses): | | | | | | | |

| Interest expense, net | (23,781) | | | (25,886) | | | (68,279) | | | (67,755) | |

| Foreign exchange, net | 1,312 | | | (140) | | | (2,301) | | | (2,288) | |

| | | | | | | |

Other, net | 249 | | | (271) | | | (825) | | | (467) | |

| (22,220) | | | (26,297) | | | (71,405) | | | (70,510) | |

Income before income taxes and equity in earnings of non-consolidated affiliates | 19,559 | | | 7,445 | | | 18,135 | | | 727 | |

| Income tax expense | 5,691 | | | 4,324 | | | 9,441 | | | 4,997 | |

| Income (loss) before equity in earnings of non-consolidated affiliates | 13,868 | | | 3,121 | | | 8,694 | | | (4,270) | |

Equity in income (loss) of non-consolidated affiliates | (4) | | | (4) | | | 503 | | | (447) | |

| Net income (loss) | 13,864 | | | 3,117 | | | 9,197 | | | (4,717) | |

| Net (income) loss attributable to noncontrolling and redeemable noncontrolling interests | (10,593) | | | (2,464) | | | (10,173) | | | 3,565 | |

| Net income (loss) attributable to Stagwell Inc. common shareholders | $ | 3,271 | | | $ | 653 | | | $ | (976) | | | $ | (1,152) | |

| Earnings (Loss) Per Common Share: | | | | | | | |

| Basic | $ | 0.03 | | | $ | 0.01 | | | $ | (0.01) | | | $ | (0.01) | |

| Diluted | $ | 0.03 | | | $ | — | | | $ | (0.01) | | | $ | (0.01) | |

| Weighted Average Number of Common Shares Outstanding: | | | | | | | |

| Basic | 108,198 | | | 110,787 | | | 111,436 | | | 118,772 | |

| Diluted | 112,190 | | | 265,006 | | | 111,436 | | | 274,864 | |

`

`SCHEDULE 2

STAGWELL INC.

UNAUDITED COMPONENTS OF NET REVENUE CHANGE

(amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Revenue - Components of Change | | | | | | Change |

| Three Months Ended September 30, 2023 | | Foreign Currency | | Net Acquisitions (Divestitures) | | Organic | | Total Change | | Three Months Ended September 30, 2024 | | Organic | | Total |

| | | | | |

| Integrated Agencies Network | $ | 306,327 | | | $ | 217 | | | $ | 906 | | | $ | 16,294 | | | $ | 17,417 | | | $ | 323,744 | | | 5.3 | % | | 5.7 | % |

| Brand Performance Network | 153,169 | | | 767 | | — | | | 2,984 | | | 3,751 | | | 156,920 | | | 1.9 | % | | 2.4 | % |

| Communications Network | 62,416 | | | 79 | | 2,970 | | | 20,755 | | | 23,804 | | | 86,220 | | | 33.3 | % | | 38.1 | % |

| All Other | 12,952 | | | (253) | | | (263) | | | 873 | | | 357 | | | 13,309 | | | 6.7 | % | | 2.8 | % |

| $ | 534,864 | | | $ | 810 | | | $ | 3,613 | | | $ | 40,906 | | | $ | 45,329 | | | $ | 580,193 | | | 7.6 | % | | 8.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Revenue - Components of Change | | | | | | Change |

| Nine Months Ended September 30, 2023 | | Foreign Currency | | Net Acquisitions (Divestitures) | | Organic | | Total Change | | Nine Months Ended September 30, 2024 | | Organic | | Total |

| | | | | |

| Integrated Agencies Network | $ | 930,660 | | | $ | 200 | | | $ | 2,408 | | | $ | 5,118 | | | $ | 7,726 | | | $ | 938,386 | | | 0.5 | % | | 0.8 | % |

| Brand Performance Network | 459,291 | | 2,145 | | 2,252 | | | 12,902 | | | $ | 17,299 | | | 476,590 | | | 2.8 | % | | 3.8 | % |

| Communications Network | 177,032 | | (70) | | 6,421 | | | $ | 42,718 | | | $ | 49,069 | | | 226,101 | | | 24.1 | % | | 27.7 | % |

| All Other | 34,404 | | | (822) | | | (3,559) | | | (4,061) | | | (8,442) | | | 25,962 | | | (11.8) | % | | (24.5) | % |

| $ | 1,601,387 | | | $ | 1,453 | | | $ | 7,522 | | | $ | 56,677 | | | $ | 65,652 | | | $ | 1,667,039 | | | 3.5 | % | | 4.1 | % |

(1) See Non-GAAP Financial Measures section above for the definition of Adjusted EBITDA and Other items, net.

Note: The Company made changes to its internal management and reporting structure in the first quarter of 2024, resulting in a change to its reportable segments (Networks). Specifically, certain agencies previously within the Brand Performance Network are now in the Integrated Agencies Network. Periods presented prior to the first quarter of 2024 have been recast to reflect the reclassification of certain reporting units (Brands) between operating segments.

`

`SCHEDULE 3

STAGWELL INC.

UNAUDITED SEGMENT OPERATING RESULTS

(amounts in thousands)

For the Three Months Ended September 30, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Integrated Agencies Network | | Brand Performance Network | | Communications Network | | All Other | | Corporate | | Total |

| Net Revenue | $ | 323,744 | | | $ | 156,920 | | | $ | 86,220 | | | $ | 13,309 | | | $ | — | | | $ | 580,193 | |

| Billable costs | 65,924 | | | 15,429 | | | 49,760 | | | (25) | | | — | | | 131,088 | |

| Revenue | 389,668 | | | 172,349 | | | 135,980 | | | 13,284 | | | — | | | 711,281 | |

| | | | | | | | | | | |

| Billable costs | 65,924 | | | 15,429 | | | 49,760 | | | (25) | | | — | | | 131,088 | |

| Staff costs | 198,252 | | | 98,716 | | | 42,644 | | | 9,207 | | | 13,160 | | | 361,979 | |

| Administrative costs | 31,593 | | | 22,600 | | | 9,034 | | | 3,978 | | | 2,351 | | | 69,556 | |

| Unbillable and other costs, net | 15,993 | | | 16,498 | | | 424 | | | 4,574 | | | — | | | 37,489 | |

Adjusted EBITDA (1) | 77,906 | | | 19,106 | | | 34,118 | | | (4,450) | | | (15,511) | | | 111,169 | |

| | | | | | | | | | | |

| Stock-based compensation | 11,000 | | | 1,500 | | | 855 | | | 379 | | | 3,201 | | | 16,935 | |

| Depreciation and amortization | 19,878 | | | 7,295 | | | 3,023 | | | 2,573 | | | 3,275 | | | 36,044 | |

| Deferred acquisition consideration | 1,114 | | | (6,949) | | | 6,778 | | | (383) | | | — | | | 560 | |

| | | | | | | | | | | |

Other items, net (1) | 3,664 | | | 8,076 | | | 1,432 | | | 98 | | | 2,581 | | | 15,851 | |

| Operating income (loss) | $ | 42,250 | | | $ | 9,184 | | | $ | 22,030 | | | $ | (7,117) | | | $ | (24,568) | | | $ | 41,779 | |

(1) See Non-GAAP Financial Measures section above for the definition of Adjusted EBITDA and Other items, net.

Note: The Company made changes to its internal management and reporting structure in the first quarter of 2024, resulting in a change to its reportable segments (Networks). Specifically, certain agencies previously within the Brand Performance Network are now in the Integrated Agencies Network. Periods presented prior to the first quarter of 2024 have been recast to reflect the reclassification of certain reporting units (Brands) between operating segments.

`

`SCHEDULE 4

STAGWELL INC.

UNAUDITED SEGMENT OPERATING RESULTS

(amounts in thousands)

For the Nine Months Ended September 30, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Integrated Agencies Network | | Brand Performance Network | | Communications Network | | All Other | | Corporate | | Total |

| Net Revenue | $ | 938,386 | | | $ | 476,590 | | | $ | 226,101 | | | $ | 25,962 | | | $ | — | | | $ | 1,667,039 | |

| Billable costs | 189,134 | | | 86,966 | | | 109,195 | | | 174 | | | — | | | 385,469 | |

| Revenue | 1,127,520 | | | 563,556 | | | 335,296 | | | 26,136 | | | — | | | 2,052,508 | |

| | | | | | | | | | | |

| Billable costs | 189,134 | | | 86,966 | | | 109,195 | | | 174 | | | — | | | 385,469 | |

| Staff costs | 579,979 | | | 296,411 | | | 123,039 | | | 24,635 | | | 35,421 | | | 1,059,485 | |

| Administrative costs | 96,097 | | | 69,196 | | | 26,117 | | | 3,447 | | | 11,396 | | | 206,253 | |

| Unbillable and other costs, net | 56,301 | | | 46,677 | | | 1,270 | | | 9,465 | | | — | | | 113,713 | |

Adjusted EBITDA (1) | 206,009 | | | 64,306 | | | 75,675 | | | (11,585) | | | (46,817) | | | 287,588 | |

| | | | | | | | | | | |

| Stock-based compensation | 25,170 | | | 4,988 | | | 2,731 | | | 729 | | | 5,308 | | | 38,926 | |

| Depreciation and amortization | 58,731 | | | 26,524 | | | 9,007 | | | 9,938 | | | 8,681 | | | 112,881 | |

| Deferred acquisition consideration | 5,690 | | | (6,454) | | | 9,097 | | | (383) | | | — | | | 7,950 | |

| Impairment and other losses | 1,500 | | | — | | | — | | | — | | | 215 | | | 1,715 | |

Other items, net (1) | 13,204 | | | 16,363 | | | 2,104 | | | 702 | | | 4,203 | | | 36,576 | |

| Operating income (loss) | $ | 101,714 | | | $ | 22,885 | | | $ | 52,736 | | | $ | (22,571) | | | $ | (65,224) | | | $ | 89,540 | |

(1) See Non-GAAP Financial Measures section above for the definition of Adjusted EBITDA and Other items, net.

Note: The Company made changes to its internal management and reporting structure in the first quarter of 2024, resulting in a change to its reportable segments (Networks). Specifically, certain agencies previously within the Brand Performance Network are now in the Integrated Agencies Network. Periods presented prior to the first quarter of 2024 have been recast to reflect the reclassification of certain reporting units (Brands) between operating segments.

`

`SCHEDULE 5

STAGWELL INC.

UNAUDITED SEGMENT OPERATING RESULTS

(amounts in thousands)

For the Three Months Ended September 30, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Integrated Agencies Network | | Brand Performance Network | | Communications Network | | All Other | | Corporate | | Total |

| Net Revenue | $ | 306,327 | | | $ | 153,169 | | | $ | 62,416 | | | $ | 12,952 | | | $ | — | | | $ | 534,864 | |

| Billable costs | 51,742 | | | 10,904 | | | 20,089 | | | (26) | | | — | | | 82,709 | |

| Revenue | 358,069 | | | 164,073 | | | 82,505 | | | 12,926 | | | — | | | 617,573 | |

| | | | | | | | | | | |

| Billable costs | 51,742 | | | 10,904 | | | 20,089 | | | (26) | | | — | | | 82,709 | |

| Staff costs | 185,034 | | | 95,488 | | | 37,412 | | | 10,391 | | | 10,589 | | | 338,914 | |

| Administrative costs | 30,983 | | | 20,580 | | | 7,626 | | | 1,849 | | | 1,301 | | | 62,339 | |

| Unbillable and other costs, net | 14,173 | | | 12,868 | | | 84 | | | 4,717 | | | — | | | 31,842 | |

Adjusted EBITDA (1) | 76,137 | | | 24,233 | | | 17,294 | | | (4,005) | | | (11,890) | | | 101,769 | |

| | | | | | | | | | | |

| Stock-based compensation | 6,051 | | | 2,399 | | | 1,252 | | | 268 | | | 2,095 | | | 12,065 | |

| Depreciation and amortization | 22,817 | | | 8,971 | | | 2,784 | | | 2,138 | | | 2,120 | | | 38,830 | |

| Deferred acquisition consideration | 1,018 | | | 2,130 | | | 3,757 | | | (504) | | | — | | | 6,401 | |

| | | | | | | | | | | |

Other items, net (1) | 6,047 | | | 3,337 | | | 244 | | | 292 | | | 811 | | | 10,731 | |

| Operating income (loss) | $ | 40,204 | | | $ | 7,396 | | | $ | 9,257 | | | $ | (6,199) | | | $ | (16,916) | | | $ | 33,742 | |

(1) See Non-GAAP Financial Measures section above for the definition of Adjusted EBITDA and Other items.

Note: The Company made changes to its internal management and reporting structure in the first quarter of 2024, resulting in a change to its reportable segments (Networks). Specifically, certain agencies previously within the Brand Performance Network are now in the Integrated Agencies Network. Periods presented prior to the first quarter of 2024 have been recast to reflect the reclassification of certain reporting units (Brands) between operating segments.

`

`SCHEDULE 6

STAGWELL INC.

UNAUDITED SEGMENT OPERATING RESULTS

(amounts in thousands)

For the Nine Months Ended September 30, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Integrated Agencies Network | | Brand Performance Network | | Communications Network | | All Other | | Corporate | | Total |

| Net Revenue | $ | 930,660 | | | $ | 459,291 | | | $ | 177,032 | | | $ | 34,404 | | | $ | — | | | $ | 1,601,387 | |

| Billable costs | 134,249 | | | 83,443 | | | 53,229 | | | (26) | | | — | | | 270,895 | |

| Revenue | 1,064,909 | | | 542,734 | | | 230,261 | | | 34,378 | | | — | | | 1,872,282 | |

| | | | | | | | | | | |

| Billable costs | 134,249 | | | 83,443 | | | 53,229 | | | (26) | | | — | | | 270,895 | |

| Staff costs | 572,893 | | | 288,932 | | | 115,846 | | | 31,124 | | | 25,850 | | | 1,034,645 | |

| Administrative costs | 93,000 | | | 64,163 | | | 25,096 | | | 1,244 | | | 13,343 | | | 196,846 | |

| Unbillable and other costs, net | 53,665 | | | 38,534 | | | 336 | | | 12,202 | | | — | | | 104,737 | |

Adjusted EBITDA (1) | 211,102 | | | 67,662 | | | 35,754 | | | (10,166) | | | (39,193) | | | 265,159 | |

| | | | | | | | | | | |

| Stock-based compensation | 15,470 | | | 3,840 | | | 2,177 | | | 427 | | | 12,701 | | | 34,615 | |

| Depreciation and amortization | 62,277 | | | 25,160 | | | 8,216 | | | 6,152 | | | 5,990 | | | 107,795 | |

| Deferred acquisition consideration | 8,118 | | | 1,112 | | | 3,403 | | | (1,752) | | | — | | | 10,881 | |

| Impairment and other losses | 10,562 | | | — | | | — | | | — | | | — | | | 10,562 | |

Other items, net (1) | 13,822 | | | 8,493 | | | 1,337 | | | 1,079 | | | 5,338 | | | 30,069 | |

| Operating income (loss) | $ | 100,853 | | | $ | 29,057 | | | $ | 20,621 | | | $ | (16,072) | | | $ | (63,222) | | | $ | 71,237 | |

(1) See Non-GAAP Financial Measures section above for the definition of Adjusted EBITDA and Other items, net.

Note: The Company made changes to its internal management and reporting structure in the first quarter of 2024, resulting in a change to its reportable segments (Networks). Specifically, certain agencies previously within the Brand Performance Network are now in the Integrated Agencies Network. Periods presented prior to the first quarter of 2024 have been recast to reflect the reclassification of certain reporting units (Brands) between operating segments.

`

`SCHEDULE 7

STAGWELL INC.

UNAUDITED RECONCILIATION OF ADJUSTED DILUTED EARNINGS PER SHARE (NON-GAAP MEASURE)

(amounts in thousands, except per share amounts)

For the Three Months Ended September 30, 2024

| | | | | | | | | | | | | | | | | | | | |

| | GAAP | | Adjustments | | Non-GAAP |

| Net income attributable to Stagwell Inc. common shareholders | | $ | 3,271 | | | $ | 19,762 | | | $ | 23,033 | |

| Net income attributable to Class C shareholders | | — | | | 36,060 | | | 36,060 | |

| Net income attributable to Stagwell Inc. and Class C shareholders and adjusted net income | | $ | 3,271 | | | $ | 55,822 | | | $ | 59,093 | |

| | | | | | |

| Weighted average number of common shares outstanding | | 112,190 | | | 1,497 | | | 113,687 | |

| Weighted average number of common Class C shares outstanding | | — | | | 151,649 | | | 151,649 | |

| Weighted average number of shares outstanding | | 112,190 | | | 153,146 | | | 265,336 | |

| | | | | | |

Diluted EPS and Adjusted Diluted EPS | | $ | 0.03 | | | | | $ | 0.22 | |

| | | | | | |

| | | | | | |

Adjustments to Net income (1) |

Amortization | | | | $ | 28,659 | | | |

| | | | | | |

| Stock-based compensation | | | | 16,935 | | | |

| Deferred acquisition consideration | | | | 560 | | | |

| Other items, net | | | | 15,851 | | | |

| | | | 62,005 | | | |

| | | | | | |

| | | | | | |

Adjusted tax expense | | | | (15,615) | | | |

| | | | 46,390 | | | |

| Net loss attributable to Class C shareholders | | | | 9,432 | | | |

| | | | $ | 55,822 | | | |

| | | | | | |

| Allocation of adjustments to Net income | | | | | | |

| Net income attributable to Stagwell Inc. common shareholders - add-backs | | | | $ | 19,762 | | | |

| | | | | | |

| Net income attributable to Class C shareholders - add-backs | | | | 26,628 | | | |

| Net income attributable to Class C shareholders | | | | 9,432 | | | |

| | | | 36,060 | | | |

| | | | $ | 55,822 | | | |

(1) Adjusted Diluted EPS is defined within the Non-GAAP Financial Measures section of the Executive Summary.

`

`SCHEDULE 8

STAGWELL INC.

UNAUDITED RECONCILIATION OF ADJUSTED DILUTED EARNINGS PER SHARE (NON-GAAP MEASURE)

(amounts in thousands, except per share amounts)

For the Nine Months Ended September 30, 2024

| | | | | | | | | | | | | | | | | | | | |

| | GAAP | | Adjustments | | Non-GAAP |

Net income (loss) attributable to Stagwell Inc. common shareholders | | $ | (976) | | | $ | 58,177 | | | $ | 57,201 | |

| Net income attributable to Class C shareholders | | — | | | 83,442 | | | 83,442 | |

Net income (loss) attributable to Stagwell Inc. and Class C and adjusted net income | | $ | (976) | | | $ | 141,619 | | | $ | 140,643 | |

| | | | | | |

| Weighted average number of common shares outstanding | | 111,436 | | | 5,780 | | | 117,216 | |

| Weighted average number of common Class C shares outstanding | | — | | | 151,649 | | | 151,649 | |

| Weighted average number of shares outstanding | | 111,436 | | | 157,429 | | | 268,865 | |

| | | | | | |

| | | | | | |

Diluted EPS and Adjusted Diluted EPS | | $ | (0.01) | | | | | $ | 0.52 | |

| | | | | | |

| | | | | | |

Adjustments to Net Income (loss) (1) |

| | | | | | |

Amortization | | | | $ | 91,870 | | | |

| Impairment and other losses | | | | 1,715 | | | |

| Stock-based compensation | | | | 38,926 | | | |

| Deferred acquisition consideration | | | | 7,950 | | | |

| | | | | | |

| Other items, net | | | | 36,576 | | | |

| | | | 177,037 | | | |

| Adjusted tax expense | | | | (41,268) | | | |

| | | | 135,769 | | | |

| Net loss attributable to Class C shareholders | | | | 5,850 | | | |

| | | | $ | 141,619 | | | |

| | | | | | |

Allocation of adjustments to net income (loss) 1 |

| Net income attributable to Stagwell Inc. common shareholders - add-backs | | | | $ | 58,177 | | | |

| | | | | | |

| Net income attributable to Class C shareholders - add-backs | | | | 77,592 | | | |

| Net income attributable to Class C shareholders | | | | 5,850 | | | |

| | | | 83,442 | | | |

| | | | $ | 141,619 | | | |

(1) Adjusted Diluted EPS is defined within the Non-GAAP Financial Measures section of the Executive Summary.

`

`SCHEDULE 9

STAGWELL INC.

UNAUDITED RECONCILIATION OF ADJUSTED DILUTED EARNINGS PER SHARE (NON-GAAP MEASURE)

(amounts in thousands, except per share amounts)

For the Three Months Ended September 30, 2023

| | | | | | | | | | | | | | | | | | | | |

| | GAAP | | Adjustments | | Non-GAAP |

| Net income attributable to Stagwell Inc. common shareholders | | $ | 653 | | | $ | 20,844 | | | $ | 21,497 | |

| Net income attributable to Class C shareholders | | 33 | | | 26,530 | | | 26,563 | |

| Net income attributable to Stagwell Inc. and Class C and adjusted net income | | $ | 686 | | | $ | 47,374 | | | $ | 48,060 | |

| | | | | | |

| Weighted average number of common shares outstanding | | 113,357 | | | 5,663 | | | 119,020 | |

| Weighted average number of common Class C shares outstanding | | 151,649 | | | — | | | 151,649 | |

| Weighted average number of shares outstanding | | 265,006 | | | 5,663 | | | 270,669 | |

| | | | | | |

| | | | | | |

| Diluted EPS and Adjusted Diluted EPS | | $ | — | | | | | $ | 0.18 | |

| | | | | | |

Adjustments to Net income (1) |

Amortization | | | | $ | 31,182 | | | |

| | | | | | |

| Stock-based compensation | | | | 12,065 | | | |

| Deferred acquisition consideration | | | | 6,401 | | | |

| Other items, net | | | | 10,731 | | | |

| | | | 60,379 | | | |

Adjusted tax expense | | | | (13,005) | | | |

| | | | $ | 47,374 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

(1) Adjusted Diluted EPS is defined within the Non-GAAP Financial Measures section of the Executive Summary.

`

`

SCHEDULE 10

STAGWELL INC.

UNAUDITED RECONCILIATION OF ADJUSTED DILUTED EARNINGS PER SHARE (NON-GAAP MEASURE)

(amounts in thousands, except per share amounts)

For the Nine Months Ended September 30, 2023

| | | | | | | | | | | | | | | | | | | | |

| | GAAP | | Adjustments | | Non-GAAP |

Net income (loss) attributable to Stagwell Inc. common shareholders | | $ | (1,152) | | | $ | 57,927 | | | $ | 56,775 | |

| Net income attributable to Class C shareholders | | (2,702) | | | 73,725 | | | 71,023 | |

Net income (loss) attributable to Stagwell Inc. and Class C and adjusted net income | | $ | (3,854) | | | $ | 131,652 | | | $ | 127,798 | |

| | | | | | |

| Weighted average number of common shares outstanding | | 118,772 | | | 10,736 | | | 129,508 | |

| Weighted average number of common Class C shares outstanding | | 156,092 | | | — | | | 156,092 | |

| Weighted average number of shares outstanding | | 274,864 | | | 10,736 | | | 285,600 | |

| | | | | | |

| | | | | | |

| Diluted EPS and Adjusted Diluted EPS | | $ | (0.01) | | | | | $ | 0.45 | |

| | | | | | |

| | | | | | |

Adjustments to Net income (loss) (1) |

| | | | | | |

Amortization | | | | $ | 86,605 | | | |

| Impairment and other losses | | | | 10,562 | | | |

| Stock-based compensation | | | | 34,615 | | | |

| Deferred acquisition consideration | | | | 10,881 | | | |

| Other items, net | | | | 30,069 | | | |

| | | | 172,732 | | | |

| Adjusted tax expense | | | | (41,080) | | | |

| | | | $ | 131,652 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

(1) Adjusted Diluted EPS is defined within the Non-GAAP Financial Measures section of the Executive Summary.

`

`SCHEDULE 11

STAGWELL INC.

UNAUDITED CONSOLIDATED BALANCE SHEETS

(amounts in thousands) | | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 |

| | | | |

| ASSETS | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 145,807 | | | $ | 119,737 | |

| Accounts receivable, net | 716,394 | | | 697,178 | |

| Expenditures billable to clients | 137,443 | | | 114,097 | |

| Other current assets | 108,187 | | | 94,054 | |

| Total Current Assets | 1,107,831 | | | 1,025,066 | |

| Fixed assets, net | 77,766 | | | 77,825 | |

| Right-of-use assets - operating leases | 223,194 | | | 254,278 | |

| Goodwill | 1,521,005 | | | 1,498,815 | |

| Other intangible assets, net | 769,596 | | | 818,220 | |

| Other assets | 97,425 | | | 92,843 | |

| Total Assets | $ | 3,796,817 | | | $ | 3,767,047 | |

| LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS ("RNCI"), AND SHAREHOLDERS’ EQUITY | | | |

| Current Liabilities | | | |

| Accounts payable | $ | 338,649 | | | $ | 414,980 | |

| Accrued media | 206,512 | | | 291,777 | |

| Accruals and other liabilities | 210,146 | | | 233,046 | |

| Advance billings | 338,789 | | | 301,674 | |

| Current portion of lease liabilities - operating leases | 61,897 | | | 65,899 | |

| Current portion of deferred acquisition consideration | 8,618 | | | 66,953 | |

| Total Current Liabilities | 1,164,611 | | | 1,374,329 | |

| Long-term debt | 1,463,925 | | | 1,145,828 | |

| Long-term portion of deferred acquisition consideration | 53,055 | | | 34,105 | |

| Long-term lease liabilities - operating leases | 250,388 | | | 281,307 | |

| Deferred tax liabilities, net | 41,728 | | | 40,509 | |

| Other liabilities | 60,220 | | | 54,905 | |

| Total Liabilities | 3,033,927 | | | 2,930,983 | |

| Redeemable Noncontrolling Interests | 18,618 | | | 10,792 | |

| Commitments, Contingencies and Guarantees | | | |

| Shareholders' Equity | | | |

| Common shares - Class A & B | 110 | | | 118 | |

| Common shares - Class C | 2 | | | 2 | |

| | | |

| Paid-in capital | 287,941 | | | 348,494 | |

| Retained earnings | 11,416 | | | 21,148 | |

| Accumulated other comprehensive loss | (13,057) | | | (13,067) | |

| Stagwell Inc. Shareholders' Equity | 286,412 | | | 356,695 | |

| Noncontrolling interests | 457,860 | | | 468,577 | |

| Total Shareholders' Equity | 744,272 | | | 825,272 | |

Total Liabilities, Redeemable Noncontrolling Interests and Shareholders’ Equity | $ | 3,796,817 | | | $ | 3,767,047 | |

`

`SCHEDULE 12

STAGWELL INC.

UNAUDITED SUMMARY CASH FLOW DATA

(amounts in thousands)

| | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| 2024 | | 2023 | | |

| Cash flows from operating activities: | | | | | |

| Net income | $ | 9,197 | | | $ | (4,717) | | | |

Adjustments to reconcile net income to cash used in operating activities: | | | | | |

| Stock-based compensation | 38,926 | | | 34,615 | | | |

| Depreciation and amortization | 112,881 | | | 107,795 | | | |

Amortization of right-of-use lease assets and lease liability interest | 58,052 | | | 57,583 | | | |

| Impairment and other losses | 1,715 | | | 10,562 | | | |

| | | | | |

| Deferred income taxes | (3,446) | | | (5,635) | | | |

| Adjustment to deferred acquisition consideration | 7,950 | | | 10,881 | | | |

| | | | | |

| Other, net | 6,371 | | | (4,248) | | | |

| Changes in working capital: | | | | | |

| Accounts receivable | (6,212) | | | (25,405) | | | |

| Expenditures billable to clients | (15,705) | | | (36,217) | | | |

| Other assets | (9,068) | | | 6,539 | | | |

| Accounts payable | (94,160) | | | (49,204) | | | |

| Accrued expenses and other liabilities | (121,647) | | | (152,216) | | | |

| Advance billings | 23,984 | | | (1,759) | | | |

| Current portion of lease liabilities - operating leases | (63,956) | | | (67,095) | | | |

| Deferred acquisition related payments | (14,112) | | | (9,021) | | | |

Net cash used in operating activities | (69,230) | | | (127,542) | | | |

| Cash flows from investing activities: | | | | | |

| Capital expenditures | (16,728) | | | (12,205) | | | |

| Acquisitions, net of cash acquired | (23,781) | | | (6,678) | | | |

| Capitalized software | (19,320) | | | (19,026) | | | |

| | | | | |

| Other | (6,656) | | | (6,939) | | | |

Net cash used in investing activities | (66,485) | | | (44,848) | | | |

| Cash flows from financing activities: | | | | | |

| Repayment of borrowings under revolving credit facility | (1,176,000) | | | (1,250,500) | | | |

| Proceeds from borrowings under revolving credit facility | 1,492,000 | | | 1,562,500 | | | |

| Shares repurchased and cancelled | (101,249) | | | (203,958) | | | |

| Distributions to noncontrolling interests | (23,583) | | | (24,538) | | | |

| Payment of deferred consideration | (28,721) | | | (31,666) | | | |

| | | | | |

| Purchase of noncontrolling interest | (3,316) | | | — | | | |

| | | | | |

| Debt issuance costs | — | | | (150) | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Net cash provided by financing activities | 159,131 | | | 51,688 | | | |

| Effect of exchange rate changes on cash and cash equivalents | 2,654 | | | (1,182) | | | |

| Net increase (decrease) in cash and cash equivalents | 26,070 | | | (121,884) | | | |

`

` | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| 2024 | | 2023 | | |

| Cash and cash equivalents at beginning of period | 119,737 | | | 220,589 | | | |

| Cash and cash equivalents at end of period | $ | 145,807 | | | $ | 98,705 | | | |

Third Quarter 2024 EARNINGS PRESENTATION November 7 | 2024

This document contains forward-looking statements. within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company’s representatives may also make forward-looking statements orally or in writing from time to time. Statements in this document that are not historical facts, including, statements about the Company’s beliefs and expectations, future financial performance, growth, and future prospects, the Company’s strategy, business and economic trends and growth, technological leadership and differentiation, potential and completed acquisitions, anticipated operating efficiencies and synergies and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Forward-looking statements, which are generally denoted by words such as “aim,” “anticipate,” “assume,” “believe,” “continue,” “could,” “create,” “develop,” “estimate,” “expect,” “focus,” “forecast,” “foresee,” “future,” “goal,” “guidance,” “in development,” “intend,” “likely,” “look,” “maintain,” “may,” “ongoing,” “opportunity,” “outlook,” “plan,” “possible,” “potential,” “predict,” “probable,” “project,” “should,” “target,” “will,” “would” or the negative of such terms or other variations thereof and terms of similar substance used in connection with any discussion of current plans, estimates and projections are subject to change based on a number of factors, including those outlined in this section. Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company. Although the management of the Company believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. The material assumptions upon which such forward-looking statements are based include, among others, assumptions with respect to general business, economic and market conditions, the competitive environment, anticipated and unanticipated tax consequences and anticipated and unanticipated costs. These forward-looking statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following: • risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients; • demand for the Company’s services, which may precipitate or exacerbate other risks and uncertainties; • inflation and actions taken by central banks to counter inflation; • the Company’s ability to attract new clients and retain existing clients; • the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements; • financial failure of the Company’s clients; • the Company’s ability to retain and attract key employees; • the Company’s ability to compete in the markets in which it operates; • the Company’s ability to achieve its cost saving initiatives; • the Company’s implementation of strategic initiatives; • the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration; • the Company’s ability to manage its growth effectively; • the Company’s ability to identify, complete and integrate acquisitions that complement and expand the Company’s business capabilities and realize cost savings, synergies or other anticipated benefits of newly acquired businesses, or that even if realized, such benefits may take longer to realize than expected; • the Company’s ability to identify and complete divestitures and to achieve the anticipated benefits therefrom; • the Company’s ability to develop products incorporating new technologies, including augmented reality, artificial intelligence, and virtual reality, and realize benefits from such products; • the Company’s use of artificial intelligence, including generative artificial intelligence; • adverse tax consequences for the Company, its operations and its stockholders, that may differ from the expectations of the Company, including that future changes in tax laws, potential increases to corporate tax rates in the United States and disagreements with tax authorities on the Company’s determinations that may result in increased tax costs; • adverse tax consequences in connection with the Transactions, including the incurrence of material Canadian federal income tax (including material “emigration tax”); • the Company’s unremediated material weaknesses in internal control over financial reporting and its ability to establish and maintain an effective system of internal control over financial reporting, including the risk that the Company’s internal controls will fail to detect misstatements in its financial statements; • the Company’s ability to accurately forecast its future financial performance and provide accurate guidance; • the Company’s ability to protect client data from security incidents or cyberattacks; • economic disruptions resulting from war and other geopolitical tensions (such as the ongoing military conflicts between Russia and Ukraine and in the Middle East), terrorist activities and natural disasters; • stock price volatility; and • foreign currency fluctuations. Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2023 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 11, 2024, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings. FORWARD LOOKING STATEMENTS & OTHER INFORMATION 2

DEFINITIONS OF NON-GAAP FINANCIAL MEASURES 3 In addition to its reported results, Stagwell Inc. has included in this earnings presentation certain financial results that the Securities and Exchange Commission (SEC) defines as "non-GAAP Financial Measures." Management believes that such non-GAAP financial measures, when read in conjunction with the Company's reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company's results. Such non-GAAP financial measures include the following: Pro Forma Results: The Pro Forma amounts presented for each period were prepared by combining the historical standalone statements of operations for each of legacy MDC and SMG. The unaudited pro forma results are provided for illustrative purposes only and do not purport to represent what the actual consolidated results of operations or consolidated financial condition would have been had the combination actually occurred on the date indicated, nor do they purport to project the future consolidated results of operations or consolidated financial condition for any future period or as of any future date. The Company has excluded a quantitative reconciliation of Adjusted Pro Forma EBITDA to net income under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. 1) Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms that the Company has held throughout each of the comparable periods presented, and (b) “non-GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisition as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such disposition as if they had been disposed of during the equivalent period in the prior year. 2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period. 3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and nonrecurring items. 4) Adjusted Diluted EPS is defined as (i) Net income (loss) attributable to Stagwell Inc. common shareholders, plus net income attributable to Class C shareholders, excluding amortization expense, impairment and other losses, stock-based compensation, deferred acquisition consideration adjustments, discrete tax items, and other items, divided by (ii) (a) the per weighted average number of common shares outstanding plus (b) the weighted average number of Class C shares outstanding (if dilutive). Other items includes restructuring costs, acquisition- related expenses, and non-recurring items, and subject to the anti-dilution rules. 5) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments. 6) Financial Guidance: The Company provides guidance on a non-GAAP basis as it cannot predict certain elements which are included in reported GAAP results. Included in this earnings presentation are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

4 FINANCIAL Outlook Reiterating Full-Year 2024 Outlook 5% - 7% Organic Net Revenue Growth 4% - 5% Organic Net Revenue Growth ex. Advocacy $400M - $450M Adjusted EBITDA ~ 50% EBITDA Conversion on Free Cash Flow $0.75 - $0.88 In Adjusted Earnings Per Share Note: Guidance as of 11/07/2024. The Company has excluded a quantitative reconciliation with respect to the Company’s 2024 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See "Non-GAAP Financial Measures" below for additional information on definitions for Organic Net Revenue, Organic Net Revenue Ex-Advocacy, Adjusted EBITDA, Adjusted Earnings Per Share, and Free Cash Flow. Please refer to our investor website at stagwellglobal.com/investors for information on Forward Looking Statements and risk factors outlined in our 2023 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 11, 2024, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings.

T H I R D Q U A R T E R H I G H L I G H T S NET REVENUE: $580M | NET LEVERAGE RATIO: 3.5x | ADJ. EBITDA: $111M Expanding CAPABILITIES & REACH Accelerating GROWTH Investing IN TECHNOLOGY Achieving NEW BUSINESS RECORDS Closed 3 acquisitions in 3Q to expand global reach and digital capabilities BERA.ai adds AI-powered brand management technology LEADERS adds social capabilities and a global influencer tech platform based out of Tel Aviv Business Traveler enhances travel media offerings globally Announced closing of Consulum in early 4Q24, adding a leading government advisory consultancy to enhance our offering in the MENA region Record $101M of net new business wins in 3Q24, bringing LTM to $345M Secured largest new business win in the company's history with Adobe at 72andSunny and 4 other agencies The total number of wins increased 32% YoY; Average size of our wins above $1 million increased 74% Revenue growth of 15% year-over-year to $711 million Digital Transformation grew 25% over the prior period; Stagwell Marketing Cloud grew 30% over the prior period US posted 17% growth year-over-year Advocacy revenue grew 85% year-over-year Bolstered Code and Theory network with Instrument and Left Field Labs additions Leading AI transformation with deployments including in Gemini, Claude, Midjourney, Adobe Firefly, etc. Activated breakthrough AR tech from Stagwell Marketing Cloud's ARound for Los Angeles Rams and Minnesota United FC Wonder Cave saw continued growth, including a 500% increase in non-advocacy messaging from February to September 2024 Note: Net Leverage Ratio defined as Net Debt divided by LTM Adjusted EBITDA.

S U M M A R Y C O M B I N E D F I N A N C I A L S Note: Figures may not foot due to rounding. Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Net Revenue $ 580,193 $ 534,864 $ 1,667,039 $ 1,601,387 Billable Costs 131,088 82,709 385,469 270,895 Revenue $ 711,281 $ 617,573 $ 2,052,508 $ 1,872,282 Billable Costs 131,088 82,709 385,469 270,895 Staff costs 361,979 338,914 1,059,485 1,034,645 Administrative costs 69,556 62,339 206,253 196,846 Unbillable and other costs, net 37,489 31,842 113,713 104,737 Adjusted EBITDA $ 111,169 $ 101,769 $ 287,588 $ 265,159 Stock-based compensation 16,935 12,065 38,926 34,615 Depreciation and amortization 36,044 38,830 112,881 107,795 Deferred acquisition consideration 560 6,401 7,950 10,881 Impairment and other losses - - 1,715 10,562 Other items, net 15,851 10,731 36,576 30,069 Operating income (loss) $ 41,779 $ 33,742 $ 89,540 $ 71,237 Adjusted EBITDA margin (on net revenue) 19.2% 19.1% 17.3% 16.6% 6 $ in Thousands

3 Q 2 4 N E T R E V E N U E Note: Figures may not foot due to rounding. Three Months Ended September 30, 2024 Nine Months Ended September 30, 2024 Net Revenue Change Net Revenue Change Sept 30, 2023 $ 534,864 $ 1,601,387 Organic revenue 40,910 7.6% 56,679 3.5% Acquisitions (divestitures), net 3,612 0.7% 7,522 0.5% Foreign currency 807 0.2% 1,451 0.1% Total Change $ 45,329 8.5% $ 65,652 4.1% Sept 30, 2024 $ 580,193 $ 1,667,039 7 $ in Thousands

80.8% 6.9% 12.3% 3 Q 2 4 N E T R E V E N U E B Y G E O G R A P H Y Note: Figures may not foot due to rounding. 3Q Organic Growth Y/Y 8 % OF NET REVENUE Geography 3Q24 YTD United States 10.8% 5.2% United Kingdom (10.1)% (2.4)% Other (0.9)% (3.9)% TOTAL 7.6% 3.5% TOTAL EX-ADVOCACY 4.6% 1.0%

G L O B A L N E T W O R K 9 North America Latin America Europe Asia Pacific • Australia • China • Hong Kong • India • Indonesia • Japan • Malaysia • Philippines • Taiwan • Thailand • Singapore • South Korea Middle East & Africa • Austria • Belgium • Bulgaria • Italy • Latvia • Romania • Slovak Republic • Slovenia • Switzerland • Turkey • Ukraine • France • Germany • Netherlands • Poland • Spain • Sweden • United Kingdom • Argentina • Aruba • Bolivia • Brazil • Curacao • Colombia • Costa Rica • Dominican • Ecuador • El Salvador • Guatemala • Honduras • Jamaica • Nicaragua • Panama • Peru • Republic • Uruguay • Venezuela • Algeria • Bahrain • Egypt • Jordan • Kuwait • Lebanon • Libya • Morocco • Nigeria • Oman • Saudi Arabia • South Africa • Tunisia • United Arab Emirates Stagwell Affiliates COUNTRIES 34+ 75+ EMPLOYEES 12K+ 21K+ Stagwell’s Affiliate Network Significantly Expands Our Global Footprint • Canada • USA • Mexico Note: As of September 30, 2024.

O U R P R I N C I P A L C A P A B I L I T I E S Creativity & Communications Blue-Chip Customer Base Performance Media & Data Addressable on a Global Scale Consumer Insights & Strategy Tracking Across the Entire Consumer Journey Digital Transformation Building & Designing Digital Platforms & Technology 2 3 4 5 10 57% 3Q24Stagwell Marketing Cloud Group SaaS and DaaS Tools for the Modern Marketer 1 Notes: Digital Revenue Percentage is percentage of Total Net Revenue from Stagwell Marketing Cloud Group, Digital Transformation, Performance Media & Data, and Consumer Insights & Strategy capabilities

R E V E N U E G R O W T H B Y C A P A B I L I T Y Notes: Advocacy includes Targeted Victory, SKDK, and TMA Direct. Figures may not foot due to rounding. EBITDA includes corporate expenses, notionally allocated ratably across each capability. 3Q24 YTD Principal Capability Organic Revenue Growth Revenue Growth Organic Revenue Growth Revenue Growth Stagwell Marketing Cloud Group 27.7% 29.5% 16.2% 16.8% Digital Transformation 22.0% 24.8% 7.7% 10.0% Performance Media & Data 8.2% 9.2% 8.1% 8.9% Consumer Insights & Strategy 2.7% 6.9% (2.4)% (1.1)% Creativity & Communications 8.2% 10.6% 7.7% 9.9% TOTAL 12.8% 15.2% 7.7% 9.6% TOTAL EX-ADVOCACY 5.9% 8.6% 2.9% 4.9% % OF REVENUE 3Q 10% 25% 11% 7% 47%

N E T R E V E N U E G R O W T H B Y C A P A B I L I T Y Notes: Advocacy includes Targeted Victory, SKDK, and TMA Direct. Figures may not foot due to rounding. EBITDA includes corporate expenses, notionally allocated ratably across each capability. 3Q24 YTD Principal Capability Organic Net Revenue Growth Net Revenue Growth Organic Net Revenue Growth Net Revenue Growth Stagwell Marketing Cloud Group 23.3% 25.6% 11.1% 11.8% Digital Transformation 14.5% 17.7% 3.8% 6.6% Performance Media & Data 1.2% 2.4% 5.7% 6.6% Consumer Insights & Strategy 3.0% 7.1% (2.0)% (0.7)% Creativity & Communications 3.9% 2.5% 2.4% 1.4% TOTAL 7.6% 8.5% 3.5% 4.1% TOTAL EX-ADVOCACY 4.6% 5.5% 1.0% 1.6% % OF NET REVENUE 3Q 10% 26% 13% 8% 43%

A D J E B I T D A G R O W T H B Y C A P A B I L I T Y Note: Advocacy includes Targeted Victory, SKDK, and TMA Direct. Figures may not foot due to rounding. *EBITDA includes corporate expenses, notionally allocated ratably across each capability. **SMC includes Around AR, Prophet, CUE, Apollo, Epicenter, SmartAssets, Maru, Stagwell Cloud, Data2Brands QR Code, Leaders Principal Capability 3Q24 YTD Stagwell Marketing Cloud Group 16.3% (17.3)% Digital Transformation 27.5% 13.3% Performance Media & Data (24.0)% (6.4)% Consumer Insights & Strategy (11.2)% (1.0)% Creativity & Communications 7.9% 11.7% TOTAL 9.2% 8.5% TOTAL EX-ADVOCACY (6.8)% (6.7)% TOTAL EX-ADVOCACY EX-SMC** 8.2% 9.4% % OF ADJ. EBITDA* 3Q Adj. EBITDA* Growth Y/Y 4% 36% 7% 8% 45%

Three Months Ended, Nine Months Ended, Sept 30, 2024 Sept 30, 2023 % Change Sept 30, 2024 Sept 30, 2023 % Change Total Revenue $711 $618 15.2% $2,053 $1,872 9.6% Advocacy Revenue 99 54 84.6% 236 141 67.9% Total Ex Advocacy 612 564 8.6% 1,817 1,731 4.9% Three Months Ended, Nine Months Ended, Sept 30, 2024 Sept 30, 2023 % Change Sept 30, 2024 Sept 30, 2023 % Change Total Net Revenue $580 $535 8.5% $1,667 $1,601 4.1% Advocacy Net Revenue 56 38 47.7% 143 101 41.8% Total Ex Advocacy 524 497 5.5% 1,524 1,500 1.6% Three Months Ended, Nine Months Ended, Sept 30, 2024 Sept 30, 2023 % Change Sept 30, 2024 Sept 30, 2023 % Change Total Adj. EBITDA $111 $102 9.2% $288 $265 8.5% Advocacy Adj. EBITDA 28 12 126.7% 62 23 166.8% Total Ex Advocacy 83 90 (6.8)% 226 242 (6.7)% E X - A D V O C A C Y R E V E N U E , N E T R E V E N U E & A D J U S T E D E B I T D A Note: Advocacy includes Targeted Victory, SKDK, & TMA Direct. Actuals may not foot due to rounding $ in Millions NET REVENUE ADJ. EBITDA 14 REVENUE

N E W B U S I N E S S U P D A T E 15 PER CLIENT AT TOP 25 Notable Business WINS & EXPANSIONSNet New Business 3Q24 $101M LTM $345M Avg. Net Revenue 3Q24 $6.4M

S T A G W E L L M A R K E T I N G C L O U D G R O U P 16 Net Revenue1 1. Defined as GAAP Revenue minus Billable Costs – Includes both the Advanced Media Platform and Stagwell Marketing Cloud groups. In Millions. Net Revenue Adj. EBITDA Margin Advanced Media Platforms $44.5 15.5% Stagwell Marketing Cloud $14.7 (18.2)% TOTAL $59.3 7.2% GROWTH (y/y) 25.3% $47M $59M 3Q23 3Q24 $ in Millions

17 LIQUIDITY Available Liquidity (as of 9/30/2024) Commitment Under Credit Facility $ 640 Drawn 375 Letters of Credit 16 Undrawn Commitments Under Facility $ 249 Total Cash & Cash Equivalents 146 Total Available Liquidity $ 395 $ in Millions Note: Numbers may not foot due to rounding.

18 MAINTAINING DISCIPLINE AROUND Deferred Acquisition Costs REDUCED DAC BY $39M FROM FY23 YEAR-END BALANCE $134M $62M 3Q23 3Q24 Note: Numbers may not foot due to rounding.

A D J U S T E D E A R N I N G S P E R S H A R E Three Months Ended Sept 30, 2024 Nine Months Ended Sept 30, 2024 Reported (GAAP) Adjustments Non-GAAP Reported (GAAP) Adjustments Non-GAAP Net income attributable to Stagwell Inc. common shareholders $ 3,271 $ 19,762 $ 23,033 $ (976) $ 58,177 $ 57,201 Net income attributable to Class C Shareholders - 36,060 36,060 - 83,442 83,442 Net income – diluted EPS $ 3,271 $ 55,822 $ 59,093 $ (976) $ 141,619 $ 140,643 Weighted average number of common shares outstanding (diluted) 112,190 1,497 113,687 111,436 5,780 117,216 Weighted average number of common class C shares outstanding (diluted) - 151,649 151,649 - 151,649 151,649 Weighted average number of shares outstanding 112,190 153,146 265,336 111,436 157,429 268,865 Adjusted earnings per share (diluted) $ 0.03 $ 0.22 $ (0.01) $ 0.52 Adjustments to net income (loss) Amortization expense $ 28,659 $ 91,870 Impairment and other losses - 1,715 Stock-based compensation 16,935 38,926 Deferred acquisition consideration 560 7,950 Other items, net 15,851 36,576 Total add-backs 62,005 177,.037 Adjusted tax expense (15,615) (41,268) $ 46,390 135,769 Net loss attributable to Class C shareholders 9,432 5,850 $ 55,822 $ 141,619 19 $ and Shares in Thousands Note: Numbers may not foot due to rounding.

G A A P C O N S O L I D A T E D O P E R A T I N G P E R F O R M A N C E Revenue Cost of services Office & general expenses Depreciation & amortization Impairment & other losses Total operating expenses Operating income (Loss) Interest expense, net Foreign exchange, net Other, net Other income (expenses) Income tax expense (benefit) Income (loss) before equity in earnings of non-consolidated affiliates Equity in income (loss) of non-consolidated affiliates Net income (loss) Net income (loss) attributable to non-controlling & redeemable non-controlling interests Net income (loss) attributable to Stagwell Inc. common shareholders Earnings Per Share Basic Diluted Weighted Average Number of Shares Outstanding Basic Diluted Note: Numbers may not foot due to rounding. 20 $ and Shares in Thousands Three Months Ended Sept 30, 2024 2023 $ 711,281 $ 617,573 457,018 384,980 176,440 160,021 36,044 38,830 - - $ 669,502 $ 583,831 $ 41,779 $ 33,742 (23,781) (25,886) 1,312 (140) 249 (271) $ (22,220) $ (26,297) 5,691 4,324 $ 13,868 $ 3,121 (4) (4) $ 13,864 $ 3,117 (10,593) (2,464) $ 3,271 $ 653 $ 0.03 $ 0.01 $ 0.03 $ - 108,198 110,787 112,190 265,006 Nine Months Ended Sept 30, 2024 2023 $ 2,052,508 $ 1,872,282 1,340,456 1,201,309 507,916 481,379 112,881 107,795 1,715 10,562 $ 1,962,968 $ 1,801,045 $ 89,540 $ 71,237 (68,279) (67,755) (2,301) (2,288) (825) (467) $ (71,405) $ (70,510) 9,441 4,997 $ 8,694 $ (4,270) 503 (447) $ 9,197 $ (4,717) (10,173) 3,565 $ (976) $ (1,152) $ (0.01) $ (0.01) $ (0.01) $ (0.01) 111,436 118,772 111,436 274,864

C A P I T A L S T R U C T U R E Note: Share count assumes full conversion of Class C shares to Class A on a one-to-one basis. Numbers may not foot due to rounding 1. Excludes non-controlling interest of Stagwell Class C shareholders to reflect NCI balance pro forma for full conversion of Class C shares to Class A. 2. A portion of the DAC will be paid with approximately 3.0m shares assuming conversion as of 9/30/24. 3. Includes redeemable non-controlling interest and obligations in connection with profit interests held by employees. 4. Non-consolidated investments 5. Share Count does not include unvested stock grants, unsettled SARs or portion of DAC to be settled in stock. Pro Forma total share count as of 10/31/2024 would be 111.5m Class A shares, 151.6 Class C shares, 3.5m shares to settle DAC and 8.6m share-based awards, for a total of 275.3m shares outstanding. 6. Estimated shares to be issued upon the exercise of settled SAR awards using treasury method. Net Debt & Debt-Like ($M, as of 9/30/2024) Revolving Credit Facility $ 375 Bonds 1,100 NCI1 23 DAC2 62 RNCI3 34 Less: Investments4 15 Less: Cash 146 TOTAL NET DEBT & DEBT-LIKE $ 1,433 Share Count5 (Thousands, as of 10/31/2024) Class A 111,549 Class C (equal voting & economic rights to Class A) 151,649 Share-based awards6 8,602 DILUTED 271,800 21

22 APPLYING A PROVEN PLAYBOOK to scale Stagwell Marketing Cloud Group Building complementary software solutions leveraging the domain expertise and distribution channels already in place at Stagwell Advanced Media Platforms Proprietary & Premium Owned Media Channels Media Studio Solution for Modern Media Planners and Buyers Harris Quest Research Market Research Products by The Harris Poll PRophet Comms Tech AI-Driven Platform for Modern Communicators Digital Services Technology Digital Transformation Building Digital Platforms & Consumer Experiences Performance Media & Data Integrated Omnichannel Media, Data & E-Commerce Consumer Insights & Strategy Tracking Across the Consumer Journey Creativity & Communications Blue-Chip Customer Base 1 2 3 4

23 We've developed a proven strategy to develop and incubate new technologies, making informed product roadmap decisions based off agency clients while leveraging our world-class tech team STAGWELL MARKETING CLOUD GROUP Product Incubation Playbook WE BUILD ADVANCED PRODUCTS MORE EFFICIENTLY than the rest Faster Shared infrastructure + tech expertise DEVELOP & ITERATE FAST Cheaper World's most ambitious clients + upselling opportunities LOWER GO-TO-MARKET COSTS Better Proprietary data + the best marketers in the world INTERNAL TESTING & INSIGHTS THAT DELIVER BETTER PRODUCTS

24 REAL-TIME INSIGHTS Product Spotlight Customer Benefit Unlocking continuous brand tracking on an affordable, global, modern basis for research professionals

25 ARTIFICAL INTELLIGENCE Product Spotlight Customer Benefit Revolutionizing the PR process through AI, saving PR professionals from millions of tedious working hours