Tenable Holdings, Inc. ("Tenable") (Nasdaq: TENB), the exposure

management company, today announced financial results for the

quarter ended September 30, 2024.

"We delivered strong results in Q3, surpassing expectations on

both the top and bottom line," said Amit Yoran, Chairman and CEO of

Tenable. "Cloud Security and Tenable One, our exposure management

platform, continue to drive demand as customers increasingly focus

on securing critical cloud infrastructure and assessing their

overall exposures in a hybrid world."

Third Quarter 2024

Financial Highlights

- Revenue was $227.1 million, a 13%

increase year-over-year.

- Calculated current billings was

$248.4 million, an 11% increase year-over-year.

- GAAP loss from operations was $2.1

million, compared to $7.9 million in the third quarter of

2023.

- Non-GAAP income from operations was

$45.0 million, compared to $36.6 million in the third quarter of

2023.

- GAAP net loss was $9.2 million,

compared to $15.6 million in the third quarter of 2023.

- GAAP net loss per share was $0.08,

compared to $0.13 in the third quarter of 2023.

- Non-GAAP net income was $39.3

million, compared to $27.7 million in the third quarter of

2023.

- Non-GAAP diluted earnings per share

was $0.32, compared to $0.23 in the third quarter of 2023.

- Cash and cash equivalents and

short-term investments were $548.4 million at September 30, 2024,

compared to $474.0 million at December 31, 2023.

- Net cash provided by operating

activities was $54.6 million, compared to $42.4 million in the

third quarter of 2023.

- Unlevered free cash flow was $60.8

million, compared to $48.2 million in the third quarter of

2023.

Recent Business Highlights

- Added 386 new enterprise platform

customers and 60 net new six-figure customers.

- Announced that our Board of

Directors recently approved the expansion of our existing stock

repurchase program, raising the existing authorization by $200

million.

- Released AI Aware, advanced

detection capabilities designed to rapidly surface artificial

intelligence solutions, vulnerabilities and weaknesses.

- Introduced Vulnerability

Intelligence and Exposure Response, two powerful context-driven

prioritization and response features that are designed to deliver

actionable intelligence across IT and cloud environments.

- Extended exposure management

capabilities to cloud data and AI by adding new data security

posture management (DSPM) and artificial intelligence security

posture management (AI-SPM) capabilities for Tenable Cloud

Security.

- Launched Tenable Enclave Security, a

solution that supports the needs of customers operating in highly

secure environments.

- Recognized as the top performer in

cloud security in the 2024 CRN Annual Report Card Awards.

Financial Outlook

For the fourth quarter of 2024, we currently expect:

- Revenue in the range of

$229.0 million to $233.0 million.

- Non-GAAP income from operations in

the range of $47.0 million to $49.0 million.

- Non-GAAP net income in the range of

$42.0 million to $44.0 million, assuming interest expense of $7.8

million, interest income of $6.0 million and a provision for income

taxes of $3.1 million.

- Non-GAAP diluted earnings per share

in the range of $0.33 to $0.35.

- 125.5 million diluted weighted

average shares outstanding.

For the year ending December 31, 2024, we currently expect:

- Calculated current billings in the

range of $957.0 million to $967.0 million.

- Revenue in the range of

$893.3 million to $897.3 million.

- Non-GAAP income from operations in

the range of $171.8 million to $173.8 million.

- Non-GAAP net income in the range of

$149.9 million to $151.9 million, assuming interest expense of

$32.1 million, interest income of $23.5 million and a provision for

income taxes of $12.3 million.

- Non-GAAP diluted earnings per share

in the range of $1.21 to $1.23.

- 123.5 million diluted weighted

average shares outstanding.

- Unlevered free cash flow in the

range of $225.0 million to $235.0 million.

Conference Call Information

Tenable will host a conference call on October 30, 2024 at

4:30 p.m. Eastern Time to discuss its financial results. The

conference call can be accessed at 877-407-9716 (U.S.) and

201-493-6779 (international). A live webcast of the event will be

available on the Tenable Investor Relations website at

https://investors.tenable.com. An archived replay of the live

broadcast will be available on the Investor Relations page of the

website following the call.

About Tenable

Tenable® is the exposure management company, exposing and

closing the cybersecurity gaps that erode business value,

reputation and trust. The company’s AI-powered exposure management

platform radically unifies security visibility, insight and action

across the attack surface, equipping modern organizations to

protect against attacks from IT infrastructure to cloud

environments to critical infrastructure and everywhere in between.

By protecting enterprises from security exposure, Tenable reduces

business risk for approximately 44,000 customers around the globe.

Learn more at tenable.com.

Contact Information

Investor Relationsinvestors@tenable.com

Media Relationstenablepr@tenable.com

Forward-Looking Statements

This press release includes forward-looking statements within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. All statements contained

in this press release other than statements of historical fact,

including statements regarding our future results of operations and

financial position, our platform's ability to help protect

enterprises from security exposure, business strategy and plans and

objectives for future operations, are forward-looking statements

and represent our views as of the date of this press release. The

words “anticipate,” "believe,” “continue,” “estimate,” “expect,”

“intend,” “may,” “will” and similar expressions are intended to

identify forward-looking statements. We have based these

forward-looking statements on our current expectations and

projections about future events and financial trends that we

believe may affect our financial condition, results of operations,

business strategy, short-term and long-term business operations and

objectives and financial needs. These forward-looking statements

are subject to a number of assumptions and risks and uncertainties,

many of which involve factors or circumstances that are beyond our

control that could affect our financial results. These risks and

uncertainties are detailed in the sections titled "Risk Factors"

and "Management's Discussion and Analysis of Financial Condition

and Results of Operations" in our Annual Report on Form 10-K for

the year ended December 31, 2023 as well as other filings that we

make from time to time with the SEC, which are available on the

SEC's website at sec.gov. Moreover, we operate in a very

competitive and rapidly changing environment. New risks emerge from

time to time. It is not possible for our management to predict all

risks, nor can we assess the impact of all factors on our business

or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those contained in

any forward-looking statements we may make. In light of these

risks, uncertainties and assumptions, the future events and trends

discussed in this press release may not occur and actual results

could differ materially and adversely from those anticipated or

implied in any forward-looking statements. Except as required by

law, we are under no obligation to update these forward-looking

statements subsequent to the date of this press release, or to

update the reasons if actual results differ materially from those

anticipated in the forward-looking statements.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with GAAP, we use

certain non-GAAP financial measures, as described below, to

understand and evaluate our core operating performance.

These non-GAAP financial measures, which may be different

than similarly titled measures used by other companies, are

presented to enhance the overall understanding of our financial

performance and should not be considered a substitute for, or

superior to, the financial information prepared and presented in

accordance with GAAP.

We believe that these non-GAAP financial measures

provide useful information about our financial performance, enhance

the overall understanding of our past performance and future

prospects and allow for greater transparency with respect to

important metrics used by management for financial and operational

decision-making. We include these non-GAAP financial measures to

present our financial performance using a management view and

because we believe that these measures provide an additional

comparison of our core financial performance over multiple periods

with other companies in our industry.

Reconciliations of non-GAAP financial measures to the most

directly comparable GAAP financial measures are included in the

financial tables accompanying this press release.

Calculated Current Billings: We define calculated current

billings, a non-GAAP financial measure, as total revenue recognized

in a period plus the change in current deferred revenue in the

corresponding period. We believe that calculated current billings

is a key metric to measure our periodic performance. Given that

most of our customers pay in advance (including multi-year

contracts), but we generally recognize the related revenue ratably

over time, we use calculated current billings to measure and

monitor our ability to provide our business with the working

capital generated by upfront payments from our customers. We

believe that calculated current billings, which excludes deferred

revenue for periods beyond twelve months in a customer’s

contractual term, more closely correlates with annual contract

value and that the variability in total billings, depending on the

timing of large multi-year contracts and the preference for annual

billing versus multi-year upfront billing, may distort growth in

one period over another.

Free Cash Flow and Unlevered Free Cash Flow: We define free cash

flow, a non-GAAP financial measure, as net cash provided by

operating activities less purchases of property and equipment and

capitalized software development costs. We believe free cash

flow is an important liquidity measure of the cash that is

available (if any), after purchases of property and equipment and

capitalized software development costs, for investment in our

business and to make acquisitions. We believe that free cash flow

is useful as a liquidity measure because it measures our ability to

generate cash. We define unlevered free cash flow as free cash flow

plus cash paid for interest and other financing costs. We believe

unlevered free cash flow is useful as a liquidity measure as it

measures the cash that is available to invest in our business and

meet our current debt obligations and future financing needs.

However, given our debt obligations, non-cancelable commitments and

other contractual obligations, unlevered free cash flow does not

represent residual cash flow available for discretionary

expenses.

Non-GAAP Income from Operations and Non-GAAP Operating Margin:

We define these non-GAAP financial measures as their respective

GAAP measures, excluding the effect of stock-based compensation,

acquisition-related expenses, restructuring expenses, costs related

to the intra-entity asset transfers resulting from the internal

restructuring of legal entities, and amortization of acquired

intangible assets. Acquisition-related expenses include transaction

and integration expenses, as well as costs related to the

intercompany transfer of acquired intellectual property.

Restructuring expenses include non-ordinary course severance,

employee related benefits, and other charges. We believe that the

exclusion of these expenses provides for a useful comparison of our

operating results to prior periods and to our peer companies, which

commonly exclude restructuring expenses.

Non-GAAP Net Income and Non-GAAP Earnings Per Share: We define

non-GAAP net income as GAAP net loss, excluding the effect of

stock-based compensation, acquisition-related expenses,

restructuring expenses and amortization of acquired intangible

assets, including the applicable tax impacts. In addition, we

exclude the tax impact and related costs of intra-entity asset

transfers resulting from the internal restructuring of legal

entities as well as deferred income tax benefits recognized in

connection with acquisitions. We use non-GAAP net income to

calculate non-GAAP earnings per share.

Non-GAAP Gross Profit and Non-GAAP Gross Margin: We define

non-GAAP gross profit as GAAP gross profit, excluding the effect of

stock-based compensation and amortization of acquired intangible

assets. Non-GAAP gross margin is defined as non-GAAP gross profit

as a percentage of revenue.

Non-GAAP Sales and Marketing Expense, Non-GAAP Research and

Development Expense and Non-GAAP General and Administrative

Expense: We define these non-GAAP measures as their respective GAAP

measures, excluding stock-based compensation, acquisition-related

expenses and costs related to intra-entity asset transfers

resulting from the internal restructuring of legal entities.

|

TENABLE HOLDINGS, INC.CONSOLIDATED

STATEMENTS OF OPERATIONS(unaudited) |

| |

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

(in thousands, except per share data) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

$ |

227,088 |

|

|

$ |

201,529 |

|

|

$ |

664,290 |

|

|

$ |

585,404 |

|

| Cost of revenue(1) |

|

50,499 |

|

|

|

45,754 |

|

|

|

148,229 |

|

|

|

134,774 |

|

| Gross profit |

|

176,589 |

|

|

|

155,775 |

|

|

|

516,061 |

|

|

|

450,630 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Sales and marketing(1) |

|

99,083 |

|

|

|

94,759 |

|

|

|

300,037 |

|

|

|

289,750 |

|

|

Research and development(1) |

|

48,020 |

|

|

|

37,052 |

|

|

|

136,896 |

|

|

|

113,080 |

|

|

General and administrative(1) |

|

31,569 |

|

|

|

31,877 |

|

|

|

92,889 |

|

|

|

85,614 |

|

|

Restructuring |

|

— |

|

|

|

— |

|

|

|

6,070 |

|

|

|

— |

|

| Total operating expenses |

|

178,672 |

|

|

|

163,688 |

|

|

|

535,892 |

|

|

|

488,444 |

|

| Loss from operations |

|

(2,083 |

) |

|

|

(7,913 |

) |

|

|

(19,831 |

) |

|

|

(37,814 |

) |

|

Interest income |

|

5,989 |

|

|

|

7,662 |

|

|

|

17,587 |

|

|

|

19,323 |

|

|

Interest expense |

|

(8,148 |

) |

|

|

(8,119 |

) |

|

|

(24,333 |

) |

|

|

(23,208 |

) |

|

Other income (expense), net |

|

359 |

|

|

|

(6,502 |

) |

|

|

(858 |

) |

|

|

(7,993 |

) |

| Loss before income taxes |

|

(3,883 |

) |

|

|

(14,872 |

) |

|

|

(27,435 |

) |

|

|

(49,692 |

) |

| Provision for income

taxes |

|

5,328 |

|

|

|

693 |

|

|

|

10,734 |

|

|

|

6,944 |

|

| Net loss |

$ |

(9,211 |

) |

|

$ |

(15,565 |

) |

|

$ |

(38,169 |

) |

|

$ |

(56,636 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share, basic and

diluted |

$ |

(0.08 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.32 |

) |

|

$ |

(0.49 |

) |

| Weighted-average shares used

to compute net loss per share, basic and diluted |

|

119,169 |

|

|

|

115,954 |

|

|

|

118,466 |

|

|

|

114,967 |

|

_______________

(1) Includes stock-based compensation as follows:

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| Cost of revenue |

$ |

3,216 |

|

$ |

3,011 |

|

$ |

9,486 |

|

$ |

8,542 |

| Sales and marketing |

|

15,941 |

|

|

15,805 |

|

|

47,517 |

|

|

46,622 |

| Research and development |

|

12,435 |

|

|

9,242 |

|

|

35,395 |

|

|

27,871 |

| General and

administrative |

|

10,092 |

|

|

8,777 |

|

|

30,403 |

|

|

25,777 |

|

Total stock-based compensation |

$ |

41,684 |

|

$ |

36,835 |

|

$ |

122,801 |

|

$ |

108,812 |

|

TENABLE HOLDINGS, INC.CONSOLIDATED BALANCE

SHEETS |

| |

| |

September 30, 2024 |

|

December 31, 2023 |

| (in thousands, except

per share data) |

(unaudited) |

|

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

312,207 |

|

|

$ |

237,132 |

|

|

Short-term investments |

|

236,242 |

|

|

|

236,840 |

|

|

Accounts receivable (net of allowance for doubtful accounts of $971

and $470 at September 30, 2024 and December 31, 2023,

respectively) |

|

192,648 |

|

|

|

220,060 |

|

|

Deferred commissions |

|

49,858 |

|

|

|

49,559 |

|

|

Prepaid expenses and other current assets |

|

52,575 |

|

|

|

61,882 |

|

| Total current assets |

|

843,530 |

|

|

|

805,473 |

|

| Property and equipment,

net |

|

39,780 |

|

|

|

45,436 |

|

| Deferred commissions (net of

current portion) |

|

64,405 |

|

|

|

72,394 |

|

| Operating lease right-of-use

assets |

|

32,127 |

|

|

|

34,835 |

|

| Acquired intangible assets,

net |

|

99,474 |

|

|

|

107,017 |

|

| Goodwill |

|

541,292 |

|

|

|

518,539 |

|

| Other assets |

|

13,811 |

|

|

|

23,177 |

|

| Total assets |

$ |

1,634,419 |

|

|

$ |

1,606,871 |

|

| |

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable and accrued expenses |

$ |

17,833 |

|

|

$ |

16,941 |

|

|

Accrued compensation |

|

43,040 |

|

|

|

66,492 |

|

|

Deferred revenue |

|

583,940 |

|

|

|

580,779 |

|

|

Operating lease liabilities |

|

6,099 |

|

|

|

5,971 |

|

|

Other current liabilities |

|

6,205 |

|

|

|

5,655 |

|

| Total current liabilities |

|

657,117 |

|

|

|

675,838 |

|

| Deferred revenue (net of

current portion) |

|

163,512 |

|

|

|

169,718 |

|

| Term loan, net of issuance

costs (net of current portion) |

|

357,334 |

|

|

|

359,281 |

|

| Operating lease liabilities

(net of current portion) |

|

43,706 |

|

|

|

48,058 |

|

| Other liabilities |

|

8,195 |

|

|

|

7,632 |

|

| Total liabilities |

|

1,229,864 |

|

|

|

1,260,527 |

|

| |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Common stock (par value: $0.01; 500,000 shares authorized; 121,344

and 117,504 shares issued at September 30, 2024 and

December 31, 2023, respectively) |

|

1,213 |

|

|

|

1,175 |

|

|

Additional paid-in capital |

|

1,330,517 |

|

|

|

1,185,100 |

|

|

Treasury stock (at cost: 1,471 and 356 shares at September 30, 2024

and December 31, 2023, respectively) |

|

(64,925 |

) |

|

|

(14,934 |

) |

|

Accumulated other comprehensive income |

|

954 |

|

|

|

38 |

|

|

Accumulated deficit |

|

(863,204 |

) |

|

|

(825,035 |

) |

| Total stockholders’

equity |

|

404,555 |

|

|

|

346,344 |

|

| Total liabilities and

stockholders’ equity |

$ |

1,634,419 |

|

|

$ |

1,606,871 |

|

|

TENABLE HOLDINGS, INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS(unaudited) |

| |

| |

Nine Months Ended September 30, |

|

(in thousands) |

|

2024 |

|

|

|

2023 |

|

| Cash flows from

operating activities: |

|

|

|

| Net loss |

$ |

(38,169 |

) |

|

$ |

(56,636 |

) |

| Adjustments to

reconcile net loss to net cash provided by operating

activities: |

|

|

|

Depreciation and amortization |

|

24,434 |

|

|

|

18,900 |

|

|

Stock-based compensation |

|

122,801 |

|

|

|

108,812 |

|

|

Net accretion of discounts and amortization of premiums on

short-term investments |

|

(6,141 |

) |

|

|

(5,903 |

) |

|

Amortization of debt issuance costs |

|

1,003 |

|

|

|

941 |

|

|

(Gain) loss on other investments |

|

(1,452 |

) |

|

|

5,000 |

|

|

Restructuring |

|

4,528 |

|

|

|

— |

|

|

Other |

|

4,128 |

|

|

|

1,800 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

26,911 |

|

|

|

9,084 |

|

|

Prepaid expenses and other assets |

|

29,868 |

|

|

|

17,524 |

|

|

Accounts payable, accrued expenses and accrued compensation |

|

(22,921 |

) |

|

|

447 |

|

|

Deferred revenue |

|

(3,153 |

) |

|

|

16,856 |

|

|

Other current and noncurrent liabilities |

|

(5,480 |

) |

|

|

(5,475 |

) |

|

Net cash provided by operating activities |

|

136,357 |

|

|

|

111,350 |

|

| |

|

|

|

| Cash flows from

investing activities: |

|

|

|

| Purchases of property and

equipment |

|

(1,924 |

) |

|

|

(1,299 |

) |

| Capitalized software

development costs |

|

(5,930 |

) |

|

|

(4,707 |

) |

| Purchases of short-term

investments |

|

(227,210 |

) |

|

|

(217,239 |

) |

| Sales and maturities of

short-term investments |

|

234,865 |

|

|

|

242,864 |

|

| Proceeds from other

investments |

|

3,512 |

|

|

|

— |

|

| Purchases of other

investments |

|

(1,250 |

) |

|

|

— |

|

| Business combinations, net of

cash acquired |

|

(29,162 |

) |

|

|

— |

|

|

Net cash (used in) provided by investing activities |

|

(27,099 |

) |

|

|

19,619 |

|

| |

|

|

|

| Cash flows from

financing activities: |

|

|

|

| Payments on term loan |

|

(2,813 |

) |

|

|

(2,813 |

) |

| Proceeds from loan

agreement |

|

— |

|

|

|

424 |

|

| Proceeds from stock issued in

connection with the employee stock purchase plan |

|

16,262 |

|

|

|

16,224 |

|

| Proceeds from the exercise of

stock options |

|

4,798 |

|

|

|

2,421 |

|

| Purchase of treasury

stock |

|

(49,991 |

) |

|

|

— |

|

| Other financing

activities |

|

— |

|

|

|

(213 |

) |

|

Net cash (used in) provided by financing activities |

|

(31,744 |

) |

|

|

16,043 |

|

| Effect of exchange rate

changes on cash and cash equivalents and restricted cash |

|

(2,439 |

) |

|

|

(2,562 |

) |

| Net increase in cash and cash

equivalents and restricted cash |

|

75,075 |

|

|

|

144,450 |

|

| Cash and cash equivalents and

restricted cash at beginning of period |

|

237,132 |

|

|

|

300,866 |

|

| Cash and cash equivalents and

restricted cash at end of period |

$ |

312,207 |

|

|

$ |

445,316 |

|

|

TENABLE HOLDINGS, INC.REVENUE COMPONENTS

AND RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES(unaudited) |

| |

| Revenue |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| Subscription revenue |

$ |

208,554 |

|

$ |

183,268 |

|

$ |

608,727 |

|

$ |

531,133 |

| Perpetual license and

maintenance revenue |

|

11,769 |

|

|

12,200 |

|

|

35,941 |

|

|

36,535 |

| Professional services and

other revenue |

|

6,765 |

|

|

6,061 |

|

|

19,622 |

|

|

17,736 |

|

Revenue(1) |

$ |

227,088 |

|

$ |

201,529 |

|

$ |

664,290 |

|

$ |

585,404 |

_______________

(1) Recurring revenue, which includes revenue from subscription

arrangements for software (both recognized ratably over the

subscription term and upon delivery) and cloud-based solutions and

maintenance associated with perpetual licenses, represented 96% of

revenue in the three and nine months ended September 30, 2024 and

95% of revenue in the three and nine months ended September 30,

2023.

| Calculated Current

Billings |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

(in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

$ |

227,088 |

|

|

$ |

201,529 |

|

|

$ |

664,290 |

|

|

$ |

585,404 |

|

| Deferred revenue (current),

end of period |

|

583,940 |

|

|

|

518,372 |

|

|

|

583,940 |

|

|

|

518,372 |

|

| Deferred revenue (current),

beginning of period(1) |

|

(562,587 |

) |

|

|

(495,199 |

) |

|

|

(580,887 |

) |

|

|

(502,115 |

) |

|

Calculated current billings |

$ |

248,441 |

|

|

$ |

224,702 |

|

|

$ |

667,343 |

|

|

$ |

601,661 |

|

________________(1) Deferred revenue (current), beginning of

period for the nine months ended September 30, 2024 includes

$0.1 million related to acquired deferred revenue.

| Remaining Performance

Obligations |

September 30, |

|

(in thousands) |

|

2024 |

|

|

2023 |

| Remaining performance

obligations, short-term |

$ |

592,351 |

|

$ |

528,367 |

| Remaining performance

obligations, long-term |

|

179,210 |

|

|

168,817 |

|

Remaining performance obligations |

$ |

771,561 |

|

$ |

697,184 |

| Free Cash Flow and

Unlevered Free Cash Flow |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

(in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net cash provided by operating

activities |

$ |

54,607 |

|

|

$ |

42,411 |

|

|

$ |

136,357 |

|

|

$ |

111,350 |

|

| Purchases of property and

equipment |

|

(733 |

) |

|

|

(201 |

) |

|

|

(1,924 |

) |

|

|

(1,299 |

) |

| Capitalized software

development costs |

|

(1,163 |

) |

|

|

(1,894 |

) |

|

|

(5,930 |

) |

|

|

(4,707 |

) |

|

Free cash flow(1) |

|

52,711 |

|

|

|

40,316 |

|

|

|

128,503 |

|

|

|

105,344 |

|

| Cash paid for interest and

other financing costs |

|

8,055 |

|

|

|

7,843 |

|

|

|

23,505 |

|

|

|

26,786 |

|

|

Unlevered free cash flow(1) |

$ |

60,766 |

|

|

$ |

48,159 |

|

|

$ |

152,008 |

|

|

$ |

132,130 |

|

________________

(1) Free cash flow and unlevered free cash flow for the periods

presented were impacted by:

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

(in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Employee stock purchase plan

activity |

$ |

(3,653 |

) |

|

$ |

(2,236 |

) |

|

$ |

(6,283 |

) |

|

$ |

(2,507 |

) |

| Acquisition-related

expenses |

|

(663 |

) |

|

|

(571 |

) |

|

|

(1,326 |

) |

|

|

(830 |

) |

| Restructuring |

|

(492 |

) |

|

|

— |

|

|

|

(5,911 |

) |

|

|

— |

|

| Non-GAAP Income from

Operations and Non-GAAP Operating Margin |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

(dollars in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Loss from operations |

$ |

(2,083 |

) |

|

$ |

(7,913 |

) |

|

$ |

(19,831 |

) |

|

$ |

(37,814 |

) |

| Stock-based compensation |

|

41,684 |

|

|

|

36,835 |

|

|

|

122,801 |

|

|

|

108,812 |

|

| Acquisition-related

expenses |

|

360 |

|

|

|

4,598 |

|

|

|

1,284 |

|

|

|

4,728 |

|

| Restructuring |

|

— |

|

|

|

— |

|

|

|

6,070 |

|

|

|

— |

|

| Amortization of acquired

intangible assets |

|

5,014 |

|

|

|

3,055 |

|

|

|

14,443 |

|

|

|

9,208 |

|

|

Non-GAAP income from operations |

$ |

44,975 |

|

|

$ |

36,575 |

|

|

$ |

124,767 |

|

|

$ |

84,934 |

|

| Operating margin |

|

(1 |

)% |

|

|

`(4 |

)% |

|

|

(3 |

)% |

|

|

(6 |

)% |

| Non-GAAP operating margin |

|

20 |

% |

|

|

18 |

% |

|

|

19 |

% |

|

|

15 |

% |

| Non-GAAP Net Income

and Non-GAAP Earnings Per Share |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

(in thousands, except per share data) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss |

$ |

(9,211 |

) |

|

$ |

(15,565 |

) |

|

$ |

(38,169 |

) |

|

$ |

(56,636 |

) |

| Stock-based compensation |

|

41,684 |

|

|

|

36,835 |

|

|

|

122,801 |

|

|

|

108,812 |

|

| Tax impact of stock-based

compensation(1) |

|

1,528 |

|

|

|

(1,207 |

) |

|

|

1,626 |

|

|

|

1,046 |

|

| Acquisition-related

expenses(2) |

|

360 |

|

|

|

4,598 |

|

|

|

1,284 |

|

|

|

4,728 |

|

| Restructuring(2) |

|

— |

|

|

|

— |

|

|

|

6,070 |

|

|

|

— |

|

| Amortization of acquired

intangible assets(3) |

|

5,014 |

|

|

|

3,055 |

|

|

|

14,443 |

|

|

|

9,208 |

|

| Tax impact of

acquisitions |

|

(52 |

) |

|

|

(48 |

) |

|

|

(130 |

) |

|

|

(161 |

) |

|

Non-GAAP net income |

$ |

39,323 |

|

|

$ |

27,668 |

|

|

$ |

107,925 |

|

|

$ |

66,997 |

|

| |

|

|

|

|

|

|

|

|

Net loss per share, diluted |

$ |

(0.08 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.32 |

) |

|

$ |

(0.49 |

) |

| Stock-based compensation |

|

0.35 |

|

|

|

0.32 |

|

|

|

1.04 |

|

|

|

0.94 |

|

| Tax impact of stock-based

compensation(1) |

|

0.01 |

|

|

|

(0.01 |

) |

|

|

0.01 |

|

|

|

0.01 |

|

| Acquisition-related

expenses(2) |

|

0.01 |

|

|

|

0.04 |

|

|

|

0.01 |

|

|

|

0.04 |

|

| Restructuring(2) |

|

— |

|

|

|

— |

|

|

|

0.05 |

|

|

|

— |

|

| Amortization of acquired

intangible assets(3) |

|

0.04 |

|

|

|

0.02 |

|

|

|

0.12 |

|

|

|

0.08 |

|

| Tax impact of

acquisitions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Adjustment to diluted earnings

per share(4) |

|

(0.01 |

) |

|

|

(0.01 |

) |

|

|

(0.03 |

) |

|

|

(0.02 |

) |

|

Non-GAAP earnings per share, diluted |

$ |

0.32 |

|

|

$ |

0.23 |

|

|

$ |

0.88 |

|

|

$ |

0.56 |

|

| |

|

|

|

|

|

|

|

|

Weighted-average shares used to compute GAAP net loss per share,

diluted |

|

119,169 |

|

|

|

115,954 |

|

|

|

118,466 |

|

|

|

114,967 |

|

| |

|

|

|

|

|

|

|

|

Weighted-average shares used to compute non-GAAP earnings per

share, diluted |

|

123,288 |

|

|

|

121,473 |

|

|

|

123,206 |

|

|

|

120,273 |

|

________________

(1) The tax impact of stock-based compensation is based on the

tax treatment for the applicable tax jurisdictions.(2) The tax

impact of acquisition-related expenses and restructuring are not

material.(3) The tax impact of the amortization of acquired

intangible assets is included in the tax impact of acquisitions.(4)

An adjustment to reconcile GAAP net loss per share, which excludes

potentially dilutive shares, to non-GAAP earnings per share, which

includes potentially dilutive shares.

| Non-GAAP Gross Profit

and Non-GAAP Gross Margin |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

(dollars in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Gross profit |

$ |

176,589 |

|

|

$ |

155,775 |

|

|

$ |

516,061 |

|

|

$ |

450,630 |

|

| Stock-based compensation |

|

3,216 |

|

|

|

3,011 |

|

|

|

9,486 |

|

|

|

8,542 |

|

| Amortization of acquired

intangible assets |

|

5,014 |

|

|

|

3,055 |

|

|

|

14,443 |

|

|

|

9,208 |

|

|

Non-GAAP gross profit |

$ |

184,819 |

|

|

$ |

161,841 |

|

|

$ |

539,990 |

|

|

$ |

468,380 |

|

| Gross margin |

|

78 |

% |

|

|

77 |

% |

|

|

78 |

% |

|

|

77 |

% |

| Non-GAAP gross margin |

|

81 |

% |

|

|

80 |

% |

|

|

81 |

% |

|

|

80 |

% |

| Non-GAAP Sales and

Marketing Expense |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

(dollars in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Sales and marketing

expense |

$ |

99,083 |

|

|

$ |

94,759 |

|

|

$ |

300,037 |

|

|

$ |

289,750 |

|

| Less: Stock-based

compensation |

|

15,941 |

|

|

|

15,805 |

|

|

|

47,517 |

|

|

|

46,622 |

|

| Less: Acquisition-related

expenses |

|

3 |

|

|

|

— |

|

|

|

52 |

|

|

|

— |

|

|

Non-GAAP sales and marketing expense |

$ |

83,139 |

|

|

$ |

78,954 |

|

|

$ |

252,468 |

|

|

$ |

243,128 |

|

|

Non-GAAP sales and marketing expense % of revenue |

|

37 |

% |

|

|

39 |

% |

|

|

38 |

% |

|

|

42 |

% |

| Non-GAAP Research and

Development Expense |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

(dollars in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Research and development

expense |

$ |

48,020 |

|

|

$ |

37,052 |

|

|

$ |

136,896 |

|

|

$ |

113,080 |

|

| Less: Stock-based

compensation |

|

12,435 |

|

|

|

9,242 |

|

|

|

35,395 |

|

|

|

27,871 |

|

| Less: Acquisition-related

expenses |

|

— |

|

|

|

— |

|

|

|

(20 |

) |

|

|

— |

|

|

Non-GAAP research and development expense |

$ |

35,585 |

|

|

$ |

27,810 |

|

|

$ |

101,521 |

|

|

$ |

85,209 |

|

|

Non-GAAP research and development expense % of revenue |

|

16 |

% |

|

|

14 |

% |

|

|

15 |

% |

|

|

15 |

% |

| Non-GAAP General and

Administrative Expense |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

(dollars in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| General and administrative

expense |

$ |

31,569 |

|

|

$ |

31,877 |

|

|

$ |

92,889 |

|

|

$ |

85,614 |

|

| Less: Stock-based

compensation |

|

10,092 |

|

|

|

8,777 |

|

|

|

30,403 |

|

|

|

25,777 |

|

| Less: Acquisition-related

expenses |

|

357 |

|

|

|

4,598 |

|

|

|

1,252 |

|

|

|

4,728 |

|

|

Non-GAAP general and administrative expense |

$ |

21,120 |

|

|

$ |

18,502 |

|

|

$ |

61,234 |

|

|

$ |

55,109 |

|

|

Non-GAAP general and administrative expense % of revenue |

|

9 |

% |

|

|

9 |

% |

|

|

9 |

% |

|

|

9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following adjustments to reconcile forecasted non-GAAP

income from operations, non-GAAP net income, non-GAAP earnings per

share, free cash flow and unlevered free cash flow are subject to a

number of uncertainties and assumptions, each of which are

inherently difficult to forecast. As a result, actual adjustments

and GAAP results may differ materially.

| Forecasted Non-GAAP

Income from Operations |

Three Months EndingDecember 31,

2024 |

|

Year EndingDecember 31, 2024 |

| (in

millions) |

Low |

|

High |

|

Low |

|

High |

|

Forecasted income (loss) from operations |

$ |

0.6 |

|

$ |

2.6 |

|

$ |

(19.2 |

) |

|

$ |

(17.2 |

) |

| Forecasted stock-based

compensation |

|

41.3 |

|

|

41.3 |

|

|

164.1 |

|

|

|

164.1 |

|

| Forecasted acquisition-related

expenses |

|

— |

|

|

— |

|

|

1.3 |

|

|

|

1.3 |

|

| Forecasted restructuring |

|

— |

|

|

— |

|

|

6.1 |

|

|

|

6.1 |

|

| Forecasted amortization of

acquired intangible assets |

|

5.1 |

|

|

5.1 |

|

|

19.5 |

|

|

|

19.5 |

|

|

Forecasted non-GAAP income from operations |

$ |

47.0 |

|

$ |

49.0 |

|

$ |

171.8 |

|

|

$ |

173.8 |

|

| Forecasted Non-GAAP

Net Income and Non-GAAP Earnings Per Share |

Three Months EndingDecember 31,

2024 |

|

Year EndingDecember 31, 2024 |

| (in millions, except

per share data) |

Low |

|

High |

|

Low |

|

High |

|

Forecasted net loss(1) |

$ |

(6.2 |

) |

|

$ |

(4.2 |

) |

|

$ |

(44.4 |

) |

|

$ |

(42.4 |

) |

| Forecasted stock-based

compensation |

|

41.3 |

|

|

|

41.3 |

|

|

|

164.1 |

|

|

|

164.1 |

|

| Forecasted tax impact of

stock-based compensation |

|

1.9 |

|

|

|

1.9 |

|

|

|

3.5 |

|

|

|

3.5 |

|

| Forecasted acquisition-related

expenses |

|

— |

|

|

|

— |

|

|

|

1.3 |

|

|

|

1.3 |

|

| Forecasted restructuring |

|

— |

|

|

|

— |

|

|

|

6.1 |

|

|

|

6.1 |

|

| Forecasted amortization of

acquired intangible assets |

|

5.1 |

|

|

|

5.1 |

|

|

|

19.5 |

|

|

|

19.5 |

|

| Forecasted tax impact of

acquisitions |

|

(0.1 |

) |

|

|

(0.1 |

) |

|

|

(0.2 |

) |

|

|

(0.2 |

) |

|

Forecasted non-GAAP net income |

$ |

42.0 |

|

|

$ |

44.0 |

|

|

$ |

149.9 |

|

|

$ |

151.9 |

|

| |

|

|

|

|

|

|

|

|

Forecasted net loss per share, diluted(1) |

$ |

(0.05 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.37 |

) |

|

$ |

(0.36 |

) |

| Forecasted stock-based

compensation |

|

0.34 |

|

|

|

0.34 |

|

|

|

1.38 |

|

|

|

1.38 |

|

| Forecasted tax impact of

stock-based compensation |

|

0.02 |

|

|

|

0.02 |

|

|

|

0.03 |

|

|

|

0.03 |

|

| Forecasted acquisition-related

expenses |

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

0.01 |

|

| Forecasted restructuring |

|

— |

|

|

|

— |

|

|

|

0.05 |

|

|

|

0.05 |

|

| Forecasted amortization of

acquired intangible assets |

|

0.04 |

|

|

|

0.04 |

|

|

|

0.16 |

|

|

|

0.16 |

|

| Forecasted tax impact of

acquisitions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Adjustment to diluted earnings

per share(2) |

|

(0.02 |

) |

|

|

(0.01 |

) |

|

|

(0.05 |

) |

|

|

(0.04 |

) |

|

Forecasted non-GAAP earnings per share, diluted |

$ |

0.33 |

|

|

$ |

0.35 |

|

|

$ |

1.21 |

|

|

$ |

1.23 |

|

| |

|

|

|

|

|

|

|

|

Forecasted weighted-average shares used to compute GAAP net loss

per share, diluted |

|

120.0 |

|

|

|

120.0 |

|

|

|

119.0 |

|

|

|

119.0 |

|

|

Forecasted weighted-average shares used to compute non-GAAP

earnings per share, diluted |

|

125.5 |

|

|

|

125.5 |

|

|

|

123.5 |

|

|

|

123.5 |

|

________________(1) The forecasted GAAP net loss assumes income

tax expense of $4.9 million and $15.6 million in the three months

and year ending December 31, 2024, respectively.

(2) Adjustment to reconcile GAAP net loss per share, which

excludes potentially dilutive shares, to non-GAAP earnings per

share, which includes potentially dilutive shares.

| Forecasted Free Cash

Flow and Unlevered Free Cash Flow |

Year EndingDecember 31, 2024 |

| (in

millions) |

Low |

|

High |

|

Forecasted net cash provided by operating activities |

$ |

206.7 |

|

|

$ |

216.7 |

|

| Forecasted purchases of

property and equipment |

|

(5.9 |

) |

|

|

(5.9 |

) |

| Forecasted capitalized

software development costs |

|

(6.7 |

) |

|

|

(6.7 |

) |

|

Forecasted free cash flow |

|

194.1 |

|

|

|

204.1 |

|

| Forecasted cash paid for

interest and other financing costs |

|

30.9 |

|

|

|

30.9 |

|

|

Forecasted unlevered free cash flow |

$ |

225.0 |

|

|

$ |

235.0 |

|

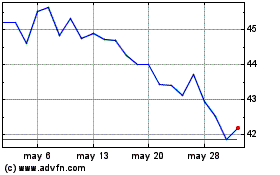

Tenable (NASDAQ:TENB)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Tenable (NASDAQ:TENB)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024