false

0001905956

0001905956

2024-10-16

2024-10-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

October 16, 2024

TREASURE GLOBAL INC

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41476 |

|

36-4965082 |

(State or other jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

276 5th Avenue, Suite 704 #739

New York, New York |

|

10001 |

| (Address of registrant’s principal executive office) |

|

(Zip code) |

+6012 643 7688

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.00001 per share |

|

TGL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01. Other Events.

As previously disclosed, on October 10, 2024,

Treasure Global Inc (the “Company” or “we”) entered into a Share Purchase Agreement (the “Purchase Agreement”)

with Alumni Capital LP (“Alumni Capital”), a Delaware limited partnership. Pursuant to the Purchase Agreement,

the Company has the right, but not the obligation to cause Alumni Capital to purchase up to $6,000,000 the Company’s common

stock, par value $0.00001 (the “Commitment Amount”), at the Purchase Price (defined below) during the period beginning on

the execution date of the Purchase Agreement and ending on the earlier of (i) the date on which Alumni Capital has purchased

$6,000,000 of the Company’s common stock pursuant to the Purchase Agreement or (ii) December 31, 2025.

In consideration for Alumni Capital’s

execution and performance under the Purchase Agreement, the Company issued to Alumni Capital a purchase warrant dated October

10, 2024 for a term of three (3) years (the “Purchase Warrant”), to purchase up to a number of common stock equal to ten percent

(10%) of the Commitment Amount divided by the exercise price of the Purchase Warrant. The exercise price per share of the Purchase Warrant

will be calculated by dividing the $5,000,000 valuation by the total number of outstanding shares of common stock as of the Exercise Date.

On October 16, 2024, we filed a prospectus supplement,

dated as of October 16, 2024 (the “Prospectus Supplement”) under the registration statement on Form S-3 (File No. 333-278171),

in respect of the financing with Alumni Capital. The Prospectus Supplement included certain updated disclosures regarding the Company,

in particular, in the sections captioned “Prospectus Supplement Summary—Recent Developments”. Neither the Purchase Warrant

nor the common stocks underlying the Purchase Warrant are covered by the Prospectus Supplement. In addition, the Company is filing, as

exhibits hereto, an opinion of Sichenzia Ross Ference Carmel LLP and the consent of WWC, P.C., as Exhibit 5.1 and Exhibit 23.1, respectively.

Capitalized terms that are not defined herein may have meanings assigned to them in the Purchase Agreement and the Purchase Warrant.

Item 9.01. Financial Statement and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 17, 2024 |

TREASURE GLOBAL INC. |

| |

|

|

| |

By: |

/s/ Carlson Thow |

| |

Name: |

Carlson Thow |

| |

Title: |

Chief Executive Officer |

2

Exhibit 5.1

October

16, 2024

Treasure Global Inc

276 5th Avenue, Suite 704 #739

New York, New York

Ladies and Gentlemen,

We have acted as counsel to

Treasure Global Inc, a Delaware corporation (the “Company”), in connection with the issuance of this opinion that relates

to a Registration Statement on Form S-3 (No. 333-278171), including the base prospectus contained therein, and a prospectus supplement

dated October 16, 2024 (together, the “Registration Statement”) filed by the Company with the Securities and Exchange Commission

under the Securities Act of 1933, as amended (the “Securities Act”). The Registration Statement covers the resale, by the

selling stockholder listed therein, from time to time pursuant to Rule 415 under the Securities Act as set forth in the Registration Statement,

of up to $1,000,000 shares (the “Shares”) of common stock, par value $0.00001 per share, of the Company (“Common Stock”)

that have been or may be issued to Alumni Capital LP (the “Selling Stockholder”) pursuant to the Purchase Agreement dated

as of October 10, 2024 (the “Purchase Agreement”), by and between the Company and the Selling Stockholder.

This opinion letter is being

delivered in accordance with the requirements of Item 601(b)(5)(i) of Regulation S-K under the Securities Act, and no opinion is expressed

herein as to any matter pertaining to the contents of the Registration Statement.

In connection with the issuance

of this opinion letter, we have examined originals or copies, certified or otherwise identified to our satisfaction, of such records of

the Company and such agreements, certificates and receipts of public officials, certificates of officers or other representatives of the

Company and others, and such other documents as we have deemed necessary or appropriate as a basis for the opinions stated below. As to

any facts relevant to the opinions stated herein that we did not independently establish or verify, we have relied upon statements and

representations of officers and other representatives of the Company and of public officials.

In our examination, we have

assumed (i) the genuineness of all signatures, including endorsements, (ii) the legal capacity and competency of all natural persons,

(iii) the authenticity of all documents submitted to us as originals, (iv) the conformity to original documents of all documents submitted

to us as facsimile, electronic, certified or photostatic copies, and the authenticity of the originals of such copies and (v) the accuracy,

completeness and authenticity of certificates of public officials.

Based upon the foregoing and

subject to the qualifications and assumptions stated herein, we are of the opinion that the Shares have been duly authorized by all requisite

corporate action on the part of the Company under the Delaware General Corporation Law (“DGCL”) and, when the Shares are delivered

and paid for in accordance with the terms of the Purchase Agreement and when evidence of the issuance thereof is duly recorded in the

Company’s books and records, the Shares will be validly issued, fully paid and non-assessable.

1185 AVENUE OF THE AMERICAS

| 31ST FLOOR | NEW YORK, NY | 10036

T (212) 930-9700 | F (212) 930-9725 | WWW.SRFC.LAW

Our opinion is expressly limited

to the matters set forth above, and we render no opinion, whether by implication or otherwise, as to any other matters relating to the

Company, the Shares, the Purchase Agreement or any other agreements or transactions that may be related thereto or contemplated thereby.

We are expressing no opinion as to any obligations that parties other than the Company may have under or in respect of the Shares or as

to the effect that their performance of such obligations may have upon any of the matters referred to above. No opinion may be implied

or inferred beyond the opinion expressly stated above.

The opinion we render herein

is limited to those matters governed by the DGCL as of the date hereof and we disclaim any obligation to revise or supplement the opinion

rendered herein should the above-referenced laws be changed by legislative or regulatory action, judicial decision or otherwise. We express

no opinion as to whether, or the extent to which, the laws of any particular jurisdiction apply to the subject matter hereof.

This opinion letter is rendered

as of the date first written above, and we disclaim any obligation to advise you of facts, circumstances, events or developments that

hereafter may be brought to our attention or that may alter, affect or modify the opinion expressed herein.

We hereby consent to the filing

of this opinion as an exhibit to the Registration Statement. We also hereby consent to the reference to our firm under the heading “Legal

Matters” in the Registration Statement. In giving this consent, we do not thereby admit that we are within the category of persons

whose consent is required under Section 7 of the Securities Act or the General Rules and Regulations under the Securities Act. It is understood

that this opinion is to be used only in connection with the offer and sale of the Shares being registered while the Registration Statement

is effective under the Securities Act.

Very truly yours,

| |

/s/ Sichenzia Ross Ference Carmel LLP |

| |

|

| |

Sichenzia Ross Ference Carmel LLP |

1185 AVENUE OF THE AMERICAS

| 31ST FLOOR | NEW YORK, NY | 10036

T (212) 930-9700 | F (212) 930-9725 | WWW.SRFC.LAW

Exhibit 23.1

Consent of Independent Registered

Public Accounting Firm

We hereby consent to the incorporation

by reference to this Registration Statement No.333-278171 on Prospectus Supplement of Treasure Global Inc and its subsidiaries (collectively

the “Company”) of our report dated September 30, 2024 included in this Company’s annual report on Form 10-K, relating

to the audit of the consolidated balance sheets of the Company as of June 30, 2024 and 2023, and the related consolidated statement of

operations and comprehensive loss, changes in stockholders’ deficiency, and cash flows in each of the year for the two years period

ended June 30, 2024 and the related notes included herein.

We also consent to the reference of

WWC, P.C. as an independent registered public accounting firm, as experts in matters of accounting and auditing.

| |

/s/ WWC, P.C. |

| San Mateo, California |

WWC, P.C. |

| October 16, 2024 |

Certified Public

Accountants |

| |

PCAOB ID: 1171 |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

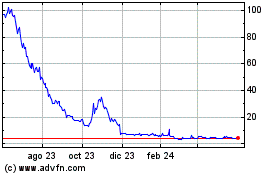

Treasure Global (NASDAQ:TGL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

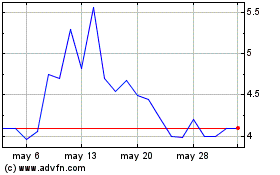

Treasure Global (NASDAQ:TGL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024