UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September

30, 2024 (September 27, 2024)

TMT

Acquisition Corp

(Exact

name of registrant as specified in its charter)

| Cayman

Islands |

|

001-41667 |

|

N/A |

| (State

or other jurisdiction |

|

(Commission |

|

(I.R.S.

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 420

Lexington Ave, Suite 2446 |

|

|

| New

York, NY |

|

10170 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (347) 627-0058

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under

any of the following provisions:

| ☒ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units,

each consisting of one ordinary share and one right |

|

TMTCU |

|

The

Nasdaq Stock Market LLC |

| Ordinary

shares, par value $0.0001 per share |

|

TMTC |

|

The

Nasdaq Stock Market LLC |

| Rights,

each right entitling the holder to receive two-tenths of one ordinary share |

|

TMTCR |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

The

disclosure included under Item 2.03 is incorporated by reference.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

As

previously disclosed, TMT Acquisition Corp, a Cayman Islands exempted company (“TMTC” or the “SPAC”)

entered into definitive agreement to effect a business combination (the “Business Combination”) with eLong Power Holding

Limited, a Cayman Islands exempted company (“eLong Power”), via an Agreement and Plan of Merger, dated December 1,

2023, as amended on February 29, 2024.

Further

to the above, on August 23, 2024, Ms. Xiaozhen Li, a limited partner of the SPAC’s sponsor entity, deposited $250,000 into the

working capital account of the SPAC. Ms. Li’s deposit is evidenced by a convertible promissory note (the “Note”)

issued by the SPAC in the principal amount of $250,000 to Ms. Li on September 27, 2024. The Note bears no interest and is repayable

in full upon consummation of the Business Combination. The Note payee may, at her election, convert her Note, in whole or in part, into

TMTC units, provided that written notice of such intention is given to TMTC at least two (2) business days prior to the consummation

of the Business Combination. The number of TMTC units to be received by the Note payee in connection with such conversion shall be an

amount determined by dividing (x) the sum of the outstanding principal amount payable to such payee by (y) $10.00. Each TMTC unit consists

of one (1) TMTC ordinary share and one (1) right to receive two-tenths (2/10) of one (1) TMTC ordinary share.

A

copy of the Note is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. The disclosures

set forth in this Item 2.03 are intended to be summaries only and are qualified in their entirety by reference to the Note.

Additional

Information and Where to Find It

In

connection with the proposed business combination, eLong Power has filed a registration statement on Form F-4 (File No. 333-280512) that

includes a preliminary proxy statement of TMTC and a preliminary prospectus of eLong Power. Once a definitive version is available, the

proxy statement/prospectus will be sent to all TMTC shareholders. Before making any voting decision, securities holders of TMTC are urged

to read the proxy statement/prospectus and all other relevant documents that are filed or that will be filed with the SEC in connection

with the proposed business combination, as they become available, because they contain and will contain important information about the

proposed business combination and the parties to the proposed business combination.

Investors

and securities holders may obtain free copies of the preliminary proxy statement/prospectus and, once available, the definitive proxy

statement/prospectus, and all other relevant documents that are filed or that will be filed with the SEC, through the website maintained

by the SEC at www.sec.gov. These documents may also be obtained free of charge by written request to TMT Acquisition Corporation, 420

Lexington Avenue, Suite 2446, New York, New York 10170.

Participants

in the Solicitation

eLong

Power and TMTC and certain of their respective directors, executive officers, and other members of management and employees may, under

SEC rules, be deemed to be participants in the solicitations of proxies from TMTC’s shareholders in connection with the proposed

transaction. Information about TMTC’s directors and executive officers and their ownership of TMTC’s securities is set forth

in TMTC’s filings with the SEC, including TMTC’s final prospectus of March 27, 2023 in connection with TMTC’s initial

public offering and its Quarterly Report on Form 10-Q for the fiscal period ended June 30, 2024. Information about certain changes in

the ownership of TMTC’s securities may also be found in Forms 3, 4 and 5 and in Schedules 13D and 13G filed with the SEC by the

beneficial owners thereof.

Additional

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests is also included

in the proxy statement/prospectus. Shareholders, potential investors, and other interested persons in respect of eLong Power and TMTC

should read the preliminary and, once available, definitive proxy statement/prospectus carefully before making any voting or investment

decisions. You may obtain free copies of these documents from the sources indicated above.

About

eLong Power

eLong

Power Holding Limited, a Cayman Islands exempted company, is committed to the research and development, manufacturing, sales and service

of high-power lithium-ion batteries for electric vehicles and construction machinery, as well as large-capacity, long-cycle lithium-ion

batteries for energy storage systems. eLong Power is led by Ms. Xiaodan Liu, eLong Power’s Chairwoman and CEO.

eLong

Power has a comprehensive product and technology system that includes battery cells, modules, system integration, and battery management

system development, based on high-power lithium-ion batteries and battery system products for long-cycle energy storage devices. eLong

Power offers advanced energy applications and full life cycle services. Its product portfolio includes products utilizing lithium manganese

oxide and lithium iron phosphate, among others, to meet the needs of high-power applications and energy storage applications in various

scenarios.

About

TMT Acquisition Corp

TMT

Acquisition Corp is a blank check company, also commonly referred to as a special purpose acquisition company (SPAC), formed for the

purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization, or similar business combination with

one or more businesses or entities. TMTC is led by Dajiang (“DJ”) Guo, Chairman and Chief Executive Officer, and Jichuan

Yang, Chief Financial Officer, who are growth-oriented executives with a long track record of value creation across industries.

Forward-looking

Statements

This

press release may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, including statements regarding the benefits of the transaction, the anticipated timing

of the transaction, the products offered by eLong Power and the markets in which it operates, and eLong Power’s projected future

results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,”

“anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,”

“plan,” “may,” “should,” “will,” “would,” “will be,” “will

continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and

other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and

uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document,

including, but not limited to: the risk that the transaction may not be completed by TMTC’s business combination deadline and the

potential failure to obtain an extension of the business combination deadline if sought by TMTC; the failure to satisfy the conditions

to the consummation of the transaction, including the adoption of the business combination agreement by the shareholders of TMTC; the

satisfaction of the minimum net tangible assets amount following redemptions by TMTC’s public shareholders; the occurrence of any

event, change or other circumstance that could give rise to the termination of the business combination agreement; the effect of the

announcement or pendency of the transaction on eLong Power’s business relationships, performance, and business generally; risks

that the proposed business combination disrupts current plans or operations of eLong Power; the outcome of any legal proceedings that

may be instituted against eLong Power or TMTC related to the business combination agreement or the proposed business combination; the

ability to maintain the listing of TMTC’s securities (which would be eLong Power Inc. securities) on Nasdaq after the closing of

the transaction; after the closing of the transaction, the price of eLong Power Inc.’s securities may be volatile due to a variety

of factors, including changes in the competitive and highly regulated industries in which eLong Power Inc. will operate, variations in

performance across competitors, changes in laws and regulations affecting eLong Power Inc.’s business and changes in its capital

structure; the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination,

and identify and realize additional opportunities provided by the business combination; its need for substantial additional funds; the

parties’ dependence on third-party suppliers; risks relating to the results of research and development activities, market and

other conditions; its ability to attract, integrate, and retain key personnel; risks related to its growth strategy; patent and intellectual

property matters; and the parties’ ability to obtain, perform under and maintain financing and strategic agreements and relationships.

These risks have been and may be further impacted by Covid-19 and global geopolitical events, such as the war in Ukraine and the Middle

East. Accordingly, these forward-looking statements do not constitute guarantees of future performance, and you are cautioned not to

place undue reliance on these forward-looking statements. Risks regarding TMTC’s and eLong Power’s business are described

in detail in TMTC’s and eLong Power’s SEC filings which are available on the SEC’s website at www.sec.gov, including

in eLong Power’s registration statement on Form F-4 (File No. 333-280512) and TMTC’s registration statement on Form S-1 (File

No. 333-259879), filed with the SEC and updated by TMTC’s and eLong Power’s subsequent filings with the SEC. These forward-looking

statements speak only as of the date hereof, and TMTC expressly disclaims any obligation or undertaking to release publicly any updates

or revisions to any forward-looking statements contained herein to reflect any change in our expectations or any changes in events, conditions,

or circumstances on which any such statement is based, except as required by law.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits. The following exhibits are filed with this Form 8-K:

*

Certain of the exhibits and schedules to this exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2) or 601(a)(5),

as applicable. TMTC agrees to furnish supplementally a copy of all omitted exhibits and schedules to the SEC upon its request.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

September 30, 2024 |

TMT

Acquisition Corp |

| |

|

|

| |

By: |

/s/

Dajiang Guo |

| |

Name: |

Dajiang

Guo |

| |

Title: |

Chief

Executive Officer |

Exhibit 10.1

THIS PROMISSORY NOTE (“NOTE”) HAS NOT

BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”). THIS NOTE HAS BEEN ACQUIRED FOR INVESTMENT

ONLY AND MAY NOT BE SOLD, TRANSFERRED OR ASSIGNED IN THE ABSENCE OF REGISTRATION OF THE RESALE THEREOF UNDER THE SECURITIES ACT OR AN

OPINION OF COUNSEL REASONABLY SATISFACTORY IN FORM, SCOPE AND SUBSTANCE TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED.

PROMISSORY NOTE

Principal Amount: US$250,000

Dated: September 27,

2024

FOR VALUE RECEIVED, TMT Acquisition Corp (the

“Maker” or the “Company”) promises to pay to the order of Ms. Xiaozhen Li, or her assignees or successors

in interest (the “Payee”), the principal sum of Two Hundred and Fifty Thousand dollars (US$250,000), on the terms and

conditions described below. All payments on this Note shall be made by wire transfer of immediately available funds to such account as

the Payee may from time to time designate by written notice in accordance with the provisions of this note (the “Note”).

| 1. |

Principal. The principal balance of this Note shall be payable by the Maker to the Payee upon the date on which the Maker consummates a business combination or merger with a qualified target company (as described in its Prospectus (as defined below)) (a “Business Combination”) (such date, the “Maturity Date”). The principal balance may be prepaid at any time prior to the Maturity Date without penalty. Under no circumstances shall any individual, including but not limited to any officer, director, employee or stockholder of the Maker, be obligated personally for any obligations or liabilities of the Maker hereunder. |

| |

|

| 2. |

Conversion Rights. The Payee has the right, but not the obligation, to convert this Note, in whole or in part, into private units (the “Units”) of the Maker, each consisting of one ordinary share and one right to receive two-tenths (2/10) of one ordinary share upon the consummation of a Business Combination, as described in the Prospectus of the Maker (the “Prospectus”), by providing the Maker with written notice of her intention to convert this Note at least two business days prior to the closing of a Business Combination. The number of Units to be received by the Payee in connection with such conversion shall be an amount determined by dividing (x) the sum of the outstanding principal amount payable to such Payee by (y) $10.00. |

| |

(a) |

Fractional Units. No fractional Units will be issued upon conversion of this Note. In lieu of any fractional Units to which Payee would otherwise be entitled, the Maker will pay to Payee in cash the amount of the unconverted principal balance of this Note that would otherwise be converted into such fractional Units. |

| |

|

|

| |

(b) |

Effect of Conversion. If the Maker timely receives notice of the Payee’s intention to convert this Note at least two business days prior to the closing of a Business Combination, this Note shall be deemed to be converted on such closing date. At its expense, the Maker will, upon receipt of such conversion notice, as soon as practicable after consummation of a Business Combination, issue and deliver to Payee, at Payee’s address as requested by Payee in her conversion notice, a certificate or certificates for the number of Units to which Payee is entitled upon such conversion (bearing such legends as are customary pursuant to applicable state and federal securities laws), including a check payable to Payee for any cash amounts payable as a result of any fractional Units as described herein. |

| 3. |

Interest. No interest shall accrue on the unpaid principal balance of this Note. |

| |

|

| 4. |

Application of Payments. All payments shall be applied first to payment in full of any costs incurred in the collection of any sum due under this Note, including but not limited to reasonable attorney’s and auditor’s fees and expenses, then to the payment in full of any late charges, and finally to the reduction of the unpaid principal balance of this Note. |

| 5. |

Events of Default. The following shall constitute an event of default (each, an “Event of Default”): |

| |

(a) |

Failure to Make Required Payments. Failure by the Maker to pay the principal amount due pursuant to this Note more than 5 business days of the Maturity Date. |

| |

|

|

| |

(b) |

Voluntary Bankruptcy, etc. The commencement by the Maker of a voluntary case under any applicable bankruptcy, insolvency, reorganization, rehabilitation or other similar law, or the consent by it to the appointment of or taking possession by a receiver, liquidator, assignee, trustee, custodian, sequestrator (or other similar official) of the Maker or for any substantial part of its property, or the making by it of any assignment for the benefit of creditors, or the failure of the Maker generally to pay its debts as such debts become due, or the taking of corporate action by the Maker in furtherance of any of the foregoing. |

| |

|

|

| |

(c) |

Involuntary Bankruptcy, etc. The entry of a decree or order for relief by a court having jurisdiction in the premises in respect of the Maker in an involuntary case under any applicable bankruptcy, insolvency or other similar law, or appointing a receiver, liquidator, assignee, custodian, trustee, sequestrator (or similar official) of the Maker or for any substantial part of its property, or ordering the winding-up or liquidation of its affairs, and the continuance of any such decree or order unstayed and in effect for a period of 60 consecutive days. |

| |

|

|

| |

(d) |

Breach of Other Obligations. The Maker fails to perform or comply with any one or more of its obligations under this Note. |

| |

|

|

| |

(e) |

Cross Default. Any present or future indebtedness of the Maker in respect of moneys borrowed or raised becomes (or becomes capable of being declared) due and payable prior to its stated maturity by reason of any event of default, or any such indebtedness is not paid when due or, as the case may be, within any applicable grace period. |

| |

|

|

| |

(f) |

Enforcement Proceedings. A distress, attachment, execution or other legal process is levied or enforced on or against any assets of the Maker which is not discharged or stayed within 30 days. |

| |

|

|

| |

(g) |

Unlawfulness and Invalidity. It is or becomes unlawful for the Maker to perform any of its obligations under this Note, or any obligations of the Maker under this Note are not or cease to be legal, valid, binding or enforceable. |

| |

(a) |

Upon the occurrence of an Event of Default specified in Section 5(a) and 5(d) hereof, the Payee may, by written notice to the Maker, declare this Note to be due immediately and payable, whereupon the unpaid principal amount of this Note, and all other amounts payable hereunder, shall become immediately due and payable without presentment, demand, protest or other notice of any kind, all of which are hereby expressly waived, notwithstanding anything contained herein or in the documents evidencing the same to the contrary. |

| |

|

|

| |

(b) |

Upon the occurrence of an Event of Default specified in Sections 5(b), 5(c), 5(e), 5(f) and 5(g) hereof, the unpaid principal balance of this Note, and all other sums payable with regard to this Note hereunder, shall automatically and immediately become due and payable, in all cases without any action on the part of the Payee. |

| 7. |

Taxes. The Maker will pay all amounts due hereunder free and clear of and without reduction for any taxes, levies, imposts, deductions, withholding or charges imposed or levied by any governmental authority or any political subdivision or taxing authority thereof with respect thereto (“Taxes”). The Maker will pay on behalf of the Payee all such Taxes so imposed or levied and any additional amounts as may be necessary so that the net payment of principal and any interest on this Note received by the Payee after payment of all such Taxes shall be not less than the full amount provided hereunder. |

| 8. |

Waivers. The Maker and all endorsers and guarantors of, and sureties for, this Note waive presentment for payment, demand, notice of dishonor, protest, and notice of protest with regard to the Note, all errors, defects and imperfections in any proceedings instituted by the Payee under the terms of this Note, and all benefits that might accrue to the Maker by virtue of any present or future laws exempting any property, real or personal, or any part of the proceeds arising from any sale of any such property, from attachment, levy or sale under execution, or providing for any stay of execution, exemption from civil process, or extension of time for payment; and the Maker agrees that any real estate that may be levied upon pursuant to a judgment obtained by virtue hereof or any writ of execution issued hereon, may be sold upon any such writ in whole or in part in any order desired by the Payee. |

| |

|

| 9. |

Unconditional Liability. The Maker hereby waives all notices in connection with the delivery, acceptance, performance, default, or enforcement of the payment of this Note, and agrees that its liability shall be unconditional, without regard to the liability of any other party, and shall not be affected in any manner by any indulgence, extension of time, renewal, waiver or modification granted or consented to by the Payee, and consents to any and all extensions of time, renewals, waivers, or modifications that may be granted by the Payee with respect to the payment or other provisions of this Note, and agrees that additional makers, endorsers, guarantors, or sureties may become parties hereto without notice to the Maker or affecting the Maker’s liability hereunder. For the purpose of this Note, “business day” shall mean a day (other than a Saturday, Sunday or public holiday) on which banks are open in China and New York for general banking business. |

| |

|

| 10. |

Notices. All notices, statements or other documents which are required or contemplated by this Note shall be made in writing and delivered: (i) personally or sent by first class registered or certified mail, overnight courier service to the address most recently provided in writing to such party or such other address as may be designated in writing by such party, (ii) by fax to the number most recently provided to such party or such other fax number as may be designated in writing by such party, or (iii) by email, to the email address most recently provided to such party or such other email address as may be designated in writing by such party. Any notice or other communication so transmitted shall be deemed to have been given on (a) the day of delivery, if delivered personally, (b) only if the receipt is acknowledged, the day after such receipt, if sent by fax or email, (c) the business day after delivery to an overnight courier service, if sent by an overnight courier service, or (d) 5 days after mailing if sent by first class registered or certified mail. |

| |

|

| 11. |

Construction. This Note shall be construed and enforced in accordance with the laws of New York, without regard to conflict of law provisions thereof. |

| |

|

| 12. |

Severability. Any provision contained in this Note which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction. |

| |

|

| 13. |

Trust Waiver. The Payee hereby waives any and all right, title, interest or claim of any kind (“Claim”) in or to any amounts contained in the trust account deriving from the proceeds of the IPO conducted by the Maker and the proceeds of the sale of securities in a private placement (if any) prior to the effectiveness of the IPO, as described in greater detail in the Prospectus filed with the Securities and Exchange Commission in connection with the IPO (the “Trust Account Funds”), and hereby agrees not to seek recourse, reimbursement, payment or satisfaction for any Claim from the Trust Account Funds or any distribution therefrom for any reason whatsoever. If Maker does not consummate the Business Combination, this Note shall be repaid only from amounts other than Trust Account Funds, if any. |

| |

|

| 14. |

Amendment; Waiver. Any amendment hereto or waiver of any provision hereof may be made with, and only with, the written consent of the Maker and the Payee. |

| |

|

| 15. |

Assignment. This Note shall be binding upon the Maker and its successors and assigns and is for the benefit of the Payee and her successors and assigns, except that the Maker may not assign or otherwise transfer its rights or obligations under this Note. The Payee may at any time without the consent of or notice to the Maker assign to one or more entities all or a portion of her rights under this Note. |

[signature page follows]

IN WITNESS WHEREOF, Maker, intending to be

legally bound hereby, has caused this Note to be duly executed by the undersigned as of the day and year first above written.

| MAKER: |

|

| |

|

| TMT Acquisition Corp |

|

| |

|

|

| By: |

/s/ Dajiang Guo |

|

| Name: |

Dajiang Guo |

|

| Title: |

Chief Executive Officer and Director |

|

[signature page to the promissory note]

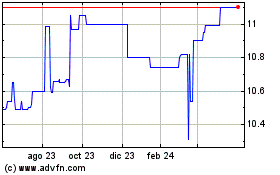

TMT Acquisition (NASDAQ:TMTCU)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

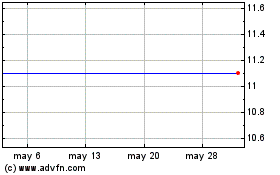

TMT Acquisition (NASDAQ:TMTCU)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025