UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

20-F

(Mark

One)

☐ REGISTRATION

STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended March 31, 2024

OR

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL

COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from to

Commission

file number: 001-41407

TOP

Financial Group Limited

(Exact

name of Registrant as specified in its charter)

Cayman

Islands

(Jurisdiction

of incorporation or organization)

118

Connaught Road West

Room

1101

Hong

Kong

(Address

of principal executive offices)

Ka

Fai Yuen

+852-3107-0731

paul.yuen@zyzq.com.hk

118

Connaught Road West

Room

1101

Hong

Kong

(Name,

Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities

registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Ordinary shares, par value $0.001 per share | | TOP | | The Nasdaq Stock Market LLC Nasdaq Capital Market |

Securities

registered or to be registered pursuant to Section 12(g) of the Act: None

Securities

for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate

the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered

by the annual report: 37,015,807 ordinary shares issued and outstanding as of March 31, 2024.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒ Yes ☐ No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth

company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | | Accelerated filer ☐ | | Non-accelerated filer ☒ |

| | | | | Emerging growth company ☒ |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | | International Financial Reporting Standards as issued | | Other ☐ |

| | | by the International Accounting Standards Board ☐ | | |

If

“Other” has been checked in response to the previous question, indicate by check mark which financial statement item the

registrant has elected to follow.

☐ Item 17 ☐ Item 18

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Securities Exchange Act of 1934).

☐ Yes ☒ No

(APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate

by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of

the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

Table

of Contents

INTRODUCTION

Except

where the context otherwise requires and for purposes of this annual report only the term:

| |

● |

“Asian

investors” refers to the Asian population around the globe. |

| |

● |

“China”

or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report only, Taiwan; |

| |

● |

“Controlling

Shareholder” refers to Zhong Yang Holdings (BVI) Limited; |

| |

● |

“HK$”

or “Hong Kong dollars” refers to the legal currency of Hong Kong; |

| |

● |

“HKSFC”

refers to the Securities and Futures Commission of Hong Kong; |

| |

● |

“HKSFO”

refers to the Securities and Futures Ordinance (Cap. 571) of Hong Kong; |

| |

● |

“Hong

Kong” refers to Hong Kong Special Administrative Region of the People’s Republic of China; |

| |

● |

“Ordinary

Shares” refers to the Company’s ordinary shares, par value US$0.001 per share; |

| |

|

|

| |

● |

“Operating

Subsidiaries” refers to WIN100 TECH, WIN100 WEALTH, Winrich, ZYCL and ZYSL; |

| |

● |

“Predecessor

Parent Company” or “ZYHL” refers to Zhong Yang Holdings Limited, a company with limited liability under the laws

of Hong Kong. |

| |

● |

“SEC”

refers to the United States Securities and Exchange Commission; |

| |

● |

“SEHK”

refers to the Stock Exchange of Hong Kong Limited; |

| |

● |

“TFGL”,

“TOP”, the “Company”, “we,” “us,” “or “our” refers to TOP Financial

Group Limited, a Cayman Islands exempted company, and, in the context of describing its operation and business, its subsidiaries; |

| |

● |

“TOP

500” refers to TOP 500 SEC PTY LTD, a company formed under the laws of Australia; |

| |

● |

“TOP

ASSET MANAGEMENT” refers to TOP ASSET MANAGEMENT PTE.LTD., a company formed under the laws of Singapore; |

| |

● |

“TOP

FINANCIAL” refers to TOP FINANCIAL PTE.LTD., a company formed under the laws of Singapore; |

| |

● |

“US$”

or “U.S. dollars” refers to the legal currency of the United States; |

| |

● |

“WIN100

MANAGEMENT” refers to WIN100 Management Limited, a company incorporated under the laws of the British Virgin Islands; |

| |

● |

“WIN100

TECH” refers to WIN100 TECH Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“WIN100

WEALTH” refers to WIN100 WEALTH LIMITED, a company incorporated under the laws of the British Virgin Islands; |

| |

● |

“Winrich”

refers to Winrich Finance Limited, a company incorporated under the laws of the Hong Kong; |

| |

● |

“ZYAL

BVI” refers to ZYAL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“ZYCL”

refers to Zhong Yang Capital Limited, a company with limited liability under the laws of Hong Kong. |

| |

● |

“ZYCL

BVI” refers to ZYCL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“ZYFL

(BVI)” refers to ZYFL (BVI) Limited, a company incorporated under the laws of the British Virgin Islands; |

| |

● |

“ZYIL

(BVI)” refers to ZYIL (BVI) Limited, a company incorporated under the laws of the British Virgin Islands; |

| |

● |

“ZYNL

(BVI)” refers to ZYNL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“ZYPL

(BVI)” refers to ZYPL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“ZYSL”

refers to Zhong Yang Securities Limited, a company with limited liability under the laws of Hong Kong. |

| |

● |

“ZYSL

(BVI)” refers to ZYSL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“ZYTL

(BVI)” refers to ZYTL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“ZYXL

(BVI)” refers to ZYXL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

TFGL is a holding company with operations conducted

in Hong Kong through its operating subsidiaries in Hong Kong, using Hong Kong dollars. The reporting currency is U.S. dollars. Assets

and liabilities denominated in foreign currencies are translated at year-end exchange rates, income statement accounts are translated

at average rates of exchange for the year and equity is translated at historical exchange rates. Any translation gains or losses are recorded

in other comprehensive income (loss). Gains or losses resulting from foreign currency transactions are included in net income. The conversion

of Hong Kong dollars into U.S. dollars are based on the exchange rates set forth in the H.10 statistical release of the Board of Governors

of the Federal Reserve System. Unless otherwise noted, all translations from Hong Kong dollars to U.S. dollars and from U.S. dollars to

Hong Kong dollars in this annual report were made at a year-end spot rate of HK$7.8259 to US$1.00 or an average rate of HK$7.8246 to US$1.00

for the fiscal year ended March 31, 2024, at a year-end spot rate of HK$7.8499 to US$1.00 or an average rate of HK$7.8389 to US$1.00 for

the fiscal year ended March 31, 2023, and at a year-end spot rate of HK$7.8325 to US$1.00 and an average rate for HK$7.7844 to US$1.00

for the fiscal year ended March 31, 2022.

We

obtained the industry and market data used in this annual report or any document incorporated by reference from industry publications,

research, surveys and studies conducted by third parties and our own internal estimates based on our management’s knowledge and

experience in the markets in which we operate. We did not, directly or indirectly, sponsor or participate in the publication of such

materials, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual

report. We have sought to provide current information in this annual report and believe that the statistics provided in this annual report

remain up-to-date and reliable, and these materials are not incorporated in this annual report other than to the extent specifically

cited in this annual report.

DISCLOSURE

REGARDING FORWARD-LOOKING STATEMENTS

This

annual report contains forward-looking statements that reflect our current expectations and views of future events, all of which are

subject to risks and uncertainties. Forward-looking statements give our current expectations or forecasts of future events. You can identify

these statements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these

statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,”

“anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,”

“would,” “should,” “could,” “may” or other similar expressions in this annual report.

These statements are likely to address our growth strategy, financial results and product and development programs. You must carefully

consider any such statements and should understand that many factors could cause actual results to differ from our forward-looking statements.

These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known

and some that are not. No forward-looking statement can be guaranteed and actual future results may vary materially. Factors that could

cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

| |

● |

our

goals and strategies; |

| |

● |

our

future business development, financial condition and results of operations; |

| |

● |

introduction

of new product and service offerings; |

| |

● |

expected

changes in our revenues, costs or expenditures; |

| |

● |

our

expectations regarding the demand for and market acceptance of our products and services; |

| |

● |

expected

growth of our customers, including consolidated account customers; |

| |

● |

competition

in our industry; |

| |

● |

government

policies and regulations relating to our industry; |

| |

|

|

| |

● |

the

length and severity of the recent COVID-19

outbreak and its impact on our business and industry |

| |

● |

any

recurrence of the COVID-19 pandemic

and scope of related government orders and restrictions and the extent of the impact of the COVID-19 pandemic

on the global economy; |

| |

● |

other

factors that may affect our financial condition, liquidity and results of operations; and |

| |

● |

other

risk factors discussed under “Item 3. Key Information

— 3.D. Risk Factors.” |

We

base our forward-looking statements on our management’s beliefs and assumptions based on information available to our management

at the time the statements are made. We caution you that actual outcomes and results may, and are likely to, differ materially from what

is expressed, implied or forecast by our forward-looking statements. Accordingly, you should be careful about relying on any forward-looking

statements. Except as required under the federal securities laws, we do not have any intention or obligation to update publicly any forward-looking

statements after the distribution of this annual report, whether as a result of new information, future events, changes in assumptions,

or otherwise.

PART

I

Item

1. Identity of Directors, Senior Management and Advisers

Not

applicable for annual reports on Form 20-F.

Item

2. Offer Statistics and Expected Timetable

Not

applicable for annual reports on Form 20-F.

Item

3. Key Information

Corporate

Structure

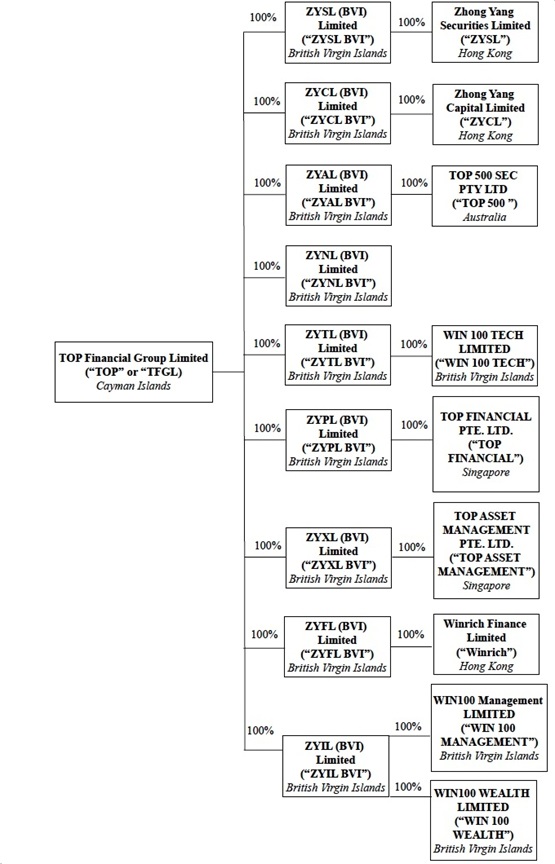

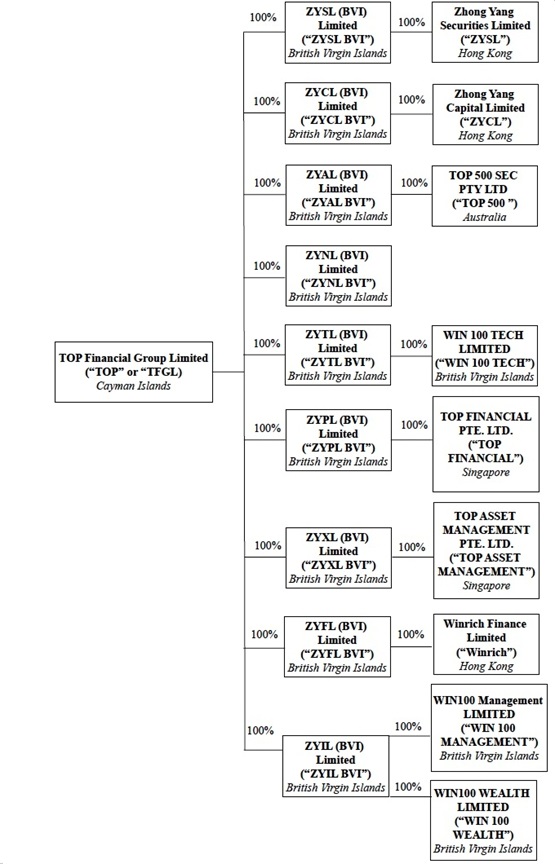

The

following diagram illustrates the corporate structure of TOP Financial Group Limited and its subsidiaries as of the date of this annual

report.

Our

Subsidiaries and Business Functions

ZYSL

(BVI) was formed as the investment holding company of ZYSL under the laws of the British Virgin Islands on August 29, 2019 as part of

the reorganization. It does not engage in any material operation. It is a direct subsidiary of TFGL.

ZYCL

(BVI) was formed as the investment holding company of ZYCL under the laws of the British Virgin Islands on August 29, 2019 as part of

the reorganization. It does not engage in any material operation. It is a direct subsidiary of TFGL.

ZYAL

(BVI) was formed under the laws of the British Virgin Islands on January 7, 2021. It is a holding company and does not engage in any

material operation. It is a direct subsidiary of TFGL.

ZYTL

(BVI) was formed under the laws of the British Virgin Islands on January 12, 2021. It is a holding company and does not engage in any

material operation. It is a direct subsidiary of TFGL.

ZYNL

(BVI) was formed under the laws of the British Virgin Islands on January 20, 2021. It is a holding company and does not engage in any

material operation. It is a direct subsidiary of TFGL.

ZYPL

(BVI) and ZYXL (BVI) were formed under the laws of the British Virgin Islands on July 14, 2022. Each of ZYXL (BVI) and ZYPL (BVI) is

a holding company and does not engage in any material operation and each is a direct subsidiary of TFGL.

ZYFL

(BVI) and ZYIL (BVI) were formed under the laws of the British Virgin Islands on November 11, 2022. Each of ZYFL (BVI) and ZYIL (BVI)

is a holding company and does not engage in any material operation and each is a direct subsidiary of TFGL.

ZYSL

was formed in accordance with laws and regulations of Hong Kong on April 22, 2015 with a registered capital of HKD 18,000,000 (approximately

US$2.3 million). ZYSL is a limited liability corporation licensed with HKSFC to carry out regulated activities including Type 1 Dealing

in Securities and Type 2 Dealing in Futures Contracts. It is a direct subsidiary of ZYSL (BVI) and an indirect subsidiary of TFGL.

ZYCL

was established in accordance with laws and regulations of Hong Kong on September 29, 2016 with a registered capital of HKD 5,000,000

(approximately US$0.6 million). ZYCL is a limited liability corporation licensed with the HKSFC to carry out regulated activities Type

4 Advising on Securities, Type 5 Advising on Futures Contracts and Type 9 Asset Management. It is a direct subsidiary of ZYCL (BVI) and

an indirect subsidiary of TFGL.

WIN100

TECH was formed under the laws of the British Virgin Islands on May 14, 2021. WIN100 TECH is a Fintech development and IT support company.

It provides trading solutions for clients trading on the world’s major derivatives and stock exchanges. It is a

direct subsidiary of ZYTL (BVI) and an indirect subsidiary of TFGL.

WIN100

WEALTH was formed under the laws of the British Virgin Islands on July 21, 2021. WIN100 WEALTH borrowed $6 million from TGFL in the form

of intra-company loans and invest such amount in financial products. It is a direct subsidiary of ZYIL (BVI) and an indirect subsidiary

of TFGL.

Winrich was formed under the laws of Hong Kong

on February 24, 2023. Winrich is a licensed money lending company governed by the Money Lenders Ordinance in Hong Kong. It is a direct

subsidiary of ZYFL (BVI) and an indirect subsidiary of TFGL.

WIN100 MANAGEMENT was formed under the laws of

the British Virgin Islands on March 19, 2024. It does not engage in any material operation. We plan to apply the Approved Manager from

British Virgin Island Financial Services Commission through WIN100 MANAGEMENT. It is a direct subsidiary of ZYIL (BVI) and an indirect

subsidiary of TFGL.

TOP

500 was formed under the laws of Australia on October 22, 2008. TOP 500 owns an Australian Financial Services License (AFSL: 328866).

It does not have any material operation as of the date of this annual report. We plan to provide financial services in Australia that

includes arranging or providing financial advice on financial products such as derivatives, foreign exchange contracts, stock and bond

issuance etc. through TOP 500. It is a direct subsidiary of ZYAL (BVI) and an indirect subsidiary of TFGL.

TOP

ASSET MANAGEMENT was formed under the laws of Singapore on November 28, 2022. It does not engage in any material operation. We plan to

register with the Monetary Authority of Singapore as a Registered Fund Management Company to carry out Fund Management services. It is

a direct subsidiary of ZYXL (BVI) and an indirect subsidiary of TFGL.

TOP

FINANCIAL was formed under the laws of Singapore on November 28, 2022. It does not engage in any material operation. We plan to acquire

the CMS license from the Monetary Authority of Singapore to carry out regulated activities in Dealing in Capital Market. It is a direct

subsidiary of ZYPL (BVI) and an indirect subsidiary of TFGL.

Holding

Company Structure

TFGL

is a holding company incorporated in the Cayman Islands with no material operations of its own. We conduct our operations primarily in

Hong Kong through our subsidiaries in Hong Kong. Investors in our Ordinary Shares are purchasing equity securities of TFGL, the Cayman

Islands holding company, instead of shares of our Operating Subsidiaries in Hong Kong. Investors in our Ordinary Shares should be aware

that they may never directly hold equity interests in our Operating Subsidiaries.

As

a result of our corporate structure, TFGL’s ability to pay dividends may depend upon dividends paid by our Operating Subsidiaries.

If our existing Operating Subsidiaries or any newly formed ones incur debt on their own behalf in the future, the instruments governing

their debt may restrict their ability to pay dividends to us.

Transfers

of Cash between Our Company and Our Subsidiaries

Our

management monitors the cash position of each entity within our organization regularly and prepare budgets on a monthly basis to ensure

each entity has the necessary funds to fulfill its obligation for the foreseeable future and to ensure adequate liquidity. In the event

that there is a need for cash or a potential liquidity issue, it will be reported to our Chief Financial Officer and subject to approval

by our board of directors, we will enter into an intercompany loan for the subsidiary.

For

TFGL to transfer cash to its subsidiaries, TFGL is permitted under the laws of the Cayman Islands and its memorandum and articles of

association to provide funding to our subsidiaries incorporated in the British Virgin Islands and Hong Kong through loans or capital

contributions without restrictions on the amount of the funds. TFGL’s subsidiaries formed

under the laws of the British Virgin Islands are permitted under the laws of the British Virgin Islands to provide funding to their respective

subsidiaries formed in Hong Kong through loans or capital contributions without restrictions on the amount of the funds.

For

the subsidiaries to transfer cash to TFGL, according to the BVI Business Companies Act 2004 (as amended), a British Virgin Islands company

may make dividends distribution to the extent that immediately after the distribution, such company’s assets do not exceed its

liabilities and that such company is able to pay its debts as they fall due. According to the Companies Ordinance of Hong Kong, a Hong

Kong company may only make a distribution out of profits available for distribution. Other than the above, we did not adopt or maintain

any cash management policies and procedures as of the date of this annual report.

The

following describes the dividends and distributions made by our subsidiaries. TFGL has not made any dividends or distributions to U.S.

investors as of the date of this annual report.

On

March 24, 2020, ZYSL and ZYCL declared interim cash dividends of HK$3.9 million (approximately US$0.5 million) and HK$1.5 million (approximately

US$0.2 million), respectively, to the then sole shareholder, i.e. the Predecessor Parent Company, Zhong Yang Holdings Limited. As of

March 31, 2020, the dividend declared by ZYCL has been fully settled by directly deducting the dividend amount from the amount due from

Zhong Yang Holdings Limited, and the dividend declared by ZYSL was recorded as dividend payable. On June 19, 2020, ZYSL settled such

dividend payable in cash.

On

November 25, 2020, ZYSL declared an interim cash dividend of HK$24.8 million (equivalent to $3.2 million) to its sole shareholder ZYSL

(BVI), following which event ZYSL (BVI) declared an interim cash dividend to its sole shareholder, TFGL, and TFGL declared an interim

cash dividend to its shareholders for the same amount on the same day. None of the shareholders of TFGL at the time was a U.S. person.

Without any withholding tax levied on dividends in Hong Kong, British Virgin Islands, and Cayman Islands, the interim cash dividends

were settled with the shareholders in cash on November 25, 2020.

On

January 19, 2021, ZYSL declared an interim cash dividend of HK11.6 million (equivalent to US$1.5 million) to the then sole shareholder,

the Predecessor Parent Company. The dividend was settled with the Predecessor Parent Company in cash in three installments of US$0.5

million each on January 19, 2021, January 20, 2021 and March 3, 2021.

Under

the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends

paid by us. The laws and regulations of the PRC on currency conversion control do not currently have any material impact on the transfer

of cash from TFGL to ZYSL or ZYCL or from ZYSL or ZYCL to TFGL. There are no restrictions or limitations under the laws of Hong Kong

imposed on the conversion of HK dollar into foreign currencies and the remittance of currencies out of Hong Kong, nor is there any restriction

on any foreign exchange to transfer cash between TFGL and its subsidiaries, across borders and to U.S. investors, nor there is any restrictions

and limitations to distribute earnings from the subsidiaries, to TFGL and U.S. investors and amounts owed.

For

TFGL to make dividends to its shareholders, subject to the Companies Act (2022 Revision) of the Cayman Islands, which we refer to as

the Companies Act below, and our Amended and Restated Memorandum and Articles of Association, our board of directors may authorize and

declare a dividend to shareholders from time to time out of the profits from the Company, realized or unrealized, or out of the share

premium account, provided that the Company will remain solvent, meaning the Company is able to pay its debts as they come due in the

ordinary course of business. There is no further Cayman Islands statutory restriction on the amount of funds which may be distributed

by us in the form of dividends.

We

do not have any present plan to declare or pay any dividends on our Ordinary Shares in the foreseeable future. We currently intend to

retain all available funds and future earnings, if any, for the operation and expansion of our business. Any future determination related

to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of

operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant,

and subject to the restrictions contained in any future financing instruments, in our Amended and Restated Memorandum and Articles of

Association and in the Companies Act.

During

the fiscal years ended March 31, 2024, 2023 and 2022, cash transfers and/or transfers of other assets between our Company and our subsidiaries

were as follows:

| No. | |

Transfer From | |

Transfer To | |

Amount (US$) | | |

Date | |

Purpose |

| 1 | |

TGFL | |

WIN100 WEALTH | |

$ | 1,000,000 | | |

February 14, 2023 | |

Intra-company loan |

| 2 | |

TGFL | |

ZYSL | |

$ | 3,000,000 | | |

March 10, 2023 | |

Capital injection |

| 3 | |

TGFL | |

WIN100 WEALTH | |

$ | 5,000,000 | | |

April 18, 2023 | |

Intra-company loan |

| 4 | |

TGFL | |

WIN100 WEALTH | |

$ | 1,900,000 | | |

December 6, 2023 | |

Intra-company loan |

| 5 | |

TGFL | |

WINRICH | |

$ | 1,180,772 | | |

September 6, 2023 | |

Intra-company loan |

See

“Item 8. Financial Information – A. Consolidated Statements and Other Financial Information – Dividend Policy”

and “Item 3. Key Information — 3.D. Risk Factors — Risks Relating

to our Corporate Structure – We rely on dividends and other distributions on equity paid by the Operating Subsidiaries to fund

any cash and financing requirements we may have, and any limitation on the ability of the Operating Subsidiaries to make payments to

us could have a material adverse effect on our ability to conduct our business”.

Enforceability

of Civil Liabilities

TFGL

was incorporated under the laws of the Cayman Islands as an exempted company with limited liability because of certain benefits associated

with being a Cayman Islands entity, such as political and economic stability, an effective judicial system, a favorable tax system, the

absence of exchange control or currency restrictions and the availability of professional and support services. However, the Cayman Islands

has a less developed body of securities laws as compared to the United States and provides protections for investors to a lesser extent.

In addition, Cayman Islands companies may not have standing to sue before the federal courts of the United States.

Substantially

all of our assets are located in Hong Kong. In addition, two of our seven directors and officers are nationals and/or residents of the

United States. The other five of our directors and officers are nationals and/or residents of countries other than the United States,

and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult

for investors to effect service of process within the United States upon these persons or to enforce against us or them, judgments obtained

in United States courts, including judgments predicated upon the civil liability provisions of the securities laws of the United States

or any state thereof.

We

have been advised by our counsel as to Cayman Islands law that the United States and the Cayman Islands do not have a treaty providing

for reciprocal recognition and enforcement of judgments of courts of the United States in civil and commercial matters (other than in

relation to arbitral awards) and that a final judgment for the payment of money rendered by any general or state court in the United

States based on civil liability, whether or not predicated solely upon the U.S. federal securities laws, may not be enforceable in the

Cayman Islands. We have also been advised by our counsel as to Cayman Islands law that a final and conclusive judgment obtained in U.S.

federal or state courts under which a sum of money is payable as compensatory damages (i.e., not being a sum claimed by a revenue authority

for taxes or other charges of a similar nature by a governmental authority, or in respect of a fine or penalty or multiple or punitive

damages) may be the subject of an action on a debt at common law in the Grand Court of the Cayman Islands.

Implication

of the Holding Foreign Companies Accountable Act (the “HFCA Act”)

The

HFCA Act was enacted on December 18, 2020. The HFCA Act states if the SEC determines that a company has filed audit reports issued by

a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021,

the SEC shall prohibit the company’s shares from being traded on a national securities exchange or in the over the counter trading

market in the United States.

On

March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements

of the HFCA Act. A company will be required to comply with these rules if the SEC identifies it as having a “non-inspection”

year under a process to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCA

Act, including the listing and trading prohibition requirements described above.

On

June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, legislation

entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law

by President Biden, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable

Act and amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if

its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period for triggering

the prohibition on trading.

On

December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act,

which took effect on January 10, 2022. The rules apply to registrants that the SEC identifies as having filed an annual report with an

audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that PCAOB is unable to inspect

or investigate completely because of a position taken by an authority in foreign jurisdictions.

On

December 16, 2021, PCAOB announced the PCAOB HFCA Act determinations (the “PCAOB determinations”) relating to the PCAOB’s

inability to inspect or investigate completely registered public accounting firms headquartered in mainland China of the PRC or Hong

Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in the PRC or

Hong Kong.

On

August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “SOP”) with the China Securities

Regulatory Commission and the Ministry of Finance of China. The SOP, together with two protocol agreements governing inspections and

investigations (together, the “SOP Agreement”), establishes a specific, accountable framework to make possible complete inspections

and investigations by the PCAOB of audit firms based in mainland China and Hong Kong, as required under U.S. law. The SOP Agreement remains

unpublished and is subject to further explanation and implementation. Pursuant to the fact sheet with respect to the SOP Agreement disclosed

by the SEC, the PCAOB shall have sole discretion to select any audit firms for inspection or investigation and the PCAOB inspectors and

investigators shall have a right to see all audit documentation without redaction. On December 15, 2022, the PCAOB Board determined that

the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland

China and Hong Kong and voted to vacate its previous determinations to the contrary.

YCM

CPA Inc., the independent registered public accounting firm that issues the audit report for the fiscal year ended March 31, 2024, 2023

and 2022 included in this annual report, is currently subject to PCAOB inspections and the PCAOB is thus able to inspect YCM CPA Inc.

YCM CPA Inc. is headquartered in Irvine, California and has been inspected by the PCAOB. In the future, if there is any regulatory change

or step taken by PRC regulators or the SEC or Nasdaq applies additional and more stringent criteria, and if PCAOB determines that it

is not able to inspect YCM CPA Inc. at such future time, Nasdaq may delist our Ordinary Shares and the value of our Ordinary Shares may

significantly decline or become worthless. See “Item 3. Key Information — 3.D. Risk Factors — Risks Relating to

Our Ordinary Shares— Our Ordinary Shares may be prohibited from being traded on a national exchange under the Holding Foreign

Companies Accountable Act (the “HFCA Act”), if the Public Company Accounting Oversight Board (the “PCAOB”) is

unable to inspect our auditors for two consecutive years beginning in 2021. The delisting of our Ordinary Shares, or the threat of their

being delisted, may materially and adversely affect the value of your investment.”

Permission

Required from the Hong Kong Authorities

Due

to the licensing requirements of the HKSFC, ZYSL and ZYCL are required to obtain necessary licenses to conduct their business in Hong

Kong and their business and responsible personnel are subject to the relevant laws and regulations and the respective rules of the HKSFC.

ZYSL currently holds a Type 1 license for dealing in securities and a Type 2 license for dealing in futures contracts. ZYCL currently

holds a Type 4 license for advising on securities, a Type 5 license for advising on futures contracts and a Type 9 license for asset

management. See “Item 4. Information on the Company—4.B. Business Overview—Regulation—Licensing

Regime Under the HKSFO”. These licenses have no expiration date and will remain valid unless they are suspended, revoked or cancelled

by the HKSFC. We pay standard governmental annual fees to the HKSFC and are subject to continued regulatory obligations and requirements,

including the maintenance of minimum paid-up share capital and liquid capital, maintenance of segregated accounts, and submission of

audited accounts and other required documents, among others. See “Item 4. Information on

the Company—4.B. Business Overview—Regulation—Licensing Regime Under the HKSFO”.

A company must obtain

a money lender's license to carrying on business as a money lender in Hong Kong. The licensing of money lenders and regulation of money-lending

transactions are governed by the Money Lenders Ordinance, Chapter 163 of the Laws of Hong Kong. Winrich obtained the money lender’s

license from the Licensing Court of Hong Kong on September 5, 2023, to conduct it business. See “Item

4. Information on the Company—4.B. Business Overview—Regulation— Money Lenders Ordinance (Chapter 163 of the

Laws of Hong Kong)”.

Neither we nor any of

our subsidiaries are required to obtain any permission or approval from Hong Kong authorities to offer the securities of TFGL to foreign

investors.

Recent

Regulatory Development in the PRC

We

are aware that, recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations

in certain areas in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing

supervision over China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the

scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement.

For

example, on June 10, 2021, the Standing Committee of the National People’s Congress enacted the PRC Data Security Law, which took

effect on September 1, 2021. The law requires data collection to be conducted in a legitimate and proper manner, and stipulates that,

for the purpose of data protection, data processing activities must be conducted based on data classification and hierarchical protection

system for data security.

On

July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly

issued a document to crack down on illegal activities in the securities market and promote the high-quality development of the capital

market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement

and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system

of extraterritorial application of the PRC securities laws.

On

August 20, 2021, the 30th meeting of the Standing Committee of the 13th National People’s Congress voted and passed the “Personal

Information Protection Law of the People’s Republic of China”, or “PRC Personal Information Protection Law”,

which became effective on November 1, 2021. The PRC Personal Information Protection Law applies to the processing of personal information

of natural persons within the territory of China that is carried out outside of China where (1) such processing is for the purpose of

providing products or services for natural persons within China, (2) such processing is to analyze or evaluate the behavior of natural

persons within China, or (3) there are any other circumstances stipulated by related laws and administrative regulations.

On

December 28, 2021, the CAC jointly with the relevant authorities formally published Measures for Cybersecurity Review (2021) which took

effect on February 15, 2022 and replace the former Measures for Cybersecurity Review (2020) issued on July 10, 2021. Measures for Cybersecurity

Review (2021) stipulates that operators of critical information infrastructure purchasing network products and services, and online platform

operator (together with the operators of critical information infrastructure, the “Operators”) carrying out data processing

activities that affect or may affect national security, shall conduct a cybersecurity review, any online platform operator who controls

more than one million users’ personal information must go through a cybersecurity review by the cybersecurity review office if

it seeks to be listed in a foreign country.

On

February 17, 2023, the China Securities Regulatory Commission (“CSRC”) promulgated the Trial Administrative Measures of Overseas

Securities Offering and Listing by Domestic Companies, or the “Trial Measures,” and five supporting guidelines, which came

into effect on March 31, 2023. Pursuant to the Trial Measures, domestic companies that seek to offer or list securities overseas, both

directly and indirectly, shall complete filing procedures with the CSRC pursuant to the requirements of the Trial Measures within three

working days following its submission of initial public offerings or listing application. If a domestic company fails to complete required

filing procedures or conceals any material fact or falsifies any major content in its filing documents, such domestic company may be

subject to administrative penalties, such as an order to rectify, warnings, fines, and its controlling shareholders, actual controllers,

the person directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and

fines.

In

connection with our issuance of securities to foreign investors, under current PRC laws, regulations and regulatory rules, as of the

date of this annual report, we do not believe we are currently required to obtain permissions from or complete any filing with the CSRC,

or required to go through cybersecurity review by the CAC, given that (1) our Operating Subsidiaries are incorporated in Hong Kong or

the British Virgin Islands and are located in Hong Kong, (2) we have no subsidiary, VIE structure nor any direct operations in mainland

China, and (3) pursuant to the Basic Law of the Hong Kong Special Administrative Region (the “Basic Law”), which is a national

law of the PRC and the constitutional document for Hong Kong, national laws of the PRC shall not be applied in Hong Kong except for those

listed in Annex III of the Basic Law (which is confined to laws relating to defense and foreign affairs, as well as other matters outside

the autonomy of Hong Kong). In addition, we have not been asked to obtain such permissions or to complete any filing by any PRC authority

or received any denial to do so. However, the PRC government has recently indicated an intent to exert more oversight and control over

offerings that are conducted overseas and/or foreign investment by issuers like us. There remains significant uncertainty as to the enactment,

interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities.

If

(i) we inadvertently conclude that certain regulatory permissions and approvals are not required or (ii) applicable laws, regulations,

or interpretations change in a way that requires us to complete such filings or obtain such approvals in the future, and (iii) we

are required to obtain such permissions or approvals in the future, but fail to receive or maintain such permissions or approvals, we

may face sanctions by the CSRC, the CAC or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on

us, limit our operations, limit our ability to pay dividends outside of China, limit our ability to list on stock exchanges outside of

China or offer our securities to foreign investors or take other actions that could have a material adverse effect on our business, financial

condition, results of operations and prospects, may hinder our ability to offer Ordinary Shares to investors in the future and may cause

the value of our Ordinary Shares to significantly decline or be worthless.

Additionally,

due to long arm provisions under the current PRC laws and regulations, there remains regulatory uncertainty with respect to the implementation

and interpretation of laws in China. We are also subject to the risks of uncertainty about any future actions the Chinese government

or authorities in Hong Kong may take in this regard.

Should

the Chinese government choose to exercise significant oversight and discretion over the conduct of our business, they may intervene in

or influence our operations. Such governmental actions:

| |

●

|

could

result in a material change in our operations; |

| |

●

|

could

hinder our ability to continue to offer securities to investors; and |

| |

●

|

may

cause the value of our Ordinary Shares to significantly decline or be worthless. |

3.A.

[Reserved]

3.B.

Capitalization and Indebtedness

Not

applicable for annual reports on Form 20-F.

3.C.

Reasons for the Offer and Use of Proceeds

Not

applicable for annual reports on Form 20-F.

3.D.

Risk Factors

Risk

Factor Summary

You

should carefully consider all of the information in this annual report before making an investment in our Ordinary Shares. Below please

find a summary of the principal risks and uncertainties we face, organized under relevant headings. In particular, as we are a Hong Kong-based

company incorporated in the Cayman Islands, you should pay special attention to subsections headed “Item 3. Key Information—3.D.

Risk Factors—Risks Related to Our Corporate Structure.” and “Item 3. Key Information—3.D. Risk Factors—Risks

Related to Doing Business in the Jurisdictions in which the Operating Subsidiaries Operate”.

Our

business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely

affect our business, financial condition, results of operations, cash flows, and prospects. These risks are discussed more fully below

and include, but are not limited to, risks related to:

Risks

Relating to Our Corporate Structure

| |

●

|

We

rely on dividends and other distributions on equity paid by the Operating Subsidiaries to fund any cash and financing requirements

we may have, and any limitation on the ability of the Operating Subsidiaries to make payments to us could have a material adverse

effect on our ability to conduct our business (page 10). |

Risks

Relating to Doing Business in the Jurisdictions in which the Operating Subsidiaries Operate

| |

● |

Substantially

all of the Operating Subsidiaries’ operations are in Hong Kong. However, due to the long arm provisions under the current

PRC laws and regulations, the Chinese government may exercise significant oversight and discretion over the conduct of such business

and may intervene in or influence such operations. at any time, which could result in a material change in the operations of the

Operating Subsidiaries and/or the value of our Ordinary Shares. The PRC government may also intervene or impose restrictions on our

ability to move money out of Hong Kong to distribute earnings and pay dividends or to reinvest in our business outside of Hong Kong.

Changes in the policies, regulations, rules, and the enforcement of laws of the Chinese government may also be quick with little

advance notice and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system cannot be certain (page

11). |

| |

●

|

We

may become subject to a variety of PRC laws and other obligations regarding data security, and any failure to comply with applicable

laws and obligations could have a material and adverse effect on our business, financial condition and results of operations (page

12). |

| |

●

|

If

the Chinese government chooses to extend the oversight and control over offerings that are conducted overseas and/or foreign investment

in mainland China based issuers to Hong Kong-based issuers, such action may significantly limit or completely hinder our ability

to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or

be worthless (page 13). |

| |

●

|

The

Hong Kong legal system embodies uncertainties which could limit the legal protections available to ZYSL and ZYCL (page 13).

|

| |

●

|

The

Hong Kong regulatory requirement of prior approval for the transfer of shares in excess of a certain threshold may restrict

future takeovers and other transactions (page 13). |

| |

●

|

The

enforcement of foreign civil liabilities in the Cayman Islands and Hong Kong is subject to certain conditions. Therefore, certain

judgments obtained against us by our shareholders may be difficult to enforce in such jurisdictions (page 13). |

Risks

Relating to our Ordinary Shares

| |

●

|

Our

Ordinary Shares may be prohibited from being traded on a national exchange under the Holding Foreign Companies Accountable Act (the

“HFCA Act”), if the Public Company Accounting Oversight Board (the “PCAOB”) is unable to inspect our auditors

for two consecutive years beginning in 2021. The delisting of our Ordinary Shares, or the threat of their being delisted, may

materially and adversely affect the value of your investment (page 14). |

| |

●

|

The

trading price of our Ordinary Shares may be volatile, which could result in substantial losses to you. Such volatility, including

any stock run-ups, may be unrelated to our actual or expected operating performance and financial condition or prospects, making

it difficult for prospective investors to assess the rapidly changing value of our Ordinary Shares (page 15). |

| |

●

|

The

trading price of our ordinary shares experienced substantial price fluctuations in April and May 2023. On May 11, 2023 the SEC ordered

a 10-day trading suspension of our ordinary shares. A repeat suspension could occur. Because our ordinary shares has at times been thinly traded,

our ordinary shares may continue to experience price volatility and low liquidity, which could result in substantial losses to investors

(page 17). |

| |

●

|

The

sale or availability for sale of substantial amounts of our Ordinary Shares in the public market and/or securities that are exercisable

or convertible into out Ordinary Shares could adversely affect their market price (page 17). |

| |

|

|

| |

● |

There

can be no assurance that we will not be a passive foreign investment company, or PFIC, for United States federal income tax purposes

for any taxable year, which could subject United States investors in our Ordinary Shares to significant adverse United States income

tax consequences (page 20). |

Risks

Relating to Our Business and Industry

| |

● |

Our

Operating Subsidiaries have a relatively short operating history compared to some of our established competitors and face significant

risks and challenges in a rapidly evolving market, which makes it difficult to effectively assess our future prospects (page 21). |

| |

● |

Unfavorable

financial market and economic conditions in Hong Kong, China, and elsewhere in the world could materially and adversely affect our

business, financial condition, and results of operations (page 22). |

| |

● |

The

online brokerage service industry and the financial services industry are intensely competitive. If we are unable to compete effectively,

we may lose our market share and our results of operations and financial condition may be materially and adversely affected (page

23). |

| |

● |

During

the years ended March 31, 2024, 2023 and 2022, our top five customers accounted for a significant portion of our total revenues.

The loss of any such customers or a material decline in their trading activities through us would have an adverse effect on our operating

results (page 23). |

| |

● |

We

may not succeed in promoting and sustaining our brand, which could have an adverse effect on our future growth and business (page

25). |

| |

● |

Our

businesses depend on key management executives and professional staff, and our business may suffer if we are unable to recruit and

retain them (page 25). |

| |

● |

We

are subject to extensive and evolving regulatory requirements, the non-compliance with which may result in penalties, limitations,

and prohibitions on our future business activities or suspension or revocation of our licenses, and consequently may materially and

adversely affect our business, financial condition, and results of operations. In addition, we may, from time to time, be subject

to regulatory inquiries and investigations by relevant regulatory authorities or government agencies in Hong Kong or other applicable

jurisdictions (page 26). |

| |

● |

We

face additional risks as we offer new products and services, transact with a broader array of clients and counterparties and expose

ourselves to new geographical markets (page 27). |

| |

|

|

| |

● |

Geopolitical

risks and political uncertainty may adversely impact economic conditions, increase market volatility, and negatively affect the demand

for our services, our results of operations and financial condition (page 30) |

| |

● |

We

may incur losses or experience disruption of our operations as a result of unforeseen or catastrophic events, including pandemics,

terrorist attacks, or natural disasters (page 33). |

| |

● |

Aggressive

competition could reduce our market share, revenues and profits (page 33). |

Risks

Relating to our Corporate Structure

We

rely on dividends and other distributions on equity paid by the Operating Subsidiaries to fund any cash and financing requirements we

may have, and any limitation on the ability of the Operating Subsidiaries to make payments to us could have a material adverse effect

on our ability to conduct our business.

TFGL

is a holding company, and we rely on dividends and other distributions on equity paid by the Operating Subsidiaries for our cash and

financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders and service any

debt we may incur. We do not expect to pay cash dividends in the foreseeable future. We anticipate that we will retain any earnings to

support operations and to finance the growth and development of our business. If any of the Operating Subsidiaries incurs debt on its

own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to

us. See “Item 8. Financial Information – A. Consolidated Statements and Other Financial Information – Dividend Policy”

for more information.

According

to the BVI Business Companies Act 2004 (as amended), a British Virgin Islands company may make dividends distribution to the extent that

immediately after the distribution, such company’s assets do not exceed its liabilities and that such company is able to pay its

debts as they fall due. According to the Companies Ordinance of Hong Kong, a Hong Kong company may only make a distribution out of profits

available for distribution. Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong

in respect of dividends paid by us. Any limitation on the ability of our Hong Kong subsidiaries to pay dividends or make other distributions

to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business,

pay dividends, or otherwise fund and conduct our business.

Risks

Relating to Doing Business in the Jurisdictions in which the Operating Subsidiaries Operate

Substantially

all of the Operating Subsidiaries’ operations are in Hong Kong. However, due to the long arm provisions under the current PRC laws

and regulations, the Chinese government may exercise significant oversight and discretion over the conduct of our business and may intervene

in or influence our operations at any time, which could result in a material change in our operations and/or the value of our Ordinary

Shares. The PRC government may also intervene or impose restrictions on our ability to move money out of Hong Kong to distribute earnings

and pay dividends or to reinvest in our business outside of Hong Kong. Changes in the policies, regulations, rules, and the enforcement

of laws of the Chinese government may also be quick with little advance notice and our assertions and beliefs of the risk imposed by

the PRC legal and regulatory system cannot be certain.

TFGL is a holding company,

and our Operating Subsidiaries, ZYSL, ZYCL, and Winrich, all formed in Hong Kong, and WIN100 TECH and WIN100 WEALTH, both incorporated

in the British Virgin Islands, conduct operations in Hong Kong. Our operations are primarily located in Hong Kong and some of our clients

are PRC individuals or companies that have shareholders or directors that are PRC individuals. As of the date of this annual report, we

do not expect to be materially affected by recent statements by the Chinese government indicating an intent to exert more oversight and

control over offerings that are conducted overseas and/or foreign investment in China-based issuers. However, due to long arm provisions

under the current PRC laws and regulations, there remains regulatory uncertainty with respect to the implementation and interpretation

of laws in China. The PRC government may choose to exercise significant oversight and discretion, and the policies, regulations, rules,

and the enforcement of laws of the Chinese government to which we are subject may change rapidly and with little advance notice to us

or our shareholders. As a result, the application, interpretation, and enforcement of new and existing laws and regulations in the PRC

are often uncertain. In addition, these laws and regulations may be interpreted and applied inconsistently by different agencies or authorities,

and may be inconsistent with our current policies and practices. New laws, regulations, and other government directives in the PRC may

also be costly to comply with, and such compliance or any associated inquiries or investigations or any other government actions may:

| |

● |

delay

or impede our development; |

| |

● |

result

in negative publicity or increase our operating costs; |

| |

● |

require

significant management time and attention; and/or |

| |

● |

subject

us to remedies, administrative penalties and even criminal liabilities that may harm our business, including fines assessed for our

current or historical operations, or demands or orders that we modify or even cease our business practices. |

We

are aware that recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in

certain areas in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing

supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the

scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions

are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new

laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact

such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list

on an U.S. or other foreign exchange.

The

Chinese government may intervene or influence our operations at any time or may exert control over offerings conducted overseas and foreign

investment in Hong Kong-based issuers, which may result in a material change in our operations and/or the value of our Ordinary Shares.

For example, there is currently no restriction or limitation under the laws of Hong Kong on the conversion of HK dollar into foreign

currencies and the transfer of currencies out of Hong Kong and the laws and regulations of the PRC on currency conversion control do

not currently have any material impact on the transfer of cash between the ultimate holding company and the Operating Subsidiaries in

Hong Kong. However, the Chinese government may, in the future, impose restrictions or limitations on our ability to move money out of

Hong Kong to distribute earnings and pay dividends to and from the other entities within our organization or to reinvest in our business

outside of Hong Kong. Such restrictions and limitations, if imposed in the future, may delay or hinder the expansion of our business

to outside of Hong Kong and may affect our ability to receive funds from our Operating Subsidiaries in Hong Kong. The promulgation of

new laws or regulations, or the new interpretation of existing laws and regulations, in each case, that restrict or otherwise unfavorably

impact the ability or way we conduct our business, could require us to change certain aspects of our business to ensure compliance, which

could decrease demand for our services, reduce revenues, increase costs, require us to obtain more licenses, permits, approvals or certificates,

or subject us to additional liabilities. To the extent any new or more stringent measures are required to be implemented, our business,

financial condition and results of operations could be adversely affected and such measured could materially decrease the value of our

Ordinary Shares, potentially rendering it worthless.

We

may become subject to a variety of PRC laws and other obligations regarding data security offerings that are conducted overseas and/or

foreign investment in China-based issuers, and any failure to comply with applicable laws and obligations could have a material and adverse

effect on our business, financial condition and results of operations and may hinder our ability to offer or continue to offer Ordinary

Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless.

On

June 10, 2021, the Standing Committee of the National People’s Congress enacted the PRC Data Security Law, which took effect on

September 1, 2021. The law requires data collection to be conducted in a legitimate and proper manner, and stipulates that, for the purpose

of data protection, data processing activities must be conducted based on data classification and hierarchical protection system for

data security.

On

July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly

issued a document to crack down on illegal activities in the securities market and promote the high-quality development of the capital

market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement

and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system

of extraterritorial application of the PRC securities laws.

On

August 20, 2021, the 30th meeting of the Standing Committee of the 13th National People’s Congress voted and passed the “Personal

Information Protection Law of the People’s Republic of China”, or “PRC Personal Information Protection Law”,

which became effective on November 1, 2021. The PRC Personal Information Protection Law applies to the processing of personal information

of natural persons within the territory of China that is carried out outside of China where (1) such processing is for the purpose of

providing products or services for natural persons within China, (2) such processing is to analyze or evaluate the behavior of natural

persons within China, or (3) there are any other circumstances stipulated by related laws and administrative regulations.

On

December 28, 2021, the CAC jointly with the relevant authorities formally published Measures for Cybersecurity Review (2021) which took

effect on February 15, 2022 and replace the former Measures for Cybersecurity Review (2020) issued on July 10, 2021. Measures for Cybersecurity

Review (2021) stipulates that operators of critical information infrastructure purchasing network products and services, and online platform

operator (together with the operators of critical information infrastructure, the “Operators”) carrying out data processing

activities that affect or may affect national security, shall conduct a cybersecurity review, any online platform operator who controls

more than one million users’ personal information must go through a cybersecurity review by the cybersecurity review office if

it seeks to be listed in a foreign country.

On

February 17, 2023, the CSRC promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies,

or the “Trial Measures,” and five supporting guidelines, which came into effect on March 31, 2023. Pursuant to the Trial

Measures, domestic companies that seek to offer or list securities overseas, both directly and indirectly, shall complete filing procedures

with the CSRC pursuant to the requirements of the Trial Measures within three working days following its submission of initial public

offerings or listing application. If a domestic company fails to complete required filing procedures or conceals any material fact or

falsifies any major content in its filing documents, such domestic company may be subject to administrative penalties, such as an order

to rectify, warnings, fines, and its controlling shareholders, actual controllers, the person directly in charge and other directly liable

persons may also be subject to administrative penalties, such as warnings and fines.

In

connection with our issuance of securities to foreign investors, under current PRC laws, regulations and regulatory rules, as of the

date of this annual report, we do not believe we are currently required to obtain permissions from or complete any filing with the CSRC,

or required to go through cybersecurity review by the CAC, given that (1) our Operating Subsidiaries are incorporated in Hong Kong or

the British Virgin Islands and are located in Hong Kong, (2) we have no subsidiary, VIE structure nor any direct operations in mainland

China, and (3) pursuant to the Basic Law of the Hong Kong Special Administrative Region (the “Basic Law”), which is a national

law of the PRC and the constitutional document for Hong Kong, national laws of the PRC shall not be applied in Hong Kong except for those

listed in Annex III of the Basic Law (which is confined to laws relating to defense and foreign affairs, as well as other matters outside

the autonomy of Hong Kong). In addition, we have not been asked to obtain such permissions or to complete any filing by any PRC authority

or received any denial to do so. However, the PRC government has recently indicated an intent to exert more oversight and control over

offerings that are conducted overseas and/or foreign investment by issuers like us. There remains significant uncertainty as to the enactment,

interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities.

If

(i) we inadvertently conclude that certain regulatory permissions and approvals are not required or (ii) applicable laws, regulations,

or interpretations change in a way that requires us to complete such filings or obtain such approvals in the future, and (iii) we

are required to obtain such permissions or approvals in the future, but fail to receive or maintain such permissions or approvals, we

may face sanctions by the CSRC, the CAC or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on

us, limit our operations, limit our ability to pay dividends outside of China, limit our ability to list on stock exchanges outside of

China or offer our securities to foreign investors or take other actions that could have a material adverse effect on our business, financial

condition, results of operations and prospects, may hinder our ability to offer Ordinary Shares to investors in the future and may cause

the value of our Ordinary Shares to significantly decline or be worthless.

If

the Chinese government chooses to extend the oversight and control over offerings that are conducted overseas and/or foreign investment

in mainland China-based issuers to Hong Kong-based issuers, such action may significantly limit or completely hinder our ability to offer

or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless.

Recent

statements, laws and regulations by the Chinese government, including the Measures for Cybersecurity Review (2021), the PRC Personal

Information Protection Law and the Trial Measures, have indicated an intent to exert more oversight and control over offerings that are

conducted overseas and/or foreign investments in China-based issuers. It is uncertain whether the Chinese government will adopt additional

requirements or extend the existing requirements to apply to our Operating Subsidiaries located in Hong Kong. We could be subject to

approval or review of Chinese regulatory authorities to pursue future offerings. Any future action by the PRC government expanding

the categories of industries and companies whose foreign securities offerings are subject to review by the CSRC or CAC or filing with

the CSRC could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause

the value of such securities to significantly decline or be worthless.

The

Hong Kong legal system embodies uncertainties which could limit the legal protections available to Our Operating Subsidiaries.

Hong Kong

is a Special Administrative Region of the PRC. Following British colonial rule from 1842 to 1997, China assumed sovereignty under

the “one country, two systems” principle. The Hong Kong Special Administrative Region’s constitutional document,

the Basic Law, ensures that the current political situation will remain in effect for 50 years. Hong Kong has enjoyed the freedom

to function with a high degree of autonomy for its affairs, including currencies, immigration and customs operations, and its independent

judiciary system and parliamentary system. On July 14, 2020, the United States signed an executive order to end the special

status enjoyed by Hong Kong post-1997. As the autonomy currently enjoyed may be compromised, it could potentially impact Hong Kong’s

common law legal system and may, in turn, bring about uncertainty in, for example, the enforcement of our contractual rights. This could,

in turn, materially and adversely affect our business and operations. Additionally, intellectual property rights and confidentiality

protections in Hong Kong may not be as effective as in the United States or other countries. Accordingly, we cannot predict

the effect of future developments in the Hong Kong legal system, including the promulgation of new laws, changes to existing laws

or the interpretation or enforcement thereof, or the pre-emption of local regulations by national laws. These uncertainties could

limit the legal protections available to us, including our ability to enforce our agreements with our clients.

The

Hong Kong regulatory requirement of prior approval for the transfer of shares in excess of a certain threshold may restrict future

takeovers and other transactions.

Section 132

of Securities and Futures Ordinance (Cap. 157 of the laws of Hong Kong) (the “SFO”) requires prior approval from the

HKSFC for any company or individual to become a substantial shareholder of a HKSFC-licensed company in Hong Kong. Under the

SFO, a person will be a “substantial shareholder” of a licensed company if he, either alone or with associates, has an interest

in, or is entitled to control the exercise of, the voting power of more than 10% of the total number of issued shares of the licensed

company, or exercises control of 35% or more of the voting power of a company that controls more than 10% of the voting power of the

licensed company. Further, all potential parties who will be new substantial shareholder(s) of the HKSFC-licensed subsidiaries,

which are ZYSL and ZYCL, are required to seek prior approval from the HKSFC. This regulatory requirement may discourage, delay or

prevent a change in control of TFGL, which could deprive the holders of our Ordinary Shares the opportunity to receive a premium for

their Ordinary Shares as part of a future sale and may reduce the price of our Ordinary Shares upon the consummation of a future proposed

business combination.

The

enforcement of foreign civil liabilities in the Cayman Islands and Hong Kong is subject to certain conditions. Therefore, certain judgments

obtained against us by our shareholders may be difficult to enforce in such jurisdictions.

We

are a company formed under the laws of the Cayman Islands. We conduct our operations outside the United States and substantially all

of our assets are located outside the United States. In addition, two of our seven directors and officers are nationals and/or residents

of the United States. The other five of our directors and officers are nationals and/or residents of countries other than the United

States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be

difficult or impossible for you to bring an action against us or against them in the United States in the event that you believe that

your rights have been infringed under the U.S. federal securities laws or otherwise. Even if you are successful in bringing an action