via NewMediaWire -- Interactive Strength Inc. d/b/a FORME (the

"Company", or “FORME”) (NASDAQ: TRNR), today announced its

financial results for the second quarter of 2023.

The Company incurred a net loss of $13.6 million

for the second quarter of 2023, or a loss of $1.02 per diluted

share, as compared with a net loss of $11.9 million, or a loss of

$24.46 per diluted share for the same period in 2022, due primarily

to expenses incurred in connection with the Company’s initial

public offering (the “IPO”).

Adjusted EBITDA, a non-GAAP financial measure,

was a $5.7 million loss for the quarter. Adjusted EBITDA for the

second quarter reflects $4.3 million of non-cash stock-based

compensation. For more information regarding the non-GAAP financial

measures discussed in this press release, please see "Non-GAAP

Financial Measures" and "Reconciliation of GAAP to Non-GAAP

Financial Measures" below.

Additionally, the Company entered into a

non-binding letter of intent and exclusivity agreement to acquire a

connected fitness equipment business. The potential transaction, if

consummated, is expected to accelerate FORME’s commercialization

path, result in immediate scale across all functions and create a

high-growth and profitable platform that sells connected fitness

equipment and digital fitness services across B2B and B2C

channels.

Based on internal projections from the target’s

management, 2023 combined gross revenues are projected to exceed

$10 million and 2024 combined gross revenues are projected to

exceed $25 million. By the fourth quarter of 2024, the combined

business is expected to be cash flow positive and to achieve

positive adjusted EBITDA based on identified cost synergies. It is

currently anticipated that all of the equity of the target company

will be exchanged for TRNR equity and be subject to a “lock-up”

until at least the end of October 2024, similar to pre-IPO

shareholders. There will be a separate press release providing more

information on the potential acquisition.

CEO CommentsTrent Ward,

co-founder and CEO of FORME, said, “While the second quarter

revenue was an improvement on the first quarter, we believe the

most exciting driver in the business going forward is the letter of

intent and exclusivity agreement into which we have entered, and

which we believe should result in a transformational acquisition

that can accelerate our commercialization path. We expect this

transaction can help us achieve immediate scale across all of our

cost centers, resulting in a high-growth and profitable platform

that sells connected fitness equipment and digital fitness services

across B2B and B2C channels.”

“Specifically, for the second quarter, hardware

installations drove the fitness product revenue to more than triple

from the first quarter, and it would have been higher, but a number

of installations slipped to July as a result of consumers’ holiday

travel in June.”

“We are excited about what we are seeing in the

B2B channel, as evidenced by our new partnership with The Risher

Companies that was announced earlier this month. We expect that

fitness product sales into the B2B channel will drive a material

percentage of our hardware installations going forward as we are

focusing more on this higher return on capital channel. In fact,

the strength of the performance in the B2B channel, as well as our

belief that the FORME business would benefit from it, were key

reasons for our interest in the potential acquisition.”

"If the transaction is consummated and we

generate the expected combined gross revenues, we expect to that

the combined business will be generating profitability on an

adjusted EBITDA basis by the fourth quarter of 2024.”

About Interactive Strength

Inc.

Interactive Strength Inc. (NASDAQ: TRNR) d/b/a

Forme is a digital fitness platform that combines premium connected

fitness hardware products with personal training and coaching (from

real humans) to deliver an immersive experience and better outcomes

for both consumers and trainers. We believe we are the pioneer

brand in the emerging sector of virtual personal training and

health coaching and that our products and services are accelerating

a powerful shift towards outcome-driven fitness solutions. The

company is headquarters in Austin, Texas, USA. Visit formelife.com

for more information, and connect with Forme on Facebook, and

Instagram.

Channels for Disclosure of

Information

In compliance with disclosure obligations under

Regulation FD, we announce material information to the public

through a variety of means, including filings with the Securities

and Exchange Commission (“SEC”), press releases, company blog

posts, public conference calls, and webcasts, as well as via our

investor relations website. Any updates to the list of disclosure

channels through which we may announce information will be posted

on the investor relations page on our website. The inclusion of our

website address or the address of any third-party sites in this

press release are intended as inactive textual references only.

Non-GAAP Financial Measures

In addition to our results determined in

accordance with accounting principles generally accepted in the

United States, or GAAP, we believe the following non-GAAP financial

measures are useful in evaluating our operating performance.

The Company's non-GAAP financial measure in this

press release consist of Adjusted EBITDA, which we define as net

(loss) income, adjusted to exclude: other expense (income), net;

income tax expense (benefit); depreciation and amortization

expense; stock-based compensation expense; vendor settlements; and

IPO readiness costs and expenses.

The Company believes the above adjusted

financial measures help facilitate analysis of operating

performance and the operating leverage in our business. We believe

that these non-GAAP financial measures are useful to investors for

period-to-period comparisons of our business and in understanding

and evaluating our operating results for the following reasons:

- Adjusted EBITDA is

widely used by investors and securities analysts to measure a

company’s operating performance without regard to items such as

stock-based compensation expense, depreciation and amortization

expense, other expense (income), net, and provision for income

taxes that can vary substantially from company to company depending

upon their financing, capital structures, and the method by which

assets were acquired;

- Our management uses

Adjusted EBITDA in conjunction with financial measures prepared in

accordance with GAAP for planning purposes, including the

preparation of our annual operating budget, as a measure of our

core operating results and the effectiveness of our business

strategy, and in evaluating our financial performance; and

- Adjusted EBITDA

provides consistency and comparability with our past financial

performance, facilitate period-to-period comparisons of our core

operating results, and may also facilitate comparisons with other

peer companies, many of which use similar non-GAAP financial

measures to supplement their GAAP results.

Our use of Adjusted EBITDA, or any other

non-GAAP financial measures we may use in the future, is presented

for supplemental informational purposes only and should not be

considered as a substitute for, or in isolation from, our financial

results presented in accordance with GAAP. Further, these non-GAAP

financial measures have limitations as analytical tools. Some of

these limitations are, or may in the future be, as follows:

- Although

depreciation and amortization expense are non-cash charges, the

assets being depreciated and amortized may have to be replaced in

the future, and Adjusted EBITDA does not reflect cash capital

expenditure requirements for such replacements or for new capital

expenditure requirements;

- Adjusted EBITDA

excludes stock-based compensation expense, which has recently been,

and will continue to be for the foreseeable future, a significant

recurring expense for our business and an important part of our

compensation strategy;

- Adjusted EBITDA

does not reflect: (1) changes in, or cash requirements for, our

working capital needs; (2) interest expense, or the cash

requirements necessary to service interest or principal payments on

our debt, which reduces cash available to us; or (3) tax payments

that may represent a reduction in cash available to us;

- Adjusted EBITDA

does not reflect impairment charges for fixed assets, and gains

(losses) on disposals for fixed assets;

- Adjusted EBITDA

does not reflect gains associated with vendor settlements.

- Adjusted EBITDA

does not reflect IPO readiness costs and expenses that do not

qualify as equity issuance costs.

- Adjusted EBITDA

does not reflect non cash fair value gains (losses) on convertible

notes, warrants and unrealized currency gains (losses).

Further, the non-GAAP financial measures

presented may not be comparable to similarly titled measures

reported by other companies due to differences in the way that

these measures are calculated. For example, the expenses and other

items that we exclude in our calculation of Adjusted EBITDA may

differ from the expenses and other items, if any, that other

companies may exclude from Adjusted EBITDA when they report their

operating results. Because companies in our industry may calculate

such measures differently than we do, their usefulness as

comparative measures is limited. Because of these limitations,

Adjusted EBITDA should be considered along with other operating and

financial performance measures presented in accordance with

GAAP.

Cautionary Statement Regarding

Forward-Looking StatementsThis release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. All statements other than

statements of historical fact are, or may be deemed to be,

forward-looking statements. In some cases, forward-looking

statements can be identified by the use of forward-looking terms

such as “anticipate,” “estimate,” “believe,” “continue,” “could,”

“intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,”

“expect,” “objective,” “projection,” “forecast,” “goal,”

“guidance,” “outlook,” “effort,” “target,” “trajectory” or the

negative of these terms or other comparable terms. However, the

absence of these words does not mean that the statements are not

forward-looking. Forward-looking statements include, but are not

limited to, statements regarding: the non-binding letter of intent

and exclusivity agreement to acquire a connected fitness equipment

business; statements regarding the potential transaction, including

the expected impact and benefits thereof (such as the anticipated

acceleration of FORME's commercialization path, the ability to

achieve immediate scale across all functions and create a

high-growth and profitable platform, and the anticipated impact on

FORME's operating results); internal management projections of the

target and the potential transaction, including with respect to

2023 and 2024 combined gross revenues and that, by the fourth

quarter of 2024, the combined business is expected to be cash flow

positive and to have positive adjusted EBITDA based on identified

cost synergies if the gross revenue projections are achieved; (iv)

the anticipated timeframe for the potential transaction; (v) our

expectation that fitness product sales into the B2B channel will

drive a material percentage of our hardware installations going

forward as we are focusing more on this higher return on capital

channel, the utility of non-GAAP financial measures; and the

anticipated features and benefits of our product and service

offerings. These forward-looking statements are subject to risks

and uncertainties which may cause actual results to differ

materially from those expressed or implied in such forward-looking

statements. These risk and uncertainties include, but are not

limited to, the following: our ability to achieve or maintain

profitability; our future capital needs and ability to obtain

additional financing to fund our operations; the growth rate, if

any, of our business and revenue and our ability to manage any such

growth; risks related to our subscription or any future revenue

model; our limited operating history; our ability to continue as a

“going concern”; our ability to compete successfully; fluctuations

in our operating results and factors affecting the same; our

reliance on sales of our Forme Studio equipment; our ability to

sustain competitive pricing levels; the growth rate, if any, of our

target markets and our industry; the ability of our customers to

obtain financing to purchase our products; our ability to forecast

demand for our products and services, anticipate consumer

preferences, and manage our inventory; our ability to attract and

retain members, personal trainers, health coaches, and fitness

instructors; our ability to expand our commercial and corporate

wellness business; unforeseen costs and potential liability in

connection with our products and services; our dependence on

third-party systems and services; and risks related to potential

acquisitions, intellectual property, litigation, dependence on key

personnel, privacy, cybersecurity, and other regulatory, tax, and

accounting matters, and international operations, as well as the

risks and uncertainties discussed in our most recently filed

periodic reports on Form 10-Q and subsequent filings and as

detailed from time to time in our SEC filings. Given these risks

and uncertainties, you should not place undue reliance on these

forward-looking statements. All forward-looking statements set

forth in this release are qualified by these cautionary statements,

and there can be no assurance that the actual results or

developments anticipated by the Company will be realized or, even

if substantially realized, that they will have the expected

consequence to or effects on the Company or its business or

operations. These forward-looking statements reflect our

management’s beliefs and views with respect to future events and

are based on estimates and assumptions as of the date of this press

release. Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee that

the future results, levels of activity, performance, or events and

circumstances reflected in the forward-looking statements will be

achieved or occur. Accordingly, you should not rely upon

forward-looking statements as predictions of future events.

Forward-looking statements set forth in this release speak only as

of the date hereof, and we do not undertake any obligation to

update forward-looking statements to reflect subsequent events or

circumstances, changes in expectations or the occurrence of

unanticipated events, except to the extent required by law.

TRNR Investor Contactir@formelife.com

INTERACTIVE STRENGTH INC. AND

SUBSIDIARIES KEY PERFORMANCE AND BUSINESS

METRICS(unaudited)(In

thousands)

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Total Households (at end of

period) |

|

|

226 |

|

|

|

140 |

|

|

|

226 |

|

|

|

140 |

|

| Total Members (at end of

period) |

|

231 |

|

|

140 |

|

|

231 |

|

|

|

140 |

|

| Annual Recurring Revenue |

|

$ |

371,000 |

|

|

$ |

65,282 |

|

|

$ |

371,000 |

|

|

$ |

65,282 |

|

| Average Annualized Recurring

Revenue per Household |

|

$ |

1,570 |

|

|

$ |

478 |

|

|

$ |

1,607 |

|

|

$ |

483 |

|

| Net Dollar Retention Rate |

|

|

251 |

% |

|

NM |

|

|

|

159 |

% |

|

NM |

|

| Net Loss (in thousands) |

|

$ |

(13,602 |

) |

|

$ |

(11,970 |

) |

|

$ |

(29,563 |

) |

|

$ |

(24,661 |

) |

| Adjusted EBITDA (in thousands)

(1) |

|

$ |

(5,731 |

) |

|

$ |

(9,876 |

) |

|

$ |

(10,157 |

) |

|

$ |

(20,648 |

) |

NM - Not meaningful.(1) Please refer to the reconciliation table

titled "Reconciliation of Non-GAAP Financial Measures"

HouseholdsWe believe our ability to expand the

number of households is an indicator of our market penetration and

growth. Total households are defined as individuals or entities

with an active paid membership and training.

MembersOur total member count is a key

indicator of the size of our future revenue opportunity. We define

a member as someone who has a unique profile on our platform,

either as the primary membership owner or an associated user within

the household.

ARRGiven the recurring nature of usage on our

platform, we view annual recurring revenue as an important

indicator of our progress towards growth targets and of the overall

health of the member base. We calculate ARR at a point in time by

multiplying the latest monthly period’s revenue by 12.

ARPHWe believe that our average recurring

revenue per household, which we refer to as ARPH, is a strong

indication of our ability to deliver value to our members and we

use this metric to track expanding usage on our platform by our

existing members. We calculate ARPH on a monthly basis as our total

revenue in that period divided by the number of households

determined as of the last day of that period. For a quarterly or

annual period, ARPH is determined as the weighted average monthly

ARPH over such three or 12-month period.

Net Dollar Retention RateOur ability to

maintain long-term revenue growth and achieve profitability is

dependent on our ability to retain and grow revenue from our

existing members. To help us measure our performance in this area,

we monitor our net dollar retention rate. We calculate net dollar

retention rate monthly by starting with the revenue from the cohort

of all members during the corresponding month 12 months prior, or

the Prior Period Revenue. We then calculate the revenue from these

same members as of the current month, or the Current Period

Revenue, including any expansion and net of any contraction or

attrition from these members over the last 12 months. The

calculation also includes revenue from members that generated

revenue before, but not in, the corresponding month 12 months

prior, but subsequently generated revenue in the current month and

are therefore reflected in the Current Period Revenue. We include

this group of re-engaged members in this calculation because our

members may use our platform for workouts that stop and start over

time. We then divide the total Current Period Revenue by the total

Prior Period Revenue to arrive at the net dollar retention rate for

the relevant month. For a quarterly or annual period, the net

dollar retention rate is determined as the average monthly net

dollar retention rates over such three or 12-month period.

RECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL MEASURESINTERACTIVE STRENGTH INC. AND

SUBSIDIARIESCONSOLIDATED RECONCILIATION OF

ADJUSTED EBITDA TO NET

LOSS(unaudited)(In

thousands)

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

| |

|

(in

thousands) |

|

|

| Net Loss |

|

$ |

(13,602 |

) |

|

$ |

(11,970 |

) |

|

$ |

(29,563 |

) |

|

$ |

(24,661 |

) |

|

| Adjusted to exclude the

following: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other expense (income),

net |

|

|

1,664 |

|

|

|

513 |

|

|

|

(990 |

) |

|

|

908 |

|

|

| Income tax benefit (expense) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

| Depreciation and amortization

expense |

|

|

1,636 |

|

|

|

1,490 |

|

|

|

3,236 |

|

|

|

2,927 |

|

|

| Stock-based compensation expense

(1) |

|

|

4,299 |

|

|

|

91 |

|

|

|

18,938 |

|

|

|

178 |

|

|

| Vendor settlements (2) |

|

|

— |

|

|

|

— |

|

|

|

(2,595 |

) |

|

|

— |

|

|

| IPO readiness costs and expenses

(3) |

|

|

272 |

|

|

|

— |

|

|

|

817 |

|

|

|

— |

|

|

| Adjusted EBITDA (4) |

|

$ |

(5,731 |

) |

|

$ |

(9,876 |

) |

|

$ |

(10,157 |

) |

|

$ |

(20,648 |

) |

|

(1) Stock based compensation (2) Gain on forgiveness of debt of

$2.6 million related to the third-party Content Provider.(3)

Adjusts for IPO readiness costs and expenses that do not qualify as

equity issuance costs.(4) Please refer to the "Non-GAAP Financial

Measures" section of the press release.

INTERACTIVE STRENGTH INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE

LOSS(unaudited)(In thousands,

except share and per share amounts)

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Fitness product revenue |

|

$ |

224 |

|

|

$ |

81 |

|

|

$ |

296 |

|

|

$ |

258 |

|

|

Membership revenue |

|

|

32 |

|

|

|

16 |

|

|

|

56 |

|

|

|

28 |

|

|

Training revenue |

|

|

60 |

|

|

|

— |

|

|

|

121 |

|

|

|

— |

|

|

Total revenue |

|

|

316 |

|

|

|

97 |

|

|

|

473 |

|

|

|

286 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of fitness product revenue |

|

|

(427 |

) |

|

|

(729 |

) |

|

|

(1,169 |

) |

|

|

(1,283 |

) |

|

Cost of membership |

|

|

(939 |

) |

|

|

(503 |

) |

|

|

(1,901 |

) |

|

|

(1,992 |

) |

|

Cost of training |

|

|

(88 |

) |

|

|

(386 |

) |

|

|

(191 |

) |

|

|

(690 |

) |

|

Total cost of revenue |

|

|

(1,454 |

) |

|

|

(1,618 |

) |

|

|

(3,261 |

) |

|

|

(3,965 |

) |

|

Gross loss |

|

|

(1,138 |

) |

|

|

(1,521 |

) |

|

|

(2,788 |

) |

|

|

(3,679 |

) |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

2,326 |

|

|

|

5,463 |

|

|

|

5,439 |

|

|

|

10,430 |

|

|

Sales and marketing |

|

|

591 |

|

|

|

1,992 |

|

|

|

1,191 |

|

|

|

4,001 |

|

|

General and administrative |

|

|

7,883 |

|

|

|

2,481 |

|

|

|

23,730 |

|

|

|

5,643 |

|

|

Total operating expenses |

|

|

10,800 |

|

|

|

9,936 |

|

|

|

30,360 |

|

|

|

20,074 |

|

| Loss from operations |

|

|

(11,938 |

) |

|

|

(11,457 |

) |

|

|

(33,148 |

) |

|

|

(23,753 |

) |

| Other income (expense), net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net |

|

|

87 |

|

|

|

(338 |

) |

|

|

204 |

|

|

|

(323 |

) |

|

Interest income (expense) |

|

|

(1,436 |

) |

|

|

(175 |

) |

|

|

(1,228 |

) |

|

|

(561 |

) |

|

Gain upon debt forgiveness |

|

|

— |

|

|

|

— |

|

|

|

2,595 |

|

|

|

— |

|

|

Change in fair value of convertible notes |

|

|

(171 |

) |

|

|

— |

|

|

|

(252 |

) |

|

|

(24 |

) |

|

Change in fair value of warrants |

|

|

(144 |

) |

|

|

— |

|

|

|

2,266 |

|

|

|

— |

|

|

Total other income (expense), net |

|

|

(1,664 |

) |

|

|

(513 |

) |

|

|

3,585 |

|

|

|

(908 |

) |

| Loss before provision for income

taxes |

|

|

(13,602 |

) |

|

|

(11,970 |

) |

|

|

(29,563 |

) |

|

|

(24,661 |

) |

|

Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net loss attributable to common

stockholders |

|

$ |

(13,602 |

) |

|

$ |

(11,970 |

) |

|

$ |

(29,563 |

) |

|

$ |

(24,661 |

) |

| Net loss per share - basic and

diluted |

|

$ |

(1.02 |

) |

|

$ |

(24.46 |

) |

|

$ |

(2.81 |

) |

|

$ |

(63.22 |

) |

| Weighted average common stock

outstanding—basic and diluted |

|

|

13,340,777 |

|

|

|

489,379 |

|

|

|

10,513,068 |

|

|

|

390,092 |

|

INTERACTIVE STRENGTH INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(unaudited)(In thousands,

except share and per share amounts)

|

|

|

June 30, |

|

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,403 |

|

|

$ |

226 |

|

|

Accounts receivable, net of allowances |

|

|

14 |

|

|

|

— |

|

|

Inventories, net |

|

|

2,364 |

|

|

|

4,567 |

|

|

Vendor deposits |

|

|

3,280 |

|

|

|

3,603 |

|

|

Prepaid expenses and other current assets |

|

|

1,488 |

|

|

|

1,426 |

|

|

Total current assets |

|

|

8,549 |

|

|

|

9,822 |

|

| Property and equipment, net |

|

|

810 |

|

|

|

1,326 |

|

| Right-of-use-assets |

|

|

309 |

|

|

|

110 |

|

| Intangible assets, net |

|

|

3,205 |

|

|

|

3,834 |

|

| Long-term inventories |

|

|

2,418 |

|

|

|

— |

|

| Deferred offering costs |

|

|

— |

|

|

|

2,337 |

|

| Other assets |

|

|

6,424 |

|

|

|

7,018 |

|

| Total

Assets |

|

$ |

21,715 |

|

|

$ |

24,447 |

|

| Liabilities and

stockholders' equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

8,326 |

|

|

$ |

7,743 |

|

|

Accrued expenses and other current liabilities |

|

|

1,953 |

|

|

|

5,304 |

|

|

Operating lease liability, current portion |

|

|

52 |

|

|

|

106 |

|

|

Deferred revenue |

|

|

58 |

|

|

|

29 |

|

|

Loan payable |

|

|

6,034 |

|

|

|

6,708 |

|

|

Income tax payable |

|

|

7 |

|

|

|

7 |

|

|

Convertible note payable |

|

|

— |

|

|

|

4,270 |

|

|

Total current liabilities |

|

|

16,430 |

|

|

|

24,167 |

|

| Operating lease liability, net of

current portion |

|

|

257 |

|

|

|

9 |

|

| Warrant liabilities |

|

|

17 |

|

|

|

3,004 |

|

| Total

liabilities |

|

$ |

16,704 |

|

|

$ |

27,180 |

|

| Commitments and contingencies

(Note 13) |

|

|

|

|

|

|

| Stockholders'

equity |

|

|

|

|

|

|

|

Common stock, par value $0.0001; 900,000,000 and 369,950,000 shares

authorized as of June 30, 2023 and December 31, 2022, respectively;

14,178,514 and 2,450,922 shares issued and outstanding as of June

30, 2023 and December 31, 2022, respectively. |

|

|

7 |

|

|

|

4 |

|

|

Additional paid-in capital |

|

|

149,991 |

|

|

|

112,436 |

|

|

Accumulated other comprehensive income |

|

|

114 |

|

|

|

365 |

|

|

Accumulated deficit |

|

|

(145,101 |

) |

|

|

(115,538 |

) |

| Total stockholders' equity

(deficit) |

|

|

5,011 |

|

|

|

(2,733 |

) |

| Total liabilities and

stockholders' equity (deficit) |

|

$ |

21,715 |

|

|

$ |

24,447 |

|

INTERACTIVE STRENGTH INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENT OF

CASH FLOWS(unaudited)(In

thousands)

|

|

|

Six Months Ended June 30, |

|

|

|

|

2023 |

|

|

2022 |

|

| Cash Flows

From Operating Activities: |

|

|

|

|

|

|

| Net loss |

|

$ |

(29,563 |

) |

|

$ |

(24,661 |

) |

| Adjustments to reconcile net loss

to net cash used in operating activities: |

|

|

|

|

|

|

|

Foreign currency |

|

|

228 |

|

|

|

404 |

|

|

Depreciation |

|

|

516 |

|

|

|

643 |

|

|

Amortization |

|

|

2,719 |

|

|

|

2,285 |

|

|

Amortization of operating lease assets |

|

|

53 |

|

|

|

— |

|

|

Inventory valuation loss |

|

|

261 |

|

|

|

374 |

|

|

Stock-based compensation |

|

|

18,938 |

|

|

|

180 |

|

|

Gain upon debt forgiveness |

|

|

(2,595 |

) |

|

|

— |

|

|

Interest (income) expense |

|

|

(77 |

) |

|

|

561 |

|

|

Amortization of debt discount |

|

|

1,305 |

|

|

|

— |

|

|

Change in fair value of convertible notes |

|

|

252 |

|

|

|

24 |

|

|

Warrants issued to service providers |

|

|

442 |

|

|

|

— |

|

|

Change in fair value of warrants |

|

|

(2,266 |

) |

|

|

— |

|

| Changes in operating assets and

liabilities |

|

|

|

|

|

|

|

Accounts receivable |

|

|

(14 |

) |

|

|

— |

|

|

Inventories |

|

|

(662 |

) |

|

|

(1,526 |

) |

|

Prepaid expenses and other current assets |

|

|

(62 |

) |

|

|

(502 |

) |

|

Vendor deposits |

|

|

323 |

|

|

|

(834 |

) |

|

Other assets |

|

|

(17 |

) |

|

|

(1 |

) |

|

Accounts payable |

|

|

(178 |

) |

|

|

(546 |

) |

|

Accrued expenses and other current liabilities |

|

|

(773 |

) |

|

|

491 |

|

|

Deferred revenue |

|

|

29 |

|

|

|

4 |

|

|

Operating lease liabilities |

|

|

(59 |

) |

|

|

— |

|

|

Net cash used in operating activities |

|

|

(11,200 |

) |

|

|

(23,104 |

) |

| Cash Flows

From Investing Activities: |

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

— |

|

|

|

(276 |

) |

|

Acquisition of internal use software |

|

|

(343 |

) |

|

|

(2,744 |

) |

|

Acquisition of software and content |

|

|

(525 |

) |

|

|

(3,004 |

) |

|

Net cash used in investing activities |

|

|

(868 |

) |

|

|

(6,024 |

) |

| Cash Flows

From Financing Activities: |

|

|

|

|

|

|

|

Payments of loans |

|

|

(377 |

) |

|

|

(1,147 |

) |

|

Proceeds from loans |

|

|

275 |

|

|

|

— |

|

|

Proceeds from issuance of common stock upon initial public

offering, net of offering costs |

|

|

10,820 |

|

|

|

— |

|

|

Payments of offering costs |

|

|

(1,308 |

) |

|

|

— |

|

|

Proceeds from senior secured notes |

|

|

2,000 |

|

|

|

— |

|

|

Payments of senior secured notes |

|

|

(2,000 |

) |

|

|

— |

|

|

Proceeds from issuance of Preferred Stock - Series A, net of

issuance costs |

|

|

— |

|

|

|

30,001 |

|

|

Proceeds from issuance of convertible notes |

|

|

— |

|

|

|

5,902 |

|

|

Proceeds from the issuance of common stock A |

|

|

4,247 |

|

|

|

2,063 |

|

|

Proceeds from the exercise of common stock options |

|

|

30 |

|

|

|

24 |

|

|

Repayment Bounce Back Loan |

|

|

— |

|

|

|

(69 |

) |

|

Net cash provided by financing activities |

|

|

13,687 |

|

|

|

36,774 |

|

|

Effect of exchange rate on cash |

|

|

(442 |

) |

|

|

(79 |

) |

| Net Change

In Cash and Cash Equivalents |

|

|

1,177 |

|

|

|

7,567 |

|

| Cash and restricted cash at

beginning of year |

|

|

226 |

|

|

|

1,697 |

|

| Cash and restricted cash at end

of year |

|

$ |

1,403 |

|

|

$ |

9,264 |

|

| Supplemental

Disclosure Of Cash Flow

Information: |

|

|

|

|

|

|

| Property & equipment in

AP |

|

|

18 |

|

|

|

191 |

|

| Inventories in AP and

accrued |

|

|

815 |

|

|

|

532 |

|

| Capitalized software and content

in AP |

|

|

— |

|

|

|

319 |

|

| Issuance of Series A preferred

stock in connection with convertible notes payable |

|

|

— |

|

|

|

5,926 |

|

| Deferred offering costs in AP and

accrued |

|

|

3,299 |

|

|

|

— |

|

| Exercise of stock warrants |

|

|

2,468 |

|

|

|

— |

|

| Right-of-use assets obtained in

exchange for new operating lease liabilities |

|

|

313 |

|

|

|

— |

|

| Conversion of convertible notes

into common stock |

|

|

4,521 |

|

|

|

— |

|

| Decrease in right-of-use asset

and operating lease liabilities due to lease termination |

|

|

61 |

|

|

|

— |

|

| Issuance of Common Stock from

Rights Offering |

|

|

202 |

|

|

|

— |

|

| Net exercise of options |

|

|

323 |

|

|

|

— |

|

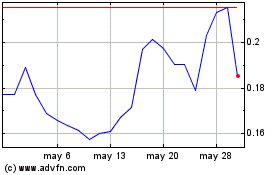

Interactive Strength (NASDAQ:TRNR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Interactive Strength (NASDAQ:TRNR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024