As filed with

the Securities and Exchange Commission on January 22, 2025

File No.

333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM S-3

REGISTRATION

STATEMENT

UNDER THE SECURITIES ACT OF 1933

___________________

TRANSCAT,

INC.

(Exact name of registrant as specified in its charter)

Ohio

(State or other

jurisdiction of incorporation or organization) |

|

16-0874418

(I.R.S. Employer Identification Number) |

35 Vantage

Point Drive

Rochester, New York 14624

(585) 352-7777

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Lee

D. Rudow

President and Chief

Executive Officer

Transcat, Inc.

35 Vantage Point Drive

Rochester, New York 14624

(585) 352-7777

(Name, address, including zip code and telephone number, including area code, of agent for service)

___________________

COPIES TO:

Alexander

R. McClean, Esq.

Margaret K. Rhoda, Esq.

Harter Secrest & Emery LLP

1600 Bausch & Lomb Place

Rochester, New

York 14604

(585)

232-6500 |

Approximate

date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If the only

securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box. ☐

If any of

the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities

Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this

Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form

is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon

filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form

is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check

mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated

filer |

☒ |

|

|

|

Accelerated

filer |

☐ |

| Non-accelerated filer |

☐ |

|

|

|

Smaller reporting company |

☐ |

| Emerging growth company |

☐ |

|

|

|

|

|

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PROSPECTUS

Transcat,

Inc.

96,006 Shares

of Common Stock Offered by the Selling Shareholder

This

prospectus relates to the offer and resale by the selling shareholder identified herein of up to 96,006 shares of our common stock, par

value $0.50 per share (“Common Stock”). This prospectus provides you with a general description of the shares of Common Stock.

You should carefully read this prospectus and the documents incorporated by reference before buying any of the shares of Common Stock

being offered.

We

are registering the offer and sale of the shares of the Common Stock owned by the selling shareholder to satisfy registration rights

we have granted to the selling shareholder pursuant to a registration rights agreement dated as of December 10, 2024. We have agreed

to bear all of the expenses incurred in connection with the registration of the Common Stock covered by this prospectus. The selling

shareholder will pay or assume brokerage commissions and similar charges, if any, incurred in the sale of the shares of Common Stock.

The

registration of shares of Common Stock hereunder does not mean that the selling shareholder will actually offer or sell the full number

of shares being registered pursuant to this prospectus. The selling shareholder may sell the shares of Common Stock registered hereby

from time to time. The shares of Common Stock may be offered and sold by the selling shareholder through public or private transactions,

at market prices prevailing at the time of sale or at negotiated prices. The selling shareholder may retain underwriters, dealers or

agents from time to time. For additional information on the methods of sale, you should refer to the section entitled “Plan of

Distribution” in this prospectus.

We

are not selling any shares of our Common Stock pursuant to this prospectus, and we will not receive any proceeds from any sale by the

selling shareholder of the shares of Common Stock covered by this prospectus.

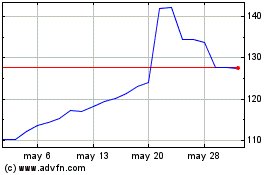

Our

Common Stock is traded on the Nasdaq Global Market under the symbol “TRNS.” On January 16, 2025, the last reported sale price

of our Common Stock on the Nasdaq Global Market was $103 per share.

Investing

in our Common Stock involves risk. You should carefully read the information included and incorporated by reference into this prospectus

for a discussion of the factors you should carefully consider in determining whether to invest in our Common Stock, including the discussion

of risks described under “Risk Factors” on page 5 of this prospectus.

___________________

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

___________________

The date of this

prospectus is January 22, 2025.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus relates to the resale by the Selling Shareholder, as defined in the section of this prospectus entitled “Selling Shareholder,”

of up to 96,006 shares of our Common Stock.

This

prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”)

under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to which the Selling Shareholder named herein

may, from time to time, offer and sell or otherwise dispose of the shares of Common Stock covered by this prospectus. You should rely

only on the information contained in, or incorporated by reference into, this prospectus and any applicable prospectus supplement we

have authorized for use in connection with this offering. We have not authorized anyone to provide you with additional information or

information different from that contained in, or incorporated by reference into, this prospectus and any applicable prospectus supplement.

This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer

or solicitation is unlawful or in any state or other jurisdiction where the offer is not permitted. The information contained in this

prospectus, any applicable prospectus supplement, and the documents incorporated by reference herein and therein, is accurate only as

of their respective dates, regardless of the time of delivery of this prospectus, any applicable prospectus supplement, or any sale of

a security. Our business, financial condition, results of operations and prospects may have changed since such date.

It

is important for you to read and consider all information contained in this prospectus and any prospectus supplement, including the documents

incorporated by reference, in making your investment decision. This prospectus contains summaries of certain provisions contained in

some of the documents described herein, but reference is made to the actual documents for complete information. Copies of some of the

documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement

of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where

You Can Find More Information.”

This

prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our

control. Please read the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

Unless

the context otherwise requires, references in this prospectus to “Transcat,” the “Company,” “we,”

“us,” and “our” refer to Transcat, Inc. and its subsidiaries, unless the context clearly indicates otherwise.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements relate to expectations, estimates, beliefs, assumptions and predictions of future events and are identified by words such

as “can,” “focus,” “intends,” “may,” “plan,” “will,” “would,”

and other similar words. Forward-looking statements are not statements of historical fact and thus are subject to risks, uncertainties

and other factors that could cause actual results to differ materially from historical results or those expressed in such forward-looking

statements.

These

forward-looking statements are not guarantees of future performance, nor should they be relied upon as representing management’s

views as of any subsequent date. Forward-looking statements involve significant risks and uncertainties and actual results may differ

materially from those presented, either expressed or implied, in this prospectus, any prospectus supplement, and the documents we incorporate

by reference, including among others, statements regarding our strategy, future operations, financial objectives, prospects, plans, objectives

of management and expected performance levels are forward-looking statements. Factors that might cause such differences include, but

are not limited to:

| · | general

economic conditions applicable to our business, including inflationary impacts and changes

in interest rates, |

| · | the

highly competitive nature of the industries in which we compete and in the nature of our

two business segments, |

| · | the

concentration of Service segment customers in the life science and other FDA-regulated businesses

and industrial manufacturing industries, |

| · | the

significant competition we face in our Distribution segment, |

| · | any

impairment of our goodwill or intangible assets, |

| · | tariffs

and trade relations, |

| · | our

ability to successfully complete and integrate business acquisitions, |

| · | cybersecurity

risks, including the risk of significant disruptions in our information technology systems,

|

| · | our

ability to recruit, train and retain quality employees, skilled technicians and senior management,

|

| · | fluctuations

in our operating results, |

| · | our

ability to achieve or maintain adequate utilization and pricing rates for our technical service

providers, |

| · | the

prices we are able to charge for our services in our Service segment, |

| · | our

ability to adapt our technology, |

| · | reliance

on our enterprise resource planning system, |

| · | technology

updates, supply chain delays or disruptions, |

| · | the

risks related to current and future indebtedness, |

| · | foreign

currency rate fluctuations, |

| · | risks

related to protecting our intellectual property, |

| · | geopolitical

events, adverse weather events or other catastrophes or natural disasters or widespread public

health crises, |

| · | negative

publicity and other reputational harm, |

| · | the

volatility of our stock price and the relatively low trading volume of our common stock,

|

| · | changes

in tax rates, accounting standards, legal requirements and listing standards, and |

| · | legal

and regulatory risks related to our international operations. |

We

caution you not to place undue reliance on any forward-looking statements, which speak only as of the date made, and advise that various

factors, including those described above, could affect our financial performance and could cause our actual results or circumstances

for future periods to differ materially from those anticipated or projected. See “Risk Factors” and also “Risk Factors”

in Item IA of Part I of our Annual Report on Form 10-K for the fiscal year ended March 30, 2024, which is incorporated herein by reference,

for further information. Except as required by law, we do not undertake, and specifically disclaim any obligation to publicly release

any revisions to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after

the date of such statements.

PROSPECTUS

SUMMARY

This

summary highlights, and is qualified in its entirety by, the more detailed information included elsewhere or incorporated by reference

in this prospectus. This summary does not contain all of the information that may be important to you. You should read and carefully

consider the entire prospectus, especially as described in “Risk Factors,” before deciding to invest in the Common Stock.

The

Company

We

are a leading provider of accredited calibration services, enterprise asset management services, and value-added distributor of professional

grade handheld test, measurement and control instrumentation. We are focused on providing services and products to highly regulated industries,

particularly the life science industry, which includes pharmaceutical, biotechnology, medical device and other FDA-regulated businesses.

Additional industries served include FAA-regulated businesses, including aerospace and defense industrial manufacturing; energy and utilities,

including oil and gas and alternative energy; and other industries that require accuracy in their processes, confirmation of the capabilities

of their equipment, and for which the risk of failure is very costly.

We

offer a variety of services and solutions including permanent and periodic onsite services, mobile calibration services, pickup and delivery

and in-house services. As of December 10, 2024, we operated 26 calibration service centers strategically located across the United States,

Puerto Rico, Canada, and Ireland. We also serve our customers onsite at their facilities for daily, weekly or longer-term periods. In

addition, we have several imbedded customer-site locations that we refer to as “client-based labs,” where we provide calibration

services, and in some cases other related services, exclusively for the customer and where we reside and work every day. We also have

a fleet of mobile calibration laboratories that can provide service at customer sites which may not have the space or utility capabilities

we require to service their equipment.

We

also operate as a leading value-added distributor that sells and rents national and proprietary brand instruments to customers globally.

Through our website, in-house sales team and printed and digital marketing materials, we offer access to more than 150,000 test, measurement

and control instruments, including products from approximately 450 leading brands. Most instruments we sell and rent require calibration

service to ensure that they maintain the most precise measurements. By having the capability to calibrate these instruments at the time

of sale and at regular post-sale intervals, we can give customers a value-added service that most of our competitors are unable to provide.

Calibrating before shipping means the customer can place their instruments into service immediately upon receipt, reducing downtime.

We

were incorporated under the laws of the State of Ohio in 1964. Our principal executive office is located at 35 Vantage Point Drive, Rochester,

New York 14624, and our telephone number is (585) 352-7777. Our website address is www.transcat.com. The information contained on, or

that can be accessed through, our website is not a part of this prospectus. We have included our website address in this prospectus solely

as an inactive textual reference.

The

Offering

| Common

Stock Offered |

All

of the 96,006 shares of Common Stock offered by this prospectus are being sold by the Selling Shareholder. |

| Use

of Proceeds |

We

will not receive any proceeds from the sale of shares of Common Stock offered by

this prospectus.

|

| Nasdaq

Global Market Trading Symbol |

TRNS |

RISK

FACTORS

Investing in our Common Stock involves risks. Before making an investment decision, you should carefully consider the specific

risks set forth under the caption “Risk Factors” in our filings with the SEC, which are incorporated by reference into this

prospectus and any prospectus supplement. See “Where You Can Find More Information.”

USE

OF PROCEEDS

We

will not receive any proceeds from the shares of our Common Stock offered for resale by the Selling Shareholder. We

have agreed to bear all of the expenses incurred in connection with the registration of the Common Stock covered by this prospectus and

the Selling Shareholder will pay or assume brokerage commissions and similar charges, if any, incurred in the sale of the shares of Common

Stock.

SELLING

SHAREHOLDER

On

December 10, 2024, we entered into a Membership Unit Purchase Agreement (the “Martin Purchase Agreement”) with Martin Holding

Inc. (the “Seller”) and Richard L. Brion (the “Selling Shareholder”), pursuant to which we acquired all of the

membership units of Martin Calibration LLC (“Martin”), a privately-held Delaware limited liability company. Martin is an

ISO-17025 accredited calibration laboratory network and has been a regional Midwest leader in the metrology business for almost 35 years.

With its flagship Minneapolis lab, Martin has six additional labs in or near Chicago, Milwaukee, Eau Claire, Tempe, and Los Angeles.

Martin serves customers in the highly regulated medical, life science, aerospace, and nuclear sectors providing in-lab and onsite services

across a broad range of disciplines.

The

aggregate purchase price under the Martin Purchase Agreement was $79 million, subject to customary adjustments set forth in the agreement,

paid in a combination of (i) $69 million in cash and (ii) approximately $10 million in Common Stock, or 96,006 shares of Common Stock.

In connection with the Martin Purchase Agreement, we entered into a registration rights agreement pursuant to which we agreed to register

for resale under the Securities Act the shares of Common Stock issued pursuant to the Martin Purchase Agreement. Under the Martin Purchase

Agreement, Mr. Brion entered into a customary lock-up agreement with the Company pursuant to which he agreed not to sell or otherwise

dispose of the shares of Common Stock until 45 days after the effectiveness under the Securities Act of the registration statement of

which this prospectus forms a part.

We

have agreed to bear all of the expenses incurred in connection with the registration of the Common Stock covered by this prospectus.

The Selling Shareholder will pay or assume brokerage commissions and similar charges, if any, incurred in the sale of the shares of Common

Stock.

This

prospectus covers the resale from time to time by the Selling Shareholder identified in the table below of an aggregate of up to 96,006

shares of our Common Stock, subject to any appropriate adjustment as a result of any stock split, stock dividend, or other distribution

with respect to, or in an exchange or replacement, or in connection with a combination of shares, distribution, recapitalization, merger,

consolidation, other reorganization or other similar event. Other than the transactions contemplated by the Martin Purchase Agreement,

as described above, the Selling Shareholder and its affiliates have not held a position or office, or had any material relationship,

with us within the last three years.

The

table below: (i) lists the Selling Shareholder and other information regarding the beneficial ownership (as determined under Section 13(d)

of the Exchange Act and the rules and regulations thereunder) of our Common Stock by the Selling Shareholder; (ii) has been prepared

based upon

information furnished to us by the Selling Shareholder; and (iii) to our knowledge, is accurate as of the date of this

prospectus. The Selling Shareholder may sell all, some or none of its securities in this offering. The Selling Shareholder identified

in the table below may have sold, transferred or otherwise disposed of some or all of its securities since the date of this prospectus

in transactions exempt from or not subject to the registration requirements of the Securities Act. Information concerning the Selling

Shareholder may change from time to time and, if necessary, we will amend or supplement this prospectus accordingly and as required.

| |

|

Shares Beneficially

Owned Prior to the

Offering (1) |

|

Maximum

Number of

Shares to

be sold in

this

|

|

Shares Beneficially

Owned After the

Offering (1)(2) |

|

| Selling Shareholder |

|

Number

|

|

Percentage |

|

Offering |

|

Number |

|

Percentage |

|

| Richard L. Brion |

|

96,206 |

|

1.0 |

% |

96,006 |

|

200 |

|

* |

|

| TOTAL |

|

96,206 |

|

1.0 |

% |

96,006 |

|

200 |

|

* |

|

| * |

Less than 1%. |

| (1) |

Percentage ownership for the Selling Shareholder

is determined in accordance with Section 13(d) of the Exchange Act and the rules and regulations thereunder and is based on 9,309,257

outstanding shares of our Common Stock as of December 28, 2024. |

| (2) |

The totals reported in this column assume that

(a) all of the securities registered by the registration statement of which this prospectus is a part are sold in this offering;

(b) the Selling Shareholder does not (i) sell any of the shares of Common Stock, if any, that have been issued to it other than those

covered by this prospectus; and (ii) acquire additional shares of our Common Stock after the date of this prospectus and prior to

the completion of this offering. |

DESCRIPTION

OF COMMON STOCK

Introduction

The

following section describes the material features and rights of our Common Stock. The summary does not purport to be exhaustive and is

qualified in its entirety by reference to our Articles of Incorporation, as amended (the “Articles”) and our Code of Regulations,

as amended (the “Code of Regulations”), each of which is filed as an exhibit to the Registration Statement of which this

prospectus is a part, and to applicable sections of the Ohio General Corporation Law (the “OGCL”).

General

We

are authorized to issue up to 30,000,000 shares of Common Stock. Each share of Common Stock entitles the holder to the same rights, and

is the same in all respects, as each other share of Common Stock. Holders of Common Stock are entitled to: (i) one vote per share on

all matters requiring a shareholder vote; (ii) a ratable distribution of dividends, if and when, declared by the board of directors (the

“Board”); and (iii) in the event of a liquidation, dissolution or winding up of us, to share ratably in all assets remaining

available for distribution to them after payment of liabilities. Holders of Common Stock, as such, have no conversion, preemptive or

other subscription rights, and there are no redemption provisions applicable to the Common Stock. The shares of Common Stock being offered

by this prospectus will be fully paid and nonassessable.

Dividends

Our

credit agreement, as amended, limits our ability to pay cash dividends to certain levels over the term of the credit agreement and in

any fiscal year. We have not declared any cash dividends since our inception and have no current plans to pay any dividends in the foreseeable

future.

Transfer Agent

& Registrar

The

transfer agent and registrar for our Common Stock is Computershare.

Listing

Our

Common Stock is listed on the Nasdaq Global Market under the trading symbol “TRNS.”

Anti-takeover

Effects of Certain Provisions in our Articles of Incorporation, Code of Regulations and the OGCL

Articles

of Incorporation and Code of Regulations

Some

provisions of our Articles and Code of Regulations may be deemed to have an anti-takeover effect and may collectively operate to delay,

defer or prevent a tender offer, a proxy contest or takeover attempt that a shareholder might consider in his or her best interest, including

those attempts that might result in a premium over the market price for the shares held by our shareholders. These provisions are intended

to discourage certain types of coercive takeover practices and inadequate takeover bids. This also encourages persons seeking to acquire

control of us to negotiate with us first. As a result, shareholders who might desire to participate in such transactions may not have

an opportunity to do so. In addition, these provisions will also render the removal of our Board or management more difficult. The following

discussion is a summary of certain material provisions of our Articles and Code of Regulations, copies of which are filed as exhibits

to the Registration Statement of which this prospectus is a part.

Our

Articles require the affirmative vote of the holders of at least 75% of the capital stock of the Company entitled to vote in order to

authorize: (i) any merger or consolidation of the Company with any other corporation if such transaction would otherwise by law require

a vote of the shareholders; (ii) any combination or majority share acquisition with or by any corporation if such transaction would otherwise

by law require a vote of the shareholders; or (iii) any lease, sale, exchange, transfer or other disposition of all or substantially

all of the assets of the Company to any other person or entity; if, in any such event, such other corporation, person or entity is the

beneficial owner of ten percent or more of the outstanding capital stock of the Company entitled to vote thereon. Notwithstanding the

forgoing, such restrictions do not apply if the Company’s Board of Directors approves a memorandum of understanding with the other

corporation, person or entity prior to the time it becomes the owner of ten percent or more of the outstanding shares of the Company’s

capital stock.

Additionally,

the affirmative vote of the holders of at least 75% of the capital stock of the Company entitled to vote is required to amend, alter

or repeal any of the foregoing provisions of our Articles.

Finally,

the Board is currently divided into three classes. At the 2024 annual meeting of shareholders, our shareholders approved an amendment

to the Code of Regulations to declassify the Board of Directors. In effect, all directors elected at the 2025 annual meeting and any

later annual meeting of shareholders will be elected for one-year terms. Accordingly, the transition from a classified Board with staggered

terms to a declassified Board with all Board members serving one-year terms will not be complete until the 2028 annual meeting, at which

point all directors will stand for election for a one-year term. Until the Board is declassified, it would take at least two annual elections

to replace a majority of our Board.

Ohio General

Corporation Law

Certain

provisions of the OGCL make a change in control of an Ohio corporation more difficult. Below is a summary of the Ohio anti-takeover statutes.

Ohio

Control Share Acquisition Statute

The

OGCL provides that certain notice and informational filings, and special shareholder meeting and voting procedures, must occur prior

to the acquisition of an issuer’s shares that would entitle the acquirer to exercise or direct the voting power of the issuer in

the election of directors within any of the following ranges: (i) one-fifth or more but less than one-third of such voting power, (ii)

one-third or more but less than a majority of such voting power; or (iii) a majority or more of such voting power.

The

Ohio Control Share Acquisition Statute does not apply to a corporation if its articles of incorporation or code of regulations so provide.

We have not opted out of the application of the Ohio Control Share Acquisition Statute.

Ohio

Merger Moratorium Statute

Chapter

1704 of the OGCL addresses a range of business combinations and other transactions (including mergers, consolidations, asset sales, loans,

disproportionate distributions of property and disproportionate issuances or transfers of shares or rights to acquire shares) between

an Ohio corporation and an “Interested Shareholder” which is defined as a shareholder who, alone or with others, may exercise

or direct the exercise of at least 10% of the voting power of the corporation in the election of directors. The Ohio Merger Moratorium

Statute prohibits such transactions between the corporation and an Interested Shareholder for a period of three years after a person

becomes an Interested Shareholder, unless, prior to such date, the

directors approved either the business combination or other transaction

or approved the acquisition that caused the person to become an Interested Shareholder.

After

the three-year period, transactions between the corporation and the Interested Shareholder are permitted if:

| ● | the

transaction is approved by the holders of shares with at least two-thirds of the voting power

of the corporation in the election of directors or the approval of the holders of a majority

of the voting shares held by persons other than an Interested Shareholder; or |

| ● | the

business combination results in shareholders, other than the Interested Shareholder, receiving

the higher of the highest amount paid in the past by the Interested Shareholders for the

corporation’s shares or the amount that would be due to the shareholders if the corporation

were to dissolve. |

The

Ohio Merger Moratorium Statute does not apply to a corporation if its articles of incorporation or code of regulations so provide. We

have not opted out of the application of the Ohio Merger Moratorium Statute.

Ohio

Anti-Greenmail Statute

Pursuant

to the Ohio Anti-Greenmail Statute, a public corporation formed in Ohio may recover profits that a shareholder makes from the sale of

the corporation’s securities within 18 months after making a proposal to acquire control or publicly disclosing the possibility

of a proposal to acquire control. The corporation may not, however, recover from a person who proves either: (i) that his sole purpose

in making the proposal was to succeed in acquiring control of the corporation and there were reasonable grounds to believe that he would

acquire control of the corporation; or (ii) that his purpose was not to increase any profit or decrease any loss in the shares. Also,

before the corporation may obtain any recovery, the aggregate amount of the profit realized by such person must exceed $250,000. Any

shareholder may bring an action on behalf of the corporation if a corporation refuses to bring an action to recover these profits. The

party bringing such an action may recover his attorneys’ fees if the court having jurisdiction over such action orders recovery

of any profits.

The

Ohio Anti-Greenmail Statute does not apply to a corporation if its articles of incorporation or code of regulations so provide. We have

not opted out of the application of the Ohio Anti-Greenmail Statute.

PLAN

OF DISTRIBUTION

The

Selling Shareholder, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of Common

Stock or interests in shares of Common Stock received after the date of this prospectus from the Selling Shareholder as a gift, pledge,

partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of its shares of

Common Stock covered by this prospectus on any stock exchange, market or trading facility on which the shares of Common Stock are traded

or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related

to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The

Selling Shareholder may use any one or more of the following methods when disposing of the shares of Common Stock:

| · | ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | block

trades in which the broker-dealer will attempt to sell the shares as agent, but may position

and resell a portion of the block as principal to facilitate the transaction; |

| · | purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| · | an

exchange distribution in accordance with the rules of the applicable exchange; |

| · | privately

negotiated transactions; |

| · | short

sales effected after the date the registration statement of which this prospectus is a part

is declared effective by the SEC; |

| · | through

the writing or settlement of options or other hedging transactions, whether through an options

exchange or otherwise; |

| · | broker-dealers

may agree with the Selling Shareholder to sell a specified number of such shares at a stipulated

price per share; |

| · | the

in-kind distribution of the shares by an investment fund to its limited partners, members

or other equity holders; |

| · | a

combination of any such methods of sale; and |

| · | any

other method permitted by applicable law. |

The

Selling Shareholder may sell all, some or none of the shares of Common Stock covered by this prospectus. If sold under the registration

statement of which this prospectus forms a part, the shares of Common Stock will be freely tradeable in the hands of persons other than

our affiliates that acquire such shares.

The

Selling Shareholder may, from time to time, pledge or grant a security interest in some or all of the shares of Common Stock owned by

it and, if it defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell the shares of

Common Stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable

provision of the Securities Act amending the list of Selling Shareholder to include the pledgee, transferee or other successors in interest

as a Selling Shareholder under this prospectus. The Selling Shareholder also may transfer the shares of Common Stock in other circumstances,

in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In

connection with the sale of our Common Stock or interests therein, the Selling Shareholder may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the Common Stock in the course of hedging the positions they

assume. To the extent permitted by applicable securities laws, the Selling Shareholder may also sell shares of our Common Stock short

and deliver these securities to close out its short positions, or loan or pledge the Common Stock to broker-dealers that in turn may

sell these securities. The Selling Shareholder may also enter into option or other transactions with broker-dealers or other financial

institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial

institution of shares of Common Stock offered by this prospectus, which shares such broker-dealer or other financial institution may

resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

aggregate proceeds to the Selling Shareholder from the sale of the Common Stock offered by the Selling Shareholder will be the purchase

price of the Common Stock less discounts or commissions, if any. The Selling Shareholder reserves the right to accept and, together with

its agents from time to time, to reject, in whole or in part, any proposed purchase of Common Stock to be made directly or through agents.

We will not receive any of the proceeds from this offering.

The

Selling Shareholder also may resell all or a portion of the shares of Common Stock in open market transactions in reliance upon Rule

144 under the Securities Act, provided that it meets the criteria and conforms to the requirements of that rule.

The

Selling Shareholder and any underwriters, broker-dealers or agents that participate in the sale of the Common Stock or interests therein

may be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions

or profit they earn on any resale of the shares of Common Stock covered by this prospectus may be underwriting discounts and commissions

under the Securities Act. Any Selling Shareholder who is an “underwriter” within the meaning of Section 2(a)(11) of the Securities

Act will be subject to the prospectus delivery requirements of the Securities Act.

To

the extent required, the shares of our Common Stock to be sold, the name of the Selling Shareholder, the respective purchase prices and

public offering prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular

offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement

that includes this prospectus.

In

order to comply with the securities laws of some states, if applicable, the Common Stock may be sold in these jurisdictions only through

registered or licensed brokers or dealers. In addition, in some states the Common Stock may not be sold unless it has been registered

or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

We

have advised the Selling Shareholder that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares

in the market and to the activities of the Selling Shareholder and its affiliates. In addition, to the extent applicable we will make

copies of this prospectus (as it may be supplemented or amended from time to time) available to the Selling Shareholder for the purpose

of satisfying the prospectus delivery requirements of the Securities Act. The Selling Shareholder may indemnify any broker-dealer that

participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities

Act.

We

have agreed to indemnify the Selling Shareholder against certain liabilities, including liabilities under the Securities Act and state

securities laws, relating to the registration of the shares offered by this prospectus.

We

have agreed with the Selling Shareholder to keep the registration statement of which this prospectus constitutes a part effective until

the earliest to occur of (i) the 12-month anniversary of the issuance of the shares of Common Stock, (ii) a Change of Control, and (iii)

such time as all the shares of Common Stock covered by this prospectus have been sold by the Selling Shareholder or may be disposed of

by the Selling Shareholder in compliance with Rule 144.

For

purposes hereof, a “Change of Control” means an event or series of events (i) as a result of which any “person”

or “group” (as such terms are used in Sections 13(d) and 14(d) of the Exchange Act) becomes the “beneficial owner”

(as defined in Rules 13d-3 and 13d-5 under the Exchange Act, except that a person or group shall be deemed to have “beneficial

ownership” of all Common Stock that such person or group has the right to acquire, whether such right is exercisable immediately

or only after the passage of time (such right, an “option right”)), directly or indirectly, of 50% or more of the Common

Stock entitled to vote for members of the Company’s board of directors on a fully diluted basis (and taking into account all such

Common Stock that such person or group has the right to acquire pursuant to any option right); or (ii) that results in the sale of all

or substantially all of the assets or businesses of the Company and its consolidated subsidiaries, taken as a whole; provided, however

that such event or events shall not constitute a Change of Control if, following the occurrence thereof, shares of Common Stock continue

to be listed for trading on

any market or exchange of The Nasdaq Stock Market LLC, or any other market or exchange on which the shares

of Common Stock covered by this prospectus are listed for trading.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. Our filings with the SEC are available

to the public through the SEC's website at www.sec.gov. Our annual, quarterly and current reports and amendments to those reports, if

any, are also available via the internet at our website, www.transcat.com, by following the links to “Investor Relations”

and “SEC Filings.” The information on, or accessible through, our internet site, or any other internet site described herein,

is not a part of, and is not incorporated or deemed to be incorporated by reference in, this prospectus, and you should not consider

it to be a part of this prospectus. We will provide to each person, including any beneficial owner, to whom a prospectus is delivered

a copy of any or all of the information that has been incorporated by reference in the prospectus but not delivered with the prospectus.

In addition, you may request copies of our filings with the SEC, including the documents listed below under the heading “Incorporation

of Certain Information by Reference,” at no cost, by calling us at (585) 352-7777 or by writing to us at: Transcat, Inc., Attn:

Corporate Secretary, 35 Vantage Point Drive, Rochester, New York 14624.

We

have filed with the SEC a registration statement under the Securities Act relating to the offering of these securities. The registration

statement, including the attached exhibits, contains additional relevant information about us and the Common Stock. This prospectus does

not contain all of the information set forth in the registration statement. You may review a copy of the registration statement and the

documents incorporated by reference therein through the SEC’s internet web site referred to above.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

THIS

PROSPECTUS INCORPORATES DOCUMENTS BY REFERENCE THAT ARE NOT PRESENTED IN OR DELIVERED WITH THIS PROSPECTUS. YOU SHOULD RELY ONLY ON THE

INFORMATION CONTAINED IN THIS PROSPECTUS AND IN THE DOCUMENTS THAT WE HAVE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS. WE HAVE NOT

AUTHORIZED ANYONE TO PROVIDE YOU WITH INFORMATION THAT IS DIFFERENT FROM OR IN ADDITION TO THE INFORMATION CONTAINED IN THIS DOCUMENT

AND INCORPORATED BY REFERENCE INTO THIS PROSPECTUS.

The

SEC allows us to incorporate by reference into this prospectus certain information we file with it, which means that we can disclose

important information by referring you to those documents. The information incorporated by

reference is considered to be part of this prospectus. Because we are incorporating by reference future filings with the SEC, this prospectus

is continually updated and those future filings may modify or supersede some of the information included or incorporated in this prospectus.

We incorporate by reference all the documents listed below and all documents subsequently filed with the SEC under

Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on or after

(i) the date of the initial registration statement and prior to effectiveness of the registration statement, and (ii) the date of this

prospectus and prior to the completion or termination of the offering under this prospectus; provided, however, that we are not incorporating,

in each case, any documents or information deemed to have been furnished and not filed in accordance with SEC rules:

| · | Our

Annual Report on Form 10-K for the fiscal year ended March 30, 2024, filed with the SEC on

May 28, 2024, including the information specifically incorporated by reference into the Form

10-K from our definitive proxy statement for the 2024 Annual Meeting of Shareholders filed

on July 23, 2024. |

| · | Our

Quarterly Reports on Form 10-Q for the quarters ended June 29, 2024 and September 28, 2024,

filed with the SEC on August 7, 2024 and November 6, 2024, respectively. |

| · | Our

Current Reports on Form 8-K filed with the SEC on April 9, 2024 as amended on April 10, 2024,

April 15, 2024, May 20, 2024 (Film No. 24964648) as amended on May 22, 2024, May 20, 2024

(Film No. 24964793), September 13, 2024, December 10, 2024, and December 23, 2024. |

| · | The

description of our Common Stock, par value $0.50 per share, contained in Amendment Number

1 to our Registration Statement on Form S-3 (Registration No. 333-42345), filed with the

SEC on February 5, 1998, Exhibit 4.1 to our Annual Report on Form 10-K for the fiscal year

ended March 30, 2019, filed with the SEC on June 7, 2019, and any amendment or report filed

for the purpose of updating such description. |

Nothing

in this prospectus shall be deemed to incorporate information furnished, but not filed, with the SEC, including pursuant to Item 2.02

or Item 7.01 of Form 8-K and any corresponding information or exhibit furnished under Item 9.01 of Form 8-K.

Information

in this prospectus supersedes related information in the documents listed above and information in subsequently filed documents supersedes

related information in both this prospectus and the incorporated documents.

To

obtain copies of these filings, see “Where You Can Find More Information” in this prospectus.

LEGAL

MATTERS

The

validity of the securities offered hereby will be passed upon for us by Harter Secrest & Emery LLP.

EXPERTS

The

consolidated financial statements of Transcat, Inc. as of March 30, 2024 and March 25, 2023, and for each of the years in the three-year

period ended March 30, 2024, and the effectiveness of internal control over financial reporting as of March 30, 2024, have been audited

by Freed Maxick P.C. (f/k/a Freed Maxick CPAs, P.C.), an independent registered public accounting firm, as stated in their reports thereon,

which are incorporated by reference herein, and have been so incorporated in reliance upon such reports of and upon the authority of

said firm as experts in accounting and auditing.

Transcat,

Inc.

96,006

Shares of Common Stock Offered by the Selling Shareholder

Prospectus

January

22, 2025

No

dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus.

You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares of Common Stock

offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus

is current only as of its date.

Part II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance

and Distribution.

The

expenses (other than underwriting compensation) to be incurred by us in connection with the issuance and distribution of our securities

being registered hereby are:

| Securities

and Exchange Commission filing fee |

|

$ |

1,509 |

| Accounting

fees and expenses* |

|

|

2,500 |

| Legal

fees and expenses* |

|

|

35,000 |

| Miscellaneous* |

|

|

5,991 |

| Total

expenses |

|

$ |

45,000* |

Item 15. Indemnification of Directors

and Officers.

We

are incorporated under the Ohio General Corporation Law (the “OGCL”). Article VI of our Code of Regulations, as amended,

provides that we shall indemnify our directors and officers to the fullest extent authorized by the OGCL. With respect to indemnification

of directors and officers, Section 1701.13 of the OGCL provides that a corporation may indemnify or agree to indemnify any person who

was or is a party, or is threatened to be made a party, to any threatened, pending or completed action, suit, or proceeding, whether

civil, criminal, administrative or investigative, other than an action by or in the right of the corporation, by reason of the fact that

he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director,

trustee, officer, employee, member, manager or agent of another corporation, domestic or foreign, nonprofit or for profit, a limited

liability company, or a partnership, joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments,

fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action, suit, or proceeding, if

he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and,

with respect to any criminal action or proceeding, if he had no reasonable cause to believe his conduct was unlawful. Under this provision

of the OGCL, the termination of any action, suit or proceeding by judgment, order, settlement, or conviction, or upon a plea of nolo

contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner he

reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding,

he had reasonable cause to believe that his conduct is unlawful.

Furthermore,

the OGCL provides that a corporation may indemnify or agree to indemnify any person who was or is a party, or is threatened to be made

a party, to any threatened, pending, or completed action or suit by or in the right of the corporation to procure a judgment in its favor

by reason of the fact that he is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request

of the corporation as a director, trustee, officer, employee, member, manager, or agent of another corporation, domestic or foreign,

nonprofit or for profit, a limited liability company, or a partnership, joint venture, trust or other enterprise, against expenses, including

attorneys’ fees, actually and reasonably incurred by him in connection with the defense or settlement of such action or suit, if

he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, except

that no indemnification shall be made in respect of: (i) any claim, issue or matter as to which such person is adjudged to be liable

for negligence or misconduct in the performance of his duty to the corporation unless, and only to the extent that, the court of common

pleas or the court in which such action or suit was brought

determines,

upon application, that, despite the adjudication of liability, but in view of all the circumstances of the case, such person is fairly

and reasonably entitled to indemnify for such expenses as the court of common pleas or such other court shall deem proper; or (ii) any

action or suit in which the only liability asserted against a director is pursuant to OGCL Section 1701.95 (relating to unlawful loans,

dividends, and distributions of assets).

In

addition, Section 1701.13(E)(5)(a) requires a corporation to pay any expenses, including attorneys’ fees, of a director in defending

an action, suit, or proceeding referred to above as they are incurred, in advance of the final disposition of the action, suit, or proceeding,

upon receipt of an undertaking by or on behalf of the director in which he agrees to both (i) repay such amount if it is proved by clear

and convincing evidence that his action or failure to act involved an act or omission undertaken with deliberate intent to cause injury

to the corporation or undertaken with reckless disregard for the best interests of the corporation and (ii) reasonably cooperate with

the corporation concerning the action, suit, or proceeding. Section 1701.13(E)(7) and (F)(2) further authorizes a corporation to enter

into contracts regarding indemnification and to purchase and maintain insurance on behalf of any director, trustee, officer, employee

or agent for any liability asserted against him or arising out of his status as such. The Company presently maintains insurance policies

that provide coverage for our directors and officers in certain situations where we cannot directly indemnify such directors or officers.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us

pursuant to the foregoing provisions, we have been informed that in the opinion of the Securities and Exchange Commission, such indemnification

is against public policy as expressed in the Securities Act, and is therefore unenforceable.

Item 16. Exhibits.

EXHIBIT

INDEX

| Exhibit

No. |

|

Description |

| |

|

|

| 3.1(a) |

|

Articles of Incorporation, as amended, are incorporated herein by reference

from Exhibit 4(a) to the Company’s Registration Statement on Form S-8 (Registration No. 33-61665) filed on August 8, 1995. |

| |

|

|

| 3.1(b) |

|

Certificate of Amendment to the Articles is incorporated herein by

reference from Exhibit 3(i) to the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 1999. |

| |

|

|

| 3.1(c) |

|

Certificate of Amendment to the Articles is incorporated herein by

reference from Exhibit 3.1 to the Company’s Annual Report on Form 10-K for the year ended March 31, 2012. |

| |

|

|

| 3.1(d) |

|

Certificate of Amendment to the Articles is incorporated herein by

reference from Exhibit 3.1 to the Company’s Quarterly Report on Form 10-Q for the quarter ended September 26, 2015. |

| |

|

|

| 3.2 |

|

Code of Regulations, as amended through September 11, 2024, are incorporated

herein by reference from Exhibit 3.1 to the Company's Current Report on Form 8-K filed on September 13, 2024. |

| |

|

|

| 5.1* |

|

Opinion of Harter Secrest & Emery LLP. |

| |

|

|

| 10.1*^ |

|

Membership Unit Purchase Agreement, dated December 10, 2024, by and

among Transcat, Inc., Martin Holding Inc., and Richard L. Biron. |

| * |

Filed herewith. |

| ^ |

Schedules and similar attachments have been omitted pursuant to Item

601(a)(5) of Regulation S-K. The Company will furnish a copy of any omitted schedule or similar attachment to the Securities and

Exchange Commission upon request. |

Item 17.

Undertakings.

| (a) | The

undersigned registrant hereby undertakes: |

| (1) | To

file, during any period in which offers or sales are being made, a post-effective amendment

to this registration statement: |

| (i) | To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To

reflect in the prospectus any facts or events arising after the effective date of the registration

statement (or the most recent post-effective amendment thereof) which, individually or in

the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was

registered) and any deviation from the low or high end of the estimated maximum offering

range may be reflected in the form of prospectus filed with the Commission pursuant to Rule

424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent

change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement; and |

| (iii) | To

include any material information with respect to the plan of distribution not previously

disclosed in the registration statement or any material change to such information in the

registration statement. |

provided,

however, that paragraphs (a)(1)(i), (ii) and (iii) do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section

15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form

of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| (2) | That,

for the purpose of determining any liability under the Securities Act of 1933, each such

post-effective amendment shall be deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof. |

| (3) | To

remove from registration by means of a post-effective amendment any of the securities being

registered which remain unsold at the termination of the offering. |

| (4) | That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| (i) | Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part

of the registration statement as of the date the filed prospectus was deemed part of and

included in the registration statement; and |

| (ii) | Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of

a registration statement in reliance on Rule 430B relating to an offering made pursuant to

Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by

section 10(a) of the Securities Act shall be deemed to be part of and included in the registration

statement as of the earlier of the date such form of prospectus is first used after effectiveness

or the date of the first contract of sale of securities in the offering described in the

prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person

that is at that date an underwriter, such date shall be deemed to be a new effective date

of the registration statement relating to the securities in the registration statement to

which that prospectus relates, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof. Provided, however, that no statement

made in a registration statement or prospectus that is part of the registration statement

or made in a document incorporated or deemed incorporated by reference into the registration

statement or prospectus that is part of the registration statement will, as to a purchaser

with a time of contract of sale prior to such effective date, supersede or modify any statement

that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such effective date. |

| (b) | The

undersigned registrant hereby undertakes that, for purposes of determining any liability

under the Securities Act of 1933, each filing of the registrant’s annual report pursuant

to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable,

each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the

Securities Exchange Act of 1934) that is incorporated by reference in the registration statement

shall be deemed to be a new registration statement relating to the securities offered therein,

and the offering of such securities at that time shall be deemed to be the initial bona

fide offering thereof. |

| (c) | Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted

to directors, officers and controlling persons of the registrant pursuant to the foregoing

provisions, or otherwise, the registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the

Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the registrant of expenses incurred or

paid by a director, officer or controlling person of the registrant in the successful defense

of any action, suit or proceeding) is asserted by such director, officer or controlling person

in connection with the securities being registered, the registrant will, unless in the opinion

of its counsel the matter has been settled by controlling precedent, submit to a court of

appropriate jurisdiction the question whether such indemnification by it is against public

policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication

of such issue. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Rochester, State of New York, on this 22nd day of January 2025.

| |

|

TRANSCAT, INC. |

| |

|

|

| |

By: |

/s/ Lee D.

Rudow |

| |

|

Lee D. Rudow |

| |

|

President and Chief Executive Officer |

POWER OF

ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints each of Lee

D. Rudow and Thomas L. Barbato, each of them acting

individually, as his or her true and lawful attorney-in-fact and agent with full powers of substitution and resubstitution, to act for

him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments to this registration statement

(including post-effective amendments and registration statements filed pursuant to Rule 462 under the Securities Act of 1933, as

amended, and otherwise), and any other documents in connection therewith, and to file the same, with all exhibits thereto, with the Securities

and Exchange Commission, granting unto said attorneys-in-fact and agents the full power and authority to do and perform each and every

act and thing requisite and necessary to be done in connection therewith, as fully for all intents and purposes as he or she might or

could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or his or their substitute

or substitutes, may lawfully do or cause to be done by virtue hereof. Each of the undersigned has executed this power of attorney

as of the date indicated.

Pursuant

to the requirements of the Securities Act of 1933,

this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signatures |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Lee D. Rudow |

|

Director,

President and Chief Executive Officer |

|

January

22, 2025 |

| Lee

D. Rudow |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Thomas L. Barbato |

|

Senior

Vice President of Finance, Chief

Financial Officer and Treasurer

(Principal Financial Officer) |

|

January

22, 2025 |

| Thomas

L. Barbato |

| |

|

|

|

|

| /s/

Scott D. Deverell |

|

Controller

and Principal Accounting Officer |

|

January

22, 2025 |

| Scott

D. Deverell |

|

(Principal

Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

Gary J. Haseley |

|

Chairman

of the Board of Directors |

|

January

22, 2025 |

| Gary

J. Haseley |

|

|

|

|

| Signatures |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Craig D. Cairns |

|

Director |

|

January

22, 2025 |

| Craig

D. Cairns |

|

|

|

|

| |

|

|

|

|

| /s/

Dawn DePerrior |

|

Director |

|

January

22, 2025 |

| Dawn

DePerrior |

|

|

|

|

| |

|

| /s/

Oksana S. Dominach |

|

Director |

|

January

22, 2025 |

| Oksana

S. Dominach |

|

|

|

|

| |

|

| /s/

Christopher Gillette |

|

Director |

|

January

22, 2025 |

| Christopher

Gillette |

|

|

|

|

| |

|

| /s/

Charles P. Hadeed |

|

Director |

|

January

22, 2025 |

| Charles

P. Hadeed |

|

|

|

|

| |

|

/s/

Mbago M. Kaniki |

|

Director |

|

January

22, 2025 |

| Mbago

M. Kaniki |

|

|

|

|

| |

|

|

|

|

| /s/

Cynthia Langston |

|

Director |

|

January

22, 2025 |

| Cynthia

Langston |

|

|

|

|

| |

|

| /s/

Robert L. Mecca |

|

Director |

|

January

22, 2025 |

| Robert

L. Mecca |

|

|

|

|

Exhibit

5.1

January

22, 2025

Transcat,

Inc.

35

Vantage Point Drive

Rochester,

New York 14624 |

|

| Re: | Registration

Statement on Form S-3 |

Ladies

and Gentlemen:

We

have acted as counsel to Transcat, Inc., an Ohio corporation (the “Company”), in connection with its filing of a Registration

Statement on Form S-3, together with the exhibits thereto (the “Registration Statement”) to be filed on the date hereof,

with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Securities Act”), registering

the resale by the selling shareholder (the “Selling Shareholder”) of 96,006 shares of the Company’s common stock

(the “Shares”), par value $0.50 per share, issued by the Company to the Selling Shareholder on December 10, 2024,

pursuant to the Membership Unit Purchase Agreement dated December 10, 2024. This opinion is furnished to you at your request to enable

you to fulfill the requirements of Item 601(b)(5) of Regulation S-K in connection with the filing of the Registration Statement.

For

purposes of this opinion, we have with your permission made the following assumptions, in each case without independent verification:

(i) the due authorization, execution and delivery of all documents by the parties thereto other than the Company; (ii) the genuineness

of all signatures on all documents submitted to us; (iii) the authenticity and completeness of all documents, corporate records, certificates

and other instruments (the “Records”) submitted to us; (iv) that photocopy, electronic, certified, conformed, facsimile

and other copies submitted to us of the Records conform to the original Records; (v) the legal capacity of all individuals executing

documents; (vi) that all documents are the valid and binding obligations of each of the parties thereto other than the Company, enforceable

against such parties in accordance with their respective terms and that no such documents have been amended or terminated orally or in

writing; and (vii) that the statements contained in the certificates and comparable documents of public officials, officers and representatives

of the Company and other persons on which we have relied for the purposes of this opinion are true and correct. As to all questions of

fact material to this opinion, we have relied (without independent verification) upon certificates or comparable documents of officers

and representatives of the Company.

| 1600

BAUSCH & LOMB PLACE ROCHESTER, NY 14604-2711 PHONE: 585.232.6500 FAX: 585.232.2152 |

| rochester,

ny • buffalo, ny • albany, ny • corning, ny • new

york, ny |

Transcat,

Inc.

January

22, 2025

Page

2

Based

upon, and subject to and limited by the foregoing, we are of the opinion that the Shares are validly issued, fully paid and non-assessable.

We

express no opinion with respect to the effect of any law other than the applicable provisions of the Ohio Revised Code as currently in

effect.

This

opinion letter has been prepared in accordance with the customary practice of lawyers who regularly give, and lawyers who regularly advise

opinion recipients concerning, opinions of the type contained herein.

This

opinion letter deals only with the specified legal issues expressly addressed herein, and you should not infer any opinion that is not

explicitly addressed herein from any matter stated in this letter.

We

consent to the filing of this opinion as an exhibit to the Registration Statement and the reference to this firm under the caption “Legal

Matters” in the prospectus contained in the Registration Statement. In giving such consent, we do not hereby admit that we are

within the category of persons whose consent is required under Section 7 of the Securities Act and the rules and regulations thereunder.

This opinion is rendered to you as of the date hereof and we assume no obligation to advise you or any other person hereafter with regard

to any change after the date hereof in the circumstances or the law that may bear on the matters set forth herein even though the change

may affect the legal analysis or legal conclusion or other matters in this letter.

Very

truly yours,

/s/

Harter Secrest & Emery LLP

Exhibit

10.1

| |

MEMBERSHIP

UNIT PURCHASE AGREEMENT

among

TRANSCAT,

INC.,

MARTIN

HOLDING INC.

and

RICHARD

L. BRION

|

|

Dated

December 10, 2024

Table

of Contents

| Article I. THE TRANSACTION |

2 |

| 1.1 |

Purchase Transaction |

2 |

| 1.2 |

Purchase Price; Payment |

2 |

| 1.3 |

Closing

Statement; Adjustment |

3 |

| 1.4 |

Payment of Indebtedness and Company Transaction Expenses |

5 |

| 1.5 |

Escrow |

6 |

| 1.6 |

Transfer of Assets Prior to Closing |

6 |

| 1.7 |

Transaction Bonuses |

6 |

| Article II. CLOSING |

6 |

| 2.1 |

Closing Date |

6 |

| 2.2 |

Closing Deliveries |

7 |

| Article III. REPRESENTATIONS AND WARRANTIES OF SELLER PARTIES |

9 |

| 3.1 |

Authority; Execution and Delivery |

9 |

| 3.2 |

Organization |

9 |

| 3.3 |

No Conflict; Consents |

9 |

| 3.4 |

Capitalization; Title to Company Units |

10 |

| 3.5 |

Subsidiaries |

11 |

| 3.6 |

Financial Statements; Undisclosed Liabilities |

11 |

| 3.7 |

Absence of Certain Changes or Events |

11 |

| 3.8 |

Title, Condition and Sufficiency of Assets |

12 |

| 3.9 |

Real Property |

13 |

| 3.10 |

Accounts Receivable |

14 |

| 3.11 |

Intellectual Property |

14 |

| 3.12 |

Material Contracts |

15 |

| 3.13 |

Litigation |

16 |

| 3.14 |

Compliance with Laws; Permits |

17 |

| 3.15 |

Environmental Matters |

17 |

| 3.16 |

Taxes |

17 |

| 3.17 |

Employee

Relations |

20 |

| 3.18 |

Employee Benefit Matters |

21 |

| 3.19 |

Transactions with Related Parties |

23 |

| 3.20 |

Insurance |

24 |

| 3.21 |

Relationship with Significant Customers |

24 |

| 3.22 |

Relationship with Significant Suppliers |

25 |

| 3.23 |

Anti-Corruption Laws |

25 |

| 3.24 |

Privacy Laws |

25 |

| 3.25 |

Product and Service Warranties |

26 |

| 3.26 |

Banking Relationships |

26 |

| 3.27 |

Inventory |

26 |

| 3.28 |

Books and Records |

26 |

| 3.29 |

Purchase for Investment |

26 |

| 3.30 |

Legend |

27 |

| 3.31 |

Registration Rights |

27 |

| 3.32 |

Sophisticated Investor |

27 |

| 3.33 |

Existing Ownership |

27 |

| 3.34 |

No General Solicitation |

27 |

| 3.35 |

Reliance on Exemptions |

27 |

| 3.36 |

Brokers |

28 |

| 3.37 |

No Other Representations and Warranties |

28 |

| Article IV. REPRESENTATIONS AND WARRANTIES OF BUYER |

28 |

| 4.1 |

Organization |

28 |

| 4.2 |

Authority |

28 |

| 4.3 |