UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission File Number: 001-39738

UCOMMUNE INTERNATIONAL

LTD

(Exact name of registrant as specified in its charter)

Floor B1, Tower D

No. 2 Guang Hua Road

Chaoyang District, Beijing

People’s Republic

of China, 100026

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

EXPLANATORY NOTE

This

current report on Form 6-K (this “Form 6-K”) and the exhibit to this Form 6-K are incorporated by reference into the registration

statement on Form F-3 of Ucommune International Ltd (File No. 333-257664) and the registration statement on Form F-3 of Ucommune

International Ltd (File No. 333-266899), and shall be a part thereof from the date on which this current report is furnished, to the

extent not superseded by documents or reports subsequently filed or furnished.

Amendment to Warrants

On January 26, 2022, Ucommune International Ltd

(the “Company” or “we”) entered into a securities purchase agreement (the “Securities Purchase Agreement”)

with JAK Opportunities LLC (the “Purchaser”) for a US$3,000,000 principal amount 8% senior debenture convertible into Class

A ordinary shares (the “Debenture”) and three series of warrants to purchase Class A ordinary shares (the “Warrants”).

On March 1, 2022, the Company and the Purchaser

entered into amendment agreements (the “Initial Amendment Agreements”) to the Securities Purchase Agreement, Debenture and

Warrants to set a floor price of US$0.30 per Class A ordinary share, par value of US$0.0001 each (the “Floor Price”) for the

conversion price of the Debenture and exercise price of the Warrants.

On April 22, 2022, the Company effected a share

consolidation of 20 ordinary shares with par value of US$0.0001 each in the Company’s issued and unissued share capital into one

ordinary share with par value of US$0.002 each of the Company (the “2022 Share Consolidation”). Under the Initial Amendment

Agreements, the Floor Price shall be proportionately decreased upon a stock split or share subdivision of Class A ordinary shares, and

proportionately increased in the case of a reverse stock split or share combination of Class A ordinary shares. Following the 2022 Share

Consolidation, the Floor Price became US$6.00 per Class A ordinary share, par value of US$0.002 per share.

On August 29, 2022, the Company and the Purchaser

entered into additional amendment agreements (the “Second Amendment Agreements”) to the Securities Purchase Agreement, Debenture

and Warrants to amend the conversion price of the Debenture, the exercise price of the Warrants and the Floor Price to US$4.50 per Class

A ordinary share, par value of US$0.002 per share. The Second Amendment Agreements shall become effective on September 6, 2022, unless

Nasdaq objects to any of amendments therein prior to such date.

On October 25, 2022, the Company and the Purchaser

entered into additional amendment agreements (the “Third Amendment Agreements”) to the Securities Purchase Agreement, Debenture

and Warrants to amend the conversion price of the Debenture, the exercise price of the Warrants and the Floor Price to US$2.30 per Class

A ordinary share, par value of US$0.002 per share. The Third Amendment Agreements shall become effective on November 4, 2022, unless Nasdaq

objects to any of amendments therein prior to such date.

On January 24, 2023, the Company and the Purchaser

entered into additional amendment agreements (the “Fourth Amendment Agreements”) to the Securities Purchase Agreement, Debenture

and Warrants to amend the conversion price of the Debenture, the exercise price of the Warrants and the Floor Price to US$1.30 per Class

A ordinary share, par value of US$0.002 per share. In addition, the Maturity Date under and as defined in the Debenture shall be amended

and restated from January 25, 2023 to July 25, 2023, and the Termination Date for purposes of the Series B Warrant shall be amended and

restated to September 30, 2023. The Fourth Amendment Agreements shall become effective on February 7, 2023 unless Nasdaq objects to any

of amendments therein prior to such date, except that the amended Maturity Date of the Debenture shall become effective upon execution.

On June 7, 2023, the Company and the Purchaser

entered into additional amendment agreements (the “Fifth Amendment Agreements”) to the Securities Purchase Agreement, Debenture

and Warrants to amend the conversion price of the Debenture and the floor for conversion price of the Debenture to US$0.70 per Class A

ordinary share, par value of US$0.002 per share, while the exercise price of the Warrants and the floor for exercise price of the Warrants

shall remain at US$1.30 per Class A ordinary share, par value of US$0.002 per share. In addition, the Termination Date for purposes of

the Series B Warrant shall be amended and restated to December 31, 2023. The Fifth Amendment Agreements have become effective upon execution.

On August 1, 2023, the Company fully repaid the

remaining principal amount plus interests accrued and unpaid under the Debenture.

On November 29, 2023, the Company effected a share

consolidation of 12 ordinary shares with par value of US$0.002 each in the Company’s issued and unissued share capital into one

ordinary share with par value of US$0.024 each of the Company (the “2023 Share Consolidation”). Following the 2023 Share Consolidation,

the Floor Price per Class A ordinary share, par value of US$0.024 each (each an “Ordinary Share”) has been automatically adjusted

to US$15.6, and effective on December 21, 2023, the exercise price of the Warrants has been automatically adjusted to US$3.37 per Ordinary

Share pursuant to the mechanism provided under Section 3(a)(ii) of the Warrants.

On January 30, 2024, the Company and the Purchaser

entered into an additional amendment agreement (the “Sixth Amendment Agreement,” and together with the Initial Amendment Agreements,

the Second Amendment Agreements, the Third Amendment Agreements, the Fourth Amendment Agreements and the Fifth Amendment Agreements, the

“Amendment Agreements”) to the Warrants to amend and restate the Termination Date for purposes of the Series B Warrant to

December 31, 2024 for the Ordinary Shares issuable upon exercise of the Series B Warrant that are registered under the registration statement

on Form F-3 of Ucommune International Ltd (File No. 333-257664) (the “F-3 Registration Statement”), and to 12 months following

the effectiveness of a registration statement to be filed under the Securities Act registering the remaining unregistered Ordinary Shares

issuable upon exercise of the Series B Warrant for such remaining Ordinary Shares. With respect to the Ordinary Shares issuable upon exercise

of each of the Warrants that are registered under the F-3 Registration Statement, the Floor Price shall be amended and restated to US$3.37

per Ordinary Share. The Sixth Amendment Agreement has become effective upon execution.

The foregoing summary of the Amendment Agreements

does not purport to be complete and is qualified in its entirety by reference to the full text of the relevant documents. Copies of the

Sixth Amendment Agreement are attached hereto as Exhibit 4.1, which is incorporated herein by reference.

Safe Harbor Statements

This Form 6-K contains forward-looking statements

within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made under

the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements can be identified

by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,”

“plans,” “believes,” “estimates,” “potential,” “continue,” “ongoing,”

“targets,” “guidance” and similar statements. The Company may also make written or oral forward-looking statements

in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders,

in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Any

statements that are not historical facts, including statements about the Company’s beliefs and expectations, are forward-looking

statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ

materially from those contained in any forward-looking statement, including but not limited to the following: the Company’s growth

strategies; its future business development, results of operations and financial condition; its ability to understand members’ needs

and provide products and services to attract and retain members; its ability to maintain and enhance the recognition and reputation of

its brand; its ability to maintain and improve quality control policies and measures; its ability to establish and maintain relationships

with members and business partners; trends and competition in China’s agile office space market; changes in its revenues and certain

cost or expense items; the expected growth of China’s agile office space market; PRC governmental policies and regulations relating

to the Company’s business and industry, and general economic and business conditions in China and globally and assumptions underlying

or related to any of the foregoing. Further information regarding these and other risks, uncertainties or factors is included in the Company’s

filings with the SEC. All information provided in this Form 6-K and in the attachments is as of the date of this Form 6-K, and the Company

undertakes no obligation to update any forward-looking statement, except as required under applicable law.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| UCOMMUNE INTERNATIONAL LTD |

|

| |

|

| By: |

/s/ Zirui Wang |

|

| Name: |

Zirui Wang |

|

| Title: |

Chief Executive Officer and

Chief Risk Officer |

|

Date: January 31, 2024

[Signature Page to Form 6-K]

5

Exhibit 4.1

UCOMMUNE INTERNATIONAL LTD

Floor B1, Tower D

No.2 Guang Hua Road

Chaoyang District, Beijing

People’s Republic of China, 100026

January 30, 2024

JAK Opportunities LLC

17 State Street, 2100

New York, New York 10004

Dear Sirs and Madams:

Reference is made to the Series

A Warrant, Series B Warrant and Series C Warrant, each dated January 26, 2022 and amended on March 1, 2022, August 29, 2022, October 25,

2022, January 24, 2023 and June 7, 2023 (collectively, the “Warrants”), between Ucommune International Ltd and

JAK Opportunities LLC (the “Holder”), as the holder named therein. Capitalized terms not otherwise defined herein

shall have the meanings ascribed to such terms in the Warrants.

Upon execution of this letter

agreement:

| 1. | For purposes of the Series B Warrant, the “Termination Date” shall be amended and restated

to (i) December 31, 2024 for the 260,417 Class A ordinary shares with par value of $0.024 each (each an “Ordinary Share”)

issuable upon exercise of the Series B Warrant that are registered under the registration statement on Form F-3 of Ucommune International

Ltd (File No. 333-257664) (the “F-3 Registration Statement”), and to (ii) 12 months following the effectiveness

of a registration statement to be filed under the Securities Act registering the remaining unregistered Ordinary Shares issuable upon

exercise of the Series B Warrant for such remaining Ordinary Shares; and, for avoidance of doubt, Footnote 2 of each Warrant shall be

amended to change the “Termination Date” for Series B Warrant accordingly. |

| 2. | Section 5(o) of each of the Warrants shall be amended and restated as follows: |

“o) Floor

for Exercise Price of the Warrant. Notwithstanding anything to the contrary in the Transaction Documents, the Exercise Price of the Warrant

for the (i) 52,084 Ordinary Shares issuable upon exercise of the Series A Warrant, (ii) 260,417 Ordinary Shares issuable upon exercise

of the Series B Warrant and (iii) 260,417 Ordinary Shares issuable upon exercise of the Series C Warrant that are registered under the

F-3 Registration Statement shall in no event be lower than $3.37 (the “Floor Price”). The Floor Price shall be proportionately

decreased upon a stock split or share subdivision of Ordinary Shares, and shall be proportionately increased in the case of a reverse

stock split or share combination of Ordinary Shares. The Company agrees that while the Warrant remains outstanding, it will not issue

Ordinary Shares or Ordinary Share Equivalents at a price per share or with a conversion or exercise price per share, as applicable, that

is below $15.6 without the prior written consent of the Holder.”

For the avoidance of doubt,

following the share consolidation on November 29, 2023, in which every 12 ordinary shares with par value of $0.002 were consolidated into

one ordinary share with par value of $0.024 (the “Share Consolidation”), the Exercise Price per Ordinary Share

in Section 2(b) of each of the Warrants shall be automatically adjusted to $3.37 pursuant to Section 3(a)(ii) therein, and the Floor Price

for the Ordinary Shares issuable upon exercise of each of the Warrants that are not registered under the F-3 Registration Statement shall

be automatically adjusted to $15.6 pursuant to Section 5(o) therein; and the amended Floor Price in Section 5(o) above for the registered

Ordinary Shares have already been adjusted to reflect the Share Consolidation.

Each of the Warrants and this

letter agreement shall be read together and shall have the same effect as if each such Warrant and this letter agreement were contained

in one document. Except as expressly modified by this letter agreement, the terms and obligations of the Warrants and the Transaction

Documents remain unchanged and the Warrants and Transaction Documents shall continue in full force and effect.

This letter agreement shall

be governed by, construed and enforced in accordance with, the laws of the State of New York, without regard to the conflict of laws principles

thereof.

If you are in agreement with

the foregoing, please have this letter agreement executed by your authorized representative and return a copy to the undersigned.

| |

Very Truly Yours, |

| |

|

| |

UCOMMUNE INTERNATIONAL LTD |

| |

|

| |

By: |

/s/ Zirui Wang |

| |

Name: |

Zirui Wang |

| |

Title: |

Chief Executive Officer and

Chief Risk Officer |

| Confirmed and Agreed to: |

|

| |

|

| JAK Opportunities LLC |

|

| |

|

| By: |

/s/ Antonio Ruiz-Gimenez |

|

| Name: |

Antonio Ruiz-Gimenez |

|

| Title: |

Managing Member |

|

[Signature Page to Warrant Amendment]

3

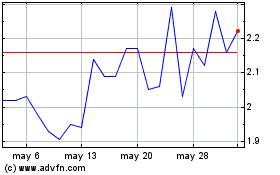

Ucommune (NASDAQ:UK)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Ucommune (NASDAQ:UK)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025