Form 8-K - Current report

29 Agosto 2024 - 3:06PM

Edgar (US Regulatory)

0001403568false00014035682024-08-292024-08-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 29, 2024

ULTA BEAUTY, INC.

(Exact name of registrant as specified in its charter)

| | |

Delaware | 001-33764 | 38-4022268 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | |

| 1000 Remington Blvd., Suite 120, Bolingbrook, Illinois 60440 | |

| (Address of Principal Executive Offices and zip code) | |

(630) 410-4800

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 C.F.R. §230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 C.F.R. §240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 C.F.R. §240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 C.F.R. §240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | | ULTA | | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 29, 2024, Ulta Beauty, Inc. issued a press release regarding its consolidated financial results for the second quarter ended August 3, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The exhibits listed in the Exhibit Index below are being furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| ULTA BEAUTY, INC. |

| | |

Date: August 29, 2024 | By: | /s/ Jodi J. Caro |

| | Jodi J. Caro |

| | General Counsel, Chief Risk & Compliance Officer |

Exhibit 99.1

ULTA BEAUTY ANNOUNCES SECOND QUARTER FISCAL 2024 RESULTS

Net Sales of $2.6 Billion Compared to $2.5 Billion in the Year-Ago Quarter

Comparable Sales Decreased 1.2%

Net Income of $252.6 Million or $5.30 Per Diluted Share

Bolingbrook, IL – August 29, 2024 – Ulta Beauty, Inc. (NASDAQ: ULTA) today announced financial results for the thirteen-week period (“second quarter”) and twenty-six-week period (“first six months”) ended August 3, 2024 compared to the same periods ended July 29, 2023.

| | | | | | | | | | | | | |

| | 13 Weeks Ended | | | 26 Weeks Ended |

| | August 3, | | July 29, | | | August 3, | | July 29, |

(Dollars in millions, except per share data) | | 2024 | | 2023 | | | 2024 | | 2023 |

Net sales | | $ | 2,552.1 | | $ | 2,529.8 | | | $ | 5,277.9 | | $ | 5,164.1 |

Comparable sales (1) | | | (1.2%) | | | 8.0% | | | | 0.2% | | | 8.7% |

Gross profit (as a percentage of net sales) | | | 38.3% | | | 39.3% | | | | 38.8% | | | 39.7% |

Selling, general and administrative expenses | | $ | 644.8 | | $ | 600.7 | | | $ | 1,310.7 | | $ | 1,212.8 |

Operating income (as a percentage of net sales) | | | 12.9% | | | 15.5% | | | | 13.8% | | | 16.1% |

Diluted earnings per share | | $ | 5.30 | | $ | 6.02 | | | $ | 11.78 | | $ | 12.90 |

New store openings, net | | | 16 | | | 3 | | | | 26 | | | 7 |

| (1) | Comparable sales are calculated based on the comparable 13 and 26 calendar weeks in the current and prior year. |

“While we are encouraged by many positive indicators across our business, our second quarter performance did not meet our expectations, driven primarily by a decline in comparable store sales. We are clear about the factors that adversely impacted our store performance, and we have actions underway to address the trends,” said Dave Kimbell, chief executive officer. “We are focused on driving stronger sales and traffic and continuing to exercise financial discipline. In light of our first half trends and a more cautious outlook, we have updated our full year expectations. I remain confident in the power of our differentiated model, the strength of our financial foundation, and our ability to deliver value for our shareholders over the long term.”

Second Quarter of Fiscal 2024 Compared to Second Quarter of Fiscal 2023

| ● | Net sales increased 0.9% to $2.6 billion compared to $2.5 billion, primarily due to new store contribution and growth in other revenue. |

| ● | Comparable sales (sales for stores open at least 14 months and e-commerce sales) decreased 1.2% compared to an increase of 8.0%, driven by a 1.8% decrease in transactions and a 0.6% increase in average ticket. |

| ● | Gross profit was $978.2 million compared to $993.6 million. As a percentage of net sales, gross profit decreased to 38.3% compared to 39.3%, primarily due to lower merchandise |

| | margins and deleverage of store fixed costs, partially offset by growth in other revenue and lower inventory shrink. |

| ● | Selling, general and administrative (SG&A) expenses were $644.8 million compared to $600.7 million. As a percentage of net sales, SG&A expenses increased to 25.3% compared to 23.7%, primarily due to deleverage of store payroll and benefits, corporate overhead primarily due to strategic investments, store expenses, and marketing expenses, partially offset by lower incentive compensation. |

| ● | Operating income was $329.2 million, or 12.9% of net sales, compared to $391.6 million, or 15.5% of net sales. |

| ● | The tax rate was 24.3% compared to 24.2%. |

| ● | Net income was $252.6 million compared to $300.1 million. |

| ● | Diluted earnings per share was $5.30 compared to $6.02. |

First Six Months of Fiscal 2024 Compared to First Six Months of Fiscal 2023

| ● | Net sales increased 2.2% to $5.3 billion compared to $5.2 billion, primarily due to new store contribution and growth in other revenue. |

| ● | Comparable sales increased 0.2% compared to an increase of 8.7%, driven by a 0.4% increase in average ticket and a 0.2% decrease in transactions. |

| ● | Gross profit was flat at $2.0 billion. As a percentage of net sales, gross profit decreased to 38.8% compared to 39.7%, primarily due to lower merchandise margin and deleverage of store fixed costs, partially offset by growth in other revenue. |

| ● | SG&A expenses were $1.3 billion compared to $1.2 billion. As a percentage of net sales, SG&A expenses increased to 24.8% compared to 23.5%, primarily due to deleverage of corporate overhead primarily due to strategic investments, store payroll and benefits, store expenses, and marketing expenses, partially offset by lower incentive compensation. |

| ● | Operating income was $730.1 million, or 13.8% of net sales, compared to $833.7 million, or 16.1% of net sales. |

| ● | The tax rate was 23.7% compared to 23.5%. |

| ● | Net income was $565.7 million compared to $647.2 million. |

| ● | Diluted earnings per share was $11.78, including a $0.10 benefit due to income tax accounting for stock-based compensation, compared to $12.90, including a $0.14 benefit due to income tax accounting for stock-based compensation. |

Balance Sheet

Cash and cash equivalents at the end of the second quarter of fiscal 2024 totaled $414.0 million.

Merchandise inventories, net at the end of the second quarter of fiscal 2024 increased 10.1% to $2.0 billion compared to $1.8 billion at the end of the second quarter of fiscal 2023. The increase was primarily due to inventory to support new brand launches, the opening of the new market fulfillment center in Greer, SC, and the addition of 49 net new stores since July 29, 2023.

Share Repurchase Program

During the second quarter of fiscal 2024, the Company repurchased 549,852 shares of its common stock at a cost of $212.3 million. During the first six months of fiscal 2024, the Company repurchased 1.1 million shares of its common stock at a cost of $497.5 million. As of August 3, 2024, $1.6 billion remained available under the $2.0 billion share repurchase program announced in March 2024.

Store Update

During the second quarter of fiscal 2024, the Company opened 17 new stores, relocated one store, remodeled nine stores, and closed one store. During the first six months of fiscal 2024, the Company opened 29 new stores, relocated two stores, remodeled nine stores, and closed three stores. At the end of the second quarter of fiscal 2024, the Company operated 1,411 stores totaling 14.8 million square feet.

Fiscal 2024 Outlook

For fiscal 2024, the Company plans to:

| | | | | |

| | | Prior FY24 Outlook | | Updated FY24 Outlook |

Net sales | | | $11.5 billion to $11.6 billion | | $11.0 billion to $11.2 billion |

Comparable sales | | | 2% to 3% | | (2%) to 0% |

New stores, net | | | 60-65 | | no change |

Remodel and relocation projects | | | 40-45 | | no change |

Operating margin | | | 13.7% to 14.0% | | 12.7% to 13.0% |

Diluted earnings per share | | | $25.20 to $26.00 | | $22.60 to $23.50 |

Share repurchases | | | approximately $1 billion | | no change |

Interest income | | | approximately $13 million | | no change |

Effective tax rate | | | approximately 24% | | no change |

Capital expenditures | | | $415 million to $490 million | | $400 million to $450 million |

Depreciation and amortization expense | | | $270 million to $275 million | | $265 million to $270 million |

Conference Call Information

A conference call to discuss second quarter of fiscal 2024 results is scheduled for today, August 29, 2024 at 4:30 p.m. ET / 3:30 p.m. CT. Investors and analysts who are interested in participating in the call are invited to dial (877) 704-4453. Participants may also listen to a real-time audio webcast of the conference call by visiting the Investor Relations section of the Company’s website located at https://www.ulta.com/investor. A replay will be made available online approximately two hours following the live call for a period of 30 days.

About Ulta Beauty

At Ulta Beauty (NASDAQ: ULTA), the possibilities are beautiful. Ulta Beauty is the largest specialty U.S. beauty retailer and the premier beauty destination for cosmetics, fragrance, skin care products, hair care products and salon services. In 1990, the Company reinvented the beauty retail experience by offering a new way to shop for beauty – bringing together All Things Beauty, All in One Place®. Today, Ulta Beauty operates 1,411 retail stores across 50 states and also distributes its products through its website, which includes a collection of tips, tutorials, and social content. For more information, visit www.ulta.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, which reflect the Company’s current views with respect to, among other things, future events and financial performance. These statements can be identified by the use of forward-looking words such as “outlook,” “believes,” “expects,” “plans,” “estimates,” “targets,” “strategies” or other comparable words. Any forward-looking statements contained in this press release are based upon the Company’s historical performance and on current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by the Company or any other person that the future plans, estimates, targets, strategies or expectations contemplated by the Company will be achieved. Such forward-looking statements are subject to various risks and uncertainties, which include, without limitation:

| ● | macroeconomic conditions, including inflation, elevated interest rates and recessionary concerns, as well as continuing labor cost pressures, and transportation and shipping cost pressures, have had, and may continue to have, a negative impact on our business, financial condition, profitability, and cash flows (including future uncertain impacts); |

| ● | changes in the overall level of consumer spending and volatility in the economy, including as a result of macroeconomic conditions and geopolitical events; |

| ● | our ability to sustain our growth plans and successfully implement our long-range strategic and financial plan; |

| ● | the ability to execute our operational excellence priorities, including continuous improvement, Project SOAR (the replacement of our enterprise resource planning platform), and supply chain optimization; |

| ● | our ability to gauge beauty trends and react to changing consumer preferences in a timely manner; |

| ● | the possibility that we may be unable to compete effectively in our highly competitive markets; |

| ● | the possibility of significant interruptions in the operations of our distribution centers, fast fulfillment centers, and market fulfillment centers; |

| ● | the possibility that cybersecurity or information security breaches and other disruptions could compromise our information or result in the unauthorized disclosure of confidential information; |

| ● | the possibility of material disruptions to our information systems, including our Ulta.com website and mobile applications; |

| ● | the failure to maintain satisfactory compliance with applicable privacy and data protection laws and regulations; |

| ● | changes in the good relationships we have with our brand partners, our ability to continue to obtain sufficient merchandise from our brand partners, and/or our ability to continue to offer permanent or temporary exclusive products of our brand partners; |

| ● | our ability to effectively manage our inventory and protect against inventory shrink; |

| ● | changes in the wholesale cost of our products and/or interruptions at our brand partners’ or third-party vendors’ operations; |

| ● | epidemics, pandemics or natural disasters, which could negatively impact sales; |

| ● | the possibility that new store openings and existing locations may be impacted by developer or co-tenant issues; |

| ● | our ability to attract and retain key executive personnel; |

| ● | the impact of climate change on our business operations and/or supply chain; |

| ● | our ability to successfully execute our common stock repurchase program or implement future common stock repurchase programs; |

| ● | a decline in operating results which could lead to asset impairment and store closure charges; and |

| ● | other risk factors detailed in the Company’s public filings with the Securities and Exchange Commission (the SEC), including risk factors contained in its Annual Report on Form 10-K for the fiscal year ended February 3, 2024, as such may be amended or supplemented in its subsequently filed Quarterly Reports on Form 10-Q. |

The Company’s filings with the SEC are available at www.sec.gov. Except to the extent required by the federal securities laws, the Company does not undertake to publicly update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

Investor Contact:

Kiley Rawlins, CFA

Vice President, Investor Relations

krawlins@ulta.com

Media Contact:

Crystal Carroll

Senior Director, Public Relations

ccarroll@ulta.com

Exhibit 1

Ulta Beauty, Inc.

Consolidated Statements of Income

(In thousands, except per share data)

| | | | | | | | | | |

| | 13 Weeks Ended |

| | August 3, | | July 29, |

| | 2024 | | 2023 |

| | (Unaudited) | | (Unaudited) |

Net sales | | $ | 2,552,087 | | 100.0% | | $ | 2,529,809 | | 100.0% |

Cost of sales | | | 1,573,910 | | 61.7% | | | 1,536,197 | | 60.7% |

Gross profit | | | 978,177 | | 38.3% | | | 993,612 | | 39.3% |

| | | | | | | | | | |

Selling, general and administrative expenses | | | 644,821 | | 25.3% | | | 600,692 | | 23.7% |

Pre-opening expenses | | | 4,155 | | 0.2% | | | 1,278 | | 0.1% |

Operating income | | | 329,201 | | 12.9% | | | 391,642 | | 15.5% |

Interest income, net | | | (4,526) | | (0.2%) | | | (4,449) | | (0.2%) |

Income before income taxes | | | 333,727 | | 13.1% | | | 396,091 | | 15.7% |

Income tax expense | | | 81,171 | | 3.2% | | | 95,989 | | 3.8% |

Net income | | $ | 252,556 | | 9.9% | | $ | 300,102 | | 11.9% |

| | | | | | | | | | |

Net income per common share: | | | | | | | | | | |

Basic | | $ | 5.32 | | | | $ | 6.05 | | |

Diluted | | $ | 5.30 | | | | $ | 6.02 | | |

| | | | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | | | |

Basic | | | 47,505 | | | | | 49,617 | | |

Diluted | | | 47,667 | | | | | 49,849 | | |

Exhibit 2

Ulta Beauty, Inc.

Consolidated Statements of Income

(In thousands, except per share data)

| | | | | | | | | | |

| | 26 Weeks Ended |

| | August 3, | | July 29, |

| | 2024 | | 2023 |

| | (Unaudited) | | (Unaudited) |

Net sales | | $ | 5,277,935 | | 100.0% | | $ | 5,164,072 | | 100.0% |

Cost of sales | | | 3,229,978 | | 61.2% | | | 3,115,603 | | 60.3% |

Gross profit | | | 2,047,957 | | 38.8% | | | 2,048,469 | | 39.7% |

| | | | | | | | | | |

Selling, general and administrative expenses | | | 1,310,734 | | 24.8% | | | 1,212,821 | | 23.5% |

Pre-opening expenses | | | 7,074 | | 0.1% | | | 1,936 | | 0.0% |

Operating income | | | 730,149 | | 13.8% | | | 833,712 | | 16.1% |

Interest income, net | | | (11,426) | | (0.2%) | | | (11,797) | | (0.2%) |

Income before income taxes | | | 741,575 | | 14.1% | | | 845,509 | | 16.4% |

Income tax expense | | | 175,906 | | 3.3% | | | 198,356 | | 3.8% |

Net income | | $ | 565,669 | | 10.7% | | $ | 647,153 | | 12.5% |

| | | | | | | | | | |

Net income per common share: | | | | | | | | | | |

Basic | | $ | 11.83 | | | | $ | 12.97 | | |

Diluted | | $ | 11.78 | | | | $ | 12.90 | | |

| | | | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | | | |

Basic | | | 47,815 | | | | | 49,885 | | |

Diluted | | | 48,022 | | | | | 50,157 | | |

Exhibit 3

Ulta Beauty, Inc.

Condensed Consolidated Balance Sheets

(In thousands)

| | | | | | | | | |

| | August 3, | | February 3, | | July 29, |

| | 2024 | | 2024 | | 2023 |

| | (Unaudited) | | | | | (Unaudited) |

Assets | | | | | | | | | |

Current assets: | | | | | | | | | |

Cash and cash equivalents | | $ | 413,962 | | $ | 766,594 | | $ | 388,627 |

Receivables, net | | | 200,863 | | | 207,939 | | | 174,444 |

Merchandise inventories, net | | | 1,998,286 | | | 1,742,136 | | | 1,815,539 |

Prepaid expenses and other current assets | | | 132,023 | | | 115,598 | | | 110,524 |

Prepaid income taxes | | | 53,607 | | | 4,251 | | | 30,114 |

Total current assets | | | 2,798,741 | | | 2,836,518 | | | 2,519,248 |

| | | | | | | | | |

Property and equipment, net | | | 1,225,850 | | | 1,182,335 | | | 1,073,144 |

Operating lease assets | | | 1,599,735 | | | 1,574,530 | | | 1,549,146 |

Goodwill | | | 10,870 | | | 10,870 | | | 10,870 |

Other intangible assets, net | | | 357 | | | 510 | | | 718 |

Deferred compensation plan assets | | | 46,280 | | | 43,516 | | | 40,087 |

Other long-term assets | | | 55,575 | | | 58,732 | | | 55,547 |

Total assets | | $ | 5,737,408 | | $ | 5,707,011 | | $ | 5,248,760 |

| | | | | | | | | |

Liabilities and stockholders’ equity | | | | | | | | | |

Current liabilities: | | | | | | | | | |

Accounts payable | | $ | 566,904 | | $ | 544,001 | | $ | 521,315 |

Accrued liabilities | | | 348,042 | | | 382,468 | | | 328,247 |

Deferred revenue | | | 394,987 | | | 436,591 | | | 354,253 |

Current operating lease liabilities | | | 281,301 | | | 283,821 | | | 287,359 |

Accrued income taxes | | | — | | | 11,310 | | | — |

Total current liabilities | | | 1,591,234 | | | 1,658,191 | | | 1,491,174 |

| | | | | | | | | |

Non-current operating lease liabilities | | | 1,647,698 | | | 1,627,271 | | | 1,593,040 |

Deferred income taxes | | | 88,461 | | | 85,921 | | | 56,012 |

Other long-term liabilities | | | 61,855 | | | 56,300 | | | 56,657 |

Total liabilities | | | 3,389,248 | | | 3,427,683 | | | 3,196,883 |

| | | | | | | | | |

Commitments and contingencies | | | | | | | | | |

| | | | | | | | | |

Total stockholders’ equity | | | 2,348,160 | | | 2,279,328 | | | 2,051,877 |

Total liabilities and stockholders’ equity | | $ | 5,737,408 | | $ | 5,707,011 | | $ | 5,248,760 |

Exhibit 4

Ulta Beauty, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

| | | | | | |

| | 26 Weeks Ended |

| | August 3, | | July 29, |

| | 2024 | | 2023 |

| | (Unaudited) | | (Unaudited) |

Operating activities | | | | | | |

Net income | | $ | 565,669 | | $ | 647,153 |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | |

Depreciation and amortization | | | 130,053 | | | 119,862 |

Non-cash lease expense | | | 163,481 | | | 152,867 |

Deferred income taxes | | | 2,540 | | | 666 |

Stock-based compensation expense | | | 19,272 | | | 21,539 |

Loss on disposal of property and equipment | | | 5,204 | | | 3,878 |

Change in operating assets and liabilities: | | | | | | |

Receivables | | | 7,076 | | | 24,978 |

Merchandise inventories | | | (256,150) | | | (212,088) |

Prepaid expenses and other current assets | | | (16,425) | | | 19,722 |

Income taxes | | | (60,666) | | | 8,194 |

Accounts payable | | | 29,715 | | | (38,752) |

Accrued liabilities | | | (33,634) | | | (102,763) |

Deferred revenue | | | (41,604) | | | (40,424) |

Operating lease liabilities | | | (170,779) | | | (163,527) |

Other assets and liabilities | | | 15,127 | | | (12,497) |

Net cash provided by operating activities | | | 358,879 | | | 428,808 |

| | | | | | |

Investing activities | | | | | | |

Capital expenditures | | | (186,301) | | | (204,748) |

Other investments | | | (5,091) | | | (1,687) |

Net cash used in investing activities | | | (191,392) | | | (206,435) |

| | | | | | |

Financing activities | | | | | | |

Repurchase of common shares | | | (501,768) | | | (559,011) |

Stock options exercised | | | 9,196 | | | 9,147 |

Purchase of treasury shares | | | (23,459) | | | (21,759) |

Debt issuance costs | | | (4,088) | | | — |

Net cash used in financing activities | | | (520,119) | | | (571,623) |

| | | | | | |

Net decrease in cash and cash equivalents | | | (352,632) | | | (349,250) |

Cash and cash equivalents at beginning of period | | | 766,594 | | | 737,877 |

Cash and cash equivalents at end of period | | $ | 413,962 | | $ | 388,627 |

Exhibit 5

Ulta Beauty, Inc.

Store Update

| | | | | | | | |

| | Total stores open | | Number of stores | | Number of stores | | Total stores |

| | at beginning of the | | opened during the | | closed during the | | open at |

Fiscal 2024 | | quarter | | quarter | | quarter | | end of the quarter |

1st Quarter | | 1,385 | | 12 | | 2 | | 1,395 |

2nd Quarter | | 1,395 | | 17 | | 1 | | 1,411 |

| | | | | | | | |

| | | | Gross square feet for | | | | |

| | Total gross square | | stores opened or | | Gross square feet for | | Total gross square |

| | feet at beginning of | | expanded during the | | stores closed | | feet at end of the |

Fiscal 2024 | | the quarter | | quarter | | during the quarter | | quarter |

1st Quarter | | 14,515,593 | | 114,786 | | 15,615 | | 14,614,764 |

2nd Quarter | | 14,614,764 | | 178,624 | | 10,800 | | 14,782,588 |

Exhibit 6

Ulta Beauty, Inc.

Sales by Category

The following tables set forth the approximate percentage of net sales by primary category:

| | | | |

| | 13 Weeks Ended |

| | August 3, | | July 29, |

| | 2024 | | 2023 |

Cosmetics | | 39% | | 40% |

Skincare | | 24% | | 23% |

Haircare | | 20% | | 22% |

Fragrance | | 11% | | 9% |

Services | | 4% | | 4% |

Other | | 2% | | 2% |

| | 100% | | 100% |

| | | | |

| | 26 Weeks Ended |

| | August 3, | | July 29, |

| | 2024 | | 2023 |

Cosmetics | | 40% | | 42% |

Skincare | | 24% | | 22% |

Haircare | | 19% | | 21% |

Fragrance | | 11% | | 9% |

Services | | 4% | | 4% |

Other | | 2% | | 2% |

| | 100% | | 100% |

Certain sales departments were reclassified between categories in the prior year to conform to current year presentation, including moving the bath category from Fragrance to Skincare.

v3.24.2.u1

Document and Entity Information

|

Aug. 29, 2024 |

| Document and Entity Information [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 29, 2024

|

| Entity File Number |

001-33764

|

| Entity Registrant Name |

ULTA BEAUTY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

38-4022268

|

| Entity Address, Address Line One |

1000 Remington Blvd.

|

| Entity Address, Adress Line Two |

Suite 120

|

| Entity Address, State or Province |

IL

|

| Entity Address, City or Town |

Bolingbrook

|

| Entity Address, Postal Zip Code |

60440

|

| City Area Code |

630

|

| Local Phone Number |

410-4800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

ULTA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001403568

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

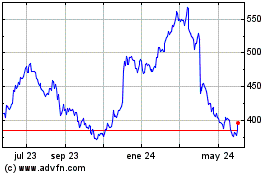

Ulta Beauty (NASDAQ:ULTA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

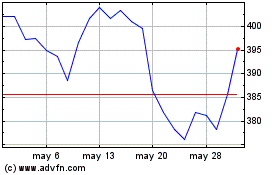

Ulta Beauty (NASDAQ:ULTA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024