UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2024

Commission File Number 001-33434

CREDIT SUISSE AG

(Translation of Registrant’s Name Into English)

Paradeplatz 8, CH-8001 Zurich, Switzerland

(Address of Principal Executive Offices)

| Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. |

Form 20-F  Form 40-F Form 40-F  |

| |

| Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____ |

| |

| Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____ |

Explanatory note

This report on Form 6-K contains the exhibit set forth below. This report

on Form 6-K and such exhibit are hereby incorporated by reference into Registration Statement No. 333-272539 of Credit Suisse AG.

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CREDIT SUISSE AG

|

|

| Date: May 8, 2024 |

By: |

/s/ Stephen Griffin |

|

| |

|

Name: |

Stephen Griffin |

|

| |

|

Title: |

Authorized Officer |

|

| |

| |

By: |

/s/ Frank Lee |

|

| |

|

Name: |

Frank Lee |

|

| |

|

Title: |

Authorized Officer |

|

Exhibit 99.1

|

CREDIT SUISSE |

| |

Eleven Madison Avenue

New York, NY 10010

|

Telephone +1 212-325-2000

Fax +1 212-325-7924

|

|

Media Release

May 8, 2024 |

| Credit Suisse Announces Expected Coupon Payments on Credit Suisse X-Links® Exchange Traded Notes (the “ETNs”) |

On May 1, 2024, Credit Suisse announced

expected coupon payments for the following ETNs:

| ETN Ticker |

ETN Name |

Closing Indicative Value on 4/30/24 |

Ex-Date |

Record Date |

Payment Date |

Expected Coupon Amount per ETN1 |

Coupon Frequency |

Expected Current Yield2 |

| USOI |

Credit Suisse X-Links® Crude Oil Shares Covered Call ETN |

$75.4289 |

5/21/24 |

5/22/24 |

5/28/24 |

$0.9989 |

Monthly |

19.11%3 |

| GLDI |

Credit Suisse X-Links® Gold Shares Covered Call ETN |

$146.9796

|

5/21/24 |

5/22/24 |

5/28/24 |

$1.8477 |

Monthly |

11.10%3 |

| SLVO |

Credit Suisse X-Links® Silver Shares Covered Call ETN |

$75.4835 |

5/21/24 |

5/22/24 |

5/28/24 |

$2.1247 |

Monthly |

17.78%3 |

1. On April 15, 2024, the Credit Suisse

Nasdaq Gold FLOWSTM 103 Index, the Credit Suisse Nasdaq Silver FLOWSTM 106 Index and the Credit Suisse Nasdaq WTI

Crude Oil FLOWSTM 106 Index (the “Indices”) concluded the notional sale of options on GLD shares, SLV shares and

USO shares, respectively, with May 2024 expiration. We expect that the notional cash distribution generated by this sale of options will

be withdrawn from the Indices on May 13, 2024, subject to adjustment in the event of any market disruption events. Assuming no redemption

or acceleration of GLDI, SLVO and USOI, and that the notional cash distribution is withdrawn from the Indices on May 13, 2024, we expect

to declare a Coupon Amount for GLDI, SLVO and USOI, respectively, equal to the corresponding Expected Coupon Amount. The Expected Coupon

Amount is subject to change upon the occurrence of a disruption event or other unforeseen circumstances.

2. For each ETN, the Expected Current

Yield equals the Expected Coupon Amount annualized and divided by the Closing Indicative Value, as discussed in more detail below. The

Expected Current Yield, which is based on an ETN’s Expected Coupon Amount and its two most recent coupon payments, is not indicative

of future coupon payments, if any, on the ETNs. In particular, future coupon payments on an ETN may differ significantly from its Expected

Current Yield, if its Closing Indicative Value fluctuates widely in a volatile market. You are not guaranteed any coupon payment or distribution

under the ETNs. Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected

Coupon Amount for any ETN may vary significantly from coupon period to coupon period and may be zero. Accordingly, the Expected Current

Yield will change over time, and such change may be significant. Any payment on the ETNs is subject to Credit Suisse’s ability

to pay its obligations as they become due. For more information regarding any ETN's coupon payments, please refer to such ETN's pricing

supplement.

3. The Expected Current Yield for the

ETN equals the sum of (i) the Expected Coupon Amount, plus (ii) the amount of the ETN's two most recent coupon payments, multiplied

by four (to annualize such amounts), divided by the Closing Indicative Value, and rounded to two decimal places for ease of

analysis. The Expected Current Yield is subject to change upon the occurrence of a disruption event or other unforeseen circumstances.

| Media

Release |

May 8, 2024

Page 2/2 |

Press Contact

Vanita Sehgal, Credit Suisse, vanita.sehgal@credit-suisse.com

Credit Suisse ETNs

Telephone: +1 800 320 1225; Email: ETN.Desk@credit-suisse.com

The ETNs may not be suitable for all

investors and should be purchased only by knowledgeable investors who understand the potential consequences of investing in the ETNs.

The ETNs are subject to the credit risk of Credit Suisse. You may receive less, and possibly significantly less, than the principal amount

of your investment at maturity or upon repurchase or sale. Coupon payments on the ETNs will vary and could be zero. There is no actual

portfolio of assets in which any investor in the ETNs has any ownership or other interest. Investors in the ETNs do not have voting rights,

distribution rights or other rights with respect to the assets included in the tracked indices. An investment in the ETNs involves significant

risks. For further information regarding risks, please see the section entitled “Risk Factors” in the applicable pricing

supplement.

Disclaimer

This document was produced by and the

opinions expressed are those of Credit Suisse as of the date of writing and are subject to change. It has been prepared solely for information

purposes and for the use of the recipient. It does not constitute an offer or an invitation by or on behalf of Credit Suisse to any person

to buy or sell any security. Any reference to past performance is not necessarily a guide to the future. The information and analysis

contained in this publication have been compiled or arrived at from sources believed to be reliable but Credit Suisse does not make any

representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof.

Credit Suisse has filed a registration

statement (including a prospectus) with the Securities and Exchange Commission, or SEC, for the offering to which this press release

relates. Before you invest, you should read the applicable Pricing Supplement, the Prospectus Supplement dated June 26, 2023 and the

Prospectus dated June 26, 2023 that Credit Suisse has filed with the SEC for more complete information about Credit Suisse and this offering.

You may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov or clicking the hyperlinks below:

USOI:

Pricing Supplement dated April 18, 2024,

including the Prospectus Supplement dated June 26, 2023, and Prospectus dated June 26, 2023: https://www.sec.gov/Archives/edgar/data/1053092/000121390024034197/ea0204162-01_424b2.htm

GLDI:

Pricing Supplement dated

August 3, 2023, including the Prospectus Supplement dated June 26, 2023, and Prospectus dated June 26, 2023: https://www.sec.gov/Archives/edgar/data/1053092/000121390023062969/ea159326_424b2.htm

SLVO:

Pricing Supplement dated August 3, 2023,

including the Prospectus Supplement dated June 26, 2023, and Prospectus dated June 26, 2023: https://www.sec.gov/Archives/edgar/data/1053092/000121390023062971/ea159324_424b2.htm

Alternatively, Credit Suisse, Credit Suisse

Securities (USA) LLC or any agent or any dealer participating in this offering will arrange to send you the applicable pricing supplement,

prospectus supplement and prospectus if you so request by calling 1-800-320-1225.

This document was produced by and the

opinions expressed are those of Credit Suisse as of the date of writing and are subject to change.

X-Links® is a registered

trademark of Credit Suisse Securities (USA) LLC.

Copyright © 2024, CREDIT SUISSE and/or

its affiliates. All rights reserved.

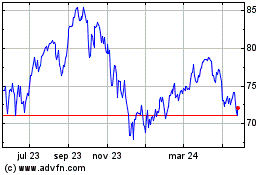

UBS AG ETRACS Crude Oil ... (NASDAQ:USOI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

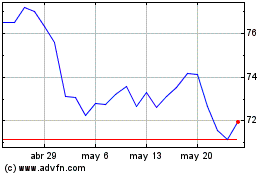

UBS AG ETRACS Crude Oil ... (NASDAQ:USOI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025