false

0001829794

0001829794

2024-08-06

2024-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13

OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

__________________________

Volcon, Inc.

(Exact Name of Registrant as Specified in its Charter)

__________________________

| Delaware |

001-40867 |

84-4882689 |

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification Number) |

3121

Eagles Nest Street, Suite 120

Round Rock, TX 78665

(Address of principal executive offices and zip

code)

(512) 400-4271

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

|

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c)). |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.00001 per share |

|

VLCN |

|

NASDAQ |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.02. |

Results of Operations and Financial Condition. |

On August 6, 2024, Volcon,

Inc. the (“Company”) issued a press release announcing the financial results for the three and months ended June 30, 2024.

A copy of the press release is furnished as Exhibit 99.1 to this report.

In accordance with General Instruction

B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under

the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of

the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Volcon, Inc. |

| |

(Registrant) |

| |

|

| Date: August 6, 2024 |

/s/ Greg Endo |

| |

Greg Endo

Chief Financial Officer |

Exhibit 99.1

Volcon ePowersports

Reports Second Quarter 2024 Operational and Financial Results

AUSTIN, TX (August 6, 2024) - Volcon Inc. (NASDAQ: VLCN) (“Volcon’’,

the “Company” or “we”), the first all-electric, off-road powersports company, today reported its operational highlights

and financial results for the quarter ended June 30, 2024

Company Highlights:

| ● |

|

Regained Nasdaq compliance July 17, 2024 subject to Nasdaq’s Discretionary Panel Monitor |

| ● |

|

Raised $12 million in July 2024 from an equity offering |

| ● |

|

Delivered three additional Stags to the Army Corp |

| ● |

|

Signed agreements with a manufacturer to build a new version of the Grunt EVO and with another manufacturer to build a new model of UTV, both pending completion of regulatory testing of these vehicles |

| ● |

|

Appointed Adrian Solgaard as a new independent member of the board of directors |

As previously noted in our first quarter operational and financial results

update, Volcon presented its plan of compliance to the Nasdaq Hearing Panel on March 26, 2024 regarding ongoing compliance with the bid

price and equity compliance. On July 17, 2024, the Company received notice that we had demonstrated compliance with all requirements,

but will be subject to a Discretionary Panel Monitor for a period of one year.

On July 12, 2024 the Company completed an offering of common stock and

pre funded warrants that raised gross proceeds of $12 million, which further supported our equity compliance with Nasdaq as noted above.

Approximately $2.9 million of the net proceeds were used to repay the outstanding principal on the May 2024 Notes resulting in the Company

having less than $40,000 of debt on its balance sheet.

The Company shipped the Army Corp three more Stags in May 2024 and anticipates

additional deliveries to complete the Army Corp’s orders by August 2024, a delay of one month from our previously announced anticipated

shipment by July 2024. The delay was due to manufacturing delays incurred for the delayed availability of certain components. Our manufacturer

has completed these units and they are awaiting a final quality inspection by us.

We have signed an agreement with a manufacturer to develop and produce

the next generation of the Grunt. We expect to receive prototypes of this model by the third quarter 2024. We will be performing testing

as well as completing regulatory compliance testing and expect this model to be available in the first quarter of 2025.

We have also signed an agreement with the manufacturer of a UTV to distribute

this model in North America. This will be a utility UTV with a single row bench seat and a dump bed. We also granted the manufacturer

the right to sell this unit outside of North America using the Volcon brand in exchange for a royalty on each unit sold by the manufacturer.

The royalty period begins in year three of the agreement. We expect to receive prototypes of this model by third 2024. We will be performing

testing as well as completing regulatory compliance testing and expect this model to be available in the first quarter of 2025. This UTV

will initially be assembled by us in Texas using the manufacturer’s parts until the manufacturer can complete its production facility

in Thailand and can ship completed units directly to us.

Finally, as previously announced, the board of directors has appointed

Adrian Solgaard to the board as an independent director.

John Kim, CEO, notes “We have made some significant changes in the

direction of our products and business. We have significantly improved our balance sheet and equity structure and, having demonstrated

compliance with Nasdaq, have the ability to take advantage of opportunities to raise additional cash if circumstances are favorable to

do so. We have reduced headcount costs and have streamlined the development of new products by working with manufacturers who have significant

design, development and production capabilities allowing us to reduce product development costs and time to get new products to market.

Where possible we are also negotiating to have no or insignificant minimum order quantities to reduce cash requirements and minimize inventory

on hand. The future of Volcon’s products will follow this model as we work to achieve profitability.”

Financial highlights:

| |

|

3 Months Ended |

|

| GAAP |

|

June 30, 2024 |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Revenue |

|

$ |

940,863 |

|

|

$ |

1,033,548 |

|

|

$ |

1,083,800 |

|

| Cost of goods sold |

|

|

(3,113,429 |

) |

|

|

(1,621,580 |

) |

|

|

(6,283,944 |

) |

| Gross Margin |

|

|

(2,172,566 |

) |

|

|

(588,032 |

) |

|

|

(5,200,144) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales & Marketing |

|

|

543,671 |

|

|

|

760,564 |

|

|

|

1,365,186 |

|

| Product Development |

|

|

805,550 |

|

|

|

814,945 |

|

|

|

1,932,705 |

|

| General & Administrative |

|

|

2,007,514 |

|

|

|

2,080,794 |

|

|

|

1,384,872 |

|

| Total Operating Expenses |

|

|

3,356,735 |

|

|

|

3,656,303 |

|

|

|

4,682,763 |

|

| Loss from Operations |

|

|

(5,529,301 |

) |

|

|

(4,244,335 |

) |

|

|

(9,882,907 |

) |

| Other Income (Expense) |

|

|

4,922,883 |

|

|

|

(21,803,709 |

) |

|

|

6,467,255 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(606,418 |

) |

|

$ |

(26,048,044 |

) |

|

$ |

(3,415,652 |

) |

| ● |

|

Revenue: The Company’s revenue for the second quarter of 2024 was $0.9 million compared to the first quarter of 2024 which was $1.0 million, consistent with revenue for the fourth quarter of 2023. Revenue for the second quarter of 2024 includes Stag sales of $ 0.2 million. Second quarter revenue also includes Grunt EVO sales of $0.3 million consistent with first quarter 2024 compared to approximately $0.4 million in the fourth quarter of 2023. Brat revenue in the second quarter of 2024 was $0.2 million compared to $0.5 million in the first quarter of 2024 and $0.6 million in the fourth quarter of 2023. |

| |

|

|

| ● |

|

Cost of Goods Sold: Included in cost of goods sold for the second quarter of 2024 is a charge of

$1.1 million for a settlement agreement with a vendor who supplies certain suspension

components for the Stag. The Company will pay for excess raw materials purchased by the vendor based on an early production forecast

initially provided to the vendor, which was subsequently revised. Cost of goods sold for the second quarter also

includes a charge of $0.4 million for the write off of Stag tooling due to the limited profit expected on the Stag resulting in an

impairment on the recovery of these costs. Cost of goods sold for the quarter ended December 31, 2023 includes a

charge of $2.1 million for cancellation of our agreement with Torrot to purchase Volcon Youth motorcycles, a charge of $0.3 million

for purchase order cancelation costs for excess raw materials and a charge $1.4 million related to the write off of inventory of

Grunt EVO parts contributed to the manufacturer for credits on future unit purchases. |

| |

|

|

| ● |

|

Operating Expenses: The Company’s operating expenses for the second quarter of 2024 were

$3.4 million compared to $3.7 million and $4.7 million in the first quarter of 2024 and fourth quarter of 2023, respectively. Our

sales and marketing costs have decreased as we have realigned our sales and marketing efforts and reduced headcount. Our

product development costs have declined since 2023 due to lower prototype costs due to completion of Stag development and beginning

of production. Our general and administrative costs for the second quarter of 2024 were consistent with the costs in the first

quarter of 2024. General and administrative costs in the fourth quarter of 2023 were $0.7 million lower than the second and first

quarter of 2024 due to lower payroll related costs, including stock-based compensation, due to the reversal of 2023 executive

bonuses that were not awarded by the board of directors, and they were also $0.1 million lower due to a refund of product liability

premiums on the renewal of our product liability policies. The Company continues to focus on reducing operating costs while

continuing to make investments in product development to continue to build our product offerings. |

| |

|

|

| ● |

|

Net loss: The Company’s net loss was $0.6 million for the quarter

ended June 30, 2024 compared to $26.0 million for the first quarter of 2024 and $3.4 million for the fourth quarter of 2023.

Net loss in the second quarter of 2024 includes the recognition of a gain of $5.1 million for warrants issued in our November 2023 public

offering as these warrants were deemed to be liabilities and were recorded at fair value with changes being recorded in income. As discussed

above, upon modification of these warrants they were no longer liabilities and we recognized a gain for the change in fair value on the

modification date and reclassified the remaining liability balance to equity.

Net loss in the first quarter of 2024 includes the recognition of a loss

of $19.8 million for warrants issued in our November 2023 public offering as these warrants were deemed to be liabilities and are recorded

at fair value with changes being recorded in income. The first quarter 2024 net loss also includes a loss of $0.3 million from

the conversion of some of the convertible notes to common stock and a loss of $1.3 million for the exchange of the remaining convertible

notes for convertible preferred stock. Interest expense for the first quarter of 2024 decreased by $0.1 million due to the conversion

and exchange of all convertible notes by early March 2024. |

| |

|

|

| |

|

Net loss in the fourth quarter of 2023 includes the recognition of $2.1 million in cost of goods sold to terminate the agreement with Torrot to produce the Volcon Youth motorcycles as we are discontinuing this product line and a write down of $1.1 million to reduce the inventory at December 31, 2023 to its estimated net realizable value. In addition, a gain of $8.4 million was recognized for warrants issued in our November 2023 public offering as these warrants were deemed to be liabilities and are recorded at fair value with changes being recorded in income. Finally, issuance costs of $1.4 million were recognized for the warrant liabilities for the allocation of issuance costs from the public offering to these financial instruments. Interest expense decreased by $0.7 million due to the extension in September 2023 of the due date of the outstanding convertible notes to January 2025. |

| |

|

|

| ● |

|

Adjusted EBITDA: Adjusted EBITDA for each quarter represents net loss adjusted to add back

stock-based compensation, depreciation and amortization expense, interest expense, the loss/gain on derivative liabilities and

warrant liabilities, and the add back of issuance costs in the fourth quarter of 2024. The Company’s adjusted

EBITDA for the second quarter of 2024 was a loss of $5.1 million compared to the first quarter of 2024 loss of $4.1 million, and

compared to the fourth quarter of 2023 loss of $9.4 million. See “Non-GAAP Reconciliation” below. |

For the latest Company updates, follow Volcon on YouTube, Facebook, Instagram,

and LinkedIn. Investor information about the Company, including press releases, company SEC filings, and more can be found at http://ir.volcon.com.

About Volcon

Based in the Austin, Texas area, Volcon was founded as the first all-electric

power sports company producing high-quality and sustainable electric vehicles for the outdoor community. Volcon electric vehicles are

the future of off-roading, not only because of their environmental benefits but also because of their near-silent operation, which allows

for a more immersive outdoor experience.

Volcon’s vehicle roadmap includes both motorcycles and UTVs. Its first

product, the innovative Grunt, began shipping to customers in late 2021 and combines a fat-tired physique with high-torque electric power

and a near-silent drive train. The Volcon Grunt EVO, an evolution of the original Grunt with a belt drive, an improved suspension, and

seat, began shipping to customers in October 2023. The Brat is Volcon’s first foray into the wildly popular eBike market for both

on-road and off-road riding and is currently being delivered to dealers across North America. Volcon debuted the Stag in July 2022 and

entered the rapidly expanding UTV market and shipped its first production unit in February 2024. The Stag empowers the driver to explore

the outdoors in a new and unique way that gas-powered UTVs cannot. The Stag offers the same thrilling performance of a standard UTV without

the noise (or pollution), allowing the driver to explore the outdoors with all their senses.

Volcon Contacts

For Media: media@volcon.com

For Dealers: dealers@volcon.com

For Investors: investors@volcon.com

For Marketing: marketing@volcon.com

For more information on Volcon or to learn more about its complete motorcycle

and side-by-side line-up, visit: www.volcon.com

NON-GAAP RECONCILIATION

We believe presenting adjusted EBITDA provides management and investors

consistency and facilitates period to period comparisons of operations, as it eliminates the effects of certain variations to overall

performance.

The following table reconciles net loss to adjusted EBITDA for the three

months ended June 30, 2024, March 31, 2024 and December 31, 2023:

| Adjusted EBITDA |

|

3 Months Ended |

|

| |

|

June 30,

2024 |

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

| Net loss |

|

$ |

(606,418 |

) |

|

$ |

(26,048,044 |

) |

|

$ |

(3,415,652 |

) |

| Share-based compensation (benefit) expense |

|

|

287,751 |

|

|

|

(1,922 |

) |

|

|

404,568 |

|

| Depreciation and amortization expense |

|

|

99,517 |

|

|

|

97,720 |

|

|

|

75,405 |

|

| Interest expense |

|

|

196,997 |

|

|

|

329,968 |

|

|

|

451,266 |

|

| Loss from conversion and exchange of convertible notes |

|

|

– |

|

|

|

1,647,608 |

|

|

|

– |

|

| Issuance costs |

|

|

– |

|

|

|

– |

|

|

|

1,444,547 |

|

| (Gain) loss on change in fair value of derivative liabilities |

|

|

(5,111,291 |

) |

|

|

19,838,987 |

|

|

|

(8,365,424 |

) |

| Adjusted EBITDA |

|

$ |

(5,133,444 |

) |

|

$ |

(4,135,683 |

) |

|

$ |

(9,405,290 |

) |

Forward-Looking Statements:

Some of the statements in this release are forward-looking statements,

which involve risks and uncertainties. Forward-looking statements in this press release include, without limitation, whether the Company

can maintain Nasdaq compliance, whether the Company’s manufacturer can increase production of the Stag to meet expected deliveries

to customers, and whether manufacturers of new products can delivery the new models and they can pass regulatory compliance and testing.

Although the Company believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, expectations

may prove to have been materially different from the results expressed or implied by such forward-looking statements. The Company has

attempted to identify forward-looking statements by terminology including ’‘believes,’’ ’‘estimates,’’ ’‘anticipates,’’ ’‘expects,’’ ’‘plans,’’

’‘projects,’’ ’‘intends,’’ ’‘potential,’’ ’‘may,’’ ’‘could,’’ ’‘might,’’ ’‘will,’’ ’’should,’’ ’‘approximately’’ or other words that convey

uncertainty of future events or outcomes to identify these forward-looking statements. These statements are only predictions and involve

known and unknown risks, uncertainties, and other factors. Any forward-looking statements contained in this release speak only as of its

date. The Company undertakes no obligation to update any forward-looking statements contained in this release to reflect events or circumstances

occurring after its date or to reflect the occurrence of unanticipated events. More detailed information about the risks and uncertainties

affecting the Company is contained under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K and

subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC, which are available on the SEC’s

website, www.sec.gov.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

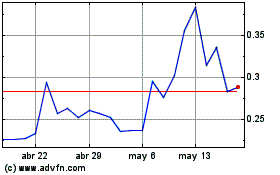

Volcon (NASDAQ:VLCN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Volcon (NASDAQ:VLCN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024