false

0001716166

0001716166

2024-09-12

2024-09-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the

Securities

Exchange act of 1934

Date

of Report (Date of earliest event reported): September 12, 2024 (September 7, 2024)

Vivos

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-39796 |

|

81-3224056 |

(State

or other jurisdiction

of incorporation or organization) |

|

(Commission

file number) |

|

(IRS

Employer

Identification

No.) |

7921

Southpark Plaza, Suite 210

Littleton,

Colorado 80120

(Address

of principal executive offices) (Zip Code)

(844)

672-4357

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

VVOS |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

5.02 |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Board

Approval of Vivos Therapeutics, Inc. 2024 Omnibus Equity Incentive Plan

On

September 7, 2024, the Board of Directors (the “Board”) of Vivos Therapeutics, Inc. (the “Company”),

with the recommendation of the Compensation Committee of the Board (the “Compensation Committee”), approved, subject

to the approval of the Company’s stockholders, the Vivos Therapeutics, Inc. 2024 Omnibus Equity Incentive Plan (the “2024

Omnibus Plan”). The 2024 Omnibus Plan is intended to replace the Company’s Amended and Restated 2019 Stock Option and

Stock Issuance Plan, as amended (the “2019 Plan”).

Description

of the 2024 Omnibus Plan

The

purpose of the 2024 Omnibus Plan is to promote the success and enhance the value of the Company by linking the personal interest of the

participants to those of the Company’s stockholders by providing the participants with an incentive for outstanding performance.

Non-employee directors, officers, employees and consultants of the Company or its subsidiaries or affiliates will be eligible to participate

in the 2024 Omnibus Plan. The 2024 Omnibus Plan provides for the grant of options to purchase shares of the Company’s common stock,

par value $0.0001 per share (“Common Stock”), including stock options intended to qualify as incentive stock options

(“ISOs”) under Section 422 of the Internal Revenue Code of 1986, as amended, and nonqualified stock options that are

not intended to qualify (“NQSOs”), stock appreciation rights (“SARs”), restricted stock awards,

and other equity-based or equity-related awards including restricted stock units and performance units. The 2024 Omnibus Plan shall be

administered by the Compensation Committee or, with respect to non-employee directors, the Board of Directors of the Company.

The

2019 Plan will be automatically replaced and superseded by the 2024 Omnibus Plan on the date on which the 2024 Omnibus Plan is approved

by the Company’s stockholders. A proposal to approve the 2024 Omnibus Plan is expected to be presented at the Company’s 2024

Annual Meeting of Stockholders (the “Annual Meeting”), provided that any outstanding awards granted under the 2019

Plan will remain in effect pursuant to their terms. If stockholder approval is not received at the Annual Meeting, the 2019 Plan will

remain in place, pursuant to its terms, until it expires.

If

the 2024 Omnibus Plan is approved, as of its effective date, a total of 1,600,000 shares of Common Stock will be available for future

awards under the 2024 Omnibus Plan. No awards will be granted under the 2019 Plan or any other prior plan on or after the effective date

of the 2024 Omnibus Plan and after the 2024 Omnibus Plan becomes effective any unused shares left in the 2019 Plan will be retired. The

Company anticipates that the 1,600,000 shares of Common Stock will allow the 2024 Omnibus Plan to operate for several years, although

this could change based on other factors, including but not limited to merger and acquisition activity.

Issuance

of Contingent Option Awards pursuant to the 2024 Omnibus Plan

On

September 7, 2024, the Board, with the recommendation of the Compensation Committee, approved, subject to stockholder approval of the

2024 Omnibus Plan at the Annual Meeting, contingent stock option awards (the “Contingent Options”) to the following

named executive officers of the Company and other Company employees or consultants in the following amounts:

| Name

and Position |

|

Number

and Type of Awards |

| R.

Kirk Huntsman, Chairman and CEO |

|

315,421

ISOs |

| Bradford

Amman, Chief Financial Officer, Treasurer and Secretary |

|

149,533

ISOs |

| All

Other Company Employees and Consultants |

|

555.533

options (ISOs and NQSOs) |

| TOTAL |

|

1,020,487

options |

The

Contingent Options were granted at an exercise price of $2.62 per share (the closing price of the Common Stock on September 6, 2024)

and are subject to time-based vesting as follows: one-third of the shares of Common Stock subject to the proposed Contingent Options

shall vest and become exercisable on each of the first, second and third anniversaries of the date of grant. The Contingent Options will

be null and void if the stockholders do not approve the 2024 Omnibus Plan at the Annual Meeting.

Amended

and Restated CEO and CFO Employment Agreements

On

September 7, 2024, the Board, with the recommendation of the Compensation Committee and with reference to data provided by a third-party

compensation consultant, reviewed and approved amended and restated employment agreements for each of R. Kirk Huntsman, the Company’s

Chief Executive Officer, and Bradford Amman, the Company’s Chief Financial Officer, Secretary and Treasurer that will take effect

on January 1, 2025 (collectively, the “Amended Employment Agreements”). The Amended Employment Agreements supersede

and replace in their entirety each of Mr. Huntsman’s and Mr. Amman’s Employment Agreements with the Company, dated October

8, 2020. The capitalized terms used in this Current Report on Form 8-K will have the meanings set forth in the Amendment Employment Agreements

unless otherwise defined herein.

Description

of the Amended Employment Agreements

The

Amended Employment Agreements provides Mr. Huntsman and Mr. Amman, respectively, for: (i) a base salary of $450,000 and $320,000, an

increase from $389,595 and $259,648, respectively (ii) a target annual cash incentive compensation bonus equal to 75% and 50% of their

respective base salary, payable semi-annually; (iii) Mr. Huntsman and Mr. Amman continued participation in the Company’s long-term

equity compensation programs with anticipated future grants having a grant date value that does not exceed 150% and 100% of their respective

base salary; and (iv) participation in the Company’s standard employee benefit plans and programs available to the Company’s

executives.

The

Amended Employment Agreements also provides for certain severance benefits in the event that Mr. Huntsman’s or Mr. Amman’s

employment is terminated by the Company other than for Cause (as defined therein), Disability (as defined therein) or death, or if Mr.

Huntsman or Mr. Amman resigns for Good Reason (as defined therein).

| |

● |

In

the event of a termination other than for Cause or for Good Reason, Mr. Huntsman or Mr. Amman (subject to his execution of a release

of claims in favor of the Company) shall be entitled to receive: (i) a pro-rated Management Incentive Plan payment; (ii) a cash severance

payment equal to 12 months of Mr. Huntsman or Mr. Amman then Base Salary (the “Base Salary Severance”); (iii)

a lump cash payment equal to 12 times the monthly premium required to be paid by Mr. Huntsman or Mr. Amman to continue his respective

group health care and dental care coverage as in effect for the year in which the termination of employment occurs, based on the

monthly COBRA premium in effect as of the termination date; and (iv) all of Mr. Huntsman’s or Mr. Amman’s outstanding

equity awards that are not yet vested shall vest in full. |

| |

|

|

| |

● |

In

the event Mr. Huntsman or Mr. Amman dies or becomes Disabled, Mr. Huntsman or Mr. Amman or his respective estate (subject to Mr.

Huntsman’s or Mr. Amman’s execution of a release of claims in favor of the Company) shall be entitled to receive: (i)

a pro-rated Management Incentive Plan payment; (ii) the Base Salary Severance but it shall be reduced from 12 to 6 months; (iii)

a lump cash payment equal to 6 times the monthly premium required to be paid by Mr. Huntsman or Mr. Amman to continue his respective

group health care and dental care coverage as in effect for the year in which the termination of employment occurs, based on the

monthly COBRA premium in effect as of the termination date; and (iv) all of Mr. Huntsman or Mr. Amman’s outstanding equity

awards that are not yet vested shall vest in full. |

The

Amended Employment Agreements also provides for certain severance benefits in the event of a Change in Control (as defined therein).

| |

● |

In

the event of a Change In Control, and notwithstanding the fact that Mr. Huntsman or Mr. Amman may continue to provide services from

and after the Change In Control, on the date of a Change In Control, all of Executive’s outstanding equity awards that are

not yet vested shall vest in full. |

| |

|

|

| |

● |

In

the event of a termination other than for Cause or for Good Reason during the 12 month period following the Change in Control, Mr.

Huntsman or Mr. Amman (subject to his execution of a release of claims in favor of the Company) shall be entitled to receive: (i)

a pro-rated Management Incentive Plan payment; (ii) the Base Salary Severance but it shall be increased to 24 months; and (iii) a

lump cash payment equal to 24 times the monthly premium required to be paid by Mr. Huntsman or Mr. Amman to continue his respective

group health care and dental care coverage as in effect for the year in which the termination of employment occurs, based on the

monthly COBRA premium in effect as of the termination date. |

The

Amended Employment Agreements include standard restrictive covenant precluding both Mr. Huntsman or Mr. Amman from engaging in competitive

activities for 24 months following their respective termination of employment for any reason.

Mr.

Huntsman will not receive any additional compensation for his service as a member of the Board.

Both

Mr. Huntsman and Mr. Amman will also enter into the Company’s new standard form of Employee Confidential Information and Invention

Assignment Agreement.

The

foregoing descriptions of the 2024 Omnibus Plan and the Amended Employment Agreements are not complete and are qualified in their entirety

by reference to the full text of the 2024 Omnibus Plan and the Amended Employment Agreements, which the Company expect to file as an

exhibit to its Quarterly Report on Form 10-Q for the period ended September 30, 2024.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VIVOS

THERAPEUTICS, INC. |

| |

|

|

| Dated:

September 12, 2024 |

By: |

/s/

Bradford Amman |

| |

|

Bradford

Amman |

| |

|

Chief

Financial Officer |

v3.24.2.u1

Cover

|

Sep. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 12, 2024

|

| Entity File Number |

001-39796

|

| Entity Registrant Name |

Vivos

Therapeutics, Inc.

|

| Entity Central Index Key |

0001716166

|

| Entity Tax Identification Number |

81-3224056

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7921

Southpark Plaza

|

| Entity Address, Address Line Two |

Suite 210

|

| Entity Address, City or Town |

Littleton

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80120

|

| City Area Code |

(844)

|

| Local Phone Number |

672-4357

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

VVOS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

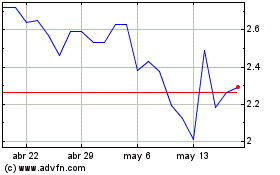

Vivos Therapeutics (NASDAQ:VVOS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Vivos Therapeutics (NASDAQ:VVOS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024