| Prospectus

Supplement |

Filed

pursuant to Rule 424(b)(5) |

| (to

Prospectus dated February 14, 2022) |

Registration

No. 333-262554 |

709,220

Shares

Common

Stock

We

are offering 709,220 shares of our common stock, $0.0001 par value per share, directly to several institutional investors pursuant

to this prospectus supplement and the accompanying prospectus. The per share offering price of the shares is $4.935.

In a concurrent

private placement, we are also selling to the purchasers of the shares of our common stock in this offering, warrants to purchase up

to an aggregate of 709,220 shares of our common stock, or the Purchase Warrants. The Purchase Warrants issued in the private placement

and the shares of our common stock issuable upon the exercise of the Purchase Warrants are not being registered under the Securities

Act of 1933, as amended, or the Securities Act, are not being offered pursuant to this prospectus supplement and the accompanying prospectus

and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder.

The Purchase Warrants will have an exercise price of $4.81 per share, will be exercisable immediately upon issuance and will expire two

years from the date of issuance.

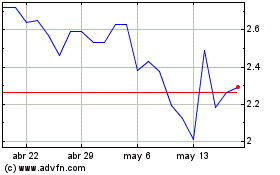

Our

common stock is listed on The NASDAQ Capital Market under the symbol “VVOS.” On December 20, 2024, the last reported

sale price of our common stock on The Nasdaq Capital Market was $4.98 per share.

As

of the date of this prospectus supplement, the aggregate market value of our outstanding common stock held by non-affiliates, known as

our public float, was approximately $24,401,841 based on 4,899,968 outstanding shares of common stock held by non-affiliates

and a per share price of $4.98, the closing price of our common stock on December 20, 2024, which is the highest closing sale

price of our common stock on The Nasdaq Capital Market within the prior 60 days was $4.98 on December 20, 2024. During the twelve (12)

calendar months prior to and including the date of this prospectus supplement, we sold securities with an aggregate market value of approximately

$4,296,008 pursuant to General Instructions I.B.6 of Form S-3.

Investing

in our common stock is speculative involves a high degree of risk. Before buying any of our securities, you should carefully read

“Risk Factors” on page S-7 of this prospectus supplement, and under similar headings in the other documents that are incorporated

by reference into this prospectus supplement and the accompanying prospectus.

We

have engaged H.C. Wainwright & Co., LLC to act as our exclusive placement agent in connection with this offering to use its reasonable

best efforts to place the shares of common stock offered by this prospectus supplement and the accompanying prospectus. The placement

agent has no obligation to buy any of the shares from us or to arrange for the purchase or sale of any specific number or dollar amount

of shares. We have agreed to pay the placement agent the placement agent fees set forth in the table below, which assumes that we sell

all of the shares we are offering. See “Plan of Distribution” beginning on page S-11 of this prospectus supplement for more

information regarding these arrangements.

| | |

Per Share | | |

Total | |

| Offering price | |

$ | 4.935 | | |

$ | 3,500,000 | |

| Placement agent’s fees (1) | |

$ | 0.34545 | | |

$ | 245,000 | |

| Proceeds, before expenses, to us (2) | |

$ | 4.58955 | | |

$ | 3,255,000 | |

| (1) | We

have also agreed: (i) to pay a management fee to the placement agent equal to 1% of the aggregate

gross proceeds raised in this offering; (ii) to reimburse certain expenses of the placement

in connection with this offering; (iii) and to issue to the placement agent, or its designees,

warrants to purchase shares of common stock equal to 7% of the aggregate number of shares

of common stock issued in this offering. See

“Plan of Distribution.” |

| (2) | The

amount of the offering proceeds to us presented in this table does not include proceeds from

the exercise, if any, of the Purchase Warrants or the warrants to be issued to the placement agent. |

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement and the accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal

offense.

Delivery

of the shares of common stock being offered pursuant to this prospectus supplement and the accompanying prospectus is expected to be

made on or about December 24, 2024, subject to customary closing conditions.

H.C.

Wainwright & Co.

The

date of this prospectus supplement is December 22, 2024

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

No

dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus supplement

or the accompanying prospectus. You must not rely on any unauthorized information or representations. This prospectus supplement and

the accompanying prospectus are an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions

where it is lawful to do so. The information contained in this prospectus supplement and the accompanying prospectus is current only

as of their respective dates.

ABOUT

THIS PROSPECTUS SUPPLEMENT

On

February 7, 2022, we filed with the SEC a registration statement on Form S-3 (File No. 333-262554) utilizing a shelf registration process

relating to the securities described in this prospectus supplement, which registration statement was declared effective on February 14,

2022. Under this shelf registration process, we may, from time to time, sell up to $75 million in the aggregate of shares of common stock,

shares of preferred stock, debt securities, warrants, rights and units.

This

document consists of two parts. The first part is the prospectus supplement, including the documents incorporated by reference herein,

which describes the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated

by reference therein, provides more general information. In general, when we refer only to the prospectus, we are referring to both parts

of this document combined. Before you invest, you should carefully read this prospectus supplement, the accompanying prospectus, all

information incorporated by reference herein and therein, as well as the additional information described under the heading “Where

You Can Find More Information.” These documents contain information you should carefully consider when deciding whether to invest

in our securities.

This

prospectus supplement may add, update or change information contained in the accompanying prospectus. To the extent there is a conflict

between the information contained in this prospectus supplement and the accompanying prospectus, you should rely on information contained

in this prospectus supplement, provided that if any statement in, or incorporated by reference into, one of these documents is inconsistent

with a statement in another document having a later date, the statement in the document having the later date modifies or supersedes

the earlier statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any

statement so superseded will be deemed not to constitute a part of this prospectus.

You

should rely only on the information contained in this prospectus supplement, the accompanying prospectus, any document incorporated by

reference herein or therein, or any free writing prospectuses we may provide to you in connection with this offering. Neither we nor

the placement agent has authorized anyone to provide you with any different information. We take no responsibility for, and can provide

no assurance as to the reliability of, any other information that others may provide to you. The information contained in this prospectus

supplement, the accompanying prospectus, and in the documents incorporated by reference herein or therein is accurate only as of the

date such information is presented. Our business, financial condition, results of operations and prospects may have changed since that

date.

This

prospectus supplement and the accompanying prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities

other than the shares of common stock to which it relates, nor do this prospectus supplement and the accompanying prospectus constitute

an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such

offer or solicitation in such jurisdiction.

Securities

offered pursuant to the registration statement to which this prospectus supplement relates may only be offered and sold if not more than

three years have elapsed since February 14, 2022, the initial effective date of the registration statement, subject to the extension

of this period in compliance with applicable SEC rules.

We

note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that

is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for

the purpose of allocating risk among the parties to such agreement, and should not be deemed to be a representation, warranty or covenant

to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations,

warranties and covenants should not be relied on as accurately representing the current state of our affairs.

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

prospectus supplement and the documents incorporated by reference herein contain forward-looking statements that reflect our current

expectations and views of future events. The forward-looking statements are contained principally in the sections included or incorporated

by reference entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results

of Operations.” Readers are cautioned that known and unknown risks, uncertainties and other factors, including those over which

we may have no control and others listed or incorporated by reference in the “Risk Factors” section of this prospectus supplement,

may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking

statements.

You

can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,”

“anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,”

“is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking

statements largely on our current expectations and projections about future events that we believe may affect our financial condition,

results of operations, business strategy and financial needs. These forward-looking statements include statements relating to:

| |

● |

our

ability to continue to refine and execute our business plan, including the launch and advancement of our recently announced marketing

and distribution alliance, recruitment of dentists to enroll in our Vivos Integrated Practice (VIP) program and utilize The Vivos

Method; |

| |

|

|

| |

● |

the

understanding and adoption by dentists and other healthcare professionals of The Vivos Method, including our proprietary oral appliances,

as a treatment for dentofacial abnormalities and/or mild to severe OSA and snoring in adults; |

| |

|

|

| |

● |

our

expectations concerning the effectiveness of treatment using The Vivos Method and patient relapse after completion of treatment; |

| |

|

|

| |

● |

the

potential financial benefits to VIP dentists from treating patients with The Vivos Method; |

| |

|

|

| |

● |

our

potential profit margin from the enrollment of VIPs, VIP service fees, sales of The Vivos Method treatments and appliances and leases

of SleepImage® home sleep testing rings; |

| |

|

|

| |

● |

our

ability to properly train VIPs in the use of The Vivos Method inclusive of the services we offer independent dentist for use in treating

their patients in their dental practices; |

| |

|

|

| |

● |

our

ability to formulate, implement and modify as necessary effective sales, marketing and strategic initiatives to drive revenue growth

(including, for example, our recently announced marketing and distribution alliance, our Medical Integration Division, our SleepImage®

home sleep apnea test and our arrangements with durable medical equipment companies (“DMEs”)); |

| |

|

|

| |

● |

the

viability of our current intellectual property and intellectual property created in the future; |

| |

|

|

| |

● |

acceptance

by the marketplace of the products and services that we market; |

| |

|

|

| |

● |

government

regulations and our ability to obtain applicable regulatory approvals and comply with government regulations including under healthcare

laws and the rules and regulations of the U.S. Food and Drug Administration (“FDA”) and non-U.S. equivalent regulatory

bodies; |

| |

|

|

| |

● |

our

ability to retain key employees; |

| |

|

|

| |

● |

adverse

changes in general market conditions for medical devices and the products and services we offer; |

| |

|

|

| |

● |

our

ability to generate cash flow and profitability and continue as a going concern; |

| |

|

|

| |

● |

our

future financing plans; and |

| |

|

|

| |

● |

our

ability to adapt to changes in market conditions (including as a result of the COVID-19 pandemic, rising inflation and volatile capital

markets) which could impair our operations and financial performance. |

These

forward-looking statements involve numerous risks and uncertainties. Although we believe that our expectations expressed in these forward-looking

statements are reasonable, our expectations may later be found to be incorrect. Our actual results of operations or the results of other

matters that we anticipate could be materially different from our expectations. Important risks and factors that could cause our actual

results to be materially different from our expectations are generally set forth in “Risk Factors,” “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and other sections included or

incorporated by reference in this prospectus supplement. You should thoroughly read this prospectus supplement and the documents incorporated

herein by reference with the understanding that our actual future results may be materially different from and worse than what we expect.

We qualify all of our forward-looking statements by these cautionary statements. We qualify all of our forward-looking statements by

these cautionary statements.

The

forward-looking statements made or incorporated by reference in this prospectus supplement relate only to events or information as of

the date on which the statements are made in or incorporated by reference in this prospectus supplement. Except as required by law, we

undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events

or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this

prospectus supplement, the documents incorporated by reference into this prospectus supplement and the documents we have filed as exhibits

to the registration statement, of which this prospectus supplement forms a part, and our other filings with the SEC completely and with

the understanding that our actual future results may be materially different from what we expect.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights information contained elsewhere in this prospectus supplement or incorporated by reference herein (see “Incorporation

of Certain Information by Reference”). It does not contain all of the information you need to consider in making your investment

decision. Before making an investment decision, you should read this entire prospectus supplement and all documentation incorporated

herein by reference carefully and you should consider, among other things, the matters set forth under “Risk Factors” and

our financial statements and related notes thereto appearing or incorporated by reference in this prospectus supplement.

References

in this prospectus to “Vivos”, “the Company”, “we”, “us”, “our” or “its”,

unless the context otherwise requires, refer to Vivos Therapeutics, Inc., a Delaware corporation, together with its consolidated subsidiaries.

Unless

the context specifically requires otherwise, all share and per share figures appearing in this prospectus give effective to a 1-for-25

reverse stock split of our common stock which became effective on October 25, 2023.

Overview

We

are a revenue stage medical technology company focused on the development and commercialization of a suite of innovative diagnostic and

multi-disciplinary treatment modalities for patients with dentofacial abnormalities and the wide array of medical conditions that may

result from them (including all severities of obstructive sleep apnea (OSA) in adults and moderate to severe in children). We believe

our proprietary oral appliances, diagnostic tools, myofunctional therapy, clinical treatments, continuing education, and practice solutions

represent a powerful and highly effective set of resources for healthcare providers of all disciplines who treat patients suffering from

debilitating and even life-threatening breathing and sleep disorders and their comorbidities.

To

date, our primary focus has been on expanding awareness of, and providing treatment options for OSA for and through the dental industry,

which we believe represents a large and relatively untapped market for OSA treatment. As our business has evolved, we have expanded our

marketing, provider outreach, and treatment programs to encompass a broader more multidisciplinary approach, with a greater emphasis

on working with medical doctors and other healthcare providers beyond dentists. Now that we have established a national network of Vivos-trained

dentists, we are pivoting our focus to the source of where we believe the vast majority of OSA patients are first diagnosed and treated—the

medical profession (including sleep centers and doctors and dentists who offer OSA treatment) as well durable medical equipment (DME)

companies who manufacture and distribute OSA therapies. See “New Marketing and Distribution Alliance Strategy” below for

more information.

In

this prospectus supplement, we sometimes refer to doctors, dentists and other medical professionals who treat OSA as “providers”

(including our own Vivos-trained dentists).

Studies

have shown our comprehensive and multidisciplinary approach represents a significant improvement in the treatment of mild to severe OSA

in comparison to or when combined with other largely palliative treatments such as continuous positive airway pressure (or CPAP) or oral

myofunctional therapy. We call our solution The Vivos Method.

Our

Products and Services

Currently,

The Vivos Method comprises the following products and services:

| |

● |

Vivos

Complete Airway Repositioning and/or Expansion (CARE) oral appliance therapy including our: |

| |

○ |

Daytime

Nighttime Appliance (or DNA appliance®) was granted 510(k) clearance from the U.S. Food & Drug Administration

(or FDA) as a Class II medical device in December 2022 for the treatment of snoring and mild to moderate OSA, jaw repositioning and

snoring in adults. It is the only oral appliance ever to receive FDA clearance to treat OSA without mandibular advancement as its

primary mechanism of action. In November 2023, our DNA appliance was cleared by the FDA to treat moderate and severe OSA in adults,

18 years of age and older along with positive airway pressure (PAP) and/or myofunctional therapy, as needed. In September 2024, our

DNA appliance was cleared by the FDA to treat moderate to severe OSA and snoring in children aged 6 to 17. |

| |

|

|

| |

○ |

Mandibular

Repositioning Nighttime Appliance (or mRNA appliance®) has 510(k) clearance from the FDA as a Class II medical

device for the treatment of snoring and mild to moderate OSA in adults. In November 2023, our mRNA appliance was cleared by the FDA

to treat moderate and severe OSA in adults, 18 years of age and older along with positive airway pressure (PAP) and/or myofunctional

therapy, as needed. |

| |

|

|

| |

○ |

Modified

Mandibular Repositioning Nighttime Appliance (or mmRNA appliance), for which we were granted FDA Class II market clearance

in August 2021 for treating mild to moderate OSA, jaw reposition and snoring in adults. In November 2023, our mmRNA appliance was

cleared by the FDA to treat moderate and severe OSA in adults, 18 years of age and older along with positive airway pressure (PAP)

and/or myofunctional therapy, as needed. |

The

November 2023 clearance of our CARE appliances for the indication described above represents the first time the FDA has ever granted

an oral appliance a clearance to treat severe OSA. We believe this unprecedented decision by the FDA will generate broader acceptance

throughout the medical community for our treatment options, leading to the potential for higher patient referrals and case starts as

well as collaboration with medical professionals. We also believe it will enhance our value proposition to third-party distribution partners

such as DME companies. This approval could also clear the way for greater reimbursement levels from medical insurance payors and Medicare.

For example, in April 2024 we received the required regulatory approvals to enable Medicare reimbursement for our CARE oral medical devices.

In

September 2024, our DNA appliance was cleared by the FDA to treat moderate to severe OSA and snoring in children aged 6 to 17. We believe

this breakthrough regulatory clearance represents a huge opportunity to capture significant market share in the pediatric OSA sector

that is desperate for innovation and effective alternatives.

| |

● |

Vivos

oral appliances and therapies outside of CARE system include: |

| |

○ |

Vivos

Guides are pre-formed, flexible, BPA-free, base polymer, monoblock intraoral guide and rescue appliances. The Guides are

FDA Class I registered product for orthodontic tooth positioning typically used by dentists in children to address malocclusions

and promote proper guided growth and development of the mouth and jaws. |

| |

|

|

| |

○ |

Vivos

VersaTM is an FDA 510(k) cleared Class II device for treating mild to moderate OSA in adults. It is a comfortable,

easy-to-wear, medical grade nylon, 3D printed oral appliance featuring mandibular advancement as its mechanism of action. It is priced

to be very cost effective and offers Vivos providers and patients a comfortable and effective product at a much lower price point

for treatment. As with all other non-CARE oral appliances, the Vivos Versa must be worn nightly for life in order to remain clinically

effective. We believe many Vivos Versa patients will eventually migrate up to our proprietary Vivos CARE products. While we do not

own this product, we are a reseller of this product. |

| |

○ |

Vivos

MyoCorrect oral myofunctional therapy (OMT) services. Studies have shown OMT to be a clinically valuable adjunctive treatment

for patients with breathing and sleep disorders. When combined with Vivos’ CARE products and treatments, OMT can deliver an

enhanced effect in many patients using our appliances. MyoCorrect treatment services are cost-effective for providers and convenient

for patients. MyoCorrect is billable to medical insurance in most cases and constitutes an additional profit center for both Vivos

and providers. |

| |

|

|

| |

○ |

Vivos

Vida ™ is an FDA cleared appliance as unspecified classification for the alleviation of TMD symptoms, and aids in treating

bruxism and TMJ Dysfunction. The Vivos Vida help to alleviate symptoms such as TMJ/TMD, headaches and facial muscle pain. The Vivos

Vida is worn during sleep, and serves to protect the teeth and restorations from destructive forces of bruxism. It is a custom fabricated

appliance, designed for patient comfort. |

| |

|

|

| |

○ |

Vivos

Vida Sleep ™ is an FDA 510(k) cleared Class II for treating mild to moderate OSA in adults. It uses the Vivos Unilateral

BiteBlock Technology and is designed to advance the mandible incrementally to stabilize the patient’s oropharyngeal airway.

It is highly efficient and has a sleep design which promotes space for the tongue to sit in the roof of the palate. It’s novel

design decreases contact points between the maxillary and mandibular teeth that may help reduce clenching and overall bite forces

that occur during sleep. |

| |

● |

VivoScore

(from SleepImage), Rhinomanometry (from GM Instruments), Cone Beam Computerized Tomography or CBCT (from multiple vendors), Joint

Vibration Analysis (from BioResearch) and other key diagnostic technologies play an essential role as part of The Vivos Method

in patient assessment, proper clinical diagnosis, treatment planning, progress measurement, and optimal outcome facilitation. We

believe the combination and integration of such diagnostic tools and equipment as particularly taught to and practiced by Vivos-trained

providers constitutes a key trade secret of our company. |

| |

|

|

| |

● |

Vivos

AireO2 is an Electronic Health Record (EHR) software program specifically designed for use as a full practice

management software program in a medical or dental practice environment where treating breathing and sleep disorders is performed.

The program is very well suited to handle both medical and dental billing and is integral in our Treatment Navigator program. |

| |

|

|

| |

● |

Adjunctive

Treatment from specialty chiropractors and other healthcare providers according to a very specific set of particular integrated

protocols has also proven to enhance and improve clinical outcomes using CARE and other Vivos devices. |

| |

|

|

| |

● |

Treatment

Navigator is our most recent program to assist a clinician’s patients who may have a breathing or sleep disorder to

get screened, diagnosed by a board-certified sleep specialist, obtain insurance verification of benefits and preauthorization (where

required), have their questions answered, and receive assistance with scheduling, financing, medical billing or any other concerns

regarding treatment options best suited to their individual situation. Dentists typically pay set fees to us for this service. |

| |

|

|

| |

● |

Vivos

Billing Intelligence Service (BIS) is our medical and dental billing service. It is both a subscription and fee for service

program for healthcare practitioners who wish to optimize their insurance reimbursement by leveraging both medical and dental benefits.

We are unaware of any other software platform or service on the market that offers the same set of features or capabilities. |

| |

|

|

| |

● |

Vivos

Airway Intelligence Service (AIS) is our technical support and advisory service that supports clinicians in their patient

data analysis, case selection, treatment planning and treatment implementation. AIS reports and services are priced into the cost

of appliances to providers. |

| |

|

|

| |

● |

The

Vivos Institute® (TVI) is widely regarded as one of the top educational and learning centers for dentofacial related

breathing and sleep disorders in North America. Opened in 2021, TVI is housed in a state-of-the-art 18,000 square foot facility near

the Denver International Airport where doctors from around the world come to receive instruction and advanced clinical training in

a wide range of topics delivered by leading national and international medical sleep specialists, cardiologists, pediatric sleep

specialists, dentists, orthodontists, specially trained chiropractors, nutritionists, key industry business leaders, and university-based

clinical researchers. |

These

products and services are used in a collaborative multidisciplinary treatment model comprising dentists, general practice physicians,

sleep specialist physicians, myofunctional therapists, nutritionists, chiropractors, physical therapists, and healthcare professionals.

Our subscription-based program to train dentists and offer them other value-added services is called the Vivos Integrated Practice

(VIP) program.

During

2023, we expanded our product portfolio by acquiring certain devices (now known as Vivos Vida, Vivos Versa

and Vivos Vida Sleep) from Advanced Facialdontics, LLC. During 2022, we commenced and grew our screening and home sleep

test (or HST) program (which we call our VivoScore Program) featuring SleepImage® technology,

a 510(k) cleared ring-based recorder and diagnostic platform for home sleep apnea testing. We market and distribute our SleepImage HST

in the U.S. and Canada pursuant to a licensing agreement with MyCardio LLC. Based on our direct experience with our Vivos-trained providers,

approximately 61,000 VivoScore HSTs were performed during 2023. Due to the volume of business that we have generated with MyCardio LLC,

we now receive pricing and terms for SleepImage® products and services that are well below their published retail prices.

We believe the rapid growth of our VivoScore program confirms our belief that the SleepImage® HST offers significant commercial

advantages over existing home sleep apnea products and technologies in the market and allows healthcare providers to more efficiently

screen, diagnose and initiate treatment for OSA in their patients.

We

have not yet seen a corresponding increase in patient enrollment in The Vivos Method treatment, however, and based on feedback from our

Vivos-trained providers, we believe this to be a function of staffing turnover and labor shortages that continue to plague the dental

workplace. Throughout 2023, we continued to address this by conducting additional regional dental team training sessions on integrating

Vivos products and treatments. In addition, we drastically reduced the number of Practice Advisors who had previously been dispatched

as “boots on the ground” to help facilitate case starts and provide Vivos-trained providers with support, and we replaced

them with a new service called Treatment Navigator which we piloted and rolled out in the late summer and fall of 2022.

Treatment

Navigators work effectively as extensions of the dental office, working directly with perspective patients to provide them information

on The Vivos Method, aiding in education, screening, insurance verification of benefits and preauthorization, coordination among various

professional practitioners, recordkeeping, problem solving, as well as, delivering a home sleep test and following up with scheduling

an appointment with a VIP in their area. Dental offices who wish to avail themselves of this service pay Vivos enrollment fees and per

case fees for the service, thus adding an important new revenue line and profit center to the business. Based on our evaluation of the

Treatment Navigator program, we have restructured the Treatment Navigator program into a monthly subscription-based model.

New

Marketing and Distribution Alliance Strategy

In

June 2024, we announced the execution of a strategic marketing and distribution alliance with Rebis Health Holdings, LLC (who we refer

to as Rebis), an operator of multiple sleep testing and treatment centers in Colorado. This alliance, which we hope will be the first

of a series of similar alliances across the country, marks an important pivot in our marketing and distribution model for our cutting

edge OSA appliances. Under the new alliance, we are collaborating with Rebis to offer OSA patients a full spectrum of evidence-based

treatments such as our own advanced, proprietary and FDA-cleared CARE oral medical devices, oral appliances and additional adjunctive

therapies and methods including CPAP machines. As of the date of this prospectus, the program has commenced in two of Rebis’ existing

sleep treatment centers in Colorado.

This

strategic alliance was announced alongside a $7.5 million equity private placement by us with an affiliate of New Seneca Partners, Inc.

(who we refer to as Seneca). The new marketing and distribution strategic alliance is based on a revenue-sharing model between us and

Rebis. Subject to certain conditions, Seneca will participate in our net cash flow allocation from the alliance up to an agreed-upon

amount as partial consideration for the management advisory services Seneca is providing to us.

Summary

of Risks Affecting Our Business

Investing

in our common stock is highly speculative and involves significant risks and uncertainties. In evaluating our company, our business

and any investment in our company, readers should carefully consider the risk factors described under the heading “Risk Factors”

in this prospectus and the risk factors incorporated by reference from Part I, Item 1A of our Annual Report on Form 10-K beginning on

Page 25, as filed with the SEC on March 28, 2024 (see “Incorporation of Certain Information by Reference”).

Emerging

Growth Company Under the JOBS Act

We

are an “emerging growth company,” or EGC, as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act.

We will remain an EGC until the earlier of: (i) the last day of the fiscal year in which we have total annual gross revenue of $1.235

billion or more; (ii) the last day of the fiscal year following the fifth anniversary of the date of the completion of our initial public

offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv)

the date on which we are deemed to be a large accelerated filer under the rules of the SEC. For so long as we remain an EGC, we are permitted

and intend to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging

growth companies. These exemptions include:

| |

● |

not

being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, or Section 404; |

| |

|

|

| |

● |

not

being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory

audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial

statements; |

| |

|

|

| |

● |

being

permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements,

with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

disclosure; |

| |

|

|

| |

● |

reduced

disclosure obligations regarding executive compensation; and |

| |

|

|

| |

● |

exemptions

from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute

payments not previously approved. |

We

may take advantage of these provisions until December 31, 2025 (the last day of the fiscal year following the fifth anniversary of our

initial public offering) if we continue to be an emerging growth company. We would cease to be an emerging growth company if we have

more than $1.235 billion in annual revenue, have more than $700 million in market value of our shares held by non-affiliates or issue

more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these

reduced burdens. We have elected to provide two years of audited financial statements. Additionally, we have elected to take advantage

of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for

complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier

of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition

period provided in Section 7(a)(2)(B) of the Securities Act.

Corporate

Information

Our

principal offices are located at 7921 Southpark Plaza, Suite 210, Littleton, Colorado 80120, and our telephone number is (844) 672-4357.

Our website is www.vivos.com. Our website and the information on or that can be accessed through such website are not part of

this prospectus.

Available

Information

We

maintain a website at www.vivos.com. You may access our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports

on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act with the SEC free

of charge at our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC.

The reference to our website address does not constitute incorporation by reference of the information contained on our website, and

you should not consider the contents of our website in making an investment decision with respect to our common stock.

THE

OFFERING

| Common

stock offered by us in this offering |

|

709,220

shares of our common stock |

| |

|

|

| Common

stock outstanding immediately before this offering |

|

5,180,300

shares |

| |

|

|

| Common

stock outstanding immediately after this offering |

|

5,889,520

shares |

| |

|

|

| Use

of proceeds |

|

We

estimate that the net proceeds to us from this offering will be approximately $3.05 million, after deducting the placement

agent’s fees and estimated offering expenses payable by us. We intend to use the proceeds of this offering for acquisitions

or strategic partnerships with businesses synergistic with the business of the Company and for working capital and general corporate

purposes. See “Use of Proceeds” for more information. |

| |

|

|

| Concurrent Private Placement |

|

In a concurrent private placement, we are also selling

to the purchasers of shares of our common stock in this offering Purchase Warrants to purchase up to an aggregate of 709,220 shares

of our common stock. The Purchase Warrants will have an exercise price of $4.81 per share, will be exercisable immediately upon issuance

and will expire two years from the date of issuance. The Purchase Warrants issued in the private placement and the shares of our

common stock issuable upon the exercise of the Purchase Warrants are not being registered under the Securities Act at this time,

are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the

exemption provided in Section 4(a)(2) under the Securities Act and Rule 506 (b) promulgated thereunder. There is no established public trading market for the Purchase Warrants, and we do not expect a market to develop.

We do not intend to apply for listing of the Purchase Warrants on any securities exchange or other nationally recognized trading system.

Without an active trading market, the liquidity of the Purchase Warrants will be limited. See “Private

Placement Transaction.” |

| |

|

|

| Risk

factors |

|

An

investment in our common stock is speculative and involves substantial risks. You should read carefully the “Risk Factors”

included and incorporated by reference in this prospectus supplement, including the risk factors incorporated by reference from our

filings with the SEC. |

| |

|

|

| Nasdaq

Capital Market symbol for common stock |

|

“VVOS” |

The

number of shares of our common stock that will be outstanding immediately after this offering as shown above is based on 5,180,300

shares outstanding as of the date of this prospectus supplement and excludes as of September 30, 2024 (vested and unvested):

| ● | 1,248,199

shares

of common stock underlying options to purchase shares of our common stock issued and outstanding

as with a weighted average exercise price of $8.73 per share; |

| | | |

| ● | 579,514

shares

of common stock reserved for future issuance under our outstanding equity incentive plans; |

| | | |

| ● | 8,899,093

shares

of common stock issuable upon the exercise of outstanding common stock warrants with a weighted

exercise price of $3.04 per share, which comprises of: |

| ● | 2,705,768

shares

of common stock issuable upon the exercise of outstanding pre-funded common stock warrants

with an exercise price of $0.0001 per share; |

| | | |

| | ● | 2,717,652

shares of common stock issuable upon the exercise of outstanding short and long-term warrants

with a weighted average exercise price of $4.49 per share; |

| | | |

| | ● | 3,220,266

shares of common stock issuable upon the exercise of outstanding pre-funded common stock

warrants with an exercise price of $2.204

per share; and |

| | | |

| | ● | 95,467

shares of our common stock underlying the placement agent warrants issued to the placement

agent in connection with our registered direct offering in September 2024 |

| | ● | 709,220

shares of our common stock that may be issued upon exercise of the Purchase Warrants; and |

| | | |

| ● | up

to 49,645 shares of our common stock underlying the placement agent warrants to be

issued to the placement agent in connection with this offering. |

RISK

FACTORS

Investing

in our securities is speculative involves a high degree of risk. You should carefully consider the risks described below and all

of the information contained or incorporated by reference in this prospectus supplement, including the risk factors described in our

Annual Report on Form 10-K for the year ended December 31, 2021, any subsequent Quarterly Reports on Form 10-Q, and all other information

contained or incorporated by reference into this prospectus supplement and the accompanying base prospectus before deciding whether to

purchase the securities offered hereby. Our business, financial condition, results of operations and prospects could be materially and

adversely affected by these risks.

Risks

Related to Our Business

We

are placing significant emphasis on our new provider-based marketing and distribution model to grow our revenues. This new model is unproven

and may not produce the benefits we anticipate. This makes it difficult to evaluate our future prospects and may increase the risk of

your investment.

In

June 2024, we announced the execution of a strategic marketing and distribution alliance with Rebis, an operator of multiple sleep testing

and treatment centers in Colorado. This alliance, which we hope will be the first of a series of similar alliances across the country,

marks an important pivot in our marketing and distribution model for our cutting edge OSA appliances. Under the new alliance, we are

collaborating with Rebis to offer OSA patients a full spectrum of evidence-based treatments such as CPAP machines, and our own advanced,

proprietary and FDA-cleared CARE oral medical devices, oral appliances and additional adjunctive therapies and methods. This new model

differs from our current model which emphasizes a subscription-based relationship with our VIP dentists together with sales of our OSA

devices to VIPs and the provision of services to VIPs. The new marketing and distribution strategic alliance is based on a revenue-sharing

model between us and Rebis.

We

are placing significant emphasis on establishing and growing this new model as a means of increasing our revenue. However, this new model

is unproven and we have no operating history associated with this new model. There is therefore a lack of information for you to evaluate

our future prospects utilizing this new model. Moreover, there is a material risk that this new model will not increase our revenues

or be additive to our stockholders’ equity in the manner we anticipate. Our inability to introduce and scale this marketing and

distribution model would materially harm our business and operating results and likely cause our stock price to suffer.

Risks

Related to This Offering

We

issued a large number of shares of common stock and warrants to purchase common stock in connection with our recent financing activities.

Substantial future sales of such shares of our common stock could cause the market price of our common stock to decline or have other

adverse effects on our company.

In

connection with our private placement financing activities since November 2023, we issued a large number of shares and warrants to purchase

common stock. We registered such shares and shares underlying warrants totaling an aggregate of 130,000 shares of common stock and 2,811,179

shares of common stock underlying warrants or pre-funded warrants for public resale. We also issued 1,363,812 shares of common stock

and warrants to a placement agent to purchase up to 95,467 shares of common stock in connection with a registered direct financing in

September 2024. While registered, these shares will be freely tradable. Sales of a substantial number of these shares in the public

market, or the perception that these sales might occur, could depress the market price of our common stock or cause such market price

to decline significantly. Such sales or the perception that such sales might occur could also impair our ability to raise capital through

the sale of additional equity securities. We are unable to predict with any certainty the effect that such sales, or the perception that

such sales may occur, may have on the prevailing market price of our shares or other adverse impacts that this situation could have on

our company.

Our

management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds

and the proceeds may not be invested successfully.

Our

management will have broad discretion as to the use of the net proceeds from this offering and could use them for purposes other than

those contemplated at the time of commencement of this offering. Accordingly, you will be relying on the judgment of our management regarding

the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds

are being used appropriately. It is possible that, pending their use, we may invest the net proceeds in a way that does not yield a favorable,

or any, return for us. The failure of our management to use such funds effectively could have a material adverse effect on our business,

financial condition, operating results and cash flows.

You

will experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase.

Since

the price per share of our common stock being offered is substantially higher than the net tangible book value per share of our common

stock, you will suffer immediate and substantial dilution in the net tangible book value of the common stock you purchase in this offering.

Based on an offering price of $4.935 per share, if you purchase shares of common stock in this offering, you will suffer immediate

and substantial dilution of $3.56 per share with respect to the net tangible book value of the common stock. See the section

entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you invest in this offering.

You

may experience future dilution as a result of future equity offerings and other issuances of our common stock or other securities. In

addition, this offering and future equity offerings and other issuances of our common stock or other securities may adversely affect

our common stock price.

In

order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into

or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may not be able to

sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid

by the investor in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing

stockholders. The price per share at which we sell additional shares of our common stock or securities convertible into common stock

in future transactions may be higher or lower than the price per share in this offering. You will incur dilution upon exercise of any

outstanding stock options, warrants or upon the issuance of shares of common stock under our stock incentive programs. We cannot predict

the effect, if any, that market sales of those shares of common stock or the availability of those shares for sale will have on the market

price of our common stock.

USE

OF PROCEEDS

We

estimate that the net proceeds from this offering will be approximately $3.05 million, after deducting the placement agent’s

fees and the estimated offering expenses payable by us (excluding proceeds, if any, from the exercise of Purchase Warrants or placement

agent warrants). We intend to use the proceeds of this offering for acquisitions or strategic partnerships with businesses synergistic

with the business of the Company and for working capital and general corporate purposes.

The

precise amount and timing of the application of such net proceeds will depend upon our funding requirements and the availability and

cost of other funds. Our board of directors and management will have considerable discretion in the application of the net proceeds from

this offering, and it is possible that we may allocate the proceeds differently than investors in the offering may desire or that we

may fail to maximize the return on these proceeds. You will be relying on the judgment of our management with regard to the use of proceeds

from this offering, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being

used appropriately.

We

may temporarily invest the net proceeds in short-term, interest-bearing instruments or other investment-grade securities.

DIVIDEND

POLICY

We

have not declared or paid dividends to stockholders since inception and do not plan to pay cash dividends in the foreseeable future.

We currently intend to retain earnings, if any, to finance our growth.

DILUTION

Purchasers

of shares of our common stock in this offering will experience an immediate dilution of the net tangible book value per share of our

common stock. Our net tangible book value as of September 30, 2024 was approximately $4,439,131, or $0.93 per share,

of our common stock (based upon 4,765,300 shares of our common stock outstanding as of that date). Net tangible book value per share

is equal to our total tangible assets less our total liabilities, divided by the number of shares of our outstanding common stock.

Dilution

per share of common stock equals the difference between the amount paid by purchasers of common stock in this offering and the net tangible book value per share of our common stock immediately after this offering.

Based on the sale by us in

this offering of 709,220 shares of common stock at an offering price of $4.935 per share, after deducting estimated offering

expenses and placement agent’s fees and expenses payable by us, our pro forma net tangible book value as of September 30,

2024 would have been approximately $7,493,181, or $1.37 per share of our common stock. This represents an immediate increase

in pro forma net tangible book value to existing stockholders of $0.44 per share of our common stock and an immediate dilution

to purchasers in this offering of $3.56 per share of our common stock.

| The following table illustrates this per-share of our common stock dilution: | |

| |

| Offering price per share of common stock | |

$ | 4.935 | |

| Net tangible book value per share as of September 30, 2024 | |

$ | 0.93 | |

| Increase in net tangible book value per share attributable to this offering | |

$ | 0.44 | |

| Net tangible book value per share as of September 30, 2024 after giving effect to this

offering | |

$ | 1.37 | |

| Dilution per share to the new investors in this offering | |

$ | 3.56 | |

The

information above is as of the September 30, 2024 and excludes, as of that date (vested and unvested):

| ● | 1,248,199

shares of common stock underlying options to purchase shares of our common stock issued and

outstanding as with a weighted average exercise price of $8.73 per share; |

| | | |

| ● | 579,514

shares of common stock reserved for future issuance under our outstanding equity incentive

plans; |

| | | |

| ● | 8,899,093

shares of common stock issuable upon the exercise of outstanding common stock warrants with

a weighted exercise price of $3.04 per share, which comprises of: |

| ● | 2,705,768

shares of common stock issuable upon the exercise of outstanding pre-funded common stock

warrants with an exercise price of $0.0001 per share; |

| | | |

| | ● | 2,717,652

shares of common stock issuable upon the exercise of outstanding short and long-term warrants

with a weighted average exercise price of $4.49 per share; |

| | | |

| | ● | 3,220,266

shares of common stock issuable upon the exercise of outstanding pre-funded common stock

warrants with an exercise price of $2.204 per share; and |

| | | |

| | ● | 95,467

shares of our common stock underlying the placement agent warrants to be issued to the placement

agent in connection with our registered direct offering in September 2024 |

| ● | 709,220

shares of our common stock that may be issued upon exercise of the Purchase Warrants; and |

| | | |

| | ● | up

to 49,645 shares

of our common stock underlying the placement agent warrants to be issued to the placement

agent in connection with this offering. |

To

the extent that outstanding exercisable options or warrants are exercised, you may experience further dilution. In addition, we may need

to raise additional capital and to the extent that we raise additional capital by issuing equity or convertible debt securities your

ownership will be further diluted.

PRIVATE

PLACEMENT TRANSACTION

In

a concurrent private placement, or the Private Placement Transaction, we are selling to purchasers of our common stock in this offering

Purchase Warrants to purchase up to an aggregate of 709,220 shares of our common stock.

The

following summary of certain terms and provisions of the Purchase Warrants that are being offered hereby is not complete and is subject

to, and qualified in its entirety by, the provisions of the Purchase Warrant, the form of which will be filed as an exhibit to our Current

Report on Form 8-K. Prospective investors should carefully review the terms and provisions of the form of Purchase Warrant for a complete

description of the terms and conditions of the Purchase Warrants.

The

Purchase Warrants and the shares of our common stock issuable upon the exercise of the Purchase Warrants are not being registered under

the Securities Act, are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered

pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and/or Rule 506(b) promulgated thereunder. Accordingly,

purchasers may only sell shares of common stock issued upon exercise of the Purchase Warrants pursuant to an effective registration statement

under the Securities Act covering the resale of those shares, an exemption under Rule 144 under the Securities Act or another applicable

exemption under the Securities Act.

Exercisability.

The Purchase Warrants will be exercisable immediately upon issuance and at any time thereafter up to two years from the date of issuance,

at which time any unexercised Purchase Warrants will expire and cease to be exercisable. The Purchase Warrants will be exercisable, at

the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement

registering the issuance of the shares of common stock underlying the Purchase Warrants under the Securities Act is effective and available

for the issuance of such shares, or an exemption from registration under the Securities Act is available for the issuance of such shares,

by payment in full in immediately available funds for the number of shares of common stock purchased upon such exercise. If at the time

of exercise a registration statement registering the issuance of the shares of common stock underlying the Purchase Warrants under the

Securities Act is not effective or available, the holder may, in its sole discretion, elect to exercise the Purchase Warrant through

a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of common stock determined according

to the formula set forth in the Purchase Warrant. No fractional shares of common stock will be issued in connection with the exercise

of a Purchase Warrant. In lieu of fractional shares, we will pay the holder an amount in cash equal to the fractional amount multiplied

by the exercise price or round up to the next whole share.

Exercise

Limitation. A holder will not have the right to exercise any portion of the warrant if the holder (together with its affiliates)

would beneficially own in excess of 4.99% (or, upon election of the holder, 9.99%) of the number of shares of our common stock outstanding

immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Purchase

Warrants. However, any holder may increase or decrease such percentage, provided that any increase will not be effective until the 61st

day after such election.

Exercise

Price. The Purchase Warrants will have an exercise price of $4.81 per share. The exercise price is subject to appropriate adjustment

in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting

our common stock and also upon any distributions of assets, including cash, stock or other property to our stockholders.

Transferability.

Subject to applicable laws, the Purchase Warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange

Listing. There is no established trading market for the Purchase Warrants and we do not expect a market to develop. In addition,

we do not intend to apply for the listing of the Purchase Warrants on any national securities exchange or other trading market. Without

an active trading market, the liquidity of the Purchase Warrants will be limited.

Fundamental

Transactions. If a fundamental transaction occurs, then the successor entity will succeed to, and be substituted for us, and may

exercise every right and power that we may exercise and will assume all of our obligations under the Purchase Warrants with the same

effect as if such successor entity had been named in the Purchase Warrant itself. If holders of our common stock are given a choice as

to the securities, cash or property to be received in a fundamental transaction, then the holder shall be given the same choice as to

the consideration it receives upon any exercise of the Purchase Warrant following such fundamental transaction.

Rights

as a Stockholder. Except as otherwise provided in the Purchase Warrants or by virtue of such holder’s ownership of shares of

our common stock, the holder of a Purchase Warrant does not have the rights or privileges of a holder of our common stock, including

any voting rights, until the holder exercises the Purchase Warrant.

Registration

Rights. We have agreed to file a registration statement covering of the resale of the shares issuable upon the exercise of the Purchase

Warrants (the “Purchase Warrant Shares”) within 30 days of the date of the securities purchase agreement entered into between

the purchasers and us. We must use commercially reasonable efforts to cause such registration statement to become effective within 90

days following the closing date of the offering and to keep such registration statement effective at all times until the purchasers no

longer own any Purchase Warrants or Purchase Warrant Shares.

PLAN

OF DISTRIBUTION

Pursuant

to an engagement letter agreement dated May 2, 2024, as amended (the “Engagement Letter”), we have engaged H.C. Wainwright

& Co, LLC (“Wainwright” or the “placement agent”) to act as our exclusive placement agent in connection with

this offering. Under the terms of the Engagement Letter, Wainwright is not purchasing the shares offered by us in this offering, and

is not required to sell any specific number or dollar amount of shares, but will assist us in this offering on a reasonable best-efforts

basis. The terms of this offering were subject to market conditions and negotiations between us, Wainwright and prospective investors.

Wainwright will have no authority to bind us by virtue of the Engagement Letter. Wainwright may engage sub-agents or selected dealers

to assist with this offering. We may not sell the entire amount of the shares offered pursuant to this prospectus supplement.

The

placement agent proposes to arrange for the sale of the shares we are offering pursuant to this prospectus supplement and accompanying

prospectus to one or more institutional or accredited investors through securities purchase agreements directly between the purchaser

and us. We will only sell to such investors who have entered into the securities purchase agreement with us.

We

have agreed to indemnify the placement agent against specified liabilities, including liabilities under the Securities Act, and to contribute

to payments the placement agent may be required to make in respect thereof.

Pursuant

to the terms of the securities purchase agreement, from the date hereof until 45 days after the closing date of this offering,

we may not issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of common stock or common

stock equivalents, subject to certain exceptions set forth in the securities purchase agreement.

In

addition, we have also agreed with the purchasers of our common stock, subject to certain exceptions, from the date of this prospectus

supplement until one year after the closing date of this offering, that we will not effect or enter into an agreement to effect a “Variable

Rate Transaction” as defined in the securities purchase agreement.

Fees

and Expenses; Placement Agent Warrants

We

have agreed to pay the placement agent a placement agent fee equal to 7.0% of the aggregate purchase price of the shares of our common

stock sold in this offering. The following table shows the per share and total cash placement agent’s fees we will pay to the placement

agent in connection with the sale of the shares of our common stock offered pursuant to this prospectus supplement and the accompanying

prospectus, assuming the purchase of all of the shares offered hereby.

| | |

Per Share | | |

Total | |

| Offering price | |

$ | 4.935 | | |

$ | 3,500,000 | |

| Placement agent’s fees (1) | |

$ | 0.34545 | | |

$ | 245,000 | |

| Proceeds, before expenses, to us | |

$ | 4.58955 | | |

$ | 3,255,000 | |

In

addition, we have agreed to pay Wainwright a management fee equal to 1% of the gross proceeds raised in the offering or

$35,000. We have also agreed to reimburse the placement agent a non-accountable expense allowance of $25,000, an expense

allowance of $50,000 for fees and expenses of its legal counsel and other out-of-pocket expenses and $15,950 for its

clearing fees. We estimate that the total expenses of the offering payable by us, excluding the placement agent’s fees, will

be approximately $75,000. In addition, we have agreed to pay Wainwright the following compensation in connection with any

future exercise of the Purchase Warrants: (i) a cash fee equal to 7.0% of the aggregate gross exercise price paid in cash with

respect to the exercise of such Purchase Warrants; and (ii) a management fee equal to 1.0% of the aggregate gross exercise price

paid in cash with respect to the exercise of such Purchase Warrants and issue to Wainwright (or its designees) warrants to purchase

shares of our common stock representing 7.0% of the shares of common stock underlying the such Purchase Warrants that have been

exercised.

At

the closing of this offering, we will also issue to Wainwright or its designees, warrants (the “Wainwright Warrants”) to

purchase 49,645 shares of common stock (7.0% of the aggregate number of shares of common stock issued in this offering). The

Wainwright Warrants have substantially the same terms as the Purchase Warrants, except that they have an exercise price per

share equal to $6.1688 (125% of the offering price per share in this offering).

The

placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions

received by them and any profit realized on the resale of the shares sold by them while acting as principals might be deemed to be underwriting

discounts or commissions under the Securities Act. As an underwriter, the placement agent would be required to comply with the requirements

of the Securities Act and the Securities Exchange Act of 1934, as amended, or the Exchange Act, including, without limitation, Rule 415(a)(4)

under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of

purchases and sales of shares by the placement agent acting as principal. Under these rules and regulations, the placement agent:

| ● | may

not engage in any stabilization activity in connection with our securities; and |

| | | |

| ● | may

not bid for or purchase any of our securities or attempt to induce any person to purchase

any of our securities, other than as permitted under the Exchange Act, until it has completed

its participation in the distribution. |

This

prospectus supplement and the accompanying prospectus may be made available in electronic format on websites or through other online

services maintained by the placement agent or by an affiliate of the placement agent. Other than this prospectus supplement and the accompanying

prospectus, the information on the placement agent’s website and any information contained in any other website maintained by the

placement agent is not part of this prospectus supplement and the accompanying prospectus or the registration statement of which this

prospectus supplement and the accompanying prospectus form a part, has not been approved and/or endorsed by us or the placement agent,

and should not be relied upon by investors.

The

foregoing does not purport to be a complete statement of the terms and conditions of the securities purchase agreement and other documentation

associated with this offering. A copy of such documents will be included as an exhibit to an SEC filing and incorporated by reference

into the registration statement of which this prospectus supplement and the accompanying prospectus form a part. See “Information

Incorporated by Reference” and “Where You Can Find More Information.”

No

action has been or will be taken in any jurisdiction (except in the United States) that would permit a public offering of the securities

offered by this prospectus supplement and accompanying prospectus, or the possession, circulation or distribution of this prospectus

supplement and accompanying prospectus or any other material relating to us or the securities offered hereby in any jurisdiction where

action for that purpose is required. Accordingly, the securities offered hereby may not be offered or sold, directly or indirectly, and

neither of this prospectus supplement and accompanying prospectus nor any other offering material or advertisements in connection with

the securities offered hereby may be distributed or published, in or from any country or jurisdiction except in compliance with any applicable

rules and regulations of any such country or jurisdiction. The placement agent may arrange to sell securities offered by this prospectus

supplement and accompanying prospectus in certain jurisdictions outside the United States, either directly or through affiliates, where

it is permitted to do so.

Relationships

The

placement agent and its affiliates may provide from time to time in the future certain commercial banking, financial advisory, investment

banking and other services for us in the ordinary course of their business, for which they may receive customary fees and commissions.

In addition, from time to time, the placement agent and its affiliates may effect transactions for their own accounts or the account

of customers, and hold on behalf of themselves or their customers, long or short positions in our debt or equity securities or loans,

and may do so in the future. Wainwright served as our placement agent in connection with the registered direct offering of our shares

in September 2024 and received cash fees and warrants to purchase common stock in connection therewith. Except as disclosed in this

prospectus supplement, we have no present arrangements with the placement agent for any further services.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is VStock Transfer, LLC.

Listing

Our

common stock is traded on the Nasdaq Capital Market under the symbol “VVOS.”

LEGAL

MATTERS

The

validity of the shares of common stock being offered by this prospectus supplement will be passed upon for us by Ellenoff Grossman &

Schole LLP, New York, New York. Lowenstein Sandler LLP, New York, New York, is acting as counsel for the placement agent in connection

with the securities offered hereby.

EXPERTS

The

consolidated financial statements of Vivos Therapeutics, Inc. as of and for the year ended December 31, 2023 incorporated in this prospectus

supplement by reference from Vivos Therapeutics, Inc.’s Annual Report on Form 10-K and 10-K/A for the year ended December 31, 2023,

have been audited by Moss Adams LLP, an independent registered public accounting firm, as stated in their report (which report expresses

an unqualified opinion and includes an explanatory paragraph relating to a going concern uncertainty), which is incorporated herein by

reference. Such consolidated financial statements are incorporated by reference in reliance upon the report of such firm given their

authority as experts in accounting and auditing.

The

consolidated financial statements of Vivos Therapeutics, Inc. as of and for the year ended December 31, 2022 incorporated in this prospectus

supplement by reference from Vivos Therapeutics, Inc.’s Annual Report on Form 10-K and 10-K/A for the year ended December 31, 2023,

have been audited by Plante & Moran, PLLC, an independent registered public accounting firm, as stated in their report, which is

incorporated herein by reference. Such consolidated financial statements are incorporated by reference in reliance upon the report of

such firm given their authority as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities offered by this

prospectus supplement. This prospectus supplement and the accompanying prospectus, which are part of the registration statement, omits

certain information, exhibits, schedules and undertakings set forth in the registration statement, as permitted by the SEC. For further

information pertaining to us and the securities offered in this prospectus supplement, reference is made to that registration statement

and the exhibits and schedules to the registration statement. Statements contained in this prospectus supplement and the accompanying

prospectus as to the contents or provisions of any documents referred to in this prospectus are not necessarily complete, and in each

instance where a copy of the document has been filed as an exhibit to the registration statement, reference is made to the exhibit for

a more complete description of the matters involved.

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the

public on a website maintained by the SEC at www.sec.gov.

General

information about our company, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K,

as well as any amendments and exhibits to those reports, are available free of charge through our website at www.biolase.com as soon

as reasonably practicable after we file them with, or furnish them to, the SEC. Information on, or than can be accessed through, our

website is not incorporated into this prospectus supplement or other securities filings and is not a part of these filings.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus supplement the information we file with it, which means

that we can disclose important information to you by referring you to those documents. The information we incorporate by reference is

an important part of this prospectus supplement, and later information that we file with the SEC will automatically update and supersede