Filed

pursuant to Rule 424(b)(3)

Registration

Statement No. 333-281065

Prospectus

Supplement No. 5

(To

Prospectus)

Up

to 10,000,000 Ordinary Shares

This

prospectus supplement is being filed to update and supplement the information contained in the prospectus (as supplemented or amended

from time to time, the “Prospectus”), which forms a part of our Registration Statement on Form F-1 (Registration No. 333-281065),

as amended and supplemented, with the information contained in our Report on Form 6-K/A, furnished with the Securities and Exchange Commission

on September 26, 2024. The Prospectus relates to the issuance by VivoPower International PLC of up to 10,000,000 Ordinary Shares in a

best efforts offering.

This

prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered

or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should

be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus

supplement, you should rely on the information in this prospectus supplement.

Our

Ordinary Shares are listed on The Nasdaq Capital Market (“Nasdaq”) under the symbol “VVPR.” The last sale price

of our Ordinary Shares on Nasdaq on September 25, 2024 was $1.35 per share.

We

may further amend or supplement the Prospectus and this prospectus supplement from time to time by filing amendments or supplements as

required. You should read the entire Prospectus, this prospectus supplement and any amendments or supplements carefully before you make

your investment decision.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 9 of the Prospectus for a discussion

of information that should be considered in connection with an investment in our securities.

Neither

the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined

if this prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus supplement is September 26, 2024.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K/A

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

September

25, 2024

Commission

File Number 001-37974

VIVOPOWER

INTERNATIONAL PLC

(Translation

of registrant’s name into English)

The

Scalpel, 18th Floor, 52 Lime Street

London

EC3M 7AF

United

Kingdom

+44-203-667-5158

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form

20- F ☒ Form 40-F ☐

This

Amendment No. 1 to Form 6-K (this “Amendment”) amends the Report of Foreign Private Issuer on Form 6-K originally filed by

VivoPower International PLC (the “Company”) on September 25, 2024 (the “Original Form 6-K”). The purpose of this

Amendment is to include an additional paragraph in the original press release, outlining that VivoPower will acquire FAST, issuing restricted

shares, resulting in 49% ownership by VivoPower shareholders and 51% by FAST shareholders, with insiders committing to a lock-up of their

shares.

A

copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

This

Report on Form 6-K, including Exhibit 99.1, is hereby incorporated by reference into the Company’s Registration Statements on Form

S-8 (File Nos. 333-227810, 333-251546, 333-268720, 333-273520), Form F-3 (File No. 333-276509) and Form F-1 (File No. 333-267481).

EXHIBIT

INDEX

Exhibit

99.1 — Press Release

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| Date:

September 26, 2024 |

VivoPower

International PLC |

| |

|

| |

/s/

Kevin Chin |

| |

Kevin

Chin |

| |

Executive

Chairman |

Exhibit

99.1

(Updated)

VivoPower and Future Automotive Solutions Technologies (FAST) proforma $1.13bn merged entity to be UK headquartered to qualify for $21bn

government clean energy investment programs

UK

remains attractive market for hydrogen companies with significant incentives introduced and announced by UK Government

UK

Government clean energy initiatives include establishing Great British Energy unit to be capitalised with US$11bn, augmented with the

$9.7bn investment into National Wealth Fund

Priority

investment for both Great British Energy unit and National Wealth Fund is scaling up UK green hydrogen sector

VivoPower

has been headquartered in UK since 2016

Transaction

subject to completion of number of conditions precedent, including closing of Tembo’s previously announced business combination

and satisfactory completion of independent third-party opinion

LONDON,

26 September 2024 – Nasdaq-listed VivoPower International Plc (“VivoPower”, the “Company”)

(Nasdaq: VVPR) previously announced that it entered into a strategic heads of agreement (the “Heads of Agreement”)

to merge with Future Automotive Solutions and Technologies (“FAST”), a hydrogen conversion technology company headquartered

in Canada (together, the “Merger” or the “Transaction”). The Heads of Agreement is exclusive for

90 days but is non-binding.

The

Company hereby provides further details on the proposed domicile of the combined entity and the proposed merger structure.

Domicile

and Headquarters in the UK

Upon

completion of the Transaction, the combined entity intends to remain headquartered in the United Kingdom. This is in an effort to qualify

for significant and attractive potential UK Government incentives that have been announced. The incumbent UK Government that was elected

in July 2024 has announced that clean energy is one of its top two missions, alongside economic growth. It has re-affirmed a goal of

decarbonising the UK’s electricity generation to achieve net zero carbon emissions by 2030 and has re-instated a policy to ban

the sale of diesel and petrol internal combustion engine vehicles by 2030. This had previously been deferred to 2035 under the previous

UK Government. It has mandated for two investment bodies to be capitalised and tasked with driving investment into clean energy projects

and companies, of which green hydrogen is an investment priority. These bodies are the Great British Energy unit and the National Wealth

Fund, which have been allocated a combined budget of US$21bn.

In

2023, Bloomberg New Energy Finance (BNEF) noted that investment in the UK clean energy transition sector increased 84% year on year in

the UK, ranking it fourth in the world. BNEF analysts estimate that this figure would need to be more than double to meet the UK’s

2030 net zero goal.

VivoPower

International PLC

www.vivopower.com

Pro

Forma Structure

The

expected structure of the pro forma combined company following the Merger is set out in the table below.

It

is currently proposed that VivoPower will acquire FAST and issue restricted shares in VivoPower as consideration. Following the completion

of the merger, VivoPower will remain a UK PLC corporation that is 49% owned by VivoPower shareholders and 51% by FAST shareholders.

The

Heads of Agreement values the pro forma combined company at an equity valuation of $1.13bn. This means VivoPower’s shareholders

will hold 49% valued at $556m whilst FAST shareholders will own 51%, valued at $578m.

It

is currently proposed that VivoPower will acquire FAST and issue restricted shares in VivoPower as consideration. Following the completion

of the merger, VivoPower will remain a UK PLC corporation that is 49% owned by VivoPower shareholders and 51% by FAST shareholders. VivoPower

insiders and affiliates will also commit to a lock up of their shares in the merged entity.

About

VivoPower

Established

in 2014 and listed on Nasdaq since 2016, VivoPower is an award-winning global sustainable energy solutions B Corporation company focused

on electric solutions for off-road and on-road customised and ruggedised fleet applications as well as ancillary financing, charging,

battery and microgrids solutions.

VivoPower’s

core purpose is to provide its customers with turnkey decarbonisation solutions that enable them to move toward net-zero carbon status.

VivoPower has operations and personnel covering Australia, Canada, the Netherlands, the United Kingdom, the United States, the Philippines,

and the United Arab Emirates.

About

FAST

FAST

is a Canadian headquartered hydrogen technology company that focuses on developing technologies that promote the adoption of hydrogen.

FAST will be launching several vehicle models powered by hydrogen powered internal combustion engines as well as a conversion platform

for gasoline and diesel vehicles to run on hydrogen. FAST has offices and factory facilities in Toronto (Canada), Tokyo (Japan) and Yamagata

(Japan).

Forward-Looking

Statements

This

communication includes certain statements that may constitute “forward-looking statements” for purposes of the U.S. federal

securities laws. Forward-looking statements include, but are not limited to, statements that refer to projections, forecasts or other

characterisations of future events or circumstances, including any underlying assumptions. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking. Forward-looking statements may include, for example, statements about the achievement

of performance hurdles, or the benefits of the events or transactions described in this communication and the expected returns therefrom.

Forward-looking statements in this press release include statements regarding VivoPower and FAST’s ability to reach a definitive

agreement and to complete the merger transaction as set out in the heads of agreement. These statements are based on VivoPower’s

management’s current expectations or beliefs and are subject to risk, uncertainty, and changes in circumstances. Actual results

may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or

regulatory factors, and other risks and uncertainties affecting the operation of VivoPower’s business. These risks, uncertainties

and contingencies include changes in business conditions, fluctuations in customer demand, changes in accounting interpretations, management

of rapid growth, intensity of competition from other providers of products and services, changes in general economic conditions, geopolitical

events and regulatory changes, and other factors set forth in VivoPower’s filings with the United States Securities and Exchange

Commission. The information set forth herein should be read in light of such risks. VivoPower is under no obligation to, and expressly

disclaims any obligation to, update or alter its forward-looking statements whether as a result of new information, future events, changes

in assumptions or otherwise.

Contact

Shareholder

Enquiries

shareholders@vivopower.com

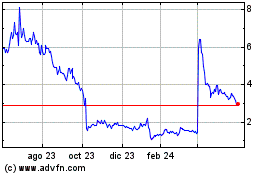

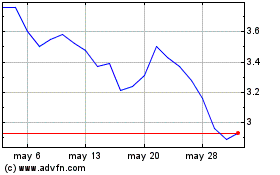

VivoPower (NASDAQ:VVPR)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

VivoPower (NASDAQ:VVPR)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024