0001527541FALSE00015275412023-12-072023-12-070001527541us-gaap:CommonStockMember2023-12-072023-12-070001527541us-gaap:SeriesBPreferredStockMember2023-12-072023-12-070001527541us-gaap:SeriesDPreferredStockMember2023-12-072023-12-070001527541us-gaap:ConvertibleSubordinatedDebtMember2023-12-072023-12-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): December 7, 2023

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-35713 | | 45-2681082 |

(State or other jurisdiction

of incorporation or organization) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

2529 Virginia Beach Blvd. Virginia Beach, VA | | 23452 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (757) 627-9088

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | WHLR | | Nasdaq Capital Market |

| Series B Convertible Preferred Stock | | WHLRP | | Nasdaq Capital Market |

| Series D Cumulative Convertible Preferred Stock | | WHLRD | | Nasdaq Capital Market |

| 7.00% Subordinated Convertible Notes due 2031 | | WHLRL | | Nasdaq Capital Market |

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

Notification of Listing Deficiency.

On December 7, 2023, Wheeler Real Estate Investment Trust, Inc. (the “Company”) received a letter (the “Notice”) from the listing qualifications staff (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that it is not in compliance with the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”) for continued listing. The Bid Price Rule requires listed securities to maintain a minimum bid price of $1.00 per share, and Nasdaq Listing Rule 5810(c)(3)(A) (the “Compliance Period Rule”) provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days.

The Notice has no immediate effect on the listing of the Company’s common stock, par value $0.01 per share (the “Common Stock”), which continues to trade on The Nasdaq Capital Market under the symbol “WHLR.” An indicator of the Company’s non-compliance, however, will be displayed with quotation information related to the Common Stock on NASDAQ.com and NASDAQTrader.com and may be displayed by other third party providers of market data information.

First 180-day Compliance Period

In accordance with the Compliance Period Rule, the Company has 180 calendar days to regain compliance. If, at any time before the end of this first 180-day period, or through June 4, 2024, the closing bid price of the Common Stock closes at or above $1.00 per share for a minimum of 10 consecutive business days, subject to the Staff’s discretion to extend this period pursuant to Nasdaq Listing Rule 5810(c)(3)(H), the Staff will provide written notification that the Company has achieved compliance with the Bid Price Rule.

Second 180-day Compliance Period

If the Company does not regain compliance during the first 180-day compliance period, then the Staff may grant the Company a second 180 calendar day period to regain compliance, provided that on the 180th day of the first compliance period the Company meets the continued listing requirement for market value of publicly held shares of at least $1 million for a minimum of ten consecutive business days and all other initial listing standards for The Nasdaq Capital Market, with the exception of the bid price requirement. In addition, the Company would be required to notify Nasdaq of its intent to cure the minimum bid price deficiency during the second compliance period. If the Company does not indicate its intent to cure the deficiency, or if it does not appear to Nasdaq that it is possible for the Company to cure the deficiency, the Company may not be eligible for the second 180-day compliance period.

Action or Response by the Company

The Company intends to continue to monitor the closing bid price of its Common Stock and seek to regain compliance with all applicable Nasdaq requirements within the allotted compliance periods. The Company plans to evaluate all available options for regaining compliance with the Minimum Bid Rule, which may include implementing a reverse stock split.

Staff Delisting Determination; Hearing Before Hearings Panel

If the Company does not regain compliance within the allotted compliance periods, including any extensions that may be granted by the Staff, the Staff will issue a Staff Delisting Determination notification. The Company would then be entitled to appeal that determination to a Nasdaq hearings panel (the “Hearings Panel”). The Company may, within seven calendar days of the date of the Staff Delisting Determination notification, request a written or oral hearing before the Hearings Panel to review the Staff Delisting Determination. A timely request for a hearing will ordinarily stay the suspension and delisting action pending the issuance of a written Hearings Panel decision. After the hearing, the Hearings Department, on behalf of the Hearings Panel, would issue a Panel decision. If the Hearings Panel were to issue a decision to delist the Common Stock,

the Hearings Department would immediately take action to suspend the trading of the Common Stock. If the Company does not appeal a decision to delist and the Nasdaq Listing and Hearing Review Council does not call the matter for review, Nasdaq would follow specified procedures to submit an application on Form 25 to the Securities and Exchange Commission to strike the Common Stock from listing.

Item 8.01 Other Events.

On December 12, 2023, the Company made available on its website at https://ir.whlr.us/series-d/series-d-redemption an updated form of frequently asked questions (the “Series D Preferred Stock Redemption FAQs”) to assist holders of its Series D Cumulative Convertible Preferred Stock (the “Series D Preferred Stock”) who wish to request that the Company redeem any or all of such holder’s shares of Series D Preferred Stock.

Information contained on the Company’s website is not incorporated by reference into this Current Report on Form 8-K and should not be considered to be part of this Current Report on Form 8-K.

A copy of the Series D Preferred Stock Redemption FAQs is also filed as Exhibit 99.1 to this Current Report on Form 8-K.

Forward-Looking Statements.

This Current Report on Form 8-K includes forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “intends”, “plans”, “seek”, “may”, “will”, and “would”, or the negative of such terms, or other comparable terminology. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, which could cause actual results to differ materially from the forward-looking statements contained herein due to many factors. In particular, no assurances can be made regarding the Company’s ability to regain compliance with the Bid Price Rule and the Compliance Period Rule described above. If the Company is unsuccessful in regaining compliance with such rules, the Company’s Common Stock may be delisted from The Nasdaq Capital Market, which could have a material adverse impact on the Company.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| WHEELER REAL ESTATE INVESTMENT TRUST, INC. |

| |

| By: | | /s/ M. Andrew Franklin |

| | Name: M. Andrew Franklin |

| | Title: Chief Executive Officer and President |

Dated: December 13, 2023

SERIES D CUMULATIVE CONVERTIBLE PREFERRED STOCK

REDEMPTIONS – FREQUENTLY ASKED QUESTIONS

Redemptions

What are Redemptions?

After September 21, 2023, each holder (a “Series D Preferred Holder”) of Series D Cumulative Convertible Preferred Stock (the “Series D Preferred Stock”) of Wheeler Real Estate Investment Trust, Inc. (the “Company”) has the right, at such holder’s option, to request that the Company redeem any or all of such holder’s shares of Series D Preferred Stock on a monthly basis – with redemptions commencing in October 2023 – at a redemption price of $25.00 per share, plus the amount of all accrued but unpaid dividends to and including the redemption date (the “Redemption Price”).

The Redemption Price is payable by the Company, at our option, in cash or in equal value of shares of our common stock, par value $0.01 (the “Common Stock”), or in any combination of cash and shares of Common Stock.

The Company intends to settle redemptions of Series D Preferred Stock in shares of Common Stock.

Redemption Process

What is the process to redeem shares of Series D Preferred Stock?

Stockholders seeking redemption of their Series D Preferred Stock will be required to complete a Holder Redemption Notice and a Stock Ownership Statement (copies of each form are available on the Company’s website at https://ir.whlr.us/series-d/series-d-redemption) and send the two forms to the Company via email at investorrelations@whlr.us or via regular or overnight mail to Computershare, the Company’s transfer and redemption agent. Each Series D Preferred Holder must also arrange for its broker to submit instructions for each Redemption to DTC via its PTOP system. Both actions must occur for a Redemption to be deemed complete.

Fully completed Redemption requests received on or before the 25th day of any month (the “Redemption Request Date”) will be entitled to receive the Redemption Price on the 5th day of the following month or, if such date is not a business day, on the next succeeding business day (such date, the “Holder Redemption Date”).

I own other securities of the Company. Am I eligible to participate in these Redemptions?

Only Series D Preferred Holders are eligible to participate in these Redemptions.

Will the Company pre-screen my Redemption request forms and advise me if I am missing any required information?

If a Series D Preferred Holder has any questions about the Holder Redemption Notice, the Stock Ownership Statement or any other aspect of the Redemptions, please contact Investor Relations at investorrelations@whlr.us. Any incomplete forms that are submitted to the Company will be returned. The Company will not pre-screen any Redemption request forms.

Is the Redemption option available indefinitely?

For so long as you are a holder of the Series D Preferred Stock, and the redemption option is a term of the Series D Preferred Stock, you will have the option to redeem those shares in accordance with the terms of the Series D Preferred Stock. Fully completed Redemption requests received on or before the Redemption Request Date of any month will be entitled to receive the Redemption Price on the next Holder Redemption Date.

I note that the Holder Redemption Form requires certain information about my broker that holds my Series D Preferred Stock. Is any other action required by my broker for me to redeem my Series D Preferred Stock and receive Common Stock in exchange therefor at my brokerage account?

In addition to submitting a Holder Redemption Notice and a Stock Ownership Statement, each Series D Preferred Holder must arrange for its broker to submit instructions for each Redemption to DTC via its PTOP system for the Redemption to be processed.

I note that a prior version of the Holder Redemption Form required medallion signature guarantees. What is that and is it required?

A medallion signature guarantee is one of several special certification stamps that guarantees that a signature authorizing a transfer of securities is in fact authentic. While we initially required a medallion stamp guarantee as part of the Redemption process, we have now determined it is not required and have updated the form accordingly. We will accept signatures on the form without a medallion signature guarantee.

I note that the forms require that they be sent via regular or overnight mail to Computershare or via email to the Company. May I just email the Company the forms?

Yes, either option is available to you. Fully completed redemption forms will be accepted if they are received either via regular or overnight mail by Computershare or via email by the Company by each monthly deadline.

For each Redemption, how will the Company calculate the number of shares of Common Stock to be issued per share of Series D Preferred Stock?

The number of shares of Common Stock to be issued per share of Series D Preferred Stock will be equal to the quotient obtained by dividing (i) the sum of the $25.00 liquidation preference per share of Series D Preferred Stock plus an amount equal to all accrued and unpaid dividends thereon (see section below regarding dividend amount) to and including the Holder Redemption Date (unless the Holder Redemption Date is after a dividend record date of December 30th, March 30th, June 30th or September 30th and prior to the corresponding dividend payment date of January 15th, April 15th, July 15th or October 15th, in which case no additional amount for such accrued and unpaid dividend payment shall be included in this sum) by (ii) the volume weighted average price per share of Common Stock for the ten consecutive trading days immediately preceding, but not including, the Holder Redemption Date as reported on Nasdaq.

Fractional shares of Common Stock will not be issued and instead Computershare shall pay you the amount of the cash value of any entitlement to fractional shares.

What is the first Holder Redemption Date?

October 5, 2023.

How long will it take for the Company deliver the Common Stock following my Redemption?

Delivery of Common Stock will be made as soon as possible after the applicable Holder Redemption Date in accordance with customary settlement cycles.

Dividend and Tax Issues

What is the amount of the dividends per share on the Series D Preferred Stock?

Until September 21, 2023, the Series D Preferred Holders are entitled to receive cumulative cash dividends at a rate of 10.75% per annum of the $25.00 liquidation preference per share, or at $2.6875 per share per annum (the “Current Rate”). Commencing on September 21, 2023, the Series D Preferred Holders will be entitled to cumulative cash dividends at an annual dividend rate of the Current Rate increased by 2% of the liquidation preference per share, which shall increase by an additional 2% of the liquidation preference per share on each subsequent anniversary thereafter, subject to a maximum annual dividend rate of 14%. Dividends are payable quarterly in arrears on or before each Dividend Payment Date of each year.

What are the tax consequences to me as a result of my Redemption of my Series D Preferred Stock?

Redemption of Series D Preferred Stock solely in exchange for Common Stock (whether or not an isolated transaction) is treated as a recapitalization, and therefore as a corporate reorganization, under Section 368(a)(1)(E) of the Internal Revenue Code. Stockholders generally will not recognize gain or loss upon the Redemption of Series D Preferred Stock entirely in exchange for our Common Stock.

However, the lesser of (1) the amount by which the fair market value of the Common Stock received in the Redemption (determined immediately following the Redemption) exceeds the issue price of the Series D Preferred

Stock, or (2) the amount of accumulated and unpaid dividends, will be treated as a deemed distribution of property made by the Company.

For more information on the tax consequences of a Redemption, see “U.S. Federal Income Tax Considerations – U.S. Federal Income Tax Considerations of Redemption or Conversion of Series D Preferred Stock for Common Stock,” beginning on page 61 of the Form S-11 that was filed by the Company with the SEC on September 1, 2023.

The application of the U.S. federal income tax laws to these redemptions is highly complex and, in certain cases, unsettled. Stockholders are urged to consult with their own tax advisors regarding the U.S. federal income tax consequences of any redemption of Series D Preferred Stock for Common Stock.

When will the Company make available the Form 8937 for each Redemption?

On or before the 45th day following each Redemption or, if earlier, January 15 of the year following the calendar year of each Redemption, we will post an IRS Form 8937 with respect to that Redemption on the Company’s website at https://ir.whlr.us/series-d/series-d-redemption.

Non-U.S. Investors

I am an investor located outside the United States. Am I eligible to redeem my Series D Preferred Stock?

Yes.

Stock Registration

I received unregistered shares of Common Stock in redemption of my Series D Preferred Stock in December. What does "unregistered" mean? How are unregistered shares different from registered shares?

“Unregistered” means that shares of Common Stock that you received in redemption of your Series D Preferred Stock in December have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or under any applicable state securities laws. Unregistered shares are different from registered shares in that unregistered shares cannot be freely sold through a stock exchange.

Are unregistered shares of Common Stock "restricted"?

Yes. Your unregistered shares of Common Stock are restricted because they may not be sold without an effective registration statement under the Securities Act or an opinion of counsel in a form satisfactory to the Company that such registration is not required under the Securities Act.

Why did the Company issue me unregistered shares?

The significant declines and ongoing material fluctuations in the Company’s Common Stock price coupled with the unpredictable volume of monthly Series D Preferred Stock redemption requests have made it extremely challenging for the Company to plan for sufficient registered shares of Common Stock to meet the ongoing monthly redemption requests. Accordingly, the Company plans to issue unregistered shares of Common Stock to meet the ongoing monthly redemption requests until the Company has registered enough shares of Common Stock to provide registered shares to cover the entirety of the remaining issue of Series D Preferred Stock.

Where are my unregistered shares of Common Stock located?

Your unregistered shares of Common Stock sit on the books and records of Computershare, the Company’s transfer and redemption agent, where the Company has established an account for you in your name. If you have not already received one, you can request an account statement by emailing Katie Minyard of Computershare at Kathryn.Minyard@computershare.com.

Can I move my unregistered shares to my account at my broker?

Your unregistered shares can be held only where they are issued – on the books of Computershare – until the restriction is removed. The restriction will be removed following the effectiveness of a registration statement under the Securities Act with respect to these shares.

Does the Company plan to register my unregistered shares?

Yes. The Company plans to register the unregistered shares issued in the December 2023 Common Stock issuance and any unregistered shares issued in subsequent monthly Series D Preferred Stock redemption cycles.

When will the Company begin issuing registered shares of Common Stock again for the Series D Preferred Stock redemptions?

As described above, the Company plans to issue unregistered shares of Common Stock to meet the ongoing monthly redemption requests until the Company has registered enough shares of Common Stock to provide registered shares to cover the entirety of the remaining issue of Series D Preferred Stock. Efforts are underway to register the shares. But it is unclear that this process will be complete by the time of the January redemption cycle and may continue beyond that.

Forward-Looking Statements

This Frequently Asked Questions contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “will,” “can”, “may”, and “plans,” or the negative of such terms, or other comparable terminology, and include statements about the Company’s intention to register unregistered shares of Common Stock. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, which could cause actual results to differ materially from the forward-looking statements contained herein due to many factors. These forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this Current Report on Form 8-K, and the Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statement contained herein, or to reflect any change in our expectations with regard thereto or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by applicable law.

v3.23.3

Cover

|

Dec. 07, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 07, 2023

|

| Entity Registrant Name |

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-35713

|

| Entity Tax Identification Number |

45-2681082

|

| Entity Address, Address Line One |

2529 Virginia Beach Blvd

|

| Entity Address, City or Town |

Virginia Beach

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23452

|

| City Area Code |

757

|

| Local Phone Number |

627-9088

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001527541

|

| Amendment Flag |

false

|

| Common Stock, $0.01 par value per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

WHLR

|

| Security Exchange Name |

NASDAQ

|

| Series B Convertible Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series B Convertible Preferred Stock

|

| Trading Symbol |

WHLRP

|

| Security Exchange Name |

NASDAQ

|

| Series D Cumulative Convertible Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series D Cumulative Convertible Preferred Stock

|

| Trading Symbol |

WHLRD

|

| Security Exchange Name |

NASDAQ

|

| 7.00% Subordinated Convertible Notes due 2031 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.00% Subordinated Convertible Notes due 2031

|

| Trading Symbol |

WHLRL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_ConvertibleSubordinatedDebtMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

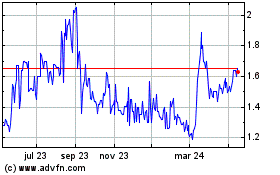

Wheeler Real Estate Inve... (NASDAQ:WHLRP)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

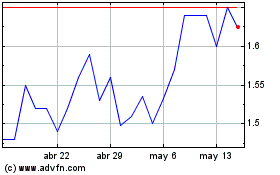

Wheeler Real Estate Inve... (NASDAQ:WHLRP)

Gráfica de Acción Histórica

De May 2023 a May 2024