The Datavault Intellectual Property Portfolio

Adds Coveted Blockchain Utilities and Patented DataValue®

and DataScore® Supercomputer Software Applications

These Datavault Patents Comprise Part of the

Asset Purchase by WiSA Technologies, Inc.

Data Vault Holdings, Inc.®, a private company leading the way in

data visualization, valuation, and monetization, which has entered

into a definitive asset purchase agreement to sell its Datavault®

and ADIO® IP and IT assets to WiSA Technologies, Inc. (“WiSA

Technologies” or the “Company”) (NASDAQ: WISA), a leading provider

of immersive, wireless sound technology for intelligent devices and

next-generation home entertainment systems, today announced its

Datavault operation has received three new patents and one new

allowance from the United States Patent Office and related

International Publication of its now patented innovations.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241030615306/en/

“By leveraging data aggregation and strategy-based automation

intelligence, we are providing a faster, more accurate way to

generate data including tax returns and other perfunctory and

automated data sources,” stated Nathaniel Bradley, CEO of Data

Vault Holdings. “These newly issued and allowed patents to Data

Vault Holdings are testament to our foresight in recognizing the

need for automated meta layer solutions across industries,

including a strong presence in professional and legal services,

fintech, and life sciences. The technology provides a foundation

for understanding the value of data we create, and even the data we

produce in our daily lives, which can be valuable and securely

monetized. These patents add to our extensive portfolio of

intellectual property, which showcases the diversity of our

solutions across multiple sectors.”

“Datavault’s dedication to innovation within blockchain,

machine learning, and supercomputer-enabled artificial intelligence

has yielded impressive patent and trademark portfolios,”

said Brian Owens, a veteran patent attorney from Goodhue, Coleman

& Owens, P.C. “DataValue, DataScore and The Information Data

Exchange represent technology inventions with great utility in many

fields, and it’s gratifying to see these inventions validated

through these recent issuances and publications of Data Vault

Holdings.”

Patents Received and Allowed Datavault received the

following United States Patents:

- Platform for Management of User Data, U.S. Patent

12,100,025, was issued on September 24, 2024, and a U.S. Patent

11,960,622 was issued on April 16, 2024.

- These are Datavault’s second and third patents received

cover blockchain and secure token driven data scoring,

valuation, visualization and monetization on its patented

Information Data Exchange®.

- Triggered Responses to Real-time Electroencephalography,

U.S. Patent 12,020,787 was issued on June 25, 2024. It is the

second in a family of life sciences patents with innovations in

Brain Computer Interface BCI technologies which the Datavault

invention teaches a secure, privacy protected and non-invasive

neurological data capture and the integration of automated data

capture through mobile biometric sensors.

In addition, on September 10, 2024, Datavault received notice of

allowance for its Platform and Method for Preparing a Tax

Return, U.S. patent application number 17/507,459. This

blockchain solution provides more efficient scoring, valuation,

visualization of and Information Data Exchange monetization of

accounting and tax data and enables the creation of tax returns. It

allows independent business operators to automate via artificial

intelligence and machine learning, enhanced systems to create,

anonymize and monetize data through Datavault’s Information Data

Exchange®.

Markets for These Innovations SkyQuest projected in

September 2024 that the Data Monetization Market will attain a

value of $17 billion by 2031, with a CAGR of 10.7% from 2024 to

2031. Growing adoption of digital transformation initiatives around

the world and rising demand for data across all industry verticals

are fueling the demand for data monetization. Increasing

realization of the importance of data in business operations and

success is also expected to favor data monetization market

development across the study period and beyond.

The global neurology market size was $3.3 billion in 2023,

growing to $3.6 billion in 2024, and expected to reach around $71

billion by 2033, expanding at a compound annual growth rate of 7.6%

from 2024 to 2033.1 Neuralink (Link), a private company founded by

Elon Musk, has achieved a market cap in excess of $5.0 billion.2

Neuralink is developing a fully-implanted, wireless, high-channel

count, brain-computer interface (BCI). Datavault’s innovations

provide for a non-evasive augmentation to BCI systems as well as

standalone data display, valuation and monetization

capabilities.

Automation is rapidly transforming the tax preparation industry.

According to Deloitte’s Tax in a Data-Driven World report, many

organizations are increasingly adopting automation technologies to

manage large volumes of financial data. In fact, 41% of

organizations have already implemented automation tools for

tax-related processes3 reflecting the growing need for solutions

that reduce manual effort and improve speed and accuracy. As tax

preparation becomes more complex with evolving financial

regulations, automated platforms like those based on Data Vault

Holding’s new patent will play a critical role in reducing the time

and resources required to manage tax data.

1 Neurology Market Revenue and Trends, Precedence

Research, Press Release July 19, 2024 2 Musk's

Neuralink valued at about $5 billion despite long road to market |

Reuters, June 5, 2023 3 Deloitte: Tax in a Data-Driven

World#Figure 1:

https://www.deloitte.com/content/dam/assets-shared/docs/services/tax/2024/dttl-tax-technology-report-2023.pdf

Summary of WiSA Technologies & Data Vault Holdings

Proposed Asset Purchase As announced on September 4, 2024, WiSA

Technologies, Inc. entered a definitive asset purchase agreement to

purchase the Datavault® and ADIO® intellectual property and

information technology assets of privately held Data Vault Holdings

(the “Asset Purchase”). Subject to customary closing conditions and

approval by the stockholders of WiSA Technologies, the closing is

expected in Q1 2025. A webcast about the transaction is accessible

under the Investors section of WiSA Technologies’ website.

About Data Vault Holdings Inc. Data Vault Holdings is a

technology holding company that provides a proprietary, cloud-based

platform for the delivery of blockchain objects. Data Vault

Holdings provides businesses with the tools to monetize data assets

securely over its Information Data Exchange® (IDE). The company is

in the process of finalizing the consolidation of its affiliates

Data Donate Technologies, Inc., ADIO LLC, and Datavault Inc. as

wholly owned subsidiaries under one corporate structure. Learn more

about Data Vault Holdings here.

Cautionary Note Regarding Forward-Looking Statements This

press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended. These forward-looking statements, include,

among others, the Company’s and Data Vault Holdings’ (“Datavault”)

expectations with respect to the proposed asset purchase (the

“Asset Purchase”) between them, including statements regarding the

benefits of the Asset Purchase, the anticipated timing of the Asset

Purchase, the implied valuation of Datavault, the products offered

by Datavault and the markets in which it operates, and the

Company’s and Datavault’s projected future results and market

opportunities. Readers are cautioned not to place undue reliance on

these forward-looking statements. Actual results may differ

materially from those indicated by these forward-looking statements

as a result of a variety of factors, including, but are not limited

to: (i) risks and uncertainties impacting WiSA’s business

including, risks related to WiSA’s current liquidity position and

the need to obtain additional financing to support ongoing

operations, WiSA’s ability to continue as a going concern, WiSA’s

ability to maintain the listing of its common stock on Nasdaq,

WiSA’s ability to predict the timing of design wins entering

production and the potential future revenue associated with design

wins, WiSA’s ability to predict its rate of growth, WiSA’s ability

to predict customer demand for existing and future products and to

secure adequate manufacturing capacity, consumer demand conditions

affecting WiSA’s customers’ end markets, WiSA’s ability to hire,

retain and motivate employees, the effects of competition on WiSA’s

business, including price competition, technological, regulatory

and legal developments, developments in the economy and financial

markets, and potential harm caused by software defects, computer

viruses and development delays, (ii) risks related to the Asset

Purchase, including WiSA’s ability to close the Asset Purchase in a

timely manner or at all, or on the terms anticipated, whether due

to WiSA’s ability to satisfy the applicable closing conditions and

secure stockholder approval from its stockholders or otherwise, as

well as risks related to WiSA’s ability to realize some or all of

the anticipated benefits from the Asset Purchase, (iii) any risks

that may adversely affect the business, financial condition and

results of operations of Datavault, including but not limited to

cybersecurity risks, the potential for AI design and usage errors,

risks related to regulatory compliance and costs, potential harm

caused by data privacy breaches, digital business interruption and

geopolitical risks, and (iv) other risks as set forth from time to

time in WiSA’s filings with the U.S. Securities and Exchange

Commission. The information in this press release is as of the date

hereof and neither the Company nor Datavault undertakes any

obligation to update such information unless required to do so by

law. The reader is cautioned not to place under reliance on forward

looking statements. Neither the Company nor Datavault gives any

assurance that either the Company or Datavault will achieve its

expectations.

This press release shall not constitute a solicitation of a

proxy, consent or authorization with respect to any securities or

in respect of the proposed Asset Purchase. This press release shall

not constitute an offer to sell, or the solicitation of an offer to

buy, nor will there be any sale of these securities in any state or

other jurisdiction in which such offer, solicitation or sale would

be unlawful prior to the registration or qualification under the

securities laws of such state or jurisdiction. No offering of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act, or an

exemption therefrom.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030615306/en/

Investors Contact for WiSA Technologies and Data Vault

Holdings: David Barnard, LHA Investor Relations, 415-433-3777,

wisa@lhai.com

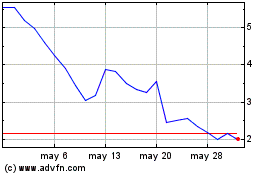

WiSA Technologies (NASDAQ:WISA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

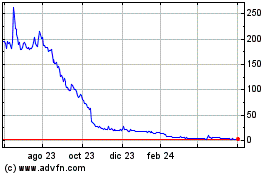

WiSA Technologies (NASDAQ:WISA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024