- Increases revenue 240% in Q3 2024 from Q2

2024 -

WiSA Technologies, Inc. (NASDAQ: WISA), which is in a definitive

agreement to acquire AI, blockchain and Data Web 3.0 IP assets of

Data Vault Holdings, Inc.® (“Data Vault”) to form a data technology

& licensing company leveraging IP & proprietary HPC

software, reported third quarter 2024 financial results in its Form

10-Q, which was filed on November 14, 2024. In its conference call

and presentation today at 8:00 am PT / 11:00 am ET, WiSA CEO Brett

Moyer will discuss the Company’s results and provide a general

business update.

“In Q3 2024, we delivered 240% sequential revenue growth, driven

by both WiSA HT and our new WiSA E IP being in production with a

multi-national licensee,” said Brett Moyer, CEO of WiSA

Technologies. “With WiSA E TX intellectual property now shipping in

media boxes with android OS and expected to be in stores for

Christmas, we expect to further this momentum with additional

design wins and production advancements in 2025. Further leveraging

our WiSA E technology, we are expanding the addressable market by

adapting this software for Linux implementations in 2025.”

WiSA Technologies Q3 2024 and Recent Operating

Highlights

- Hired Stanley Mbugua as Vice President of Finance, who will

also assume the role of Chief Accounting Officer, effective

November 30, 2024.

- Achieved WiSA E wireless milestone with immersive audio

software embedded onto an Amlogic reference design, which became

available for customer implementation and showcased the IBC show in

Amsterdam.

- Executed licensing agreements with leading HDTV brands,

covering 43% of the HDTV market that uses the Android operating

system.

Q3 2024 and Subsequent Financial Highlights

- Q3 2024 revenue was $1.2 million, up 52% from $0.8 million in

Q3 2023. The increase in revenue was a result of an increase in

Components sales of $0.7 million, partially offset by a decrease in

Consumer Audio Product sales of $0.3 million.

- Q3 2024 gross margin as a percentage of sales was 19%, compared

to negative 217% in Q3 2023. The improvement in gross margin

compared to the prior period is mainly attributable to an increase

of $0.4 million increase in revenue between comparison periods and

due to the fact that Q3 2023 included a $1.4 million increase in

inventory reserves whereas Q3 2024 had only a nominal increase in

inventory reserves.

- Held $3.9 million cash at September 30, 2024.

WiSA Technologies Investor Conference Call

Management will host its third quarter 2024 results conference

call at 8:00 am PT / 11:00 am ET, on Friday, November 15, 2024.

The conference call will be available through a live webcast

found here: Webcast | Third Quarter 2024 Results

Those without internet access or who wish to dial in may call:

1-833-366-1124 (domestic), or 1-412-317-0702 (international). All

callers should dial in approximately 10 minutes prior to the

scheduled start time and ask to be joined into the WiSA

Technologies call.

A webcast replay of the call will be available approximately one

hour after the end of the call and will be available for 90 days,

at the above webcast link. A telephonic replay of the call will be

available through November 22, 2024, and may be accessed by calling

1- 877-344-7529 (domestic) or 1- 412-317-0088 (international) or

Canada (toll free) 855-669-9658 and using access code 4877124.

A presentation of the Q3 2024 results will be accessible on

Friday, November 15, 2024, under the “Investors” section of WiSA

Technologies’ website.

About WiSA Technologies, Inc.

WiSA is a leading provider of immersive, wireless sound

technology for intelligent devices and next-generation home

entertainment systems. Working with leading CE brands and

manufacturers such as Harman International, a division of Samsung;

LG; Hisense; TCL; Bang & Olufsen; Platin Audio; and others, the

company delivers immersive wireless sound experiences for

high-definition content, including movies and video, music, sports,

gaming/esports, and more. WiSA Technologies, Inc. is a founding

member of WiSA™ (the Wireless Speaker and Audio Association) whose

mission is to define wireless audio interoperability standards as

well as work with leading consumer electronics companies,

technology providers, retailers, and ecosystem partners to

evangelize and market spatial audio technologies driven by WiSA

Technologies, Inc. The company is headquartered in Beaverton, OR

with sales teams in Taiwan, China, Japan, Korea, and

California.

About Data Vault Holdings, Inc.

Data Vault Holdings Inc. is a technology holding company that

provides a proprietary, cloud-based platform for the delivery of

blockchain objects. Data Vault Holdings Inc. provides businesses

with the tools to monetize data assets securely over its

Information Data Exchange® (IDE). The company is in the process of

finalizing the consolidation of its affiliates Data Donate

Technologies, Inc., ADIO LLC, and Datavault Inc. as wholly owned

subsidiaries under one corporate structure. Learn more about Data

Vault Holdings Inc. here.

LEGAL DISCLAIMER

Forward-Looking Statements

This press release of WiSA Technologies, Inc. (NASDAQ: WISA)

(the “Company”, “us”, “our” or “WiSA”) contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements, include, among others, the Company’s and Data Vault

Holdings, Inc.’s (“Datavault”) expectations with respect to the

proposed asset purchase (the “Asset Purchase) between them,

including statements regarding the benefits of the Asset Purchase,

the anticipated timing of the Asset Purchase, the implied valuation

of Datavault, the products offered by Datavault and the markets in

which it operates, and the Company’s and Datavault’s projected

future results and market opportunities, as well as information

with respect to WiSA’s future operating results and business

strategy. Readers are cautioned not to place undue reliance on

these forward-looking statements. Actual results may differ

materially from those indicated by these forward-looking statements

as a result of a variety of factors, including, but are not limited

to: (i) risks and uncertainties impacting WiSA’s business

including, risks related to its current liquidity position and the

need to obtain additional financing to support ongoing operations,

WiSA’s ability to continue as a going concern, WiSA’s ability to

maintain the listing of its common stock on Nasdaq, WiSA’s ability

to predict the timing of design wins entering production and the

potential future revenue associated with design wins, WiSA’s

ability to predict its rate of growth, WiSA’s ability to predict

customer demand for existing and future products and to secure

adequate manufacturing capacity, consumer demand conditions

affecting WiSA’s customers’ end markets, WiSA’s ability to hire,

retain and motivate employees, the effects of competition on WiSA’s

business, including price competition, technological, regulatory

and legal developments, developments in the economy and financial

markets, and potential harm caused by software defects, computer

viruses and development delays, (ii) risks related to the Asset

Purchase, including WiSA’s ability to close the Asset Purchase in a

timely manner or at all, or on the terms anticipated, whether due

to WiSA’s ability to satisfy the applicable closing conditions and

secure stockholder approval from WiSA stockholders or otherwise, as

well as risks related to WiSA’s ability to realize some or all of

the anticipated benefits from the Asset Purchase, (iii) any risks

that may adversely affect the business, financial condition and

results of operations of Datavault, including but not limited to

cybersecurity risks, the potential for AI design and usage errors,

risks related to regulatory compliance and costs, potential harm

caused by data privacy breaches, digital business interruption and

geopolitical risks, and (iv) other risks as set forth from time to

time in WiSA’s filings with the U.S. Securities and Exchange

Commission (the “SEC”). The information in this press release is as

of the date hereof and neither the Company nor Datavault undertakes

any obligation to update such information unless required to do so

by law. The reader is cautioned not to place under reliance on

forward looking statements. Neither the Company nor Datavault gives

any assurance that either the Company or Datavault will achieve its

expectations.

This press release shall not constitute an offer to sell, or the

solicitation of an offer to buy, nor will there be any sale of

these securities in any state or other jurisdiction in which such

offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of such

state or jurisdiction. No offering of securities shall be made

except by means of a prospectus meeting the requirements of Section

10 of the Securities Act, or an exemption therefrom.

Additional Information and Where to Find It

In connection with the proposed Asset Purchase, WiSA intends to

file with the SEC a definitive proxy statement. The definitive

proxy statement for WiSA (if and when available) will be mailed to

stockholders of WiSA. WISA STOCKHOLDERS ARE URGED TO READ THE PROXY

STATEMENT AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

ASSET PURCHASE.

WiSA stockholders will be able to obtain free copies of these

documents (if and when available) and other documents containing

important information about WiSA and Data Vault, once such

documents are filed with the SEC, through the website maintained by

the SEC at http://www.sec.gov. Copies of the documents filed with

the SEC will also be made available free of charge by contacting

WiSA using the contact information below.

Participants in the Solicitation

WISA and its directors, executive officers and other members of

its management and employees may be deemed to be participants in

the solicitation of proxies from WiSA’s stockholders in connection

with the Asset Purchase. Stockholders are urged to carefully read

the proxy statement regarding the Asset Purchase when it becomes

available, because it will contain important information.

Information regarding the persons who may, under the rules of the

SEC, be deemed participants in the solicitation of WiSA’s

stockholders in connection with the Asset Purchase will be set

forth in the proxy statement when it is filed with the SEC.

Information about WiSA’s executive officers and directors will be

set forth in the proxy statement relating to the Asset Purchase

when it becomes available. You can obtain free copies of these and

other documents containing relevant information at the SEC’s web

site at www.sec.gov or by directing a request to the address or

phone number set forth below.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241115061441/en/

For further information, please contact: WiSA Technologies, Inc.

15268 NW Greenbrier Pkwy Beaverton, OR 97006 (408) 627-4716

Investors Contact for WiSA Technologies and Data Vault

Holdings: David Barnard, Alliance Advisors Investor Relations,

415-433-3777, wisa@lhai.com

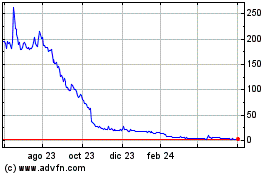

WiSA Technologies (NASDAQ:WISA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

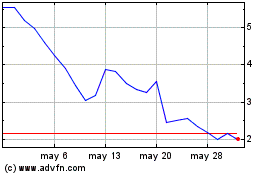

WiSA Technologies (NASDAQ:WISA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024