0001083301FALSENasdaq00010833012024-04-022024-04-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 13, 2024

TERAWULF INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-41163 | 87-1909475 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

9 Federal Street

Easton, Maryland 21601

(Address of principal executive offices) (Zip Code)

(410) 770-9500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value per share | WULF | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On May 13, 2024, TeraWulf Inc. (“TeraWulf” or the “Company”) issued a press release (“Press Release”) announcing the Company’s results for the first quarter ended March 30, 2024. The Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On May 13, 2024, the Company posted a presentation to its website at https://investors.terawulf.com (the “Presentation”). A copy of the Presentation is furnished as Exhibit 99.2 to this Report. The Company expects to use the Presentation, in whole or in part, and possibly with modifications, in connection with the earnings call with investors, analysts and others.

The information contained in the Presentation is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission (“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Presentation speaks only as of the date of this Report. The Company undertakes no duty or obligation to publicly update or revise the information contained in the Presentation, although it may do so from time to time. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure. In addition, the exhibit furnished herewith contains statements intended as “forward-looking statements” that are subject to the cautionary statements about forward-looking statements set forth in such exhibit. By furnishing the information contained in the Presentation, the Company makes no admission as to the materiality of any information in the Presentation that is required to be disclosed solely by reason of Regulation FD.

The information contained in Items 2.02 and 7.01 of this Report (as well as in Exhibits 99.1 and 99.2 attached hereto) is furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and such information shall not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104.1 | | Cover Page Interactive Data File (embedded within the inline XBRL document). |

Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of TeraWulf’s management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) conditions in the cryptocurrency mining industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors

affecting the cost, efficiency and profitability of cryptocurrency mining; (2) competition among the various providers of cryptocurrency mining services; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf’s operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining; (4) the ability to implement certain business objectives and to timely and cost-effectively execute integrated projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations; (6) loss of public confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation; (7) adverse geopolitical or economic conditions, including a high inflationary environment; (8) the potential of cybercrime, money-laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break-down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing); (9) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and infrastructure equipment meeting the technical or other specifications required to achieve its growth strategy; (10) employment workforce factors, including the loss of key employees; (11) litigation relating to TeraWulf and/or its business; (12) potential differences between the unaudited results disclosed in this release and the Company’s final results when disclosed in its Annual Report on Form 10-K as a result of the completion of the Company’s final adjustments, annual audit by the Company’s independent registered public accounting firm, and other developments arising between now and the disclosure of the final results; and (13) other risks and uncertainties detailed from time to time in the Company’s filings with the SEC. Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company’s filings with the SEC, which are available at www.sec.gov.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | |

| TERAWULF INC. |

| |

| By: | /s/ Patrick A. Fleury |

| Name: | Patrick A. Fleury |

| Title: | Chief Financial Officer |

Dated: May 13, 2024

TeraWulf Reports First Quarter 2024 Financial Results

Self-mined 1,057 bitcoin in Q1 2024, an 8.9% increase over Q4 2023, on a total installed hashrate of 8.0 EH/s.

Q1 2024 revenue grows 82.2% over Q4 2023 to $42.4 million.

Q1 2024 Non-GAAP Adjusted EBITDA increases 95.4% over Q4 2023 to $32.0 million.

Paid down approximately $63.6 million of debt so far in 2024, demonstrating the power of low-cost, profitable operations.

On track to reach ~10.2 EH/s in Q3 2024, with plans to grow to ~13.3 EH/s by Q1 2025.

EASTON, Md. – May 13, 2024 – TeraWulf Inc. (Nasdaq: WULF) (“TeraWulf” or the “Company”), which owns and operates vertically integrated, domestic bitcoin mining facilities powered by 95% zero-carbon energy, today announced its unaudited interim financial results for the first quarter of fiscal year 2024 and provided an operational update.

First Quarter 2024 GAAP Operational and Financial Highlights

•Self-mined 767 bitcoin at the Lake Mariner Facility and realized another 6 bitcoin earned from profit sharing associated with a hosting agreement.

•Revenue increased to $42.4 million in Q1 2024 compared to $23.3 million in Q4 2023.

•Gross profit (exclusive of depreciation) increased to $28.0 million in Q1 2024 compared to $14.4 million in Q4 2023.

•Total installed hashrate capacity at the Lake Mariner Facility of 6.1 EH/s as of March 31, 2024, representing an increase of 205.0% relative to the same prior year period.

•Announced new miner purchase and option agreement with Bitmain, including 5,000 Antminer S21 bitcoin miners for a total price of $17.5 million, which has been fully paid. The miners are expected to be delivered to the Lake Mariner Facility in the second quarter of 2024. The Company also made a $9.6 million deposit on an additional 30,000 miners with secured pricing of approximately $16.00 per terahash.

| | | | | | | | | | | |

| Key GAAP Metrics ($ in thousands) | Three Months Ended Q1 2024 | Three Months Ended Q4 2023 | % Change |

| Revenue | $ | 42,433 | | $ | 23,285 | | 82.2 | % |

Gross profit (exclusive of depreciation) | $ | 28,025 | | $ | 14,353 | | 95.3 | % |

| Gross profit margin | 66.0 | % | 61.6 | % | 7.1 | % |

First Quarter 2024 Non-GAAP Operational and Financial Highlights

•Self-mined 1,057 bitcoin across the Lake Mariner and Nautilus Cryptomine facilities, inclusive of 6 bitcoin earned from profit sharing associated with a hosting agreement at the Lake Mariner Facility.

•Total value of bitcoin self-mined1 of $56.8 million2 in Q1 2024 compared to $35.2 million3 in Q4 2023.

•Power cost per bitcoin self-mined increased quarter-over-quarter, to $15,501 per bitcoin in Q1 2024 from $10,308 per bitcoin in Q4 2023 , due to the 15.5% increase in network difficulty. during the period and higher realized energy prices at the Lake Mariner Facility in New York.

•Adjusted EBITDA increased 95.4% to $32.0 million in Q1 2024 compared to $16.4 million in Q4 2023.

| | | | | | | | | | | |

| Key Non-GAAP Metrics4 | Three Months Ended Q1 2024 | Three Months Ended Q4 2023 | % Change |

| Bitcoin Self-Mined5 | 1,057 | | 971 | | 8.9 | % |

| Value per Bitcoin Self-Mined6 | $ | 53,750 | | $ | 36,300 | | 48.1 | % |

| Power Cost per Bitcoin Self-Mined7 | $ | 15,501 | | $ | 10,308 | | 50.4 | % |

| Avg. Operating Hash Rate (EH/s)8 | 6.8 | | 5.1 | | 33.3 | % |

Management Commentary

"During the first quarter, TeraWulf delivered outstanding results, setting a new benchmark for profitability among publicly traded bitcoin miners," stated Paul Prager, CEO of TeraWulf. "During this period, we also further solidified our financial foundation by reducing debt and augmenting our cash reserves."

1 Includes BTC earned from profit sharing associated with a hosting agreement that expired in February 2024 at the Lake Mariner Facility and TeraWulf's net share of BTC produced at the Nautilus Cryptomine Facility.

2 Values profit share BTC at $53,750 per BTC as opposed to $38,000 per BTC, which was the quoted price of bitcoin in the Company’s principal market at the time of hosting contract inception.

3 Values profit share BTC at $36,300 per BTC as opposed to $38,000 per BTC, which was the quoted price of bitcoin in the Company’s principal market at the time of hosting contract inception.

4 The Company’s share of the earnings or losses of operating results at the Nautilus Cryptomine Facility is reflected within “Equity in net income (loss) of investee, net of tax” in the consolidated statements of operations. Accordingly, operating results of the Nautilus Cryptomine Facility are not reflected in revenue, cost of revenue or cost of operations lines in TeraWulf’s consolidated statements of operations. The Company uses these metrics as indicators of operational progress and effectiveness and believes they are useful to investors for the same purposes and to provide comparisons to peer companies. All figures except Bitcoin Self-Mined are estimates.

5 Includes BTC earned from profit sharing associated with a hosting agreement that expired in February 2024 at the Lake Mariner Facility and TeraWulf’s net share of BTC produced at the Nautilus Cryptomine Facility.

6 Computed as the weighted-average opening price of BTC on each respective day the Self-Mined Bitcoin is earned. Excludes value earned from hosting contract, which expired in February 2024, for which the quoted price of BTC in the Company’s principal market at the time of contract inception was approximately $38,000.

7 The Q1 2024 and Q4 2023 calculations exclude 6 and 13 bitcoin, respectively, earned via hosting profit share.

8 While nameplate inventory for TeraWulf’s two facilities is 8.0 EH/s, inclusive of gross total hosted miners, actual monthly hash rate performance depends on a variety of factors, including (but not limited to) performance tuning to increase efficiency and maximize margin, scheduled outages (scopes to improve reliability or performance), unscheduled outages, curtailment due to participation in various cash generating demand response programs, derate of ASICS due to adverse weather and ASIC maintenance and repair.

"Capital efficiency remains central to our strategic approach. Our focus on sustainable and prudent growth underscores our commitment to maximizing returns on invested capital," Prager emphasized. "We take pride in outperforming our competitors in terms of profit generation per exahash while minimizing shareholder dilution. This quarter's performance underscores our dedication to delivering tangible value.”

"Our extensive 600 megawatts of owned and scalable digital infrastructure capacity form the cornerstone of our competitive edge. This infrastructure uniquely positions us, enabling the leveraging of our industry-leading bitcoin mining as the foundational element for developing an alternative compute hosting business. This move is perfectly aligned with the escalating demand for high-power data center capacity," continued Prager.

"We're actively exploring opportunities with various stakeholders, ranging from hyperscalers to enterprise-level clients, to leverage our more than 300 megawatts of available infrastructure capacity," Prager continued. "With access to low-cost, zero-carbon power, we are well-positioned to meet the escalating demand for sustainable computing solutions. As we near the completion of Building 4 and begin construction on Building 5 at Lake Mariner, we are strategically expanding our bitcoin mining hash rate while concurrently developing a robust high-performance computing offering. This dual-pronged approach positions us favorably to capitalize on emerging opportunities in both markets.”

Production and Operations Update

As of March 31, 2024, TeraWulf had an operational miner fleet consisting of approximately 66,900 of the latest generation miners. This fleet was divided between the Company’s two locations: the wholly owned Lake Mariner Facility in New York and the nuclear-powered Nautilus Cryptomine Facility in Pennsylvania. The Lake Mariner Facility housed 51,100 miners, while the Nautilus Cryptomine Facility had 15,800 self-miners. The total installed hashrate across both sites was 8.0 EH/s, with a total operational capacity of 210 MW.

TeraWulf is currently expanding mining operations at its wholly owned Lake Mariner Facility in New York with the addition of Building 4, which is expected to increase the facility’s bitcoin mining infrastructure capacity from its current 160 MW to 195 MW by mid 2024, which is expected to further increase TeraWulf’s total operational capacity to more than 10.0 EH/s. The Company has also recently initiated construction activities for Building 5 at the Lake Mariner Facility, which is expected to add an incremental 50 MW of bitcoin mining capacity, bringing TeraWulf’s total operational capacity to approximately 300 MW by the first quarter of 2025.

In Pennsylvania, the Company currently has 50 MW of operational mining capacity at the Nautilus Cryptomine Facility, a joint venture with Cumulus Coin, LLC. TeraWulf’s additional 50 MW of expansion capacity at the Nautilus Cryptomine Facility is planned to come online in 2025, accommodating up to 2.5 EH/s of additional operational mining capacity at the site.

As previously announced, the Company is finalizing the design for a large-scale, high-performance computing (HPC) / AI project at the Lake Mariner Facility and has committed an initial 2 MW block of power, capable of deploying thousands of the latest generation graphics processing units (GPUs). The Company has upgraded the internet interconnection at the Lake Mariner Facility to align with bandwidth requirements of AI, designed closed loop liquid cooling, and power supply for 100% redundancy in support of the project.

Miner Purchase Agreements

During the first quarter of 2024, the Company entered into a new miner purchase and option agreement with Bitmain for the purchase of S21 miners. In connection with this agreement, the Company has paid $17.5 million for 5,000 S21 miners, which are expected to be delivered in the second quarter of 2024 and occupy Building 4 at the Lake Mariner Facility. TeraWulf has also made a deposit of $9.6 million towards an additional 30,000 miners with secured pricing of approximately $16.00 per terahash.

First Quarter 2024 GAAP Financial Results

Revenue in the first quarter of 2024 increased 82.2% to $42.4 million as compared to $23.3 million in the fourth quarter of 2023. This increase is attributable to a significant growth in operating self-mining hashrate as well as a higher average bitcoin price relative to the fourth quarter of 2023. Notably, revenue and expenses reported in the TeraWulf GAAP income statement excludes revenue and expenses from the Nautilus joint venture; the net financial impact of the Nautilus joint venture is captured within equity in net income (loss) of investee, net of tax in the consolidated statements of operations.

Gross profit in the first quarter of 2024 increased 95.3% to $28.0 million compared to $14.4 million in the fourth quarter of 2023. Gross profit margin as a percentage of revenue increased to 66.0% in the first quarter of 2024 compared to 61.6% in the fourth quarter of 2023, primarily driven by a 33.3% increase in average operating hashrate and 48.1% increase in average value per bitcoin self-mined quarter-over-quarter.

During the first quarter of 2024, the Company repaid $33.4 million of debt, followed by an additional $30.2 million repayment in April 2024, collectively reducing the debt balance to $75.8 million. In total, the Company has reduced its debt balance by $70.2 million since the start of the fourth quarter of 2023, with $51.6 million of this repayment funded by cash flow from operations and only $18.6 million from equity proceeds.

About TeraWulf

TeraWulf (Nasdaq: WULF) owns and operates vertically integrated, environmentally clean bitcoin mining facilities in the United States. Led by an experienced group of energy entrepreneurs, the Company currently has two bitcoin mining facilities: the wholly owned Lake Mariner Facility in New York, and Nautilus Cryptomine Facility in Pennsylvania, a joint venture with Cumulus Coin, LLC. TeraWulf generates domestically produced bitcoin powered primarily by nuclear and hydro energy with a goal of utilizing 100% zero-carbon energy. With a core focus on ESG that ties directly to its business success, TeraWulf expects to offer attractive mining economics at an industrial scale.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are

based on the current expectations and beliefs of TeraWulf’s management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) conditions in the cryptocurrency mining industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors affecting the cost, efficiency and profitability of cryptocurrency mining; (2) competition among the various providers of cryptocurrency mining services; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf’s operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining, and/or regulation regarding safety, health, environmental and other matters, which could require significant expenditures; (4) the ability to implement certain business objectives and to timely and cost-effectively execute integrated projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations; (6) loss of public confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation; (7) adverse geopolitical or economic conditions, including a high inflationary environment; (8) the potential of cybercrime, money-laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break-down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing); (9) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and infrastructure equipment meeting the technical or other specifications required to achieve its growth strategy; (10) employment workforce factors, including the loss of key employees; (11) litigation relating to TeraWulf and/or its business; and (12) other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”). Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company’s filings with the SEC, which are available at www.sec.gov.

Company Contact:

Jason Assad

Director of Corporate Communications

assad@terawulf.com

(678) 570-6791

CONSOLIDATED BALANCE SHEETS

AS OF MARCH 31, 2024 AND DECEMBER 31, 2023

(In thousands, except number of shares and par value)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| (unaudited) | | |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 45,824 | | | $ | 54,439 | |

| Digital currency | 2,018 | | | 1,801 | |

| | | | | | | | | | | |

| Prepaid expenses | 3,973 | | | 4,540 | |

| Other receivables | 1,668 | | | 1,001 | |

| Other current assets | 873 | | | 806 | |

| Total current assets | 54,356 | | | 62,587 | |

| Equity in net assets of investee | 91,866 | | | 98,613 | |

| Property, plant and equipment, net | 237,889 | | | 205,284 | |

| Right-of-use asset | 10,691 | | | 10,943 | |

| Other assets | 586 | | | 679 | |

| TOTAL ASSETS | $ | 395,388 | | | $ | 378,106 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable | $ | 14,313 | | | $ | 15,169 | |

| Accrued construction liabilities | 938 | | | 1,526 | |

| Other accrued liabilities | 5,494 | | | 9,179 | |

| Share based liabilities due to related party | — | | | 2,500 | |

| Other amounts due to related parties | 975 | | | 972 | |

| Current portion of operating lease liability | 49 | | | 48 | |

| Insurance premium financing payable | 983 | | | 1,803 | |

| Current portion of long-term debt | 99,360 | | | 123,465 | |

| Total current liabilities | 122,112 | | | 154,662 | |

| Operating lease liability, net of current portion | 886 | | | 899 | |

| Long-term debt | 47 | | | 56 | |

| TOTAL LIABILITIES | 123,045 | | | 155,617 | |

| | | |

| Commitments and Contingencies (See Note 12) | | | |

| | | |

| STOCKHOLDERS' EQUITY: | | | |

Preferred stock, $0.001 par value, 100,000,000 authorized at March 31, 2024 and December 31, 2023; 9,566 issued and outstanding at March 31, 2024 and December 31, 2023; aggregate liquidation preference of $11,709 and $11,423 at March 31, 2024 and December 31, 2023, respectively | 9,273 | | | 9,273 | |

Common stock, $0.001 par value, 400,000,000 authorized at March 31, 2024 and December 31, 2023; 302,921,785 and 276,733,329 issued and outstanding at March 31, 2024 and December 31, 2023, respectively | 303 | | | 277 | |

| Additional paid-in capital | 532,238 | | | 472,834 | |

| Accumulated deficit | (269,471) | | | (259,895) | |

| Total stockholders' equity | 272,343 | | | 222,489 | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 395,388 | | | $ | 378,106 | |

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(In thousands, except number of shares and loss per common share; unaudited)

| | | | | | | | | | | |

| Three Months Ended

March 31, |

| 2024 | | 2023 |

| | | |

| Revenue | $ | 42,433 | | | $ | 11,533 | |

| Cost of revenue (exclusive of depreciation shown below) | 14,408 | | | 5,002 | |

| Gross profit | 28,025 | | | 6,531 | |

| | | |

| Cost of operations: | | | |

| Operating expenses | 785 | | | 308 | |

| Operating expenses – related party | 888 | | | 597 | |

| Selling, general and administrative expenses | 12,289 | | | 6,492 | |

| Selling, general and administrative expenses – related party | 2,620 | | | 2,898 | |

| Depreciation | 15,088 | | | 5,433 | |

| Gain on fair value of digital currency, net | (1,329) | | | — | |

| Realized gain on sale of digital currency | — | | | (603) | |

| Impairment of digital currency | — | | | 627 | |

| Total cost of operations | 30,341 | | | 15,752 | |

| | | |

| Operating loss | (2,316) | | | (9,221) | |

| Interest expense | (11,045) | | | (6,834) | |

| Loss on extinguishment of debt | (2,027) | | | — | |

| Other income | 500 | | | — | |

| Loss before income tax and equity in net income (loss) of investee | (14,888) | | | (16,055) | |

| Income tax benefit | — | | | — | |

| Equity in net income (loss) of investee, net of tax | 5,275 | | | (10,167) | |

| Loss from continuing operations | (9,613) | | | (26,222) | |

| Loss from discontinued operations, net of tax | — | | | (35) | |

| Net loss | (9,613) | | | (26,257) | |

| Preferred stock dividends | (286) | | | (259) | |

| Net loss attributable to common stockholders | $ | (9,899) | | | $ | (26,516) | |

| | | |

| Loss per common share: | | | |

| Continuing operations | $ | (0.03) | | | $ | (0.16) | |

| Discontinued operations | - | | | — | |

| Basic and diluted | $ | (0.03) | | | $ | (0.16) | |

| | | |

| | | | | | | | | | | |

| Weighted average common shares outstanding: | | | |

| Basic and diluted | 290,602,725 | | 165,015,228 |

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(In thousands; unaudited)

| | | | | | | | | | | |

| Three Months Ended

March 31, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (9,613) | | | $ | (26,257) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | |

| Amortization of debt issuance costs, commitment fees and accretion of debt discount | 7,593 | | | 3,549 | |

| Related party expense to be settled with respect to common stock | — | | | 313 | |

| Common stock issued for interest expense | — | | | 26 | |

| Stock-based compensation expense | 6,931 | | | 876 | |

| Depreciation | 15,088 | | | 5,433 | |

| Amortization of right-of-use asset | 252 | | | 250 | |

| Increase in digital currency from mining and hosting services | (41,537) | | | (9,940) | |

| Gain on fair value of digital currency, net | (1,329) | | | — | |

| Realized gain on sale of digital currency | — | | | (603) | |

| Impairment of digital currency | — | | | 627 | |

| Proceeds from sale of digital currency | 54,391 | | | 9,982 | |

| Loss on extinguishment of debt | 2,027 | | | — | |

| Equity in net (income) loss of investee, net of tax | (5,275) | | | 10,167 | |

| Loss from discontinued operations, net of tax | — | | | 35 | |

| Changes in operating assets and liabilities: | | | |

| Decrease in prepaid expenses | 567 | | | 717 | |

| Increase in other receivables | (667) | | | — | |

| Increase in other current assets | (67) | | | (241) | |

| Decrease (increase) in other assets | 22 | | | (83) | |

| Decrease in accounts payable | (1,686) | | | (2,435) | |

| Decrease in other accrued liabilities | (3,906) | | | (1,354) | |

| Increase in other amounts due to related parties | 67 | | | 325 | |

| Decrease in operating lease liability | (12) | | | (10) | |

| Net cash provided by (used in) operating activities from continuing operations | 22,846 | | | (8,623) | |

| Net cash used in operating activities from discontinued operations | — | | | (90) | |

| | | | | | | | | | | |

| Net cash provided by (used in) operating activities | 22,846 | | | (8,713) | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Investments in joint venture, including direct payments made on behalf of joint venture | — | | | (2,285) | |

| Purchase of and deposits on plant and equipment | (46,979) | | | (9,986) | |

| Net cash used in investing activities | (46,979) | | | (12,271) | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Principal payments on long-term debt | (33,412) | | | — | |

| Payments of prepayment fees associated with early extinguishment of long-term debt | (314) | | | — | |

| Proceeds from insurance premium and property, plant and equipment financing | — | | | 295 | |

| Principal payments on insurance premium and property, plant and equipment financing | (827) | | | (1,451) | |

| Proceeds from issuance of common stock, net of issuance costs paid of $0 and $1,051 | 50,722 | | | 26,562 | |

| Proceeds from common stock to be issued, net of issuance costs of $0 and $56 | — | | | 4,390 | |

| Proceeds from warrant issuances | — | | | 2,500 | |

| Payments of tax withholding related to net share settlements of stock-based compensation awards | (651) | | | — | |

| Proceeds from issuance of convertible promissory note | — | | | 1,250 | |

| Payment of contingent value rights liability related to proceeds from sale of net assets held for sale | — | | | (3,899) | |

| Net cash provided by financing activities | 15,518 | | | 29,647 | |

| | | |

| Net change in cash and cash equivalents | (8,615) | | | 8,663 | |

| Cash and cash equivalents at beginning of period | 54,439 | | | 8,323 | |

| Cash and cash equivalents at end of period | $ | 45,824 | | | $ | 16,986 | |

| | | |

| Cash paid during the period for: | | | |

| Interest | $ | 3,726 | | $ | 5,399 |

| Income taxes | $ | — | | $ | — |

Non-GAAP Measure

To provide investors with additional information in connection with our results as determined in accordance with generally accepted accounting principles in the United States (“GAAP”), we disclose Adjusted EBITDA as a non-GAAP measure. This measure is not a financial measure calculated in accordance with GAAP, and it should not be considered as a substitute for net income, operating income, or any other measure calculated in accordance with GAAP, and may not be comparable to similarly titled measures reported by other companies.

We define Adjusted EBITDA as income (loss) from continuing operations adjusted for (i) impacts of interest, taxes, depreciation and amortization; (ii) preferred stock dividends, stock-based compensation expense and related party expense to be settled with respect to common stock, all of which are non-cash items that the Company believes are not reflective of its general business performance, and for which the accounting requires management judgment, and the resulting expenses could vary significantly in comparison to other companies; (iii) equity in net income (loss) of investee, net of tax, related to Nautilus; (iv) other income which is related to interest income or income for which management believes is not reflective of the Company’s ongoing operating activities; (v) loss on extinguishment of debt, which is not reflective of the Company’s general business performance; and (vi) loss from discontinued operations, net of tax, which is not be applicable to the Company’s future business activities. The Company’s non-GAAP Adjusted EBITDA also includes the impact of distributions from investee received in bitcoin related to a return on the Nautilus investment, which management believes, in conjunction with excluding the impact of equity in net income (loss) of investee, net of tax, is reflective of assets available for the Company’s use in its ongoing operations as a result of its investment in Nautilus.

Management believes that providing this non-GAAP financial measure allows for meaningful comparisons between the Company's core business operating results and those of other companies, and provides the Company with an important tool for financial and operational decision making and for evaluating its own core business operating results over different periods of time. In addition to management's internal use of non-GAAP Adjusted EBITDA, management believes that Adjusted EBITDA is also useful to investors and analysts in comparing the Company’s performance across reporting periods on a consistent basis. Management believes the foregoing to be the case even though some of the excluded items involve cash outlays and some of them recur on a regular basis (although management does not believe any of such items are normal operating expenses necessary to generate the Company’s bitcoin related revenues). For example, the Company expects that share-based compensation expense, which is excluded from Adjusted EBITDA, will continue to be a significant recurring expense over the coming years and is an important part of the compensation provided to certain employees, officers, directors and consultants. Additionally, management does not consider any of the excluded items to be expenses necessary to generate the Company’s bitcoin related revenue.

The Company's Adjusted EBITDA measure may not be directly comparable to similar measures provided by other companies in the Company’s industry, as other companies in the Company’s industry may calculate non-GAAP financial results differently. The Company's Adjusted EBITDA is not a measurement of financial performance under GAAP and should not be considered as an alternative to operating loss or any other measure of performance derived in accordance with GAAP. Although management utilizes internally and presents Adjusted EBITDA, the Company only utilizes that measure supplementally and does not consider it to be a substitute for, or superior to, the information provided by GAAP financial results. Accordingly, Adjusted EBITDA is not meant to be considered in isolation of, and should be read in conjunction with, the information contained in the Company’s consolidated financial statements, which have been prepared in accordance with GAAP.

The following table is a reconciliation of the Company’s non-GAAP Adjusted EBITDA to its most directly comparable GAAP measure (i.e., net loss attributable to common stockholders) for the periods indicated (in thousands):

| | | | | | | | | | | |

| Three Months Ended

March 31, |

| 2024 | | 2023 |

| Net loss attributable to common stockholders | $ | (9,899) | | | $ | (26,516) | |

| Adjustments to reconcile net loss attributable to common stockholders to non-GAAP Adjusted EBITDA: | | | |

| Preferred stock dividends | 286 | | 259 |

| Loss from discontinued operations, net of tax | — | | 35 |

| Equity in net (income) loss of investee, net of tax | (5,275) | | 10,167 |

| Distributions from investee, related to Nautilus | 12,022 | | — |

| Income tax benefit | — | | — |

| Other income | (500) | | — |

| Loss on extinguishment of debt | 2,027 | | — |

| Interest expense | 11,045 | | 6,834 |

| Depreciation | 15,088 | | 5,433 |

| Amortization of right-of-use asset | 252 | | 250 |

| Stock-based compensation expense | 6,931 | | 876 |

| Related party expense to be settled with respect to common stock | — | | | 313 |

| Non-GAAP Adjusted EBITDA | $ | 31,977 | | $ | (2,349) |

1

➢ ➢ ➢ ➢ ➢ ➢ Note: Figures represent illustrative estimates. WULF Compute metrics represent range for white space or rack ready colocation for illustrative purposes only.

4 ➢ Owned infrastructure to scale flexibly ➢ Lowest cost producer of BTC ➢ Sustainable: 100% zero-carbon target ➢ ESG is core to operations, risk mitigation, and reputational value ➢ 8 EH/s deployed and 210 MW operational ➢ Target 295 MW operational by YE 2024 ➢ Additional 300 MW of growth capacity ➢ 3,407 BTC mined in 2023 1,057 BTC mined in Q1 2024 ➢ $0.032/kWh realized power cost in 2023 $0.035/kWh target for 2024 ➢ 95% zero-carbon energy Rapidly scaling since inception with significant owned capacity for growth 3 MW 60 MW 60 MW 110 MW 160 MW 195 MW 245 MW 30 MW 50 MW 50 MW 50 MW 50 MW 35 MW 50 MW 300 MW 0.3 EH/s 2.0 EH/s 3.3 EH/s 5.5 EH/s 10.2 EH/s 13.3 EH/s 31.0 EH/s 0.0 5.0 EH/s 10.0 EH/s 15.0 EH/s 20.0 EH/s 25.0 EH/s 30.0 EH/s 35.0 EH/s 0 100 MW 200 MW 300 MW 400 MW 500 MW 600 MW 700 MW 1H 2022 2H 2022 1H 2023 2H 2023 1H 2024 2H 2024 2025E + LMD Nautilus Under Construction Planned Deployment Total Hash Rate (2)(1)

➢ ➢ ➢ ➢ ➢ (1) Source: NYISO Power Trends 2023 report (https://www.nyiso.com/power-trends). (2) Reflects TeraWulf’s 50 MW interest in the Nautilus Cryptomine facility and option to expand by 50 MW, which the Company exercised in February 2024. 5 ➢ ➢ ➢

Strategically located in regions with significant energy surplus 6 ✓ ✓ ✓ ✓ ✓ ✓

Lowest-cost producer of Bitcoin with large-scale infrastructure optionality ➢ Existing sites have more than 300 MW of available capacity to expand ➢ Attractive site strategically positioned to support other forms of compute ➢ Achieved $0.032/kWh all-in power cost in 2023 ➢ Target $0.035/kWh all-in power cost in 2024 ➢ Recent 7 EH/s purchase and option agreement for S21 miners ➢ Locks in pricing at ~$16 per terahash ➢ Reduced debt by 50% in the last 6 months with free cash flow generation ➢ 2024 growth plan largely funded; expect to be debt free in 2025 with substantial free cash flow to reinvest in business

Achieved record free cash flow generation 8 Metric Amount Comments End of Period Hash Rate 8.0 EH/s ➢ 167% increase year-over-year Bitcoin Produced 1,057 ➢ 11.6 BTC per day; +8% over Q423; +110% over Q123 Power Cost $0.041/kWh ➢ Represents power cost per BTC of $15,501 Revenue (1) $42.4 million ➢ Value per BTC self-mined (non-GAAP) averaged ~$53k Gross Profit (1) $28.0 million ➢ 95% increase quarter-over-quarter Non-GAAP Adjusted EBITDA (2) $32.0 million ➢ 95% increase quarter-over-quarter; EBITDA/EH of $4,100 Cash and Cash Equivalents $45.8 million ➢ Excludes BTC of $2 million (3) Net Debt (4) $60.2 million ➢ Additional $30 million repayment was made in April 2024 ➢ Anticipate $15-$20 million repayment in July 2024 (1) GAAP measure; excludes Nautilus. (2) Non-GAAP measure; includes Nautilus. (3) Based on the market price per one Bitcoin of $71,333 on March 31, 2024. (4) Net Debt as of 3/31/24 calculated as follows: $106.0 million principal balance of debt less $45.8 million of cash.

All figures include WULF’s net share of Nautilus operations 9 514 889 980 959 1,051 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 3.3 5.5 5.5 5.5 8.0 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 $8.7 $19.4 $18.7 $25.0 $40.5 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 ($2.3) $7.6 $9.0 $16.4 $32.0 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 (1) Excludes bitcoin earned via hosting profit share. (2) Includes gross total hosted hash rate. (3) Calculated as Revenue less Cost of Revenue (exclusive of depreciation, inclusive of demand response proceeds); includes WULF’s share of Nautilus JV. (4) Includes distributions from Nautilus. ➢Record BTC production of 1,051 in Q1 2024, despite ~16% increase in network hash rate quarter-over-quarter ➢62% increase in Gross Profit and 95% increase in Adjusted EBITDA quarter-over-quarter ➢Operating hash rate expansion in Q4 2023 and phase-out of hosting operations in Q1 2024 contributed to significant increase in gross margin ➢ Implies average EBITDA per EH of $4.1 million vs. peer average of $2.9 million per EH

10 ➢ Approximately $106 million of debt and $46 million of cash at March 31, 2024 ➢ Principal repayments in Q2 2024 reduced debt further to $76 million ➢ Company anticipates additional repayment of $15-$20 million in early Q3 2024 ➢ $8.1 million of annual interest savings from debt repaid since Q4 2023 Cash As of March 31, 2024 Net Debt As of March 31, 2024 Greatly improved balance sheet and liquidity

TeraWulf delivers more profitability with less dilution than any of its peers 11Source: Public filings and publicly available earnings transcripts, and good faith calculations by WULF based thereon. Note: Core Scientific emerged from bankruptcy in January 2024; 1Q 2024 stock-based comp does not reflect management incentive plan. $4.4 $4.1 $4.1 $3.2 $1.9 $0.9 CLSK WULF CORZ CIFR MARA RIOT $0.0 $63.4 $84.8 $510.4 $533.9 $560.3 CORZ WULF CIFR RIOT CLSK MARA $1.1 $6.9 $8.3 $9.8 $32.0 $51.9 CORZ WULF CIFR CLSK RIOT MARA < -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- ($ i n m il li o n s )- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- > NOT GOOD “Revenue is vanity, profit is sanity, but cash is KING.” Alan Miltz, co-author of Scaling Up GOOD

Plan to repay debt with free cash flow and expand mining to over 10 EH/s; maintain optionality for future growth 12 (1) Reflects cash balance as of April 30, 2024, and assumes market price of BTC of $60,637 as of April 30, 2024. (2) Assumes average BTC price and network hash rate of $75,000 and 600 EH/s, respectively, May 1 – December 31, 2024. (3) Includes 24 kV line upgrades required for Phase 2 of capacity expansion at Lake Mariner facility. (4) Reflects capex associated with 2 MW AI/HPC pilot infrastructure at Lake Mariner facility.

Realized cost-to-mine of ~$29k in Q1 2024; projected of ~$40k for balance of 2024 13 Q1 2024 [1] Q2 2024 [2] 2H 2024 Full Year 2024 Illustrative Market Inputs: Network Hash Rate (EH/s) 630 630 Transaction Fees (%) 10% 10% Illustrative Operating Inputs: Miner Fleet Efficiency (J/TH) [3] 25.6 23.7 Total Hash Rate (EH/s) 8.0 10.2 Total Bitcoin Mined 1051 695 1,462 3,208 $ in 000’s $/BTC $/PH/Day $ in 000’s $/BTC $/PH/Day $ in 000’s $/BTC $/PH/Day $ in 000’s Power Cost (@ $0.035/kWh) $16,292 $15,501 $26 $15,777 $22,701 $22 $36,232 $24,776 $20 $68,301 SG&A for the Period 8,028 7,639 13 6,491 9,339 9 12,981 8,877 7 27,500 Other OpEx for the Period 3,113 2,962 5 3,462 4,982 5 6,925 4,735 4 13,500 Interest Expense for the Period [4] 3,726 3,545 6 2,180 3,137 3 3,295 2,253 2 9,201 Total Cost $31,159 $29,647 $50 $27,910 $40,159 $39 $59,433 $40,641 $33 $118,502 (1) Actual results, excludes 6 BTC earned via hosting profit share. (2) Reflects actual April production; May and June BTC quantity projected using inputs above. (3) Assumes 4% ancillary load. Nameplate miner efficiency is 24.6 J/TH pre-halving and 22.8 J/TH post-halving. (4) Interest expense in 2024 based on 11.5% interest rate and $76 million balance of debt outstanding in Q2 2024 and $57 million outstanding in Q2-Q4 2024. Does not reflect anticipated incremental debt repayments with cash generated in Q2- Q4 2024.

Optimizing LAND, MWs and CAPITAL for the most efficient long-term value creation 14 Cloud Service Provider Colocation – Whitespace & Rack Ready Build to Suit Description Shell data center and GPU clusters; space, power, cooling, fiber/internet, security, compute, storage and environment. Shell data center; lease rack ready whitespace including redundant power, cooling, fiber/internet, and security Data center built to spec; lease space, redundant power, cooling, fiber/internet, and security Customer Multiple Managed through cloud platform partner Multiple Enterprise and well funded startup customers Single – Hyperscaler (e.g., Magnificent 7) Contract Size 0.1 – 50 MW 0.5 – 100 MW+ 100+ MW Contract Term 1 – 36 months 1 – 7+ years 15+ years with renewals O&M WULF managed WULF managed Tenant managed Build Cost per MW $27 – 30 million (1) $4 – 8 million (1) $2 – 4 million (4) Financing Equity & Debt Equity (initially) Highly Bankable Revenue per MW $11 – 18 million (2) $1.3 – 1.5 million (3) $0.2 – 0.5 million Margins 70 – 80% 65 – 75% 90% + Valuation Range 7-12x EBITDA 10-15x EBITDA 15-20x EBITDA (1) Build cost for CSP and colocation model reflect liquid cooling infrastructure. (2) Low end of range based on long-term reserve contract at $2.1/GPU/hr with 100% rental utilization, high end of range represents $4.50/GPU/hr of on-demand revenue at 80% rental utilization. (3) Does not include customer pass-through energy expense. Subject to term length and payment terms (4) Based on air cooled powered shell infrastructure. NNN Rent Structure; customer pays all OpEx directly.

Significant mismatch in data center demand and power growth – increasing the value of land and power assets ➢ Electricity demand growth driven largely by GenAI and data centers significantly outpacing the expected supply growth of available power capacity ▪ Over time, the imbalance will continue to increase the value of the time limiting resource – power and land ➢ The top constraint for data center market growth today is access to power capacity, with the key constraint being time to power ➢ Near term access to power adds meaningful time advantages for data center developers which suggest that they are willing to pay significant premiums for quicker access to power ➢ Players with access to the key limiting resource – land and power – are well situated to capture tremendous value over the next decade Electricity production annual growth through 2035 (3) Power price premium willingly paid for bringing data centers online faster by 2 years (2) Expected US data center power capacity by 2030 (1) Projected annual growth of power demand for GenAI (2) Data center electrical consumption annual growth through 2035 (3) U.S. data center demand 2023 (1) (1) Source: Data Center Dynamics dated January 15, 2024: “Newmark: US Data center power consumption to double by 2030”. (2) Source: Morgan Stanley Research dated March 24, 2024: “Powering GenAI: The Tortoise and the Hare”; MS base case assumptions. (3) Source: Eastdil Secured Digital Infrastructure Sector Update 2024 Capital Markets Outlook.

TeraWulf is led by an accomplished, diverse management team with 30+ years of experience in developing and managing energy infrastructure and disruptive technology N A Z A R K H A N Co-Founder, Chief Operating Officer & Chief Technology Officer 20+ years in energy infrastructure and cryptocurrency mining; previously at Evercore K E R R I L A N G L A I S Chief Strategy Officer 20+ years of M&A, financing, strategy, and power sector experience; previously at Goldman Sachs S E A N F A R R E L L SVP, Operations 13+ years of energy experience in renewables, grid optimization, digitalization, and storage solutions; previously at Siemens Energy P A U L P R A G E R Co-Founder, Chairman & Chief Executive Officer 30+ year energy infrastructure entrepreneur; USNA Foundation Investment Committee Trustee P A T R I C K F L E U R Y Chief Financial Officer 20+ years of financial experience in the energy, power, and commodity sectors’ previously at Platinum Equity and Blackstone S T E F A N I E F L E I S C H M A N N Chief Legal Officer General Counsel for 15+ years overseeing all legal and compliance matters; previously at Paul, Weiss 17

As of May 10, 2024 18 Note: all figures are approximate.

19 (1) Includes WULF’s net share of miners contributed to Nautilus JV. (2) Miner orders to be installed 2H 2024 (3) Figures include 4% ancillary load, nameplate efficiency of miners alone is 27.6 J/TH for 23E, 24.6 J/TH for 2Q 24, and 22.8 for 2H 24 Model Quantity Hash Rate Efficiency J/TH S19 J/J-Pro 27,500 100 30 S19 JXP/XP 31,500 146 21.5 S19K Pro 4,000 120 23 MicroBT M30s 1,200 100 31 S21 Pro2 5,000 234 15 S212 5,000 200 17.5 5.2 2.7 Below 25 J/TH Above 25 J/TH 7.5 2.7 Below 25 J/TH Above 25 J/TH 28.7 J/TH 25.6 J/TH 23.7 J/TH 23E Efficiency 2Q 24 Efficiency 2H 24 Efficiency ➢ ➢ Highly efficient fleet drives profitability

$0.032 $0.025 $0.017 $0.031 $0.061 $0.032 $0.033 $0.040 $0.042 $0.040 2018 2019 2020 2021 2022 2023 2024E 2025E 2026E 2027E Actual Projected Average $3.5 ¢ per kWh76% 24% Capacity (210 MW) Lake Mariner Nautilus $0.040 $0.020 Power Cost ($/kWh) Lake Mariner Nautilus Blended Power Cost (incl. Demand Response) Annual guidance of 3.5 cents per kWh average cost of power across both sites 20 Historical Average (2018-2023) = $0.033 per kWh (1) NYISO Zone A prices atypically high during Q2-Q3 2022 due to elevated gas prices, regional transmission outages, weather events and supply constraints due to pandemic and war in Ukraine. (2) Includes transmission charges, taxes and demand response proceeds received at Lake Mariner. (3) Source: Bloomberg NYISO Zone A ATC forward curve as of 03/11/24; excludes transmission charges, taxes and demand response proceeds expected to be received at Lake Mariner. (1) (3) (2)

✓ ✓ ✓ ✓ 21

✓ ✓

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

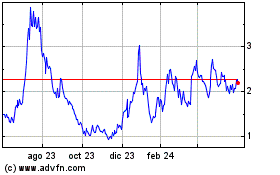

TeraWulf (NASDAQ:WULF)

Gráfica de Acción Histórica

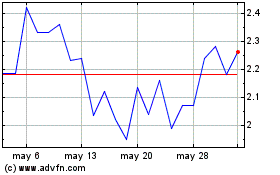

De Abr 2024 a May 2024

TeraWulf (NASDAQ:WULF)

Gráfica de Acción Histórica

De May 2023 a May 2024