Wynn Resorts, Limited (NASDAQ:WYNN) (“Wynn Resorts”) announced

today that its indirect wholly-owned subsidiary, Wynn Las Vegas,

LLC (“Wynn Las Vegas”) has commenced a cash tender offer (the

“Tender Offer”) to purchase a portion of Wynn Las Vegas and Wynn

Las Vegas Capital Corp.’s (collectively, the “Issuers”) 5.500%

Senior Notes due 2025 (the “Notes”) in a principal amount of up to

$800 million, exclusive of any applicable premiums paid in

connection with the Tender Offer and accrued and unpaid interest.

The terms and conditions of the Tender Offer are set forth in an

Offer to Purchase, dated February 8, 2024 (the “Offer to

Purchase”), which is being sent to all registered holders

(collectively, the “Holders”) of Notes.

Title of Security

Issuers

CUSIP Numbers (1)

Principal Amount Outstanding

(2)

Tender Cap

Base Consideration (3)(4)

Early Tender Premium (3)

Total Consideration (3)(4)

5.500% Senior Notes due 2025

Wynn Las Vegas, LLC

Wynn Las Vegas Capital Corp.

983130 AV7

U98347 AK0

$1,400,001,000

$800,000,000

$972.17

$30.00

$1,002.17

(1) No representation is made as to the

correctness or accuracy of the CUSIP numbers listed in this press

release, the Offer to Purchase or printed on the Notes. They are

provided solely for the convenience of Holders of the Notes. (2)

Includes $20.0 million in principal balance of Notes held by Wynn

Resorts. Wynn Resorts will not participate in this Offer. (3) Per

$1,000 principal amount of Notes. (4) Excludes Accrued Interest,

which will be paid in addition to the Base Consideration or the

Total Consideration, as applicable.

Holders of Notes must validly tender and not validly withdraw

their Notes on or before 5:00 p.m., New York City time, on February

22, 2024, unless extended (such date and time, as the same may be

extended, the “Early Tender Time”) in order to be eligible to

receive the Total Consideration. Holders of Notes who validly

tender their Notes after the Early Tender Time and on or before the

Expiration Time (as defined below) will be eligible to receive only

the applicable Base Consideration, which is equal to the Total

Consideration minus the Early Tender Premium, as set forth in the

table above. In addition to the applicable consideration, Holders

whose Notes are accepted for purchase in the Tender Offer will

receive accrued and unpaid interest to, but excluding, the date on

which the Tender Offer is settled (“Accrued Interest”). The

settlement date for Notes validly tendered and accepted for

purchase before the Early Tender Time (if Wynn Las Vegas, LLC

elects to do so) is currently expected to be on or about February

23, 2024 and the final settlement date, if any, is expected to be

March 11, 2024.

The Tender Offer is scheduled to expire at 5:00 P.M., New York

City time, on March 8, 2024 unless extended or earlier terminated

(such date and time, as the same may be extended, the “Expiration

Time”). As set forth in the Offer to Purchase, validly tendered

Notes may be validly withdrawn at any time on or before 5:00 p.m.,

New York City time, on February 22, 2024, unless extended (the

“Withdrawal Deadline”).

Completion of the Tender Offer is subject to certain market and

other conditions, including Wynn Resorts Finance, LLC and Wynn

Resorts Capital Corp.’s (the “New Notes Issuers”) arranging their

new debt financing on terms satisfactory to them and receipt of the

net proceeds therefrom. Wynn Las Vegas reserves the right, in its

sole discretion, to waive any and all conditions to the Tender

Offer with respect to the Notes.

If any Notes are validly tendered and the principal amount of

such tendered Notes exceeds the Tender Cap as set forth in the

table above, any principal amount of the Notes accepted for payment

and purchased, on the terms and subject to the conditions of the

Tender Offer, will be prorated based on the principal amount of

validly tendered Notes, subject to the Tender Cap and any prior

purchase of Notes on any day following the Early Tender Date and

prior to the Expiration Date.

Any Notes that are validly tendered at or prior to the Early

Tender Date (and not validly withdrawn at or prior to the

Withdrawal Deadline) will have priority over any Notes that are

validly tendered after the Early Tender Date. Accordingly, if the

principal amount of any Notes validly tendered at or prior to the

Early Tender Date (and not validly withdrawn at or prior to the

Withdrawal Deadline) and accepted for purchase equals or exceeds

the Tender Cap, no Notes validly tendered after the Early Tender

Date will be accepted for purchase.

This press release shall not constitute an offer to purchase or

the solicitation of an offer to sell the Notes. The complete terms

and conditions of the Tender Offer are described in the Offer to

Purchase, a copy of which may be obtained from D.F. King & Co.,

Inc., the tender and information agent for the Tender Offer, at

wynn@dfking.com, by telephone at (866) 796-3441 (U.S. toll free)

and (212) 269-5550 (banks and brokers) or in writing at D.F. King

& Co., Inc., 48 Wall Street, 22nd Floor, New York, NY 10005,

Attention: Michael Horthman.

Wynn Las Vegas has engaged Deutsche Bank Securities Inc. and

Scotia Capital (USA) Inc. to act as the dealer managers in

connection with the Tender Offer. Questions regarding the terms of

the Tender Offer may be directed to Deutsche Bank Securities Inc.

by telephone at (855) 287-1922 (U.S. toll-free) and (212) 250-7527

(collect) or Scotia Capital (USA) Inc. by telephone at (833)

498-1660.

Forward-Looking Statements

This release contains forward-looking statements, including

those related to the tender for Notes and whether or not Wynn Las

Vegas will consummate the Tender Offer. Such forward-looking

statements are subject to a number of risks and uncertainties that

could cause actual results to differ materially from those we

express in these forward-looking statements, including, but not

limited to, reductions in discretionary consumer spending, adverse

macroeconomic conditions and their impact on levels of disposable

consumer income and wealth, changes in interest rates, inflation, a

decline in general economic activity or recession in the U.S.

and/or global economies, extensive regulation of our business,

pending or future legal proceedings, ability to maintain gaming

licenses and concessions, dependence on key employees, general

global political conditions, adverse tourism trends, travel

disruptions caused by events outside of our control, dependence on

a limited number of resorts, competition in the casino/hotel and

resort industries, uncertainties over the development and success

of new gaming and resort properties, construction and regulatory

risks associated with current and future projects (including Wynn

Al Marjan Island), cybersecurity risk and our leverage and ability

to meet our debt service obligations. Additional information

concerning potential factors that could affect Wynn Resorts’

financial results is included in Wynn Resorts’ Annual Report on

Form 10-K for the year ended December 31, 2022, as supplemented by

Wynn Resorts’ other periodic reports filed with the Securities and

Exchange Commission from time to time. Neither Wynn Resorts nor

Wynn Las Vegas are under any obligation to (and expressly disclaim

any such obligation to) update or revise their forward-looking

statements as a result of new information, future events or

otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240208423245/en/

Price Karr 702-770-7555 investorrelations@wynnresorts.com

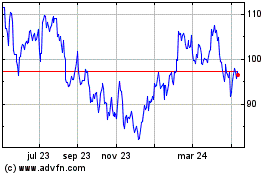

Wynn Resorts (NASDAQ:WYNN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

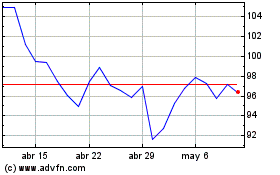

Wynn Resorts (NASDAQ:WYNN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024