0001174922false00011749222024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 22, 2024

WYNN RESORTS, LIMITED

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Nevada | 000-50028 | 46-0484987 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| 3131 Las Vegas Boulevard South | | |

| Las Vegas, | Nevada | | 89109 |

| (Address of principal executive offices) | | (Zip Code) |

(702) 770-7555

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 | | WYNN | | Nasdaq Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 1.01 | Entry into a Material Definitive Agreement. |

Supplemental Indenture for 7.125% Senior Notes due 2031

On February 23, 2024, Wynn Resorts, Limited (the “Company”) announced that Wynn Resorts Finance, LLC (“WRF”) and its subsidiary, Wynn Resorts Capital Corp. (“Wynn Resorts Capital” and, together with WRF, the “Issuers”), each an indirect wholly-owned subsidiary of the Company, issued $400 million aggregate principal amount of 7.125% Senior Notes due 2031 (the “Notes”). The Notes were issued as additional notes pursuant to a supplemental indenture (the “Supplemental Indenture”), dated as of February 23, 2024, among the Issuers, the guarantors party thereto (the “Guarantors”) and U.S. Bank Trust Company, National Association, as trustee (the “Trustee”), to the indenture (the “Existing Indenture,” as amended by the Supplemental Indenture and as further amended or supplemented from time to time, the “Indenture”), dated as of February 16, 2023, among the Issuers, the Guarantors and the Trustee. The Notes constitute the same series of securities as the $600 million 7.125% Senior Notes due 2031 issued on February 16, 2023 pursuant to the Existing Indenture (the “Existing Notes”). The Notes were offered and sold in reliance on exemptions from the registration requirements of the Securities Act of 1933. The Notes will mature on February 15, 2031. Interest is payable in cash semi-annually on February 15 and August 15 of each year, beginning on August 15, 2024.

The Notes are jointly and severally guaranteed by all of WRF’s domestic subsidiaries that guarantee the Issuers’ existing senior secured credit facilities, except Wynn Resorts Capital, which is the co-issuer of the Notes, the Issuers’ 5.125% senior notes due 2029 and the Existing Notes.

The Issuers may redeem the Notes, in whole or in part, at any time or from time to time prior to November 15, 2030 at a redemption price equal to the greater of (1) 100% of the principal amount of the Notes to be redeemed and (2) a “make-whole” amount, plus in either case accrued and unpaid interest, if any, to, but not including, the redemption date.

On or after November 15, 2030, the Issuers may redeem the Notes, in whole or in part, at the redemption prices set forth in the Indenture plus accrued and unpaid interest. The Notes are subject to disposition and redemption requirements imposed by gaming laws and regulations of applicable gaming regulatory authorities.

The Indenture contains covenants that limit the ability of the Issuers and the guarantors to, among other things, (1) enter into sale-leaseback transactions, (2) create or incur liens to secure debt, and (3) merge, consolidate or sell all or substantially all of the Issuers’ assets. These covenants are subject to exceptions and qualifications set forth in the Indenture.

In the event of a change of control triggering event, the Issuers must offer to repurchase the Notes at a repurchase price equal to 101% of the aggregate principal amount thereof plus any accrued and unpaid interest, to, but not including, the repurchase date.

The Indenture also contains customary events of default, including (1) failure to make required payments, (2) failure to comply with certain covenants, (3) failure to pay certain other indebtedness, (4) certain events of bankruptcy and insolvency, and (5) failure to pay certain judgments. An event of default under the Indenture allows either the Trustee or the holders of at least 25% in aggregate principal amount of the Notes, as applicable, issued under such Indenture to accelerate the amounts due under the Notes, or in the case of a bankruptcy or insolvency, will automatically cause the acceleration of the amounts due under the Notes.

The foregoing description of the Indenture is qualified in its entirety by reference to the full text of the Existing Indenture and the Supplemental Indenture, which are filed herewith as Exhibits 4.1 and 4.2 and incorporated herein by reference.

On February 22, 2024, the Company issued a press release announcing early results of the previously announced cash tender offer by its indirect wholly-owned subsidiary, Wynn Las Vegas, LLC, to purchase up to $800,000,000 in aggregate principal amount of Wynn Las Vegas, LLC and Wynn Las Vegas Capital Corp.’s outstanding 5.500% Senior Notes due 2025. A copy of the press release is attached hereto as Exhibit 99.1 and is hereby incorporated by reference.

From time to time after completion of the tender offer, Wynn Las Vegas, LLC may purchase additional notes in the open market, in privately negotiated transactions, through tender offers, or otherwise, or may redeem, discharge or defease the notes that are able to be redeemed, discharged or defeased pursuant to their terms. Any future purchases of the notes may be on the same terms or on terms that are more or less favorable to holders of the notes than the terms of the tender offer. Any future

purchases of the notes by Wynn Las Vegas, LLC will depend on various factors existing at that time. There can be no assurance as to which, if any, of these alternatives (or combinations thereof) Wynn Las Vegas, LLC may choose to pursue in the future.

Forward-Looking Statements

This report, including Exhibit 99.1, contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are based upon management’s current expectations, beliefs, assumptions and estimates, and on information currently available to us, all of which are subject to change, and are not guarantees of timing, future results or performance. These forward-looking statements involve certain risks and uncertainties and other factors that could cause actual results to differ materially from those indicated in such forward-looking statements, as discussed further in the attached press release.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d)Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| 4.1 | |

| 4.2 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | WYNN RESORTS, LIMITED |

| | |

| Dated: February 23, 2024 | | By: | | /s/ Julie Cameron-Doe |

| | | | Julie Cameron-Doe |

| | | | Chief Financial Officer |

Exhibit 4.2

SUPPLEMENTAL INDENTURE

FIRST SUPPLEMENTAL INDENTURE (this “Supplemental Indenture”) dated as of February 23, 2024, by and among Wynn Resorts Finance, LLC, a Nevada limited liability company (“Wynn Resorts Finance”) and Wynn Resorts Capital Corp., a Nevada corporation (“Wynn Resorts Capital,” and together with Wynn Resorts Finance, the “Issuers”), each of the parties identified on Annex A hereto (the “Guarantors”) and U.S. Bank Trust Company, National Association, as Trustee (the “Trustee”).

WITNESSETH:

WHEREAS, the Issuer, the Guarantors, and the Trustee are party to an indenture, dated as of February 16, 2023 (the “Base Indenture” and together with this Supplemental Indenture, the “Indenture”), providing for the issuance by the Issuer of its 7.125% Senior Notes due 2031;

WHEREAS, pursuant to and on the date of the Base Indenture, the Issuer initially issued $600,000,000 aggregate principal amount of its 7.125% Senior Notes due 2031 (the “Existing Notes”);

WHEREAS, Section 2.13 of the Base Indenture provides that, without the consent of any Holder of the Notes, the Issuers may amend the Base Indenture to facilitate the issuance of Additional Notes (as defined in the Base Indenture) under the Base Indenture;

WHEREAS, the Issuer wishes to issue an additional $400,000,000 aggregate principal amount of its 7.125% Senior Notes due 2031 as Additional Notes (the “New Notes”);

WHEREAS, Section 9.01(g) of the Base Indenture provides that, without the consent of any Holder of the Notes, the Issuer, the Guarantors and the Trustee may amend or supplement the Base Indenture to provide for the issuance of Additional Notes in accordance with the limitations set forth the Base Indenture;

WHEREAS, Section 9.01(d) of the Base Indenture provides that, without the consent of any Holder of the Notes, the Issuer, the Guarantors and the Trustee may amend or supplement the Base Indenture to make any change that does not adversely affect the legal rights under the Indenture of any Holder of the Notes;

WHEREAS, the Issuer and the Guarantors are authorized to execute and deliver this Supplemental Indenture;

WHEREAS, the Issuer has requested that the Trustee execute and deliver this Supplemental Indenture; and

WHEREAS, all conditions and requirements necessary to the execution and delivery of this Supplemental Indenture have been done and performed, and the execution and delivery hereof has been in all respects authorized.

NOW THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt of which is hereby acknowledged the Issuer, the Guarantors and the Trustee mutually covenant and agree as follows:

1.Defined Terms. Capitalized terms used herein without definition shall have the meanings assigned to them in the Base Indenture. The words “herein,” “hereof” and “hereby” and other words of similar import used in this Supplemental Indenture refer to this Supplemental Indenture as a whole and not to any particular section hereof.

2.Amount of New Notes. The aggregate principal amount of New Notes to be authenticated and delivered under this Supplemental Indenture on February 23, 2024 is $400,000,000.

3.Terms of New Notes. The New Notes are to be issued as Additional Notes under the Indenture and shall:

a.be issued as part of the existing series of Existing Notes under the Indenture, and the New Notes and the Existing Notes shall be a single class for all purposes under the Indenture, including, without limitation, with respect to waivers, amendments, redemptions and offers to purchase;

b.be issued on February 23, 2024 at a purchase price of 103.000% of the principal amount plus accrued interest from February 15, 2024;

c.be issuable in whole in the form of one or more Global Notes to be held by DTC and in the form, including appropriate transfer restriction legends, provided in Exhibit A to the Base Indenture;

d.initially bear, in the case of New Notes sold under Regulation S of the Securities Act, the CUSIP number of U98354 AD2 and ISIN of USU98354AD20; and

e.bear, in the case of New Notes sold under Rule 144A of the Securities Act, the same CUSIP number and ISIN as the Existing Notes that are Rule 144A Notes.

4.Amendments to the Indenture

a.The definition of “Revolving Credit Facility” under Section 1.01 of the Indenture is hereby deleted in its entirety and replaced with the following:

“Revolving Credit Facility” means the first lien revolving credit facility, as amended, in an aggregate principal amount of up to $750.0 million entered into on September 20, 2019 by Wynn Resorts Finance.”

b.The definition of “Term Facility” under Section 1.01 of the Indenture is hereby deleted in its entirety and replaced with the following:

“Term Facility” means the first lien term loan A facility, as amended, in an aggregate principal amount of up to $825.0 million entered into on September 20, 2019 by Wynn Resorts Finance.”

c.The definitions of “2023 LV Notes” and “2025 WRF Notes” under Section 1.01 and any references thereto are deleted in their entirety.

5.Ratification of Base Indenture; Supplemental Indenture; Part of Indenture. The Base Indenture is in all respects ratified and confirmed and all the terms, conditions and provisions thereof shall remain in full force and effect. This Supplemental Indenture shall form a part of the Base Indenture for all purposes, and every Holder of a Note or New Note heretofore or hereafter authenticated and delivered shall be bound hereby.

6.GOVERNING LAW. THIS SUPPLEMENTAL INDENTURE SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK, INCLUDING, WITHOUT LIMITATION, SECTION 5-1401 OF THE NEW YORK OBLIGATIONS LAW.

7.Trustee’s Assumption; Trustee Makes No Representation. The Trustee assumes no duties, responsibilities or liabilities under this Supplemental Indenture other than as set forth in the Base Indenture. The Trustee makes no representation as to the validity or sufficiency of this Supplemental

Indenture. The Trustee shall not be responsible for any statement or recital herein or any statement or recital contained in any document in connection with the sale of the New Notes.

8.Counterparts. The parties may sign any number of copies of this Supplemental Indenture. Each signed copy shall be an original, but all of them together represent the same agreement.

9.Effect of Headings. The Section headings herein are for convenience of reference only, are not to be considered a part of this Supplemental Indenture and shall in no way modify or restrict any of the terms or provisions hereof.

If the foregoing is in accordance with your understanding, please indicate your acceptance of this Agreement by signing in the space provided below.

Very truly yours,

ISSUERS:

WYNN RESORTS FINANCE, LLC

By: /s/ Julie Cameron-Doe

Name: Julie Cameron-Doe

Title: Treasurer

WYNN RESORTS CAPITAL CORP.

By: /s/ Julie Cameron-Doe

Name: Julie Cameron-Doe

Title: Treasurer

[Signature Page to Supplemental Indenture]

GUARANTORS:

EBH HOLDINGS, LLC

EVERETT PROPERTY, LLC

WYNN AMERICA GROUP, LLC

WYNN GROUP ASIA, INC.

WYNN LAS VEGAS HOLDINGS, LLC

WYNN LAS VEGAS CAPITAL CORP.

By: /s/ Julie Cameron-Doe

Name: Julie Cameron-Doe

Title: Treasurer

WYNN LAS VEGAS, LLC

By: /s/ Dean Lawrence

Name: Dean Lawrence

Title: Chief Financial Officer and Senior Vice President

WYNN MA, LLC

By: /s/ John Santon

Name: John Santon

Title: Chief Financial Officer

WYNN SUNRISE, LLC

By: Wynn Las Vegas, LLC its sole member

By: Wynn Las Vegas Holdings, LLC, its sole member

By: Wynn America Group, LLC, its sole member

By: Wynn Resorts Finance, LLC, its sole member

By: Wynn Resorts Holdings, LLC, its sole member

By: Wynn Resorts, Limited, its sole member

By: /s/ Julie Cameron-Doe

Name: Julie Cameron-Doe

Title: Chief Financial Officer

[Signature Page to Supplemental Indenture]

U.S. BANK TRUST COMPANY, NATIONAL ASSOCIATION,

as Trustee

By: /s/ Joshua A. Hahn

Name: Joshua A. Hahn

Title: Vice President

[Signature Page to Supplemental Indenture]

Annex A

EBH Holdings, LLC

Wynn Group Asia, Inc.

Everett Property, LLC

Wynn America Group, LLC

Wynn Las Vegas Holdings, LLC

Wynn Las Vegas, LLC

Wynn MA, LLC

Wynn Sunrise, LLC

Wynn Las Vegas Capital Corp.

Exhibit 99.1

Wynn Resorts Announces Early Results of Tender Offer for Cash by Wynn Las Vegas, LLC for its 5.500% Senior Notes due 2025

LAS VEGAS, February 22, 2024 (BUSINESS WIRE) — Wynn Resorts, Limited (NASDAQ: WYNN) (“Wynn Resorts”) today announced the early results and upsizing of the previously announced tender offer (the “Tender Offer”) by its indirect wholly-owned subsidiary, Wynn Las Vegas, LLC, to purchase a portion of Wynn Las Vegas, LLC and Wynn Las Vegas Capital Corp.’s outstanding 5.500% Senior Notes due 2025 (the “Notes”). The Tender Offer is subject to the terms and conditions set forth in the Offer to Purchase dated February 8, 2024 (the “Offer to Purchase”).

The following table sets forth, among other things, the principal amount of Notes validly tendered and accepted for purchase as of 5:00 p.m., New York City time, on February 22, 2024 (such date, the “Early Tender Date”):

| | | | | | | | | | | | | | | | | |

Title of Notes

| CUSIP Numbers

| Aggregate Principal Amount Outstanding

| Tender Cap

| Principal Amount Tendered at Early Tender Date

| Principal Amount Accepted for Purchase

|

5.500% Senior Notes due 2025

| 983130 AV7

U98347 AK0

| $1,400,001,000

| $800,000,000

| $677,975,000

| $677,975,000

|

The Tender Offer is scheduled to expire at 5:00 P.M., New York City time, on March 8, 2024 unless extended or earlier terminated (such date and time, as the same may be extended, the “Expiration Time”). Withdrawal and revocation rights expired at 5:00 p.m., New York City time, on February 22, 2024. Notes that have been tendered may no longer be withdrawn.

All Notes validly tendered (and not validly withdrawn) at or prior to the Early Tender Date and accepted for purchase will be purchased by Wynn Las Vegas, LLC on the “Early Settlement Date,” which is currently expected to occur on February 23, 2024. Payment for the Notes that are purchased will include accrued and unpaid interest from the last interest payment date to, but excluding, the Early Settlement Date.

For Notes that are validly tendered after the Early Tender Date but on or before the Expiration Time and that are accepted for payment and purchase, settlement will occur on the “Final Settlement Date,” which is currently expected to occur on March 11, 2024.

This press release does not constitute an offer to purchase or the solicitation of an offer to sell the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Deutsche Bank Securities Inc. and Scotia Capital (USA) Inc. are the dealer managers for the Tender Offer. Persons with questions regarding the Tender Offer should contact Deutsche Bank Securities Inc. by telephone at (855) 287-1922 (U.S. toll-free) and (212) 250-7527 (collect) or Scotia Capital (USA) Inc. by telephone at (833) 498-1660. Requests for copies of the Offer to Purchase should be directed to D.F. King & Co., Inc., the tender and information agent for the Tender Offer, at wynn@dfking.com, by telephone at (866) 796-3441 (U.S. toll free) and (212) 269-5550 (banks and brokers) or in writing at D.F. King & Co., Inc., 48 Wall Street, 22nd Floor, New York, NY 10005, Attention: Michael Horthman.

Forward-Looking Statements

This release contains forward-looking statements, including those related to the tender for Notes and whether or not Wynn Las Vegas, LLC will consummate the Tender Offer. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those we express in these forward-

looking statements, including, but not limited to, reductions in discretionary consumer spending, adverse macroeconomic conditions and their impact on levels of disposable consumer income and wealth, changes in interest rates, inflation, a decline in general economic activity or recession in the U.S. and/or global economies, extensive regulation of our business, pending or future legal proceedings, ability to maintain gaming licenses and concessions, dependence on key employees, general global political conditions, adverse tourism trends, travel disruptions caused by events outside of our control, dependence on a limited number of resorts, competition in the casino/hotel and resort industries, uncertainties over the development and success of new gaming and resort properties, construction and regulatory risks associated with current and future projects (including Wynn Al Marjan Island), cybersecurity risk and our leverage and ability to meet our debt service obligations. Additional information concerning potential factors that could affect Wynn Resorts’ financial results is included in Wynn Resorts’ Annual Report on Form 10-K for the year ended December 31, 2022, as supplemented by Wynn Resorts’ other periodic reports filed with the Securities and Exchange Commission from time to time. Neither Wynn Resorts nor Wynn Las Vegas, LLC are under any obligation to (and expressly disclaim any such obligation to) update or revise their forward-looking statements as a result of new information, future events or otherwise, except as required by law.

SOURCE:

Wynn Resorts, Limited

CONTACT:

Price Karr

702-770-7555

investorrelations@wynnresorts.com

v3.24.0.1

Document and Entity Information

|

Feb. 22, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 22, 2024

|

| Entity Registrant Name |

WYNN RESORTS, LIMITED

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

000-50028

|

| Entity Tax Identification Number |

46-0484987

|

| Entity Address, Address Line One |

3131 Las Vegas Boulevard South

|

| Entity Address, City or Town |

Las Vegas,

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89109

|

| City Area Code |

702

|

| Local Phone Number |

770-7555

|

| Title of 12(b) Security |

Common stock, par value $0.01

|

| Trading Symbol |

WYNN

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001174922

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

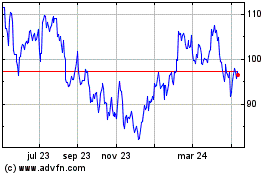

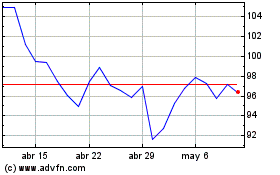

Wynn Resorts (NASDAQ:WYNN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Wynn Resorts (NASDAQ:WYNN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024