UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 24, 2024

22nd Century Group, Inc.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

001-36338 |

98-0468420 |

(State or Other Jurisdiction of

Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

|

500 Seneca Street, Suite 507, Buffalo, New York

(Address of Principal Executive Office) |

14204

(Zip Code) |

Registrant’s

telephone number, including area code: (716) 270-1523

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

Registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

Trading

Symbol |

Name

of Exchange on Which Registered |

| Common Stock, $0.00001 par value per share |

XXII |

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.07 Submission of Matters to a Vote of Security Holders.

A 2024 Special Meeting of Stockholders of the

Company was held on Wednesday, January 24, 2024 to vote on the following proposals:

| (1) |

To approve an amendment to the Company’s Articles of Incorporation, as amended, to effect a reverse stock split of the Company’s outstanding common stock at a ratio between 1-for-2 and 1-for-16, to be determined at the discretion of the Board of Directors, for the purpose of complying with the Nasdaq Listing Rules, subject to the Board or Directors’ discretion to abandon such amendment. In accordance with the voting results listed below, the proposal was approved. |

| For | | |

Against | | |

Abstain | | |

Broker non-votes | |

| | 21,678,116 | | |

7,225,428 | | |

218,772 | | |

0 | |

| (2) |

To approve an amendment to the Company’s Articles of Incorporation to increase the number of authorized shares of common stock from sixty-six million, six hundred sixty-six thousand sixty hundred sixty-seven (66,666,667) to two hundred fifty million (250,000,000). The votes were cast as follows: |

| For | | |

Against | | |

Abstain | | |

Broker non-votes | |

| | 20,785,163 | | |

8,114,389 | | |

222,764 | | |

0 | |

| (3) |

To approve the issuance of shares of the Company’s common stock upon exercise of the warrants to purchase common stock (the “Inducement Warrants”) issued to accredited investors pursuant to warrant inducement agreements in accordance with the terms of the Inducement Warrants, as required by and in accordance with Nasdaq Listing Rules. In accordance with the voting results listed below, the proposal was approved. |

| For | | |

Against | | |

Abstain | | |

Broker non-votes | |

| | 15,798,872 | | |

4,135,656 | | |

117,841 | | |

9,069,947 | |

| (4) |

The approval of an adjournment of the Special Meeting to a later date, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, Proposals 1, 2, and 3. In accordance with the voting results listed below, the proposal was approved. |

| For | | |

Against | | |

Abstain | | |

Broker non-votes | |

| | 21,718,539 | | |

7,138,191 | | |

265,586 | | |

0 | |

Adjournment with Respect to Proposal 2

The Special Meeting was adjourned to February 15, 2024, solely with

respect to Proposal 2 in order to provide additional time for stockholders to consider and vote on such proposal. The remaining proposals

are closed. The Special Meeting will reconvene at 11:00 a.m. Eastern Time on February 15, 2024, at 11988 El Camino Real, Suite 400, San

Diego, CA 92130, solely for the purpose of considering Proposal 2.

On January 24, 2024, the Company issued a press

release announcing the results of the Special Meeting and the adjournment of the Special Meeting solely with respect to Proposal 2. A

copy of such press release is attached to this Current Report on Form 8-K as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

22ND CENTURY GROUP, INC. |

| |

|

| |

/s/ Lawrence Firestone |

| Date: January 24, 2024 |

Lawrence Firestone |

| |

Chief Executive Officer |

Exhibit 99.1

22nd Century

Group Announces Partial Adjournment of Annual Meeting for Proposal 2, All Other Proposals Passed

Transforming

Business into Lean Operating Base, Extending Cash Runway, Shareholder Meeting to Re-convene February 15

MOCKSVILLE,

N.C., January 24, 2024 — 22nd Century Group, Inc. (Nasdaq: XXII) (the “Company” or “22nd Century”),

a biotechnology company focused on utilizing advanced plant technologies to improve health and wellness, today announced that the Company

conducted its January 24, 2024 special meeting of stockholders (the “Meeting”) and adjourned the Meeting solely with respect

to Proposal 2 set forth in its Definitive Proxy Statement (the “Proxy Statement”) previously filed with the Securities and

Exchange Commission. Proposal 2 is a proposal to increase the number of authorized number of shares of common stock. All other proposals

were passed at the Special Meeting with strong support from stockholders.

“We sincerely

appreciate the support of our stockholders on these important items as we work to swiftly effect a turnaround of the business,”

stated Larry Firestone, Chairman and Chief Executive Officer of 22nd Century. “In the seven weeks since I joined the Company, we

have fully focused the business on our tobacco operations, implemented aggressive operating cost reductions and extended our balance

sheet runway. We are also actively working to improve our tobacco business margins and increase the returns from those assets as we work

to make this company self-sufficient, including efforts to increase the channels and channel support for VLN sales. While I am pleased

with the progress on these and other initiatives we have underway, Proposal 2 is still critically important to ensuring that the Company

can address any strategic needs as we bridge to self-sustaining operations as quickly as possible. We hope that the adjournment will

enable additional shareholders to vote for this proposal, or those who may have voted against to reverse their vote and support our efforts

to complete the turnaround process.”

The Company has

adjourned the Special Meeting solely with respect to Proposal 2 to provide its stockholders additional time to vote on Proposal 2. The

Special Meeting will resume with respect to Proposal 2 at 11:00 a.m. Eastern Time on February 15, 2024. The reconvened meeting will be

held at 11988 El Camino Real, Suite 400, San Diego, CA 92130. The record date for determining stockholders eligible to vote at the Special

Meeting will remain the same. To date, more than 48% of all shares outstanding as of the record date have voted in favor of the proposal.

Stockholders as

of close of business on December 6, 2023, the record date for the Special Meeting, who have not yet voted are encouraged to vote over

the Internet at http://www.proxyvote.com/.

About 22nd Century

Group, Inc.

22nd Century Group,

Inc. (Nasdaq: XXII) is an agricultural biotechnology company focused on tobacco harm reduction, reduced nicotine tobacco

and improving health and wellness through plant science. With dozens of patents allowing it to control nicotine biosynthesis in the tobacco

plant, the Company has developed proprietary reduced nicotine content (RNC) tobacco plants and cigarettes, which have become the cornerstone

of the FDA’s Comprehensive Plan to address the widespread death and disease caused by smoking. The Company received

the first and only FDA Modified Risk Tobacco Product (MRTP) authorization for a combustible cigarette in December 2021. 22nd Century

uses modern plant breeding technologies, including genetic engineering, gene-editing, and molecular breeding to deliver solutions for

the life science and consumer products industries by creating new, proprietary plants with optimized alkaloid and flavonoid profiles

as well as improved yields and valuable agronomic traits.

Learn

more at xxiicentury.com, on Twitter, on LinkedIn, and on YouTube.

Learn

more about VLN® at tryvln.com.

###

Cautionary Note Regarding Forward-Looking

Statements

Except for historical

information, all of the statements, expectations, and assumptions contained in this press release are forward-looking statements, including

but not limited to our full year business outlook. Forward-looking statements typically contain terms such as “anticipate,”

“believe,” “consider,” “continue,” “could,” “estimate,” “expect,”

“explore,” “foresee,” “goal,” “guidance,” “intend,” “likely,”

“may,” “plan,” “potential,” “predict,” “preliminary,” “probable,”

“project,” “promising,” “seek,” “should,” “will,” “would,” and

similar expressions. Actual results might differ materially from those explicit or implicit in forward-looking statements. Important

factors that could cause actual results to differ materially are set forth in “Risk Factors” in the Company’s Annual

Report on Form 10-K filed on March 9, 2023 and Quarterly Reports on Form 10-Q filed May 9, 2023, August 14, 2023 and November 6, 2023.

All information provided in this press release is as of the date hereof, and the Company assumes no obligation to and does not intend

to update these forward-looking statements, except as required by law.

Investor Relations & Media Contact

Matt Kreps

Investor Relations

22nd Century Group

mkreps@xxiicentury.com

214-597-8200

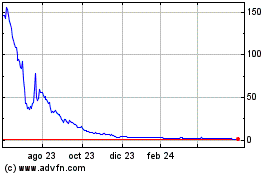

22nd Century (NASDAQ:XXII)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

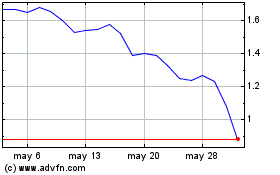

22nd Century (NASDAQ:XXII)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025