|

Prospectus Supplement

(To Prospectus dated March 31, 2023) |

|

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-270473 |

5,153,508 Shares of Common Stock

We are offering 5,153,508 shares of our common

stock, par value $0.00001 per share (“common stock”), to certain investors pursuant to this prospectus supplement and the

accompanying prospectus in a registered direct offering.

In a concurrent private placement, we are issuing

to such investors accompanying warrants (the “common warrants”) to purchase an aggregate of up to 10,307,016 shares of our

common stock. The common warrants and the common stock issuable upon the exercise of the common warrants are not being registered under

the Securities Act of 1933, as amended (the “Securities Act”), are not being offered pursuant to this prospectus supplement

and the accompanying prospectus, and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act

and/or Regulation D promulgated thereunder. The is no established public trading market for the common warrants and we do not expect a

market to develop. In addition, we do not intend to list the common warrants on the Nasdaq Capital Market, any other national securities

exchange or any other nationally recognized trading system.

The combined offering price of each share of common

stock and accompanying common warrant is $0.228. The common warrants are exercisable after the date on which an approval, as required by the applicable rules

and regulations of the Nasdaq Capital Market from our stockholders with respect to the issuance of the common warrants and the shares

upon exercise thereof, is received and deemed effective under Nevada law (the “Stockholder Approval Date”) at an exercise price of $1.00 per share of common stock, expire on the date that is five (5) years

after the Stockholder Approval Date and are subject to adjustment in certain circumstances, including that upon any subsequent equity

sales at a price per share lower than the then effective exercise price of such common warrants, then such exercise price shall be lowered

to such price at which the shares were offered. The shares of common stock and the accompanying common warrants will be issued separately

but can only be purchased together in this offering.

As a result of this offering, the exercise price

on 20,672,887 of our previously outstanding warrants will be automatically adjusted to the offering price of each share of common stock

and accompanying common warrant sold in this offering.

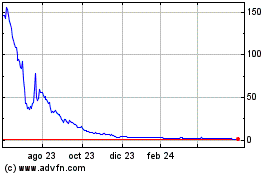

Our common stock is listed on the Nasdaq Capital

Market under the symbol “XXII.” On September 26, 2024, the closing price of our common stock was $0.2527 per share. The aggregate

market value of our outstanding common stock held by non-affiliates as of the date of this prospectus supplement was approximately $16.2

million, based on approximately 21.2 million shares of common stock outstanding, approximately 21.1 million of which were held by non-affiliates,

and a per share price of $0.77 based on the closing sale price of our common stock on July 29, 2024. We previously sold approximately

$4.2 million of securities pursuant to General Instructions I.B.6 of Form S-3 during the prior 12 calendar month period that ends on,

and includes, the date of this prospectus supplement. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities

registered on this registration statement in a public primary offering with a value exceeding more than one-third of our public float

in any 12-month period so long as our public float remains below $75,000,000, or the Baby Shelf Limitation.

We have retained Dawson James Securities, Inc.

to act as the exclusive placement agent in connection with this offering. The placement agent is not purchasing or selling any of the

common stock but has agreed to use its best efforts to arrange for the sale of the shares of common stock. We have agreed to pay the placement

agent the placement agent fees set forth in the table below, which assumes that we sell all of the securities we are offering. See “Plan

of Distribution” beginning on page S-9 of this prospectus supplement for more information regarding these arrangements.

Investing in our securities involves a

high degree of risk. You should read this prospectus supplement and the accompanying prospectus carefully before you make your

investment decision. See “Risk Factors” beginning on page S-5 of this prospectus supplement, page 1 of the

accompanying prospectus, and the information, including risk factors, contained in the other documents we file or have filed with

the Securities and Exchange Commission that are incorporated by reference in this prospectus supplement and in the accompanying

prospectus, for a discussion of the factors you should consider before investing in our common stock.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

There is no arrangement for funds to be received in escrow, trust or

similar arrangement.

| | |

Per Share and

Accompanying Common

Warrant | | |

Total | |

| Offering price | |

$ | 0.228 | | |

$ | 1,174,999.82 | |

| | |

| | | |

| | |

| Placement Agent Fees(1) | |

$ | 0.01368 | | |

$ | 70,499.99 | |

| | |

| | | |

| | |

| Proceeds, before expenses, to us(2) | |

$ | 0.21432 | | |

$ | 1,104,499.83 | |

(1) We estimate the total expenses of this offering,

excluding the placement agent fees and expenses, will be approximately $100,000. We will pay the placement agent a cash fee equal to six

percent (6%) of the aggregate gross proceeds raised in this offering. In addition, we will pay the placement agent a cash fee equal to

six percent (6%) of the aggregate cash exercise price received by us upon exercise of common warrants issued in connection with this offering

that were solicited by the placement agent. We will also reimburse the placement agent for its expenses, including the reimbursement of

legal fees not to exceed $50,000. In addition, we have agreed to issue the placement agent or its designees warrants to purchase up to

309,211 shares of common stock (equal to 6% of the aggregate number of shares of common stock sold in this offering) at an exercise price

of $1.25 (the “placement agent warrants”; and together with the common warrants, the “Warrants”). See “Plan

of Distribution” for a complete description of the compensation to be received by the placement agent.

(2) The amount of the offering proceeds to us presented in this table

does not give effect to any exercise of the Warrants being issued in this offering.

We are a “smaller reporting company”

under the federal securities laws and, as such, we have elected to comply with certain reduced public company reporting requirements and

scaled disclosures for this prospectus and future filings. See “Prospectus Supplement Summary — Implication of Being a Smaller

Reporting Company.”

Delivery of the shares of common stock and the

Warrants is expected to be made on or about October 1, 2024.

Dawson James Securities, Inc.

The date of this prospectus supplement is September

27, 2024.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

We are offering to sell, and are seeking offers

to buy, the securities only in jurisdictions where such offers and sales are permitted. The distribution of this prospectus supplement

and the accompanying prospectus and the offering of the securities in certain jurisdictions may be restricted by law. Persons outside

the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about

and observe any restrictions relating to the offering of the securities and the distribution of this prospectus supplement and the accompanying

prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used

in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the

accompanying prospectus to or by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

About

This Prospectus Supplement

This prospectus supplement

relates to the offering of our securities. Before buying securities offered hereby, we urge you to read carefully this prospectus supplement,

the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering, together

with the documents incorporated by reference herein, as described under the heading “Incorporation of Certain Documents by Reference.”

These documents contain important information that you should consider when making your investment decision. This prospectus supplement

contains information about the common stock offered hereby.

This document is in two parts.

The first part is this prospectus supplement, which describes the specific terms of the securities we are offering. The second part is

the accompanying prospectus, including the documents incorporated by reference therein, which provides more general information, some

of which may not apply to this offering. This prospectus supplement and the information incorporated by reference in this prospectus supplement

also may add to, update and change information contained in, or incorporated by reference into, the accompanying prospectus. Generally,

when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between

(i) the information contained in this prospectus supplement and (ii) the information contained in the accompanying prospectus or in any

document incorporated by reference that was filed with the Securities and Exchange Commission (the “SEC”) before the date

of this prospectus supplement, you should rely on the information in this prospectus supplement. If any statement in one of these documents

is inconsistent with a statement in another document having a later date, for example, a document incorporated by reference in this prospectus

supplement or the accompanying prospectus, the statement in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement to which the accompanying

prospectus forms a part or to any document that is incorporated by reference in this prospectus supplement or the accompanying prospectus

were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among

the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should

not be relied on as accurately representing the current state of our affairs.

The accompanying prospectus

is part of a registration statement that we filed with the SEC using a shelf registration process. Under the shelf registration process,

from time to time, we may offer and sell any of the securities described in the accompanying prospectus separately or together with other

securities described therein, subject to the Baby Shelf Limitation.

You should rely only on the

information contained in, or incorporated by reference into, this prospectus supplement, the accompanying prospectus, the documents incorporated

by reference herein, and any related free writing prospectus that we authorized to be distributed to you. Neither

we nor the placement agent have authorized anyone to provide you with different or additional information. If anyone provides you

with different or additional information, you should not rely on it. Neither we nor any of the placement

agents are making an offer to sell these shares of common stock in any jurisdiction where the offer or sale is not permitted, and

you should not consider this prospectus supplement or the accompanying prospectus to be an offer or solicitation relating to the securities

in any jurisdiction in which such an offer or solicitation relating to the securities is not authorized. You should assume that the information

contained in this prospectus supplement, the accompanying prospectus, any related free writing prospectus that we have authorized to be

delivered to you and the documents incorporated by reference herein and therein is accurate only as of their respective dates, regardless

of the time of delivery of such documents or of any sale of securities. Our business, financial condition, results of operations and prospects

may have changed since those dates. Furthermore, you should not consider this prospectus supplement or the accompanying prospectus to

be an offer or solicitation relating to the securities if the person making the offer or solicitation is not qualified to do so, or if

it is unlawful for you to receive such an offer or solicitation.

Unless otherwise indicated,

information contained in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein concerning

our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market

share, is based on information from our own management estimates and research, as well as from industry and general publications and research,

surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of

our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and

estimates of our and our industry's future performance are necessarily subject to a high degree of uncertainty and risk due to a variety

of factors, including those described in “Risk Factors” in this prospectus supplement and the accompanying prospectus, and

in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the SEC on March 28, 2024, which is incorporated

by reference into this prospectus supplement. These and other important factors could cause our future performance to differ materially

from our assumptions and estimates. See “‘Forward-Looking’ Information.”

This prospectus supplement,

the accompanying prospectus, and the information incorporated herein and therein by reference includes trademarks, service marks and trade

names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus

supplement or the accompanying prospectus are the property of their respective owners.

For purposes of this prospectus

supplement and the accompanying prospectus, references to “Company,” “22nd Century,” “we,” “us,”

“our,” and “ours” refer to 22nd Century Group, Inc. and its subsidiaries where the context so requires, unless

otherwise indicated or the context otherwise requires.

“Forward-Looking”

Information

This prospectus supplement and the information

incorporated by reference in this prospectus supplement include “forward-looking statements” within the meaning of Section

27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements,

other than statements of historical fact, included or incorporated by reference herein regarding our expectations, beliefs, plans, objectives,

prospects, financial condition, assumptions or future events are forward-looking statements. You can identify these statements by words

such as “aim,” “anticipate,” “assume,” “believe,” “could,” “due,”

“estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,”

“potential,” “positioned,” “predict,” “should,” “target,” “will,”

“would” and other similar expressions that are predictions of or indicate future events and future trends. These

forward-looking statements are based on current expectations, estimates, forecasts and projections about our business and the industry

in which we operate and our management’s beliefs and assumptions. These statements are not guarantees of future performance or development

and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. All forward-looking statements

are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including the following

summary of risk factors:

| · | We have had a history of losses and negative cash flows, and we may be unable to achieve and sustain profitability

and positive cash flows from operations. |

| · | Our ability to continue as a going concern. |

| · | Our ability to regain compliance with the NASDAQ listing requirements. |

| · | Our competitors generally have, and any future competitors may have, greater financial resources and name

recognition than we do, and they may therefore develop products or other technologies similar or superior to ours, or otherwise compete

more successfully than we do. |

| · | Our research and development process may not develop marketable products, which would result in loss of

our investment into such process. |

| · | The failure of our information systems to function as intended or their penetration by outside parties

with the intent to corrupt them could result in business disruption, litigation and regulatory action, and loss of revenue, assets, or

personal or confidential data (cybersecurity). |

| · | We may be unsuccessful at commercializing our Very Low Nicotine “VLN” tobacco using the reduced

exposure claims authorized by the Food and Drug Administration (“FDA”). |

| · | The manufacturing of tobacco products subjects us to significant governmental regulation and the failure

to comply with such regulations could have a material adverse effect on our business and subject us to substantial fines or other regulatory

actions. |

| · | We may become subject to litigation related to cigarette smoking and/or exposure to environmental tobacco

smoke, or ETS, which could severely impair our results of operations and liquidity. |

| · | The loss of a significant customer for whom we manufacture tobacco products could have an adverse impact

on our results of operation. |

| · | Product liability claims, product recalls, or other claims could cause us to incur losses or damage our

reputation. |

| · | The FDA could force the removal of our products from the U.S. market. |

| · | Certain of our proprietary rights have expired or may expire or may not otherwise adequately protect our

intellectual property, products and potential products, and if we cannot obtain adequate protection of our intellectual property, products

and potential products, we may not be able to successfully market our products and potential products. |

| · | We license certain patent rights from third-party owners. If such owners do not properly maintain or enforce

the patents underlying such licenses, our competitive position and business prospects could be harmed. |

| · | Our stock price may be highly volatile and could decline in value. |

| · | We are a named defendant in certain litigation matters, including federal securities class action lawsuits

and derivative complaints; if we are unable to resolve these matters favorably, then our business, operating results and financial condition

may be adversely affected. |

| · | Future sales of our common stock will result in dilution to our common stockholders. |

| · | We do not expect to declare any dividends on our common stock in the foreseeable future. |

You also should carefully review the risk factors

and cautionary statements described in the other documents we file or furnish from time to time with the SEC, including our Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The forward-looking

statements included in this prospectus supplement, the accompanying prospectus and any other offering material, or in the documents incorporated

by reference into this prospectus supplement, the accompanying prospectus and any other offering material, are made only as of the date

of the prospectus supplement, the accompanying prospectus, any other offering material or the incorporated document.

We do not assume any obligation to update any forward-looking statements.

We disclaim any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future

events or otherwise.

Prospectus Supplement Summary

The following

summary highlights basic information about 22nd Century, this offering, and selected information contained elsewhere in or incorporated

by reference into this prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all of

the information that you should consider before deciding whether to invest in our securities. You should review this entire prospectus

supplement and the accompanying prospectus carefully, including our consolidated financial statements and other information incorporated

by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision. In addition, please

read the “Risk Factors” section beginning on page S-3 of this prospectus supplement and in the documents incorporated by reference

into this prospectus supplement and the accompanying prospectus.

Overview

22nd Century Group, Inc. is a

tobacco products company with sales and distribution of our own proprietary new reduced nicotine tobacco products authorized as Modified

Risk Tobacco Products by the FDA. Additionally, we provide contract manufacturing services for conventional combustible tobacco products

for third-party brands.

Our mission in tobacco is dedicated

to mitigating the harms of smoking through our proprietary reduced nicotine content (“RNC”) tobacco plants and our Very Low

Nicotine, VLN® combustible cigarette products. In December 2021, we secured

the first and only authorization from the FDA to market a combustible cigarette, our brand VLN® as

a Modified Risk Tobacco Product (“MRTP”) using certain reduced nicotine exposure claims. In April 2022, the inaugural launch

of our proprietary VLN® cigarettes commenced through a pilot program in select

Circle K stores in and around Chicago, Illinois. Building on the success of the pilot, we initiated a phased rollout strategy in 2023,

progressing state by state and region by region to a store footprint spanning more than 5,000 stores in 26 states. Our VLN®

tobacco products are supported by a substantial intellectual property portfolio comprising issued

patents and patent applications related to tobacco plants, and in particular our reduced nicotine tobacco plants.

In addition to continued focus

on VLN®, we renewed our focus on utilizing our tobacco assets to attract additional

tobacco business to help fund the growth of VLN®. In addition to existing

business relationships with multiple tobacco products companies, we will continue to expand the number of brands in our contract manufacturing

operations (“CMO”) portfolio in 2024.

Our Annual Report on Form 10-K for the year ended December 31,

2023, and the subsequent reports filed pursuant to the Exchange Act provide additional information about our business, operations and

financial condition.

Recent Developments

Warrant Inducement

On September 29, 2024, we commenced a warrant

inducement offering (the “Warrant Inducement”) with the holders of outstanding warrants to purchase 5,079,244 shares of common

stock, consisting of: (i) common stock purchase warrants to purchase 3,245,744 shares of common stock issued on or about November 29,

2023, and (ii) common stock purchase warrants to purchase 1,833,500 shares of common stock issued on or about April 9, 2024 ((i) and (ii)

collectively, the “Existing Warrants”), which are exercisable for an equal number of shares of common stock at an exercise

price of $0.228. We will offer the holders of the Existing Warrants an inducement period, which ends at 5:00 p.m. EDT on September 29,

2024 (the “Inducement Period”), whereby we will agree to issue new warrants (the “Inducement Warrants”) to purchase

up to a number of shares of common stock equal to 200% of the number of shares of common stock issued pursuant to the exercise by the

holders of the Existing Warrants during the Inducement Period, for cash, at an exercise price equal to the Nasdaq Minimum Price (as defined

in the as defined in Nasdaq Listing Rule 5635(d)). The Warrant Inducement is expected to close on October 1, 2024, subject to customary

closing conditions.

The Inducement Warrants will be issued in reliance

upon an exemption from registration pursuant to Section 4(a)(2) under the Securities Act of 1933. We have agreed to, as soon as reasonably

practicable, but in any event no later than five calendar days following the Stockholder Approval Date, file a registration statement

covering the resale of the shares of our common stock issued or issuable upon the exercise of the Inducement Warrants. The shares of common

stock issuable upon exercise of the Existing Warrants have been previously registered for issuance pursuant to a Registration Statement

on Form S-3 (File No. 333-279046), which was declared effective by the SEC on May 9, 2024.

Nasdaq Compliance

On April 4, 2024, we received a letter from Nasdaq Stock Market LLC

(“Nasdaq”) indicating that we were not in compliance with Nasdaq Listing Rule 5550(b)(1), because (i) our stockholders’

equity (deficit) of ($8,410,000) as of December 31, 2023, as reported in our Annual Report on Form 10-K for the year ended December 31,

2023, was below the minimum stockholders’ equity requirement of $2,500,000 and (ii) we did not, as of April 3, 2024, meet the alternatives

standards of market value of listed securities or net income from continuing operations for compliance with Nasdaq Listing Rule 5550(b)(1).

The letter indicated that we had a period of 45 calendar days from the date of the letter to submit a plan to regain compliance. We submitted

our plan to regain compliance to Nasdaq on May 17, 2024. On June 3, 2024, we received a letter from Nasdaq notifying us that Nasdaq had

reviewed our plan for regaining compliance with Nasdaq Listing Rule 5550(b)(1) and granted us a 180-calendar day extension from April

4, 2024 (or until October 1, 2024), to evidence compliance with Nasdaq Listing Rule 5550(b)(1). As a result of this offering and other

actions, we believe that we satisfy the stockholders’ equity requirement of at least $2.5 million pursuant to Nasdaq Listing Rule

5550(b)(1) for continued listing on the Nasdaq.

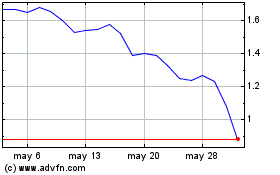

On July 16, 2024, we received a deficiency

letter from the Nasdaq Listing Qualifications Department notifying us that, for the last 30 consecutive business days, the closing bid

price for our common stock has been below the minimum $1.00 per share required for continued listing on The Nasdaq Capital Market pursuant

to Nasdaq Listing Rule 5550(a)(2) (“Rule 5550(a)(2)”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we have been

given 180 calendar days, or until January 13, 2025, to regain compliance with Rule 5550(a)(2).

Any delisting of our common stock from trading

on Nasdaq would likely have a material adverse effect on our stock price and liquidity.

Corporate Information

We are a Nevada corporation and our corporate

headquarters is located at 321 Farmington Road, Mocksville, North Carolina 27028. Our telephone number is (716) 270-1523. Our internet

address is www.xxiicentury.com. We do not incorporate the information on our website into this prospectus supplement or in the accompanying

prospectus, and you should not consider it to be a part of this prospectus supplement or the accompanying prospectus. Our web site address

is included as an inactive textual reference only.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Item

10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among

other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last

day of the fiscal year in which (i) the market value of our common stock held by non-affiliates exceeds $250 million as of the prior June

30, or (ii) our annual revenue exceeded $100 million during such completed fiscal year and the market value of our common stock held by

non-affiliates exceeds $700 million as of the prior June 30.

The Offering

| Issuer |

22nd Century Group, Inc. |

| |

|

| Common stock offered by us |

5,153,508 shares of common stock. |

| |

|

| Offering price |

$0.228 per share of common stock and accompanying common warrant. |

| |

|

| Concurrent private placement |

In a concurrent private placement, we are selling to the purchasers of our common stock accompanying common warrants to purchase up to an aggregate of 10,307,016 shares of common stock, which common warrants are exercisable after the Stockholder Approval Date (as defined in the Securities Purchase Agreement) at an exercise price of $1.00 per share of common stock and expire on the date that is five (5) years after the Stockholder Approval Date. We will receive proceeds from the concurrent private placement transaction of warrants to be purchased by any investor in the concurrent private placement solely to the extent such warrants are exercised for cash. The common warrants and the common stock issuable upon the exercise of the common warrants are not being registered under the Securities Act, are not being offered pursuant to this prospectus supplement and the accompanying prospectus, and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and/or Regulation D promulgated thereunder. There is no established public trading market for the common warrants being issued in the concurrent private placement, and we do not expect a market to develop. We do not intend to apply for listing of the common warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the common warrants will be limited. |

| |

|

|

Placement Agent Warrants

|

We will also issue placement agent warrants to purchase up to 309,211 shares of common stock (and the shares of common stock issuable upon the exercise of the placement agent warrants) to the placement agent or its designees as part of the compensation payable to the placement agent in connection with this offering. The placement agent warrants and the common stock issuable upon the exercise of the placement agent warrants are not being registered under the Securities Act, are not being offered pursuant to this prospectus supplement and the accompanying prospectus, and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and/or Regulation D promulgated thereunder. There is no established public trading market for the placement agent warrants being issued in connection with this offering, and we do not expect a market to develop. We do not intend to apply for listing of the placement agent warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the placement agent warrants will be limited. |

| |

|

| Shares of common stock to be outstanding after this offering(1) |

26,356,714 shares of common stock (assuming the sale of all securities covered by this prospectus supplement but assuming no exercise of any common warrants or placement agent warrants). |

| |

|

| Use of proceeds |

We intend to use the net proceeds from this offering for general corporate purposes. See “Use of Proceeds” in this prospectus supplement. |

| |

|

| Risk factors |

An investment in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-3 of this prospectus supplement and other information included in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| |

|

| Nasdaq Capital Market symbol |

Our common stock is traded on the Nasdaq Capital Market under the symbol “XXII.” |

| (1) | The number of shares outstanding after this offering is based

on 21,203,206 shares of common stock outstanding as of September 26, 2024, and excludes: |

| · | 21,157,600 shares of common stock issuable upon the exercise

of 21,157,600 warrants at an exercise price of $2.824 per share, which exercise price will be automatically adjusted to an exercise price

of $0.228 in connection with this offering to equal to the combined offering price of each share and accompanying common warrants sold

in this offering; |

| · | 1,150,000 shares of common stock issuable upon the exercise

of 1,150,000 pre-funded warrants; |

| · | 4,207 shares of our common stock issuable upon the exercise

of fully vested and immediately exercisable stock options at a weighted-average exercise price of $369.43 per share; |

| · | 146,321 shares of unvested restricted stock units; and |

| · | 5,191,421 shares of our common stock reserved for future award

grants under the under the 22nd Century Group, Inc. 2021 Omnibus Incentive Plan. |

| | | |

| | | Except as otherwise indicated, all information

in this prospectus supplement assumes no exercise or settlement of outstanding options or restricted stock and no exercise of the Warrants. |

RISK FACTORS

An

investment in our common stock involves a high degree of risk. Prior to making a decision about investing in our common stock, you should

consider carefully the specific risk factors discussed in the sections entitled “Risk Factors” contained in our most recent

Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on March 28, 2024, which are incorporated into

this prospectus supplement and the accompanying prospectus by reference in their entirety, as updated or superseded by the risks and uncertainties

described under similar headings in the other documents that are filed after the date hereof and incorporated by reference into this prospectus

supplement and the accompanying prospectus, together with other information in this prospectus supplement and the accompanying prospectus,

the documents incorporated by reference and any free writing prospectus that we may authorize for use in connection with this offering.

These risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known

to us, or that we currently view as immaterial, may also impair our business. Past financial performance may not be a reliable indicator

of future performance, and historical trends should not be unduly relied upon to anticipate results or trends in future periods. If any

of the risks or uncertainties described in our SEC filings or any additional risks and uncertainties actually occur, our business, financial

condition, results of operations and cash flow could be materially and adversely affected. In that case, the trading price of our common

stock could decline and you might lose all or part of your investment. Please also read carefully the section above titled “Forward-Looking

Information.”

Risks Related to our Business and Continued Operations

We have a history of losses, and we

expect to incur significant expenses and continuing losses for the foreseeable future and there is substantial doubt regarding our ability

to continue as a going concern.

As indicated in our Annual

Report on Form 10-K for the year ended December 31, 2023, we have incurred significant losses and negative cash flows from operations

since inception and expect to incur additional losses until such time that we can generate significant revenue and profit in our tobacco

business, which casts substantial doubt regarding our ability to continue as a going concern. As of September 26, 2024, we had cash and

cash equivalents of approximately $3.0 million.

Doubts about our ability

to continue as a going concern have and could continue to negatively impact our relationships with our commercial partners and our ability,

as part of our cost-cutting measures, to obtain, maintain, restructure and/or terminate agreements with them, or negatively impact our

negotiating leverage with such parties, which could have a material adverse effect on our business, financial condition and results of

operations or result in litigation. Furthermore, any loss of key personnel, employee attrition or material erosion of employee morale

arising out of doubts about our ability to operate as a going concern could have a material adverse effect on our ability to effectively

conduct our business, and could impair our ability to execute our business plan, thereby having a material adverse effect on our business,

financial condition and results of operations.

We continue to seek and

evaluate opportunities to raise additional funds through the issuance of our securities, asset sales, and through arrangements with strategic

partners. If capital is not available to us when, and in the amounts needed, we could be required to liquidate our inventory, cease or

curtail operations, or seek protection under applicable bankruptcy laws or similar state proceedings. There can be no assurance that we

will be able to raise the capital we need to continue our operations.

Risks Related to this Offering

We have outstanding warrants with anti-dilution

price protection and this offering will result in the exercise price on such warrants being reduced to the combined offering price of

each share and accompanying common warrant sold in this offering.

We have approximately 20,672,887 outstanding warrants

with anti-dilution price protection. This offering of our securities will result in the exercise price on such warrants being reduced

to the combined offering price of each share and accompanying common warrant sold in this offering. In addition, the exercise price on

these warrants and the warrants sold in this offering will have the exercise price reduced in the event of any future offerings of securities

at a lower price than the current exercise price (subject to limited exceptions). Such warrants may deter future investors and can result

in further dilution to our investors.

Nasdaq may delist our common stock from

trading on its exchange which could limit investors’ ability to make transactions in our common stock and subject us to additional

trading restrictions.

Our common stock

is currently listed on the Nasdaq. If Nasdaq delists our common stock from trading on its exchange, we could face significant material

adverse consequences, including:

| · | a limited availability of market

quotations for our common stock; |

| · | reduced liquidity with respect

to our securities; |

| · | a determination that shares

of our common stock are “penny stock” which will require brokers trading in our shares to adhere to more stringent rules,

possibly resulting in a reduced level of trading activity in the secondary trading market for our shares; |

| · | a limited amount of news and

analyst coverage; and |

| · | a decreased ability to issue additional common stock or obtain

additional financing in the future. |

On April 4, 2024, we received a letter from Nasdaq

indicating that we were not in compliance with Nasdaq Listing Rule 5550(b)(1), because (i) our stockholders’ equity (deficit) of

($8,410,000) as of December 31, 2023, as reported in our Annual Report on Form 10-K for the year ended December 31, 2023, was below the

minimum stockholders’ equity requirement of $2,500,000 and (ii) we did not, as of April 3, 2024, meet the alternatives standards

of market value of listed securities or net income from continuing operations for compliance with Nasdaq Listing Rule 5550(b)(1). The

letter indicated that we had a period of 45 calendar days from the date of the letter to submit a plan to regain compliance. We submitted

our plan to regain compliance to Nasdaq on May 17, 2024. On June 3, 2024, we received a letter from Nasdaq notifying us that Nasdaq had

reviewed our plan for regaining compliance with Nasdaq Listing Rule 5550(b)(1) and granted us a 180-calendar day extension from April

4, 2024 (or until October 1, 2024), to evidence compliance with Nasdaq Listing Rule 5550(b)(1).

On July 16, 2024, we

received a deficiency letter from the Nasdaq Listing Qualifications Department notifying us that, for the last 30 consecutive business

days, the closing bid price for our common stock has been below the minimum $1.00 per share required for continued listing on The Nasdaq

Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (“Rule 5550(a)(2)”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A),

we have been given 180 calendar days, or until January 13, 2025, to regain compliance with Rule 5550(a)(2).

Any delisting

of our common stock from trading on Nasdaq would likely have a material adverse effect on our stock price and liquidity.

Fluctuations in the price of our common

stock, including as a result of actual or anticipated sales of shares by us and/or our directors, officers or stockholders, may make our

common stock more difficult to resell.

The market price and trading volume of our common

stock have been, and may continue to be, subject to significant fluctuations due not only to general stock market conditions, but also

to changes in sentiment in the market regarding the industry in which we operate, our operations, business prospects or liquidity, or

this offering. In addition to the risk factors discussed in our periodic reports and in this prospectus supplement, the price and volume

volatility of our common stock may be affected by actual or anticipated sales of common stock by us and/or our directors, officers or

stockholders, whether in the market, in connection with business acquisitions, in this offering or in subsequent public offerings. Stock

markets in general have at times experienced extreme volatility unrelated to the operating performance of particular companies. These

broad market fluctuations may adversely affect the trading price of our common stock, regardless of our operating results.

As a result, these fluctuations in the market

price and trading volume of our common stock may make it difficult to predict the market price of our common stock in the future, cause

the value of your investment to decline and make it more difficult to resell our common stock.

Management will have broad discretion as

to the use of the proceeds of this offering, and we may use the proceeds in ways in which you and other stockholders may disagree.

We have not designated the amount of net proceeds

we will receive from this offering for any particular purpose. We may use a portion of the net proceeds to acquire or invest in new or

different businesses, products and intellectual property. Our management will have broad discretion over the use and investment of the

net proceeds from this offering, and, accordingly, investors in this offering will need to rely upon the judgment of our management with

respect to the use of proceeds, with only limited information concerning our specific intentions. Our stockholders may not agree

with the manner in which our management chooses to allocate and spend the net proceeds.

You may experience future dilution as a

result of future equity offerings.

In order to raise additional capital, we may in

the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices

that may not be the same as the price per share in this offering. We may sell shares or other securities in any future offering at a price

per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities

in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common

stock, or securities convertible or exchangeable into our common stock, in future transactions may be higher or lower than the price per

share paid by investors in this offering.

There is no public market for the Warrants

being offered in this offering.

There is no established public trading market

for the Warrants in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the Warrants

on any securities exchange or nationally recognized trading system, including the NASDAQ. Without an active market, the liquidity of the

Warrants will be limited.

Holders of the Warrants purchased in this

offering will have no rights as holders of common stock until such holders exercise their Warrants and acquire our common stock.

Until holders of the Warrants acquire our common

stock upon exercise of such Warrants, holders of the Warrants will have no rights with respect to our common stock underlying such Warrants.

Upon exercise of the Warrants, the holders will be entitled to exercise the rights of a holder of common stock only as to matters for

which the record date occurs after the exercise date.

We do not anticipate paying cash dividends

and, accordingly, stockholders must rely on share appreciation for any return on their investment.

We currently intend to retain our future earnings,

if any, to fund the development and growth of our businesses and do not anticipate that we will declare or pay any cash dividends on our

capital stock in the foreseeable future. In addition, our ability to pay dividends is limited by covenants of our existing and outstanding

indebtedness and may be limited by covenants of any future indebtedness we incur. As a result, capital appreciation, if any, of our common

stock will be your sole source of gain on your investment for the foreseeable future. Investors seeking cash dividends should not invest

in our common stock.

Our common stock may become the target of

a “short squeeze.”

In recent years, the securities of several companies

have increasingly experienced significant and extreme volatility in stock price due to short sellers of common stock and buy-and-hold

decisions of longer investors, resulting in what is sometimes described as a “short squeeze.” Short squeezes have caused extreme

volatility in those companies and in the market and have led to the price per share of those companies to trade at a significantly inflated

rate that is disconnected from the underlying value of the company. Sharp rises in a company’s stock price may force traders in

a short position to buy the shares to avoid even greater losses. Many investors who have purchased shares in those companies at an inflated

rate face the risk of losing a significant portion of their original investment as the price per share has declined steadily as interest

in those shares have abated. We may be a target of a short squeeze, and investors may lose a significant portion or all of their investment

if they purchase our shares at a rate that is significantly disconnected from our underlying value.

Use

of Proceeds

We estimate that the net proceeds

from the sale of shares in this offering will be approximately $1.0 million, after deducting placement agent fees and expenses, as well

as our estimated expenses related to the offering. This estimate excludes the proceeds, if any, from the exercise of the common warrants

sold in the private placement concurrently with this offering.

We expect to use any proceeds

that we receive from this offering for general corporate purposes. Accordingly, we retain broad discretion over the use of the net proceeds

from this offering. The precise amount and timing of the application of such proceeds will depend upon our liquidity needs and the availability

and cost of other capital over which we have little or no control. As of the date of this prospectus supplement, we cannot specify with

certainty all of the particular uses, and the respective amounts we may allocate to those uses, for the net proceeds we receive.

PLAN

OF DISTRIBUTION

Pursuant to an engagement

agreement between us and Dawson James Securities, Inc. (“Dawson James” or the “placement agent”) we have engaged

Dawson James as our exclusive placement agent to solicit offers to purchase the shares in this offering. The placement agent is not purchasing

or selling any of the shares we are offering, and it is not required to arrange the purchase or sale of any specific number of shares

or dollar amount, but it has agreed to use commercially reasonable efforts to arrange for the sale of the shares. The placement agent

may retain sub-agents and selected dealers in connection with this offering.

The placement agent proposes

to arrange for the sale of the shares we are offering pursuant to this prospectus supplement and the accompanying prospectus to one or

more investors through securities purchase agreements directly between the purchasers and us. All of the shares will be sold at the same

price and, we expect, at a single closing. We established the price following negotiations with prospective investors and with reference

to the prevailing market price of our common stock, recent trends in such price and other factors. It is possible that not all of the

shares we are offering pursuant to this prospectus supplement and the accompanying prospectus will be sold at the closing, in which case

our net proceeds would be reduced. We anticipate that the sale of the shares will be completed on the date indicated on the cover page

of this prospectus supplement, subject to customary closing conditions. On the closing date, the following will occur:

| · | we will receive funds in the amount of the aggregate purchase price; |

| · | Dawson James, as placement agent, will receive the placement agent fees in accordance with the terms of

the engagement agreement; and |

| · | we will deliver the shares and common warrants to the investors. |

In connection with this offering,

the placement agent may distribute this prospectus supplement and the accompanying prospectus electronically.

We will pay the placement agent a cash fee equal

to six percent (6%) of the aggregate gross proceeds raised in this offering. In addition, we will pay the placement agent a cash fee equal

to six percent (6%) of the aggregate cash exercise price received by us upon exercise of common warrants issued in connection with this

offering that were solicited by the placement agent. We will also reimburse the placement agent for their expenses, including the reimbursement

of legal fees not to exceed $50,000.

| | |

Per Share and

Accompanying Common

Warrant | | |

Total | |

| Offering price | |

$ | 0.228 | | |

$ | 1,174,999,82 | |

| Placement Agent Fees | |

$ | 0.01368 | | |

$ | 70,499.99 | |

| Proceeds, before expenses, to us | |

$ | 0.21432 | | |

$ | 1,104,499.83 | |

The estimated offering expenses payable by

us, excluding the placement agent fees and expenses, will be approximately $100,000.

Placement Agent Warrants

In addition, we have agreed to issue to the placement

agent or its designees as part of the compensation payable to the placement agent in connection with this offering warrants to purchase

up to 309,211 shares of common stock (equal to 6% of the aggregate number of shares of common stock sold in this offering) at an exercise

price of $1.25 per share. The placement agent warrants and the shares of our common stock issuable upon exercise thereof are not being

registered pursuant to this prospectus supplement and accompanying prospectus. The placement agent warrants will be exercisable after

the Stockholder Approval Date and will expire five (5) years from the commencement of sales in the offering. Except as provided above,

the placement agent warrants will have substantially the same terms as the common warrants issued to the investors in the concurrent private

placement.

Indemnification

We have agreed to indemnify the placement agent

against certain liabilities, including liabilities under the Securities Act, and liabilities arising from breaches and representations

and warranties by us as contained in the engagement letter. We have also agreed to contribute to payments the placement agent may be required

to make in respect of such liabilities.

Regulation M

Dawson James may be deemed to be an underwriter

within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the resale

of the shares sold by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act.

As an underwriter, Dawson James would be required to comply with the requirements of the Securities Act and the Exchange Act, including,

without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These

rules and regulations may limit the timing of purchases and sales of shares by Dawson James acting as principal. Under these rules and

regulations, Dawson James:

| · | may not engage in any stabilization activity in connection with our securities; and |

| · | may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as

permitted under the Exchange Act, until it has completed its participation in the distribution. |

Electronic Distribution

A prospectus supplement in

electronic format may be made available on websites or through other online services maintained by the placement agent of the offering,

or by its affiliates. Other than the prospectus supplement in electronic format, the information on the placement agent’s websites

and any information contained in any other website maintained by the placement agent is not part of this prospectus supplement or the

registration statement of which this prospectus supplement forms a part, has not been approved and/or endorsed by us or the placement

agent in its capacity as placement agent and should not be relied upon by investors.

Listing

Our common stock is listed on the Nasdaq Capital

Market under the symbol “XXII.”

Selling Restrictions

No action has been taken in

any jurisdiction (except in the United States) that would permit a public offering of our common stock, or the possession, circulation

or distribution of this prospectus supplement, the accompanying prospectus or any other material relating to us or our common stock in

any jurisdiction where action for that purpose is required. Accordingly, our common stock may not be offered or sold, directly or indirectly,

and none of this prospectus supplement, the accompanying prospectus or any other offering material or advertisements in connection with

our common stock may be distributed or published, in or from any country or jurisdiction, except in compliance with any applicable rules

and regulations of any such country or jurisdiction.

Affiliations

The placement agent and its

affiliates have provided, and may in the future provide, various investment banking, financial advisory and other financial services to

us and our affiliates for which they have received, and in the future may receive, advisory or transaction fees, as applicable. The placement

agent has acted as the placement agent in registered direct offerings, warrant inducements, and a confidentially marketed public offering

in the past three years and it received compensation for such offerings. Except as disclosed in this prospectus supplement, we have no

present arrangements with the placement agent for any further services.

PRIVATE

PLACEMENT TRANSACTION

Concurrently with the sale of shares of common

stock in this offering, we will issue and sell to certain investors accompanying common warrants to purchase an aggregate of up to 10,307,016

shares of our common stock, which common warrants will be exercisable after the Stockholder Approval Date at an exercise price of $1.00

per share of common stock and will expire on the date that is five (5) years after the Stockholder Approval Date. Such common warrants

are subject to adjustment in certain circumstances, including upon any subsequent equity sales at a price per share lower than the then-effective

exercise price of such common warrants, in which case such exercise price shall be lowered to the price at which the shares were offered.

The common warrants and the

common stock issuable upon the exercise of the common warrants are not being registered under the Securities Act of 1933, as amended (the

“Securities Act”), are not being offered pursuant to this prospectus supplement and the accompanying prospectus, and are being

offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and/or Regulation D promulgated thereunder. The

is no established public trading market for the common warrants and we do not expect a market to develop. In addition, we do not intend

to list the common warrants on the Nasdaq Capital Market, any other national securities exchange or any other nationally recognized trading

system. The investors are required to be “accredited investors” as such term is defined in Rule 501(a) under the Securities

Act. We have agreed to file a registration statement on Form S-3 providing for the resale of the shares of common stock underlying the

common warrants by the investors within 30 calendar days of September 27, 2024.

A holder of common warrants

will have the right to exercise the common warrants on a “cashless” basis if there is no effective registration statement

registering the resale of the common warrant shares. Subject to limited exceptions, a holder of common warrants will not have the right

to exercise any portion of its warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or 9.99%

at the election of the holder prior to the date of issuance) of the number of shares of our common stock outstanding immediately after

giving effect to such exercise, provided that the holder may increase or decrease the beneficial ownership limitation up to 9.99%. Any

increase in the beneficial ownership limitation shall not be effective until 61 days following notice of such change to us. In addition,

as more fully described in the form of common warrant, in certain circumstances, upon a fundamental transaction, the holder will have

the right to require us to repurchase its common warrants at the Black Scholes value.

Except as otherwise provided

in the common warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the common warrants

do not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise their common warrants,

as applicable.

The summary of certain terms

and provisions of the common warrants is not complete and is subject to, and qualified in its entirety by, the provisions of the form

of the common warrants which was filed as an exhibit to a Current Report on Form 8-K after the date of this prospectus supplement and

which is incorporated by reference herein.

Description

of the securities we are offering

The following is a description of our capital

stock and certain provisions of our amended and restated articles of incorporation, amended and restated bylaws and certain provisions

of applicable law. The following is only a summary and is qualified by applicable law and by the provisions of our amended and restated

articles of incorporation and amended and restated bylaws, copies of which are included as exhibits to the registration statement of which

this prospectus forms a part. We are incorporated in the State of Nevada. The rights of our stockholders are generally covered by Nevada

law and our amended and restated articles of incorporation and amended and restated bylaws. The terms of our capital stock are therefore

subject to Nevada law.

General

Our authorized capital stock

consists of 250,000,000 shares of common stock, $0.00001 par value per share, and 10,000,000 shares of preferred stock, $0.00001 par value

per share. As of September 26, 2024, 21,203,206 shares of common stock were issued and outstanding and no shares of preferred stock were

issued and outstanding.

Our common stock is traded

on the Nasdaq Capital Market under the symbol “XXII.” Holders of our common stock are entitled to one vote for each share

held on all matters submitted to a vote of stockholders and do not have cumulative voting rights. Holders of common stock are entitled

to receive ratably such dividends, if any, as may be declared by the board of directors out of funds legally available therefore, subject

to a preferential dividend right of outstanding preferred stock. Upon the liquidation, dissolution or our winding up, the holders of common

stock are entitled to receive ratably our net assets available after the payment of all debts and other liabilities and subject to the

prior rights of any outstanding preferred stock. The rights, preferences and privileges of holders of our common stock are subject to,

and may be adversely affected by the rights of the holders any series of preferred stock that we may designate and issue in the future.

Legal

Matters

The validity of the shares

of our common stock being offered hereby will be passed upon for us by Foley & Lardner LLP, Jacksonville, Florida. Haynes and Boone,

LLP, New York, New York is acting as counsel for the placement agent in connection with this offering.

Experts

The consolidated financial

statements to the Annual Report on Form 10-K for the year ended December 31, 2023, are incorporated herein by reference and have been

so incorporated in reliance on the report of Freed Maxick CPAs, P.C., an independent registered public accounting firm, (which contains

an explanatory paragraph describing conditions that raise substantial doubt about our ability to continue as a going concern as described

in Note 1 to the consolidated financial statements) given on the authority of said firm as experts in auditing and accounting.

Where

You Can Find More Information

We file annual, quarterly

and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet website at http://www.sec.gov

which contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Our SEC filings are available to the public from the SEC’s Internet website.

This prospectus supplement

and the accompanying prospectus are part of a registration statement that we have filed with the SEC relating to the securities to be

offered. This prospectus supplement and the accompanying prospectus omit some of the information we have included in the registration

statement and the accompanying exhibits and schedules in accordance with the rules and regulations of the SEC, and we refer you to the

omitted information. The statements this prospectus supplement makes pertaining to the content of any contract, agreement or other document

that is an exhibit to the registration statement necessarily are summaries of their material provisions and do not describe all provisions,

exceptions and qualifications contained in those contracts, agreements or documents. You should read those contracts, agreements or documents

for information that may be important to you. The registration statement, exhibits and schedules are available through its Internet website.

Incorporation

of Certain Documents by Reference

The SEC allows us to “incorporate

by reference” much of the information we file with the SEC, which means that we can disclose important information to you by referring

you to those publicly available documents. The information that we incorporate by reference in this prospectus supplement is considered

to be part of this prospectus supplement. Because we are incorporating by reference future filings with the SEC, this prospectus supplement

is continually updated and those future filings may modify or supersede some of the information included or incorporated in this prospectus

supplement. This means that you must look at all of the SEC filings that we incorporate by reference to determine if any of the statements

in this prospectus supplement or in any document previously incorporated by reference have been modified or superseded. This prospectus

supplement incorporates by reference the documents listed below and any future filings we make with the SEC under Sections 13(a), 13(c),

14 or 15(d) of the Exchange Act (in each case, other than information furnished under Item 2.02 or Item 7.01 of Form 8-K) on or after

the date of this prospectus supplement until the earlier of the date on which all of the securities registered hereunder have been sold

or the registration statement of which this prospectus is a part has been withdrawn:

| · | Our Current Reports on Form 8-K filed with the SEC on September

13, 2024, September 9,

2024, August 28,

2024, August 16,

2024, July 30, 2024, July

22, 2024, June 28,

2024, June 4, 2024, May

30, 2024, May 10,

2024, April 30,

2024, April 18,

2024, April 9,

2024, April 8, 2024, April

5, 2024, April 3,

2024, February 15,

2024, February 13,

2024, January 25,

2024, and January 24,

2024; |

We will provide without charge to each person

to whom a prospectus is delivered a copy of any or all of the information that has been incorporated by reference into but not delivered

with this prospectus supplement. Requests should be directed to our principal executive offices at:

22nd Century Group, Inc.

321 Farmington Rd

Mocksville, NC 27028

(716) 270-1523

You should rely only on the

information contained in this prospectus supplement, including information incorporated by reference herein as described above, the accompanying

prospectus (including information incorporated by reference therein) and any free writing prospectus that we may authorize to be delivered

to you. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. You should not assume that the information in this prospectus supplement or the accompanying prospectus

is accurate as of any date other than the date on the front of those documents or that any document incorporated by reference is accurate

as of any date other than its filing date. You should not consider this prospectus supplement or the accompanying prospectus to be an

offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation relating to the securities

is not authorized. Furthermore, you should not consider this prospectus supplement or the accompanying prospectus to be an offer or solicitation

relating to the securities if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive

such an offer or solicitation.

PROSPECTUS

22nd Century Group, Inc.

DEBT SECURITIES

COMMON STOCK

PREFERRED STOCK

WARRANTS

SUBSCRIPTION RIGHTS

SECURITIES PURCHASE CONTRACTS

UNITS

We may offer and sell from

time to time up to $250 million of any combination of the securities described in this prospectus, from time to time, in one or more offerings,

in amounts, at prices and on terms determined at the times of offerings.

This prospectus describes

the general manner in which our securities may be offered using this prospectus. We will provide specific terms of the securities, including

the offering prices, in one or more supplements to this prospectus. The supplements may also add, update or change information contained

in this prospectus. You should read this prospectus and the prospectus supplement relating to the specific issue of securities carefully

before you invest.

We may offer the securities

for sale directly to the purchasers or through one or more underwriters, dealers and agents to be designated at a future date. The supplements

to this prospectus will provide the specific terms of the plan of distribution.

Our common stock is listed on the Nasdaq Capital

Market under the symbol “XXII.” The last reported sale price of the common stock on March 6, 2023 was $0.9356 per share.

Each prospectus supplement will indicate if the securities offered thereby will be listed on any securities exchange.

Investing in our securities

involves risk. Please read carefully the section entitled “Risk Factors” on Page 1 of this prospectus and any similar

section contained in the applicable prospectus supplement and/or other offering material concerning factors you should consider before

investing in our securities which may be offered hereby.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 31, 2023.

TABLE OF CONTENTS

ABOUT

THIS PROSPECTUS

Unless the context otherwise

requires, references in this prospectus to “Company,” “22nd Century,” “we,” “us,” “our,”

and “ours” refer to 22nd Century Group, Inc. and its subsidiaries where the context so requires.

This prospectus is part of

a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf”

registration process. Under this shelf registration process, we may, from time to time, sell the securities described in this prospectus,

in one or more offerings, up to the maximum aggregate dollar amount $250 million. This prospectus provides you with a general description

of the securities that we may offer. Each time we offer securities, we will provide a prospectus supplement and/or other offering

material that will contain specific information about the terms of that offering. The prospectus supplement and/or other offering material

may also add, update or change information contained in this prospectus. You should read this prospectus and the applicable prospectus

supplement and any other offering material together with the additional information described under the heading “Where You Can Find

More Information.”

You should rely only on the

information contained or incorporated by reference in this prospectus and in any prospectus supplement or other offering material. We

have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. We are not making offers to sell the securities in any jurisdiction in which an offer is not authorized

or in which the person making that offer is not qualified to do so or to anyone to whom it is unlawful to make an offer. You should not

assume that the information contained in this prospectus or any prospectus supplement or any other offering material, or the information

we previously filed with the SEC that we incorporate by reference in this prospectus or any prospectus supplement, is accurate as of any

date other than its respective date. Our business, financial condition, results of operations and prospects may have changed since

those dates.

RISK

FACTORS

Investing in our securities

involves risks. Before making an investment decision, you should carefully consider the risks and other information we include or incorporate

by reference in this prospectus and any prospectus supplement. In particular, you should consider the risk factors described under the

heading “Risk Factors” in our most recent Annual Report on Form 10-K as may be revised or supplemented by our subsequent

Quarterly Reports on Form 10-Q or Current Reports of Form 8-K, each of which are on file with the SEC and are incorporated herein

by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future.

In addition to those risk factors, there may be additional risks and uncertainties which are not currently known to us or that we currently

deem immaterial. Our business, financial condition or results of operations could be materially adversely affected by any of these

risks. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities. Additional

risk factors may be included in a prospectus supplement relating to a particular offering of securities.

“FORWARD-LOOKING”

INFORMATION

This registration statement

and the information incorporated by reference herein include “forward-looking statements” within the meaning of Section 27A

of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements,

other than statements of historical fact, included or incorporated by reference herein regarding our expectations, beliefs, plans, objectives,

prospects, financial condition, assumptions or future events are forward-looking statements. You can identify these statements by words

such as “aim,” “anticipate,” “assume,” “believe,” “could,” “due,”

“estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,”

“potential,” “positioned,” “predict,” “should,” “target,” “will,”

“would” and other similar expressions that are predictions of or indicate future events and future trends. These forward-looking

statements are based on current expectations, estimates, forecasts and projections about our business and the industry in which we operate

and our management’s beliefs and assumptions. These statements are not guarantees of future performance or development and involve

known and unknown risks, uncertainties and other factors that are in some cases beyond our control. All forward-looking statements are

subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including the following

summary of risk factors:

| · | We have had a history of losses and negative cash flows, and we may be unable to achieve and sustain profitability

and positive cash flows from operations. |

| · | Our competitors generally have, and any future competitors may have, greater financial resources and name

recognition than we do, and they may therefore develop products or other technologies similar or superior to ours, or otherwise compete

more successfully than we do. |

| · | Our research and development process may not develop marketable products, which would result in loss of

our investment into such process. |