Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

14 Junio 2024 - 7:53AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

TENDER

OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 1)

JOYY Inc.

(Name of Subject Company (Issuer))

JOYY Inc.

(Name of Filing Person (Issuer))

1.375% Convertible Senior Notes due 2026

(Title of Class of Securities)

98426T AF3

(CUSIP Number of Class of Securities)

David Xueling Li

Chief Executive Officer

Tel: +65 6351-9330

30 Pasir Panjang Road #15-31A Mapletree Business

City,

Singapore 117440

with copy to:

|

Haiping Li, Esq.

Skadden, Arps, Slate, Meagher & Flom

LLP

c/o 42/F, Edinburgh Tower

The Landmark

15 Queen’s Road Central

Hong Kong

+852 3740-4700 |

Yilin Xu, Esq.

Skadden, Arps, Slate, Meagher & Flom

LLP

30/F, China World Office 2

No. 1, Jianguomenwai Avenue

Chaoyang District

Beijing 100004, China

+86 (10) 6535-5500 |

(Name, address and telephone number of person

authorized to receive notices and communications on behalf of the filing person)

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| ¨ |

third-party tender offer subject to Rule 14d-1. |

| x |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| ¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing

is a final amendment reporting the results of the tender offer: x

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

INTRODUCTORY STATEMENT

This Amendment No. 1 to Schedule TO (this

“Amendment No. 1”) amends and supplements the Tender Offer Statement on Schedule TO that was initially filed by JOYY

Inc. (the “Company”) on April 12, 2024 (the “Schedule TO”) relating to the Company’s 1.375% Convertible

Senior Notes due 2026 (the “2026 Notes”). This Amendment No. 1 relates to the final results of the Company’s repurchase

of the 2026 Notes that have been validly surrendered for repurchase and not withdrawn pursuant to the Company’s repurchase right

notice to the holders of the 2026 Notes (the “Holders”) dated April 12, 2024 (the “Repurchase Right Notice”).

The information contained in the Schedule TO, including the Repurchase Right Notice, as supplemented and amended by the information contained

in Item 11 below, is incorporated herein by reference. Except as specifically provided herein, this Amendment No. 1 does not modify

any of the information previously reported on the Schedule TO.

This Amendment No. 1 amends and supplements

the Schedule TO as set forth below and constitutes the final amendment to the Schedule TO. This Amendment No. 1 is intended to satisfy

the disclosure requirements of Rule 13e-4(c)(4) under the Securities Exchange Act of

| ITEM 11. | ADDITIONAL INFORMATION. |

Item 11 of the Schedule TO is hereby amended and

supplemented to include the following information:

The repurchase right offer expired at 5:00 p.m.,

New York City time, on Thursday, June 13, 2024 (the “Expiration Date”). The Company has been advised by Citibank, N.A.,

as paying agent (the “Paying Agent”), that pursuant to the terms of the Repurchase Right Notice, US$405,445,000 aggregate

principal amount of the 2026 Notes were validly surrendered and not withdrawn as of the Expiration Date. The Company has accepted all

of the surrendered 2026 Notes for repurchase pursuant to the terms of the Repurchase Right Notice and has forwarded cash in payment of

the repurchase price to the Paying Agent for distribution to the Holders that had exercised their Repurchase Right. The aggregate amount

of the repurchase price is US$405,445,000. As June 15, 2024 is a Saturday, the paying agent will pay the repurchase price for the

2026 Notes tendered and the accrued interest on all of the 2026 Notes no later than Monday, June 17, 2024, the next succeeding business

day following the repurchase date, pursuant to the indenture dated as of June 24, 2019 relating to the 2026 Notes.

Item 12 of the Schedule TO is hereby amended and

supplemented to include the following information:

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

| (a)(1)† |

|

Repurchase Right Notice to Holders of 1.375% Convertible Senior Notes due 2026 issued by the Company, dated as of April 12, 2024. |

| (a)(5)(A)† |

|

Press Release issued by the Company, dated as of April 12, 2024. |

| (a)(5)(B)* |

|

Press Release issued by the Company, dated as of June 14, 2024. |

| (d) |

|

Indenture, dated as of June 24, 2019, between the Company and Citicorp International Limited, as trustee (incorporated by reference to Exhibit 4.65 to the Company’s annual report on Form 20-F (File No. 001-35729) filed with the Securities and Exchange Commission on April 27, 2020). |

| (b)* |

|

Filing Fee Table |

| * | Filed herewith. |

| † | Previously filed |

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

JOYY Inc. |

| |

|

| |

By: |

/s/ David Xueling

Li |

| |

Name: |

David Xueling Li |

| |

Title: |

Chairman and Chief Executive Officer |

Dated: June 14, 2024

Exhibit (a)(5)(B)

JOYY Inc. Announces the Results of the Repurchase

Right Offer for its 1.375% Convertible Senior Notes due 2026

SINGAPORE, June 14, 2024 — JOYY Inc. (Nasdaq: YY) (“JOYY”

or the “Company”), a global technology company, today announced the results of its previously announced repurchase right offer

relating to its 1.375% Convertible Senior Notes due 2026 (CUSIP No. 98426T AF3) (the “2026 Notes”). The repurchase right

offer expired at 5:00 p.m., New York City time, on Thursday, June 13, 2024. Based on information from Citibank, N.A. as the paying

agent for the 2026 Notes, US$405,445,000 aggregate principal amount of the 2026 Notes were validly surrendered and not withdrawn prior

to the expiration of the repurchase right offer. The aggregate cash purchase price of these 2026 Notes is US$405,445,000. The Company

has accepted all of the surrendered 2026 Notes for repurchase and has forwarded cash in payment of the same to the paying agent for distribution

to the applicable holders. As June 15, 2024 is a Saturday, the paying agent will pay the repurchase price for the 2026 Notes tendered

and the accrued interest on all of the 2026 Notes no later than Monday, June 17, 2024, the next succeeding business day following

the repurchase date, pursuant to the indenture dated as of June 24, 2019 relating to the 2026 Notes.

Materials filed with the SEC will be available electronically without

charge at the SEC’s website, http://www.sec.gov. Documents filed with the SEC may also be obtained without charge at the

Company’s website, https://ir.joyy.com.

About JOYY Inc.

JOYY is a leading global technology company with a mission to enrich

lives through technology. JOYY currently operates several social products, including Bigo Live for live streaming, Likee for short-form

videos, Hago for multiplayer social networking, an instant messaging product, and others. The Company has created a highly engaging and

vibrant user community for users across the globe. JOYY’s ADSs have been listed on the NASDAQ since November 2012.

Investor Relations Contact

JOYY Inc.

Jane Xie/Maggie Yan

Email: joyy-ir@joyy.com

ICR, Inc.

Robin Yang

Email: joyy@icrinc.com

Exhibit (b)

Calculation of Filing Fee Tables

Schedule TO

(Form Type)

JOYY Inc.

(Name of Issuer)

Table 1 – Transaction Valuation

| | |

Transaction

Valuation | | |

Fee Rate | | |

Amount of

Filing Fee | |

| Fees to Be Paid | |

$ | 406,038,000 | (1) | |

| 0.01476 | %(2) | |

$ | 59,931.21 | (2) |

| Fees Previously Paid | |

| — | | |

| | | |

| — | |

| Total Transaction Valuation | |

$ | 406,038,000 | | |

| | | |

| | |

| Total Fees Due for Filing | |

| | | |

| | | |

$ | 59,931.21 | (2) |

| Total Fees Previously Paid | |

| | | |

| | | |

$ | 59,931.21 | (2) |

| Total Fee Offsets | |

| | | |

| | | |

| — | |

| Net Fee Due | |

| | | |

| | | |

| — | |

| (1) | Calculated solely for purposes

of determining the filing fee. The repurchase price of the 1.375% Convertible Senior Notes due 2026 (the “2026 Notes”), as

described herein, is US$1,000 per US$1,000 principal amount outstanding, with accrued and unpaid interest on the 2026 Notes of nil on

June 15, 2024. As of April 11, 2024, there was US$406,038,000 aggregate principal amount of 2026 Notes outstanding, resulting

in an aggregate maximum purchase price of US$406,038,000. |

| (2) | The filing fee of US$59,931.21 was previously paid in connection with the filing of the Tender Offer Statement

on Schedule TO on April 12, 2024 by JOYY Inc. (File No. 005-87080). The amount of the filing fee was calculated in accordance

with Rule 0-11 of the Securities Exchange Act of 1934, as amended, and equals US$147.60 for each US$1,000,000 of the value of the

transaction. |

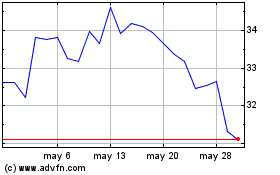

JOYY (NASDAQ:YY)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

JOYY (NASDAQ:YY)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024